Donald Trump meets his match: the markets

Donald Trump insists his U-turns on tariffs are part of a long-term plan to force countries to strike trade deals. But in each scenario, he was presented with evidence that his decisions would cause chaos on Wall St.

President Trump has met his biggest opponent – and it’s the stock market.

Since returning to Washington three months ago, Trump has toppled federal agencies, consolidated executive power, challenged global alliances and reconfigured America’s economic relationships around the globe. His moves have been met with protests, court challenges, dipping poll numbers and political opposition.

Yet so far, the only force that has reliably prompted him to back down is Wall Street.

In recent weeks, Trump has softened his economic and trade stances following periods of market turmoil. Early this month, he imposed a 90-day pause on many of the tariffs he had put in place just days earlier, as the stock market cratered and a sell-off of US bonds rattled investors. This week, he softened his tone on China after ratcheting up tariffs on imports from the country to 145%. And he ruled out – for now – attempting to fire Federal Reserve Chair Jerome Powell after his public musings about terminating him triggered another market plunge.

Both the president and White House officials argue that the sharp U-turns are all part of a long-term plan to force allies and adversaries alike to strike trade deals with the U.S. And they stress that Trump remains determined to follow through on his pledge to reset global trade.

But in each scenario, Trump was presented with evidence by his aides and cabinet secretaries, including Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, that holding firm on his decisions would spur further disarray in the markets, according to people familiar with the matter. Earlier this month, Trump acknowledged that he paused the tariffs in part because he watched the bond markets and people were getting a “little queasy.” “The only interest guiding President Trump’s decision-making is the best interest of the American people,” White House spokesman Kush Desai said.

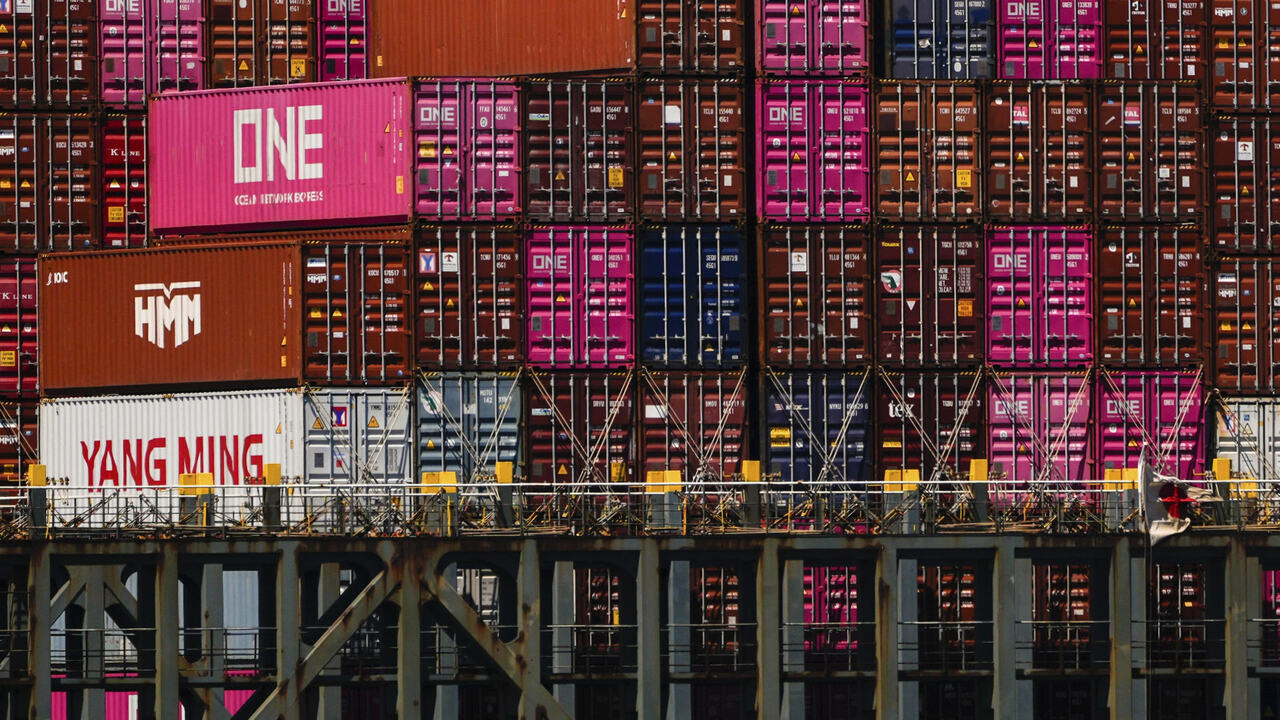

The president is also hearing regularly from executives concerned about how his trade policies are affecting their bottom lines. On Monday, Trump met with top executives at the country’s biggest retailers, including Target, Walmart and Home Depot, who delivered a stark warning to the president that tariffs could scramble supply chains and raise prices, according to people familiar with the discussion.

Trump’s current and former advisers said he watches the markets closely, and as an avid media consumer can’t avoid the dramatic ups and downs that have been displayed across television screens and on front pages for weeks.

“He looks at the markets as a barometer of how things are going,” said David Urban, a former Trump political adviser. “In his view, it’s an important barometer of people’s opinion of life and the financial world.”

But Trump’s dual goals of driving market gains and reshoring American manufacturing through stiff tariffs are sometimes at odds.

“There’s this inherent tension with the president’s love for the markets and his disdain for the American worker being played,” Urban said. “That’s the tension we’re seeing play out right now. Those two mindsets are largely kind of pulling in opposite directions.” Since Trump took office, the S & P 500 index is down roughly 10%, the index’s worst performance in the first 94 days of any presidential term on record, according to Dow Jones Market Data. The S & P’s data goes back to 1928.

The president has long taken credit when markets are up, and distanced himself from the markets when they are down. He often argues that he inherited a “sick” market from former President Joe Biden. And he warned during the presidential campaign that electing then-Vice President Kamala Harris would trigger a “Kamala crash” and a “1929-style depression.” Trump’s public comments underscore his fixation on the twists and turns of the markets.

“I think it’s going very well – The MARKETS are going to BOOM,” Trump posted on Truth Social earlier this month after he announced a wave of tariffs on dozens of countries, prompting the worst market sell-off in years. “THIS IS A GREAT TIME TO GET RICH.” Trump shrugged off the market plunge, suggesting it was a price worth paying to reshape the economy. “I don’t want anything to go down, but sometimes you have to take medicine to fix something,” Trump said at the time.

Shortly before he announced the 90-day pause on tariffs, Trump wrote on social media, “THIS IS A GREAT TIME TO BUY!!” After markets surged in response to the pause, Trump boasted that the financier Charles Schwab, his lunch guest at the White House, just made $2.5 billion off the news.

Trump’s team could also use markets as a cudgel against China. In a recent television interview, Bessent didn’t rule out delisting Chinese stocks from U.S. exchanges.

The president expressed pride in stockmarket gains during his first term. “I’m very proud of that. Now we have to go up, up, up,” Trump said in an interview with ABC News after the Dow Jones Industrial Average hit 20,000 in 2017.

Trump has repeatedly asserted that the stock market went up 88% in his first term, calling it “the greatest ever in the history of our country.” The S & P 500 index jumped about 67% during Trump’s first term. That is higher than in Biden’s time in office, which saw a 56% gain. The index made greater gains during Barack Obama’s first term, as the economy recovered from the 2008-09 financial crisis.

The Dow Jones Industrial Average made its biggest daily gain in two years after Trump won last year’s election. But the postelection market gains have been erased.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout