ASX reverses 0.7pc under Telstra, Commonwealth Bank drag

Steady dividends weren’t enough to offset weak guidance at Telstra, pulling the ASX down 0.7pc, but a special payout sent AMP up by 11pc.

- Culture reboot a ‘top priority’: AMP

- Loss for Woodside in worst conditions in 40 years

- AMP to pay special dividend, profit halves

- Treasury plots US upheaval as profit falls

That’s all from the Trading Day blog for Thursday, August 13. Australian stocks were volatile as results swayed sentiment, even after the S&P 500 benchmark index flirted with a new record overnight. By the close, the ASX was down by 0.67pc, with losses led by Telstra after earnings disappointment.

AMP’s special dividend helped it net an 11pc boost, while AGL lifted profit and QBE reported a spike in claims.

July jobless data beat estimates but showed unemployment grew to 7.5pc.

8.23pm: So far, so good for reporting season

It’s early in the August reporting period for corporate Australia, but so far it’s no disaster.

With 14 of the top 200 companies — including heavyweights such as Commonwealth Bank, Telstra and Transurban — out in the past two days, earnings season was about 20 per cent of the way through by number. But even after a modest pullback on Thursday, the stockmarket is only about 2 per cent away from six-month highs after bouncing as much as 40 per cent from an eight-year low of 4402.5 in March.

After hitting a two-month high of 6186.1 on Tuesday, the S&P/ASX 200 index hit a three-day low of 6075.80 on Thursday before closing down 0.7 per cent at 6091, with heavyweight stocks including CBA, Telstra and CSL accounting for most of the fall.

For the best part of five months, the local market has been pulled higher by global fiscal and monetary stimulus, with the second wave of coronavirus on the east coast of Australia and fresh mobility restrictions in Victoria causing only moderate underperformance, as US markets neared record highs amid improving coronavirus trends, as well as vaccine hopes and the prospect of another round of fiscal stimulus, even if negotiations are stalled in congress.

Earnings per share forecasts bottomed about three months after the ASX 200 bottomed in March, and the consensus estimate has basically followed the index higher as usual.

But, as JPMorgan strategists have observed, the current 12-month forward price-earnings multiple above 20 times implies a 20 per cent bounce in earnings, negative interest rates or a combination of both.

Ben Wilmot 7.16pm: Goodman Group brushes off virus woes

Industrial property powerhouse the Goodman Group has surged on the back of the coronavirus crisis due to rising demand for deliveries and data services, boosting full-year operating profit by 12.5 per cent to $1.06bn.

The company, which owns and manages warehouses around the world, lifted operating earnings per security by 11.4 per cent to 57.5c, and flagged a 9 per cent lift for this financial year.

Goodman, which has transformed from a traditional landlord into a major international funds manager, is benefiting from the rapid growth of e-commerce, which has been accelerated by the pandemic.

Bridget Carter 5.38pm: Sydney Airport priced

Sydney Airport’s book build for the shortfall of shares for its $2bn equity raising has been priced at $5.30 per share.

It comes after earlier in the day it was covered at $5.20 per share and also 80 per cent covered at $5.25 per share, according to a book message sent out to investors earlier in the day.

Investment bank UBS launched a renounceable entitlement offer for the airport to provide balance sheet strength amid COVID-19 disruptions.

A book build was launched for the shortfall of shares not taken up by institutional shareholders, which was 20m shares worth $93m at the offer price.

The floor price for the book build that enables new investors to take up stock was $4.56 per share and bids were being accepted in 5c increments from $4.60.

Bridget Carter 5.12pm: JPMorgan hires Mann

DataRoom | Investment bank JPMorgan has poached Credit Suisse banker Duncan Mann to co-head its Australian and New Zealand industrial company coverage along with Seth Schwartz.

Mr Mann will also be head of financial sponsors and will report to the Australia and New Zealand co-heads Jabe Jerram and Simon Ranson.

In an internal memo, JPMorgan said Mr Mann would be “further enhancing our strategic client agenda and building our corporate franchise, working in close partnership with our existing coverage and product teams”.

At Credit Suisse, Mr Mann was head of Financial Sponsors and also responsible for Industrials Coverage across Australia and New Zealand, since 2019.

Before this role, he spent a decade in a range of senior roles, including co-head of Financial Sponsors, Asia Pacific at Deutsche Bank, in Hong Kong and Sydney.

He will start in November.

4.40pm: Results winners, losers dominate trade

Earnings beats and misses dominate the most traded stocks on Thursday, with outperformance in Treasury Wines and AMP and disappointment from Telstra.

In some of the most notable earnings, Telstra maintained its dividend, but a weak outlook statement pulled shares lower by 8.3 per cent to $3.11.

AMP on the other hand was a standout, adding as much as 14 per cent intraday after announcing a special dividend from its AMP Life sale, even as its profit was more than halved for the full year.

Treasury posted a 12.3 per cent lift to $12.83 on more upbeat sales out of China, while QBE lifted 6.8 per cent to $10.71 and Flight Centre put on 5 per cent to $12.27 after noting its cash burn was slower and balance sheet in better shape than expected.

Gold miner Evolution gained 3.3 per cent to $5.72 as it touted its “great year” while Goodman jumped by 1.3 per cent to $17.93 as its focus on logistics paid off during the pandemic.

Here are the biggest movers at the close:

Bridget Carter 4.25pm: Techfront hires Ebbeck as chief

Dataroom | Techfront Australia has hired Nick Ebbeck as its new chief executive.

Mr Ebbeck, who has been the company’s chief operating officer, will replace Neil Maxwell as the boss of the media company.

He had earlier worked as a director of Harvey Norman Business & Education and was a commercial sales director of JB Hi-Fi for Australia and New Zealand after working as head of commercial sales for Dick Smith across the same region.

It comes after the interests of Techfront Australia, which includes its outdoor advertising LED screen provider Screencorp, have emerged from administration following a Deed of Company Arrangement.

Ryan Eagle and Gayle Dickerson of KPMG were earlier appointed administrators to Screencorp, Techfront Australia and Techfront Infrastructure Solutions.

The company makes large screens for billboard operators in the Australian market such as oOh!media and JCDecaux and also works with the AFL, NRL and Lendlease.

4.11pm: Earnings pull ASX to 0.7pc loss

Mixed corporate earnings pulled the local sharemarket in both directions through the day, but negative momentum ultimately sent the index to a second consecutive loss.

Shares pushed higher early after the US benchmark came within a whisker of February’s record high, but weakness in heavyweights Telstra and Commonwealth Bank kept the index in the red through the afternoon.

At the close, shares were down 41 points or 0.67 per cent to 6091, while the All Ords fell by 33 points or 0.53 per cent to 6223.9.

