Bitcoin futures rocket on trading debut

The world’s first cryptocurrency futures are a reality after starting trade with a bang yesterday.

The world’s first cryptocurrency futures are a reality after starting trade with a bang yesterday.

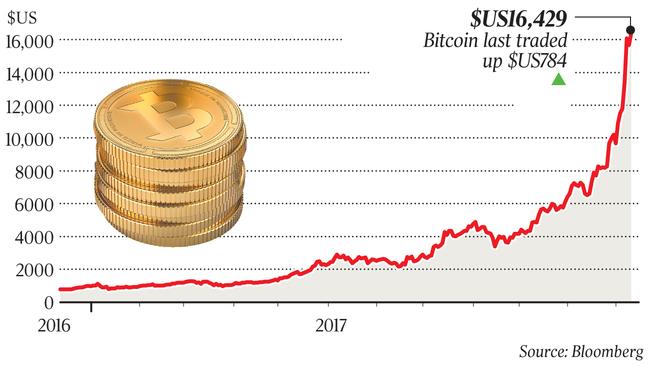

Rather than challenge Main Street’s rampant enthusiasm for cryptocurrencies, institutional investors appeared to back their ascendancy yesterday, driving the price of bitcoin even higher.

In a sign that fund managers expect the crypto phenomenon to continue, cash-settled bitcoin futures for January expiry surged as much as 26 per cent to $US18,850, triggering a series of trading halts by the exchange operator aimed at smoothing volatility to preserve an orderly market.

The underlying currency rose more than 8 per cent to $US16,916.80.

The successful debut of the bitcoin derivative — which could allow for the development of other products including exchange traded funds — took the world’s premier cryptocurrency a step closer to gaining widespread acceptance despite doubts about the sustainability of its rapid ascent.

“In terms of the evolution of cryptocurrencies, this is definitely a small but significant step in the right direction,” IG chief market strategist Chris Weston said.

“Now we just need more of the big players to participate and it will work out quite nicely.”

After opening trading on the Cboe Options Exchange at $US15,000 at 10am AEDT yesterday, bitcoin futures spiked to $US16,660 within the first six minutes of trading, an 11 per cent surge.

The exchange halted trading for two minutes at 12.31pm AEDT due to volatility, said a spokeswoman for the exchange operator, Cboe Global Markets. Prices later dropped, then rebounded and trading was subsequently halted for five minutes when prices rose 20 per cent.

The futures were trading at a 10 per cent premium to the spot price of bitcoin yesterday, suggesting futures traders believe the price of bitcoin will be higher when the contract expires, on January 17.

Volumes were muted, with about 2500 bitcoin futures contracts — worth about $US47 million ($62m) — changing hands in the first eight hours of trading. Many of the trades were for just one contract, indicating that large buyers or sellers were holding back, said Bobby Cho, head of over-the-counter trading at Cumberland, the cryptocurrency unit of Chicago trading firm DRW Holdings.

“Everyone’s just trying to get a feel for this market now,” he said.

A number of large futures brokerages, including ADM Investor Services, the brokerage unit of agriculture giant Archer Daniels Midland, have told their customers they would not be providing access to the new contract. In a notice to clients posted on its website, ADM Investor Services cited “uncertainties surrounding bitcoin and the anticipated price volatility” as a reason the brokerage would not clear the Cboe contract on Sunday.

But market proponents have hailed the introduction of bitcoin futures as a major step forward for the digital currency, which has gone from a curiosity beloved by software geeks and libertarians to the hottest new asset in financial markets. CME Group will launch its own futures next week.

Of the major banks globally, only Goldman Sachs has so far said it will be involved in clearing bitcoin futures, but other major banks are expected to follow its lead in the coming weeks.

“Liquidity is obviously poor, and that’s a reflection of the fact that you don’t have a lot of market participants offering their flow (of client activity) into the exchange,” Mr Weston said.

But while bitcoin futures were thinly traded now, Goldman’s involvement was healthy and liquidity should improve as more investment banks participated.

“That should tend to tighten the bid/ask spread and potentially lessen the volatility, which should in turn could attract more futures traders and hedge funds who work on an implied volatility basis and don’t currently have that kind of risk appetite.”

Mr Weston said while most of his firm’s existing clients were already trading bitcoin CFDs, there was a surge of inquiries from prospective clients to trade the cryptocurrency. “It’s been absolutely crazy,” he said. “There’s been a lot of interest in the past three months, but today it’s really picked up. Half the calls are all about bitcoin at the moment.”

Stephen Innes, head of APAC at QANDA, said bitcoin was “on the verge of a watershed moment, and over the next few months we should finally solve the vexing question (of whether) cryptos are accepted as a legitimate asset class by professional traders”.

“What’s undeniable is that the current euphoria and the extreme levels of price volatility offer the brave of heart some excellent speculative opportunities,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout