NEG a lifeline for coal-fired power stations

Ageing coal-fired power stations may get a lifeline from the federal government’s new national energy guarantee.

Ageing coal-fired power stations may get a lifeline from the federal government’s new national energy guarantee but could slow a gold rush of investment in new renewable generation capacity.

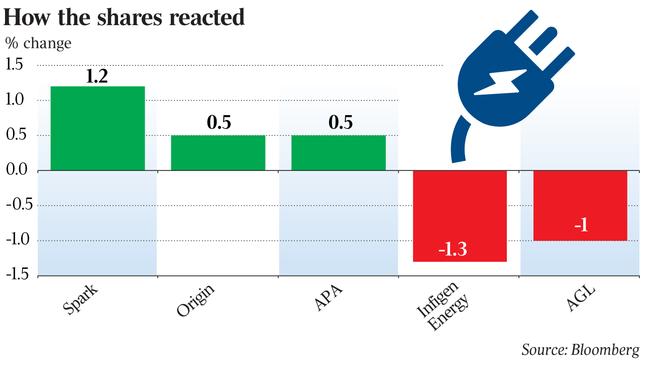

Giving cautious support to the new policy after the widely lauded clean energy target was dumped, industry chief executives and peak bodies said the national energy guarantee would only provide the policy certainty needed to drive new investment if it received bipartisan support.

“Attracting investment in new generation is critical to restoring the vitality of the National Electricity Market and, if we’re to achieve that, there is no substitute for stable, bipartisan energy policy,” EnergyAustralia chairman Graham Bradley said.

“We hope, too, this plan can lead to agreement between state and federal governments on a national approach that reduces duplication and unnecessary cost for customers,” said Mr Bradley, who chairs one of the nation’s biggest power networks.

The new energy policy, outlined yesterday, will see regulators impose separate and yet-to-be determined targets for reliability and for emissions.

Under the plan energy retailers would be required to purchase certain amounts of energy from ready-to-use sources such as coal, hydro gas and batteries, as well as renewable energy such as wind and solar that would help reduce emissions from the national electricity market.

The push is the latest in a series of policies to address energy and climate policy that have been proposed since then prime minister Tony Abbott abolished the carbon tax in 2014.

An emissions intensity scheme was ditched after a leak provoked a backbench revolt and the clean energy target proposed by Chief Scientist Alan Finkel was stalled for months because of concerns on the conservative wing of the coalition that it would preclude investment in new coal-fired generation.

Dr Finkel yesterday noted that the new policy was the first recommendation from the energy security board that his report recommended and that it placed an equivalent reliability obligation on retailers to the one that he recommended for new generation.

AGL yesterday declined to comment on whether the new policy would change its plans for Liddell.

Under pressure from the federal government, the company agreed to a 90-day deadline to consider the estimated $900m investment needed to extend the life of the plant against a move to more renewable generation. But earlier this month chief executive Andy Vesey reaffirmed the company’s plans to shut down the 1972-commissioned plant and replace the generation capacity with a mixture of renewables and gas generation.

Yesterday the company said the recommendation from the Energy Security Board for the NEG was an important step forward.

“We are heartened by the emphasis on consultation and eager to work with government and our industry peers to make this work,” a spokesman said.

“If it gets bipartisan support, we believe it will provide investment certainty.”

Grattan Institute energy policy director Tony Wood and Clean Energy Council chief executive Kane Thornton said the reliability obligation in the policy was likely to extend the life of coal-fired power stations as a source of ready-to-use energy.

“This may allow existing sources of generation to go on longer than they otherwise would,” Mr Thornton said.

“Whether it will allow a new renewable energy project to go to the bank and get a pile of debt to proceed is less clear.”

Mr Thornton said ditching the CET — which was to provide a direction for generation capacity beyond the expiry of the Renewable Energy Target in 2020 — was likely to result in a substantial slowdown in new clean energy investment and result in higher power prices.

“The Clean Energy Target was the best opportunity in years to lock in the long-term bipartisan energy policy needed to encourage investment in cleaner energy while improving system reliability and pushing down power prices,” he said.

Mr Wood said that had the NEG been in place last year it could have stopped the closure of the Northern power station in South Australia — the state’s last coal-fired plant — because it would have obliged retailers to contract for reliable power.

It could also provide the conditions for the extension of ageing plants such as AGL Energy’s Liddell unit near Newcastle to be extended beyond its scheduled closing date of 2022.

“It means that you could spend some money on them to extend their life and improve their efficiency, which would be a good thing,” Mr Wood said.

However, the NEG was still unlikely to encourage investment in new coal-fired generation, with observers pointing to comments last week from Origin Energy chief executive Frank Calabria that the risks of an eight-year development and a 40-year payback were too great for companies to consider.

Yesterday Mr Calabria said the introduction of reliability and emissions obligations for generators was consistent with the company’s need for long-term settings to reduce emissions and maintain a secure and affordable supply of energy.

“Based on initial information we believe it is a solution that has potential, and we look forward to working with governments and energy market bodies to progress it.”

Mr Calabria is scheduled to front investors at the company’s annual meeting in Sydney this morning.

Mr Bradley said that energy-buying standards for retailers had been used “to good effect” in other countries, including Hong Kong, the headquarters of EnergyAustralia’s owner China Light and Power — where it provided some of the most reliable electricity in the world.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout