Trading Day: live markets coverage; Dollar drama in retail, tech gripe; plus analysis and opinion

The ASX seals a two-and-a-half year high, while the dollar falls on retail woes as Barclay’s points the finger.

And that’s the Trading Day blog for Friday, November 3.

Samantha Woodhill 4.33pm: Stock seal fresh 2.5y high

The local share market sealed a two-and-a-half-year high after shying from the milestone in the session previous.

The benchmark S&P/ASX200 was up 28.193 points, or 0.48 per cent, at 5959.9 points. The broader All Ordinaries index was up 28.144 points, or 0.47 per cent, to 6030.3 points at the close.

AMP Capital chief economist and investment strategy head Shane Oliver said the local market remains in a “sweet spot” in the investment cycle, benefiting from solid global growth and improving profits but still benign monetary conditions.

“We remain of the view that the broad trend in share markets will remain up,” he said.

“Australian shares are likely to continue to participate in the global share rally, but remain a relative laggard thanks to a more constrained earnings outlook.”

NAB lost 0.53 per cent to $31.78. Commonwealth Bank ticked up 0.49 per cent to $77.79. Westpac edged up 0.82 per cent to $33.27 and ANZ climbed 0.23 per cent to $29.90.

Genworth Mortgage Insurance shed 1.06 per cent to $2.81 after it posted a 31 per cent third-quarter profit fall year-on-year — more to come.

4.10pm: Jobs market fails to spur spending: Barclays

Consumer spending remains anaemic despite improving labour market conditions, according to Barclays.

While spending in cafes & restaurants and departmental stores improved, household goods, other retailing and clothing remained weak.

“The entry of foreign e-commerce retailers continues to have a negative impact on inflation, as well as on sales through traditional brick-and-mortar shops,” Barclays economist Rahul Bajoria says.

He expects the RBA to wait for signs of a more broadbased recovery across businesses and household incomes before signalling any change in policy stance.

In his view the RBA will stay on hold until in the first half of 2018 before hiking in August and November.

4.07pm: DATA: Retail sales disappoint

September retail sales were unchanged versus a 0.4pc rise expected by economists.

September quarter real (inflation adjusted) retail sales rose 0.1pc versus an expected flat result for the quarter, while August retail sales were revised up to a fall of 0.5pc vs. 0.6pc fall first reported.

Monthly retails sales have been weaker than expected for the last three months.

AUD/USD dropped from $US77.15 to $US76.86 on the data release, recovering slightly to trade at US76.90 cents ahead of the closing bell.

4.05pm: “Unambiguously bad” retail picture: Westpac

Disappointing retail sales data today paint an “unambiguously bad” picture for retailers, according to Westpac.

Westpac economist Matthew Hassan notes that retailers are “cutting prices but finding no traction with volumes.”

However, he adds that the picture is not quite as bad for consumers who get some advantage from lower prices and do not look to be cutting back on consumption quite as sharply as feared.

“The wash-up still points to marginal downside risks to the wider consumption estimates in the Q3 national accounts to be released December 6,” he says.

4.03pm: WATCH: NAB chief Thorburn joins Ticky

.@NAB CEO Andrew Thorburn says the reshaping of NAB will be handled very carefully. MORE: https://t.co/EDtpEQQ0PX #ticky pic.twitter.com/lq1p5pJJvl

— Sky News Business (@SkyBusiness) November 2, 2017

.@NAB CEO Andrew Thorburn: Banks are long-term institutions so they need long-term plans. MORE: https://t.co/EDtpEQQ0PX #ticky pic.twitter.com/VGfrAvufOC

— Sky News Business (@SkyBusiness) November 2, 2017

Read: NAB wield axe despite $6.6bn profit, writes Michael Roddan

Read: NAB sackings just the start, writes Robert Gottliebsen

3.53pm: Sneak peak: best red under $25

In a sneak peak at critic James Halliday’s top 100 wines of 2017, The Weekend Australian reveals the list’s top rated red under $25 here

3.42pm: ASX hold gains as Rio hits 6y high

Local shares hold firm gains in late trade, the S&P/ASX200 up 0.6 per cent at 5957 less than 30 points shy of a post GFC-closing high of 5982.7.

Rio Tinto trades near the 6-year high of $73.25 it hit in early trade, BHP remains over 1 per cent in the black, while most major bank shares have swung around to post gains except for NAB (-0.4pc).

