ASX firmly lower; Afterpay jumps on Westpac link

The ASX 200 closed down 0.7pc, S&P reaffirmed Australia’s AAA rating and Crown made concessions about money-laundering at the Melbourne casino.

- S&P reaffirms Australia’s AAA rating

- Iron ore giant Vale on comeback trail

- Westpac, Afterpay in partnership

That’s all from the Trading Day blog for Tuesday, October 20. Australian stocks closed lower after Wall Street sank on dwindling hopes for a fresh US stimulus package. Locally, the RBA released the minutes of its last meeting, the Crown casino inquiry continued and Afterpay and Westpac announced a banking partnership.

Jared Lynch, Nick Evans 7.15pm: Melbourne CEOs call for lockdown to end

Melbourne’s most powerful corporate bosses have rallied to spark a dramatic intervention into Victoria’s long-running lockdown, with BHP boss Mike Henry and Orica managing director Alberto Calderon collecting CEO signatures on a letter demanding Premier Daniel Andrews open up faster.

The letter, seen by The Australian and which includes signatories from gold miners to soft drink makers, branded the current lockdown situation as “not sustainable” and called on Mr Andrews to lift restrictions faster to get the state back to work, lifting the mental health and economic burden from working Victorians.

The Australian understands the letter began circulating among Victoria’s top tier corporate bosses on Sunday, after Mr Andrews disappointed the state by slowing the pace of Victoria’s reopening.

Other Melbourne-based corporate heavyweights joined the demand for a faster reopening of Victoria’s economy include Alison Watkins, managing director of beverage giant Coca-Cola Amatil; Sandeep Biswas, chief executive of the country’s biggest gold miner Newcrest and Jeanne Johns, managing director of international explosives giant Incitec Pivot.

Also signing the letter are chief executive of Wesfarmers, Rob Scott; and Matt Comyn, boss of Australia’s biggest bank, CBA

The letter goes further than mirroring broader calls from business leaders for a quicker restart for small businesses and hospitality – which Mr Andrews has flagged as his likely next step on Sunday – urging Mr Andrews to allow office workers to return to work to help revive Melbourne’s CBD, all but gutted by Melbourne’s tough lockdown regime.

Lachlan Moffet Gray 4.43pm: Negligence facilitated money laundering: Coonan

Commissioner Patricia Bergin is attempting to clarify Ms Coonan’s statements to the inquiry.

“I just wanted to then raise with you the question of the advertisement,” Ms Bergin said, in reference to the official board response Crown released last year following media allegations about Crown’s relationship with junkets.

Ms Bergin clarified that Ms Coonan earlier said she would not, in hindsight, describe Crown’s junket vetting process as “robust,” which was the wording used in the advertisement.

She also clarified that Ms Coonan maintained that Crown did not “turn a blind eye” to money laundering, but that Crown’s negligence facilitated it.

Also touched on was that the advertisement referred to a young female Crown employee in China who was arrested as someone who was spuriously seeking unreasonable compensation.

Ms Bergin clarified that Ms Coonan disavowed the language used, as she believed it portrayed the young woman as a “gold digger” by suggesting she was seeking compensation 50 times her annual salary.

“I think that the CPH directors would have been able to make it in a month on their retainers under the services agreement, Ms Coonan, if you accept that from me,” Ms Bergin remarked.

Highlighting other assertions in the advertisement that Ms Coonan now agrees were ill-advised to say, Ms Bergin suggested an earlier mea culpa would have made the inquiry a lot easier.

“You can see that it has been necessary for the inquiry team to look at all of this and confront all these allegations,” she said.

“One alternative to this presentation and having to go through the advertisement could have been just to accept that the advertisement had been a bad idea subsequently, and then just have the company agree to the problem.”

Ms Bergin also suggested that Crown could look into hiring an external auditor to help with its money laundering compliance.

Ms Coonan said she wasn’t certain how it would play out, but said she was “amenable and open” to the idea.

The inquiry adjourned until tomorrow, when former Crown director and Qantas Boss Geoff Dixon will be giving evidence.

4.28pm: ASX closes firmly lower

The local sharemarket followed Wall Street lower on Tuesday as hopes of a US stimulus package being approved prior to the November election were dashed.

After a negative start to the session, the index briefly lifted into the green before a steady decline in afternoon trading.

At the close of trade, the ASX benchmark S&P/ASX200 had dropped 44.783 points, or 0.72 per cent, to 6184.6 points. The broader All Ordinaries index had fallen 38.762 points, or 0.6 per cent, to 6396.8 points.

The losses came after the index hit a new post-coronavirus crisis high on Monday.

“After an early bounce, the ASX200 has drifted lower today, taking a spill generally in sympathy with Wall Street’s drop overnight,” said IG market analyst Kyle Rodda.

“Tuesday’s sell-off doesn’t cast too ominous a sign about where the market is at currently.

“With a tense macro backdrop, a pause to the recent drive higher in Aussie stocks might be expected.”

BHP lost 1.6 per cent to $35.90, while Rio Tinto dropped 4.5 per cent to $94.13.

In financials, Westpac backtracked 1.4 per cent to $18.51, while Commonwealth Bank sank 1.2 per cent to $69.14. NAB retreated 1 per cent to $19.19 and ANZ lost 1 per cent to $19.32.

Afterpay gained 4.5 per cent to $101.94 after the buy now, pay later player announced a tie-up with Westpac, which the bank said would benefit customers on Westpac’s new digital banking platform.

Crown lifted 1.2 per cent to $8.35, rebounding somewhat after an 8.2 per cent fall on Monday, after Austrac launched a formal investigation into the casino company. News of the investigation came after a routine check identified potential non-compliance at Crown’s Melbourne casino.

Cochlear gained 2.3 per cent to $222.82 after it told the market that services revenue continues to recover, as it unveiled a slightly lower first quarter revenue figure.

The Australian dollar was 0.54pc weaker against the US dollar by the close of the ASX session, trading around US70.36c.

Ben Wilmot 4pm: Dexus flags healthcare push

Office heavyweight Dexus has flagged a significant push into healthcare property and has teamed with its specialist fund to snap up the Australian Bragg Centre in Adelaide from private developer Commercial & General for $446.2m.

Dexus is making a big push into health and is the largest listed player in the area, although others including Centuria Capital, Australian Unity and offshore players are also active.

Buying hospitals and medical facilities also helps diversify risk at a time when conventional assets like shopping centres and lower grade office towers are under pressure.

Dexus joined with its Healthcare Wholesale Property Fund to buy the centre in a 50/50 deal that will see them take full control of the asset when it is finished.

At the price the purchase is one of the largest single-asset private healthcare acquisitions in Australia and positions Dexus to take on larger portfolio-style assets.

Read more: Dexus drives further into health

David Ross 3.44pm: Financial planner fined $10,000

Disgraced celebrity financial planner Sam Henderson has been fined $10,000 after being convicted for misrepresenting his qualifications over several years.

The three charges on which Henderson was found guilty in the NSW District Court on Tuesday mark the end of an era for the celebrity financial planner but far less than the maximum penalty of 10 years’ imprisonment or significant fines totalling upwards of $80,000.

The $10,000 hit, coupled with a two-year good behaviour order, marks the closure of the first court action arising from his appearance before the royal commission into financial misconduct in 2018.

Read more: Disgraced planner Henderson fined $10,000

Lachlan Moffet Gray 3.15pm: Crown, ‘ready and suitable’ for Dec opening: Coonan

The inquiry has resumed and counsel assisting Naomi Sharp is questioning Crown chair Helen Coonan on the bank accounts of Southbank and Riverbank, shell companies that have been linked by the AFP to money laundering activity.

Ms Shap asked Ms Coonan if Crown had commenced a review into these accounts, given that banks had closed multiple accounts linked to the companies over the years due to money laundering concerns.

“I don’t think that’s correct, recently the board directed such a review and that is ongoing,” Ms Coonan replied.

Displaying a document titled “Sales playback VIP international” from the 30th January 2015, Ms Sharp drew attention to a section of the document that mandates Southbank accounts only accept deposits from personal accounts, as it more readily allows the source of funds to be traced.

But then going to a bank statement for accounts linked to the company, Ms Sharp showed that $31.8m dollars in total was deposited over 53 transactions with reference to multiple patron numbers by a company called Pai Pai Supply Chain Limited between May and August 2016.

Ms Coonan agreed this was a “red flag” for money laundering. Ms Sharp displayed a company registration search for the relevant company on the Hong Kong business registry, which showed that that the company secretary was another company called Hong Kong Huifu Enterprise Consultants Limited.

In another search, Ms Sharp showed that the company secretary is another company called Rya Management Limited - and in turn, the company director for that company is a man called Ricky Ling Kit Cheung.

Ms Sharp then showed a Panama Papers database that showed Rya management is linked to 474 entities in the British Virgin Islands.

Ms Sharp then showed another Panama Papers document for a company called White Daisy development limited, showing Mr Cheung and Raya Management are associated with the company.

“Can you think of any reason why one entity would wish to deposit funds into the patron accounts of 20 different patrons?” Ms Sharp asked.

“Well that’s in money laundering terms, classic structuring,” Ms Coonan replied.

Counsel assisting Naomi Sharp is now asking Ms Coonan whether Crown has established adequate money laundering protections ahead of the Barangaroo casino’s planned December 14 opening.

Ms Coonan said new systems were in place and a new head of financial crimes will be hired sometime in November.

“It’s a fair question, and it’s one that I ask myself and I personally went down to the site and I have met all the team managers across all of the operation areas,” she explained.

Ms Sharp asked whether the board considered the appropriateness of opening Barangaroo before the inquiry reports on February 1.

Ms Coonan said the date was arrived at because the Barangaroo building was completed ahead of schedule and it fit in with the Barangaroo precinct’s development plan.

“Whether or not we open, with the greatest of respect, is not entirely Crown’s decision,” Ms Coonan said.

Ms Sharp circled back to the earlier topics of Ms Coonan’s confidence in various executives, asking first whether Ms Coonan lost confidence in Australian Resorts CEO Barry Felstead.

“I think it was a combination of not being confident in having Mr Felstead continue but it was commensurate with his desire to retire,” Ms Coonan said.

Of CLO and ALM officer Joshua Preston, who has already been confirmed as leaving his role as ALM officer, Ms Coonan said there might be room for him elsewhere in the business.

“I think Mr Preston may be in a slightly different category, he was wearing a lot of hats...I wouldn’t want Mr Preston to be continuing in the prominent roles he had.

On CEO Ken Barton, Ms Coonan said she maintained confidence in him.

“I’ve been disappointed in some of the judgements made by Mr Barton that I’ve become aware of in the course of the hearing, however I think Mr Barton has shown a keen appreciation for the need for change.”

As a final question, Ms Sharp asked whether Crown Resorts was a suitable company to hold a NSW Casino licence.

Ms Coonan said it was a matter for the inquiry, but remarked: “I do think we are ready and suitable and obviously will respect and listen to the recommendations of the inquiry.”

3pm: Software company Elmo reiterates guidance

Software company Elmo has reaffirmed its full-year guidance as it said cash recorded $15.6m in cash receipts, up 29.8 per cent on the same quarter a year ago.

“ELMO continues its growth journey,” chief financial officer James Haslam said.

“Cash receipts for the 12-months to 30 September 2020 totalled $61.1 million, representing growth of 30.4 per cent on the 12-month period to 30 September 2019.

“This is a new 12-month record for ELMO.”

Elmo shares last down 0.4 per cent at $5.68.

2.58pm: Zip Co lifts on Visa tie-up

Shares in buy now, pay later player Zip Co are trading higher after the company was granted a principal issuer licence with Visa.

The launch of the new Tap & Zip product will allow Zip customers to shop anywhere that accepts Visa, Zip Co said in a statement to the ASX this morning.

Still, UBS analysts said that while the announcement would materially increase the company’s total available market, there were downside risks associated with the move.

“Today’s announcement is significant though difficult to quantify,” UBS analysts said.

“We see some risk of cannibalisation from higher margin transactions processed via the Zip platform, where we estimate Zip generates merchant fees of 2 per cent to 3 per cent on average, to lower margin interchange.

“We also see a risk to future merchant growth given Zip’s customers can now access such merchants without paying a higher fee, though going forward we still believe merchants will continue to integrate directly with Zip where there is a clear benefit to the merchant from marketing directly to Zip’s customers.”

Zip shares last up 0.4 per cent to $7.20.

2.11pm: ASX slips after lunch

The ASX has slumped to a new intraday low in afternoon trade, down 0.6 per cent at 6192 points.

The major miners and the big banks are leading the falls, with BHP down 1.9 per cent and Rio down 1.6 per cent. Westpac is down 0.9 per cent and CBA is 0.9 per cent lower.

Cochlear is up 2.1 per cent after the company flagged a recovery in revenue this morning, while Afterpay is up 6 per cent after announcing a tie-up with Westpac.

1.55pm: SK Hynix in $9bn memory chip deal

The world’s second-largest chipmaker, South Korea’s SK Hynix, has announced a $US9 billion deal to buy Intel’s flash memory chip operation as it seeks to bolster its position against rival behemoth Samsung Electronics.

SK Hynix is already the world number two maker of DRAM chips, used in computers and servers, and the second-largest chipmaker overall.

But it has lagged in the market for flash memory -- or NAND -- chips, which are used in everyday devices such as smartphones and USB storage drives, as well as industrial and medical equipment.

In a regulatory filing, SK Hynix said it will acquire Intel’s “entire NAND business division excluding the Optane division” for 10.3 trillion won, with Intel’s factory in Dalian, China, included in the deal.

SK Hynix ranked fourth by global NAND sales in the second quarter this year, according to market researcher Trendforce. Intel was sixth.

Their combination will see SK Hynix leapfrog Japan’s Kioxia and Western Digital of the United States into second place with a market share of more than 23 percent, the Trendforce numbers showed.

AFP

1.46pm: Cyber-scams surge as Aussies work from home

A lift in the number of Aussies working from home has prompted a surge in remote access cyber-scams, with ransomware and business email compromise scams up significantly since the start of the pandemic, according to Commonwealth Bank.

“The cost of cybercrime to the Australian economy is increasing every year, and every day we hear stories from our customers, including business customers, who are dealing with the financial and emotional costs of cybercrime,” CBA chief information security officer Keith Howard said.

According to the Australian Cyber Security Centre, cyberattacks on Australian businesses cost the economy $29 billion a year.

“Australian businesses need to ensure they update their operating systems and applications on their computers and phones; ensure all staff are using strong and unique passwords; establish robust payment processes with multiple approvers; train staff on how to recognise suspicious emails; and set expectations with staff on how to handle corporate and customer data securely,” Mr Howard said.

CBA has launched a range of cyber resources for business customers to help them improve their cyber security.

1.23pm: Used vehicle prices surge on production halts

Prices of wholesale used vehicles rose for a fifth consecutive month in September, up 3.8 per cent compared to August and up 29.9 per cent on the same point in 2019.

Passenger car prices grew 2.1 per cent in September compared to August, while larger-vehicle segments increased by 8.7 per cent, according to the Datium Insights-Moody’s Analytics Price Index.

Preference for larger vehicles has been growing over the past six years and demand has accelerated partly due to lower petrol prices.

“The increased demand for trucks and SUVs has been difficult to satisfy in the current environment,” Moody’s senior economist Michael Brisson said.

“Production of new vehicles was halted worldwide at the beginning of the outbreak, leading to shortages of popular vehicles in lots across the world.”

Moody’s forecasts growth in used vehicle prices to slow and finally subside as markets readjust towards the end of the year.

Lachlan Moffet Gray 1.02pm: Coonan had ‘no knowlege’ of Packer’s VIP involvement

Returning to a board paper produced by Ken Barton and with input from Ms Coonan presented in August of this year that noted that Crown’s VIP business historically had a “aggressive sales culture with a higher risk appetite than the rest of the business”.

Ms Sharp asked whether this higher risk appetite was driven by executives from James Packer’s private company through which he holds his Crown shares, Consolidated Press Holdings.

“I simply don’t know that. I don’t think so,” Ms Coonan replied.

Commissioner Patrica Bergin interjected to observe that it looks as though the VIP business operated in a “silo” with ultimate oversight from Australian resorts CEO Barry Felstead, CPH executive and Crown board member Michael Johnston and James Packer.

“Well what I can say is that I have no direct knowledge of that other than I thought the VIP team was run by the VIP team, I had no knowledge of Mr Johnston’s involvement and no real knowledge of Mr Packer’s involvement,” Ms Coonan said in response.

Ms Bergin went on to say that it seemed Mr Felstead seemed only to report to Mr Packer about the VIP business prior to the arrests of Crown staff in China.

“You have this concurrence of the board operating in Melbourne and Sydney and Perth dealing with figures...but no one telling you what was actually happening on the ground up there.

She suggested it was not so much a failure of the board to be informed, as Mr Packer was a member at that time, but rather “It was a failure with someone not informing the balance of the board,” in reference to Mr Packer.

The Counsel adjourned for lunch and will return at 2pm.

Ben Wilmot 12.58pm: ESR picks up major redevelopment site

The logistics property boom is rolling on with the ESR Australia Development Partnership snapping up a major redevelopment site in Acacia Ridge in Brisbane.

The partnership will buy an 18 hectare infill site in the prime industrial precinct and develop it out to add to its $2.7bn worth of property in Australia.

The vehicle bought the estate from private equity and property house Blackstone and it already has some income-producing warehouses as well as vacant land.

ESR Australia will develop the site in stages to become a premium logistics estate with the potential for a total space of about 100,000sq m. A 2.5 ha pad is available for immediate development of about 14,000sq m with an approval in place.

The balance of the site will be redeveloped over the next few years. The existing improvements on the site are predominately older style warehousing built in the 1960s.

ESR chief executive Phil Pearce said the location was targeted due to the strong demand for premium logistics assets and the potential for redevelopment in this land-constrained market.

The acquisition comes after the recent closing of partnership, including the backing of Singaporean sovereign wealth fund, and the acquisition of 79 ha in south east Melbourne in July.

Bridget Carter 12.57pm: Universal Store prepares to IPO

Clothing retailer Universal Store has hired broker Morgans for its initial public offering as it prepares to head to the boards as a company with a market value at just under $300m.

The company, which is owned by private equity firm Catalyst and Brett Blundy, is pricing its float this week.

It is understood that the pricing will equate to between 13 and 14 times its net profit, with the size of the raise to be about $150m.

Already working on the float is JPMorgan and UBS.

More to come.

Adam Creighton 12.40pm: All states shed jobs

Every state and territory shed jobs in late September, the Australian Bureau of Statistics said on Tuesday, in a worrying sign the path back to full employment will be a long one.

The total number of payroll jobs fell almost 1 per cent in the last two weeks of September, ranging from a 1.2 per cent drop in the Northern Territory to a 0.7 per cent decline in South Australia, despite both jurisdictions’ having ended their lockdown restrictions months ago.

“Nationally, payroll jobs remain 4.1 per cent lower than mid-March; 7.7 per cent lower in Victoria and 2.8 per cent lower in the rest of Australia,” said Bjorn Jarvis, head of labour statistics at the ABS.

The tax office’s payroll system had 440,000 fewer jobs on October 3 than it had in March, the ABS said.

Only three of the 19 industries tracked by the ABS has more jobs than in March: financial services, public administration and health and social assistance.

Perry Williams 12.38pm: CIMIC loses $1bn dispute

Contractor CIMIC has lost a long running $1bn dispute with Chevron on its giant Gorgon LNG export project in Western Australia.

Australia’s largest construction company has been chasing $1.15bn for work it was originally awarded in 2009 for the design, supply and construction of Gorgon’s 2km jetty that carries LNG from the plant to waiting export tankers.

However, the companies fell out after a dispute over cost blowouts related to changes to the scope and conditions for the $US54bn Gorgon project with a process of arbitration starting in 2016.

CIMIC said on Tuesday it had been awarded $78m in arbitration with a $35m payment to be made to Chevron.

CIMIC’s claims on Gorgon, which started producing gas in 2017, have previously been reported as being worth $2.2bn. However, CIMIC has only recognised $1.14bn of revenue on the contract or roughly half of the costs it had incurred.

CIMIC said on Tuesday it had only been holding a $675m provision, suggesting the company may be forced to take a substantial hit in its next set of financial accounts.

“The overall financial outcome for CIMIC’s profit and loss statement and balance sheet of the one-off impact from this award is expected to be offset by some of the existing $675m provision, as well as the one-off pre-tax gain of around $2.2bn from the Thiess transaction. The award has no impact on CIMIC’s operational business or CIMIC’s cash position,” CIMIC said in a statement.

CIMIC, formerly known as Leighton Holdings, in January took a $1.8bn writedown after axing its troubled Middle East business, blaming tough market conditions in the region.

CIMIC shares fell 2.2 per cent to $22.09 on Tuesday.

James Glynn 12.31pm: RBA minutes pave way for easing

The Reserve Bank of Australia signalled that it sees a need to further support the economy through various channels, including expanded government bond buying and lowering its official cash rate closer to zero.

According to the minutes of its October 6 policy meeting, the RBA’s board “agreed to maintain highly accommodative policy settings as long as required and to continue to consider how additional monetary easing could support jobs as the economy opens up further.”

Consistent with comments made last week by RBA Governor Philip Lowe, the board said cutting the interest rate as the economy begins to recover would mean greater policy traction was likely.

“The board discussed...the options of reducing the targets for the cash rate and the 3-year yield towards zero, without going negative, and buying government bonds further along the yield curve. These options would have the effect of further easing financial conditions in Australia,” the minutes said.

The commentary in the minutes will further strengthen bets that the RBA will announce a multifaceted easing in monetary policy at its November 3 policy meeting that includes cutting its official cash rate from 0.25pc to 0.10pc while lowering its three-year government bond yield target to the same level and announcing a significant bond-buying program targeting five and 10-year government maturities.

Dow Jones

Lachlan Moffet Gray 12.21pm: New Crown compliance chief near

Crown chairman Helen Coonan says a newly-created role overseeing criminal risks and compliance is close to being filled at the casino company.

“It’s coming in prospect as I understand it, I will be on the final interview panel. A shortlist has been identified,” she said.

On the topics of junkets, Commissioner Patricia Bergin noted that many directors have noted many allegations made against junket operators are only allegations, and that adds complexity to the determination as to whether Crown should deal with them going forward.

Ms Bergin suggested that Crown had every right to deny dealing with some of these operators, given the seriousness of the allegations against them.

“Yes, I agree with that. As a basic proposition commissioner, normally you have to be very careful about people’s reputation and what’s said about them,” Ms Coonan said, adding that with certain junket operators: “You wouldn’t have dealt with them in retrospect and you wouldn’t deal with them prospectively.”

Ms Bergin suggested it would be prudent for Crown to avoid junket operators with serious allegations against their name.

“You can most certainly take the high ground and take that course,” Ms Coonan agreed.

Counsel assisting Naomi Sharp is attempting to discern the level of financial impact Crown ceasing to deal with junkets would be, and whether there is an appetite for that at a board level.

Ms Coonan maintained that the board may decide not to deal with junkets going forward, but said “we haven’t had an opportunity in recent weeks to be able to take the time and care to work through these issues.”

However, any decision to continue dealing with junkets would mean that the greatest level of care would be taken in choosing who to deal with.

Crown has suspended dealing with junkets until June of next year.

Ms Sharp then displayed a due diligence report on Suncity head Alvin Chau that detailed Mr Chau’s former relationship with triad gangs, and asked if it was enough evidence to compel Crown to stop dealing with him.

“I believe so,” Ms Coonan replied, saying Crown wouldn’t want to deal with him “in retrospect or prospect.”

Ms Sharp displayed more due diligence documents on junket operators Crown has dealt with that contain allegations of criminal activity, and Ms Coonan indicated that Crown would most likely elect not to deal with these individuals.

An email was produced between VIP Crown executives Roland Theiler, Michael Chen and other crown staff where they discuss two junket operators Crown deals with who have links to the “underground network.”

Ms Coonan agreed the email was concerning.

“Yes, I don’t know what underground network means in this email but on the face of it you’d certainly want to know what they are talking about,” she said.

After detailing more allegations against various junket operators Crown dealt with, Ms Sharp returned to a December 2019 strategic review of Crown’s VIP business that listed Crown’s top five junkets by turnover.

One of the junkets featured in a due diligence report just presented to Ms Coonan and Ms Sharp asked if it meant Crown was dealing with a junket operator not in good repute as late as last December.

“That’s certainly a distinct possibility,” Ms Coonan replied.

12.13pm: S&P reaffirms Australia’s AAA ratings

Ratings agency S&P has affirmed Australia’s AAA ratings, with a negative outlook. The comments mark S&P’s assessment following this month’s federal budget.

