Trading Day: live markets coverage; Earnings season’s fairytale finishes; plus analysis and opinion

A sporadic ASX swings either side of flat as confessors charge through the gates to stake their claim on earnings season ‘18.

And that’s the Trading Day blog for Thursday, February 22.

Bridget Carter 5.10pm: APA shortfall enlists JPMorgan, Deutsche

JPMorgan and Deutsche Bank have launched the institutional shortfall book build for APA Group’s $500 million equity raising.

The gas infrastructure operator announced it was raising $500 million this week to help fund its new pipeline, power station and wind farm projects.

Existing shareholders have been offered new shares at an almost 7 per cent discount on their last trading value of $8.26.

Eli Greenblat 4.38pm: Retail wreck David Jones’ locker

Up-market department store David Jones is the latest victim of some of the toughest retail conditions in decades with its December half profit slumping by one third and its South African owners blaming rising household debt in Australia and a cautious shopper hurting its performance.

But there were also some self-inflicted errors as Woolworths Holdings was slow to push through new initiatives and badly handled other retail strategies.

South Africa’s Woolworths Holdings has confirmed a $712.5 million write down against its Australian department store David Jones in the wake of a poor macro-economic environment and a disappointing and delayed execution of key initiatives, however its Country Road business did achieve an above market performance.

It has called out high levels of debt in Australia and soft consumer sentiment.

Cliona O’Dowd 4.15pm: Kerr Neilson to step down as Platinum CEO

Billionaire Kerr Neilson is stepping down as CEO of Platinum Asset Management, with co-founder and chief investment officer Andrew Clifford taking on the top job from July 1.

Neilson, who founded the $4.58 billion ASX-listed company in 1994, will continue as an executive director of the group and a member of the investment team. He will also provide additional support to Platinum’s client diversification initiatives in Europe and the US, the company said.

Mr Clifford, along with fund manager Clay Smolinski, will assume full portfolio management responsibility for the flagship fund, the Platinum International Fund. Mr Neilson’s portfolio management responsibilities for Platinum’s other global equity funds and mandates will be allocated between Mr Clifford and Mr Smolinski — read more

PTM last $7.80

4.11pm: Stocks seals gains in volatile session

The S & P/ASX200 index closes 0.1 per cent higher on 5950.9 after oscillating either side of flat throughout the session, markets around the world subjected to volatility from a bipolar reaction on Wall Street to Fed speak — read more

3.50pm: WATCH: Kogan CEO on data, retail

3.45pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Nick Bishop — Aberdeen Standard Investments

3.50pm: Ric Spooner — CMC Markets

4.00pm: Scott Phillips from The Motely Fool guest hosts

4.05pm: Michael Heffernan — Phillip Capital

4.30pm: Kay Van-Peterson — Saxo Markets

(All times in AEDT)

Samantha Bailey 3.42pm: Today’s earnings season results

Qantas (+6.5pc @ $5.61)

unveiled a record underlying profit of $976 million for the first-half, up 15 per cent on the first-half the prior year, despite rising fuel costs.

Michael Hill (+3.2pc @ $1.13)

Booked a first-half profit plummet, down 66.2 per cent to $8.7m compared to the same period last year, as its US business, which the company will soon exit, weighed on earnings.

Blackmores (-14.6pc @ $136.15)

Posted a 20 per cent profit hike for the first half to $34m on the back of strong demand from China as the Australian market remained soft.

Qube (-3.6pc @ $2.42)

Said its first-half profit slipped 5 per cent to $45.2m compared to the previous corresponding period, when the company recorded a one-off benefit off the back of an acquisition.

Bellamy’s (-5.6pc @ $14.95)

Revealed a bumper first-half net profit, of $22.4m, compared to $13.2m in the first half last year as it reaffirmed it’s full-year revenue guidance.

Nine Entertainment (+15.5pc $1.96)

Revealed a 55 per cent profit jump off the back of ratings improvement and a higher advertising demand.

Crown Resorts (+4.6pc @ $13.08)

Booked a profit plunge of 33.6 per cent to $238.6m for the first half compared to the same period a year ago, chairman John Alexander calling for corporate tax reforms in Australia.

Flight Centre (+10.4pc @ $55.29)

Said its first-half profit shot up 37 per cent to $102.1m and upgraded its full-year guidance.

Kogan (+18.5pc @ $8.57)

Delivered a first half net profit of $8.3m, up from $1.5m in the first half last year, founder, CEO Ruslan Kogan saying the arrival of Amazon would only aid online-only stores.

3.36pm: WATCH: Qantas’ Joyce on growth barometer

Bridget Carter 3.33pm: Hastings investors opt for Morrison

Investors in one of Hastings Funds Management’s funds — the Utilities Trust of Australia — has dumped the group as its manager, instead voting for Morrison & Co to take control.

It follows a long-running saga with the infrastructure manager that was previously owned by Westpac Banking Corporation.

The decision will go to a unit holder vote in April before the arrangement is finalised.

Last year, Westpac sold Hastings, which has controlled $5.6 billion of prized infrastructure assets, to British-based Northill Capital, but investors in UTA were unhappy about the decision and called an extraordinary general meeting to find a new party to take control of its investments.

Earlier, another Hastings-run fund — The Infrastructure Fund- called an EGM to remove Hastings as its manager following a string of earlier departures when Westpac owned the operation.

UTA has interests in assets including the New South Wales electricity transmission business TransGrid, the state’s property registry and Perth Airport.

The “TIF” fund holds stakes in assets such as Port of Newcastle, Queensland Airports, Perth Airport, North Queensland Airports and the Sydney Desalination Plant.

Advisory firm Grant Samuel has been advising UTA.

Morrison & Co ousted IFM in the competition to take control of the fund.

The Wellington-founded Morrison & Co, which now bases most of its investment and asset management operations in Sydney, will now control around $15 billion of assets, including Canberra Data Centres and Australian National University Student Accommodation.

The infrastructure manager originally owned a lot of the assets that were under Hastings control.

In a statement, UTA said it had received strong interest following a number of high quality managers.

The formal transaction will occur on July 1 following an EGM vote by UTA Unit Holders.

“Over the last few months, the Board has considered various investment management options for UTA,” the fund’s board said in a statement.

“In selecting Morrison & Co as its new manager, the Board is confident that the combination of a high quality portfolio and the stability afforded by an experienced, well regarded infrastructure manager will be an attractive proposition for both existing and new investors.”

UTA said the tender process had delivered materially improved terms for UTA stakeholders.

“The Board’s considered view is that the change of manager will provide UTA with a strong and stable platform from which to continue to deliver value for Unit Holders.”

Read more from DataRoom

Bridget Carter 3.30pm: Morrison to seize Hastings Fund

Morrison to take control of Hastings Fund UTA.

More to come from DataRoom

3.03pm: WATCH: Nine’s Marks on TV longevity

2.48pm: Apple schemes cobalt leapfrog

Alexandra Frean writes:

Apple is seeking to buy cobalt directly from mining companies amid a looming shortage of the metal, a key ingredient for the lithium-ion batteries in its iPhones and iPads.

Fearful that the boom in electric cars might put pressure on supplies, the Californian technology giant has been in discussions to secure contracts for “several thousand metric tons” of cobalt each year for at least five years, according to Bloomberg.

While smartphones use an estimated ten grams of refined cobalt, a typical electric car battery uses five to ten kilograms.

2.09pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

2.20pm: Tim Larkworthy — FIIG Securities

2.30pm: Media Week

2.45pm: Fadi Geha Simble — CEO, Simble

3.00pm: Andrew Tyrrell — Shaw and Parnters

(All times in AEDT)

Turi Condon 1.52pm: Lowy unfazed as Unibail bid shrinks

The Lowy family and Westfield’s board have stated their full support at the group’s annual profit result for what will be Australia’s biggest takeover, the $30 billion bid for the mall owner by Europe’s Unibail-Rodamco, as sharemarket volatility cuts the value of the bid.

Answering analysts after delivering a 13.5 per cent uplift in profit to $US1.55bn for the 2017 year, co-chief executive Steven Lowy said “there is no plan B” if the transaction were not to go ahead.

“We are fully committed to the transaction and believe the transaction will be executed.”

“From the family’s, and company’s point of view, there has been no change in the strategic rationale (for the deal with Unibail),” Mr Lowy said — read more

WFD last $8.59

1.29pm: ANZ appoints new head of risk

ANZ has appointed internal candidate Kevin Corbally as its new chief risk officer, previously head of internal audit after joining ANZ in 2009 following tenure as MD and head of Corporate & Commercial Banking at Citigroup.

Mr Corbally will be a member of the Group Executive Committee and be responsible for protecting the bank’s balance sheet as well as overseeing its risk strategies, policies and processes, according to the company.

ANZ last $28.10

Elizabeth Redman 1.18pm: Metro house price quadrupling act

Housing prices have more than quadrupled in Melbourne and tripled in Sydney over the past two decades, meaning any price weakness in future would be “healthy” for the market, according to property researcher CoreLogic.

Melbourne recorded the sharpest increase in values in the country over the last 20 years, with prices rising 335 per cent.

Sydney — which was the epicentre of the most recent bull market over the last five years — recorded a 239 per cent rise in values when measured over the past two decades — more to come

1.04pm: Heng Seng hit in early trade

Hong Kong stocks sank more than one per cent at the open Thursday after Federal Reserve minutes indicated US interest rates would rise further, but mainland markets rallied as they reopened after the Chinese New Year break.

The Hang Seng index fell 1.11 per cent, or 347.44 points, to 31,084.45. But the benchmark Shanghai Composite Index jumped 1.20 per cent, or 38.41 points, to 3,237.57 and the Shenzhen Composite Index, which tracks stocks on China’s second exchange, rose 0.87 per cent, or 15.16 points, to 1,754.31.

AFP

12.52pm: ASX swing stocks at lunch

The S & P/ASX200 index posts lunchtime losses, last down 0.2 per cent at 5932 and swinging into the red after posting opening gains up to 0.3 per cent.

12.26pm: Sweet temptation in a2 Milk, Fonterra deal

Rebecca Howard writes:

A2 Milk Co is now more valuable than Fonterra in New Zealand, even though the milk marketer’s sales amount to less than 3 per cent of the dairy giant’s, as investors bet it will continue to beat expectations.

A2 shares jumped 18 per cent to $13.87 on the NZX and are trading at more than 50 times forecast per-share earnings — the highest price-to-earnings (PE ratio) of any company on the NZX 50 Index.

The market capitalisation of a2 has jumped to $10.1 billion, exceeding the $9.76b value of Fonterra based on the $6.06 price of the shares that trade in a farmer-only market on the NZX.

Shares of a2 surged Wednesday after the company posted a 150 per cent gain in first-half profit and announced a strategic partnership with Fonterra for the supply of A1 protein-free milk products in bulk powder and consumer packaged forms, in exchange for an exclusive licensing agreement to produce, sell and market a2 branded fresh milk for end sale in the New Zealand market.

Note: ASX-listed a2 Milk shares (graphed below) are on track for their third-consecutive session of record closing highs after adding nearly 30 per cent on its interim result yesterday — last up 6.3 per cent on $12.02.

SCOOP

12.07pm: Investors bank $1.7bn on a holiday

It’s hula hoop Thursday with investors caught in a back & forth market, however those who locked themselves into a punt on a holiday stocks land softly on Salvation Isle with the sector lumping on over $1.7bn in market capitalisation after reports from key industry heavyweights.

Qantas (+9.6pc @ $5.78 = $880m)

A record $976m underlying profit from the national carrier flanks plans to set up its own pilot academy and deliver Down Under five-hundred Mavericks and Icemen a year.

Webjet (+20.4pc @ $12.53 = $240m)

A near quadrupling of interim revenue to $359.8m provided more than enough headroom for the online travel agent to lift net profit in the period 25 per cent to $20m, the company citing strong growth in both its B2B Webbeds arm ex-acquisition JacTravel and consumer-facing segment behind the result.

Flight Centre (+13pc @ $56.45 = $610m)

Recently taking its own acquisitive tour around the globe, the travel outlet honed its full fiscal year before-tax profit guidance to a range between $360-$385m in news the market saw fit to reward shares with a new record high.

11.46am: ASX200 swings negative

The benchmark S & P/ASX200 turns negative to last trade on 5933, erasing earlier gains of as much 0.5 per cent.

Sarah-Jane Tasker 11.36am: China profit dips, China sweetener

The James Packer-backed Crown Resorts has taken a 33 per cent hit to its half-year profit, but Chinese high rollers have boosted activity at its Melbourne casino.

The company today revealed that its reported net profit after tax, after significant items, was 33.6 per cent lower than the period corresponding period at $238.6 million.

The result in the prior corresponding period had included profit from Crown’s interest in Macau-focused Melco Crown, plus a net gain on the sale of its shares in Melco Crown — read more

CWN last up 5.1pc on $13.14

11.27am: Flight Centre hits new altitude

Flight Centre shares jumped 13pc to a record high of $56.45 on strong results and guidance.

Underlying first-half pre-tax profit rose 23.1pc to $139.4m, which was 9.3pc above the midpoint of the $120-135m guidance range, and FY18 guidance was raised to $360m-$385m from$350m-$380m.

“Underlying volume growth appears healthy given total transaction volume growth of almost 9 per cent and airfares noted as generally having stabilised, revenue margin headwinds (down 43 bps) should be well understood — mix shift to larger corporates, online and FX — and appear controlled, while margin improvement strategies are already supporting the net PBT margin,” Macquarie says.

“For now, the airfare pricing headwind appears contained, with cost-reduction strategies continuing to progress although we remain cautious on the ability or at least willingness of management to achieve the multi-year improved cost outcome that the market is looking for.

FLT last up 9.6pc at $54.86.

11.21am: Tokyo stocks open lower

Tokyo stocks opened lower on Thursday following Wall Street drops after minutes of the US central bank’s last meeting solidified expectations for interest rate hikes ahead.

The benchmark Nikkei 225 index lost 0.78 per cent or 172.47 points to 21,798.34 in early trade while the broader Topix index was down 0.65 per cent, or 11.45 points, at 1,750.16.

AFP

Stephen Bartholomeusz 11.07am: Breaking down Qantas’ record results

Alan Joyce’s presentation of Qantas’ first-half results made several references to the group’s “momentum”. It’s hard to argue with that after the group produced a record result, outstripping the high-water mark recorded in the first six months of Qantas’ boom 2015-16 year.

The underlying pre-tax profit of $976 million was above the guidance of a profit of $900m to $950m Qantas provided with its first-quarter trading update last year, 15 per cent ahead of the same period last financial year and solidly above the $921m in the same period of 2015-16.

On a statutory basis, including $119m of one-off costs, the growth rate was even stronger, up 20 per cent to $857m.

It was a result built, as Qantas’ recent results have been built, around its core domestic operations, where continued capacity discipline by the two domestic carriers — capacity in the domestic market was reduced by 0.9 per cent — saw Qantas and Jetstar’s domestic businesses generating underlying earnings before interest and tax (EBIT) of $652m, with the Qantas brand lifting its earnings 20 per cent to a record $447m.

11.02am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Alan Joyce — CEO, Qantas

11.30am: Ruslan Kogan — CEO, Kogan

11.40am: Hugh Marks — CEO, Nine Entertainment

(All times in AEDT)

10.46am: Wagners taps record high on report

Wagners shares have surged as much as 7.2 to a record high of $4.18 as the first shares trade hands after its latest set of results.

Macquarie kept its “underperform” rating and $3.25 target price, warning that the valuation doesn’t match the risks.

But Credit Suisse kept its “outperform” rating and $4.20 target, noting that first-half pro-forma EBITDA of $28.7m was 15.4 per cent above its expectation and the company maintain FY18 guidance for $50.4m.

“Seasonality is uncertain given the lack of prospectus historic financials, but management commented that generally it expects a similar level of project activity in 2H18 but lower cement volumes due to lower seasonal activity in early January,” Credit Susse analysts said. WGN last up 6.2pc at $4.14

10.31am: Local market higher, takes helm

The S & P/ASX200 index trades 0.4 per cent higher on 5965.1 as local investors march to the beat of their own drum, Wall Street taking a sharp turn lower in late trade to close on the session lows as an ominous signal to market watchers.

Broadbased buying across the large-caps signals a return of risk appetite across sectors, while Nine Entertainment takes top 200 first place honours early with a surge nearly 20 per cent after its latest set of results.

10.13am: CHARTS: Qantas tests strong resistance

Qantas shares are testing strong resistance around $5.55.

The 100 and 200 day moving averages lie at $5.54 and $5.57 respectively.

And the top of a rising channel drawn parallel to an uptrend line from the January low comes in at $5.55.

QAN last up 5pc at $5.55.

10.09am: Opening verdict on ASX reporters

Qantas: +5pc @ $5.52

Flight Centre: +7.7pc @

Crown: +4pc @ $13.00

Nine: +15pc @ $1.96

Bellamy’s: -3.7pc @ $15.25

10.04am: Blackmores shares sink 15pc early

Blackmores shares sink 14.5 per cent at the open to $136.50 after its profit update this morning.

Annabel Hepworth 10.03am: Economy firing ‘on all cylinders’: Joyce

Qantas chief executive Alan Joyce has delivered a bullish assessment of the economy this morning.

He said that there had been some growth in the part of the business servicing the resources sector as he outlined the carrier’s half-year profit result.

“That’s a good indication I think that the Australian economy is starting to fire on all cylinders.”

The comments are significant as Qantas had pulled back on some of its regional routes.

9.56am: ASX likely flat or lower

Australia’s S & P/ASX 200 share index should be flat or down today after a late sell-off on Wall Street left the US market down two days in a row.

US stocks initially rose on Fed minutes released overnight acknowledging a stronger economic outlook without signalling faster rate hikes, however sentiment soured on higher bond yields as the debt market priced in three Fed hikes this year.

US 10-year yields rose 6 basis points to a fresh 4-year high of 2.953 per cent and the US dollar index jumped 0.5 per cent, weighing on commodities and the Aussie dollar.

The Fed minutes also said that while several officials said upside risks to the economy may have only increased, only “a couple” were worried about the economy overheating.

But “several participants cautioned that imbalances in financial markets may begin to emerge as the economy continued to operate above potential.”

After hitting a 2-week low of 16.97pc, the VIX index bounced to 20pc, leaving equities looking potentially volatile in the month ahead.

The S & P 500 seems to be rolling over after its biggest one-week rise in 5 years.

In that environment the S & P/ASX 200 looks capable of retesting its 200-DMA at 5845.

Index last 5943.7

Andrew White 9.53am: Perpetual’s Lloyd delivers parting profit

Perpetual has eked out a 3 per cent increase in net profit after growing funds under management and administration.

Delivering his final results as chief executive before he retires in June, managing director Geoff Lloyd said the $68.1m net profit was a “solid” result at a time when shareholders and customers alike valued consistency and returns.

“Over the half we have maintained our steadfast focus on protecting and growing Perpetual

for our clients — many of them multi-generational — our people and our shareholders.

Perpetual raised its interim dividend 4 per cent to $1.35 — read more

PEC last 2.6c cents

9.43am: ASX poised for steady start

The Australian share market looks set to open higher with Wall Street offered a positive lead despite some of its earlier strong gains ebbing closer to the close.

The benchmark share price futures index last indicated a flat start after earlier tipping gains of up to 34 points.

Wall Street pared earlier gains, the Dow Jones Industrial Average lost 0.7 per cent to close at 24,797.78. The broadbased S & P 500 shed 0.6 per cent to end the session at 2,701.33, while the tech-rich Nasdaq Composite Index dipped 0.2 per cent to 7,218.23.

Meanwhile, the Australian dollar tumbled a third of a cent against its US counterpart, heading toward the US78 cent mark.

The local currency was trading at US78.18 cents, from US78.52c yesterday.

AAP

Sarah-Jane Tasker 9.38am: Blackmores takes China growth dose

Vitamin company Blackmores has boosted its sales on the back of demand from China, contributing to 20 per cent interim net profit growth to $34 million but it warns the Australian market remains soft.

The Australian-listed company reported today that its group net sales were 9 per cent higher for the first half to $287m, adding it had increased its first half dividend by 15 per cent to $1.50.

“We’ve had two quarters of consistent sales growth and improved our profitability reflecting the delivery of our strategic priorities and greater stability in the business,” Richard Henfrey, chief executive of Blackmores, said.

Mr Henfrey said the first-half performance gave Blackmores a strong foundation for the full year — read more

BKL last $159.50

9.32am: Kogan profit lifts fivefold

Online retailer Kogan.com’s first-half profit has risen more than fivefold to $8.3 million.

Profit for the six months to December 31 rose from $1.5 million in the prior corresponding period as revenue soared 45.7 per cent to $209.6 million, primarily driven by customer growth and investments made in inventory and marketing.

Kogan declared an unchanged fully franked interim dividend of 3.9 cents and said revenue growth had further accelerated at the start of the second half — AAP

KGN last $7.23

Sarah-Jane Tasker 9.23am: Merck swoops on Viralytics

Global pharmaceutical giant Merck has swooped on Australian junior Viralytics in a $502 million deal to secure its immunotherapy cancer drug, which is based on a common cold virus.

MSD, which is the tradename for Merck outside of the US, has bid $1.75-cash-per-share, which is a 160 per cent premium to the one month volume weighted average price of Viralytics’ shares.

Viralytics’ flagship treatment is its Cavatak drug, which uses a formulation of a common cold virus that has been shown to preferentially infect and kill cancer cells — read more

VLA last 62c

9.14am: Ford exec ousted over allegations

Ford Motor Co. has ousted one of its top executives over allegations of inappropriate behaviour.

North America President Raj Nair is leaving the company effective immediately, Ford said in a statement. His replacement has not yet been named. Ford didn’t say what behaviour led to Nair’s departure. Ford investigated after a recent anonymous complaint about Nair was made to the company’s 24-hour hotline. “We made this decision after a thorough review and careful consideration,” said Ford President and CEO Jim Hackett. “Ford is deeply committed to providing a safe and respectful culture and we expect our leaders to fully uphold these values.” Nair expressed regret in a statement distributed by Ford.

“There have been instances where I have not exhibited leadership behaviours consistent with the principles that the company and I have always espoused,” Nair said.

AP

Samantha Woodhill 9.08am: Bellamy’s profit leaps, outlook steady

Infant formula company Bellamy’s has reaffirmed its full-year revenue guidance as it booked a bumper first-half net profit.

Revealing a net profit after tax of $22.4 million for the six months to 31 December, compared to $13.2m in the first half last year, the company said it’s on track to meet its full-year revenue growth target of within the range of 30 to 35 per cent growth on the 2017 fiscal year.

Earnings before interest, tax, depreciation and amortisation up to $34.9m compared with 10.4m in the first half last year.

The company did not declare an interim dividend, in line with the same period last year.

It comes as Chinese authorities consider the CFDA license application for its Camperdown manufacturing facility, in which Bellamy’s said it will acquire the remaining 10 per cent if the CFDA application is successful.

The Camperdown facility made an EBITDA loss of $1.4m for the first-half, impacted by a 33 day CNCA license suspension in July last year and the interval times relating to CFDA registration submissions — read more

BAL last $15.84

9.05am: Wall St falls in final minutes

Wall Street stocks tumbled into negative territory Wednesday after the minutes of the last Federal Reserve meeting revived worries about higher interest rates.

The Dow Jones Industrial Average lost 0.7 per cent to close at 24,797.78. The broadbased S & P 500 shed 0.6 per cent to end the session at 2,701.33, while the tech-rich Nasdaq Composite Index dipped 0.2 per cent to 7,218.23.

US stocks were in positive territory most of the session, but began falling about 40 minutes after the Fed released the minutes of last month’s policy meeting. The report showed central bankers believe the recent tax cuts could juice the economy more than expected in the near term, meaning further interest rate hikes likely will be needed.

The minutes kept the Fed on track to hike rates in March, which is “not new news, but confirmation” of expectations, said Art Hogan, chief market strategist at Wunderlich Securities.

Hogan said the weakness in equities coincided with a jump in the yield of the 10-year Treasury bond to a four-year high, reviving worries that higher rates could crimp growth and potentially prod more investors to exit equities in favour of bonds.

AFP

9.03am: Analyst rating changes

ARB raised to Outperform — Macquarie

WiseTech cut to SectorPerform — RBC

St Barbara raised to Overweight — JPMorgan

Sirtex cut to Neutral — UBS

Seven West cut to Hold — Morningstar

CC Amatil cut to Hold — Morningstar

NRW Holdings raised to Buy — Moelis

Lovisa cut to Hold — Morgans

Fairfax raised to Buy — UBS

Corporate Travel raised to Buy — UBS

APA Group raised to Neutral — Goldmans

A2Milk target price raised 61pc to $13.40; Buy rating kept — Bell Potter

BWX target price cut 25pc to $5.30; Hold rating kept — Bell Potter

Appen cut to Hold — Bell Potter

Melbourne IT raised to Buy — Bell Potter

Fairfax raised to Outperform — Macquarie

St Barbara raised to Neutral — Credit Suisse

Wesfamers raised to Neutral — Citi

SmartGroup raised to Buy — Citi

8.58am: Flight Centre preps for takeoff

Australian travel agency Flight Centre said half-year net profit rose by 37pc and upgraded its guidance for the full fiscal year.

The company said its net profit in the six months through December was $102.1 million. Revenue rose by 5pc to $1.37 billion while total transaction volume rose by nearly 9pc to about $10.1 billion, which the company said was a record.

The company declared an interim dividend of 60 cents per share, compared to 45 cents in the prior corresponding period.

Looking ahead, the company upgraded its underlying profit before tax expectations for the full fiscal year, saying it now believed that figure would come in between $360 million and $385 million, compared to previous guidance of $350 million and $380 million — read more

FLT last $50.07

Simon Benson 8.47am: Corman to trumpet tax cuts

Mathias Cormann will use his platform as the country’s Acting Prime Minister to escalate the government’s campaign to secure company tax cuts, writing to Senate crossbenchers and urging them to protect Australian jobs.

The direct plea to crossbenchers came as the International Monetary Fund yesterday warned that Australia was one of the highest taxing nations among the advanced economies and the rest of the world was moving to a lower tax environment.

Senator Cormann told The Australian he would use the “megaphone” of the Acting Prime Minister’s role, while Malcolm Turnbull was in Washington DC, to intensify the case for the Senate to act. “I will use the majority of the next five days of my acting prime ministership to promote the need for tax cuts,” he said.

8.39am: Wesfield books $1.6bn annual profit

Wesfield booked $1.6bn in annual net profit after tax, 13 per cent higher than the same result a year prior and brought home $707m in funds from operations (FFO) at the top end of guidance and in line with a consensus forecast by Bloomberg’s analyst survey.

WFD last $8.62

8.29am: Qantas in $378m buyback

Qantas has announced a $378m share buyback scheme alongside its interim results and a 7c per share interim unfranked dividend.

Profit rose 15 per cent in pre-tax underlying terms to $976m and 20 per cent to $857m in statutory terms, while $8.42bn in revenue came in slightly below a consensus forecast by Bloomberg’s analyst survey.

Qantas expects roughly 1 per cent full fiscal year growth in total group capacity to be driven by its international arm, forecasting a 1 per cent decline in its domestic capacity over the period.

QAN last $5.27

8.19am: Oil market braces for stocks read

Oil prices are little changed ahead of data expected to show rising crude inventories in the United States and as the dollar has strengthened from last week’s three-year lows.

Brent crude futures settled 17 cents, or 0.3 per cent, higher at $US65.42 a barrel, after trading between $US64.40 and $US65.53.

West Texas Intermediate crude (WTI) futures fell 11 cents, or 0.2 per cent, to end at $US61.68 a barrel, after trading between $US61.86 and $US60.92. US crude inventories were forecast to have risen for the fourth consecutive week, increasing 1.8 million barrels last week, an extended Reuters poll showed. Data on US inventories from the American Petroleum Institute will be released at 8.30am (AEDT) and government figures are due afterwards. Both reports were delayed a day due to a US holiday on Monday.

Rising US shale output should lead to a modest inventory build, said Stewart Glickman, an energy analyst at CFRA Research in New York “US shale continues to rise to the occasion,” he said.

Higher oil prices and rising output should feed increased investment in drilling and production, in turn boosting shale output more, he said. US crude oil production surpassed 10 million barrels per day (bpd) in November for the first time since 1970. Rising US shale output has hindered efforts by the Organization of the Petroleum Exporting Countries (OPEC) and other producers, led by Russia, to reduce bloated global inventories and prop up oil prices by cutting output.

Reuters

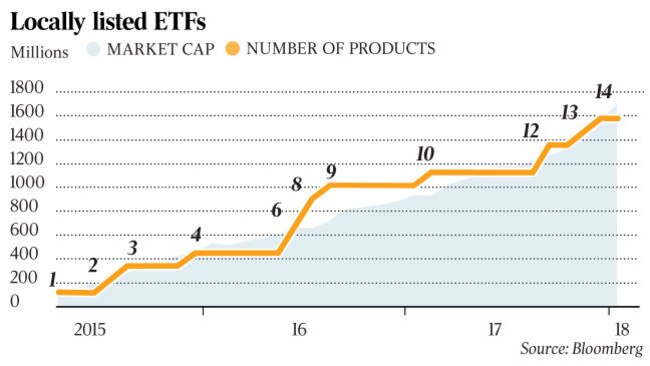

8.07am: ETFs: active funds to the masses

A proliferation of active ETFs on the ASX is bringing active funds management to the masses.

With the launch of two new income-oriented active ETFs — BetaShares Legg Mason Equity Income Fund (EINC) and Betashares Legg Mason Real Income Fund (RINC) — this week, there are now 16 of these products giving investors and their advisers access to some of the nation’s top-performing active share strategies as simply as buying shares on the ASX.

The rapid growth in active ETFs comes amid increasing demand for efficient, low-cost investments in the $3.27 billion Australian funds management industry, where 95 per cent of the funds are still actively managed despite the fact that at least 70 per cent of active fund managers fail to beat their benchmarks year after year.

Eli Greenblat 8.03am: Wesfarmers in tax cut camp

New Wesfarmers chief executive Rob Scott says he has “no doubt” lower company tax will flow through to workers’ wages, arguing Australian businesses are increasingly disadvantaged against their global rivals when it comes to taxation.

Mr Scott, who heads the nation’s biggest private sector employer, said he would advocate on behalf of his 230,000 staff who work across businesses including Coles, Bunnings, Officeworks and Kmart to refocus the attention of policymakers and the community on the vital issue of restoring a level playing field — read more

WES last $41.99

7.45am: US stocks pare gains

US stocks pared some of their gains as bond yields surged after minutes from the Federal Reserve’s January meeting showed officials plan to keep gradually raising short-term interest rates this year.

Investors have been particularly focused on economic data and commentary from central banks after concerns about rising inflation, higher government bond yields and tighter monetary policy helped trigger a stockmarket correction earlier this month.

Some money managers had feared that the central bank might move to raise rates more than the three times previously forecast for 2018.

But the minutes showed that while officials believed in January that the economy was set to grow faster than when they met at the end of last year, some remain worried inflation might continue to lag below the central bank’s 2pc target.

“It’s right on the same curve as they mentioned earlier,” said Chris Bertelsen, chief investment officer of Aviance Capital Management. “It was pretty much anticipated, but when the actual reality came out, it’s relief.”

Still, Mr Bertelsen said volatility is lurking after the recent correction.

In late trade the Dow Jones Industrial Average was recently up 14 points, or less than 0.1 per cent, at 24,979 after earlier rising as much as 300 points. The S & P 500 advanced 0.1 per cent, and the Nasdaq Composite added 0.4 per cent. Yesterday, the Dow Industrials and S & P 500 fell for the first time in seven sessions.

Prospects of a strong start to Australian trade also faded. At 7.45am (AEDT) the SPI futures index was up 12 points.

The yield on the benchmark 10-year US Treasury note rose to 2.943 per cent, a fresh four-year high, from 2.895 per cent Tuesday. Yields rise as prices fall.

Dow Jones

7.15am: Wall St rises after Fed

US stocks gained after minutes from the Federal Reserve’s January meeting showed officials plan to keep gradually raising short-term interest rates this year.

Investors have been particularly focused on economic data and commentary from central banks after concerns about rising inflation, higher government bond yields and tighter monetary policy helped trigger a stockmarket correction earlier this month.

Some money managers had feared that the central bank might move to raise rates more than the three times previously forecast for 2018.

But the minutes showed that while officials believed in January that the economy was set to grow faster than when they met at the end of last year, some remain worried inflation might continue to lag below the central bank’s 2 per cent target.

“It’s right on the same curve as they mentioned earlier,” said Chris Bertelsen, chief investment officer of Aviance Capital Management. “It was pretty much anticipated, but when the actual reality came out, it’s relief.”

The Dow Jones Industrial Average rose 185 points, or 0.7 per cent, to 25150. The S & P 500 advanced 0.7 per cent, and the Nasdaq Composite added 1.1 per cent. Yesterday, the Dow Industrials and S & P 500 fell for the first time in seven sessions.

Australian stocks are set to climb strongly at the open. At 7.15am (AEDT) the SPI futures index was up 30 points.

The yield on the benchmark 10-year US Treasury note edged down to 2.891 per cent, according to Tradeweb, from 2.895 per cent yesterday, slightly below last week’s four-year high. Yields fall as prices rise.

The WSJ Dollar Index, which tracks the US currency against a basket of 16 others, pared its gains and was recently down less than 0.1 per cent.

Despite stockmarket volatility earlier this month, many investors say robust corporate earnings and strong economic growth should help major stock indexes climb as the year goes on.

Nearly 80 per cent of S & P 500 companies that have posted earnings through Wednesday morning have exceeded analyst revenue expectations, the highest percentage since FactSet began tracking the metric in 2008. About 85 per cent of the firms in the index have reported results.

“As long as these fundamental factors remain in place, it’s really hard to poke holes in the argument that you should be in a risk-on mode at this point,” said Emily Roland, head of capital markets research at John Hancock Investments, referring to investors broadly favouring riskier investments such as stocks and commodities.

Elsewhere, the Stoxx Europe 600 inched up 0.2 per cent. Glencore was among the biggest gainers after the mining company said its net profit for 2017 rose sharply.

Dow Jones Newswires

7.00am: Aussie little changed

The Australian dollar is little changed against its US counterpart which has again risen helped by buoyant short-term US Treasury yields.

At 6.35am (AEDT), the Australian dollar was worth US78.50 cents, from US78.52c yesterday.

The dollar index, which measures the greenback against a basket of six major currencies, was up 0.14 per cent at 89.838, after hitting a one-week high of 89.998 earlier in the session, Reuters reported.

“Short-term Treasury (yields) have moved up fairly significantly overnight, reaching levels we had seen last during the Lehman crisis,” Reuters quoted currency strategist Sireen Harajli as saying.

“This higher push in yield has been beneficial for the dollar.” But the tide turned after the release of the Federal Open Market Committee minutes from the Federal Reserve, said Westpac’s Imre Speizer in a Thursday morning note.

“The USD index was mostly higher on the day, but flipped from a 0.2 per cent gain to a 0.1 per cent loss after the FOMC minute just released,” he said. “The AUD underperformed, falling from 0.7880 to 0.7830, but bounced to 0.7879 post-FOMC minutes.”

No major event risks for the local currency are on the horizon today. Mr Speizer said he thought the Australian dollar “should remain under downward pressure today, towards 0.7800, given the recently firmer US dollar”. The Aussie dollar is down against the yen and the euro.

AAP

6.45am: Fed minutes released

US central bankers said the recent tax cuts could juice the economy more than expected in the near term, meaning further interest rate hikes likely will be needed, according to meeting minutes released today.

But the minutes also revealed a split on the Federal Reserve’s policy-setting committee, with some officials saying the central bank can afford to be patient in raising the benchmark lending rate, according to the minutes of the January 30-31 meeting.

Despite the expectations for an economic boost from the December tax cuts, the minutes stressed that the impact remains uncertain.

AFP

6.40am: US dollar up ahead of Fed minutes

The US dollar continued its discreet recovery overnight, lifted by expectations that the American central bank is shifting towards tightening monetary policy quickly, dealers said.

All eyes were on the publication of minutes of the latest Federal Reserve meeting which Fed watchers will dissect in their search for insights into the central bank’s thinking.

All things being equal, higher interest rates bolster the dollar as holding the currency becomes more attractive.

The weaker pound, in turn, boosted London stocks, with the FTSE outperforming its European peers.

Paris posted small gains at the close, but Frankfurt fell “after a string of disappointing” eurozone manufacturing numbers, noted Connor Campbell, financial analyst at Spreadex trading group.

The share prices of mining giant Glencore and Lloyds Banking Group enjoyed solid gains following well-received earnings updates.

Elsewhere, both main oil contracts were lower as a stronger dollar hit recent gains for crude.

AFP