Trading Day: live markets coverage; ASX bags 6000 in Cup Day multi; plus analysis and opinion

The ASX closes above 6000 for the first time since the GFC as mining heavyweights haul the top 200 index higher.

And that’s the Trading Day blog for Tuesday, November 7.

Samantha Woodhill 4.35pm: Stocks seal close above 6000

The local share market sealed a close above 6000 and at its highest level since January 2008 on the back of strength in commodity prices.

The benchmark S&P/ASX200 was up 60.52 points, or 1.02 per cent, at 6014.3 points. The broader All Ordinaries index was up 60.212 points, or 1 per cent, to 6087.4 points at the close.

Energy stocks and materials drove the market higher after commodity prices surged across the board. Crude oil rose as the Saudi Arabian corruption probe rattled investors, while steel futures rade dragged spot iron ore higher in tandem.

“The new fuel to the fire is a further appreciation in commodities,” said IG chief market strategist Chris Weston.

“That’s obviously putting some big upside into some of these names today.”

The spot price for iron ore spiked 5.6 per cent higher to $US62.70 a tonne, according to The Steel Index.

“Worsening weather conditions in northern China have resulted in more cities implementing steel mill closures,” ANZ senior economist Jo Masters said.

“With steel output likely to fall, traders are now worried about the strain on already low inventories around the country.

“This pushed steel futures prices higher in both rebar and hot rolled coil markets.”

BHP Billiton surged to a two-year high, up 3.9 per cent to $28.75. Rio Tinto hit a six-year high, gaining 2.06 per cent to $78.20. Fortescue shot up 4.79 per cent to $5.03.

More to come.

4.00pm: RBA leaves cash rate on hold

The Reserve Bank of Australia has left interest rates unchanged at a record low of 1.5 per cent.

The widely expected decision comes after mixed signals on the domestic economy in recent weeks.

Retail sales and consumer price data disappointed, but surveys of consumer and business confidence improved and employment and international trade data exceeded expectations.

At the same time, US economic growth and manufacturing data have beaten expectations, the IMF revised up its global economic growth forecast, the Australian dollar has fallen 2 per cent, crude oil has jumped 14 per cent, copper is up 7 per cent and nickel has surged 25 per cent.

3.35pm: Rekindling takes the Melbourne Cup

Rekindling has taken out the Melbourne Cup with 16:1 odds, narrowly edging out Johannes Vermeer (14:1) in the final stretch and leaving and Max Dynamite (23:1) to place third — read more

3.16pm: ASX200 hits post-GFC 6000 high

Australia’s main share market index has regained 6000 points for the first time in almost a decade.

The S&P/ASX 200 index trades nearly 0.9 per cent higher at 6007, its highest point since February 2008.

Trading volumes remain unexpectedly high given the Victorian Melbourne Cup public holiday, sharemarket strength leading up to today’s session comes amid bullish global equities and commodity trade fuelled by the second-longest US economic expansion in history.

Overnight, the S&P 500 rose 0.1 per cent to a record high close of 2591.1, driven by a surge in crude oil prices amid uncertainty in Saudi Arabia after widespread arrests among the political and financial elite.

Further strengthening the outlook for Australian shares, spot iron ore soared 5.8 per cent to $US63.36 as steel prices rose amid pollution curbs in China.

BHP Billiton shares rose 3 per cent to a two-year high of $28.49, while Rio Tinto (+1.8pc), Woodside Petroleum (+3.2pc) and Fortescue Metals (+4.7pc) all trade in the black.

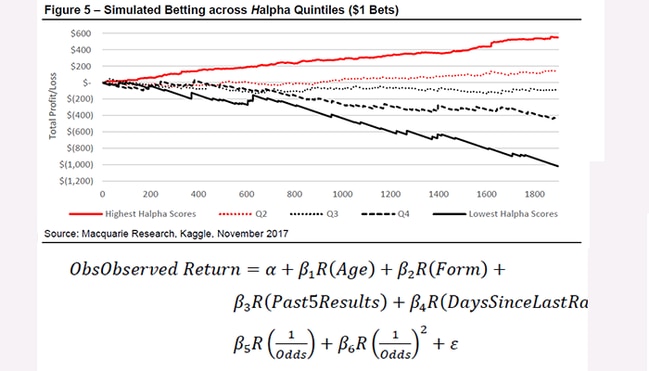

2.50pm: #4 Melbourne Cup bet biases: Macquarie

Hold onto your sweepstake: before you place your final Melbourne Cup dollar, Macquarie quants have identified four biases that tend to skew the odds toward good looking studs and away from the under ... horses.

1. Younger horses

“While younger horses are indeed more likely to win than their older peers, the effect is not as strong as punters believe.”

2. Both very long and very short odds

“Horses with either very long or very short odds are both overvalued and have odds that are too short for systematic betting on these horses to be profitable.”

3. Fewer days since last run

“There appears to be a mild over-preference for horses that have raced more recently, compared to those that have sat out for a longer period of time.”

4. Better form ratings

“As with age, horses with better form are more likely to win overall. However, punters exhibit overconfidence in this information, and so bid down the odds more than the actual magnitude of the advantage.”

Macquarie quants note that their report is not meant to be taken seriously, and is only meant for fun.

This is an excerpt from what they call fun:

2.41pm: What do economists know about tipping?

With Samantha Woodhill

Johannes Vermeer is the best value bet in the Melbourne Cup, according to Morgans, flush with fresh tips published in The Australian this morning.

Morgans economists gave 3 points to a first place tip, 2 points to second, and one point to a third.

Johannes Vermeer had the second-highest number of points: 11 — Marmelo first at 13.

However, Morgans then multiplied these numbers by the electronic market odds at 8.30am (AEDT) this morning and produced Johannes Vermeer a clear winner on this basis of a value bet.

Marmelo: $8.00 x 13 = 104

Johannes Vermeer: $10 x 11 = 110

“Economists generally have enough sense to know that they know nothing about horse races,” says Morgans.

“There are people who do — they are called tipsters.”

2.30pm: Dollar soars as RBA hold rates

The Reserve Bank has kept interest rates on hold at a historic low of 1.5 per cent for the fourteenth consecutive meeting in November.

The Australian dollar leapt 20 points higher in response to trade close to flat at US76.92 after falling as much as 0.2 per cent to US76.80 cents ahead of the decision — read more

RBA leaves rates ON HOLD at record low 1.5% for the 15th consecutive month "a safe bet on cup day" LIVE now on @SkyBusiness #ausbiz pic.twitter.com/QD0ypZI7JY

— Leanne Jones (@leannejonesbiz) November 7, 2017

James Kirby 2.15pm: 6000: A point of celebration

Does the ASX 200 finally crossing the 6000 mark really matter? You bet it does.

For investors this is a point of celebration — at its very best we are now in new territory and hopefully fresh momentum can push us higher as we move to the end of the year.

“It’s only a number,” said one senior fund manager earlier today, but some numbers matter more than others. In terms of a market breakthrough this has echoes of the much-tested and finally vaulted push to parity we had on currency markets back in 2010 when our dollar hit $US1.00.

1.03pm: Westpac avenues for capital amends: UBS

Westpac shareholders might be in for a special dividend, says UBS.

The investment bank’s analysts take a fresh look at Westpac after its full-year results released yesterday missed market expectations.

“With limited growth prospects, we expect WBC to look to return capital,” say the analysts, adding the bank’s capital reserves are all but at the “unquestionably strong” levels imposed by the prudential regulator earlier this year.

UBS raises possible avenues for distribution including increasing the ordinary dividend by 1cps each half-year, 10cps special dividends with each final dividend from 2H18 or the neutralisation of shares issued via the dividend replacement program from 2H18.

WBC last up 0.2 per cent at $32.60

12.08pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Foxtel Ch: 602)

NOW: Greg McKenna — AxiTrader

12.15pm: Janu Chan — Senior Economist, St. George

12. 45pm: Stephen Koukoulas — Managing Director, Market Economics

(All times in AEST)

12.02pm: Fox, Disney held takeover talks

Walt Disney Co. has recently held talks to buy 21st Century Fox’s cable-television networks, international distribution operations and movie and television studio, according to people close to the discussions, a tie-up that would bolster Disney’s dominance in Hollywood and allow Fox to focus on sports, news and broadcast television.

The talks were no longer active by Monday afternoon when CNBC first reported them, according to one of these people. They were very preliminary and broke down over price and other key deal terms, according to another person — Dow Jones Newswires

Read more

Elizabeth Redman 11.40am: 360 Capital takes Data Centre controls

Tony Pitt’s 360 Capital (TPG) has won control of takeover target Asia Pacific Data Centres (AJD), lifting its stake well past the half way mark after its $1.95 per security offer closed last night.

But the suitor could find challenges ahead as rival NextDC still owns a significant blocking stake in the company with 29.1 per cent, and is seen as unlikely to sell its interest as flagged by DataRoom.

Samantha Woodhill 10.53am: Iron ore tracks steel futures higher

Iron ore prices have surged as Chinese steel futures dragged the price higher overnight.

The spot price for Australia’s biggest commodity spiked up 5.6 per cent to $US62.70 a tonne, according to The Steel Index.

“Worsening weather conditions in northern China have resulted in more cities implementing steel mill closures,” ANZ senior economist Jo Masters said.

“With steel output likely to fall, traders are now worried about the strain on already low inventories around the country.

“This pushed steel futures prices higher in both rebar and hot rolled coil markets.”

It came as commodity prices hiked up across the board last night as the US dollar fell and geopolitical risks heightened, Ms Masters said — more to come

Note: Shares in exposed diversified mining heavyweights BHP and Rio Tinto hit fresh records in early trade.

10.22am: Stocks surge, BHP hits fresh 2y high

The S&P/ASX200 index trades over 0.5 per cent higher at the open at 5988.2 after briefly touching 5995.3 as dviersfied mining heavyweights haul the index higher on fresh 2.5-year highs in oil and a 5 per cent jump in spot iron ore.

BHP trades over $28 to its highest level in at least two years, while Rio Tinto continues to make fresh 6 year highs of its own.

Major bank shares all eke out marginal gains except Westpac in the session following its results.

SWING STOCKS

+ Beach Energy (4.6pc), Mayne Pharma (3.7pc), Super Retail Group (3.4pc), Woodside (2.5pc), Oil Search (2.3pc), Santos (2.3pc)

— A2 Milk (2.2pc), Graincorp (1.9pc), South32 (1.4pc)

Pia Akerman 10.03am: Coles to overhaul enterprise agreement

Coles has pledged to start consultation and approval of a new enterprise agreement with staff after settling an industrial dispute lodged by a nightshift worker.

Penelope Vickers, who has been working three shifts a week for the supermarket giant since 2012, had applied to the Fair Work Commission to terminate a 2011 Coles EBA which workers were moved to after an earlier legal challenge saw the 2014 agreement scrapped.

In a statement, Coles said Ms Vickers had agreed to withdraw her application to the Fair Work Commission and the supermarket would conduct a vote on a new agreement by the end of February.

“Coles will give eligible team members a transition payment, reflecting the pay structure in the new enterprise agreement being paid for the period between any successful vote and the commencement of the new agreement,” the company said — more to come.

WES last $42.41

9.54am: Asia-Pacific futures tip mixed opens

The ASX/S&P200 is tipped for a 0.5pc rise, Japan’s Nikkei looks set to drop 0.1 per cent, while China’s Heng Seng is tipped to open up 0.1 per cent.

9.52am: ASX to lift on Wall St, oil hopes

S&P/ASX 200 expected to open up 0.4pc after US stocks hit fresh record highs amid further gains in oil prices.

Brent crude surged 3.3pc to $US64.12 amid uncertainty in Saudi Arabia after widespread arrests among the political and financial elite.

Energy is likely to be the strongest sector in the market again today following a 2.2pc jump in the S&P 500 Energy sector.

It’s worth noting that Wall Street was mixed, with a majority of sectors closing in the red.

But the Australian resources sector will get a boost from surging iron ore prices.

Spot iron ore jumped 5.8pc to $US63.36 and Dalian iron ore futures rose 3.6pc.