“We are disappointed ... as [NAB’s] new FY20 cost guidance ($8.0bn to $8.25bn) is 1.5pc to 4pc higher than our prior forecasts,” says Mr. Mott.

“NAB’s previous cost initiatives appear to have been ineffective, and much of this investment looks to be catch-up spend.”

SWING STOCKS:

+ Sandfire Resource (6.9pc), Whitehaven Coal (4pc), Regis Resources (3.3pc) and Vocus (3.8pc)

— Mayne Pharma (5.6pc), A2 Milk (3.7pc), Nanosonics (2.6pc) and Aconnex (2.6pc)

52-WEEK HIGHS & LOWS:

+

Rio Tinto ($75.53)

Macquarie ($99.75)

CIMIC ($50.40)

Orocobre ($5.60)

Caltex ($35.20)

—

Trade Me Group ($3.84)

Mayne Pharma (63c)

Seven West Media (61c)

Southern Cross Media ($1.06)

3.34pm: NAB a ‘tactical’ sell: Morgan Stanley

Morgan Stanley analyst Richard Wiles has flagged a fall in NAB shares versus the S&P/ASX 200 in the next 60 days.

This “Research Tactical Idea” means that he’s flagging NAB shares as a short selling opportunity for hedge fund clients.

He notes that while NAB delivered a solid 2H17 result, management surprised with a new long-term plan involving a 50 per cent increase in annual investment spending.

“We expect this to drive downgrades to FY18E consensus estimates, and lead investors to reassess NAB’s earnings growth profile and ROE outlook,” Wiles says.

“At the same time, we see little margin for error on loan losses, capital or the dividend.”

He also notes that NAB shares have outperformed in the past 6 months and its P/E of about 13 times is one standard deviation above the post 2009 average.

“As such, we think it will underperform in the near-term,” Wiles adds strategists say.

NAB last down 0.5pc at $31.79

3.28pm: NAB playing ‘catch-up’, sell: UBS

NAB appears to be behind the curve, according to UBS, the bank’s newly announced cost initiatives revealing its operational starting position is “worse than we had believed.”

NAB revealed a $6.6bn fiscal year profit yesterday and alongside results announced $1.5bn in new investment, including a 4,000 strong reduction in the workforce, bringing forward analyst consensus cost forecasts, including that of UBS’ Jonathon Mott.

“We are disappointed by this announcement as its new FY20 cost guidance ($8.0bn to $8.25bn) is 1.5pc to 4pc higher than our prior forecasts,” says Mr. Mott.

“NAB’s previous cost initiatives appear to have been ineffective, and much of this investment looks to be catch-up spend.”

Business disruption, NAB’s weak starting point and the fact that competitors are not standing still collectively leave Mr. Mott sceptical of NAB’s anticipated revenue synergies.

UBS increases its 12-month target price on NAB shares to $29.00 from $27.50 on the back of the bank’s results, but maintains its ‘sell” rating.

NAB last down 0.5pc at $31.79

Samantha Woodhill 3.12pm: Public sector veteran takes Austrac helm

Justice Minister Michael Keenan has announced Nicole Rose as incoming Australian Transaction Reports and Analysis Centre CEO.

Ms Rose, who is currently the Australian Criminal Intelligence Commission chief executive, will begin the role with AUSTRAC on 13 November.

Ms Rose previously served as the director of the Office of the New South Wales Police Commissioner and as the deputy secretary for Criminal Justice Group at the Attorney-General’s Department — more to come.

Eli Greenblat 3.02pm: Lew lights fuse on Myer proxy war

Retail billionaire Solomon Lew has lit the fuse on a proxy war with the Myer board after this morning writing to Myer shareholders requesting their proxy vote to take his fight with Myer to the retailer’s annual general meeting later this month where he will vote against the election of all directors, the adoption of the remuneration report and bonuses to CEO Richard Umbers.

Mr Lew also tagged Mr Umbers attempt to recast and redefine his New Myer strategy this week as “dead on arrival’’.

In a ratcheting up of the heat and increasingly bitter battle between Myer and its biggest shareholder, Mr Lew’s Premier Investments, it looks like animosity will now break out on the floor of the AGM on November 24 as Mr Lew calls on shareholders to rally to his cause — more to come

2.43pm: ‘On the ropes’ retail raises GDP concern

Weak real retail sales data today suggest “the retail sector is on the ropes” and that overall GDP growth slowed to around 0.5pc in Q3 from 0.8pc q/q in Q2, according to Capital Economics.

The data show that retail sales values fell by 0.3pc q/q in the September quarter, and it was only because retailers decreased prices by 0.4pc q/q that sales volumes rose by 0.1pc q/q.

“In other words, retailers discounted by more than usual and didn’t get much of a return from it,” Capital Economics chief economist Paul Dales says.

He notes that department store sales values rose 2.1pc m/m in September, while restaurants rose just 0.3pc m/m gain after falling the past two months.

Clothing sales fell for the third month in a row, down 0.7pc m/m, and household goods fell for a third month due to the weaker housing market.

“Thankfully, the evidence suggests that real spending outside of retail held up well in Q3, so consumption growth may have only slowed from 0.7pc q/q in Q2 to around 0.4pc q/q in Q3,” Mr Dales says.

“But these data show that faster jobs growth is not offsetting the pressure on household incomes from low wage growth, rising utility bills, high debt and stagnating house prices.”

2.15pm: Westpac confirms Hastings sale to Northill

Westapac has confirmed it has struck a deal to sell its global infrastructure manager Hastings to British private-equity group Northill.

The deal was first flagged in The Australian’s DataRoom on Wednesday.

Hastings is expected to announce an EGM in which shareholders will have an opportunity to voice potential concerns over the prospective new owner.

More to come.

Samantha Woodhill 1.37pm: ASX top 50 double pre-tax profits

Australia’s top 50 listed companies more than doubled their pre-tax profits last financial year, pushed higher by strong gains from the miners and a decline in impairments.

Profits in the ASX top 50 companies soared 103 per cent to $120.8 billion in the 12 months through June, according to a KPMG study of company annual reports.

Impairment charges fell to $14.1bn, down sharply from 2016’s $38.5bn. While falls in commodity prices were the main trigger for impairments in 2016, this year the largest impairments involved oil and gas assets in the energy and utilities sector.

Bridget Carter 1.30pm: Fort St’s McKnight switches sides

Fort Street Advisers restructuring banker Jim McKnight has joined rival firm Houlihan Lokey in Sydney.

It follows the departure of David Tozer from the Sydney office of Houlihan Lokey recently.

Mr Tozer worked on various deals such as Emeco, Imdex, Onsite Rentals and Bis Industries — read more from DataRoom.

1.03pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Jun Bei Liu — Tribeca, Ben Le Brun — OptionsXpress

1.50pm: Yvonne Mann — Bloomberg Asia

(All times in AEST)

11.28am: ASX hits fresh 2.5y high

Australia’s S&P/ASX 200 share index has climbed 0.5pc to 2.5-year high of 5961.8.

The rise is consistent with that indicated by overnight SPI 200 futures relative to fair value.

It is being helped by gains in US stock index futures, as Apple is up 3.1pc in after-hours trading.

It is also being helped by lingering strength in commodities, with Nymex futures crude rising as much as 0.9pc.

Gains remain broadbased with all sectors except Telcos in the green.

But while three of the four major banks are up, NAB continues to falter.

Telstra and Macquarie are also slightly in the red.

11.23am: DATA: Retail sales due 11:30am AEDT

Retail sales data due at 11.30am (AEDT)

Bloomberg’s consensus estimate is for a 0.4pc m/m rise in September.

September quarter retail sales are expected to be flat.

Retail sales have been surprisingly weak in recent months.

Sue Neals 11.05am: Bubs takes a ride on goats milk

Specialist goat’s milk infant formula company and organic baby food manufacturer Bubs Australia has announced the acquisition of Australia’s biggest goat dairy farming and fresh milk business, Caprilac for $25 million.

Gippsland-based Caprilac, owned by John Gommans, runs the largest dairy goat herd in Australia, with 6500 dairy goats milked daily to produce milk for Caprilac’s well known Nulac Food s and fresh goats’ milk brand.

The purchase — which equates to the acquisition of half of Australia’s total goat milk production — includes an additional 2,000 milking goats in New Zealand also owned by Mr Gommans — read more

BUB last up 7.5pc on 86 cents

10.58am: ASX up amid fresh Dow highs

Australia’s S&P/ASX 200 share index is up 0.4pc at 5956.2 after the DJIA hit a fresh record high.

Gains are broadbased with all sectors bar telecommunications in the green.

Sandfire resources is strongest with a 7.2pc rise on broker upgrades.

OZ Minerals is up 3pc after Credit Suisse upgraded to Neutral.

But a few key heavyweight stocks are in the red.

NAB is down 0.2pc after Morgan Stanley flagged it as a selling opportunity.

Telstra is down 0.6pc after Citi slashed its target price and stayed Underweight.

Macquarie is down 0.2pc on what looks like profit taking near $100 a share.

10.26am: ASX lifts, miner strength spills over

The local sharemarket lifts decisively in early trade as big miners BHP (+1pc) and Rio (+0.5pc) offset weakness in the big four banks, down between 0.3pc and 1pc.

“There was strong support for the major Australian mining stocks yesterday, the extent to which that carries over will be one of the key features of today’s trading,” said CMC chief markets analyst Ric Spooner ahead of the open.

SWING STOCKS:

+ Sandfire Resource (5.1pc), Sims Metal (2.8pc), Seven West Media (2pc) and Fairfax (1.8pc)

— Mayne Pharma (4.5pc), Orocobre (3.1pc), Nanosonics (2.8pc) and South32 (1pc)

Bridget Carter 10.08am: Gripe to stoke Hastings EGM

Hastings Funds Management shareholders are believed to be calling an extraordinary general meeting over owner Westpac Banking Corporation’s decision to sell the infrastructure manager to British-based private equity firm Northill Capital.

Hastings controls the $5.6 billion Utilities Trust of Australia fund which owns stakes in some of Australia’s most critical infrastructure assets.

These include the Electranet in South Australia, the NSW electricity transmission network TransGrid, the state’s property registry business, the Port of Portland, Perth Airport Melbourne Airport.

The thinking is that some of the 50-odd investors in the Hastings-run UTA may be satisfied with Northill as its manager in terms of the fees it will charge to run the fund, but not in terms of its capabilities.

An EGM is now expected to be called and while the investors, which includes groups such as Cbus, Hesta and Victorian Funds Management Corporation, do not have the power to dump Hastings as manager, it is understood that the meeting will be called for them to voice their concerns — more to come from DataRoom

9.55am: ASX eyes firm bite of the Apple

Australia’s S&P/ASX 200 share index is expected to open up 0.5pc based on overnight SPI 200 futures versus fair value.

That suggests it could make a fresh 2.5 year high above Wednesday’s intraday peak at 5961.5.

BHP ADR’s equivalent close at $27.72 equates to a 1.4 per cent rise in BHP shares today.

And while gains in Apple may drive further gains on Wall Street tonight — the stock up 2.6pc in after-hours trading on a stronger-than-expected result — US non-farm payrolls data are also due.

The Australian share market also faces domestic retail sales data at 11.30am (AEDT).

Brent crude oil edged up 0.2pc to a fresh 28-month high of $60.62 and iron ore rose 0.7pc to $US59.79.

The FTSE 100 rose 0.9pc as Sterling fell 1.4pc after the BOE hiked rates but indicated limited scope for further tightening.

The S&P 500 and Nasdaq were flat but the DJIA rose 0.4pc to a fresh record closing high of 23516.26.

Boeing, United Technologies, Goldman Sachs, Microsoft, Macdonald’s and Wal-Mart rose at least 1pc.

S&P/ASX 200 last 5931.7

9.43am: TPG stung $350k for text spam

Simone Ziaziaris writes:

TPG Internet (TPM) has paid a $360,000 fine for spamming customers who had unsubscribed from the telco’s SMS messages.

An Australian Communications and Media Authority investigation found TPG’s systems were not properly processing unsubscribe requests during April, resulting in the telco continuing to send messages to customers who had withdrawn their consent.

ACMA chair Nerida O’Loughlin said TPG’s fine serves as a reminder to anyone who conducts email or SMS marketing to make sure the systems they have for maintaining their marketing lists are working well and comply with the act.

AAP

Simon Benson 9.40am: Chaos takes toll on business

A Treasury report has warned that corporate Australia is blaming a decade of political instability for contributing to an investment slump, as Scott Morrison issues a call for businesses to fuel the new investment boom in the health and education sectors.

A Heads of Treasury report commissioned last year by the Council on Financial Relations reveals the business community is still “scarred” by the global financial crisis a decade on and remains gripped by political uncertainty and high energy prices while suffering from an aversion to risk in boardrooms.

9.35am: Genworth third-quarter profit falls

Genworth Mortage Insurance third-quarter profit fell by 31 per cent on the same period a year prior to $46.7m, while gross written premium fell by 3.9 per cent on the same basis to $95.2m.

Alongside results, the company has upgraded its full year loss ratio guidance to a range between 35 to 40 per cent from that between 40 to 50 per cent forecast previously.

“Our profitability remains strong in light of the small high loan-to-value ratio (LVR) market and continued development of losses in mining areas,” says the company.

“[However] mortgage interest rate increases, particularly for investor and interest only loans, and recent changes to minimum bank equity requirements may also impact price growth this year” — read more

GMA last $2.84

9.32am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: James Dunn — Dunn Media

9.45am: Kurt Mayell — CMC Markets

10.00am: Evan Lucas — The Lucas Report

10.15pm: Michael Blythe — Chief Economist, CBA

10.30pm: Live cross — Shaw and Partners

(All times in AEST)

9.22am: Analyst rating changes

NAB cut to Hold — Shaw & Partners

NAB target price (12m) raised to $32.25 vs. $31.00; Neutral rating kept — Citi

Pilbara Minerals cut to Neutral — 12m target price raised to 95c vs. 68c — Citi

Woodside cut to Hold at Morningstar

Domino’s Pizza initiated at Neutral; $51.53 target price — Credit Suisse

OZ Minerals raised to Neutral; target price raised to $7.90 vs. $7.30 — Credit Suisse

Sandfire raised to Neutral — Credit Suisse

Sandfire raised to Buy — Goldman Sachs

Independence Group cut to Sell — Goldman Sachs

Blue Sky Alt cut to Hold — Morgans

9.15am: Bulls to run all next year: JPMorgan

John Normand thinks 2018 will be another good year for shares, but 2019 will be challenging.

JPMorgan’s London-based head of FX, commodities and international rates research says investors face a global bear market in government bonds for the first time since the late 1990s.

Further interest rate rises and balance sheet shrinkage by the Federal Reserve — potentially magnified by fiscal loosening — together with increased tapering of quantitative easing by the European Central Bank and the Bank of Japan are likely amid synchronised economic growth.

Normand says that’s fuelling concern about the outlook for stocks, credit and emerging markets, but thankfully real interest rates are very low and the global economy has a good head of steam.

Australia’s S&P/ASX 200 share index briefly touched a fresh 2½-year high of 5961.5 points in opening trading yesterday before closing down 0.1 per cent at 5931.7. It has risen 4.7 per cent this year, or 8.5 per cent including dividends. The US S&P 500 is up 15.2 per cent, or 17 per cent with dividends.

Darren Davidson 9.03am: Media mergers on hold: Stokes

Media companies have hit the pause button on mergers and acquisitions partly because of US media giant CBS’s surprise takeover of Ten Network, according to Kerry Stokes.

Australia’s media sector was poised for a wave of mergers after legislators agreed to the most sweeping shake-up of ownership controls in decades, but a flurry of deals has not yet eventuated.

Bridget Carter 9.00am: Northill closes in on Hastings claim

Northill Capital is believed to have won the Westpac run auction for Hastings Funds Management.

However, Hastings investors are said to be unhappy about being run by the global private equity firm and are planning to challenge the decision.

It follows a prolonged sales process where Charter Hall was at one stage bidding for the asset and later Morrison.

Read more from DataRoom

8.55am: Apple eyes record revenue

Tripp Mickle writes:

Apple extended its year-long rebound in the latest quarter thanks to rising iPhone demand, and the tech giant projected record revenue in the current quarter driven by sales of its highest-priced iPhone model ever.

Shipments of the company’s flagship product rose 2.6 per cent from a year earlier to 46.7 million units. Demand for the iPhone, which accounts for about two-thirds of total sales, along with an upturn in sales of Mac computers and iPad tablets helped Apple deliver its fourth consecutive quarterly increase in revenue and third quarterly increase in profit. Sales in China, a critical market for Apple, rose for the first time since early 2016 — read more from the Wall Street Journal

Note: Apple shares closed flat on Wall St ahead of its quarterly results, now trading as much as 3.7 per cent in after hours trade following the release.

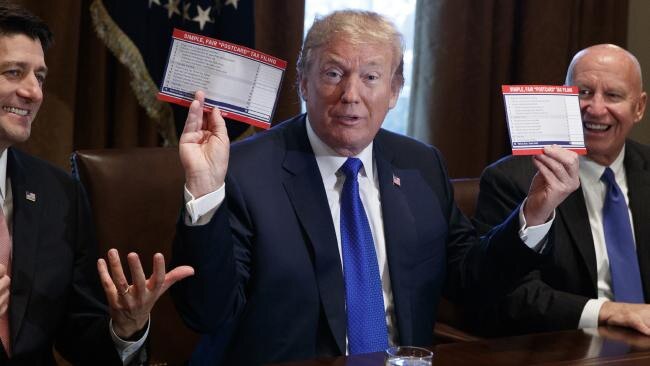

8.50am: Big US tax cut plan unveiled

Richard Rubin writes:

House Republicans in the US, seeking the biggest transformation of the US tax code in more than 30 years, aim to permanently chop the corporate tax rate from 35 per cent to 20 per cent, compress the number of individual income tax brackets, and repeal the taxes paid by large estates starting in 2024, according to a detailed summary of the plan reviewed by The Wall Street Journal.

The GOP plan repeals the deduction for state and local income and sales taxes. It allows a deduction for property taxes, but caps it at $US10,000. That limit applies to married filers and individuals — read more

Wall Street Journal

Michael Roddan 8.25am: NAB wields axe despite profit

National Australia Bank chief executive Andrew Thorburn says the lender has to “get angry about costs in a sustainable way” as he reveals plans to axe 6000 workers over three years, or about one-fifth of the bank’s workforce.

The shock plan to automate away frontline staff and roles within the bank came as the lender handed down a bumper $6.64 billion annual cash profit, which was up 2.5 per cent over the year to the end of September.

“What we’re doing is we’re simplifying the bank,” Mr Thorburn said yesterday. “And as we simplify, we automate processes and things move to digital channels. We will need less people” — read more

NAB last $31.95

8.10am: WATCH: NAB chief Thorburn joins Ticky

.@NAB CEO Andrew Thorburn says the reshaping of NAB will be handled very carefully. MORE: https://t.co/EDtpEQQ0PX #ticky pic.twitter.com/lq1p5pJJvl

— Sky News Business (@SkyBusiness) November 2, 2017

.@NAB CEO Andrew Thorburn: Banks are long-term institutions so they need long-term plans. MORE: https://t.co/EDtpEQQ0PX #ticky pic.twitter.com/VGfrAvufOC

— Sky News Business (@SkyBusiness) November 2, 2017

7.52am: ASX tipped to lift at open

The Australian market looks set to open comfortably higher following a mainly positive performance on Wall Street.

At 7am (AEDT), the share price futures index was up 19 points, or 0.32 per cent, at 5,939.

In the US, House of Representatives Republicans released proposals to overhaul the tax code which will slash the corporate tax rate to 20 per cent, from 35 per cent and reducing the number of tax brackets for individuals. The US dollar fell afterwards but later clawed back some ground with the dollar index ending the day down 0.1 per cent.

In equities, the Dow Jones Industrial Average rose 0.35 per cent, the S&P 500 gained 0.02 per cent but the Nasdaq Composite fell 0.02 per cent. Locally, in economic news on Friday, the Australian Bureau of Statistics is expected to release September retail trade figures.

No major equities news is expected.

The Australian market on Thursday closed lower as investors sold off National Australia Bank shares despite its strong profit result.

The benchmark S&P/ASX200 index fell 6.1 points, or 0.1 per cent, to 5,931.7 points.

The broader All Ordinaries index lost 3.3 points, or 0.05 per cent, to 6,002.2 points.

Meanwhile, the Australian dollar is slightly higher than its US dollar which has weakened following the release of President Donald Trump’s tax reform proposal. The local currency was trading at US77.15 cents at 7.53am (AEDT) on Friday, from US77.12c on Thursday.

AAP

7.28am: Dollar lifts against greenback

The Australian dollar is slightly higher against its US counterpart after the greenback fell following the release of President Donald Trump’s tax reform proposal.

At 7.32am (AEDT), the Australian dollar was worth US77.16 cents, up from US77.12c on Thursday.

The US dollar fell to its lowest in a week against a basket of major currencies on Thursday after Republicans in the US House of Representatives released proposals to overhaul the tax code.

The legislation called for slashing the corporate tax rate to 20 per cent from 35 per cent and reducing the number of tax brackets for individuals, according to a summary document obtained by Reuters.

The Aussie dollar is also higher against the yen and the euro.

