Trading Day: live markets coverage; Crown shares fall to 2017 low; plus analysis and opinion

The ASX extends a winning streak, while Crown falls to a year-to-date low as criminal conduct allegations surface.

Welcome to Trading Day for Wednesday, October 18.

Eli Greenblat 4.55pm: Reject Shop’s dour sales eye break

The Reject Shop has testified to the tough conditions swirling around the $300 billion retail sector since the beginning of the year, revealing that its first quarter sales for 2018 were negative, but that sales at its stores had steadily improved since August to be almost back into growth by October.

However, the dour assessment of trading conditions for the first quarter feeds into growing commentary from retail industry experts that shoppers remain cautious and unwilling to spend money, with Specialty Fashion Group issuing a profit warning today after reviewing its own first quarter sales — read more

TRS closed up 3.6pc on $4.55

4.28pm: Stocks’ winning streak comes to halt

The local share market ended the session flat, bringing an eight-day winning streak to a halt.

The benchmark S & P/ASX200 was up 0.88 points, or 0.02 per cent, at 5890.5 points. The broader All Ordinaries index was down 3.278 points, or 0.1 per cent, at 5954.801 points.

The S & P/ASX200 gave up nearly all of a 0.3 per cent intraday rise to a fresh five month high after losing six points in the closing single price auction.

Ric Spooner of CMC Market said described the session as a “firm but cautious day”.

“Investors are not being given as much reason to sell at an index level,” he said.

“But we are just seeing I think signs of a bit of caution after the strong rally we’ve seen over the last eight or nine days.”

In financials, NAB shed 0.09 per cent to $3.49. Commonwealth Bank added 0.15 per cent to $78.37. Westpac gained 0.35 per cent to $42.75 and ANZ edged up 0.03 per cent to $30.35.

BHP edged down 0.51 per cent to $27.17. Rio Tinto lost 0.76 per cent to $70.92 — read more

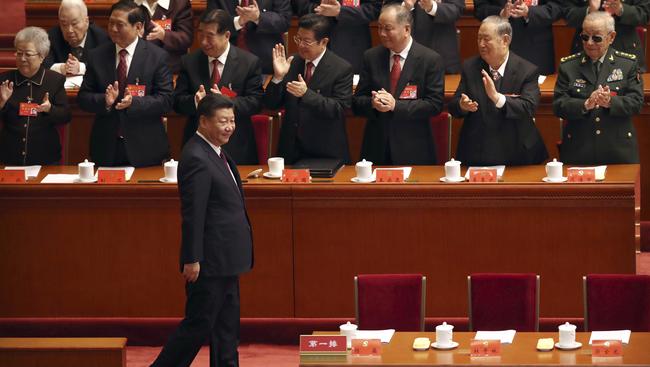

3.58pm: Xi urges state hand in economy

Liyan Qi writes:

Chinese President Xi Jinping urged the government to play a greater role in the economy, while reiterating the market’s “decisive” role.

“We should endeavour to develop an economy with more effective market mechanisms, dynamic micro-entities, and sound macro-regulation,” Mr. Xi said Wednesday in a report to kick off the 19th Communist Party Congress, which lays out key policies for the next five years and beyond.

To improved macro-regulation, he called for “giving full play to the strategic guidance of national development plans.”

Mr. Xi also pledged to deepen the supply-side structural reform — a term Beijing uses to describe its plan to cut overcapacity, debt and housing inventory — read more

Dow Jones Newswires

3.50pm: Crown plunges amid scathing allegations

With Greg Brown

Crown shares (CWN) fell as much as 8.1 per cent to $10.80, their lowest level since November last year after allegations surfaced the casino operator tampered with poker machines and encouraged money laundering.

Independent MP Andrew Wilkie tabled the allegations in parliament this morning and said if they were true, Crown could have facilitated money laundering for a number of “nefarious” reasons, such as tax fraud, drug trafficking and terrorism.

“Although the allegations focus on Crown Melbourne, they also suggest a broader pattern of misbehaviour in the poker machine industry and that obviously has grave implications for people right around Australia, including in my electorate of Denison,” Mr Wilkie told the Federation Chamber.

Crown has since responded to the allegations, demanding Mr. Wilkie provide evidence to his claims immediately — read more

CWN has since regained ground to trade 4.5 per cent in the red on $11.22.

Michael Roddan 3.45pm: Housing affordability worsens

Australia’s housing affordability crisis is worsening, with record-high debt levels exposing borrowers to greater risk of defaults and making them more vulnerable to economic and property market shocks, according to global ratings agency Moody’s.

In a new report, Moody’s found housing affordability continued to decline across the whole of Australia, on an average basis, although it was most severely felt in Brisbane and Melbourne.

Sydney, where housing prices have recently started to cool, saw an improvement in the proportion of household income being spent on mortgage repayments.

Elizabeth Redman 3.35pm: Lendlease sheds 11pc on profit warning

Investors have marked down Lendlease after it sold a quarter of its retirement living business and warned its full-year result would take a hit from underperformance in its Australian construction business.

Lendlease shares are down nearly 11 per cent on $16.59 with just under half an hour left of trade in the first session following results.

Dutch pension asset manager APG Asset Management NV bought a 25 per cent stake in Lendlease’s retirement living division for slightly north of $425 million, valuing the retirement business at a little over its $1.7 billion in carrying value.

The group also said some engineering projects would have an impact on its full-year result.

LLC last $16.92

Stephen Bartholomeusz 3.24pm: African adventures haunt Rio Tinto

At Rio Tinto’s 2011 annual meeting then-chief executive Tom Albanese spoke about the challenges of finding the mineral resources to meet the unprecedented growth in the mining sector and the intensity of competition for those resources.

“Those that are to be found are increasingly located in challenging geographies and geologies, or parts of the world where we have not historically had a presence, such as Mozambique, Guinea and Mongolia,’’ he said.

That annual meeting came not long after Rio had taken control of Riversdale Mining, with a $US3.7 billion takeover offer that was framed as a punctuation point for Rio’s post-crisis traumas and a launching pad for a new and aggressive growth era — read more

Note: Rio Tinto (RIO) along with former CEO Tom Alabanese and finance chief Guy Elliot, were charged with fraud by the US Securities and Exchange Commision earlier today, allegations centred on the eventual impairment of its Mozambique assets.

Supratim Adhikari 3.00pm: PM concedes NBN a pain point

Prime Minister Malcolm Turnbull has conceded that the National Broadband Network has become a pain point for many households, adding that the government is working to improve the experience for customers connected to the $50 billion network.

“It’s never good enough to have complaints and that is why I’m working closely, talking to the management at the NBN, as is the minister, Mitch Fifield, to improve both the installation experience and to ensure that people are getting from the retailers, the plans they deliver,” Mr Turnbull told Nine Network this morning.

The PM’s comments came after the latest report from the Telecommunications Industry Ombudsman highlighted a 159 per cent jump in NBN-related complaints in the past year.

2.45pm: Fund managers’ cash piles drop: BofAML

BofAML’s Global Fund Manager survey for October showed cash reserves hit a 2.5 year low of 4.7pc.

But while cash reserves are well below a peak of 5.8pc in October 2016, they aren’t low enough to generate a contrarian sell signal for equities.

“High FMS cash since Q1 2016 has coincided with an $18tn increase in global equity market cap,” says BofAML chief investment strategist Michael Harnett.

“A faster drop to 4.2pc is needed to end ‘Icarus’ (buy signal for equities) .”

Expectations of a macroeconomic “Goldilocks” scenario (above-trend growth with below-trend inflation) hit a record high.

Sarah-Jane Tasker 2.20pm: Crown demands Wilkie prove claims

Crown Resorts has called on Andrew Wilkie to immediately provide the relevant authorities all information relating to the matters he has alleged in parliament today.

The casino operator has told the market it rejects the allegations he has made today under parliamentary privilege concerning the improper manipulation of poker machines and other illegal or improper conduct.

CWN last down 7.3 per cent on $10.89

Damon Kitney 2.15pm: Brambles scrap bonuses on investor furore

Brambles has cut the short term incentive payments for former chief executive Tom Gorman in response to investor anger about its shock decision a year ago to scrap its 2019 targets of high-single-digit sales and stronger underlying profit growth.

At today’s annual general meeting, chairman Stephen Johns revealed there would also be no short term incentive payments made to the former President of the troubled CHEP Pallets business and that the cash payments to former chief financial officer CFO Zlatko Todorcevski would be reduced.

‘’I would like to acknowledge shareholders’ disappointment with the Company’s FY17 performance. This disappointment is reflected in the lower level of shareholder support for some of this year’s resolutions to be considered at today’s Meeting,’’ Mr Johns told investors assembled in Sydney.

‘’I want you to understand that the Board also shares your disappointment and is united in overseeing the effective management of the Company on behalf of you, our shareholders.’’

He also said the Brambles Board had also approved a number of changes to the company’s remuneration strategy to further align it with the Company’s strategy and the interests of shareholders — read more

BXB last up 1.5 per cent on $9.40

Christine Lacy 1.59pm: Morgan Stanley promotes Peck

Morgan Stanley Australian boss Richard Wagner has promoted corporate adviser Julian Peck to co-head of Australian investment banking at the group.

Peck, who has been with the group for more than a decade, was lead adviser on the $9.7b deal for the 50 year lease of the Port of Melbourne.

Eli Greenblat 1.20pm: Specialty Fashion dives to 8-year low

Specialty Fashion Group shares (SFH) plunge over 14 per cent to trade an 8-year low of $0.215 after the company warning that difficult market conditions experienced in July have continued over the first quarter and will crunch its pre-tax earnings by more than half.

In a statement to the ASX, Specialty Fashion, whose retail banners include Millers, Katies, City Chic and Rivers, said that the negative impact of the first quarter on trade means that any improvement is unlikely to be sufficient to recover the shortfall in earnings in that period.

As a result, the company warned, it expected first half underlying EBITDA to be in the range of $14 million to $17 million, against $30.4 million for the same period last year.

Rosie Lewis 1.06pm: Allegations Crown ‘shaved down’ pokies

James Packer’s Crown Casino in Melbourne illegally tampered with poker machines to increase debt losses, tolerated methods to avoid money laundering laws and ignored domestic violence and drug use in the facility, whistleblowers have alleged in damning video evidence tabled in parliament.

Independent MP and anti-gambling campaigner Andrew Wilkie has called on the federal and Victorian governments to take “immediate action” after using parliamentary privilege to disclose testimony from three former Crown employees who approached him in “recent months” to make the allegations.

Speaking in parliament’s federation chamber, Mr Wilkie said the whistleblowers alleged poker machines had been tampered with to “lower debt options” and buttons had been modified or “shaved down” to allow prohibited autoplay.

— for live updates from parliament read PoliticsNow

Note: Crown shares (CWN) extend losses to trade 6.6 per cent lower at $10.94, their lowest level since November last year.

Samantha Woodhill 12.55pm: Treasury dodges major fire damage

Treasury Wine Estates says its operations in northern California’s wine region have sustained no significant fire damage, as deadly wildfires continue to ravage the state.

“TWE is fortunate that all of our people are safe, and our infrastructure in the region remains intact with no significant fire damage,” chairman Paul Rayner said in his address to shareholders this morning.

“Our thoughts are with the Napa and Sonoma communities that have been impacted and we are offering financial and other support to these communities in their time of need.”

Treasury Wine owns and operates about 3,750 planted hectares of vineyards in the US, as well as cellar door facilities and packaging operations — read more

TWE last down 0.5pc on $14.38

Greg Brown 12.00pm: Crown faces explosive pokies claims

James Packer’s Crown Casino (CWN) allegedly tampered with poker machines and encouraged money laundering, according to whistleblower statements tabled in the federal parliament.

Independent MP Andrew Wilkie tabled the allegations in parliament this morning and said if they were true Crown could have facilitated money laundering for a number of “nefarious” reasons, such as tax fraud, drug trafficking and terrorism.

He also said there were allegations the Victorian regulator did nothing to stop the “criminal misconduct” and had even been complicit in covering it up — read more

Note: Crown shares fell as much as 6 per cent to a year-to-date low of $11.01 as the allegations surfaced.

11.43am: Crown faces criminal conduct allegations

Crown Casinos is facing allegations of criminal conduct as a result of an investigation by Independant MP Andrew Wilkie into the gambling industry.

Crown shares (CWN) fell over 6 per cent to their lowest level this year of $11.01 and have since recovered to trade at around $11.18.

Elizabeth Redman 11.30am: Property mood sours: NAB

The commercial property industry is slightly less optimistic overall as confidence edged lower in the buoyant NSW and Victorian office markets, according to a NAB survey.

Sentiment fell for the second straight quarter, losing five points to +18, although this remains well above the long-term average, according to the NAB Commercial Property Index for the third quarter.

NAB group chief economist Alan Oster highlighted the variation between the eastern seaboard and the mining affected states.