BHP ADRs equivalent close at $28.89 equates to a 2.3pc rise in BHP’s Australian-listed shares.

Otherwise it should be a quite day with Victoria on holiday for the Melbourne Cup.

The RBA is widely expected to keep interest rates steady when its meeting ends at 2.30pm (AEDT).

Index last 5953.8.

9.49am: Broadcom bids for Qualcomm

Broadcom is making an unsolicited, $US130 billion ($A182 billion) offer for rival chipmaker Qualcomm, the largest deal ever in the tech industry that will face intense regulatory scrutiny.

President Donald Trump appeared with Broadcom chief executive Hock Tan last week, saying the company is likely to relocate its headquarters from Singapore to the United States.

There has already been broad consolidation in the computer chip sector and a tie-up between the two giant companies would create a massive producer. The Broadcom offer of $US70 per share to Qualcomm stockholders would be $US60 per share in cash and $US10 per share of Broadcom.

Broadcom says its proposal is a 28 per cent premium over the closing price of Qualcomm common stock on November 2, the last “unaffected” trading day for the companies.

AAP

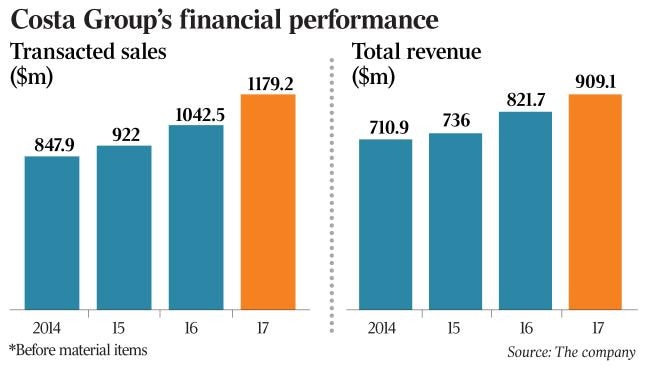

9.44am: Costa earnings upgrade berry likely

Bridget Carter and Scott Murdoch write:

Speculation is mounting that sharemarket high flyer Costa Group might issue an earnings upgrade at next week’s annual general meeting after it paid $68 million late last week to lift its shareholding in its African Blue, Morocco-based berry joint venture from 49 per cent to 90 per cent.

Shares in the nation’s largest fruit and vegetable company reached an all-time high of

$6.74 yesterday. They were issued at $2.25 per share when the company was floated at

the end of July 2015. Macquarie Group upgraded the stock to outperform in the wake of the African Blue deal, which Costa said would be earnings per share accretive in the current financial year — read more from DataRoom here

CGC last $6.74

9.33am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Foxtel Ch: 602)

NOW: David Plank — Head of Australian Ecnomics, ANZ

9.30am: Chris Weston — Chief Markets Strategist, IG

9.45am: Ric Spooner — Chief Market Analyst, CMC Markets

10.00am: June Be Liu from Tribeca Investment Partners and Michael McCarthy from CMC Markets guest host

10.15pm: Nigel Littlewood — CIO, Harness Asset Management

10.45pm: Tom Kennedy — Economist, JPMorgan

(All times in AEST)

9.14am: Saudi crackdown ignites oil supply fears

Julia Simon writes:

Oil prices have risen more than three per cent, hitting the highest since early July 2015, as Saudi Arabia’s crown prince cemented his power over the weekend with an anti-corruption crackdown, while the US rig count fall and markets continue to tighten.

Brent crude futures were trading $US1.86 or 3 per cent higher at $US62.46 a barrel by 12.00pm Monday Eastern time (4.00am Tuesday AEDT).

US West Texas Intermediate (WTI) crude rose $US1.49 or 2.7 per cent to $US57.13 a barrel.

Both benchmarks are at their highest since early July 2015.

“Whether it’s the purging of the Saudi ranks and oil rig counts ticking down and talk of OPEC extending cuts we’re seeing the volatility stretch this trading range,” said Rob Haworth, senior investment strategist at US Bank Wealth Management.

Saudi Crown Prince Mohammed bin Salman tightened his grip with the arrest of royals, ministers and investors, including billionaire Alwaleed bin Talal and the powerful head of the National Guard, Prince Miteb bin Abdullah. The arrests, which an official said were just “phase one” of the crackdown, are the latest in a series of dramatic steps by Crown Prince Mohammed bin Salman to amass more power for himself at home.

Reuters

9.06am: Suncorp ditches Tower pursuit

Suncorp’s New Zealand subsidiary Vero Insurance has received a notice of termination of the scheme implementation agreement from Tower as part of its stalled bid to acquire the insurance rival.

Suncorp says it will no longer be proceeding with its appeal of the New Zealand Commerce

Commission’s decision to decline its application to acquire Tower and will focus on maximising the value of its existing shareholding in the company — read more

SUN last $13.88

8.57am: Analyst rating changes

Westpac cut to Neutral — Credit Suisse

Westpac cut to Underperform; price target (12m) cut 3pc to $32.52 — CLSA

Platinum Asset Management raised to Neutral — Credit Suisse

Magellan Financial raised to Outperform — Credit Suisse

Super Retail raised to Neutral — JPMorgan

JB Hi-Fi raised to Neutral — JPMorgan

South32 cut to Sell — Deutsche Bank

Orica cut to Sell — Goldman Sachs

Crown Resorts cut to Hold — Morningstar

Orica price target (12m) cut 6.9pc to $18.85; Hold kept — Deustche Bank

Orica price target (12m) cut 5.7pc to $16.80; Underweight rating kept — Morgan Stanley

Orica price target (12m) cut 6.6pc $19.62; Neutral rating kept — Macquarie

Orica cut to Sell — Citi

Arena REIT initiated at Neutral; $2.25 price target (12m); Goldman Sachs

Folkestone initiated at Buy; $3.05 price target (12m); Goldman Sachs

Livehire raised to Add — Morgans

Ben Butler 8.35am: Glencore faces $100m ATO bill

Swiss miner and commodities trader Glencore faces an Australian tax bill of more than $100 million, according to the company, which is at the centre of a storm surrounding a gigantic leak of client files from top tax-haven law firm Appleby.

However, Glencore says ATO assessments levied on it are not related to a complex multibillion-dollar hedging deal between its Australian arm and one of its Bermudan companies, laid bare in the Paradise Papers leak.

8.31am: Banks a hindrance for 6000 mark

A fall in bank shares after a “low-quality” result from Westpac on Monday highlights the potential for the banks to at least temporarily derail the Australian market rally this month, particularly as three of the four majors will be trading ex-dividend by next Monday.

Notwithstanding gains in a majority of sharemarket sectors Monday, the S&P/ASX 200 fell short of the elusive 6000-point mark as Westpac dived 2.2 per cent and other banks lost ground.

Still, analysts, expecting a move above 6000 in the year ahead, are sticking to their guns.

Morgans Financial chief economist and director of strategy Michael Knox expects the S&P/ASX 200 to reach 6140 by April next year. That’s based on the “Fed Model” of equity market valuation, which compares the earnings yield of the stockmarket to long-term government bond yields.

Michael Roddan 8.23am: Westpac vows to put things right

Westpac chief executive Brian Hartzer has warned there may be more customer refunds to be paid out as the lender airs its dirty laundry, having spent more than 1 per cent of its earnings this year “putting it right” with customers found to have been disadvantaged.

The admission came as Westpac handed down a cash profit of $8.06 billion for the year to the end of September — a 3 per cent increase year-on-year.

The latest result rounded out the big bank profit season, where the big four banks delivered a combined $31.5bn in profit this financial year, an increase of 6.4 per cent compared to last financial year — read more

WBC last $32.55

.@Westpac full year cash profit up 3 per cent to $8.06 billion. MORE: https://t.co/wchhSWhJzH #ticky pic.twitter.com/KjDLEnQJFt

— Sky News Business (@SkyBusiness) November 6, 2017

7.50am: Aussie lifts against greenback

The Australian dollar is higher against its US counterpart amid escalating tension in the Middle East and as oil prices lift 3 per cent to a two-year high.

At 0635 AEDT on Tuesday, the Australian dollar was worth US76.82c, up from US76.53c on Monday.

Westpac’s Imre Speizer says that US equities markets again attained record highs overnight but the US dollar had fallen while the Australian lifted. “The US dollar index is down 0.2 per cent on the day ... (the) AUD rose from 0.7650 to 0.7682,” he said in a morning note.

The main local even risk on Tuesday would be the Reserve Bank of Australia’s interest rate decision and accompanying statement.

“The RBA policy decision is expected to be on hold. Key aspects of the statement will be on the subdued retail spending partial despite ongoing job gains, a cooling housing market and the inflation outlook.” Mr Speizer said he expected to see the local currency “consolidating in a 0.7640-0.7730 range”.

“Daily momentum remains negative, though, the next downside target at 0.7625 probably requiring further US dollar gains.” The Aussie dollar is also higher against the euro but down fractionally against the yen.

AAP

7.30am: Surging oil prices to boost ASX

The Australian market looks set to open solidly higher amid a three per cent rise in international oil prices as tension in the Middle East increases. At 7.00am (AEDT) on Tuesday, the share price futures index was up 25 points, or 0.42 per cent, at 5,958.

Oil prices surged after the crown prince of Saudi Arabia, the world’s biggest oil exporter, tightened his grip on power through an anti-corruption purge. Wall Street’s S&P 500 energy index subsequently surged 1.92 per cent. In afternoon trading, the Dow Jones Industrial Average was up 0.1 per cent, while the S&P 500 had gained 0.15 per cent, and the Nasdaq Composite had added 0.3 per cent — all three on-track for a record high close.

Locally, in economic news on Tuesday, the Reserve Bank of Australia announces its interest rate decision, while the ANZ-Roy Morgan Consumer Confidence weekly survey is slated for release.

No major equities news is expected.

The Australian share market closed lower on Monday with declines in the big banks and the materials sector offsetting a day of strong gains for local oil stocks.

The benchmark S&P/ASX200 index fell 6.1 points, or 0.1 per cent, to 5,953.8 points The broader All Ordinaries index ended the day down 3.1 points, or 0.05 per cent, at 6,027.2 points.

Meanwhile, the Australian dollar is continue to climb against the greenback following the lift in oil prices.

The local currency was trading at US76.88 cents at 7.00am (AEDT) on Tuesday, from US76.53 cents on Monday.

AAP

6.45am: Tech mega-deal boosts Nasdaq

A potential $US103-billion ($144 billion) megadeal in the chip sector is lifting the tech-heavy Nasdaq but the S&P and the Dow Industrials remains flat. On Monday, shares of Qualcomm rose 4.4 per cent to be a big boost to the Nasdaq after Broadcom offered to buy the smartphone chip supplier in what could be the biggest merger in the tech sector. Broadcom rose 2.2 per cent. Advanced Micro Devices rose 7.3 per cent on a report that it plans to team up with Intel to form a personal computer chip unit. Intel was up 0.5 per cent. Investors also kept an eye on President Trump’s comments on North Korea’s nuclear missile program and trade during his 12-day tour to Asia. US companies continue to report their quarterly earnings. With more than 400 of S&P 500 companies having reported, earnings for the third quarter are expected to have climbed eight per cent, compared to an expectation of a 5.9 per cent rise at the start of October, according to Thomson Reuters I/B/E/S. Michael Kors was up 9.9 per cent after the fashion accessories maker raised its 2017 revenue forecast.

“The third-quarter earnings season has given investors plenty of reason for optimism and with the global economy as a whole looking more healthy than it has in years, there’s little reason to be pessimistic right now,” said Craig Erlam, senior market analyst at Oanda.

In early trade on Monday, the Dow Jones Industrial Average was down 1.43 points, or 0.01 per cent, at 23,537.76, the S&P 500 was up 0.05 points, or 0.001 per cent, at 2587.89 and the Nasdaq Composite was up 12.42 points, or 0.18 per cent, at 6776.86.

Six of the 11 major S&P 500 sectors were higher, with the energy index’s 0.42 per cent rose on higher oil prices.

AAP