AAP

7.11am: US oil prices tap two-year high

US benchmark crude oil eked out a modest gain, with optimism surrounding OPEC’s efforts to rebalance the market and last week’s declines in US crude and crude-product supplies helping prices score their highest finish in more than two years.

December West Texas Intermediate crude added 24 cents, or 0.4 per cent, to settle at $54.54 a barrel on the New York Mercantile Exchange. That was the highest since July 2015, according to FactSet data.

Dow Jones

7.08am: Wall St wavers as traders digest tax plan

Stocks wobbled and bonds strengthened as investors assessed House Republicans’ proposal for the biggest tax code overhaul in decades.

The Dow Jones Industrial Average fell more than 80 points after a detailed summary of the tax plan was reported, but the blue-chip index recovered later in the day to move higher. Declines in shares of home builders and other consumer-discretionary stocks kept pressure on the S&P 500.

The S&P 500 was little changed, while the Nasdaq Composite shed less than 0.1 per cent. The Dow industrials rose 81 points, or 0.4 per cent, to 23516.

Shares of consumer-discretionary stocks in the S&P 500 slid 0.8 per cent.

Home builder Lennar fell 3.3 per cent, while PulteGroup shed 1.1 per cent. Home-improvement companies were dragged down too, with Home Depot shares falling 1.6 per cent and Lowe’s declining 4.1 per cent.

Dow Jones

6.45am: Big US corporate tax cuts on the cards

House Republicans, seeking the biggest transformation of the US tax code in more than 30 years, aim to permanently chop the corporate tax rate from 35 per cent to 20 per cent, compress the number of individual income tax brackets, and repeal the taxes paid by large estates starting in 2024, according to a detailed summary of the plan reviewed by The Wall Street Journal.

The GOP plan repeals the deduction for state and local income and sales taxes. It allows a deduction for property taxes, but caps it at $10,000. That limit applies to married filers and individuals.

To partly offset that lost revenue, Republicans plan to curtail the deductions individuals take for state and local tax payments and the ones businesses get for the interest they pay on debt. But the plan released Thursday morning stops short of touching other popular tax breaks that were being considered for change, such as the ability of individuals to park up to $18,000 a year in pretax funds into 401(k) savings accounts.

Dow Jones

6.34am: Trump picks Powell for Fed chair

President Donald Trump formally announced Thursday that he would nominate Federal Reserve governor Jerome Powell to be the next chairman of the central bank, saying he has the “wisdom and leadership” to guide the economy through any turbulence that arises.

Mr Trump introduced Mr Powell in a brief ceremony in the Rose Garden outside the White House.

“If I am confirmed by the Senate, I will do everything in my power to achieve our congressionally assigned goals of stable prices and maximum employment,” Mr Powell said.

If he wins Senate confirmation, Mr Powell will succeed the incumbent Fed chairwoman, Janet Yellen.

6.28am: Bank of England hikes rates

The Bank of England raised its benchmark interest rate Thursday, a telegraphed move that represents the latest small but significant step by the world’s major central banks to withdraw crisis-era stimulus.

The BOE lifted its policy rate to 0.5 per cent from 0.25 per cent previously, and signalled two more increases are likely through the end of 2020.

6.15am: European markets turn south

European stocks ended lower on Thursday, with shares of many exporters under pressure as the euro increased in value. British blue chips, however, climbed as the Bank of England struck a dovish note even as it raised borrowing costs for the first time in a decade.

The market continued to have plenty of corporate earnings reports to consider, with Swiss lender Credit Suisse Group saying its profit climbed.

The Stoxx Europe 600 index fell 0.5 per cent, pulling back after the pan-European benchmark closed at a more-than two-year high on Wednesday after five straight sessions of gains.

In Frankfurt, the DAX 30 index gave up 0.2 per cent following its all-time closing high on Wednesday. The UK’s FTSE 100 charged up 0.9 per cent and France’s CAC 40 slipped 0.1 per cent.

Dow Jones

6.10am: Asian markets end mixed

Though stock indexes in South Korea and Japan posted 2017 bests early on, it was only the Nikkei which finished higher and that was thanks to a last-hour rally in Tokyo.

As the Nikkei 225 finished up 0.5 per cent, Korea’s Kospi fell 0.4 per cent.

The divergences spoke to Thursday’s action throughout Asia as there was no broad market driver, allowing local developments to move equities in those locales.

Chinese stocks lagged amid worries about potential default increases from interest rates firming globally.

Dow Jones