“We are affirming our ‘AAA/A-1+’ long- and short-term local and foreign currency ratings. The negative outlook reflects a substantial deterioration of fiscal headroom at the ‘AAA’ rating level and downside risks persist,” the ratings agency said.

The rolled gold rating is critical for Australia to keep its borrowing costs low.

Here are other parts of S&P’s assessment:

• We expect the general government’s fiscal balance to narrow during the next few years after recording a deficit of about 14pc of GDP in fiscal 2021 because of the COVID-19 pandemic.

• Large economic stimulus packages will support Australia’s economic recovery, but fiscal deficits will persist and debt levels will be elevated for years to come.

• Our ratings on Australia benefit from the country’s strong institutional settings, its wealthy economy, and monetary policy flexibility. External risks are improving, with the country’s first current account surplus in about 50 years and steadier terms of trade than the past.

Other ratings agencies Fitch and Moody’s also have a “AAA” on Australia.

12.09pm: ASX back in the red at lunch

The ASX was trading lower at midday on weak leads from Wall Street, as hopes of a stimulus package prior to the November election dwindled.

After a negative start to the session, the ASX briefly bounced into the green in morning trade, before retreating once again before lunch.

The index was recently 0.28 per cent lower at 6211.801 points.

Materials are weighing, with BHP down 1.2 per cent and Rio down 0.9 per cent.

In financials, Westpac is down 0.7 per cent while CBA is 0.5 per cent lower.

Tech is the best performing sector, with Afterpay up 7.1 per cent while Xero is up 0.5 per cent and WiseTech Global is up 0.2 per cent.

Crown is 1.2 per cent higher as the casino licence inquiry rolls on.

Lachlan Moffet Gray 12.06pm: Crown culture failure conceded

Counsel assisting Naomi Sharp has discussed a board paper from September 2019 that noted Crown’s anti-money-laundering division was “under-resourced and lacking in qualified AML executives.”

She also noted that money-laundering expert and Star casino group manager Skye Arnott earlier told the inquiry that a culture of compliance is essential in a casino business.

Ms Sharp asked Ms Coonan when she became aware of the necessity of a culture of compliance.

“I think it’s been a gradual process in my thinking...as you know, the board has now moved to set up a separate department for compliance and financial fraud, significantly enforced,” Ms Coonan said, although she did not agree with Ms Sharp’s proposal that she came to the idea through the inquiry.

“It certainly sharpened my earlier view, it didn’t just tumble on me, Ms Sharp.”

Ms Sharp asked if the failure to establish this culture constituted a failure of leadership on the board’s part.

“I think we thought we had, but we clearly hadn’t,” Ms Coonan said in reference to establishing a culture of compliance.

Ms Sharp asked if Ms Coonan agreed Crown had clear notice about the risk of junkets being connected to organised crime, given the ABC broadcast a program on the subject and specifically named Crown in it.

“I really don’t have that level of recall but I do remember Crown made a response to the program,” Ms Coonan said.

Displaying that response, Ms Sharp highlighted a section that said all activities in the casino “were undertaken by the casino operator,” noting in that same year the Suncity junket commenced operations in its private room with its own cash desk at Crown Melbourne.

“I don’t know what the situation was at the time this document was created,” Ms Coonan said.

Ms Sharp asked if Crown’s decision to suspend dealings with junket operators made “in recognition of there being failures of the due diligence process in the past.”

Ms Coonan said the suspension was made to give the board an opportunity to get to the bottom of allegations surrounding junkets.

Ms Sharp asked how this review is going and Ms Coonan said: “The review is up to implementing and accepting in the sense of working through all of the 20 allegations from the Deloitte report, and the broader review has to be first undertaken by the board deciding as a matter of a threshold decision whether we have an appetite to continue with junkets at all.”

“Should we do that, it would have to be subject to an exhaustive review.”

Lachlan Moffet Gray 11.45am: Coonan not aware of Austrac probe subjects

Crown chair Helen Coonan has been questioned about yesterday’s announcement of AUSTAC’S investigation of Crown’s money laundering compliance, following checks in September of last year.

“I don’t have an enormous amount of detail about it but it certainly concerned issues to do with due diligence, as I understand it, know your customers and politically exposed persons in VIP,” Ms Coonan said.

Ms Coonan said the compliance checks were delayed due to the coronavirus, but resumed last week.

Ms Coonan said that AML compliance officer Joshua Preston - soon to leave his post - liaised with AUSTRAC previously but won’t be going forward.

“No, it won’t be Mr Preston, but Mr Preston had a team,” Ms Coonan said.

Ms Coonan said she became aware that an enforced investigation would take place “yesterday or the day before” and said that the investigation would relate to multiple factors.

“I don’t know with any particularity that I can give you other than it’s alleged non compliance in relation to certain controls, customer due diligence, some know your clients, and politically exposed persons,” she said.

Ms Coonan said she was not aware of any particular clients AUSTRAC had in its sights.

Counsel assisting Naomi Sharp has shown Crown chair Helen Coonan a record of a Crown meeting that took place in November of 2016 concerning Crown’s use of Melco’s City of Dreams Macau and Manilla casinos to facilitate customer deposits for debt repayments.

Ms Coonan said she was never made aware of this arrangement.

“Doesn’t this raise concerns that workarounds are being developed to avoid reporting requirements in Australia?” Ms Sharp asked.

“If that were the case, Ms Sharp, I’d agree with you, I just don’t think this gets us quite there,” Ms Coonan replied.

“You would agree that the board had no level of supervision over these deposit arrangements?” Ms Sharp asked.

“Well I don’t know anything about them, so it follows from that that you can’t supervise anything that’s not elevated to the board,” Ms Coonan replied.

Adeshola Ore 11.40am: IDP Education drops on AGM update

Shares in IDP Education have slumped more than 4 per cent in early trade after the company said its English language business is operating at 70 per cent capacity compared to pre-COVID levels.

In a statement to the ASX ahead of its AGM today, it said its operating capacity was up by 15 per cent compared to late August.

“Social distancing measures are still limiting our ability to deliver the test in large-scale group environments in several countries, however our shift to smaller and more frequent test sessions, enabled by computer-delivered IELTS, is helping us meet demand,” it said in the statement.

The company’s student placements are down 22 per cent for the first quarter compared to last financial year.

IDP shares last down 4.3 per cent at $19.14.

11.38am: ASX hovers around flat

The ASX has dipped into the red once again, in choppy trade after the index slumped at the open but then bounced into positive territory in morning trade.

The index is down 0.04 per cent at 6227.102 points.

Materials are the biggest weight on the market, with BHP down 0.7 per cent and Rio down 0.4 per cent.

In financials, Westpac is down 0.8 per cent while CBA is 0.1 per cent lower.

Tech is the best performing sector, with Afterpay up 5 per cent while Xero is up 0.7 per cent and WiseTech Global is up 0.5 per cent.

Lachlan Moffet Gray 11.30am: Crown ‘judgment lapse’ admitted

The casino licence inquiry has resumed and counsel assisting Naomi Sharp is asking Crown chairman Helen Coonan about bank accounts linked to Crown subsidiaries Riverbank and Southbank Iinvestments, which last year were fingered by the AFP over money-laundering concerns.

Accounts linked to the companies were closed on three different occasions by different banks over money-laundering concerns and each time then CFO Ken Barton did not investigate the accounts.

Ms Sharp asked Ms Coonan whether this conduct constituted Mr Barton turning a blind eye to the risk of money-laundering.

“Well I think my former answer remains, it must have been on this part either not appreciating what he’s been told or some lapse on his part, I cannot imagine why he wouldn’t have made some ienquiries,” Ms Coonan said.

Ms Coonan agreed that this conduct constituted a significant “lapse of judgment” on his part, and was concerned that either Mr Barton or AML officer Joshua Preston informed the board about the account closures.

“Yes, it should have been brought to the board’s attention,” Ms Coonan said.

Ms Sharp then displayed an email from Crown VIP business executive Roland Theiler to current Crown CFO Alan McGregor from earlier this year where Mr Theiler asks whether an account should be opened with an ANZ Hong Kong branch to help junkets remit debts to Crown.

Ms Sharp suggested this action constituted a workaround of Australian AML laws.

“I think that’s putting it a bit too highly...first of all, I don’t think on the face of it it’s an indication of money laundering,” Ms Coonan replied.

“It’s certainly an indication of the difficulty for some people to repatriate funds out of, no doubt, China.”

Cliona O’Dowd 11.30am: Perpetual grows assests under managment

Perpetual Investments grew its assets under management by $200m in the September quarter as institutional flows into cash and fixed income products more than offset the funds retail investors pulled from its Australian equities strategies.

In the three months through September, the wealth manager’s assets under management grew to $29bn, up 2 per cent from June 30, due to mark-to-market adjustments and positive net inflows.

Institutional investors pumped $500m into cash and fixed income over the period but at the same time retail investors and intermediaries — financial advisers who invest is Perpetual via external platform providers — ripped $300m from Australian equities.

Perpetual last down 0.9 per cent at $30.26.

11.25am: What’s impressing analysts

Ampol: raised to Buy at Jefferies

Pendal Group: cut to Hold at Morningstar

Adeshola Ore 11.22am: Lovisa boasts first quarter sales surge

Jewellery and accessories retailer Lovisa says it’s online sales grew 400 per cent in the first quarter of the financial year.

Ahead of it’s AGM on Tuesday, the company said the growth was continuing the online momentum it reported in the final quarter of the past financial year.

“Our execution online remains a focus to ensure it can become a meaningful part of our online business, with digital store fronts now in place servicing all 7 of our major markets around the world,” the retailer said in a statement to the ASX.

The company reported global store sales were down more than 10 per cent in the first quarter of the financial year.

The accessories company said it planned to reopen its 30 Melbourne stores on November 1, after they were forced to shut in August due to COVID-19 restrictions. Despite the closures of its Melbourne stores, the brand said it is no longer eligible for the federal government’s JobKeeper wage subsidy scheme.

Lovisa last down 1.8 per cent at $8.54.

Perry Williams 11.14am: Origin cautions on gas prices

Origin Energy has warned against unrealistic expectations for domestic gas prices after earlier reaffirming its 2021 earnings guidance for its energy markets division and retaining its Australia Pacific LNG production target.

The Morrison government is preparing to “strengthen price commitments” as it looks to negotiate a new heads of agreement with Queensland gas exporters including Origin to ensure sufficient supplies at affordable prices are available to the market.

Andrew Liveris, an adviser to the Morrison government, has targeted $4 a gigajoule gas as an achievable target for the east coast market despite producers rejecting it as an unrealistic price, raising concern the government may look to set a price target for gas producers.

Origin, which operates the $25bn APLNG gas export project in Queensland, cautioned against any regulatory moves at its annual general meeting on Tuesday.

“We continue to caution against arbitrary or unrealistic gas price expectations, noting the cost of domestic gas must reflect the lifecycle cost of production, and that gas producers, like any company, should be earn to a return on the significant capital required to bring gas supply to market,” Origin chief executive Frank Calabria said.

Origin also defended its decision to take a writedown on APLNG saying it had taken a more conservative view of future oil prices than its competitors.

“We could have taken a more optimistic view of the oil price as some of our competitors did and we would have had no impairment,” Origin chairman Gordon Cairns told the AGM. “As a board you would expect us to be appropriately conservative in this area.”

Origin expects earnings from its core energy markets division would decline by up to 21 per cent or $309m to a range of $1.15bn to $1.3bn in the 2021 financial year from $1.459bn in 2020.

APLNG production is also estimated to be as much as 8 per cent lower at 650-680 petajoules due to lower demand as the Asian LNG glut dampens the market.

Origin’s depressed share price remains the biggest regret for Mr Cairns who steps down as Origin chairman on Tuesday to be replaced by Scott Perkins.

“This is my one major disappointment,” Mr Cairns told the AGM. “Despite the strong operational performance over recent times, the share price is not where we would like it to be.”

Lachlan Moffet Gray 11.04am: Crown admits ‘facilitating’ money-laundering

The inquiry into Crown’s casino licence has been shown footage and photos of large cash deposits being made at Melbourne’s casino, amid questions over anti-money-laundering (AML) compliance.

Counsel assisting Ms Sharp displayed the infamous “blue cooler bag footage” which shows an individual depositing a large amount of cash from a cooler bag at the Suncity junket’s private room in the Melbourne casino in 2017.

As junket rooms are not considered reporting entities under AML regulation, there was no need to report the transaction to AUSTRAC.

Ms Coonan said that no director of Crown was aware of the transaction at the time.

Photos were shown from January and February of 2018 which shows a similarly large amount of cash being deposited at the Suncity desk.

A letter Crown’s AML officer Joshua Preston wrote to Austrac in May 2018 was then displayed in which it was claimed that Crown Melbourne identified a money-laundering risk in respect to its junkets.

In the letter, Mr Preston said Crown instructed Suncity to remove its note counter from the cash desk and that no more than $100,000 could be held at the administration desk.

Two audits of the pits revealed that $5.6m dollars in cash was found in the Suncity room, the email said, but Ms Coonan said neither she or any board member was made aware of this.

“Why wasn’t the Suncity room closed on the spot following this audit?” Ms Sharp asked.

“I can’t speculate as to why it wasn’t, but it’s a very serious matter that required urgent attention,” Ms Coonan said.

Ms Sharp asked if this was proof Crown turned a blind eye to money-laundering.

“Ms Sharp, we’ve already had this conversation about turning blind eyes,” Ms Coonan replied.

“It may have been ineptitude or lack of attention, I don’t know that it was deliberately turning a blind eye.”

Commissioner Patrica Bergin asked whether Ms Coonan agreed that however it occured, Crown was “facilitating” money-laundering.

“It’s very difficult to agree with facilitating - I think certainly there were all sorts of signs there I would say commissioner...” Ms Coonan replied.

“As I say, I just don’t know if it was ineptitude, or lack of attention to detail, or lack of training...”

“Let’s assume it was ineptitude, let’s assume it was lack of training,” Ms Bergin replied, stating that those things still allowed money-laundering to occur.

“And allowing something...on one view of it, it is not unreasonable to say this ineptitude and lack of attention facilitated it.”

“Yes,” Ms Coonan agreed.

“I think it was a turning of the blind eye I didn’t agree with.”

The inquiry adjourned for a short break.

11.00am: Afterpay shares lift after bank partnership

Afterpay shares are up 5.5 per cent in morning trade after the buy-now, pay-later service provider announced a tie-up with Westpac.

The partnership with Afterpay will benefit customers on Westpac’s new digital banking platform, which the bank said would allow it to offer its customers convenient and innovative banking services.

Westpac was last down 0.6 per cent.

Read more: Afterpay, Westpac in digital banking partnership

10.54am: No spending lift in September: CBA

Spending patterns across key sectors of the economy tracked sideways in September, according to the latest Commonwealth Bank Household Spending Intentions survey.

Still, CBA chief economist Stephen Halmarick some improvement could be expected in the near term, given the fiscal and monetary policy support being applied to the economy.

“Both home buying and motor vehicle spending intentions softened a little during September, while those for retail, travel, health & fitness, entertainment and education tracked sideways,” Mr Halmarick said.

“Notwithstanding the developments in September, spending intentions should be supported by the easing of COVID-19 restrictions in the months ahead and the significant fiscal policy stimulus detailed in the 2020/21 commonwealth budget, that will support household income and employment, as well as business cash flow and investment.”

10.50am: Crown changes its anti-money-laundering chief

Crown Resorts chief legal officer and anti-money laundering compliance officer Joshua Preston will cease to be AML officer as of tomorrow, Crown chair Helen Coonan has told the NSW casino licence inquiry.

The revelation came after counsel assisting Naomi Sharp displayed an email regulator AUSTRAC sent to Crown in 2017 which sought a justification from Crown about their continued dealings with the Suncity junket’s head Alvin Chau, who has alleged links to organised crime.

Ms Coonan said she wasn’t informed about the email, but “most definitely” should have been.

Ms Sharp remarked that Mr Preston was aware of the email and asked Ms Coonan if she still had confidence in him to discharge his duties as an AML officer.

“Yes, he’s no longer in that role,” Ms Coonan said.

“He’s about to cease as I understand it and Mr Travers (sic) will become the AML compliance officer, the statutory officer, for the three properties.

“As of tomorrow’s board meeting, that will be endorsed.”

Ms Coonan later clarified that Nick Stokes, current group general manager for AML will replace Mr Preston in his role, having initially got his name wrong.

10.40am: ASX recovers, turns positive

The ASX has bounced into positive territory after slumping as much as 0.48 per cent in opening trade.

By 10.40am (AEDT) the market was up by as much as 0.15 per cent to 6238.5.

CBA turned positive, up 0.6 per cent, while the tech sector has made gains with Xero up 0.5 per cent and Afterpay up 3.6 per cent after announcing a tie-up with Westpac.

BHP is still down 0.6 per cent, after releasing quarterly figures.

10.37am: Downer slips despite contract wins

Shares in Downer EDI have lost ground in early trade despite the engineering contractor telling the market it had been awarded two important contracts on Auckland’s City Rail Link project, worth $NZ825m.

“Downer has been working on this landmark project since April 2015 and we will continue to work closely with our joint venture partners and City Rail Link Limited to complete these additional packages and deliver improved connections across Auckland,” Downer chief executive Grant Fenn said.

One contract includes track alignment in multiple stages, as well as rebuilding and extending the existing Mt Eden station platform. The other includes the provision of track installation and control systems, as well as the installation of rail systems.

Downer last down 1.2 per cent at $4.83.

Ben Wilmot 10.31am: Stockland rides housing stimulus

Property developer Stockland is riding a wave of confidence generated by government stimulus packages and low interest rates that has seen it record the strongest housing sales in more than three years.

The residential developer, considered a bellwether for the broader market, sold a net 1799 lots in the quarter, citing the improved credit availability and the Morrison government stimulus measures.

But the company warned that lot sales had moderated slightly and the restricted capacity of builders to meet demand driven by the stimulus may hurt sales in this quarter.

The company completed 1083 residential settlements in the first quarter and had 4261 contracts on hand at the end of September.

But the company’s retirement living unit was hit with a 9 per cent sales drop, which it largely put down to tight government restrictions in Victoria.

Excluding the state, the rest of the country was up by about 15 per cent over the quarter. The company is also pushing into a new budget land lease style of development for over 55 estates.

Stockland reported that its office and industrial portfolio had high occupancy and rent collection approaching pre-COVID-19 levels, with particularly strong demand for logistics.

The company’s closely watched retail portfolio had a sales recovery as foot traffic picked up again and stores reopened. Excluding Victoria, which is about 12 per cent of the retail portfolio and Covid-19 outbreak at a Sydney centre. comparable sales growth was 3.6 per cent for the quarter and comparable total specialty sales growth was also positive at 1.7 per cent.

Stockland cautioned that some shopping centre tenants would require abatements and deferrals this financial year but these are running at a lower level under the Morrison government leasing code that will now run till year end in most states.

The company has about $1.7bn of cash and undrawn bank facilities at the end of September and is continuing to expand particularly its industrial projects.

But it has not provided earnings guidance citing the uncertainties generated by Covid-19.

10.27am: Coonan denies Crown leadership ‘coup’

Crown chairman Helen Coonan has denied she led a coup against former chairman John Alexander before she replaced him in January of this year.

Ms Sharp asked Ms Coonan when Crown’s tone changed to a more contrite one, and Ms Coonan said: “It came after this meeting and towards the end of the year in relation to concerns that momentum had stopped, or stalled, to make the changes at board level that the independent directors had indicated they supported.

“And after that process it was then of course a matter of looking at a lot of actions by the regulators.

“At that stage, I think it was something like five inquiries that were on foot and I started to come to the view that we needed to be vigilant in getting to the bottom of some of these allegations and making the changes that we made in January.”

Ms Sharp confirmed that the “changes” referred to replacing Mr Alexander, and asked Ms Coonan if she led a coup.

“There wasn’t a coup, Ms Sharp, it was a process that had some difficult aspects to it because Mr Alexander had left the country and wasn’t available in January,” Ms Coonan replied.

“Far from leading the coup, no, I agreed to take on the role as chair because there comes a moment in a process such as this where you either take some steps to move off a board or you step up and try to be part of the solution.”

Ms Sharp asked when the process of reflection for independent directors commenced.

“I think after the AGM, which was in October,” Ms Coonan replied.

10.20am: ASX follows Wall Street lower

The ASX opened in the red, slumping as much as 0.48 per cent to 6199.301 after US stocks dropped as hopes for a fresh stimulus package dwindled.

“Commodity currencies came under renewed pressure overnight, and stock futures finished the overnight session in the red,” said CMC Markets chief market strategist Michael McCarthy.

“Currency traders will look to the release of the minutes from the RBA October meeting.”

The materials sector is the biggest weight on the market this morning, with BHP down 0.7 per cent, Rio down 0.7 per cent and South32 1.8 per cent lower.

The major banks are also down, with Westpac losing 0.6 per cent while CBA is trading down 0.2 per cent.

Tabcorp is 0.6 per cent lower after a disappointing update while Cochlear is trading up 1.7 per cent after flagging a recovery in revenue.

Lachlan Moffet Gray 10.12am: Coonan questioned on high-roller review

Counsel assisting Naomi Sharp has displayed to Crown Chair Helen Coonan a confidential document - an internal paper from December 12, 2019 - concerning a strategic review of Crown’s VIP business that was tabled at a board meeting.

Ms Coonan said she read the document ahead of the meeting where it was discussed.

Ms Sharp displayed a section from the paper where it states Crown’s Barangaroo operation represents an “opportunity to capture a greater share of the global VIP market.”

She then noted that there was no mention in the document regarding the “probity” of junket operators even though the document went into detail about its “top 5 junkets.”

Also displayed was a section that described a challenge to the VIP business as being “the difficulty of transferring funds to Australia.”

Ms Coonan said it represented “difficulty in capital flows from certain Asian countries.”

Another section listed “threats” to the VIP business including “tightening AML (anti-money-laundering) regulations and the closure of bank accounts.”

“To the best of my recollection, the tightening of AML regulations related to the cost of doing business,” Ms Coonan said of the section.

Ms Sharp said she didn’t know whether the reference to bank accounts referred specifically to the accounts of shell companies Riverbank and Southbank accounts that were closed over AML concerns.

She also said that the document listing AML regulation as a “threat” should not be taken the wrong way, as it was simply a “shorthand” way of recording a cost of doing business.

“In terms of this analysis, and coming back to your AML regulations...you see it as both a cost of business but also a strength in your organisation,” Commissioner Patricia Bergin asked.

“Absolutely,” Ms Coonan replied.

Commissioner Patrica Bergin noted that an opportunity listed in the paper was the since abandoned share deal with Melco.

Ms Bergin asked if the board had any knowledge that the deal would fall through just weeks later.

“No,” Ms Coonan replied.

Austrac probe, fines potential hit Crown Resorts

10.10am: Oil Search revenue slumps as production lifts

Oil Search has posted a 7.2 per cent increase in production and a lift in total sales for the third quarter, but total revenue for the period slumped 47.6 per cent to $US189m compared to the same quarter last year.

Compared to the second quarter, revenue dropped 29 per cent.

“Despite improved oil prices during the quarter, the impact of the two-to-three month lag on LNG contract pricing and a higher portion of LNG spot sales has resulted in a 29 per cent fall in revenue,” chief executive Keiran Wulff said in a market update.

“The company’s liquidity position remained robust, with $US1.65 billion of cash and undrawn bank credit lines available at 30 September.

“Oil prices have since recovered from lows within the $US20/bbl range in the second quarter to above $US40 in the third quarter, which will rebase the LNG contract prices going forward.”

Perry Williams 10.06am: Forrest takes control of LNG import terminal

Mining billionaire Andrew Forrest has taken full control of the Port Kembla LNG import terminal in NSW after buying out the two major Japanese owners, in a sign the project will be accelerated after several delays.

The Australian Industrial Energy consortium was originally split between Mr Forrest’s privately-owned Squadron Energy, Japanese trader Marubeni and JERA, an LNG-buying joint venture between Tokyo Electric Power Co and Chubu Electric.

Mr Forrest said on Tuesday he will acquire Maurbeni’s 30.1 per cent stake and JERA’s 19.9 per cent share to assume full control of the facility.

AIE said it was now focused on accelerating the project under its Squadron arm.

“Squadron Energy is committed to the expedited development of the gas import terminal with the objective of having the capacity to supply 70 per cent of NSW’s gas needs by late 2022.”

The project has been hamstrung by delays in signing up customers.

It aims to strike binding five-year deals with its prospective east coast customers with EnergyAustralia the only named buyer so far.

AIE said in June the gas industry needed clearer signals to bring new supplies to market before it can take a final investment decision planned for the September quarter.

Five import plants have been proposed in Australia with two in NSW - the Andrew Forrest-backed Port Kembla facility and a South Korean sponsored development in Newcastle, while in Victoria AGL Energy is battling planning delays for its Crib Point scheme in the Mornington Peninsula with Viva Energy’s Geelong hub still in its infancy. Mitsubishi-backed Venice Energy also has plans for a South Australian project.

While the concept of Australia, as the world’s largest LNG exporter, importing gas has been panned in some quarters, EnergyQuest said other big producing countries such as the US, Indonesia and Malaysia also carry out the practice.

A raft of mooted LNG import projects dotted along the east coast “are the only means of securing supply sooner rather than later and at the necessary volume” and heading off a looming supply shortfall, according to EnergyQuest.

Lachlan Moffet Gray 9.59am: Crown ‘supported’ visa applicants

The inquiry into Crown’s suitability to hold a casino licence in NSW has resumed with counsel assisting the inquiry Naomi Sharp questioning Crown chair Helen Coonan.

She began by asking Ms Coonan if she accepts there have been historical problems with Crown’s handling of visas for its customers.

Ms Sharp asked whether it was true Crown “endorsed” visa applicants, but Ms Coonan said Crown merely “supported” the applicants.

“My understanding is that some information was being provided to assist the applicant with English language and things of that nature, but I don’t understand it was endorsing,” she said.

“I think they were assisting the process, it’s a very fine line.”

Ms Sharp asked whether Ms Coonan would accept Crown “vouched” for applicants, but Ms Coonan did not agree with this definition.

Ms Sharp then displayed an email DFAT sent Crown in 2010 where the government department displayed concern over Crown’s visa applications.

“It appears that Crown has become a visa agent, lodging for travel operators and junket agents. We continue to see significant levels of fraud in the case load,’’ the company was told by the official, noting 10 per cent of the applications lodged by Crown had been refused.

“This does not represent a low level of risk,” the official added.

Ms Coonan said that the email was concerning, but a review of Crown’s visa process showed there was no fraud in the visa process.

Ms Sharp then showed Ms Coonan a document checklist that Crown must fill out for every visa applicant which includes a background check and a statement saying that Crown “supports” the applicant.

Commissioner Patricia Bergin said the document’s intention was for Crown to provide the department of immigration with assurances that the visa applicant was worthy of entry.

“On one reading of this, there was an endorsement of these people because Crown had to support the application,” Ms Bergin said.

“They were certainly supporting the applicant, there’s no doubt about that,” Ms Coonan said, before relenting and saying it could be considered an “imprimata.”

9.57am: Universal tosses cinemas a lifeline

Comcast Corp’s Universal Pictures is releasing substantially more films to cinemas this holiday season as it tries to spur attendance for troubled cinemas -- and boost its push to reset distribution norms by making movies available sooner for online rental.

Even as most studios have been canceling theatrical distribution plans for 2020, Universal said it would send the romantic drama “All My Life” to US theatres on December 4, bringing to eight the total number of films it has slated for domestic theatrical release before the end of the year.

That is far more titles than any other major Hollywood studio -- and nearly double Universal’s output during the final 2 1/2 months of 2019. Like many of its competitors, though, Universal has pushed back the release of its biggest titles, including the next installment in its hit “Fast & Furious” franchise, until at least next year.

Universal’s release strategy will allow the studio to test a plan to make movies available for online rental sooner than ever after they open in theaters.

By putting lower-budget films in cinemas now, Universal is able to provide embattled theaters with more content while simultaneously carving out multiple opportunities to experiment with its new distribution model, which allows it to decide on the fly when to move new films online.

Dow Jones

9.47am: Iron ore giant Vale on comeback trail

Brazilian mining giant Vale SA said output and sales of iron ore rose in the third quarter from the second quarter as the company was able to normalize both production and logistics.

Iron-ore output rose 31.2 per cent in the third quarter from the previous three months to 88.7 million tonnes, and rose 2.3 per cent from the third quarter of last year, Vale said in its quarterly production report. Production of iron-ore pellets, a premium product, rose 21.1 per cent in the third quarter from the previous three months to 8.6 million tonnes, and fell 23.1 per cent from the third quarter of last year, Vale said.

Sales of iron ore rose 20.4 per cent in the third quarter from the second quarter to 65.8 million tonnes and fell 11.2 per cent from the third quarter of last year. Sales of pellets rose 21.8 per cent from the second quarter to 8.5 million tonnes, and fell 23.6 per cent from a year earlier.

The company’s production in the second quarter was affected by the coronavirus pandemic, which cut iron-ore output by 3.5 million tonnes. With the normalisation of production and logistics, sales performance is expected to improve even more in the fourth quarter, Vale said.

Dow Jones Newswires

Lachlan Moffet Gray 9.28am: Crown casino inquiry resumes

The NSW Independent Liquor and Gaming Authority’s Inquiry into the suitability of Crown Resorts to hold a casino licence in the state is resuming shortly, with current chairman Helen Coonan returning to give evidence.

The resumption of the inquiry comes after AUSTRAC yesterday announced it would commence an enforced investigation into Crown’s money-laundering compliance, and two days before three directors face re-election at the company’s AGM.

The Australian understands that James Packer has used his 36 per cent share to support the incumbent directors, but numerous proxy advisors and other minor shareholders have voiced their opposition to the trio: Dr John Horvath, Jane Halton and CPH executive Guy Jalland.

Ms Coonan’s performance today could be highly influential on the outcome of the AGM.

9.20am: Tabcorp revenues slip as Victoria venues shut

Tabcorp chief executive David Attenborough has told the market that based on unaudited figures, group revenues were down 5.7 per cent for the first quarter, compared to the same period last year.

In a speech released to the ASX ahead of the company’s AGM, Mr Attenborough said that revenues in the lotteries and keno business were down 6.9 per cent on the prior period, while wagering and media revenues were up 2.9 per cent despite the decline in retail and reduced net yields.

Gaming services revenues were down 55.2 per cent due to the closure of licensed venues, particularly in Victoria.

“The duration and severity of COVID-19 is unclear, however Tabcorp remains well placed with our resilient, diversified earnings base and strengthened balance sheet,” Mr Attenborough will tell shareholders today.

“Into FY21, our priorities have included driving the digital opportunity across lotteries, keno, wagering and media.

“We are also focused on improving performance in wagering & media, delivering the gaming services turnaround and the business-wide optimisation program.

“And we’ll continue to invest in initiatives that support our purpose of ‘Excitement with Integrity’ – such as our risk and compliance systems and customer care technology.”

Nick Evans 9.05am: Iron ore cash helps BHP pay down debt

BHP says it has been paying off debt as the cash pours in from its iron ore operations, with the company calling in $US2.9bn worth of debt early over the last month.

BHP released its quarterly production report on Tuesday, saying it had completed its repurchase of $US1.9bn of hybrid notes from “surplus cash” in mid-September, paying a premium of their par value, and last week called in another $US1bn worth of hybrid notes early.

With the iron ore price still tracking around $US120 a tonne for much of the September quarter, production at BHP’s Pilbara iron ore operations softened slightly compared to the June period, down 1 per cent to 74 million tonnes.

BHP said it expected December period production to be lower as it begins to link up its under-construction South Flank mine with the rest of its network, and conducts major maintenance at its Port Hedland unloading infrastructure.

The company said it remained on track to ship between 276 and 286 million tonnes of iron ore from its Pilbara operations this financial year.

9.00am: Cochlear ‘pleased with recovery’

Cochlear says services revenue “continues to recover” as it unveiled a slightly lower first quarter revenue figure, at 94 per cent of the same period last year.

Unit volumes declined 14 per cent with developed markets up slightly but emerging markets down about 40 per cent.

The hearing device company said trading activity continues to be mixed with the US, Germany and Korea showing good growth, while the UK, Italy and Spain, have regained momentum more recently as clinics re-open.

“We continue to be pleased with the pace of recovery across our developed markets,” chief executive Dig Howitt said.

“We have a suite of new products that are just starting to be launched and are generating excitement and great feedback.

“Our investment priorities this year will be focused on strengthening our competitive position and continuing to invest in many of our growth programs to set ourselves up for FY22.”

Cochlear said that while developed market surgery momentum is positive, second waves of COVID-19 are likely to persist and may result in restrictions on elective surgeries. In emerging markets, China surgeries were growing but most other countries remained well behind last year.

8.50am: Sydney Airport slump continues

Total passenger traffic in Sydney Airport for September was down 96.4 per cent on the previous corresponding period, with just 34,000 international passengers passing through the airport during the month, down 97.5 per cent on September last year.

Domestic passengers totalled 98,000 for the period, down 95.7 per cent on the same month a year ago.

“The downturn in passenger traffic is expected to persist until further government travel restrictions are eased,” the company said in a statement to the market this morning.

Some domestic travel restrictions were lifted in October.

8.40am: Westpac, Afterpay seal tie-up

Westpac has announced a partnership with Afterpay on its new digital banking platform, which the bank said would allow it to offer its customers convenient and innovative banking services.

“Fintech innovation is changing banking in important ways and our new digital banking platform is part of our long-term strategy to support this trend and better respond to changing customer needs,” Westpac chief executive Peter King said.

“The platform allows us to combine our banking experience with the innovation of our partners to support new customer experiences.

“We look forward to working with Afterpay to deliver new products and services.”

Afterpay CEO, Anthony Eisen, said the partnership would allow the company to offer cashflow management tools in a simple way.

“Afterpay is in a unique position to extend and deepen the relationship with our customers and help them to manage their money more seamlessly through savings and budgeting tools,” he said.

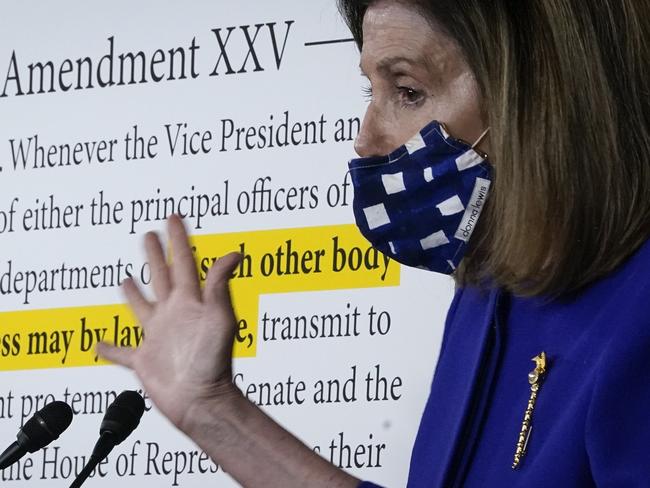

7.50am: Pelosi, Mnuchin narrow differences on stimulus

House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin continued to “narrow their differences” on issues holding up a coronavirus-relief package, her spokesman said Monday, as the two worked to see if a deal before the election would be possible.

Over the weekend, Mrs Pelosi, the California Democrat, indicated that the White House needed to reach a deal by Tuesday evening (US time) with Democrats to produce relief legislation that could pass before the election.

“The Speaker continues to hope that, by the end of the day Tuesday, we will have clarity on whether we will be able to pass a bill before the election,” Drew Hammill, Mrs. Pelosi’s spokesman said on Twitter.

The speaker spoke with Mr. Mnuchin for 53 minutes Monday, Mr. Hammill said, and the two were scheduled to speak again Tuesday.

Mrs. Pelosi sounded optimistic about the prospects of reaching a deal on a call with House Democrats Monday afternoon, according to Democratic aides, although some policy disputes remain unresolved. Mrs. Pelosi asked Democratic committee chairs to work with their GOP counterparts to hash out agreements on some of the lingering issues, Mr. Hammill said.

The White House’s latest $US1.88 trillion offer narrowed the difference with the $US2.2 trillion relief bill passed by House Democrats earlier this month, but a new overall spending level hasn’t been agreed upon.

“We’re making very, very good progress,” White House chief of staff Mark Meadows said Monday on Fox News. “If Nancy Pelosi will be reasonable, she’ll find the President of the United States to be reasonable and we’ll get something across the finish line.”

Dow Jones Newswires

7.20am: ASX set to slip at open

Australian stocks are poised to open lower, as Wall Street fell on dwindling hopes for a fresh US stimulus package.

At about 7am (AEDT), the SPI futures index was down 45 points, or 0.7 per cent.

On Monday, the ASX 200 closed up 0.9 per cent at an eight-month high of 6229.4.

The Australian dollar was this morning higher at US70.80.

Brent oil was down 0.7 per cent to $US42.62 a barrel. Spot iron ore rose 0.3 per cent to $US119.40 a tonne.

7.10am: Wall Street falls on stimulus worries

The Dow Jones Industrial Average fell about 400 points as investors’ hopes for a fresh stimulus package before the election dwindled.

Major US stock indexes opened higher but retreated over the day as a Democratic-imposed deadline for a deal approached with no clear signs of progress. It looks increasingly unlikely that a big US government spending package will be approved before November 3, analysts said.

The Dow was down 409 points, or 1.4 per cent, as of the close of trading. The blue-chips index had been up more than 105 points just after the opening bell.

The S&P 500 slid 1.6 per cent, while the technology-heavy Nasdaq Composite was down 1.7 per cent.

Investors have been closely monitoring the on-again, off-again progress of talks between lawmakers and the White House. Further relief to households or businesses battered by the coronavirus pandemic could bolster the economic recovery as the effect of previous stimulus measures wears off.

Over the weekend, House Speaker Nancy Pelosi told the White House it had until Tuesday to reach a deal with Democrats. If the deadline passes without a deal, ongoing talks would be increasingly unlikely to produce sweeping relief legislation worth trillions of dollars within the next two weeks, her aide suggested. Mrs Pelosi and Treasury Secretary Steven Mnuchin spoke Saturday night, but a number of differences remain.

“President Trump would love to have a stimulus package before the election,” said Michael Mullaney, director of global markets research at Boston Partners. “But there’s no political upside for Pelosi to sign anything before the election.”

Markets are betting that a “blue wave” election--in which Democrats win control of both the White House and Congress--will eventually result in a large stimulus package, Mr. Mullaney said, though he added that such an election result could ultimately dampen market returns due to higher taxes.

With COVID-19 continuing to impact the economy, further fiscal stimulus will be necessary, said Robert McAdie, chief cross-asset strategist at BNP Paribas.

“Without renewed fiscal stimulus you’ll see a new wave of unemployment, and a new wave of delinquencies and defaults, and that will certainly weigh on growth,” he said.

An advance in major U.S. stock indexes has stalled in recent days, leaving the S&P 500 less than 4 per cent below the record high it reached in early September. Last week, stocks eked out muted gains as investors reckoned with persistently high COVID-19 cases and political uncertainty.

Overseas, Chinese officials said that gross domestic product expanded by 4.9 per cent in the third quarter from a year earlier, putting China’s economy back toward its pre-coronavirus trajectory half a year after the pandemic gutted its economy.

Investors had a mixed reaction to the data, as the growth figure fell short of expectations. The Shanghai Composite Index fell 0.7 per cent, while Hong Kong’s Hang Seng Index rose 0.6 per cent.

The pan-continental Stoxx Europe 600 dropped 0.3 per cent. Euronext NV, which operates exchanges across Europe, said it had resolved a technical issue that had halted trading in some markets.

Dow Jones Newswires

6.10am: Wall Street falls further

The Dow Jones Industrial Average fell more than 350 points as investors’ hopes for a fresh stimulus package before the election dwindled.

Major US stock indexes opened higher but retreated over the day as a Democratic-imposed deadline for a deal approached with no clear signs of progress. It looks increasingly unlikely that a big US. government spending package will be approved before November 3, analysts said.

The Dow was down 363 points, or 1.3 per cent, in afternoon trading. The blue-chips index had been up more than 105 points just after the opening bell.

The S&P 500 slid 1.4 per cent, while the technology-heavy Nasdaq Composite was down 1.2 per cent.

Dow Jones

6.01am: Zoom shares hit record high

Shares of Zoom Video Communications were up 4pc, at a record high of $588.84, in early-afternoon US trading.

The live-video platform, which has flourished during the coronavirus pandemic, continues to thrive as a digital vehicle for working and communications amid competition from Microsoft and Slack Technologies.

Zoom shares are up 754 per cent this year, while the S&P 500 index has advanced 7 per cent in 2020.

Dow Jones

5.10am: US stocks waver on stimulus talks

US stocks fell, giving up early gains, as investors’ hopes for a fresh stimulus package before the election dwindled.