Telstra says more pain to come as profit drops but dividend holds

Telstra’s shares closed down by more than 8 per cent after boss Andy Penn detailed the impact COVID could have on Australia’s biggest telco.

Telstra shares were pummeled on Thursday after chief executive Andy Penn revealed the full extent of the damage wreaked by the COVID-19 pandemic, declaring the company is facing a $600m hit over two years and a challenge to maintain its dividend.

Mr Penn told reporters a lack of demand for international roaming services alone would cost the telco $200m in revenue for the 2021 financial year, while the health crisis could also spark further job cuts.

Telstra shares fell more than 8 per cent to $3.11, with the company grappling with the ongoing pandemic and leaving investors disappointed with its forward-looking guidance.

“We’re all very concerned obviously about the pandemic, and how it will continue to impact us all, and what second and third waves look like. I’m no expert by any stretch of the imagination on that, and I want to acknowledge that our political and other leaders are responding decisively as best they can. We’re all doing everything we can,” Mr Penn said.

Telstra on Thursday revealed a full year profit COVID-19 hit of $200m and says it expects that to double in the 2021 financial year.

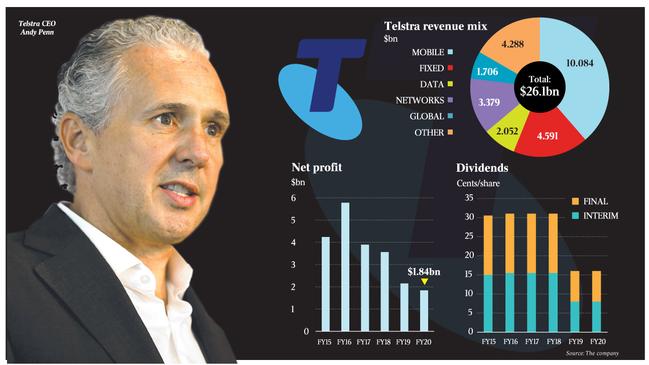

Telstra will pay a final dividend of 8c, the same as at its half-year results. Shareholders received the same amount a year ago, albeit split into a final dividend of 5c and special dividend of 3c.

Mr Penn said the company takes its dividend “very, very seriously” but said that to support it, the company would need an earnings before interest, taxation, depreciation and amortisation (EBITDA) of between $7.5bn to $8.5bn.

He flagged that the company was facing an NBN-related headwind of $700m, meaning EBITDA could fall between $6.5bn and $7bn.

“We can see what the NBN headwind is, we are committed to deliver on our productivity, and we have a high degree of confidence in that. We are doing well in terms of gaining customer numbers, and either maintaining or growing our share, and we can influence all of those. What we can’t necessarily influence is any of the external factors and the conduct of our competitors,“ he said.

Telstra reported full-year profit fell 16 per cent as the government-owned national broadband network continued to eat into earnings and mobile revenues fell.

Full year net profit fell to $1.82bn, down from $2.15bn a year earlier, while total income fell 5.9 per cent to $26.16bn, as mobile revenue fell 4.4 per cent and fixed-line revenue fell 12.1 per cent.

Stripping out one-off costs including $200m in restructuring charges, Telstra recorded underlying earnings before interest, tax, depreciation and amortisation of $7.4bn. That was in line with the bottom end of the $7.4b-$7.9bn guidance range issued with February’s half-year results and confirmed by the company in late March.

“2020 is proving to be an enormously challenging year for everyone – for governments, businesses, communities, and for all of us as individuals. The emotional, mental and economic stresses as a result of the COVID-19 pandemic and necessary restrictions are profound,” Telstra chief executive Andy Penn said in a statement.

“Importantly, it says a lot about the strength of our business and strategy that through all this we were able to meet guidance, maintain the dividend and provide guidance for the year ahead. We have also retained our strong balance sheet and A-band credit ratings.”

Telsra is also hitting pause on its job cuts, a move that will cost it $100m. The company has slashed nearly 6000 jobs since 2018 as part of its cost-cutting T22 strategy.

Mr Penn said during the year Telstra had reduced underlying fixed costs by $615m, or 9.2 per cent, putting Telstra on track to achieve its $2.5bn net cost reduction target in FY22.

“We have made the decision to keep our T22 productivity role reductions on hold for permanent Telstra employees until February,” Mr Penn said.

“We know many are doing it tough at the moment and we hope this decision will give some certainty to our people in what is a very challenging time. There will be some roles that finish in the interim but for the majority of our teams this will continue to give them some certainty at least until the new year.”

The company added 240,000 retail postpaid mobile services, including 154,000 from its budget subsidiary Belong, but its mobile revenue plummeted $461m for the year, with its postpaid handheld average revenue per user falling 8.2 per cent.

Its fixed business was also impacted, with Mr Penn blaming the NBN’s business model.

“NBN wholesale pricing remains the largest negative impact on our fixed business. Without some sort of long term change leading to improvement in economics, the risk of retail price increases, reduced customer experience or customers moving onto other networks such as 5G will increase,” he said.

“In Telstra’s case the profitability of reselling the NBN is negligible at best; that is not sustainable.

“Notwithstanding these comments I do want to acknowledge and applaud NBN’s response to COVID. NBN acted swiftly to increase capacity to retailers during this time at no charge enabling providers to support their customers as they moved quickly to work and study from home.”

Aberdeen Standard Investments director Natalie Tam said the market was not convinced Telstra’s 16 cent dividend would be sustainable. “Telstra will need to improve its mobile EBITDA, but competition has been stronger than expected,” she said. ”Telstra did adjust its prices, and Optus didn’t follow. That would have been a disappointment, particularly given Optus had been talking about market repair.

“The big part of why guidance missed was because of the negative impact from COVID, but they relate to choices Telstra has deliberately made around supporting Telstra customers and staff. Arguably $200m of it was within Telstra‘s control.”

Ian Chitterer, Vice President of Moody’s Investors Service, said Telstra’s average borrowing costs had declined to 4.6 per cent from 4.9 per cent a year earlier.

“Given the current low interest rates, we expect this downward trend to continue as Telstra refinances upcoming maturities. This will provide ongoing cash flow benefits and support its credit profile, along with solid free cash flow expectations and further asset sales.”

Telstra also flagged it had made a provision of $50m in its accounts for any potential penalties as a result of an ACCC investigation into misleading or deceptive conduct. The issue relates to how some of Telstra’s partners dealt with Indigenous Australians living in remote communities.

“Where we get it wrong we must acknowledge it, fix it and take accountability for the consequences,” Mr Penn said.

With Dow Jones Newswires

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout