Trading Day: live markets coverage; ASX, metals surge on growth hope; plus analysis and opinion

Local shares hit fresh highs as bulls rally around commodities and bring heavyweight miners up in the wake.

Welcome to Trading Day for Tuesday, October 17.

Samantha Woodhill 4.45pm: ASX posts new 5-month high

Local shares ended the session higher, on a fresh five-month high, amid commodity price strength and positive sentiment in global markets.

The benchmark S & P/ASX200 was up 42.838 points, or 0.73 per cent, at 5889.602 points. The broader All Ordinaries index was up 40.865 points, or 0.69 per cent, at 5958.102 points.

The market has risen 4.2 per cent in the last eight days, the strongest eight-session gain since the post-US election “Trump bump” began.

Commbank’s Tom Piotrowski said the share market was showing strong signs it is beginning to break out of a tight, months-long trading range, against a backdrop of stronger global growth increasing appetite for materials-heavy Australian equity.

“(China) figures have been quite optimistic around the resource space, the most recent import figures in relation to oil, and the most recent import figures for iron ore have all been quite positive,” Mr Piotrowski said.

The market closed less than two per cent off fresh multi-year highs above 6000 points.

BHP added 1.34 per cent to $27.31 and Fortescue climbed 0.4 per cent to $4.96.

Rio Tinto rose 1.29 per cent to $71.46, after chief executive Jean-Sebastien Jacques strong third-quarter production figures, despite it missing third quarter copper production expectations.

Elizabeth Redman 4.38pm: Why Lendlease is in for a bumper year

Construction and development giant Lendlease is likely to have a “bumper year” in its apartments business the year after next, and investors have moved on from concerns about risk from offshore buyers, according to research from Shaw and Partners.

The upbeat outlook came as ratings agency Moody’s tipped strong results for Australian property trusts next year, highlighting the strength of the office markets in Sydney and Melbourne.

The Shaw and Partners note backed Lendlease’s balance sheet, management team and outlook for earnings growth — read more

LLC closed up 0.3 per cent at $18.59

James Kirby 4.30pm: Retail at pointy end of mortgage squeeze

Household borrowing expenses could double for millions of mortgage holders set to move away from interest-only loans in the coming months. And with traditional ‘pay-off-the-principal’ loans costing on average $6000 per household each year, the already struggling retail sector will be hit hardest as the mortgage funding switch looms.

Roughly one in five homes across Australia have exposure to interest only loans — and with substantial out-of-cycle interest rate increases recently introduced among the major banks, retail spending is already being hit: The retail figures for August were the worst in four years.

But the full impact of reduced household income on retail will only become obvious once we know how many borrowers move to principal and interest — it is estimated that about $60 billion in outstanding interest-only loans will come up for review in the next two years.

More to come.

Ben Butler 4.15pm: Culture in ASIC head’s sights

Improving the culture of the financial services industry is a “perennial” challenge that requires a response from the entire sector, the incoming head of Australia’s corporate regulator says.

But James Shipton, who will take over as Australian Securities and Investments Commission chairman in February, warned he was prepared to use all the tools in the regulator’s arsenal to combat bad behaviour in financial markets.

Eli Greenblat 4.00pm: Consumers numb from grocery war?

The supermarket wars, waging since Australia Day 2011, are showing no sign of cooling down as Coles (WES) accelerates its discounting on key grocery lines to outpace rival Woolworths (WOW), although one analyst has warned shoppers could be suffering from “promotional fatigue” as prices are continually slashed.

A fresh report from UBS retail analyst Ben Gilbert says surveys of prices at Coles and Woolworths suggest Coles is repositioning prices lower, and has stepped up its investment against its main rival.

The UBS study of around 1.5 million prices from January to August reveals Coles’ year-to-date prices have fallen at a faster quarter on quarter rate than Woolworths, with prices at Coles supermarkets down 1 per cent in the third quarter and 2 per cent in the fourth quarter compared to Woolworths, which has had little to no change.

3.45pm: Pesky Wi-Fi bug exposed

Robert McMillan writes:

A bug in the software used to connect the world’s wireless devices could give hackers a new way to snoop on Wi-Fi traffic, sending device manufacturers scrambling to release patches.

Cryptographers said the Wi-Fi flaw, reported by a security researcher, is the most significant to have been discovered in years. It is likely, though, to have a larger effect on big corporations than consumers.

The attack works by creating a cloned wireless network that resets the victim’s encryption keys in an insecure fashion, exposing any information that had previously been encrypted via the Wi-Fi Protected Access II, or WPA2. This technology is considered state-of-the-art for wireless security and has replaced older Wi-Fi security standards such as Wi-Fi Protected Access (WPA) and Wired Equivalent Privacy (WEP) — read more

Dow Jones Newswires

Glenda Korporaal 3.20pm: RBA, BCA clash on corporate tax

Reserve Bank assistant governor Luci Ellis has challenged the Business Council’s argument about the importance of cutting the corporate tax rate in attracting foreign investment.

Ms Ellis said the corporate tax rate in Australia was “irrelevant” for domestic investors because of our system of dividend imputation.

She said if Australia could not attract foreign capital with its current tax and regulatory environment, the exchange rate would fall, and make Australia more competitive.

Business Council of Australia chief executive Jennifer Westacott told the Citi Australia and New Zealand Investment Conference today that funds would flow from Australia to the US if President Trump succeeded in his plan to cut the US corporate tax rate.

3.00pm: Metal bulls spur Rio’s 4-year high

The S & P/ASX200 index sits just 8 points shy of 5900 and Rio Tinto trades near a four-year high of $71.46 as investor appetite for base metals.

Copper prices surged overnight to their highest level since July 2014, global growth bulls rallying behind the base material for electrical wiring, combustion engine, pesticide production and an endearing ‘Dr. Copper’ coinage in light of these timely economic diagnoses.

“The better-than-expected producer prices in China on Monday boosted optimism in the market that the domestic demand in China will remain strong,” says ANZ senior commodity strategist David Hynes.

“The market is also expecting a relatively positive backdrop to emerge from the China’s Communist Party congress meeting this week.”

Spot nickel rose overnight, extending a now 14 per cent month-to-date rally, while BHP (+1.1pc) says it plans to ramp up production based on China battery material demand.

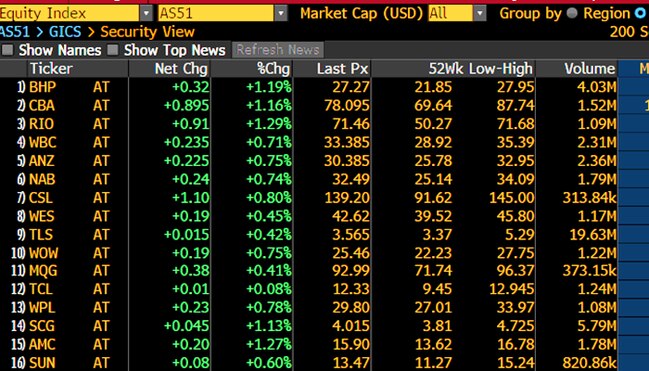

Exposed mid-small cap miners Independence Group, Western Areas and Oz Minerals litter the share market’s list of top performers, while the large-cap end of the share market is a sea of green with just over an hour left of trade:

Rachel Baxendale 2.35pm: Game changer for reliable power

Malcolm Turnbull has unveiled his new national energy guarantee, hailing it as a “game changer”, which will ensure Australians have affordable, reliable power.

Flanked by a panel of energy experts and Energy Minister Josh Frydenberg, Mr Turnbull said COAG’s Energy Security Board had estimated the guarantee would save households an average of $110-$115 a year over the 2020-2030 period.

He said the plan would ensure Australia could meet its Paris Agreement commitments to cut emissions as well as ensuring affordability and reliability.

2.20pm: ANZ sells wealth arm to IOOF

Bridget Carter and Stuart Condie write:

ANZ will sell its superannuation and financial planning businesses to IOOF Holdings for $975 million and is still weighing what to do with life insurance.

IOOF will pick up the OnePath pensions and investments business along with four aligned dealer groups as ANZ shifts to distributing rather than manufacturing advice and superannuation products.

ANZ said it will sell IOOF products under a 20-year agreement. ANZ, which has been spinning off assets as chief executive Shayne Elliott refocuses the lender on local retail banking, had been reviewing the future of its entire wealth unit before opting to split it with a partial sale — read more

IFL last $11.26 in trading halt, ANZ last up 0.7 per cent at $30.37

Supratim Adhikari 1.56pm: NBN wholesale prices hurt speeds: Telstra

Telstra boss Andrew Penn has reiterated that the telco is not scrimping on capacity on the National Broadband Network despite the rising number of complaints from its customers.

