ETFs bring active funds to masses

A proliferation of active ETFs on the ASX is bringing active funds management to the masses.

A proliferation of active ETFs on the ASX is bringing active funds management to the masses.

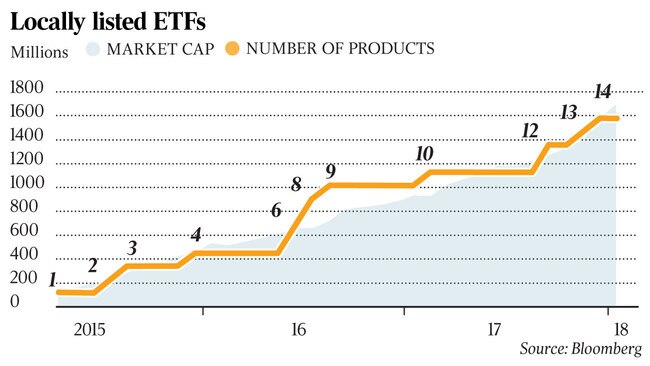

With the launch of two new income-oriented active ETFs — BetaShares Legg Mason Equity Income Fund (EINC) and Betashares Legg Mason Real Income Fund (RINC) — this week, there are now 16 of these products giving investors and their advisers access to some of the nation’s top-performing active share strategies as simply as buying shares on the ASX.

The rapid growth in active ETFs comes amid increasing demand for efficient, low-cost investments in the $3.27 billion Australian funds management industry, where 95 per cent of the funds are still actively managed despite the fact that at least 70 per cent of active fund managers fail to beat their benchmarks year after year.

“Active investing is here to stay, but we are seeing a realignment of the way money is invested,” BetaShares MD Alex Vynokur told The Australian. “The technology and innovation behind exchange-traded funds has in recent years been extended to incorporate not only index-based strategies — whether they be market capitalisation or smart beta indices — but also active fund managers.”

From an investor’s perspective it means that an entire portfolio can now be constructed out of ETFs, both across asset classes and across passive and actively managed funds. And rather than pay the minimum $30,000 required to invest in the unlisted versions of Legg Mason’s funds, for example, investors can buy the listed versions with a minimum of funds and paperwork.

Indeed the surge in active ETFs since 2015 may mark a tipping point for the industry.

BetaShares’ Vynokur says the co-branded products started this week could be the first of many.

“We are definitely intending to do more with Legg Mason and we have also been contacted by a significant number of active managers. At the end of the day we’re happy to work with quality asset managers that are aligned in we are about and what they want to achieve.

“Firms like Legg Mason and AMP Capital are very much actively-managed specialists and they are good examples of where we can collaborate to deliver much better outcomes for customers.”

Once the exclusive domain of passive managers, because of the passive exposures and low-cost investing they allowed, ETFs are increasingly being offered by active managers for their liquidity, intraday pricing, transparency and ease of access.

“ETFs are democratising investing, there’s no question about that,” Vynokur says. “But ultimately, as an actively exchange traded fund you’ve got liquidity and price certainty as opposed to the uncertainty involved in making a redemption from an unlisted fund.

“The wonderful thing about an exchange traded product is that you have more control over your investment, you can transact at any time, you have certainty of the price, and the benefit of being able to buy and sell at fair value.”

In a sell-off like the volatility storm that hit markets this month, active ETFs might allow better opportunities to sell in the early stages of a downturn and buy when the market is cheaper.

“Active managers ultimately realise that the way people prefer to invest today is very different to the way they did last century,” Vynokur says. “It’s really about a more user-friendly experience.”

Indeed, active ETFs have broad-based appeal for both retail and institutional investors.

“We are seeing a significant increase in demand for active ETFs both in Australia and globally from institutional investors because they face exactly the same issues as retail investors. “Institutions typically invest through mandates that they award to managers, or they may trade certain exposures on a swap with a counterparty, and a lot of the paperwork and processes that are involved can be made more efficient thanks to the development of the exchange traded funds industry.”

Indeed, he argues that the biggest winners from the growth of ETFs won’t just be the passive or index managers, but the funds management industry as a whole.

“Active management is going through a period of change and that will have some winners and losers. Firms like Legg Mason have a clear recognition that the way people are investing today is not the same as the way they were investing 100 years ago.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout