Trading Day: live markets coverage; Market mulls rate hike era; plus analysis and opinion

The ASX extends falls in lock-step with global markets as investors thaw expectations of dearer costs to capital.

And that’s the Trading Day blog for Thursday, March 1.

Samantha Bailey 4.24pm: Stocks floored by Fed flu

The local share market finished the session sharply lower as global markets continued to grapple with increased rate hike expectations fuelled by new US Federal Reserve chairman Jerome Powell’s first congressional testimony earlier this week.

At the close of trade, the benchmark S & P/ASX200 had fallen 42.658 points or 0.71 per cent at 5973.301 points. The broader All Ordinaries index had backtracked 41.637 points or 0.68 per cent, at 6075.7 points.

Citibank equity sales director Karen Jorritsma said the market appears to be “taking a minute” after reporting season but she remains bullish despite the market reaction to Mr Powell’s comments.

She said that for the latest reporting season, most companies analysed by Citibank either came in line with or beat expectations.

“On that basis, we remain pretty upbeat on things,” she said.

“We’ve had a very busy four weeks, it’s the first day of the month — it’s just a soft start to the quarter more than anything else.

“Our view is that things continue to get better, we still think there’s a chance of second-half earnings upgrades led by spot commodity prices so our view as a house is that we still continue to be quite bullish on the market.”

The big four banks were weaker. Commonwealth Bank stepped back 0.43 per cent to $76.06 while Westpac lost 0.26 per cent at $30.69. NAB lowered 0.2 per cent to $30.12 while ANZ dropped 0.86 per cent lower to $28.80.

4.11pm: ASX200 closes down 0.7pc

The benchmark S & P/ASX200 index closes down 0.7 per cent on 5973.3 as the session failed to garner a revival of risk appetite, the prospect of higher rates continuing to hold back investors following new US Fed chair Jerome Powell’s first congressional testimony earlier this week.

3.48pm: Woodside not a dirty word: Katana

Analysts have got it wrong on Woodside Petroleum according to Katana Asset Management portfolio manager Romano Sala Tenna.

While the $2.5 billion capital raising underway has to some extent restrained the share price, Mr Sala Tenna says there’s been a “campaign of misinformation” from sell-side analysts.

“This has led to the perception that the Scarborough asset is Distant, Dirty, Deep and Dry, when in reality only the last of these four attributes is accurate,” Mr. Sala Tenna says.

He notes that the 400km pipeline route is less than half of that earmarked for Browse, and that the Scarborough gas has nil or negligible levels of CO2. While it does have 4-5 per cent nitrogen that can’t be liquefied, Pluto was purpose built to deal with nitrogen-rich methane. At less than 1,000 metres, the depth is right in Woodside’s sweet spot for operating and it’s substantially shallower than deep water wells approaching 3km.

“Instead of being distant, dirty or deep, the acquisition of the 50 per cent of Scarborough allows Woodside to control its own destiny and provide a framework for growth all the way out to 2025.”

WPL last down 2.2pc at $28.57

3.34pm: ASX fails to mend hurt feelings

Local investors drag the weight of heavy early losses over into afternoon trade, risk appetite declining after markets’ new sounding board Fed head Jerome Powell failed to offer bullish investors sufficient wiggleroom in the budding stages of a global monetary tightening cycle.

The S & P/ASX200 index last traded down 0.7 per cent on 5969.4.

Mr. Powell cited observably better-than-expected US economic growth in his maiden congressional testimony overnight Tuesday, commentary sufficient to extend a halt in the domestic earnings-led recovery from a related Wall Street correction last month, according to CMC chief markets analyst Ric Spooner.

“While markets are showing signs of taking a wait-and-see approach to higher rates and their impact on equity valuations, concerns persist,” says Mr. Spooner.

“In this context, investors are appear unwilling to push stock indices to new highs. Having recovered towards those highs, gravity now seems to be taking its toll, with traders taking the view that the balance of risk points to some profit taking.”

The ASX10 all remain in the red — Woolies the worst performer, down 2 per cent — indicating broadbased, cross-sector pressure on the local market. Forecast shutdowns and a foreshadowed US tax-related impairment hit appetite for Orica shares (-3.5pc), while lithium plays bear heavy selling — a Tuesday note to clients by Morgan Stanley forecast 2018 as the last year of a global deficit in the alkali metal.

Meanwhile the local currency bounces of a 2-month low hit earlier in the Asia-Pacific session to last buy US77.27 cents in a marginal recovery from a reactive fall on fourth-quarter domestic capex data that failed to meet expectations.

3.25pm: Capex masks longer ‘flex’: Capital Economics

Private new capital expenditure was a bit weaker than expected in the fourth quarter, but the key point remains that investment is no longer the “Achilles heel” of the economy as firms start to “flex their spending muscles”, says Capital Economics chief economist Paul Dales.

He notes that while the 0.2pc QoQ fall in capex missed the consensus 1pc rise, it came after three quarters of healthy rises and YoY capex growth of 4pc was the best in five years.

And while the first estimate for 2018-19 missed the consensus, it beat the first estimate of the prior year, for the first time since 2012-13.

“Despite the small disappointment, it is becoming clearer and clearer that investment will increasingly support GDP growth,” Mr Dales says.

“That said, other parts of the economy aren’t doing quite as well, so it looks as though the 0.6pc Q/Q rise in GDP in the third quarter was followed by something similar in the fourth quarter.”

2.55pm: Trump summons steel, aluminium execs

Jacon M. Schelsinger writes:

The Trump administration has summoned steel and aluminium executives on short notice for a White House meeting on Thursday, telling them that an announcement could be made then on long-awaited curbs on steel and aluminium imports in the name of protecting national security, according to people familiar with the matter.

These people said that executives from companies in the two industries had been invited to the White House for a midday meeting with President Donald Trump, and that Mr. Trump and some of his advisers were hoping to use that event to announce broad tariffs or quotas.

Other people involved in the discussions, however, said that the new policies hadn’t been completed as of Wednesday night, and that the session could just turn into a meeting to discuss possible alternatives. The official White House schedule released shortly after 9pm made no mention of a meeting or an announcement.

Dow Jones Newswires

Elizabeth Redman 2.32pm: Housing slowdown’s systemic risk

Morgan Stanley analysts have tipped the housing market to slow further this year, posing risks to the economy, after national housing prices fell for the fifth month in a row.

“We expect credit growth to continue to decline through regulatory pressure, and activity in the housing market to weaken,” Morgan Stanley analysts said in a research note.

“Given the economy’s exposure to housing through leverage, this poses further risks should the weakness broaden into household sentiment and consumer spending.”

The prediction comes after CoreLogic figures showed the only capital city where housing prices rose in February was Hobart.

2.18pm: Stocks hit new session lows

The S & P/ASX200 index hits a new session low of 5957.6, down 1 per cent on yesterday’s close.

2.13pm: The Trading Day ahead

@AICDirectors #GovSummit18 on @SkyBusiness channel 602 now #ausbiz

— Nadine Blayney (@NadineBlayney) March 1, 2018

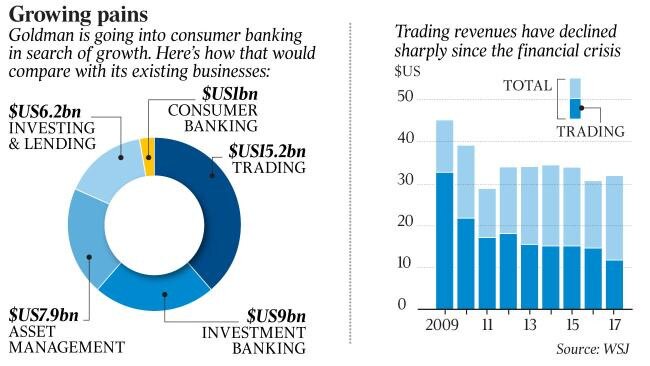

1.38pm: Goldman Sachs hits main street

Liz Hoffman and Peter Rudegeair write:

Struggling to make money in the post-crisis world, Goldman is pushing into businesses it once dismissed as pedestrian and gimmicky, assembling a suite of banking products for the middle class it hopes will power growth.

Goldman 18 months ago began making online loans of a few thousand dollars under the brand Marcus, named after founder Marcus Goldman. Individuals once needed $US10 million to get the attention of Goldman’s elite private bankers. Today, customers can open a Marcus savings account with as little as $US1.

New initiatives under way include checkout-counter loans for shoppers, wealth management and household-budgeting tools for the masses as well as insurance, mortgages and car loans. Goldman is scooping up financial-technology start-ups and pitching bank accounts to Fortune 500 companies as an employee perk, much like gym memberships or health insurance.

1.20pm: Hang Seng extends sell-off

Hong Kong stocks sank more than one per cent in the first few minutes on Thursday, extending the previous two days’ losses following another sell-off on Wall Street.