“By state, overall sentiment was dragged down by NSW (+34) and Victoria (+29), but they continue to outperform,” Mr Oster said — more to come

Supratim Adhikari 11.25am: Telstra earnings to halve: Shaw

Telstra chairman John Mullen’s assurance that the telco can hold the line on future dividend has failed to placate the sceptics, with Shaw and Partners analyst David Spotswood saying it may not have adequate firepower.

Mr Mullen and Telstra CEO Andrew Penn used the telco’s annual general meeting on Tuesday to spell out the challenges to shareholders, with a promise that there was a plan in place to ride out the tough times.

With the National Broadband Network continuing to fundamentally alter the economics of the telecommunications industry, Telstra finds itself in the eye of the storm.

The loss of its wholesale monopoly will carve over $3 billion from Telstra’s earnings and Mr Spotswood said there was no guarantee that the management’s intent will match its ability.

“We expect Telstra’s earnings to half over the next four years and we are not sure the culture is strong enough to compete with new aggressive players,” he said in a client note.

TPG Telecom is right on top of that list of ‘aggressive’ players and Mr Mullen conceded on Tuesday that Telstra will lose customers to TPG once its mobile network goes live.

“TPG is and will be a formidable competitor — of that there is absolutely no doubt,” he said.

“We do not underestimate the impact this may have, the effect on pricing, nor the fact that we must — and most certainly will — continue to invest heavily to maintain our mobile network superiority.”

Keeping its superiority will require investment and with Telstra’s margins under pressure and no immediate growth drivers at hand, Mr Spotswood said banks might be a better bet for yield chasers in the market.

“There can be no certainty Telstra can hold its dividend.”

“There are plenty of stocks with a circa 6 per cent yield whose earnings are not going to half — any of the banks, Suncorp, AMP, Macquarie Group.

TLS last down 1 per cent at $3.52

Samantha Woodhill 11.10am: CSL bows to executive pay pressure

CSL chairman John Shine says that sweeping changes have been to the company’s remuneration model, after he pledged to get it right 12 months ago when shareholders voted against the CSL’s remuneration report.

Two-thirds of shareholders voted against last year’s plan to increase non-executive salaries, while 26 per cent of votes registered their disapproval for the adoption of the entire remuneration report at last year’s annual general meeting.

The first strike resulted in managing director and CEO Paul Perreault receiving a $US8.2 million pay packet, more or less in line with the previous year — more to come.

CSL last up 0.7 per cent $139.90

11.00am: ASX200 bulls run amid Wall St signals

Australia’s S & P/ASX 200 has hit a fresh 5-month high of 5900.6 points in early trading.

The market appears to be expecting further gains on Wall Street after IBM rose 5.2pc in after-hours trading.

Rio Tinto is down 1.3pc after Citi downgraded and the SEC filed fraud charges, but a majority of sectors are up.

St Barbara is up 5.6pc after Credit Suisse upgraded, Brambles is up 3.2pc 1Q sales rose in line with expectations and AGL is up 2.4pc after Macquarie upgraded.

Index last up 0.1pc at 5893.7

Andrew White 10.55am: Origin backs public power play

Origin Energy chairman Gordon Cairns has backed the federal Government’s National Energy guarantee and warned that electricity prices are likely to rise further without agreement on long term energy and climate change policy.

Mr Cairns said that bringing on new supply would maintain downward pressure on prices and that an investment signal from national policy was a key to encouraging investment in new generation capacity.

“But we urgently need policy certainty,” told the company’s shareholders at an annual meeting in Sydney yesterday

“We cannot wait until 2020 for investment decisions to be made if we are to meet Australia’s 2030 emissions reduction target.

“We look forward to working with governments and energy market bodies to progress the new National Energy Guarantee announced yesterday, as we continue to focus on the objectives of delivering security of supply, affordable pricing and the necessary reduction in emissions over time.”

Mr Cairns told the meeting that Origin had committed to 1200Mw of renewable generation investment and planned to lift its share of the portfolio from 10 per cent to 25 per cent by 2020 — read more

10.25am: ASX lifts as corporate news sets tone

The local sharemarket posts slim gains in early trade of 0.1 per cent as local investors digest a slew of corporate news in AGM season.

Rio Tinto shares fall 0.9 per cent after the US Securities and Exhange Comission lobbed allegations of fraud against the company a two former executives.

BHP recovers after falling sharply at the open to trade just 0.6 per cent following its first quarter update.

