Trading Day: live markets coverage; All Ords hits fresh post-GFC high; plus analysis and opinion

Heavyweights haul local indices to fresh highs as Myer reveals slowing sales and A2 Milk comes off the boil.

Welcome to Trading Day for Wednesday, November 1.

Samantha Woodhill 4.30pm: Local shares hit 6-month high

The local share market sealed a six-month high closing high as banks and miners led gains on the back of US earnings season strength.

The benchmark S&P/ASX200 was up 28.783 points, or 0.49 per cent, at 5937.8 points, its highest close since March 5. The broader All Ordinaries index was up 29.104 points, or 0.49 per cent, to 6005.5 points at the close.

“US earnings continue to be pretty good so I think that’s supportive of the market more broadly for the market,” said Karen Jorritsma of Citibank.

“And then we’re movement in Australia off the back of AGM comments as they come out.”

In financials, NAB rose 0.67 per cent to $32.88. Commonwealth Bank edged up 0.05 per cent to $77.67. Westpac ticked up 0.64 per cent to $33.20 and ANZ grew 0.53 per cent to $30.08.

Rio Tinto gained 0.81 per cent to $70.01 and BHP hiked 1.54 per cent higher to $26.95.

The energy sector rose as the oil price pushed higher due to strong demand and falling inventories, according to ANZ’s David Plank.

“Prices have been well supported by reports that Saudi Arabia and other OPEC producers are ready to extend the current production cut agreement,” he said

4.25pm: Myer shares shrink on strategy day

Myer shares shrunk 4.6 per cent in the wake of the company’s strategy day for shareholders after it reeled in its outlook and revealed slowing first-quarter sales.

The department store operator’s total first-quarter sales slowed 2.8 per cent on the same period a year prior to $699m, same store sales also fell 2.1 per cent on the same basis, while management say they expect total FY17-FY20 sales per square metre to improve more than 10 per cent after previously forecasting that greater than 15 per cent.

CMC chief market strategist Michael McCarthy says Myer is attempting to “shifting the financial goalposts” and divert investor attention away from declining revenues and profitability.

“Until they turn that around, the sharemarket any reward whatsoever. Given what we’ve heard today I find it very hard to recommend Myer until there is a change of leadership.”

Analysts at investment bank Macquarie chimed in with today’s market consensus, seeing “high execution risk” associated with the department store’s ‘New Myer’ strategy, but stuck by the possibility of some upside for shareholders.

“The only obvious positive is the potential for corporate risk with PMV holding a 10.8 per cent stake.”

Premier Investments (PMV) chairman Solomon Lew slammed today’s attempt by Myer to woo shareholders with it’s strategy it describes as showing ‘green shoots’ by commenting that he “only sees weeds”.

MYR closed down 4.6 per cent to 73 cents.

Rosie Lewis 4.05pm: Senate president Stephen Parry to resign

In a statement to his Senate colleagues, Senator Parry said he would submit his resignation as both Senate president and a Tasmanian senator to Governor-General Sir Peter Cosgrove tomorrow.

“With a heavy heart I inform you that I have received advice from the British Home Office that I am a British citizen by virtue of my father’s birthplace, thereby being a dual citizen under the provisions of the Australian Constitution,” he said.

“Because my departure is rapid and an unexpected event, I will not have the usual opportunity to address you in the Senate one last time. I wish to thank all of you as colleagues, many of whom I regard as good friends — from all quarters of the chamber — for your support and confidence in me.”

The Australian dollar has pared nearly all its daily gains of up to 0.3 per cent to trade near flat at US76.58 cents after details of Mr. Parry’s citizenship emerged.

Rosie Lewis 3.43pm: Senate president Parry confirmed British

Senate president Stephen Parry has confirmation from the UK government he is a British citizen, as the Liberal and National parties fight over who should replace him in the senior role.

The Australian understands Senator Parry received advice from the UK Home Office today and will release a statement shortly.

The Australian yesterday revealed Senator Parry wrote to the home office seeking confirmation of his status, after it emerged his father was born in Britain — more to come.

.@CraigKellyMP: I’m very sad to hear the news about Senator Stephen Parry being a dual citizen. MORE: https://t.co/wPSIMvnOpr #speers pic.twitter.com/VIoaVR3mmY

— Sky News Australia (@SkyNewsAust) November 1, 2017

3.28pm: New contracts in pipeline: Domino’s

Domino’s says it welcomes today’s decision by the Fair Work Commission for the termination of the existing enterprise bargaining agreements (EBA) by January next year, and says renegotiations are already “well advanced”.

The company says it did not oppose the termination of the EBAs in question, but was granted a request for a period of time to allow the business to transition to the new proposed EBA currently under negotiation by the parties.

DMP shares remains 3.6 per cent lower at $44.93, after falling as much as 6.3 per cent in late trade.

3.10pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Craig Sidney — Shaw and Parnters

3.10pm: Jack Lowenstein — Morphic Asset Management

3.15pm: Politics Panel

3.30pm: Peter Botten — Managing Director, Oil Search

4.00pm: John Noonan — Thompson Reuters

4.05pm: Chris Weston — Chief Market Strategist, IG

4.15pm: Peter Strachan — StockAnalysis

4.20pm: Kerry Craig — Global Market Strategist, JPMorgan

4.30pm: Julia Lee — Bell Direct

Later: Premier Investments chairman Solomon Lew joins Ticky

(All times in AEST)

2.59pm: ASX hits 6m high on miner, nickel run

The S&P/ASX200 index continues to trade near the fresh 6-month high of 5952.4 it hit in earlier trade as investors in mining heavyweights BHP (+1.5pc) and Rio Tinto (+0.8pc) cheer a fresh 2-year high in nickel prices as LME Week unfolds in London.

“Nickel lead the sector higher, rising over 5pc as the market becomes increasingly confident about its place in the electric car movement,” says ANZ head of economics David Plank.

“Producers and traders speaking at the LME Week have all spoken positively about the growth in demand expected from this sector.”

Manganese and silver miner South32 taps a fresh all-time record high of $3.52 with a 4 per cent jump.

Meanwhile, investor’s secondary measure on the market the All Ordinaries index also continues to trade near the fresh post-GFC high of 6006.6 it hit in early trade.

2.45pm: Market takes Domino’s slice in late trade

Domino’s (DMP) falls as much as 6.3 per cent to a 4-week low of $43.66 in late trade on almost double average trading volume.

Samantha Woodhill 2.35pm: CIMIC lifts profit, taps new chief

CIMIC Group has named Michael Wright as its new CEO, as the construction company delivered a solid lift in third-quarter profit and confirmed guidance for the full year.

For the three months to September 30, CIMIC posted a net profit after tax of $178 million, up 20 per cent from the same period last year. The result brings its nine-month profit to $501m, up 21 per cent on last year — read more

CIM last up 0.3pc on $48.47

2.29pm: CSR ‘muted’ outlook a sore spot: Citi

CSR’s 1H18 EBIT of $209m beat Citi’s $204m estimate, but the outlook didn’t impress.

The broker says consensus expectations were “unrealistic” given the size of previously-guided property contribution.

And Gypsum supply disruptions were treated as significant items.

“Adjusting for what we think is an operational issue results were in line,” Citi analyst Simon Thackray says.

Interim dividend-per-share of 13.5cps was disappointing versus Citi estimate of 15cps.

Guidance for FY18e NPAT was within analyst range of $187m-$223m.

“However we saw outlook commentary as fairly muted,” Mr Thackray says.

Shares may have been priced for perfection after rising 28pc in the past three months.

CSR shares last up 5.9pc at $4.46.

Bridget Carter 2.10pm: Alinta ahead in Loy Yang B race

Speculation is mounting that Chow Tai Fook’s Alinta Energy will be named as the winner of the contest for Loy Yang B in two weeks, with the Hong Kong-based group offering between $1 billion and $1.3 billion for the coal fired power station.

Sources around the market say that Alinta has ousted China Resources in the competition for the Victoria coal fired power station and the board of Engie, which owns the asset, will approve the sale in the second week of November.

Read more from DataRoom

2.03pm: A2 Milk shares creamed 11pc

Paul McBeth writes:

A2 Milk Co shares have slumped 11 per cent as investors cash in on a stellar run in the stock which had been up more than 300 per cent this year.

A2 and its supplier Synlait Milk have been a breaking new ground since getting Chinese registration for their brands in September, and A2, in particular, has been a favourite among Australian investors for having managed to navigate through the Chinese market in much better shape than rivals such as Bellamy’s. Synlait (SM1) fell 5.6 per cent to $7.75.

“You have to wonder whether this is a one-day wonder,” Grant Williamson, a director at Hamilton Hindin Greene in Christchurch, said.

“When a stock takes off like A2 it usually registers a correction at some stage” — SCOOP

A2M last down 10.5pc on $6.82

Eli Greenblat 1.27pm: Myer’s green shoots ‘weeds’: Lew

Myer’s biggest shareholder, retail billionaire Solomon Lew, took little time today to come out savaging the department store’s junked earnings targets and commitment to its New Myer strategy, saying there was “very clear evidence” New Myer was a failure and that it highlighted incoming Myer chairman Garry Hounsell was “unelectable”.

Responding quickly to Myer’s daylong strategy update and new earnings targets, Mr Lew’s Premier Investments issued a statement this afternoon that also said it was alarmed at the sales drop Myer had revealed for the first quarter.

Mr Lew also took a shot at comments from Mr Hounsell that he was seeing ‘’green shoots’’ of a recovery at Myer.

“I only see weeds, no green shoots,’’ said Mr Lew today — more to come.

MYR last 4.9 at 72.75 cents.

1.05pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: James Gerrish — Shaw and Parnters

1.30pm: Andrew Wielandt — Dornbusch Partners

1.50pm: Yvonne Man — Bloomberg Asia

(All times in AEST)

Sarah-Jane Tasker 12.45pm: Sportsbet claims Tabcorp’s poll position

Corporate bookmaker Sportsbet has outranked rival Tabcorp in online wagering turnover for the first time as punters continue to shift to digital channels.

Investment bank UBS has estimated that the digital wagering market grew turnover by 22 per cent in 2017, which represented more than two-thirds of wagering turnover. In contrast, retail turnover slumped 6 per cent.

UBS analyst Matt Ryan outlined in a client note that as turnover continued to move to the online channel, his team partnered with the UBS Evidence Lab to track iOS app download share across the wagering operators — more to come.

TAH last down 0.2 per cent $4.48

Ben Butler 12.23pm: BBSW phone calls small sample: Westpac

Obscenity-laden phone calls in which Westpac’s star interest rate trader Col “The Rat” Roden boasted he could move the benchmark bank bill swap rate have been “misinterpreted” by the corporate regulator, the bank has told a court.

Counsel for Westpac, Matthew Darke, SC, told the Federal Court the bank denied engaging in any rate-rigging.

The Australian Securities and Investments Commission accuses Westpac of market manipulation and unconscionable conduct by trying to set an artificial price for the BBSW on 16 dates between April 6, 2010 and June 6, 2012.

Mr Darke said this was a “small fraction” of the 540 days in which the BBSW was traded during the period.

“No attempt is made to prove that Westpac’s trading in bank bills was uneconomic or irrational,” he said.

“There were legitimate commercial reasons for Westpac’s trading on each occasion.”

Yesterday, counsel for ASIC, Philip Crutchfield, QC, played the court recordings of phone calls featuring Mr Roden, including one in which he talked about moving the BBSW even though he “knew it was completely wrong”.

“Those communications it should be noted are an absolutely minuscule proportion of the 12m communications Westpac has produced to ASIC in the course of its investigation,” Mr Darke told the court.

“They are it seems the best ASIC can do.

“Our response to that subset of communications is to say they have been misinterpreted by ASIC.”

12.19pm: Myer shares fall 4.6pc in late trade

Myer shares (MYR) trade as much as 4.6 per cent lower in lunchtime trade at 73 cents after lowering its outlook and unveiling a 2.1 per cent fall in comparable sales, well below analyst expectations at investment bank Macquarie.

“Myer’s short- to medium-term outlook is under structural and cyclic pressure — ongoing sales weakness continues and high execution risk is attached to the New Myer Strategy — now revised down,” the broker says.

“The only obvious positive is the potential for corporate risk with PMV holding a 10.8 per cent stake.”

Macquarie has a “neutral” rating and 69 cent target price on the stock.

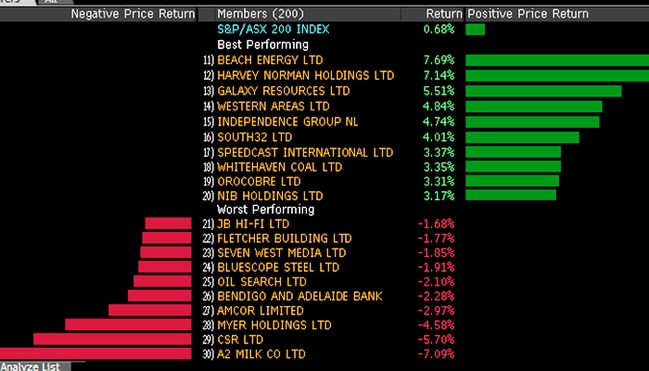

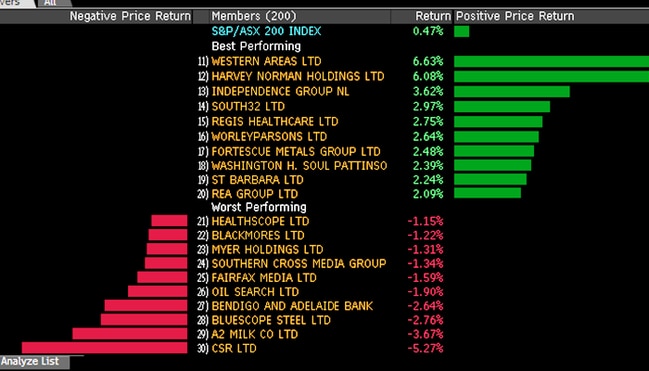

12.05pm: ASX200 grinners and groaners

The biggest gainers in S&P/ASX200 are Beach Energy (up 7.7pc), Harvey Norman (7.1pc), South32 (4pc) while the biggest losers of the S&P/ASX 200 are — A2 Milk (7pc), CSR (-5.7pc), Myer (-5pc) and Bendigo Bank (-2.3pc).

11.48am: Asia-Pacific markets share in uplift

The ASX joins peer sharemarket in the Asia-Pacific region sharing in an uplift: Japan’s NIKKEI trades 0.8pc higher, China’s tech-heavy Shenzen Composite is up 0.7pc and Korea’s Kopsi books gains as much as 0.9 per cent.

S&P/ASX200 index last 0.7 per cent higher at 5947.4, while the broader All Ordinaries index remains near the fresh post-GFC high it hit earlier today, 0.6 per cent higher at 6001.4.

Ben Butler 11.40am: Emails reveal Westpac rate-rigging: ASIC

Westpac’s intentions to fix the benchmark bank bill swap rate (BBSW) are revealed by the words of experienced interest rate traders, rather than expert evidence about the state of the market, a court has heard.

The bank’s team of experienced traders thought they could manipulate the BBSW to Westpac’s advantage, counsel for the Australian Securities and Investments Commission, Peter Collinson, QC, told the Federal Court this morning.

ASIC accuses Westpac of market manipulation and unconscionable conduct by trying to set an artificial price for the BBSW on 16 dates between April 6, 2010 and June 6, 2012.

Mr Collinson said emails between Paul Howarth, of NAB, and Matthew Blades, of broker ICAP, showed BBSW market players believed they could rig the rate.

“In substance it’s an artificial price for the bank bills,” he said.

“The yield that was set does not reflect competitive supply and demand”.

Justice Jonathan Beach challenged Mr Collinson on what information was available to traders during the five-minute trading window before 10am during which the BBSW was set at the time.

They might not know the identities of counterparties with which deals had been done, he said.

Mr Collinson said “some information” was available.

“These are sophisticated traders,” he said.

“They become very knowledgeable about how these markets work and whether the market is moving or whether it is not” — read more

WBC last up 0.3pc at $33.07

11.25am: ASX jumps to 6-month high

Australia’s S&P/ASX 200 has jumped 0.7pc to fresh 6-month high of 5948.4.

Interestingly, the All Ords is above the 6000 point mark that capped in 2015 at a fresh post-GFC high of 6006.6.

However the S&P/ASX200 remains investor’s primary read on the market, reflecting better the performance of larger, well-established public companies.

All sectors now up with materials, energy and healthcare leading the charge.

Miners are particularly strong considering recent falls in iron ore and base metals.

Banks are finally catching up after recent underperformance, led by a 0.7pc rise in Westpac.

Ben Butler 11.15am: Court throws out ASIC’s Prime Trust claim

An appeals court has thrown out declarations that directors of failed retirement village operator Prime Trust, including former health minister Michael Wooldridge, breached the law by paying the organisation’s founder, Bill Lewski, a $33m listing fee.

It is a second heavy blow relating to the case for corporate regulator the Australian Securities and Investments Commission, which last year saw bans it had won against the men thrown out by the Full Court of the Federal Court — read more

Bridget Carter 11.10am: Beach Energy sells Cooper stake

Beach Energy (BPT) has offloaded its stake in Cooper Energy Wednesday morning.

The company has held a 7.31 per cent stake in Cooper according to Bloomberg Data, which is worth about $33 million.

Shares in Cooper Energy are currently trading at about 29c.

Shares are believed to have been sold for 28c each in a trade handled through Canaccord Genuity — read more from DataRoom.

COE last down 3.5pc at 28 cents

10.30am: ASX lifts as All Ords breaches 6000

Australia’s S&P/ASX 200 share index is up 0.5pc at 5938 in early trading.

Interestingly, the All Ords is above the 6000 point mark that capped in 2015 at a fresh post-GFC high of 6006.6.

However the S&P/ASX200 remains investor’s primary read on the market, reflecting better the performance of larger, well-established public companies.

Gains are broadbased with all sectors up except for telecommunications.

The main difference today is that iron ore stocks are up despite further weakness in spot iron ore.

Banks are mixed, with a 2.1pc fall in Bendigo offset by gains in Westpac, ANZ and NAB.

Harvey Norman is up 6pc after ASCI concluded its inquiries.

CSR is reacting negatively to its results with a 5.3pc fall.

Eli Greenblat 11.05am: Rip Curl touts earnings prowess

The privately owned global surfwear retailer Rip Curl has underlined its earnings prowess in a sector that has been wiped out by brand collapses and failures, after this morning issuing its latest financial results which showed a near doubling of its full-year profit to $18.44 million for 2017.

It comes as perfect timing for Rip Curl’s majority owners, founders and business partners Doug “Claw” Warbrick and Brian “Sing Ding” Singer, who are currently investigating a possible trade sale of the business that could include a takeover from rival Billabong as revealed in The Australian’s Data Room this week.

It was a good year for the surf brand’s main shareholders, with Rip Curl paying total dividends of $18.37 million, spread between a $9.185 million final 2016 dividend and an interim dividend for 2017 of another $9.186 million. Mr Warbrick and Mr Singer own 72 per cent of Rip Curl.

Elizabeth Redman 10.43am: Sydney property slowdown gathers pace

Further evidence of a slowdown in the heated Sydney housing market has emerged, with prices falling over the last quarter for the first time since May last year.

But Melbourne values are continuing to rise, albeit at a slightly slower pace, as buyers are drawn to the city’s comparatively affordable stock, figures from property researcher CoreLogic show — read more

Bridget Carter 10.14am: Bubs raises cash for goats milk move

Bubs Australia is raising $20 million to buy goats milk producer NuLac Foods.

The $185 million company will offer share at 60c each through Bell Potter in a placement and share purchase plan.

Owning NuLac will enable Bubs to become a vertically integrated infant milk formula business.

In a term sheet sent to investors, the company says it will gain control over its supply chain and local sourcing of key ingredients to capitalise on the rapid growth of specialty milks and the formula sector domestically and in China.

The raise is a 24.1 per cent discount to the last closing price of 79c.

BUB last 80 cents

10.06am: No-show Solly sends his regrets

Will Glasgow and Christine Lacy write:

After weeks of ominous promotion by the department store’s billionaire shareholder Solomon Lew, Myer’s strategy day has arrived.

Lew — who owns about 11 per cent of the struggling retailer — has made the day the focus of his criticism of Myer’s strategy. Among other things, the billionaire has demanded the department store release its first-quarter trading results, presumably because he thinks they will reinforce his critique.

Lew won’t be along in person. That’s not because his invitation was lost in the mail. (Although, in an embarrassing oversight, Myer forgot to invite the Lew camp, which had to chase down the invite from Umbers’ IR team.)

Rather, the billionaire is sending his long-time lieutenant Mark Middledorf, who has served Lew for almost 20 years as an executive at the billionaire’s private Century Plaza group.

Read more from Margin Call, or see Myer’s first-quarter results here

10.00am: Cimic results look ‘solid’: Macquarie

Cimic’s results look “solid”, according to Macquarie.

The broker notes that nine-month NPAT of $501 million was 75 per cent of the midpoint of FY guidance, which was confirmed as $640-$700m.

“This is a solid result with broadly in-line earnings, ongoing strong cash generation and good balance sheet metrics,” the broker says.

“This prepares CIM well for its extensive pipeline of work opportunities going forward together with potential acquisition options.”

CIM last $48.35

9.57am: Calls for Flight Centre cash splash

Scott Murdoch and Bridget Carter write:

There are not many companies at the top end of the market to have experienced a 55 per cent share price rise this year, but Flight Centre has enjoyed just that.

The Queensland-based travel retailer has marched back into the sights of Australian and global investors since January and the result has been a surprisingly robust share price surge.

Flight Centre started the year with its shares trading at $30.26 and last night they were hovering around the $47 mark.

The rise of nearly 55 per cent means Flight Centre is well and truly outpacing the ASX 200, which is up around 15 per cent so far this year. Analysts believe the surging share price is the result of investors becoming increasingly confident that a major move is going to be ordered at Flight Centre soon — read more

FLT last $46.80

Eli Greenblat 9.55am: ASIC ends Harvey Norman probe

Retail billionaire Gerry Harvey has welcomed the corporate regulator’s decision on Tuesday night to wrap up its lengthy inquiry into Harvey Norman, with a conclusion the retailer had met all of its obligations.

Mr Harvey told The Australian he was he was pleased the corporate regulator had concluded the retailer met with its financial requirements, and used the acknowledgment to once again savage short sellers as “market manipulators” for alleging misdeeds by his company — read more

HVN last $3.78

9.41am: Myer first-quarter sales slow

Department store Myer has released first-quarter sales results ahead of its strategy day in Melbourne, revealing a 2.8 per cent fall in total sales on the period prior to $699m, while same store sales also fell 2.1 per cent and sales per-square-meter rose 3.6pc on the same basis.

Myer now expects total FY17-FY20 sales per square metre to improve more than 10 per cent after previously forecasting that great than 15 per cent.

The board and newly appointed chairman Garry Hounsell have come under fire from Premier Investments and its chairman Solomon Lew leading up to today’s shareholder meeting. Holding an 11 per cent stake in Myer, Premier had demanded the department store release its first quarter results today so that security holders were adequately informed of managment’s ‘New Myer’ strategy progress.

“Sales during Q1 FY2018 reflect the continuation of challenging retail conditions characterised by heightened competition and subdued consumer sentiment,” said Myer Chief Executive Officer and Managing Director Richard Umbers — read more

MYR last 76 cents.

9.37am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Chris Weston — Chief Market Strategist, IG

9.45am: Ric Spooner — Chief Market Analyst, CMC Markets

10.00pm: Julia Lee from Bell Direct and John Milroy from Ord Minnett join as guest hosts

10.00pm: Evan Lucas — The Lucas Report

10.30pm: Tim Lawless — CoreLogic

(All times in AEST)

9.35am: Global outlook strong: Tannenbaum

Carl Tannenbaum still doesn’t expect a global sharemarket correction.

China’s indebtedness remains a concern but its increasing global influence is serving it well.

The Northern Trust chief economist — a former Federal Reserve Bank of Chicago official who once headed the Fed’s Risk Group in Washington — expects the US economic recovery to continue despite the lack of substantive progress on Trump’s reforms and the Fed’s plan to gradually shrink its balance sheet and increase its funds rate to 3 per cent by 2019.

The US S&P 500 share index has almost quadrupled since the financial crisis and is heading for its strongest rise in three years with a 15 per cent gain so far.

9.30am: ASX to rise as markets hold firm

Australia’s S&P/ASX 200 is expected to open up about 0.4pc based on overnight SPI futures.

That follows slight gains on Wall Street with the Nasdaq up 0.4pc to a record high.

However, the S&P 500 and DJIA rose just 0.1pc and stayed below recent highs.

Gains followed strong US consumer confidence and Chicago manufacturing ISM data.

The shocking NY terror attack occurred after the close of US trading and didn’t affect risk assets.

Commodities were mixed, with iron ore down 0.4pc, Brent crude up 0.8pc and copper and gold both down 0.4pc.

As such the S&P/ASX 200 probably lacks sufficient catalysts to hit new six-month highs above 5938.1 today.

But a daily close above 5919.8 would be the best daily close since early May, with the index peaked at 5956.5.

Woolworths has been upgraded by Credit Suisse and Bendigo Bank downgraded by Bell Potter.

Weak sales and guidance from Myer will be in focus along with CSR results and AGMs at Amcor and Link.

Oil Search has bought a $400 million stake in oil assets in the Alaska North Slope, funded with existing cash and debt facilities.

US ISM data, the Fed decision, Fed chair appointment, and US tax news are due overnight.

S&P/ASX 200 last 5909.

9.25am: Oil Search grabs $US400m in Alaska oil

Oil Search has purchased Tier 1 oil assets in the Alaska North Slope for $US400m, including a stake in the Nanushuk oilfield.

The company’s says the acquisition equates to a cost of $US3.1/barrel, with potential resource upside to reduce the cost to $US1.3/barrel, and that the move comes at “an attractive time in the commodity cycle.”

Oil Search will fund the acquisition, exploration, appraisal and development with existing cash, cash flows and dedicated additional financing facilities, and does not expect the purchase to impact its commitment or ability to support LNG expansion in PNG or its present dividend policy.

OSH last $7.38

9.10am: CSR lifts first-half profit

Building materials supplier CSR booked a 4 per cent rise in net profit attributable to shareholders to $118.7m in the first-half, or a 32 per cent rise on an underlying basis to $136.6m.

CSR says it will deliver a 50 per cent franked first-half interim dividend of 13.5c/share after distributing an unfranked 13c/cents per share interim divided the previous fiscal year.

CSR last $4.74

9.03am: Cimic promotes deputy to CEO

Construction giant Cimic has appointed its deputy chief Michael Wright to the role of chief executive and managing director and Ignacia Segura to succeed Mr. Wright.

Mr. Wright succeeds Adolgo Valderas who has accepted a role with ACS Group and will hold the Cimic Group Director position as an alternate.

CIM last $48.35

8.46am: Analyst rating changes

Beach Energy cut to Neutral — Citi

Bendigo & Adelaide Bank cut to Hold — Bell Potter

Woolworths raised to Neutral — Credit Suisse

TPG Telecom cut to Hold — Morningstar

Sigma Healthcare raised to Buy — Morningstar

Fairfax cut to Hold — Deustche Bank

Richard Gluyas 8.32am: Westpac in so deep it ‘fixed rate’

Westpac was so financially exposed to a benchmark interest rate that it chose to manipulate the pricing instead of allowing the rate to emerge from legitimate trading in the bank bill market, the Australian Securities & Investments Commission has said.

“In effect, the tail was wagging the dog,” Philip Crutchfield QC, for the markets watchdog, told the Federal Court.

ASIC opened its landmark case yesterday against Westpac, the remaining major bank to face allegations of market manipulation after ANZ Bank and National Australia Bank negotiated nearly $100 million in combined settlements, by playing a series of taped conversations, many featuring the group’s top trader, Colin “The Rat” Roden — read more

WBC last $32.99

Damon Kitney 8.25am: Post chief to Amazon: pay taxes

New Australia Post chief executive Christine Holgate has urged US online retail juggernaut Amazon to pay its fair share of taxes in Australia when it starts operations here, noting it was the “fair and responsible” thing to do.

While stressing she wanted Amazon to be successful in Australia and looked forward to working with the US firm as a partner for its local deliveries, Ms Holgate said Australians needed to think more carefully about the contributions made by multinationals such as Amazon to the local Read more

8.10am: Oil prices near two-year highs

Oil prices settled higher again, notching a monthly gain of more than 5 per cent, but analysts said bullish sentiment that has driven Brent crude to its highest level in more than two years could encourage US producers to export more oil. Brent settled up 47 cents or 0.7 per cent to $US61.37, close to its July 2015 highs reached earlier this week, and up around 37 per cent from its 2017 lows hit in June.

US West Texas Intermediate crude (WTI) settled up 23 cents or 0.4 per cent to $US54.38, still near its highest since February and close to its highest level in more than two years.

Traders and brokers said investors were adjusting positions after price rises of around five per cent in October.

AAP

7:25am: ASX tipped to open higher

The Australian sharemarket looks set to open higher, and follow a solid lead from US stocks and European stocks, At 0700 AEDT on Wednesday, the share price futures index was up 24 point, or 0.41 per cent, at 5,912.

In the US, a jump in shares of consumer companies Mondelez and Kellogg after their quarterly reports helped put the three major Wall Street indexes on track for their largest monthly gain since February.

Locally, in economic news on Wednesday, the Australian Bureau of Statistics will release September’s Selected Living Costs index.

In equities news, CSR is slated to release its full-year results while NIB and Amcor hold their annual general meetings.

The Australian market on Tuesday closed lower, due to weakness among the big banks and miners.

The benchmark S&P/ASX200 was up 10.1 points, or 0.17 per cent, at 5,909 points, while the broader All Ordinaries index was up 7.3 points, or 0.12 per cent, at 5,976.4 points.

Meanwhile, the Australian dollar is lower against the US dollar. The local currency was trading at US76.54c at 0700 AEDT on Wednesday, from US76.80c on Tuesday.

AAP

7.10am: Dollar slips against greenback

The Australian dollar has fallen against the US dollar despite there being strong gains on Wall Street overnight.

At 0635 AEDT on Wednesday, the Australian dollar was worth US76.56c, down from US76.80c on Tuesday.

BK Asset Management’s Boris Schlossberg said commodity currencies were weaker overnight, and the Australian dollar lost ground by data that showed weak new home sales numbers.

New home sales dropped another 6.1 per cent in September, according to the latest Housing Industry Association report.

AAP

6:30am: Wall St ticks higher

Shares of Mondelez International, Kellogg and other food companies helped the S&P 500 edge higher Tuesday, putting the index on track for its best month since February.

Corporate earnings continued to dictate the market’s biggest moves, with companies generally being rewarded by investors when they beat expectations for the most recent quarter. More than half of S&P 500 companies already have released results and another big batch is scheduled to report this week, including Facebook on Wednesday and Apple on Thursday.

“If Apple looks pretty good after their earnings, it will lift the market higher,” said Chris Bertelsen, chief investment officer of Aviance Capital Partners, an investment firm with $2.2 billion in assets under management. He, like other investors, expects indexes to grind higher through the rest of this year on earnings and data that continues to paint an upbeat picture of the economy. “After that, I’d be surprised if they moved higher.”

The S&P 500 was recently up 0.2 per cent and has risen 2.3 per cent for the month so far. The Dow Jones Industrial Average added 51 points, or 0.2 per cent, to 23399, while the Nasdaq Composite rose 0.5 per cent and was on pace to tie its 1980 record of notching 62 record closes in one year.

Dow Jones

6:15am: Eurozone economy steams ahead

The eurozone economy is enjoying its strongest and most sustained period of growth since a short-lived bounce-back following the global financial crisis.

Official figures released Tuesday showed that the single currency bloc, which is made up of 19 countries, was 2.5 per cent bigger in the third quarter of 2017 than it was the year before.

That’s the highest annual growth rate since the first quarter of 2011, when the eurozone, like other major economies around the world, witnessed a temporary rebound from the deep recession caused by the global financial crisis.

While the recovery in the United States slowly gained momentum, the eurozone’s was undermined by persistent debt problems in countries like Greece. The update from Eurostat provides further confirmation that the eurozone has gained momentum this year after sidestepping a series potential risks, notably through the defeat of populist, euroskeptic parties in elections in major economies like France. Worries over Greece’s future in the single currency bloc have also abated while the current tensions in Spain over the region of Catalonia’s bid for independence do not — yet — appear to be shaking confidence either.

Though no country-by-country breakdown was provided, it’s clear from a series of surveys that the eurozone economic growth is more broadbased both across sectors and countries — it’s no longer heavily reliant on its powerhouse economy, Germany.

AAP