While Telstra currently holds a 52 per cent share of the NBN market, the telco has had to concede that it has not been able to provide advertised speeds to customers. Mr Penn said that service delivery on the NBN was dictated by a number of factors but it’s the wholesale prices charged by NBN Co that are at the heart of the problem.

The prices continue to not only hamper the quality of NBN services but also affordability and Mr Penn warned that prices could increase for households in the short-term — read more

TLS last up 0.3 per cent on $3.56

Paul Garvey 1.25pm: BHP to knuckle down on nickel

BHP has flagged it could double down on its foray into supplying nickel chemicals into the electric vehicle market.

The head of BHP’s resurgent nickel division, Eddy Haegel, told the Australian Nickel Conference in Perth this morning that the company was looking to bring forward stage two of its proposed nickel sulfate processing plant at Kwinana after being inundated with inquiries from the world’s biggest battery manufacturers.

He also revealed the company was investigating the economic and technical feasibility of moving even further downstream with the potential development of a cathode precursor plant at Kwinana — read more

BHP last up 1.3 per cent at $27.29

Note: Generic first nickel rose 1.7 per cent overnight to $US11824.5/tonne and over the last ten days has risen 14.4 per cent.

1.15pm: RBA sounds at ease with A$: TD Securities

The RBA may be more comfortable with current level of the Australian dollar, according to TD Securities Chief Asia-Pac Macro Strategist Annette Beacher.

She notes that today’s RBA minutes added “material further” before its usual comment that “appreciation of the exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast.”

“At the risk of over-analysis, we conclude that the RBA could be comfortable with the exchange rate at current levels of $US0.78-79,” she says.

“This cannot be a surprise if the RBA’s own August projections achieve above trend-growth and inflation back in the band with a working AUD assumption of 80 US cents.

“Perhaps the Australian dollar needs to be (above) 83 cents before the Bank downgrades its growth and inflation projections.”

AUD/USD didn’t react to the RBA minutes — last $US0.7842

Mark Schliebs 1.05pm: Offal beef with Coles over comma

One of the world’s biggest cattle producers has launched legal action against Coles, accusing the supermarket giant of breaching sales arrangements by exploiting a missing comma in a contract.

Australian Country Choice, one of Queensland’s largest private companies and among the country’s biggest landholders, yesterday filed the lawsuit in the Supreme Court in Brisbane relating to Coles’ alleged claims over what products — when sold to third parties — require commissions to be paid back.

At the heart of the battle is the lack of a comma between “edible meat” and “offal” in the definition of ACC products for which Coles must pay the commissions.

The statement of claim refers to an email allegedly sent by Coles to ACC in August 2016, in which the producer’s products were defined as being “edible meat offal” and “inedible meat products”.

12.45pm: RBA staunch in global uplift

Robb M. Stewart writes:

Australia’s central bankers expressed increasing confidence in the economic outlook during their latest policy meeting, although they remain watchful of risks due to high household debt levels.

The Reserve Bank of Australia has shown it is in no rush to shift interest rates, having left the benchmark cash rate unchanged for a 14th month running at the meeting earlier this month, as wages and inflation have remained subdued. That despite growth in major advanced economies having strengthened since last year and a number of central banks either starting or indicating a move toward reducing monetary stimulus.

Minutes of the Oct. 3 meeting, released Tuesday, showed that the board judged holding the cash rate steady was consistent with sustainable economic growth and attaining its inflation target over time.

Andrew White 12.31pm: Energy stocks take CET snub in stride

Energy stocks are largely taking the dumping of the clean energy target in their stride this morning.

Just before midday when the Government confirmed an about face on the Finkel Review’s final recommendation for a CET to guide investment in new electricity generation capacity, only AGL energy had moved down, with slight rises for other stocks linked to the national electricity market.

AGL fell 28c to $23.67. The company is still working on a plan to show the Federal Government how it plans to replace the 1600MW of capacity that will come out of the system when it closes in Liddell and said recently it can’t wait for new policy to invest in the new capacity needed to be replaced in the grid.

Origin — with similar generation and retail assets, but with the addition of a massive gas export project at Gladstone — rose 7c to $7.42.

Infigen Energy, Australia’s only pure-play wind farm stock, was down half a cent at 74c.

Network operators were slightly higher, despite the Federal Government yesterday passing legislation to abolish their right of appeal over regulatory rulings on how much revenue they can recover from customers.

AusNet rose half a cent to $1.735.

Spark Infrastructure — which has minority interests in grid assets across South Australia, Victoria and NSW, rose 1.5c to $2.56.

12.20pm: Oil Search posts production record

Robb M. Stewart writes:

Oil Search racked up record production volumes in the last quarter, driven by the continued rise in output from Exxon Mobil’s gas-export venture in Papua New Guinea.

The growth in production buoyed the energy company’s third-quarter sales revenue and puts it on track to deliver production for the year at the upper end of a target of 29 million-30.5 million barrels of oil equivalent.

Oil Search said it produced 7.91 million barrels in the third quarter, up 9.3 per cent on the previous quarter and 3.7 per cent ahead of a year earlier as the Exxon-led PNG LNG project produced at its highest quarterly rate since it came on-stream in 2014. The company’s oil and natural gas fields in Papua New Guinea also performed well, the company said — read more

OSH last up 0.7 per cent on $7.26

Sarah-Jane Tasker 12.05pm: Cochlear chair warns on tax change

Cochlear’s chairman Rick Holliday-Smith has warned that the global biotech could be forced to move investment offshore under proposed changes to research tax incentives.

Mr Holliday-Smith told his shareholders at today’s annual general meeting that Australia was looking to reduce research and development tax incentives at a time when many other countries appeared to be increasing incentives to attract R & D investment.

He said the changes the government was considering were complex but appeared designed to cap the levels of eligible R & D and introduce a range of qualification variables.

“We note that there are further proposed changes to incentives, which could further materially reduce the R & D tax benefits to Cochlear in Australia,” he said.

Mr Holliday-Smith said the impact of the decision to alter the R & D tax incentives could only be understood over the longer term — more to come.

COH last up 0.1 per cent on $167.98

Annabel Hepworth 11.45pm: Qantas boasts a ‘game-changer’

Qantas has announced its new 787-9 Dreamliner — the new aircraft type that will fly Perth to London non-stop and possibly from Perth to Paris or Brisbane to Chicago — will be named “Great Southern Land”.

Qantas (QAN) boss Alan Joyce said the unveiling of the first Dreamliner at Boeing’s facility at Everett near Seattle was a “game-changer” for the carrier, which last got a new aircraft type in 2008 with the Airbus A380 superjumbo.

Mr Joyce told The Australian that Qantas “has always been one of the innovators out there”, saying he expected other carriers would have an eye to what the Flying Kangaroo had done with the plane.

Sarah-Jane Tasker 11.25am: Heathcare’s AGM market remedy: UBS

The AGM season for the healthcare sector will take on a greater than usual importance, according to analysts, following slow growth across the industry in the second half of 2017.

UBS analyst Andrew Goodsall has told his clients that slower year-to-date trading carried risk that earlier commentary and guidance was too optimistic, meaning that the AGM season could represent an early opportunity to rectify any mismatch of expectations.

“Add to this the ‘reset’ prerogative available to six new sector chief executives,” he said.

The healthcare analyst said new chief executives at Primary Health Care, Sirtex and Ramsay Health Care were expected to clarify on strategy, update on trading and set, or tighten, guidance.

He added that Healthscope’s new chief executive had been already clear on lower year on year guidance but Mr Goodsall said the year to date trading update was key to ensure alignment.

“AGMs provide an opportunity to understand where boards see growth by examining how they incentivise chief executives,” the UBS analyst said.

“Several companies have chosen to reset earnings per share and total shareholder return hurdles, and the absence of a return on invested capital hurdle in some cases implies use of balance sheet to fund non-organic earnings expansion.”

11.15am: Telstra chair maps out challenges

Telstra chair John Mullen maps out external challenges facing the telco at its AGM in Melbourne.

“Telstra today is a strong, well run and well performing company, but like many companies around the world, we are also facing unprecedented change and challenge,” he tells investors.

Mr. Mullen says that for Telstra, those challenges are being driven by:

— intense competition in both the fixed and mobile marketplaces;

— an exponential rate of change in technology and connectivity;

— an unprecedented growth in capacity demand;

— a rapid acceleration in the rollout of the NBN, which will ultimately cost Telstra some $3b in EBITDA;

— the announcement that a fourth mobile network will shortly be launched in Australia.

“Those factors all underpinned the Board’s decision this year to change our dividend policy and I want to step through three of them carefully to help shareholders better understand why we took the difficult decision we did, and why it is absolutely the right decision for the company,” Mullen says.

Remember Telstra says it will now adopt an ordinary dividend payout ratio of 70 to 90 per cent of underlying earnings.

TLS last up 0.3 per cent at $3.56

11.00am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Ben Rodeny — Morgans

11.15am: Rudi Filapek-Vandyck — Editor, FNArena

11.30am: Andrew Ticehurst — Nomura

11.30am-12.00pm: Live cross — State of Australia panel featuring RBA Asst. Gov. Luci Ellis and BCA Jennifer Westacott

11.30am-12.00pm: Live cross — Citi Investment Conference

12.00pm: David Hunt — ProfitHunters Market X

12.15pm: Gerard Burg — Senior Asia Economist, NAB

(All times in AEST)

Samantha Woodhill 10.55am: Harvard lawyer to head ASIC

Harvard lawyer James Shipton has been appointed the new chairman of Australia’s corporate regulator.

Financial Services Minister Kelly O’Dwyer today announced Mr Shipton will take over as head of the Australian Securities and Investments Commission in February.

He replaces Greg Medcraft.

The announcement comes after a leading contender for the post, Credit Suisse chairman John O’Sullivan, last week withdrew his candidacy citing “unprecedented and disturbing” criticisms of him by Labor over his friendship with Malcolm Turnbull.

10.50am: ASX200 hits fresh 5-month high

Australia’s S & P/ASX 200 0.4pc to fresh 5-month high of 576.7 at the open.

Volume is light, but materials and energy are leading relatively broadbased gains.

Base metals miners are among the standouts after LME copper jumped 3.8pc and nickel rose 1.7pc after China’s PPI inflation surprised.

“The next test for the index will be whether it can resume its longer term up trend by exceeding the May peak at 5956,” says CMC Markets chief market analyst Ric Spooner.

“Amongst other things, this may depend on investors being prepared to re-ate major Australian stocks to the sort of above average valuations that have been applied to the US and other markets.”

He says the performance of base metals markets overnight suggests evidence of animal spirits that could support the local market by reinforcing optimism about the global economy.

But falls in China’s iron ore and steel futures will introduce an element of caution for buyers.

“This raises a question about the durability of the bounce in iron ore following release of China’s strong import data last week,” he says.

Dalian iron ore futures fell 2.5pc and rebar futures fell 1.9pc last night.

10.45am: Telstra CEO Penn affirms outlook

Telstra chief executive Andy Penn reiterates the telco’s financial outlook for financial 2018 in comments made at this mornings annual meeting in Melbourne.

Penn says he expects revenue to be in the range of $28.3bn-$30.2bn and earnings (EBITDA) to come in at a range of $10.7bn-$11.2bn, the same figures issued during full year results in September.

Meanwhile Telstra chairman John Mullen reiterates dividend this year is expected to be 22 cents per share fully franked, under the telco’s new dividend payout ratio down on the year previous.

TLS last up 0.3 per cent at $3.56

Matt Chambers 10.22am: Rio in Gupta talks on aluminium sale

Rio Tinto is in talks with British billionaire Sanjeev Gupta, who purchased Arrium and its Whyalla steelworks from administrators earlier this year, to buy Rio’s Australian and New Zealand aluminium assets.

It is understood Mr Gupta, who is living in Sydney, plans to visit some of the assets this week to decide whether to make a bid.

The assets include stakes in the Boyne aluminium smelter at Gladstone, the Tomago smelter in the Hunter Valley and the Bell Bay smelter in Tasmania.

The company’s Pacifc Aluminium division, which analysts have valued at up to $US1 billion, also owns the Gladstone Power Station and a majority stake in the New Zealand Aluminium Smelters business that includes the country’s only aluminium smelter at Tiwai Point in Southland — read more

RIO opened up 1.2 per cent at a fresh 3-year high of $71.35.

10.17am: Shipton appointed new ASIC chair

A Harvard lawyer has been appointed the new chairman of Australia’s corporate regulator.

Financial Services Minister Kelly O’Dwyer announced the appointment of James Shipton to the Australian Securities and Investments Commission, with his role to start in February.

“We have appointed here the most qualified and the most experienced candidate for the job ahead,” she told reporters in Canberra on Tuesday.

AAP

10.06am: ASX to lift ahead of RBA minutes

Australia’s S & P/ASX 200 is expected to open up 0.2pc after offshore gains.

The S & P 500 rose 0.2pc to a record high close of 2557.64, led by financials and telcos.

In commodities, LME copper jumped 3.8pc to a 2-year high as China September PPI rose 6.9pc vs. 6.4pc expected.

Spot iron ore rose 0.7pc to $US62.94, while Brent crude rose 1.1pc to $US57.82.

BHP ADRs equivalent close at $27.17 was 0.8pc above BHP’s Sydney close.

On the charts, the index may be confined to a 5836-5872 range with upside risk to 5900.

Dividend payments in recent weeks may be magnifying the positive reaction to offshore gains.

The index is now up 3.5pc in 7 days, its best 7-day run since the start of the “Trump bump” last November.

Focus turns to RBA minutes at 11.30am (AEDT).

Index lat 5846.8.

Supratim Adhikari 9.55am: Dividend only the beginning: Telstra

Telstra chairman John Mullen has warned shareholders that there was no easy fix to tackling the impact of the National Broadband Network on Telstra’s books.

“I have had shareholders ask why we can’t just go out and find growth businesses to replace the $3b in earnings that we are losing because of the NBN, so we can maintain the dividend at previous levels … that is very easy to say and very hard to do,” Mr Mullen said at Telstra annual general meeting.

“To expect that we can suddenly just go out and create another $3b EBITDA business overnight is simply just not realistic.

Mr Mullen said that the recent change to its dividend policy is just one of many difficult decisions the telco needs to take to remain relevant.

“Changing our dividend policy is just one change among the many that we will need to make,” Mr Mullen said at Telstra annual general meeting.

“Whether we like it or not, we have to accept that the world around us has changed dramatically and Telstra is having to change just as dramatically as well” — read more

TLS last $3.55

9.47am: Oil Search lifts 3Q production

Oil Search total third-quarter output rose 9 per cent to 7.9mmboe (million barrels of oil equivalents), while output sales rose 18 per cent to 8.2mmboe and revenue jumped 15 per cent on the same period a year prior to $US380.8 million.

Alongside results, the company maintains its calendar year 2017 output guidance range of between 29-30.5mmboe.

OSH last $7.21

9.35am: APN taps media veteran as new chief

APN Outdoor has appointed James Warburton as its new chief executive officer effective January 2018 after incumbent Richard Herring announced his departure in August.

Mr Warburton has 16 years’ experience in CEO roles with V8 Supercars Australia, Ten Network Holdings, and Universal McCann.

APN last $4.58

9.25am: Analyst rating changes

GWA raised to Neutral — Macquarie

Costa initiated at Neutral — Macquarie

Perseus raised to Buy — Canaccord

Monadelphous cut to Sell — Morningstar

Moelis initiated at Hold — Ord Minnett

Beach raised to Hold — Shaw & Partners

Altium cut to Sell — Bell Potter

Alumina initiated at Positive — Evans & Partners

GUD Holdings raised to Buy — Bell Potter

Eli Greenblat 9.22am: Fashion veteran joins Myer board

The incoming chairman of Myer, Garry Hounsell, has moved quickly to improve the board’s retail experience and mute the protests by its biggest shareholder Solomon Lew, by this morning appointing fashionista and retail management consultant Julie Ann Morrison as a director of the department store owner.

Ms Morrison, who is on the advisory board of Carla Zampati and a veteran of international up-market fashion brand group LVMH where she ran Bulgari UK.

The Australian reported on Monday she had also just been appointed chairman of Myer’s Specialty Brands Australia, a new vehicle that houses Sass & Bide, Marc’s and David Lawrence.

Mr Lew has attacked the Myer board recently for its lack of directors with direct retail experience.

MYR last $0.74

9.10am: St Barbara lifts 1Q gold output

St Barbara first-quarter gold production rose 5 per cent to 98.2k ounces, while the company has maintained its FY18 all-in-sustaining-cost guidance range of between $970-$1,035 after achieving a $889/ounce over the period.

SBM last $2.65

Matt Chambers 8.53am: Iron ore carries Rio on copper miss

Miner Rio Tinto has missed third quarter copper production expectations just as copper prices hit fresh three-year highs, slashing full-year guidance after grades slumped at Rio’s copper mine in Utah and strike action at the giant Escondida mine it owns with BHP Billiton earlier this year delayed expansion plans.

Rio’s production from its West Australian iron ore mines — by far its biggest earner — was in line with expectations and full year shipping guidance (including the share of Rio’s minority partners) was unchanged at 330,000 tonnes.

The company’s results revealed September-quarter mined copper production fell 3 per cent from the previous quarter to 120,600 tonnes, badly missing market expectations of around 150,000 tonnes.

The miss, after grades slumped and mine plans were changed at the Kennecott mine in Utah and the start of the Los Colarados concentrator expansion at the BHP-operated Escondida mine was delayed, led Rio to slice 2017 guidance from between 500,000 and 550,000 tonnes to between 460,000 to 480,000 tonnes.

WA iron ore production rose 6 per cent from the previous quarter to 85 million tonnes, in line with expectations. Shipments were 86 million tonnes — more to come.

RIO last closed at a 3-year high of $70.55

Andrew White 8.20am: Energy short quick fix: ACCC

Competition boss Rod Sims has warned there will be no “quick fixes” for soaring energy prices, with a decade of policy failings likely to take at least as long to repair.

Releasing an interim report on energy prices, Mr Sims said many of the factors driving a 63 per cent hike in costs such as high network charges were baked in and would take years before they fell.

The comments came as the government passed legislation to abolish an appeal process that the Australian Energy Regulator said had been gamed by the energy networks and added almost $11 billion to electricity costs since 2008.

8.15am: ANZ’s NZ shares in trading halt

ANZ’s New Zealand-listed shares have entered into a trading halt this morning pending news of a potential transaction, according to Bloomberg — more to come.

ANZ last $30.16

7.40am: ASX poised to start higher

The Australian share market looks set to open higher, following the lead from Wall Street where major stock indices rose overnight.

At 7am (AEDT), the local share price futures index was up 11 points, or 0.19 per cent, at 5,839.

US stocks edged higher as financial shares recovered from last week’s losses and higher oil prices lifted energy shares.

The Dow Jones Industrial Average rose 0.37 per cent, the S & P 500 gained 0.15 per cent and the Nasdaq Composite added 18.2 points, or 0.28 per cent, to 6,624.0.

In local economic news, the Reserve Bank of Australia is due to release the minutes of the board’s October monetary policy meeting, which is expected to provide opinion on the key topics of housing, jobs and the consumer.

RBA assistant governor for economics, Luci Ellis, will take part in a panel discussion at the annual Australian and New Zealand investment conference.

The Australian Bureau of Statistics will release new motor vehicles sales for September and the ANZ-Roy Morgan Consumer Confidence weekly survey is also due on Tuesday.

In equities, Rio Tinto will report on its September quarter review and Oil Search will release its third quarter production report.

Telstra is due to host its annual general meeting in Melbourne.

Yesterday strong prices for iron ore and growing global economic strength helped propel the Australian share market to a five-month high.

The benchmark S & P/ASX 200 index rose 32.6 points, or 0.56 per cent, to 5,846.8 points yesterday — its highest close since mid-May.

The Australian dollar remained resilient yesterday against the US dollar which eased in the wake of Friday’s lower-than-expected US inflation report. But this morning, the local currency has retreated slightly despite little major news flow.

Westpac senior market strategist Imre Speizer said the 0.2 per cent rise in US dollar overnight may be due to headline comments suggesting John Taylor was a favoured federal chair candidate, and after US President Donald Trump alluded to an economic development bill.

He expects the Australian dollar to consolidate in a US78.00 cents to US79.00 cent range if the USD holds its ground.

“That’s barring a surprise from today’s Reserve Bank of Australia minutes,” Mr Speizer said.

At 7am (AEDT), the local currency was worth US78.49 cents, down from US78.74 cents yesterday.

AAP

7.10am: Financials lift US indexes

Rising financial shares have pushed US stock indexes to fresh records.

The day’s moves were muted, keeping the S & P 500 and Dow Jones Industrial Average in a narrow range throughout the session.

Still, the two indexes closed at fresh highs after posting their fifth consecutive week of gains on Friday.

Data have suggested a pick-up in global growth is under way, analysts said, helping stocks chug higher even as some investors have expressed concerns about the length and the largely uninterrupted nature of the rally.

“While there’s sometimes going to be noise coming out of DC, we still have accommodative central banks around the world and benign inflation,” said David Sadkin, president of Bel Air Investment Advisors.

The combination should support stocks, although major indexes could come under pressure if central banks raise rates faster than expected, Mr. Sadkin added.

The Dow Jones Industrial Average rose 85 points, or 0.4 per cent, to 22957. The S & P 500 added 0.2 per cent, and the Nasdaq Composite advanced 0.3 per cent.

Shares of financial companies led US stock indexes higher after coming under pressure last week.

JP Morgan Chase added 2.1 per cent, Bank of America rose 1.6 per cent and Goldman Sachs Group added 1.6 per cent.

Energy stocks rose with oil prices, with Newfield Exploration and Hess among the biggest gainers in the S & P 500 energy sector.

Australian stocks are set to follow Wall Street higher. At 7am (AEDT), the SPI futures index was up nine points.

Dow Jones Newswires

7.00am: Iron ore jumps again

The price of iron ore has taken another leap, rising four per cent to $US62.40 overnight, according to The Steel Index.

It follows a 4.5 per cent surge at the weekend.

6.50am: Aussie dollar falls

The Australian dollar has retreated slightly against its US counterpart, despite little major news flow.

At 6.30am (AEDT), the local currency was worth US78.46 cents, down from US78.74 cents yesterday.

The Australian dollar remained resilient yesterday against the US dollar which eased in the wake of Friday’s lower-than-expected US inflation report.

Overnight, however, Westpac senior market strategist Imre Speizer said the US dollar index rose 0.2 per cent, possibly due to headline comments suggesting John Taylor was a favoured federal chair candidate, and after US President Donald Trump alluded to an economic development bill.

He expects the Australian dollar to consolidate in a US78.00 cents to US79.00 cent range if the USD holds its ground.

“That’s barring a surprise from today’s Reserve Bank of Australia minutes,” Mr Speizer said.

He said all eyes would be on the minutes which will provide the board’s opinion on the key topics of housing, jobs and the consumer.

“As always markets will be watching for any subtle hints on the RBA’s thinking on housing jobs and the consumer,” Mr Speizer said. The local current was also lower against the Japanese yen and the euro.

AAP

6.45am: Oil prices up on Iraq tension

Oil prices strengthened as tension in Northern Iraq’s oil-rich Kurdish region erupted, just days after the US indicated it will let the Iran nuclear deal “die another day.”

The US benchmark crude oil price was up nearly 1 per cent to $US51.87 per barrel in recent trading, while the international Brent price was up 1.2 per cent to $US57.85.

Metals prices ripped higher, with copper and palladium at multi-year highs, after China reported a 6.9 per cent year-on-year rise in its producer price index in September.

Dow Jones

6.40am: Earnings could push Dow past 23,000

The Dow Jones Industrial Average is on the verge of crossing 23,000 for the first time ever. A stack of earnings reports this week could get it there.

Nine companies in the 30-stock index that together represent a third of its weighting are set to report earnings this week, according to S & P Dow Jones Indices. A big earnings beat from one or more of the companies could give the index the juice it needs to top its next 1,000-point marker.

Tonight brings a quarterly earnings report from Goldman Sachs Group Inc. The New York-based bank is the second-highest priced stock in the Dow, and therefore makes up 7.2 per cent of the price-weighted index. UnitedHealth Group Inc., accounting for 5.8 per cent of the index, reports before the opening bell, while International Business Machines Corp, making up 4.4 per cent of the index, releases results after the close.

6.35am: Oil price lifts European markets

European stock markets mostly rose on advancing oil prices, although Madrid sank on resurgent worries over the Catalan independence crisis, dealers said.

Frankfurt and Paris each closed higher, with Frankfurt breaking the 13,000 level again. London dipped 0.1 per cent.

Meanwhile, oil prices rose after Iraqi forces swept across disputed Kirkuk province following soaring tensions over an independence referendum, seizing the governor’s office, key military sites and an oilfield.

The rising value of oil boosted the share prices of energy companies, as they tend to earn higher revenues and profits when oil prices are higher.

In Madrid, the stock market shed 0.8 per cent after Madrid warned Catalonia’s separatist leader that he has only three days left to “return to legality” after he refused to say whether he would follow through on a threat to declare independence from Spain.

AFP

The Dow industrials have climbed 16 per cent this year, cruising past three 1000-point markers in 2017 alone. The index’s first close above 22000 came more than two months ago, also fuelled by strong earnings. Apple Inc. rallied on the back of its results, accounting for nearly all of the Dow’s gain that day.

If the Dow closes above 23,000 this week, it would still take more than double the 35 days that it took the index to climb from 20,000 to 21,000 over the winter, though it would be quicker than the 154 it took to climb from 21,000 to 22,000.

Dow Jones