Origin Energy shares trade 1.2 per cent higher as the market digests the Federal government’s power policy overhaul.

CSL shares eke out 0.2 per cent gains as it pitches an overhaul of executive remuneration to its shareholders at its AGM underway today.

Brambles shares jump up over 2.8 per cent after it booked a 6 per cent increase in constant-currency revenue and responded to speculation on a potential class action over disclosure obligations.

ANZ shares trade 0.3 per cent higher after it announced the departure of its chairman John Judge and former Prime Minister John Key as his replacement.

Monash IVF shares jump 1.6 per cent after it appointed David Morris as its new CEO and managing director.

Ahead, investors eye details from China’s National Party Congress commencing later today for policy details from our largest trading partner.

10.03am: ASX200 to lift on Wall St movers

Australia’s S & P/ASX 200 share index is likely supported by offshore strength today.

While Rio Tinto shares could be hit by SEC fraud allegations, IBM shares have jumped 4.8pc after-hours.

The surge in IBM sets Wall Street up for a positive session that should keep the Australian market supported today.

That said some profit taking in resources is likely with LME copper down 1.3pc after recent strength.

Focus turns to China with the National People’s Congress starting today though details may be scarce.

Index last 5889.6

9.40am: Origin reaffirms FY18 guidance

Origin Energy has maintained its FY18 guidance including a EBITDA range between $1.7-$1.8bn on the provision that “market conditions and the regulatory environment do not materially change.”

Origin’s update comes as the Federal government delivers power policy reforms including scrapping the Finkel review-recommended CET and yet to be determined benchmarks for energy retailer’s source mix between ready-to-use (coal, hydro gas, batteries) and renewables.

ORG last $7.39

9.35am: Fraud allegations ‘unwarranted’: Rio Tinto

Rio Tinto has responded to charges laid in a Manhattan federal court by the US Securities and Exchange Commission that its allegations of fraud in relation to asset inflation are “unwarranted” and that the claims will be rejected once all facts are considered by the court.

Earlier today the SEC charged Rio Tinto and two former executives Tom Albanese and Guy Elliott allegedly inflating the value of Mozambique coal assets acquired for $3.7 billion and later sold for $50 million.

The company cites a settlement reached with the UK’s Financial Conduct Authority over the same impairment in which the body fined Rio $36.4 million, found no instances of fraud but deemed appropriate a review of the assets six months earlier than it did in time for its 2012 interim results delivered August that year.

RIO last $71.46

Matt Chambers 9.20am: BHP on track amid Chile red flag

BHP Billiton says it is on track to hit production records in copper and iron ore this financial year, leaving guidance unchanged at the giant Escondida mine it operates in Chile, despite minority partner Rio Tinto yesterday flagging reduced production.

In its first-quarter report this morning, BHP mostly hit market expectations in its main product groups of iron ore, petroleum, copper and coal and left 2017-18 production guidance unchanged.

“Our performance in the first quarter keeps us on track to deliver seven per cent volume growth in the 2018 financial year,” BHP managing director Andrew Mackenzie said.

BHP said September-quarter Western Australian iron ore production slipped 3 per cent from a year earlier to 64 million tonnes (including minority partners’ shares), because of maintenance and a June fire at its Mt Whaleback screening plant — more to come.

BHP last $27.31

9.12am: Ex-Rio execs charged with fraud

Rio Tinto, its former chief executive Tom Albanese, and ex-finance boss Guy Elliott, have been charged with fraud in the US over a failed coal investment in Mozambique.

America’s Securities and Exchange Commission said in a statement the mining giant and its two former executives are accused of inflating the value of coal assets acquired for $US3.7 billion and sold a few years later for $US50 million.

The SEC’s complaint, filed in federal court in Manhattan, alleges that Rio Tinto, Mr Albanese and Mr Elliott failed to follow accounting standards and company policies to accurately value and record its assets — read more

RIO last $71.46

9.10am: Analyst rating changes

Rio Tinto cut to Neutral — Citi

Lend Lease cut to Neutral — Macquarie

Oil Search cut to Neutral — Macquarie

AGL Energy raised to Outperform — Macquarie

Vocus cut to Hold — Morningstar

Independence Group cut to Sell — Morningstar

Lend Lease cut to Neutral — Credit Suisse

St Barbara raised to Outperform — Credit Suisse

Oil Search cut to Neutral — Credit Suisse

IOOF raised to Outperform — Credit Suisse

IOOF cut to Hold — Bell Potter

IOOF raised to Neutral — UBS

Lend Lease raised to Buy — UBS

Aveo raised to Buy — Moelis

GBST raised to Buy — Deutsche Bank

Lendlease cut to Neutral — Goldmans

9.05am: Brambles lifts 1Q revenue

Brambles has boosted its first-quarter sales six per cent, helped by a strong performance in the European pallets business and continued expansion of its IFCO business.