Since recovery, the Hang Seng index last traded down 0.7 per cent, or 211.29 points, to 30,633.43.

And the benchmark Shanghai Composite Index was flat on 3,259.44 while the Shenzhen Composite Index, which tracks stocks on China’s second exchange, swung 0.4 per cent higher to 1,819.4.

AFP

1.14pm: The Trading Day ahead

Influential non-executive director @sammostyn says there is an opportunity for board directors to step up and take more leadership on issues.

— Sky News Business (@SkyBusiness) March 1, 2018

Tune in to see the full interview at 2pm AEST today on Sky News Business Channel 602. #GovSummit18 pic.twitter.com/1cLSPfdlu5

1.00pm: A$, shares bounce on China data

The Australian dollar and shares bounced slightly as the latest data from China beat market expectations.

China’s Caixin private sector manufacturing PMI for February rose to 51.6 vs. 51.3 expected. That follows some risk aversion after China’s official manufacturing PMI data yesterday hit a 19-month low.

AUD/USD crept up to US77.35 after hitting a 2-month low of US77.24c.

The S & P/ASX 200 share index bounced to 5971 after hitting a 4-day low of 5960.5.

David Swan 12.43pm: Getswift execs snub thrift

Executives of troubled logistics software firm GetSwift Joel MacDonald and Bane Hunter have had their salaries nearly doubled, despite their company battling class action lawsuits and an investigation by corporate regulator ASIC.

Documents filed yesterday showed that while GetSwift (GSW) posted a $5.52 million loss — a drop of 964 per cent from the previous corresponding period’s $525,435 — Mr Macdonald and Mr Hunte have awarded themselves hefty pay rises.

GetSwift managing director Joel Macdonald, who was previously paid a base salary of $250,000, will now be paid $US370,000 ($472,000), as will executive chairman Bane Hunter who previously received a salary of $240,000.

More to come.

12.35pm: ASX swing stocks at lunch

Stephen Bartholmeusz 12.13pm: Powell’s aberrant hazing

Equity markets started this year with surging confidence. They finished last month on a far less certain note.

After climbing nine per cent from the start of the year to January 26 — from record levels — the US market has since slumped nearly 8.5 per cent, with the one per cent fall overnight putting a full stop to the biggest monthly fall in two years.

Moreover, after a year which was one of the least volatile in US equity market history, volatility abruptly resurfaced in February, including a quite dramatic 4.1 per cent single-day fall on February 5 as the VIX index, which reflects investor expectations of volatility, more than doubled in an instant.

From late January to the second week of February the market was down more than eight per cent before bouncing back up by more than 7.5 per cent and then tailing away by nearly 2.5 per cent in the last couple of days of the month. Levels of intraday volatility have also spiked recently.

Those gyrations, unseen last year, are at odds with the performance of the US economy and the confidence of US businesses and consumers — and the US Federal Reserve Board — in its outlook.

David Swan 12.00pm: Tax bitcoiners’ dose of legitimacy

The Australian bitcoin industry has welcomed moves to tax the digital currency, with local executives declaring it’s time regulation was ramped up.

As exclusively revealed by The Australian on Wednesday, tax-dodging Bitcoin investors will be investigated by the Australian Taxation Office, which said it will use anti-money laundering legislation due to come into force next month.

Sam Lee, Chief Executive Officer of Blockchain Global, which manages the production of roughly 1.5 per cent, 4 per cent, and 2 per cent of bitcoin, litecoin and ethereum respectively, told The Australian that without the tax guidances from the ATO in 2014 on crypto currencies, Blockchain Global wouldn’t have grown from what he described as a Melbourne start-up to a global technology powerhouse.

“As a blockchain technology venture builder, our investment criteria and success depends on regulatory clarity, therefore we support the tightening of regulations around cryptocurrencies which allows us to deploy more funds in the jurisdictions we operate,” he told The Australian.

11.43am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

11.45am: Live cross — Shaw and Partners

12.00pm: Adam Dawes from Shaw and Partners and Rudi Filapek Van Dyke from FNArena guest host

12.15pm: Tony Boyadjian — Compass Global Markets

12.30pm: David De Garis — Director of Economics, NAB

12.45pm: Hamish Kelly — Head of Global Banking, HSBC

(All times in AEDT)

11.33am: Aussie falls as 4Q capex misses

The Australian dollar hit a 2-month low of US77.36c to be down 0.3 per cent since the New York close after ABS data showed private new capital expenditure fell 0.2 in the fourth quarter from the third — 1 per cent growth was expected.

A fall in building & structures investment offset a rise in that across the plant & equipment segment.

Also weighing on the currency, firms planned to spend $84b in fiscal 2018-19 vs. $86.5b expected.

The data release has had little impact on domestic treasuries, 3 and 10 year yields are now little changed after registering an initial reactive dip.

Michael Roddan 11.24am: ACCC eye over rate rig claims

The competition watchdog was investigating the big four banks for potential cartel behaviour over the now infamous claims the sector rigged the bank bill swap rate.

Australian Competition & Consumer Commission head of enforcement and compliance Marcus Bezzi told a senate estimates hearing on Thursday that the watchdog often worked closely with the corporate regulator on investigations where there was overlapping enforcement remits.

The Australian Securities & Investments Commission recently filed a claim in the Federal Court against Commonwealth Bank over allegations it rigged the inter-bank lending benchmark, known as the BBSW.

More to come.

Bridget Carter 11.05am: Murray, Saputo Koroit hurdle lowering

Chinese powerhouse Yili and Bega Cheese are believed to have already submitted offers to Saputo to buy Murray Goulburn’s Koroit milk processing facility.

As anticipated, the Australian Competition and Consumer Commission has raised concerns about Saputo’s ownership of Murray Goulburn’s Koroit plant in western Victoria on the back of its planned $1.3 billion acquisition of the struggling dairy co-operative.

As reported in The Australian online this morning, the takeover of Murray Goulburn would see Canada’s Saputo become Australia’s dominant dairy entity.

Matt Chambers 11.04am: Incitec’s Gibson plant served lifeline

Incitec Pivot’s Gibson Island fertiliser plant at Brisbane, set to become loss-making when old gas contracts expire this year, has been given a glimmer of hope after Incitec (IPL) partner Central Petroleum won ground in Queensland’s latest release of gas ground specifically to be developed for domestic markets.

Queensland Resources Minister Anthony Lynham announced today at the Australian Domestic Gas Outlook conference in Sydney that Central and Armour Energy had been awarded ground.

10.51am: Stocks extend early falls

Australia’s S & P/ASX 200 is down 0.8pc at 5968 after hitting a 4-day low of 5962.7 in early trading.

The index seems to be trying to regain the 100 day-moving-average at 5977 after the early tumble caused by heightened risk aversion in global markets after hawkish comments from Fed’s Powell and disappointing China manufacturing data.

If it breaks the 100-DMA on a daily close basis the focus will return to the 200-DMA at 5852, although there’s potential retracement support at 5935 and 5900.

Energy, health care, materials are weakest, with Rio Tinto, Fortescue, Woolworths among the major ex-dividend stocks today.

10.36am: Aussie dollar hits 2-month low

AUD/USD hit a 2-month low of US77.57 cents in early trading amid USD strength and risk aversion in global markets after hawkish comments from Jerome Powell.

The local currency also broke below its 200-DMA — now at 0.7785 — for the first time since December. The next support level is 0.7774 — the 61.8pc retracement of the December-January rise.

But if it breaks the February low at 0.7759 on a daily close basis, AUD/USD will also form a significant downtrend that could retest 0.7500.

The US dollar looks to have benefited from month-end demand from non-US asset managers buying to preserve existing hedge ratios given the fall in stocks last month, says NAB’s head of FX strategy, Ray Attrill.

“There might possibly be more of that come during today’s sessions, if so a potential small weight on AUD/USD,” he said.

Focus turns to four-quarter capex data at 11.30am (AEDT) and China’s Caixin PMI data at 12.45am (AEDT), after the official PMI hit a 19-month low yesterday.

10.28am: Tatts interim profit drops 16pc

Tatts Group interim after-tax net profit fell 16.6 per cent to $102.3 million, while interim revenue rose 4.3 per cent to $1.48 billion.

Alongside results the company announced a 16c per share interim dividend, the same as that a year prior.

The company has recently been acquired by Tabcorp.

10.19am: Retail Food in suspension from halt

Retail Food Group shares have been suspended from trade after entering into a trading halt yesterday, the company says it is still awaiting the outcome of an auditor’s review of its interim results that it understands may not be available until Friday, March 2.

Read: McGrath Nicol eye on Retail Foods

RFG last $2.04

Elizabeth Redman 10.13am: Nation’s house prices off the boil

Housing prices fell in almost every capital city last month as the once white-hot market continues to come off the boil.

Sydney prices are now lower than they were a year ago, with the city dropping 0.5 per cent over the past 12 months and recording an annual price fall for the first time in 2012.

The harbour city was the weakest capital over the quarter, dropping 2.4 per cent, and also fell 0.6 per cent during February.

National dwelling values fell 0.2 per cent in February and have now fallen for five months in a row for the first time since March 2016.

10.10am: Orica down 7pc at the open

Shares in mining explosives producer Orica fall 6.5 per cent at the open to $17.42 after the company warned of costs of planned shutdowns and an impairment relating to a change in US tax law.

10.04am: Stocks fall toward potential support

The Australian share market faces increased risk aversion in global markets after Jerome Powell’s hawkish comments Wednesday.

Australia’s S & P/ASX 200 share index fell 0.3 per cent to 5996.5 and approaches the 100-DMA at 5975 which may act as support today.

That follows another day of steep falls on Wall Street where the Dow Jones index fell 1.5pc and the S & P 500 fell 1.1pc.

Risk aversion was also evident, the US yield curve flattening and US dollar strengthening.

The US dollar index rose 0.4pc to a 6-week high of 90.70, even though the US 10-year bond yield fell 3 basis points to 2.86pc.

Gold was flat though WTI crude fell 1.4pc on higher US inventories and LME copper fell 1.3pc after China’s manufacturing index hit a 19-month low.

Focus turns to Australian capex data at 11.30am (AEDT) and China’s unofficial PMI data at 12.45pm (AEDT).

US PCE deflator and initial jobless claims are due tonight before non-farm payrolls on Friday.

Index last 6015.96

9.51am: ASX poised to join red run

The Australian share market looks set to open half a per cent lower as equity indexes around the world turn red.

The local share price futures index was last down 0.7 per cent.

Global markets have fallen across the board in the offshore session with Asian stocks hit by disappointing manufacturing data out of Japan and China adding to the impact of new Federal Reserve chair Jerome Powell’s hawkish comments on the US economy.

European markets were dragged down by concern US interest rates could rise faster than expected following the US central bank boss’ comments while the Asian data impacted British mining companies which weighed on the FTSE.

Lower oil prices weighed on Wall Street.

The Australian Bureau of Statistics is expected to release private capital expenditure and expected expenditure data for the December quarter. Meanwhile the Ai Group’s Australian Performance Manufacturing index is set to be released.

The local currency was last 0.3 per cent lower on US77.67 cents from US77.97c on Wednesday.

AAP

9.48am: FIRB clears Oracle, Aconex $1.6bn deal

The Foreign Investment Review Board has cleared US cloud computing giant Oracle’s proposed $1.6bn acquisition of ASX-listed engineering software services developer Aconex.

ACX last $7.75

9.41am: Murray-Saputo tie-up issues: ACCC

The Australian Competition and Consumer Commission says it has concerns around the proposed acquisition of the assets of Murray Goulburn by Canadian dairy giant Saputo relating to Murray Goulburn’s Koroit dairy plant in western Victoria, in particular the impact the acquisition will have on competition for farmers’ milk in the area.

The ACCC says Saputo’s Allansford plant and Murray Goulburn’s Koroit plant would have

over two thirds of the raw milk processing capacity in the southwest Victoria / southeast

South Australia region. The two plants currently acquire the majority of raw milk from dairy

farmers in the area.

“While Saputo is proposing to acquire most of the Murray Goulburn business, our only

concern is in relation to Murray Goulburn’s Koroit plant,” said ACCC chair Rod Sims.

“Our view is that Saputo owning the Koroit plant would substantially lessen competition for

the acquisition of dairy farmers’ raw milk in the region” — read more

MGC last 84 cents

9.30am: Damage control plan for Platinum: Bell Potter

Platinum Asset Management should start its share buyback now to prevent a further share price tumble, says Bell Potter’s head of institutional sales, Richard Coppleson.

He notes that Platinum’s share price continues to fall at an “alarming pace” after the company last week revealed CEO Kerr Neilson will step back from his active role.

Mr Neilson “clearly has misjudged how the market would react, in a stock that you could say was priced for perfection at 20 times,” Coppleson says.

“One thing I’d like to see is their buyback finally get activated”, he says noting that Platinum is yet to do any of the “monster” 10pc buyback it announced in September 2016.

So I say they have to buyback stock here and now — if not they are sending a terrible signal to the market and the shorts will hit them hard.”

In his view, Platinum shares “will find it hard to recover” if the buyback is not activated.

PTM shares fell 2.4pc to a 5-month low of $6.41 yesterday.

9.21am: Analyst rating changes

Sandfire cut to Hold — Bell Potter

Altium cut to Hold — Bell Potter

Ramsay Health cut to Neutral — JPMorgan

Ramsay Health cut to Outperform — CLSA

Harvey Norman cut to Sell — CLSA

Harvey Norman raised to Neutral — Credit Suisse

Harvey Norman cut to Neutral — UBS

Steadfast raised to Buy — Baillieu Holst

Macquarie Atlas Roads raised to Overweight — Morgan Stanley

Adelaide Brighton cut to Underweight — Morgan Stanley

Mirvac raised to Buy — Citi

Ramsay Healtcare raised to Buy — Citi

9.12am: Orica flags impairment, shutdowns

Explosives and fertiliser maker Orica has outlined a number of operational issues and writedowns which will reduce its earnings (EBIT) for the first half of its 2018 fiscal year.

The company says unplanned maintenance shutdowns at its Yarwun and Kooragang Island plants will reduce earnings by around $17 million, while ongoing underperformance at its Minova business and the impact of extreme US weather will have an impact of around $15 million.

In addition, the company expects to write down $55 million due to the reduction in the US corporate tax rate, on account of loss in value of deferred tax assets and deferred interest — AAP

ORI last $18.65

Michael Roddan 9.08am: Bendigo claims bailout backstop

Bendigo and Adelaide Bank, which controls just 2 per cent of the $1.6 trillion housing market, has claimed it is too big to fail.

Bendigo Bank (BEN) chief financial officer Richard Fennell yesterday told a Productivity Committee hearing in Sydney that ratings agencies were not factoring in the bank’s likelihood of a government rescue in a crisis.

9.04am: Spotify eyes float in decade profit drought

Maureen Farrell writes:

Music-streaming company Spotify Technology cemented plans for its unusual initial public offering while revealing the financial particulars of a fast-growing company that up-ended the music industry and revolutionised how consumers listen — but spent heavily to do so.

Stockholm-based Spotify has filed to go public by submitting a so-called F-1 to the Securities and Exchange Commission that contains years of financial data and details about how the 10-year-old company will launch its IPO.

The filing showed that the company’s revenue is growing sharply but its losses are ballooning. It posted €4.1 billion ($A6.4 billion) of revenue in 2017, up nearly 39 per cent from the prior year. The company, which has yet to turn a profit, posted a loss of €1.24 billion in 2017, up from €539 million the prior year and €230 million in 2015.

8.57am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

9.00am: Live cross — OFX

9.30am: Chris Weston — Chief Market Strategist, IG

9.45am: Gareth Aird — Senior Economist, Commsec

10.00am: Tim Lawless — CoreLogic

(All times in AEDT)

Matt Chambers 8.51am: Coalition unveils US gas alliance

Australia has struck a regional energy alliance with the US to spur development of more LNG import infrastructure in South Asia and Southeast Asia and boost demand for billions of dollars of Australian and US LNG exports.

The Australia-US Strategic Partnership on Energy in the Indo-Pacific was quietly signed during Malcolm Turnbull’s recent visit to the US with 40 Australian business leaders.

8.49am: Hope Hicks resigns from Trump camp

White House communications director Hope Hicks, one of US President Donald Trump’s closest advisers, has told colleagues that she is resigning from her job, the New York Times reports.

The Times, citing White House aides, said Hicks told colleagues she had accomplished what she felt she could in her White House job.

Reuters

Eli Greenblat 8.43am: Gerry seethes at Harvey share plunge

Harvey Norman chairman and one of the nation’s richest businessmen, Gerry Harvey, was quick to hit back at big investors yesterday in the face of panic selling that sent shares in his retailer plummeting to the biggest one-day fall in 24 years, saying the market had “got it wrong” and “just didn’t get it”.

Harvey Norman shares are among the most shorted stocks on the market — with nearly 10 per cent of its issues shares held by shorters all craving for the price to slide. Its December half results were dented by nearly $21 million in impairments of an investment in a dairy farm, and the value of its property portfolio only grew by $22.7m against $75.7m last year.

Further angering shareholders was another cut of Harvey Norman’s dividend, on top of trimming its final dividend last year, which culminated in a sharemarket rout yesterday. Harvey Norman shares fell nearly 16 per cent, its largest one-day drop in 24 years, which stripped off $800m from the bedding, furniture and consumer electronics retailer’s market capitalisation — read more

HVN last $4.01

8.31am: Crude crunch lets off steam

Oil prices are lower but have pared losses, after data showing a build in US crude inventories was tempered somewhat by a drop in per cent crude production in December.

US crude inventories rose by 3 million barrels for the week ending February 23, compared with analyst expectations for a build of 2.1 million barrels. Petrol stocks also rose surprisingly.

“We had another pretty sizeable build, and with that it kind of seemed like this recent bull market had the carpet pulled out from underneath it,” said Phillip Streible, senior market strategist at RJO Futures in Chicago. In a separate, monthly report, the per cent Energy Information Administration said crude production in the month of December dipped to 9.95 million barrels, a 108,000-barrel-per-day (bpd) drop from November.

West Texas Intermediate crude fell 29 cents to $US62.72 a barrel, a 0.5 per cent decline, as of 5.03am (AEDT). Brent crude futures for the most active May contract were down 56 cents at $US66.07 a barrel. Also in the monthly report, the EIA revised its November crude production figures upward to a record 10.057 million bpd.

Prices were pressured earlier after three of the world’s top consumers of crude — China, India and Japan — reported a slowdown in monthly factory activity. The per cent dollar hit a one-month high Wednesday, putting additional pressure on crude. A stronger US dollar makes oil more expensive for holders of other currencies.

Reuters

8.24am: Rate woes loiter on Wall Street

Wall Street stocks fell for the second straight session Wednesday amid worries about higher interest rates and as petroleum-linked shares tumbled on lower oil prices.

The Dow Jones Industrial Average dropped 1.5 per cent to close at 25,028.37. The broadbased S & P 500 shed 1.1 per cent finishing at 2,713.81, while the tech-rich Nasdaq Composite Index fell 0.8 per cent to 7,273.01.

The declines followed a drop Tuesday after congressional testimony from new Federal Reserve Chairman Jerome Powell sparked talk the US central bank would accelerate its pace of interest rate hikes.

Those worries also dogged markets on Wednesday, analysts said. “I think it’s just a concern about higher interest rates,” said Jack Ablin, chief investment officer at Cresset Wealth Advisors.

“Unfortunately, we may have to wait for first quarter earnings to kind of break out of the cycle we’re in.”

Petroleum-linked equities fell sharply following a bearish US oil inventory report, with Dow member ExxonMobil, ConocoPhillips and Halliburton all losing more than two per cent.

Dick’s Sporting Goods gained 0.7 per cent after announcing it would stop selling assault-style rifles and bar all gun sales to customers under 21 years old.

Dow Jones Newwires

8.13am: Meatlovers shorting Domino’s

Will Glasgow and Christine Lacy write:

It’s the $3.5 billion question: who is shorting Domino’s, the crusty, ASX-listed jewel in billionaire Jack Cowin’s investment portfolio? The much discussed fast-food stock fell below $40 yesterday — a number to which some have ascribed significance — to close at $39.39.

That hasn’t yet triggered any further disclosure from Domino’s evangelical CEO Don Meij.

But it did take Domino’s performance in the year-to-date to a grisly 15.6 per cent fall. Over the past 12 months, the stock is down a slice of thin crust below 30 per cent. Awful news for most shareholders, but now great for the almost 16 per cent that ASIC reports have a short position on Meij’s grease shop.

When asked by Margin Call yesterday, Domino’s professed to not know the identities of the short investors whose high-conviction investment is profiting off the company’s misery.

Seems a subject Cowin and Meij might want to pursue. The snow-hating, Canadian-born Cowin owns 26 per cent of Domino’s, now worth just under $900 million, while Meij’s harassed stake is worth $72.6m.

7.50am: US stocks lose ground

The Dow Jones Industrial Average and S & P 500 headed toward a second straight day of losses Wednesday and remained on track to snap their 10-month winning streaks, as investors continued to weigh the impact of higher interest rates on the nearly nine-year bull market.

In late trade the Dow was recently down 200 points, or 0.8 per cent, at 25,210, after earlier rising as much as 166 points. The S & P 500 fell 0.5 per cent, and the Nasdaq Composite declined 0.2 per cent. The blue-chip index and the S & P 500 are off more than 3 per cent for the month, while the Nasdaq is down 1.3 per cent.

Australian stocks are tipped to slip at the open. At 7.50am (AEDT) the SPI futures index was down 33 points.

Earlier, all three US indexes turned negative before rebounding. The blue-chip index and the S & P 500 were off about 2.5 per cent for the month, while the Nasdaq was down 0.6 per cent.

Although major indexes around the world have recovered much of their losses from a big sell-off that sent the S & P 500 and Dow into correction territory on February 8, this has been the worst month in at least a year for many stock benchmarks.

After a record-setting January, a raft of misfired bets on market calm and interest-rate concerns have helped spark volatility.

Some investors have said declines are a buying opportunity with global earnings and the economic backdrop looking stronger than they have in years. Others aren’t so sure, though, fearing a pick-up in inflation might encourage central banks to tighten monetary policy more quickly than anticipated.

“I think what we’re going to see is something of a tug of war between those different forces,” said Kristina Hooper, chief global market strategist at Invesco. “That is likely to continue for some time.”

Stocks got a boost after the opening bell as official data showed that U.S. economic growth had been revised down in the fourth quarter of last year, in line with what economists expected.

The revision came after new Federal Reserve Chairman Jerome Powell’s upbeat assessment of the economy a day earlier pushed the yield on the benchmark 10-year U.S. Treasury note back near a four-year high and sent the S & P 500 and Dow to their worst day since February 8.

Some analysts think Mr. Powell’s tenure will be marked by higher market uncertainty. The S & P 500 has had 11 trading days with moves of at least 1 per cent in either direction this month, its most since January 2016.

Roughly 35 per cent of investors now expect that the Fed will raise interest rates at least four times this year, compared with about 28 per cent a week ago, according to CME Group data. The central bank has previously projected three rate increases for this year.

Overnight, the 10-year Treasury yield edged down to 2.877 per cent, according to Tradeweb, from 2.910 per cent. Yields fall as prices rise.

Elsewhere, the Stoxx Europe 600 fell 0.7 per cent. Utility stocks, considered to be bond proxies because of their steady dividends, were among the worst performers.

London closed down 0.7 per cent while Frankfurt and Paris both ended down 0.4 per cent.

Asian stocks and commodities dropped after China’s official manufacturing survey of purchasing managers fell to a 19-month low and Japanese factory output and retail sales came in weak.

Hong Kong’s Hang Seng and the Shanghai Composite closed down 1.4 per cent and 1 per cent, respectively, while Japan’s Nikkei Stock Average declined 1.4 per cent.

Dow Jones Newswires

7.10am: Dollar falls further

The Australian dollar has continued its decline against its US counterpart which has continued to strengthen following Federal Reserve chair Jerome Powell’s hawkish comments to Congress.

At 6.40am (AEDT), the Australian dollar was worth US77.84 cents, down from US77.97 cents yesterday.

The new Fed boss’ upbeat assessment of the us economy, assessed as a more hawkish signal from the central bank, encouraging some investors to believe it will raise rates four times this year rather than three.

And, that has sent the US dollar up against a basket of currencies. Westpac analysts say the US dollar index had lifted 0.2 per cent to a six-week high, while the Australian dollar had “made a roundtrip from 0.7790 to 0.7820 and back”.

They said the key domestic even risk for the local currency would be fourth- quarter capital expenditure figures.

“(They’re) expected to rise one per cent, (while) Westpac forecasts a 0.8 per cent increase with equipment capex rising one per cent and building and structures up 0.6 per cent”.

The local currency “retains downside risks, given the US dollar’s recent recovery” with its next target likely to be US77.60 cents.

The Aussie dollar is also lower against the yen but unchanged against the euro.

AAP

6.40am: US retailer’s harder line on guns

Dick’s Sporting Goods will immediately stop selling assault- style rifles and ban the sale of all guns to anyone under 21, the company said, as its CEO took on the National Rifle Association by calling for tougher gun laws after the massacre in Florida.

The strongly worded announcement from the sporting goods chain that is also a major U.S. gun retailer came as students at Marjory Stoneman Douglas High School in Parkland, Florida, returned to class for the first time since a teenager killed 17 students and educators with an AR-15 rifle two weeks ago. “When we saw what the kids were going through and the grief of the parents and the kids who were killed in Parkland, we felt we needed to do something,” Chairman and CEO Ed Stack said on ABC’s “Good Morning America.” The change in sales practices, and the emphatic words from Stack, put Dick’s out front in the falling-out between corporate America and the gun lobby. Several major corporations, including MetLife, Hertz and Delta Airlines, have cut ties with the NRA since the Florida tragedy, but until now, none were retailers that sold guns.

AP