2.30pm: Jobs beat will be short-lived: JPM

Today’s July jobs report was a beat, but JP Morgan cautions the optimism will be short-lived, with August figures likely to reverse some of the positive trends of the past few months.

Global market strategist Kerry Craig notes the key variable is how quickly August jobs fall, and to what degree the trends will reassert themselves after restrictions are “hopefully” eased in September.

“Today’s better report may provide some comfort around the state of the economy, but a million people out of work is not good,” he says.

“Next month’s report will be even worse given the new restrictions and the change to the eligibility criteria for JobKeeper, which are still filtering through.

“When combined with weakness in wage growth data the pressure is really on the consumer, and the risk to the economic outlook from the continuation of economic constraints of COVID are very clear.”

Read more: Unemployed tops 1 million

1.55pm: Do CBA’s results justify 66pc premium?

UBS has boosted its price target for Commonwealth Bank by 11pc after its results yesterday, noting a lower cost of capital.

As he lifts his target from $65 to $72, analyst Jon Mott keeps a Neutral rating, questioning whether the bank is worth a 66pc premium to peers.

“CBA’s result again demonstrates its business strength, but this appears factored into its share price,” Mr Mott says.

“Following its rally, CBA is on 10.8 times Pre-Provision Profit. This is a 66 per cent premium versus its (major local bank) peers, a record since CBA’s privatisation almost 30 years ago.

“In fact, CBA’s premium to peers is now 4 standard deviations above its long term average on a Price to Pre-Provision Profit basis.

“This reflects both the rally in CBA’s share price and the significant valuation discount in its Major Bank peers.”

CBA last down 2.4pc at $72.53.

1.49pm: ‘Encouraging signs’ in July jobs: RBC

Employment data for July surprised to the upside, even as the jobless rate grew to 7.5pc, but RBC says there are some “encouraging signs" in hours worked and employment indicators.

Chief economist Su-Lin Ong writes describes today’s data drop as mixed bag, noting that the data predates Victoria’s stage four restrictions.

With new data points from the ABS, she calculates that adding those on JobKeeper to the unemployment rate would take it to 8.3pc.

“JobKeeper and some easing in mutual obligation for Victorians (but not the rest of Australia) complicate the labour market picture near-term, but increasing stress on a number of SMEs, weaker business confidence, and heightened uncertainty suggest some greater labour shedding in the coming months,” she says.

“The government’s JobKeeper and JobSeeker measures will continue to assist in the coming months, but the paring back and eventual cessation sometime in 2021 will be another challenge for the labour market.”

Read more: Unemployment tops 1 million

David Swan 1.38pm: Telstra faces $600m two-year hit

Telstra boss Andy Penn has further detailed the company’s COVID hit, with Australia’s largest telco facing a negative financial impact of $600m over two years as a result of the global pandemic.

Speaking to investors and the media on Thursday, Mr Penn said a lack of demand for international roaming services alone would cost the telco $200m in revenue for the 2021 financial year, while the health crisis could also spark further job cuts for the telco.

Telstra shares are down more than 6 per cent to $3.16 in lunch trade, with the company grappling with the ongoing effects of the pandemic.

“We’re all very concerned obviously about the pandemic, and how it will continue to impact us all, and what second and third waves look like. I’m no expert by any stretch of the imagination on that, and I want to acknowledge that our political and other leaders are responding decisively as best they can. We’re all doing everything we can,” Mr Penn said on the call.

“What it has done is reinforce the importance of connectivity, and the digital economy, for many businesses they’ve had to rely on that in response to the restrictions that have been put in place. That’s only going to continue. It will continue to affect the way in which we work and it will impact some of our workforce capacity. Fundamentally it’ll mean our services will continue to be in demand.

“Obviously we’re going to need to find ways to support customers with different levels of service, because their businesses are impacted, and I’m confident that we have had some economic impact – $600m over a two-year period – but most of that is relatively one-off. Telstra is being referred to as a defensive stock, and I think that’s right, we are, because we’re a core service and we will continue to be in demand.”

Read more: Telstra says more pain to come, dividends hold

1.11pm: Openpay posts record month, hires CFO

Buy now, pay later aspirant Openpay has posted its best month on record, helping shares higher in afternoon trade, as it appoints a new CFO.

The group said today its active customers rose by 145pc in July, while total transaction value rose to $24m in July, a 114pc lift compared to the same time last year.

Alongside the update, Openpay said it had appointed former BNK Banking exec Jussi Nunes as its chief financial officer.

Mr Nunes will start with the group in September, and previously worked with Openpay chief Michael Eidel at Commonwealth Bank’s cash flow and transaction services business.

Mr Eidel described the new hire as having “a wealth of experience and expertise in financial services”.

OPY shares last traded up 5.2pc to $3.65.

12.40pm: Telstra’s 8pc drop weighs on ASX

Australia’s sharemarket has fallen sharply intraday on the back of disappointing results and outlook statements so far this reporting season.

The S&P/ASX 200 is having its worst day in 2 weeks after falling 0.8pc to a 3-day low of 6081.4 after reversing a 0.4pc intraday rise to 6157.3.

CBA is doing most of the damage with a 2.8pc fall after a Bell Potter’s TS Lim downgraded the stock to Hold after its full-year results yesterday.

Telstra is the next biggest drag, down 8.3pc to a 6-week low of $3.11 after its FY21 earnings guidance missed estimates by about 8pc due to weaker NBN income.

AGL Energy is down 10pc to a 5-month low of $15.15 (equalling its March 2020 low) after warning of a materially lower FY21 underlying profit amid lower margins.

On the flip side, Treasury Wine has surged 14pc, QBE is up 6pc, AMP is up 10pc and Evolution is up 4pc after their results.

But it is disappointing to see the index shy off its 200-day moving average near 6175 again today.

Perry Williams 12.30pm: Woodside may pursue NW Shelf stake

Woodside Petroleum said Chevron has issued a sale flyer to offload its 16.6 per cent stake in WA’s $34bn North West Shelf LNG plant but flagged an issue over whether it could incorporate any potential third party gas deal into the M&A process.

Woodside is seen in pole position to acquire Chevron’s share of the gas export facility but the project faces an ongoing issue over sanctioning a move to a tolling model using supplies from fields like Browse.

Weighing up a deal for Chevron’s stake could face difficulty given that uncertainty, Woodside chief executive Peter Coleman said.

“The difficult part about it is, how do you pay for something that you don’t have,” Mr Coleman told analysts after its half year results. “So it’s interesting to put an incomplete negotiation into a data room. At the end of the day, it’s still incomplete. And so I think any party looking at that asset we’ll have to look at it through that particular lens now Chevron’s process has commenced with the flyers around.

“So we’ve got some insight now to both the timing of the process and the nature of what that process will be.”

Woodside may pursue the NW Shelf stake given its strong liquidity position, RBC said.

“Woodside’s $US7.5bn of liquidity could see it emerge as an M&A contender, with particular emphasis on expanding its existing North West Shelf footprint to facilitate its project extension plans,” RBC analyst Gordon Ramsay said.

“This also makes sense when considering the challenge Woodside has in delivering on its longer-term production growth objective of more than 6 per cent CAGR from 2019-2028.”

Woodside shares last down 0.1 per cent to $20.56.

Read more: Worst oil crash in 40 years, Woodside says

Bridget Carter 11.49am: Gascoyne launches recapitalisation raise

DataRoom | West Australian gold miner Gascoyne Resources has launched its highly anticipated equity raising to secure $85m.

New shares are being issued at 2.5c each.

It comes as the group also signs a $40m debt facility through Investec Bank. The raise is part of Gascoyne’s recapitalisation.

Gascoyne will receive $35m through a placement and $50m through a two for one share accelerated pro-rata, non-renounceable entitlement offer.

The proceeds are being used to pay down debt including $40m of accrued interest.

It will also use $10m for a cash reserve to meet the requirements of its finance facility, $7m for an upfront cash payment to NRW owing and $3m for exploration activities to be undertaken through the next year.

11.43am: Aussie dollar spikes on jobs beat

The Aussie dollar spiked to US71.88c on the release of the latest jobs data, showing a bigger than expected jump in jobs.

Analysts had expected a 30,000 increase, well surpassed by the ABS data which showed a 114,700 lift, following an upwardly revised 228,400 in June.

Unemployment rose to 7.5pc, versus 7.8pc expected.

AUDUSD spiked roughly 10 points on the news, to hit US71.88c, and last traded up 0.17pc to US71.75c.

Patrick Commins 11.32am: Jobless rate climbs to 7.5pc

Australia’s unemployment has climbed to 7.5 per cent in July, from 7.4 per cent in the prior month, new figures from the Australian Bureau of Statistics show.

Employment increased by 114,700 persons, split between an additional 43,500 in the number full-time employed, and 71,200 more part-time employment, according to the seasonally adjusted numbers.

The number of unemployed people in Australia reached just over 1 million, 15,700 more than in June. There were 42 per cent more unemployed in July versus a year earlier.

The labour force participation rate climbed to 64.7 per cent, from 64.1 per cent in June.

There was a 1.3 per cent rise in the number of hours worked in the month.

ABS head of labour statistics Bjorn Jarvis said the July figures “indicate that employment had recovered by 343,000 people and hours worked had also recovered 5.5 per cent since May”.

Perry Williams 11.28am: AGL share drop biggest since GFC

AGL Energy suffered its biggest fall since the global financial crisis in early trading after it warned profit would tumble by up to a third in the 2021 financial year with a triple whammy of COVID-19 bad debts, low electricity prices and higher gas costs set to weigh on its performance.

The power giant’s shares fell by 10 per cent to $15.31, the biggest tumble since September 2008, as investors baulked at the company’s poor outlook.

RBC said it was surprised at the speed of earnings cuts and questioned if worse may be to come in FY22.

“Excluding the impact of the Loy Yang insurance recoveries in FY21, net profit is actually falling by ~35 per cent at the midpoint,” RBC analyst James Nevin said. “We think the question from here is if FY21 is going to be the bottom in terms of the flow through of lower wholesale prices or if there is more to come in FY22.”

AGL’s 2020 earnings were roughly in line with guidance but downgrades may be likely with market consensus for 2021 not reflecting the company’s downbeat outlook, Ord Minnett said.

“While management did flag strengthening headwinds in May 2020, the market did not appear to heed the warning and consensus is ~13-26 per cent too high,” Ord Minnett said.

Read more: Worse to come as AGL profit sinks

Bridget Carter 11.24am: Sydney Airport shortfall covered

DataRoom | Sydney Airport’s book build for the shortfall of shares for its $2bn equity raising is covered at $5.20 per share.

It is also 80 per cent covered at $5.25 per share according to a book message sent out to investors.

Numerous bids have also been received with price points above that level, institutional investors were told Thursday.

It comes after investment bank UBS launched a renounceable entitlement offer for the airport to provide balance sheet strength amid COVID-19 disruptions.

A book build was launched for the shortfall of shares not taken up by institutional shareholders, which was 20m shares worth $93m at the offer price.

The floor price for the book build that enables new investors to take up stock was $4.56 per share and bids were being accepted in 5c increments from $4.60.

Read more: Airport demands clearer rules after loss, $2bn raising

Robyn Ironside 11.20am: Air NZ extends hold on Aus bookings

In a further blow to hopes of a trans-Tasman bubble operating anytime soon, Air New Zealand has scratched flights to Melbourne until late October, and warned of limited availability on services to Sydney and Brisbane.

It follows the Australian Government’s extension to the cap on international arrivals until October 24. The restrictions mean international flights cannot carry more than 25 passengers into Brisbane and no more than 40 into Sydney.

International passenger arrivals into Melbourne are currently not allowed.

Air New Zealand chief commercial and customer officer Cam Wallace said the airline had extended its hold on future bookings to Melbourne until late October, to prevent further disruption to customer journeys.

“We know this is not an ideal situation for people wanting to return home to Australia and our teams are working to minimise disruption to customers as much as possible,” Mr Wallace said.

“When it comes to flights to Sydney, we do have availability from early September for those who wish to book. With Brisbane, while there is currently a hold on new bookings, we expect flights may become available as customers make changes to their bookings or no longer wish to travel, so customers should keep an eye out on our website.”

AIZ last traded down 1.6pc to $1.21.

Read more: Leaner Air New Zealand cuts capacity and staff

11.01am: How today’s reporting companies are trading

After the first hour, the benchmark ASX200 has turned lower, last down by 17 points or 0.3pc to 6115.4.

Here’s the scorecard for the companies who handed down their results:

| COMPANY | % CHANGE | LAST TRADED PRICE |

| AMP | 10.9 | $1.53 |

| Treasury Wines | 10.6 | $12.65 |

| Premier Investments | 8.7 | $18.39 |

| QBE | 6.7 | $10.73 |

| Goodman Group | 3.4 | $18.31 |

| Flight Centre | 3.3 | $12.08 |

| Evolution Mining | 2.7 | $5.69 |

| Woodside | -0.2 | $20.55 |

| Telstra | -5.3 | $3.21 |

| Breville | -6.5 | $25.53 |

| AGL | -9.9 | $15.30 |

Nick Evans 10.46am: ‘Great year’ for Evolution

Evolution Mining has declared a 9c a share dividend after the company posted a 38 per cent lift in annual profits on the back of the rising gold price.

Evolution booked a $301.6m net profit on Thursday, up from $218.2m the previous financial year, on the back of earnings before interest, tax, depreciation and amortisation of $1bn, up 41 per cent for the financial year.

Group revenue rose to $1.95bn, according to its annual accounts, after the company sold 764,6555 ounces of gold for the year – with 100,000 ounces delivered into the company’s hedge book at an average price of $1734 an ounce, compared with the $2320/oz received on average for the rest of Evolution’s gold sales.

Executive chairman Jake Klein said in a statement it had been a “great year” for the gold miner, topped off by a massive upgrade of the resource at its newly acquired Red Lake mine, bought for $US375m.

EVN shares up 2.4pc early to $5.67.

Evolution Mining $EVN Full year Result

— CommSec (@CommSec) August 12, 2020

- NPAT +38% to $301.5 mln

- Revenue +29% to $1.94 bln

- EBITDA +41% to $1.03 bln

- Final div 9 cps - to be paid on 25 Sept#ausbiz #ozearnings pic.twitter.com/qaPRrzb3zJ

10.23am: Shares erase early jump

Shares have swiftly erased their opening jump, up just 5 points in early trade as results dominate.

At the open, the ASX200 hit as much as 6157.3 – but shares quickly pulled back to trade just 2 points or 0.03pc higher to 6133.7 after the first 20 minutes.

AMP is a surprise outperformer, up 12pc after handing out a special dividend to shareholders, even as its profit dropped by half.

Elsewhere, AGL is lower by 8.2pc on its results, while Telstra falls 5pc and Treasury Wines adds 12pc.

Goodman is up by 3.7pc while QBE lifts by 6.1pc.

Lachlan Moffet Gray 10.14am: AMP shares lower than ‘intrinsic value’

AMP CEO Francesco De Ferrari has avoided answering a question on why former Australia business boss Alex Wade was placed in charge of both AMP Bank and AMP’s wealth arm.

After lengthy questioning on the topic, he said: “let me answer the question on the business model”.

“I fundamentally believe that structurally one of the biggest issues of financial services companies globally is that they tend to be very product-centred organisations.

“My objective from the beginning in transforming AMP is to build a company that is led by clients and client needs.”

Sky News’ Ticky Fullerton asks Mr De Ferrari how the company planned to unlock value for shareholders and whether AMP’s low share price made the company a potential target for a hostile takeover.

“If you look at our share price I would say … clearly its not where we’d like it to be,” Mr De Ferrari said in response. /

“The intrinsic value of the business is significantly higher than it is in the share price.

“In pursuing the strategy we have ahead, we can unlock a lot of value for our shareholders.”

AMP shares are surging 12.5pc to $1.55 at the open.

Read more: AMP pays special dividend as profit slumps

Lachlan Moffet Gray 10.07am: I make tough decisions every day: De Ferrari

As hard as AMP chief Francesco De Ferrari tries to move the discussion on, questioning remains centred on issues regarding Alex Wade and AMP’s culture.

After questions of his judgment over the hiring of Mr Wade to the position of Australian head, he says, “I take tough decisions every day”.

“ … I would love to get some questions on results on how the business is going and what we’re doing for our clients.

“I am not going to comment on speculation on this stuff.

“I would be happy to take another question.”

Mr De Ferrari earlier said that he needs to “have an environment where our employees feel free to speak up and raise concerns”.

“If I compromise on this, I will not fulfil my responsibility as CEO.”

Lisa Allen 10.03am: Flight Centre warns of loss

Flight Centre expects to deliver a COVID-19 driven loss of between $475m and $525m compared to a $343m profit a year ago.

Releasing its preliminary results for the year, Australia’s largest travel agency revealed it has at least 22 months liquidity but its earnings guidance is weaker than analysts had expected.

Flight Centre reported a $53m net outflow in July below the $65m target and netted $17m in revenue, helped along by its access to JobKeeper wage subsidies which afforded it $10m in net benefits.

Flight Centre secured about $200m in extra funds in July and more than $1 billion since April.

The travel group achieved about $17m in gross revenues including the JobKeeper subsidy with its total transaction values exceeding $200m.

Lachlan Moffet Gray 9.57am: Wade appointment my responsibility: AMP chief

AMP CEO Francesco De Ferrari says Alex Wade’s appointment was ultimately his responsibility.

Mr Wade, who was Mr De Ferrari’s chief of staff when at Credit Suisse, recently left the business over allegations of inappropriate behaviour.

“A decision to hire an executive that reports to me is my responsibility as CEO of the company,” Mr De Ferrari said.

Mr De Ferrari also said cultural change “does not happen overnight,” asserting that he has been working steadily at transforming the business since he was appointed in 2018 after being questioned over the effectiveness of his leadership.

AMP, which came under significant fire during the Hayne Royal Commission, has been working to improve its reputation in the years since.

“We have been working on improving execution and accountability since day one. You will understand that the transformation of AMP … was called the most challenging transformation in corporate Australia,” Mr De Ferrari said.

“I was very clear from the beginning, this does not happen overnight. It’s about really staying focused on the strategy, and we have a good strategy.”

Read more: AMP chief issues warning in all-staff memo

Lachlan Moffet Gray 9.51am: Culture reboot a ‘top priority’: AMP

AMP CEO Francesco De Ferrari says cultural change is now a “top priority” for the beleaguered financial company, as he sets out plans to establish a board culture working group and employee-led inclusion task force.

AMP has been under fire after its Australia boss Alex Wade stepped down last week after allegations of inappropriate behaviour.

In a call following the release of the group’s full year results, Mr Ferrari said a culture working group he heads has already had two meetings, and that he would not comment further on the circumstances surrounding Mr Wade’s departure.

“I understand the significant interest on this matter but let me clear that I will not be commenting beyond what has already been said,” he said.

“We accepted Alex’s resignation and he has left the business.”

An external expert will also be appointed to help drive cultural change at the company.

9.47am: ASX eyes 6-month high

Australia’s sharemarket may hit a 6-month high today as Victoria’s improving coronavirus trend adds to positive leads from offshore markets.

Overnight futures relative to estimated fair value suggest the S&P/ASX 200 will open up 0.8pc at 6181 points, following a 1.4pc rise in the S&P 500 to 3380.35 after it came within 5 points of its record high set pre-pandemic in February. The Nasdaq surged 2.1pc to 11012.24, with the NYFANG+ index up 3.7pc.

It came as daily new infections in the US stayed below 50,000 for the third consecutive day, vaccine hopes continued, yet US fiscal stimulus talks remained in limbo.

S&P/ASX 200 reactions to the 200-day moving average at 6175 and the June high at 6198.6 may affect sentiment this week.

The index arguably needs a big rebound in earnings estimates for sharply lower rates to validate its elevated PE multiple above 20 times. But the June high might be breached intraday after Victoria recorded just 278 new COVID-19 cases in the last 24 hours.

That’s the lowest in more than three weeks (since July 20) and the 7-day average hit an almost 3-week (since July 25) low of 365.

While it’s probably too high to consider an early easing of mobility restrictions, the trend this week is very encouraging for Melbourne-exposed stocks.

Meanwhile results from 10 of the top-200 companies including such heavyweights as Telstra, QBE, Woodside and Goodman are in the spotlight.

ABS labour-force data for July are due today with an exceptionally wide range of forecasts, the mid point is for a 30,000 rise in jobs and 7.8pc jobless rate.

Eli Greenblat 9.32am: Premier defies retail carnage

Solomon Lew’s fashion investment vehicle Premier Investments has defied the retail carnage caused by the COVID-19 pandemic to forecast a full-year profit improvement as much as 11pc for fiscal 2020.

It also said it benefited from government stimulus packages including rent and wage subsidy schemes such as JobKeeper. In March, Premier Investments was forced to temporary close around 900 of its fashion outlets and send home 7000 staff.

Although the retailer, whose brands include Just Jeans, Portmans, Peter Alexander and Smiggle, warned that as a direct result of the coronavirus pandemic its second half sales were down $106.5 million, or 18 per cent, to $484.2m, a booming online business and stronger margins for in-demand fashion would help pump up profitability.

Premier Investments said in an ASX statement on Thursday that as a direct result of the impacts of COVID-19, its fashion arm, Premier Retail, would report global sales for the second half of $484.2 million.

9.27am: Analyst rating changes

- Commonwealth Bank cut to Hold – Bell Potter

- Commonwealth Bank price target raised 10pc to $77 – Shaw and Partners

- Downer raised to Buy – Citi

- JB Hi-Fi raised to Neutral – Credit Suisse

- Magellan price target raised 8pc to 461.25 – UBS

- Metcash raised to Buy – Citi

- Seek cut to Neutral – JP Morgan

- Seek raised to Hold – Morgans

- Sydney Airport price target cut 14pc to $6.10 – UBS

- Sydney Airport raised to Neutral – JP Morgan

9.23am: Bell Potter trims CBA forecasts

Bell Potter’s highly-regarded banks analyst TS Lim has cut his Commonwealth Bank rating to Hold from Buy while keeping his price target at $78.00, as he says he now sees a total 12-month shareholder return of just 8pc.

Mr Lim’s cash net profit projections fell by 5pc for FY21 and FY22 and 3pc thereafter, due to lower non-interest income from lower card fees, fee waivers and removal of wealth contributions – offset by better cost management across the forecast universe, as well as a lower loan impaired expense charge in FY21.

But he left the valuation and price target unchanged at $78.00 per share after netting the value impact of lower cash NPAT with higher excess tier-one capital.

Read more: Economy will need ongoing stimulus, says CBA

9.19am: More to do to change culture: AMP

Along with the first half results outlined by AMP this morning chief executive Francesco De Ferrari acknowledges there is “more to do” in changing the wealth manager’s cultures and says a board-level culture working group has been established.

The move follows a string of scandals, including last week’s sudden exit of Australian wealth boss Alex Wade.

Mr De Ferrari says “driving cultural change is key to unlocking AMP’s potential and driving shareholder value”.

“To accelerate change, we’ve implemented a number of immediate actions including establishing a Board culture working group and an employee-led inclusion task force, as well as working with an external expert to drive,” he says.

AMP earlier posted a 43 per cent slump in first half earnings.

Read more: AMP declares special dividend while profit slides

Ben Wilmot 9.03am: COVID-19 a boon for Goodman

Industrial property powerhouse the Goodman Group has surged on the back of the coronavirus crisis due to rising demand for deliveries and data services, boosting operating profit by 12.5 per cent to $1.06bn.

The company, which owns and manages warehouses around the world, lifted operating earnings per security by 11.4 per cent to 57.5 cents.

Led by billionaire Greg Goodman, the company turned in a statutory profit of $1.5bn, helped by rising values of logistics properties. It smashed the $50bn barrier for total assets under management and now has an overall funds management empire of $51.6bn, which it primarily manages for major local and international pension funds.

Mr Goodman said the company was benefiting from the accelerated adoption of e-commerce, a shift to remote working and a significant increase in the demand for technology and big data.

The company flagged that it is continuing to build new projects and it already has $6.5bn of work underway across 46 projects. It said that despite the challenges of the pandemic it was well-positioned to take advantage of key trends and development activity would top $7bn in the first half of this financial year.

The company said it expects to deliver a fiscal 2021 operating profit of $1.165bn, an increase of 9.9 per cent on last year, and it would lift earnings per share to 62.7 cents, a 9 per cent lift on last year. The forecast distribution for fiscal 2021 will remain at 30c per security.

8.57am: NBN eats into Telstra earnings

Telstra Corporation said full-year profit fell 16pc as the government-owned national broadband network continued to eat into earnings and mobile revenues fell.

Australia’s largest communications provider said Thursday that net profit attributable to shareholders for the 12 months to June fell to $1.82bn from $2.15bn a year earlier. Total income fell 5.9pc to $26.16bn, as mobile revenue fell 4.4pc and fixed-line revenue fell 12.1pc.

Telstra will pay a final dividend of 8.0c, the same as at its half-year results. Shareholders received the same amount a year ago, albeit split into a final dividend of 5.0 cents and special dividend of 3.0 cents.

Stripping out one-off costs including $200m of restructuring charges, Telstra recorded underlying earnings before interest, tax, depreciation and amortisation of $7.4bn. That was in line with the bottom end of the $7.4bn-$7.9bn guidance range issued with February’s half-year results and confirmed by the company in late March.

Dow Jones Newswires

Eli Greenblat 8.51am: Treasury plots US upheaval as profit falls

Treasury Wine Estates, the maker of wines such as Wolf Blass, Penfolds and Lindemans, has posted its slimmest profit in three years and sliced its final dividend by more than half in the wake of shrinking sales across all its regions including its biggest market China.

To bolster its weakened financial performance that has seen its profit for 2020 dive 25 per cent, the company said it will make changes to its US operating model and global supply chain, which is expected to deliver respective annualised cost savings of $35m from 2021 onwards and $50m by 2023.

Releasing its full-year result Thursday, Treasury Wine Estates also said it is investigating the divestment of some of its US wine assets of which the bulk were inherited from its previous corporate incarnation as brewer Foster’s and which for two decades has struggled to make a return on its investment.

The winemaker reported a 25 per cent fall in full-year net profit to $315.8m as net sales dropped 6 per cent to $2.649bn, with earnings sliding across all its key regions of Australia, North America, Europe and Asia.

TWE last traded at $11.44.

8.47am: Dividend could support AMP shares

AMP’s announcement of substantial capital management initiatives with its first half results could see a positive share price reaction despite a significant hit from COVID-19 in terms of profit and fund outflows.

First half underlying profit fell 52pc to $149m while AMP wealth management had net outflows of $4.44bn in the first half and there was no final dividend.

But after completion of the AMP Life sale, AMP is returning up to $544m of excess capital to shareholders via a fully-franked special dividend of 10 cents a share, and an on-market share buyback of up to $200m shares over the next 12 months – equivalent to 4.2 per cent of AMP’s market capitalisation.

It’s by no means unexpected, but some analysts had thought management would prioritise running with a capital buffer and investing in growth over returning capital to shareholders.

AMP may also get a tick for buying back the 15pc of its stake in AMP Capital that it doesn’t currently own, from MUTB, at a cost of $460m, “to position business for the next phase of growth under new leadership”.

AMP Capital is the jewel in the crown and strategically it makes sense to spare capital soak up MUTB’s stake after such a big shake out in markets this year.

Read more: AMP pays special dividend, profit slumps

8.28am: AGL profit up but tougher times ahead

AGL Energy said its annual net profit rose by 12pc, but reiterated that headwinds are increasing as it feels the sting of lower wholesale power prices and rising bad debts.

AGL reported a net profit of $1.02 billion in the 12 months through June, up from $905 million a year earlier.

Revenue fell by 8.2 per cent to $12.16 billion, while underlying earnings fell by 22 per cent to $816 million. Management had been hopeful of achieving the upper end of a $780 million-$860 million range for underlying earnings, but scaled back expectations in early May as the coronavirus pandemic led to temporary restrictions on activity across the country.

AGL forecast an underlying profit of $560 million-$660 million in the current fiscal year, noting operating and market headwinds are accelerating as a result of the coronavirus pandemic. Those headwinds are driving down margins in wholesale gas and electricity, management said.

AGL said it also expects further increases in depreciation expense from recent investment in plant, systems and growth.

“Our cash flow and liquidity remains strong and we have material headroom to fund investment and further capital management initiatives,” said Graeme Hunt, AGL’s chairman.

Directors of the company declared a final dividend of 51c a share, lower than the payout of 64c per share a year ago. Combined with the interim dividend of 47c a share that brought the full-year payout to 98c.

Dow Jones Newswires

Samantha Bailey 8.25am: Breville profit slips

Breville has unveiled an 11 per cent lift in earnings but a slightly lower full-year profit in what the kitchen appliance maker said was a good year given the turbulent backdrop.

Net profit after tax attributable to shareholders fell 1.8 per cent to $66.2m for the full-year through June. Meanwhile earnings before interest, tax, depreciation and amortisation lifted 11 per cent to $126.5m for the period.

“In FY20 we faced a cluster of headwinds in the form of Brexit uncertainty, exchange rates, US tariffs and COVID-19 and equally we had our share of good fortune in terms of our inventory levels and the relevance of our products to the ‘new normal’,” said chief executive Jim Clayton.

“Overall, I am encouraged by the way our team and processes have responded, how our strategic projects have progressed, and by how we have strengthened our balance sheet against any future shocks. We emerge from fiscal year with momentum and a hardened foundation to build upon over the next five years.”

The company declared a final dividend of 20.5c per share 30 per cent franked, up from 18.5c last year.

Perry Williams 8.15am: Woodside posts $US4.07bn loss

Woodside Petroleum suffered a 27 per cent fall in underlying net profit in the first half as lower energy prices took the shine off record LNG production with chief executive Peter Coleman calling this year’s oil crash the worst in his career.

Underlying net profit after tax fell to $US303m, beating a consensus estimate of $US281m, but significantly down from $US419m for the six months to June 30. Revenue dropped 15 per cent to $1.91bn despite record production of 50.1m barrels of oil equivalent.

Taking into account $US4.37bn of writedowns recorded in July, Woodside fell to a reported net loss of $US4.06bn for the June half.

The Perth producer will pay a US26c per share dividend for the first half compared with US43c a share consensus.

Mr Coleman said the market ructions that had roiled the market were the worst he had experienced in a 40-year career.

“I would rate the external conditions created this year by the COVID-19 pandemic and oversupply in global oil and gas markets as the most difficult I’ve seen in nearly four decades in the industry.”

Cliona O’Dowd 8.05am: QBE swings to loss

QBE says it is well positioned to capitalise on accelerating pricing momentum and emerging organic growth opportunities through the COVID-19 crisis, as it swung to a first-half loss on the back of a spike in claims and a $US90m investment hit.

For the six months through June, the nation’s second-largest insurer posted a $US712m loss, compared with a $US463m profit in the prior corresponding period.

Revenue jumped 10 per cent to $US7.99bn as premium rates hardened in the half, particularly in its North American and international divisions, which saw double-digit increases in the second quarter.

Renewal rates rose at an average 8.7 during the half compared with 4.7 per cent in the first half of last year, while pricing momentum in the local market was impacted by its decision to freeze premium rates in response to COVID-19.

QBE last traded at $10.06.

7.56am: Strong bids for Sydney Airport raise

Could Sydney Airport’s capital raising be upscaled due to strong demand?

If so it would be a positive signal for the share price when trading resumes today.

Broker feedback on the bookbuild as of last night was that a relatively small amount of institutional rights – only 20m shares worth about $93m – weren’t taken up.

The book was covered 10 times at the $4.56 offer price for the $2bn entitlement offer and fully covered at $5.15 with numerous bids above that price.

Traders are wondering if the price will be raised to that point, given that it can be adjusted up until 9.15am today.

Read more: Airport demands clearer rules after loss, $2bn raising

Joyce Moullakis 7.45am: AMP to pay special dividend

AMP will pay beleaguered shareholders a special dividend and kick off a share buyback to distribute capital from the $3bn sale of its life insurance division, as the wealth group posted a sharp decline in underlying profit.

AMP’s underlying profit tumbled 42 per cent to $149m for the six months ended June 30, compared to the same period a year earlier, the 171-year old wealth group said in an ASX statement on Thursday.

AMP had last month flagged a sharply lower underlying group profit to between $140m and $150m for the six months to June 30, as the impact of COVID-19 hit the company and assets under management.

Last year’s first-half underlying profit printed at a revised $256m. Interim net profit attributable to shareholders came in at $203m, swinging from a net loss $2.29bn in the same period last year, which was due to large impairments.

A special dividend of 10c per share was declared on Thursday, although AMP will not pay a separate first-half dividend. AMP last paid an interim dividend in 2018 which was declared at 10c a share.

The company will offer to buy back up $200m in shares from investors in an on-market buyback of stock, as part of its capital management initiatives. AMP also announced it will repurchase Mitsubishi UFJ Trust and Banking Corporation’s 15 per cent stake in infrastructure and real estate arm AMP Capital.