The company, which operates in more than 60 countries primarily through the CHEP and IFCO brands, says its sales revenue grew six per cent, on the prior corresponding period, to $US1.37 million.

Chief executive Graham Chipchase said the company’s pallet and RPC businesses were enjoying strong expansion in Europe and making good progress in emerging markets such as Latin America, despite competitive environment conditions — AAP

BXB last $9.26

8.55am: BHP iron ore output falls

BHP Billiton has posted a three per cent drop in iron ore production to 56 million tonnes for the September quarter, as planned maintenance and lower stockpiles affected volumes during the quarter.

It’s petroleum production was also eight per cent lower at 50 million barrels of oil equivalent (mmboe) with its US assets impacted by Hurricane Harvey, but copper output jumped 14 per cent in the quarter to 404,000 tonnes. The resources giant has reaffirmed the full-year production and cost guidance for all commodities — AAP

BHP last $27.31

8.50am: Brambles responds to class action threat

Logistics goods and services provider Brambles has responded to media reports over a potential class action in relation to its disclosure obligations, saying it intends to vigorously defend any action if filed and cannot serve any further comments as it has not received any formal communication or proceedings.

Media speculation surfaced this morning that Maurice Blackburn is assessing investor interest and the merits of a potential case against Brambles in relation to its FY17 first quarter trading update in October 2016.

The company’s statement came alongside its first-quarter FY18 trading update that showed constant-currency revenue growth of 6 per cent on the same period a year prior to $US1.4bn.

BXB last $9.26

8.35am: Ex-Rio chief Albanese charged with fraud

Former Rio Tinto (RIO) chief executive Tom Albanese and former CFO Guy Elliot have been charged with fraud by the United States Securities and Exchanges Commission for allegedly inflating the value of coal assets acquired for $3.7 billion and later sold for $50 million.

“As alleged in our complaint, Rio Tinto’s top executives allegedly breached their disclosure obligations and corporate duties by hiding from their board, auditor, and investors the crucial fact that a multi-billion dollar transaction was a failure,” said Stephanie Avakian, Co-Director of the SEC’s Enforcement Division.

More to come.

8.20am: WATCH: ANZ wealth unit sale to IOOF

.@BridgetCarterb: Ideally ANZ was to sell all of their wealth to an offshore buyer who would pay a big number. MORE: https://t.co/XW3nMgr3z7 pic.twitter.com/T67ZQqNxKn

— Sky News Business (@SkyBusiness) October 17, 2017

8.13am: ANZ New Zealand taps Key for chair

ANZ’s New Zealand board has appointed former Prime Minister John Key as its new chairman after earlier announcing the retirement of John Judge from the post.

ANZ last $30.34

7.35am: Australian shares set to start lower

The Australian share market looks set to open lower, despite a strong lead from Wall Street’s major stock indices overnight.

At 7am (AEDT), the local share price futures index was down six points, or 0.1 per cent, at 5,865.

US stocks edged higher overnight, with the Dow Jones index briefly ticking above 23,000 on an intraday basis.

In local equities news today, Origin Energy and Treasury Wine Estates will hold their annual general meetings.

Yesterday, rising commodity and energy prices powered mining and energy stocks and lifted the Australian share market to its highest level since May. The benchmark S & P/ASX200 was up 42.8 points, or 0.73 per cent, at 5,889.6 points, while the broader All Ordinaries index was up 40.9 points, or 0.69 per cent, at 5,958.1 points.

AAP

7.25am: Dow briefly crosses 23,000

The Dow Jones Industrial Average briefly crept above 23,000 for the first time, buoyed by gains in shares of healthcare companies.

The blue-chip index crossed the milestone in intraday trading, reaching as high as 23,002.20, before paring gains. The index closed up 40.48 points, or 0.2 per cent, at 22997.44, its 50th record finish of 2017.

The S & P 500 rose 1.72 points, or 0.1 per cent, to 2559.36, a fresh record, while the Nasdaq Composite slipped 0.35 point, or less than 0.1 per cent, to 6623.66.

Australian stocks are tipped to dip at the open. At 7.25am (AEDT) the SPI futures index was down six points.

Corporate earnings have helped boost major US stock indexes to fresh highs in 2017, and the third quarter is on track to provide more fuel to the market’s rise, analysts say.

“At the end of the day, earnings are going to continue to lead the market,” said Mark Freeman, chief investment officer and portfolio manager at Westwood Holdings Group. He said that backdrop, as well as investor attitudes, are the reason he isn’t concerned as stock prices climb to new highs.

Earnings aren’t the only driver of major indexes in 2017. Investors’ optimism about solid economic growth across the globe is also pushing stocks higher, analysts say. Though some investors worry stocks are trading at prices that are high compared with the earnings generated by companies, others are willing to brush off these valuation concerns because of this positive global growth.

“In the U.S. markets, there’s no question that valuations are elevated, but the general economy is going really well,” said Jeremy Bryan, portfolio manager at Gradient Investments, who nonetheless believes there are better opportunities in Europe and emerging-market economies.

Dow Jones

7.00am: Dollar steady

The Australian dollar is steady against its US counterpart, as there was little news overnight to drive trade in currency markets.

At 6.30am (AEDT), the local currency was worth US78.47 cents, up slightly from US78.46 cents yesterday.

Westpac senior market strategist Imre Speizer said sentiment on financial markets was positive overnight with the Dow Jones index reaching new record highs.

The local currency was also lower against the Japanese yen and the euro.

AAP

6.55am: Goldman Sachs’ results beat forecasts

Goldman Sachs’ third-quarter profits fell 3 per cent from a year earlier, as the trading desks at Wall Street’s biggest investment bank were weighed down by a slow summer that also affected most of its competition. The results still beat analysts’ forecasts, however.

The Wall Street bank said it earned a profit of $US2.04 billion, or $US5.02 a share, compared with a profit of $US2.10 billion, or $US4.88 a share, in the same period a year earlier.

The firm’s per-share profit rose because there are fewer Goldman shares outstanding compared with the same period a year ago.

Analysts had been looking for Goldman to post a profit of $US4.17 a share, according to FactSet. Goldman’s trading desks, which are weighted toward bonds, currencies and commodities, struggled this quarter, as did those at its competitors JPMorgan Chase, Citigroup and Bank of America.

Net revenue in that business was $US1.45 billion, down 26 per cent from a year earlier. Markets have been abnormally quiet this year, which has hurt investment banks’ trading profits since they benefit when markets are more active.

Despite the struggling trading operation, Goldman’s investment banking business had an especially good quarter, reporting a 17 per cent rise in revenue. Revenue from underwriting and companies turning to Goldman’s investment bankers for advice both increased during the quarter.

AP

6.50am: Fed pick soon

President Donald Trump said he would choose a new Federal Reserve chair among five frontrunners in a “fairly short” time but stopped short of naming a favourite.

Current Fed Chair Janet Yellen’s term is due to expire in February. Mr Trump is reportedly considering candidates including former Fed governor Kevin Warsh, current White House economic adviser Gary Cohn, Stanford economist John Taylor, current Fed Governor Jerome Powell and Yellen herself.

AFP

6.45am: Dow tops 23,000 for first time

The Dow Jones Industrial Average briefly crept above 23,000 for the first time in intraday trade, buoyed by gains in shares of healthcare companies.

Corporate earnings have helped boost major stock indexes to fresh highs in 2017, and the third quarter is on track to provide more fuel to the market’s rise, analysts say.

Dow Jones

6.40am: European stocks flirt with records

Europe’s major stock markets held close to record highs as investors digested key economic data and US bank earnings, dealers said.

London equities slipped into negative territory despite the pound sliding. News that annual British inflation jumped in September to 3.0 per cent — the highest level in more than five years — was outweighed by comments by central bankers they were in no rush to raise interest rates.

Frankfurt also drifted lower at the end of trading, despite news that German investor confidence inched upwards in October, according to the ZEW institute’s headline barometer. During the session it rose to less than two points shy of its record high before sliding back.

Madrid rose 0.6 per cent as a judge ordered the detention of two Catalan separatist leaders.

London closed down 0.1 per cent, Frankfurt ended down 0.07 per cent and Paris fell 0.03 per cent.

AFP