Trading Day blog: live markets coverage; Bankers content with Xmas coal; plus analysis and opinion

The ASX edges out gains as Westfield climbs toward its $33bn bid, while analysts put commodities in the stocking.

And that’s the Trading Day blog for Wednesday, December 13.

4.15pm: ASX books gains on Westfield run

Local shares close the day higher after a surge in Wesfield shares propped up indices ahead of a highly anticipated cash rate decision by the US Federal Reserve expected overnight.

The benchmark S & P/ASX200 index closed 0.1 per cent, or 8 points higher on 6021.8, while the broader All Ordinaries index closed 0.2 per cent, or 10 points higher on 6103.1.

Read: Westfield deal yet to reach checkout?

Read: ‘Tis the season for mining upgrades

4.03pm: Google to open China AI hub

Google announced Wednesday that it will open a new artificial intelligence research centre in Beijing, tapping China’s talent pool in the promising technology despite the US search giant’s exclusion from the country’s internet.

Artificial intelligence, especially machine learning, has been an area of intense focus for American tech stalwarts Google, Microsoft and Facebook, and their Chinese competitors Alibaba, Tencent and Baidu as they bid to master what many consider is the future of computing.

AFP

3.45pm: USD dives on Democrat Alabama win

The US dollar fell a sharp 0.3 per cent against the yen after Democrat candidate Doug Jones defeated scandal-beset Republican Roy Moore to take the seat of Alamaba, threatening the slimming Republican majority in the Senate.

Dow Jones, S & P 500 and NASDAQ futures all fell on the result and have since regained some ground alongside the greenback — each indicating roughly a 0.1 per cent fall at the open overnight.

3.32pm: ‘Tis the season for mining upgrades

Commodity price forecast upgrades are coming thick and fast this week.

Morgan Stanley upgraded its forecasts on Monday and Credit Suisse, UBS upgraded today.

All three have lifted their iron ore price forecasts, resulting in higher earnings estimates and price targets for the major producers.

Morgan Stanley and UBS both raised their forecasts for a range of industrial commodities including hard coking coal, thermal coal, alumina, copper nickel, zinc and crude oil.

UBS also upgraded Fortescue and Whitehaven to “buy”.

The main themes include the broadening global economic recovery, China’s focus on reform and pollution and producer discipline outside of China.

FMG last up 2.8 per cent on $4.83, WHC last 1.5 per cent $4.12 after tapping a fresh 5-year high of $4.23 earlier.

3.04pm: Last Jedi Event’s new hope

Simone Ziaziaris writes:

Star Wars: Last Jedi’s premiere could awaken the force in Event Hospitality and Entertainment and drive full-year earnings to near record highs, a senior analyst says.

Morningstar’s Brian Han believes Last Jedi’s premiere on Thursday is capable of resurrecting the domestic movie industry, which is down 15 per cent in box office takings in the December half-year to date compared to a year ago.

He expects the film, the second in the latest Star Wars trilogy, to fall just shy of the success of its predecessor Star Wars: The Force Awakens that was released in December 2015.

The Force Awakens was a smash hit in cinemas and registered an all-time opening weekend box office record of $33 million in Australia and grossed $62.7 million in its 15 days of release.

It was also a major driver in Event’s record $88 million Australia cinema earnings in fiscal 2016.

“We see Star Wars: Last Jedi achieving similar success this time around, underpinning our eight per cent forecast growth in Australian cinema EBIT (earnings before interest and tax) to $85 million in fiscal 2018,” the senior equities analyst said.

“Critically, one film, no matter how strong the force is with this one, cannot eradicate the structural threats facing the cinema industry” — AAP

EVT last up 1.2 per cent on $13.29

2.45pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

3.00pm: Craig Sidney — Shaw and Parnters

3.05pm: Jack Lowenstein — Morphic Asset Management

3.15pm: Politics Panel

3.30pm: Paul Perrault — CEO, CSL

3.50pm: Ben Le Brun — Charles Schwab

4.00pm: Jeremy Hook from TMS Capital and John Noonan from Thompson Reuters

4.05pm: Chris Weston — Chief Market Strategist, IG

(All times in AEST)

2.04pm: Westfield deal yet to reach checkout?

The cat is out of the bag, but short of final approval by Wesfield shareholders of Unibail-Rodemco’s $33bn offer for the company, analysts have left room for an third player to crash the party.

JPMorgan: $10.60 target price (12m)

“The only global listed entity that could conceivably launch a competing bid would be US-listed Simon Property Group (SPG), which we believe would recognise the value of a portfolio and development pipeline of the quality of Westfield, which is extremely rare — so we can’t rule out a competing offer.”

Macquarie: $10.01 target price (12m)

“While we remain attracted to the near-term NTA growth profile and expected above sector average earnings growth, this could be supplemented by further competitive interest for WFD resulting in a higher takeover price.”

Citi throws in a curveball too. Investors piled into shopping mall stocks in the lead-up to the offer eventuating at a 17.8 per cent premium, however concerns linger over the future of retail space.

“While pricing appears favourable, our broader concern is the reason why one of the most successful pioneers of shopping centres is selling to Unibail-Rodamco,” says Citi.

WFD last up 13.9 per cent on $9.68

Stephen Bartholomeuz 1.26pm: A tale of two empires

Our two greatest and most global entrepreneurs have led eerily parallel business lives for more than 60 years. It is not really a coincidence that Sir Frank Lowy and Rupert Murdoch are now prepared to dismantle the empires they built.

It would appear that the Lowy family’s willingness to endorse the $33 billion offer for Westfield Corp and Murdoch’s willingness to contemplate the sale of the entertainment content core of 21st Century Fox involve overlapping timelines and motivations.

Both Lowy and Murdoch started their empire-building in the early 1950s, Lowy famously from a single delicatessen in Sydney’s west and Murdoch from a single newspaper, the Adelaide News. Both aggressively built on those foundations within Australia before launching international businesses that were, and are, among the most powerful within their sectors.

Both now, however, are in their mid-80s — Lowy is 87 and Murdoch, about six months younger, 86.

1.09pm: RBA drags bitcoin over coals

Supratim Adhikari and David Swan writes:

Reserve Bank Australia boss Phillip Lowe has launched a scathing attack on Bitcoin labelling the rampant trading in the cryptocurrency a “speculative mania”, adding that it’s unlikely to play a meaningful role in the future of payments.

Bitcoin is the first of a number of cryptocurrencies that are decentralised and allow user to make transactions anonymously and securely.

Launched in 2009, bitcoin has seen an exponential rise on the its price over the last 12 months, from $US1,000 to over $US17,000, with speculators continuing to pile in.

Speaking at the 2017 Australian Payment Summit in Sydney on Wednesday, Dr Lowe said that Bitcoin’s usefulness from a payments perspective is limited at best and the cryptocurrency brings with it a host of other problems.

“The value of bitcoin is very volatile, the number of payments that can currently be handled is very low,” he said.

“There are governance problems, the transaction cost involved in making a payment with bitcoin is very high and the estimates of the electricity used in the process of mining the coins are staggering” — read more

With Dow Jones and AAP

12.52pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

1.00pm: James Gerrish from Shaw and Partners and Steve Jakobsen from Saxo Bank

1.30pm: Andrew Wielandt — Dornbusch Parnters

1.50pm: Live cross — Bloomberg Asia

2.20pm: Tim Larkworth — FIIG Securities

2.30pm: Ted Dhanik — CEO, engage: BDR

(All times in AEST)

12.18pm: Newcrest in $81m Bonikro mine sale

Newcrest has struck a deal to sell 89.89pc of its interest in the Bonikro operation on the Ivory Coast for $81 million.

A consortium consisting of F & M Gold Resources Ltd. and Africa Finance Corporation has agreed to purchase the stake for $72 million cash and an estimated $9 million in future smelter royalties.

Newcrest expects to recognise a small net profit from the sale and to update its FY18 after transaction completion — read more

NCM last down 1.1 per cent $22.21

11.54am: Digital currency weighed in RBA

James Glynn writes:

The Reserve Bank of Australia is weighing the pros and cons of one day issuing a digital form of the Australian dollar.

Such an electronic dollar could operate on the kind of technology that underpins bitcoin.

RBA Governor Philip Lowe told a payments system conference the issue was being debated, adding: “The short answer to this question is that we have no immediate plans to issue an electronic form of Australian dollar bank notes, but we are continuing to look at the pros and cons.”

A so-called eAUD — an electronic form of the dollar not backed by a paper bill — could operate in tandem with physical banknotes.

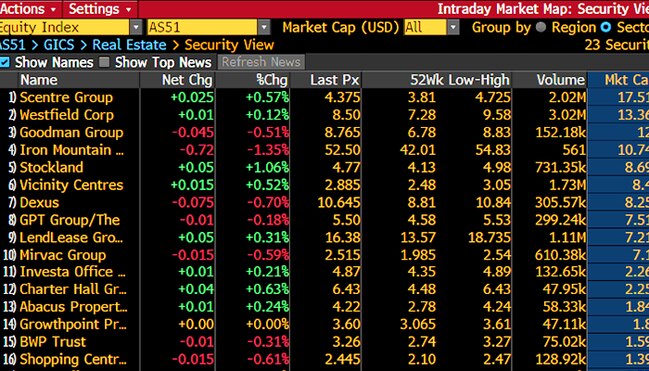

11.35am: Westfield hauls the market higher

Local shares are rallying after Westfield was lobbed a $33bn takeover offer by European heavyweight Unibail-Rodamco at a healthy 17.8 per cent premium.

The S & P/ASX200 index rose near 0.2 per cent in an instant as Wesfield commenced trade at 11.00am (AEDT), lasting holding gains near 6025.6.

Scentre Group hits a new 7 month-high as the Westfield spin-off builds on a 4 per cent run higher into yesertday’s close, while Stockland Group and Charter Hall both post gains over 0.5 per cent.

11.06am: Westfield shares hit 14m high

Westfield shares have rocketed toward the $10.01 takeover offer price lobbed by European heavyweight Unibail-Rodamco, and were last slightly below the 14-month high of $9.77 hit with a 15 per cent jump soon after the first trade was made at 11.00am (AEDT).

Unibail-Rodamco’s offer was confirmed late yesterday after the close.

WFD last up 14.6 per cent on $9.74

10.48am: ASX steady as Fed call looms

Local shares trade near flat as investors around the world ease into the US Federal Reserve’s highly anticipated cash rate decision expected overnight with near certainty of a rate hike guiding trade.

The S & P/ASX200 index last traded 0.6 points higher on 6013.6.

REITs come off the boil to trade mixed early after mall stocks rallied as much as 3 to 4 per cent on speculation of a subsequently confirmed sale of Westfield to European heavyweight Unibail-Rodamco.

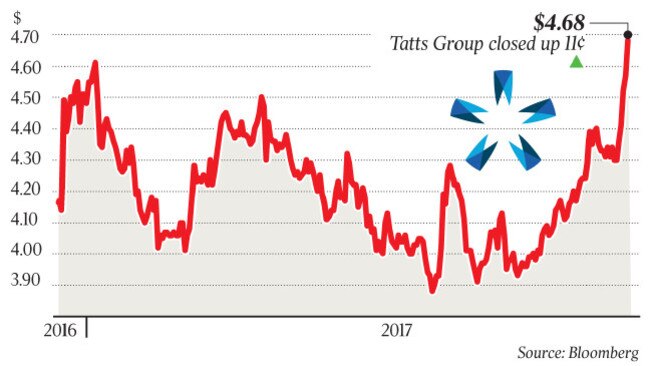

Tatts (-0.6pc) and Tabcorp (-0.9pc) both trade in the red as investors take profits after both stocks rallied into Tatts’ shareholders’ eventual vote for a proposed merger between the two after the close of trade yesterday.

Cleanaway Waste Managment shrinks strong opening gains to trade near 3 per cent higher after a successful capital raising for funds to acquire ASX-listed Tox Free Solutions.

Meanwhile, the Australian dollar also trades flat on $US76.50 cents against a stronger US dollar.

10.30am: Consumers confidence lifts: Westpac

Westpac’s read on consumer confidence rose to 103.3 points in December from 99.7 in November.

A read above 100 indicates the bank’s survey found optimists outnumbered pessimists in relation to views across the economy, interest rates and the labour market.

Westpac chief economist Bill Evans says the consumer confidence data support the view that consumer confidence and spending may have bottomed in the September quarter.

He notes that the average reading for the Index in the December quarter is 5 per cent above the average for the September quarter — which saw a “disturbing slump” in consumer spending amid talk of looming interest rate hikes.

A less threatening outlook for interest rates and the government’s recent speculation around possible tax cuts appears to have boosted confidence, according to Evans.

“This is a surprisingly strong result and confirms the lift we have seen in the Index over the last three months,” Evans says. “However, with ongoing weak income growth; a low savings rate; and high debt levels we cannot be confident that consumers have the capacity to sharply lift spending despite higher confidence.”

10.08am: Dexus down 1pc at the open

Dexus shares (DXS) fall 1 per cent at the open after rallying as much as 3 per cent yesterday after Wesfield’s foreshadowed a potential ‘significant’ corporate transaction.

After the close of trade yesterday, Westfield confirmed speculation it had accepted a takeover offer from European heavyweight Unibail-Rodamco.

9.52am: Merchant model risks obselesence: RBA

“If the banking system does not offer low cost, electronic payment methods to all Australians, other people will come in and do it,” said Reserve Bank governor Phillip Lowe at an address to the Australian Payment Summit in Sydney this morning.

“The idea that you can charge merchants 2-3 per cent for electronic payments, you might be able to do that today and it might be a great business model for financial institutions, I suspect some years down the track that model isn’t going to work the same way.”

9.42am: ASX to steady ahead of Fed

Australia’s S & P/ASX 200 share index is expected to be mostly flat before the outcome of the Fed meeting overnight.

While a quarter per cent hike in the Fed funds rate is widely expected views on the outlook for US rates next year are mixed.

Overnight futures pared intraday gains after Republican senator Rand Paul tweeted his opposition to adding to the federal debt.

However, both the S & P 500 and the Dow Jones index closed at record highs amid strong gains in the telecommunications and financial sectors.

In commodities, spot iron ore rose 0.5pc to $US68.97, coking coal rose 0.2pc to $US231.50, Brent crude oil fell 1.9pc to $US63,48, LME copper fell 0.7pc, nickel fell 0.9pc and zinc rose 0.7pc.

9.32am: Run risk to ‘private’ money: RBA’s Lowe

“In times of uncertainty and stress, people don’t want to hold privately issued fiat money,” said Reserve Bank governor Phillip Lowe at an address to the Australian Payment Summit in Sydney this morning.

“This is one reason why today physical banknotes are backed by central banks.”

9.26am: Crypto ‘mania’ feels speculative: RBA’s Lowe

“The current fascination with these [crypto]currencies feels more like a speculative mania than it has to do with their use as an efficient and convenient form of electronic payment,” said Reserve Bank governor Phillip Lowe at an address to the Australian Payment Summit in Sydney this morning.

“The value of bitcoin is very volatile, the number of payments that can currently be handled is very low.”

9.23am: Blockchain case not yet made: RBA’s Lowe

“A convincing case for issuing Australian dollars on the blockchain for use with limited private systems has not yet been made,” said Reserve Bank governor Phillip Lowe at an address to the Australian Payment Summit in Sydney this morning.

“It is certainly possible that this type of system could lead to more efficient, lower-cost business processes and payments.”

“My working hypothesis here is that such a case could develop, although we need to

work through a range of complex operational and policy questions.”

9.22am: No immediate plans for eAUD: RBA’s Lowe

“The short answer to this question is that we have no immediate plans to issue an electronic form of Australian dollar banknotes, but we are continuing to look at the pros and cons,” said Reserve Bank governor Phillip Lowe at an address to the Australian Payment Summit in Sydney this morning.

9.15am: Digital currency an avenue: RBA’s Lowe

“It is possible that the RBA might, in time, issue a new form of digital money — a variation on exchange settlement accounts — perhaps using distributed ledger technology,” said Reserve Bank governor Phillip Lowe at an address to the Australian Payment Summit in Sydney this morning.

9.09am: Analyst rating changes

Westfield raised to Buy — CLSA

Tox Free Solutions cut to Neutral — UBS

Retail Food Group raised to Neutral — UBS

Tabcorp cut to Neutral — Credit Suisse

Fortescue raised to Buy — UBS

Whitehaven raised to Buy — UBS

Pro-Pac started at Buy; $0.50 target price — Bell Potter

Asaleo Care cut to Sell; target price cut to $1.35 vs. $1.60 — Citi

AWE Group cut to Sell — Citi

9.03am: CSL chairman to retire

CSL chairman Professor John Shine, has announced his intention to retire at the conclusion of the company’s 2018 annual general meeting following 11 years on the board and six years as chair.

New board appointee Dr. Bian McNamee will assume the position of chairman-elect after such time.

CSL last $140.61

8.32am: Conditions read succumbs to gravity

A sharp fall in business conditions and a renewed downturn in business confidence may have thrown a spanner in the works for the Reserve Bank’s forecasts for above-trend economic growth next year.

Business conditions dived to 12 points in November after surging to a record high of 21 in the prior month, according to NAB’s Monthly Business Survey.

Trading conditions dropped to 16 points, from 30, and profitability tumbled to 15 points, from 26. The employment index remained firm at seven points and forward orders doubled to six points. Business confidence fell to six points, from nine in October.

The less positive business survey comes after national accounts data last week again highlighted the growing divide between the relatively upbeat business sector and seemingly restrained households, and argues against a lift in interest rates from a record low 1.5 per cent.

“We expected to see last month’s spike in business conditions unwound fairly quickly as it both came as a bit of a surprise and was also out of sorts with what we were seeing in some of the other leading indicators from the survey, such as forward orders,” NAB chief economist Alan Oster said.

Sarah-Jane Tasker 8.24am: Tatts all folks: Tabcorp wins bid

Wagering giant Tabcorp’s move on Tatts Group to create an $11 billion gaming behemoth is set to sail past the winner’s post today after the target’s shareholders overwhelmingly backed the deal.

Investors in Tatts finally had their say on the transaction yesterday, with 98.64 per cent voting in favour of the deal, which now needs only the court’s seal of approval, expected today — read more

TTS last $4.68, TAH last $5.33

8.16am: End of an era in $32bn mega-deal

Ben Wilmot and Bridget Carter write:

The $US24.7 billion ($32.8bn) friendly takeover of mall landlord Westfield Group by European shopping centre giant Unibail-Rodamco will create the “world’s best in class” retail real estate empire, according to property tycoon Sir Frank Lowy.

The new company will own shopping centres in global cities from London and Paris to New York and Los Angeles as well as a combined development pipeline of €12.3bn across Europe and the US. Unibail-Rodamco will emerge as a global property behemoth controlling 104 malls in 27 retail markets around the world — read more

WFD last $8.50 in trading halt

8.11am: Wall Street’s record run furthers

The Dow and S & P 500 pushed to fresh records Tuesday, with financial shares especially strong amid progress in Congress on the tax cut plan and expectations for higher interest rates.

Shortly after the closing bell, the Dow Jones Industrial Average stood at 24,505.36, up 0.5 per cent, its third straight record finish.

The broadbased S & P 500 rose 0.2 per cent to 2,664.15, also a third straight record, while the tech-rich Nasdaq Composite Index dipped 0.2 per cent to 6,862.32

AAP

7.40am: ASX set to open modestly up

The Australian share market looks set to open higher amid continuing positive sentiment and after better-than-expected produce price index figures boost Wall Street’s Dow and S & P500 indexes.

At 7am (AEDT), the share price futures index was up 12 points, or 0.2 per cent, at 6,030.

In the US, a Labour Department report showed that November producer prices rose as petrol prices surged and the cost of other goods increased, leading to the largest annual gain in nearly six years and pointing to a broad acceleration in wholesale inflation pressures.

In late afternoon, the Dow Jones Industrial Average was up 0.62 per cent, the S & P 500 had gained 0.27 per cent but the Nasdaq Composite had dropped 0.12 per cent.

Locally, in economic news today, Reserve Bank of Australia governor Philip Lowe is slated to speak at the Australian Payment Summit in Sydney, along with RBA Head of Payments Policy Tony Richards.

RBA Assistant Governor (Financial Markets) Chris Kent is expected to speak on the topic of The Availability of Business Finance at the 30th Australasian Finance and Banking Conference, also in Sydney.

No major equities news is expected today.

The Australian market yesterday closed higher buoyed by strength in the heavyweight energy and mining sectors.

The benchmark S & P/ASX200 index rose 14.9 points, or 0.25 per cent, to 6,013.2 points.

The broader All Ordinaries index gained 11.2 points, or 0.18 per cent, to 6,093.1 points.

AAP

7.00am: Dollar continues to climb

The Australian dollar is higher against its US counterpart, which itself has risen following strong economic data.

At 6.35am (AEDT), the Australian dollar was worth US75.57 cents, up from US75.36 cents yesterday.

Westpac’s Imre Speizer says risk sentiment in markets remains positive. He said November’s US Producer Price Index rose 0.4 per cent, against an expected 0.3 per cent, for a year on year pace of 3.1 per cent, versus the expected 2.9 per cent.

“The core measures were 0.3 per cent and 2.4 per cent. There will be some hurricane effects in these numbers, and they may start to unwind in December,” he said in a Wednesday morning note.

“The US dollar index is up 0.3 per cent on the day (and the) AUD rose from 0.7520 to 0.7580 before the firm USD dragged it lower to 0.7546.’

He said the key local event risks included speeches and panel participation by Reserve Bank governor Philip Lowe, assistant governor (Financial Markets) Christopher Kent and RBA Head of Payments Policy Tony Richards.

Also, markets would have an eye on the Westpac-MI Consumer Sentiment data. “(It) previously fell to 99.7 in November after a brief stint in October above 100 at 101.4 in October.

(The consumer mood has been downbeat over most of 2017.”

He expects the Aussie dollar to form “a near-term base above 0.7500”. The local currency is also higher against the yen and the euro on Wednesday morning.

AAP

6.45am: US stocks rise

Shares of banks and other financial firms surged, putting the Dow Jones Industrial Average and the S & P 500 on track to notch another set of record closes.

Bank stocks have been rallying in recent weeks as Republicans in the House and Senate work to complete a sweeping tax overhaul this year. Rising government bond yields, which tend to boost bank profits, gave shares of financial firms an added lift ahead of the Federal Reserve’s expected interest-rate increase early tomorrow (AEDT).

“Everything right now comes down to policy,” said Eric Wiegand, senior portfolio manager US Bank Private Wealth Management. “We’ll be watching what (Fed Chairwoman Janet) Yellen might say at her last press conference and any insights going forward. The other fixation in Washington is on the tax bill,” he added, saying that he and other investors are “looking for any signs of negotiations advancing.”

With over an hour of trade remaining, the Dow industrials rose 154 points, or 0.6 per cent, to 24540 in recent trading, while the S & P 500 gained 0.3 per cent. Both indexes were trading above their closing highs. The Nasdaq Composite fell 0.1 per cent.

Australian stocks are set to rise at the open. At 7am (AEDT), the SPI future sindex was up 11 points.

Dow Jones

6.40am: Markets rise as US Fed meets

Global stock markets were higher overnight, as investors prepared themselves for a likely increase in US interest rates.

On Wall Street, the Dow rose from record peaks, lifted by a Boeing dividend boost.

And in Europe, all of the main indices ended the session higher, with London’s FTSE 100 index advancing 0.6 per cent, the Paris CAC 40 index adding 0.8 per cent and Frankfurt’s DAX 30 up 0.5 per cent.

Energy stocks, in particular, were being boosted by a general increase in crude prices.

“The shutdown of the Forties pipeline can have a durable impact on the price because it adds to the tighter supply picture brought about by OPEC’s output cuts,” said London Capital Group analyst, Jasper Lawler.

“We suspect ... that Brent is on its way to challenge the 2015 high near $68 per barrel.”

Some degree of profit-taking had set in by late afternoon, with crude prices coming off recent highs. But the overall rise has energised the oil sector because higher prices tend to translate into bumper profits and revenues.

In London, Anglo-Dutch energy giant Royal Dutch Shell’s ‘A’ shares jumped 1.7 per cent to 2,452 pence and British rival BP gained 2.4 per cent to 511 pence.

Focus this week, meanwhile, is also on monetary policy meetings of central banks in the United States, Britain and the eurozone.

Early tomorrow (AEDT), the US Federal Reserve unveils its latest decision, followed on Friday by both the Bank of England (BoE) and the European Central Bank.

AFP