Read more: AMP pays special dividend as profit slumps

6.20am: ASX set for early rise

Australian stocks are set for a positive open following Nasdaq-led gains on Wall Street.

Around 6am (AEST) the SPI futures index was up 45 points, or 0.7 per cent.

Yesterday, the ASX finished 0.1 per cent lower despite an early lift, weighed down by commodity weakness as spot gold fell below $US1900 an ounce.

The Australian dollar was higher at US71.62c, up from US71.14c.

6.07am: S&P 500 rallies but misses record

US stocks moved higher, as the S&P 500 index flirted with its first closing record since before the pandemic shutdown took effect.

The benchmark index rose 1.4 per cent to 3380.34. The index needed to close above 3386.15 to eclipse the previous record, set February 19.

The Dow Jones Industrial Average climbed about 1.1 per cent, and the technology-heavy Nasdaq Composite Index advanced 2.1 per cent.

Stocks have risen in all but one day in August, boosted by the prospect of declining coronavirus cases at a time when the federal government and central banks are still supporting the economy.

“There’s optimism right now about an environment where the virus situation gets better but we still have a ton of stimulus in the system, “ Ilya Feygin, a managing director at broker-dealer WallachBeth Capital.

Investors are keeping a close eye on politicians’ negotiations over a new coronavirus-relief package for American households and businesses. Senate Majority Leader Mitch McConnell said talks were “at a bit of a stalemate,” dimming appetite for stocks and other risky assets on Tuesday. Still, many investors remain optimistic that a deal will be reached.

“Markets, particularly in the last day or so, seem to be pricing in a stimulus even as politicians play down the odds,” said Edward Park, deputy chief investment officer at Brooks Macdonald, an investment management firm.

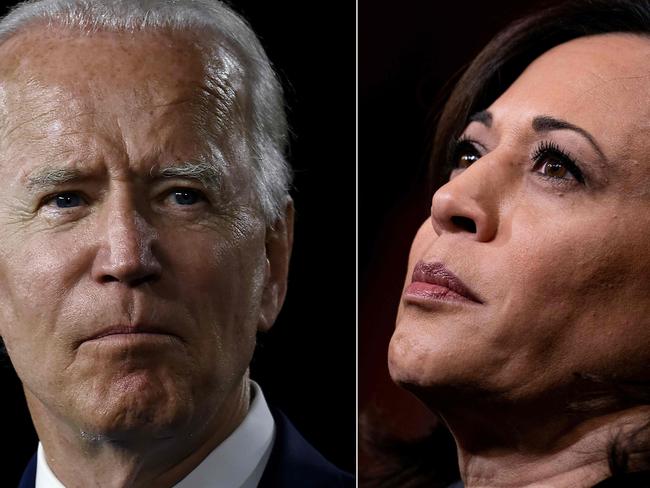

Traders also said the market was supported Wednesday by Democratic presidential candidate Joe Biden’s announcement that Kamala Harris would be his running mate. Wall Street veterans widely consider Ms. Harris to be a more moderate choice than others who were in contention for a spot on the ticket.

The steady rise leaves the stock market susceptible to reversal if cases begin to rise again or future stimulus efforts disappoint, traders said. Some have pointed to trading behaviour where stocks continually rise with few fundamental drivers, much like during the dotcom boom.

Wednesday’s gains were led by the technology giants that had dragged indexes lower a day earlier. The sector jumped 2.4 per cent in the S&P 500, with Apple, Amazon.com, Facebook and Microsoft all up more than 2 per cent. Tesla shares rose 13 per cent after the electric-car maker said it would enact a 5-for-1 stock split.

Fresh inflation data showed that US consumer prices increased by 0.6pc in July, more than the average expectation of 0.3pc, according to FactSet.

Gold prices edged 0.1pc higher, after the commodity on Tuesday fell by the most since March. Analysts said appetite for gold has been eroded this week by the rise in U.S. government bond yields. The precious metal – usually viewed as a haven asset that investors flock to when stocks are in tumult – has climbed this year even as equities advanced.

“There’s been a breakdown in the relationship between equities and gold, “ said Geoff Yu, senior markets strategist at BNY Mellon. “This happens if you believe there’s going to be moderate inflation, driven by an increase in productivity from companies.”

The U.S. crude oil benchmark rose 2.5pc to $US42.67 a barrel.

Overseas, the pan-continental Stoxx Europe 600 closed 1.1pc higher, its fourth straight day of gains.

In Asia, the Shanghai Composite Index fell 0.6pc, while Japan’s Nikkei 225 rose 0.4pc. Hong Kong’s Hang Seng index rose 1.4pc.

Dow Jones Newswires

6.05am: Cisco falls short

Network-equipment giant Cisco Systems Inc. reported a 9pc sales decline in the most recent quarter, marking the first annual sales decline in three years as the pandemic-driven economic shock takes a toll on its core business of switches and routers.

This quarter, the San Jose, California-based company expects to make 41 cents to 47 cents a share, or 69 cents to 71 cents a share as adjusted, with revenue declining 9pc to 11pc.

Analysts surveyed by FactSet expected an adjusted profit of 75 cents a share with revenue falling about 7pc to $US12.23 billion.

Dow Jones

5.40am: Job ads up 2.3pc

The latest SEEK data shows a 2.3 per cent month-on-month growth in jobs advertised in July.

The top three states contributing to the rise are Queensland, up 7.4 per cent, New South Wales, up 6.3 per cent, and Western Australia, up 5.2 per cent month-on-month in July 2020.

In Victoria, job ads declined by -12.8 per cent month-on-month as the state began stricter lockdown regulations.

Kendra Banks, managing director of SEEK ANZ, said: “While we continue to see a decline in Victorian job ads, the current figures are not as severe as the declines we experienced in March and April.”

Official jobless figures are released on Thursday.

5.38am: Gold futures settle higher

Gold futures settled higher, recouping a small portion of the more than 4pc loss they suffered a day earlier.

US Treasury yields continued to strengthen, but traded off the day’s highs, while the dollar edged lower, providing some support for gold, which is traded in the greenback. December gold rose $US2.70, or 0.1pc, to settle at $US1949 an ounce.

Dow Jones

5.36am: Oil demand faces bigger shock

The coronavirus pandemic will have an even bigger impact on the global economy and its demand for oil than previously expected, the Organisation of the Petroleum Exporting Countries said.

The cartel estimates that worldwide oil demand this year will amount to 90.6 million barrels a day, 9.1 million barrels less than last year. The 9.1 per cent decline is deeper than OPEC forecast in its previous monthly report.

OPEC also said that it expects a 4 per cent contraction in the global economy, worse than its earlier estimate of 3.7 per cent.

The Vienna-based organisation expects economic recovery in all major economies now that lockdowns have eased, but wrote that “the latest surge of infections in the US will need to be closely monitored, as a continuation of this trend may lead to an erosion in rebounding consumer confidence and spending behaviour.”

Rising coronavirus cases in India, Brazil and some eurozone countries, such as Spain, also could derail economic growth and oil demand, OPEC said.

The recovery’s vulnerability has kept oil prices stuck in neutral. Both Brent crude futures, the global benchmark, and West Texas Intermediate, the main U.S. gauge, have traded in narrow bands the past two months.

On Wednesday, Brent rose 2.1 per cent to end at $US45.43 a barrel. West Texas Intermediate gained 2.5 per cent, to $US42.67.

Dow Jones

5.32am: US deficit hits $US2.8 trillion

The US federal deficit more than tripled in the first 10 months of the fiscal year, as government spending to combat the coronavirus continued to outpace federal tax collection, the Treasury Department said.

The U.S. budget gap totalled $US2.8 trillion from October through July, 224pc bigger than the $US867 billion gap during the same period a year earlier. The government has spent $US5.6 trillion so far in the fiscal year that ends September 30, 51pc more than a year earlier, fuelled in large part by the economic relief legislation Congress enacted in March to keep households and businesses afloat during the pandemic.

Total receipts for the fiscal year are down just 1pc, totalling $US2.8 trillion, thanks to an influx of revenue last month as individuals and corporations made tax payments that the government had delayed in April and June. Those figures mostly reflect revenue based on income and business activity from before the pandemic, and are likely to shrink in the months ahead as the economy slowly emerges from a deep downturn that led to widespread business closures and millions of lay-offs.

Dow Jones

5.30am: Markets rise on rebound hopes

Stock markets rose on both sides of the Atlantic growing optimism about an economic recovery and hopes for upcoming US-China trade talks outweighed worries that US politicians may not, after all, agree to a fresh stimulus deal any time soon.

European markets were around one per cent higher at the close, with London outperforming its peers thanks to a weaker pound. London closed up 2.2 per cent, while Frankfurt and Paris both gained 0.9 per cent.

US and Chinese officials are meeting this weekend to review their trade pact. Tensions between the powers has had investors worried, but US President Donald Trump’s top economic adviser said the pact was “fine right now”.

Larry Kudlow told reporters that despite the tensions, “one area we are engaging is trade”.

He added that Beijing had vowed to stick to its promises on the January trade deal and there was evidence it was increasing purchases.

Meanwhile, optimism that US politicians will thrash out a new stimulus package to accompany Federal Reserve’s ultra-loose monetary policy was waning.

Senate Majority Leader Mitch McConnell gave traders a jolt when he told Fox News there had been no progress, fanning concerns the talks could take a lot longer than envisaged.

Meanwhile, the British pound slipped against the euro, and to a lesser extent the dollar, as Britain’s coronavirus-ravaged economy slid into its deepest recession on record.

The weakening currency helped the London stock market outshine its neighbours as investors bought into UK-based multinational companies earning much of their income in dollars.

Britain’s economy shrank by a fifth in the second quarter, more than any European neighbour, and following two quarterly contractions in a row was officially in recession.

Losses for the pound were, however, limited by data showing British GDP growth of 8.7 per cent in June – the final month of the second quarter – as the economy slowly emerged from lockdown.

AFP

5.28am: Sumner Redstone dies

Summer Redstone, the media mogul who oversaw vast holdings in television, publishing, radio and movies, has died at the age 97, his family company said.

He built his family’s drive-in movie-theatre company into a global empire that controlled ViacomCBS, making him responsible for a huge portion of the programming that millions of Americans voraciously consumed.

Redstone’s holdings will now be run by a trust for his grandchildren and their children.

Known for his intense focus on expanding his business holdings through equally creative and cynical measures, his health deteriorated significantly in recent years, raising questions about his ability to run his empire and triggering a series of legal battles with his daughter Shari Redstone.

Those disputes were resolved, however, and Shari has been the effective leader of the family’s holding company National Amusements since 2018. She played a crucial role in the engineering of Viacom and CBS’ 2019 merger. National Amusements owns the vast majority of both companies’ shares.

Dow Jones

5.27am: US consumer prices jump

US inflation is picking up pace as consumer prices jumped 0.6 per cent again in July, mirroring the June increase, and driven up by new and used car prices, government data showed.

After plunging in the first two months of the coronavirus pandemic, the consumer price index (CPI) has roared back, posting a gain that was double what economists had been expecting, the Labor Department reported.

Falling oil prices had been keeping a lid on the overall price gains, but the energy index rose 2.5 per cent last month, according to the report.

Food prices however continue to decline, falling 0.4 per cent compared to June. Excluding the volatile food and energy components, the “core” CPI gained 0.6 per cent in July – the biggest increase in this closely-watched measure since January 1991.

Overall inflation gained 1.0 per cent over the past 12 months, with so-called “core” inflation up 1.6 per cent – still far below the Federal Reserve’s 2.0 per cent target.

AFP

5.25am: Cathay Pacific reports big loss

Hong Kong carrier Cathay Pacific said it lost HK$9.9 billion ($US1.27 billion) in the first half of this year as the coronavirus pandemic sent passenger numbers tumbling, eviscerating its business.

Before the pandemic, Cathay Pacific was one of Asia’s largest international airlines and the world’s fifth-largest air cargo carrier. But it has been battered by the evaporation of global travel.

“The first six months of 2020 were the most challenging that the Cathay Pacific Group has faced in its more than 70-year history,” chairman Patrick Healy said in a stark statement announcing the results.

“The global health crisis has decimated the travel industry and the future remains highly uncertain, with most analysts suggesting that it will take years to recover to pre-crisis levels.” The airline said it carried 4.4 million passengers in the first six months of 2020 – a 76 per cent plunge on-year – as the coronavirus burst out of central China and spread around the world.

AFP

5.20am: UK in record recession

Britain’s economy shrank by a fifth in the second quarter, higher than any European neighbour, as the coronavirus pandemic slammed businesses and plunged the country into a record recession.

“It is clear that the UK is in the largest recession on record,” the Office for National Statistics said after gross domestic product (GDP) contracted by 20.4 per cent in April-June.

Britain’s recession – its first since 2009 amid the global financial crisis – was confirmed after two quarterly contractions in a row.

GDP shrank 2.2 per cent in the first three months of this year. The statistics office said that the contraction for the first six months of 2020 “was slightly below the 22.7 per cent seen in Spain but was more than double the 10.6 per cent fall in United States GDP over this period”.

But Britain’s second-quarter contraction beat Spain’s GDP of minus 18.5 per cent.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout