ASX falls into the red as health, utilities drag

At its best, the market was up 1.1pc, but drag from health and real estate stocks ultimately dragged the ASX to another flat finish.

- Health offsets energy for flat finish

- Jefferies warns of Macquarie impairment risk

- Lynas surges on US push

- Flash PMI plummets on shutdowns

- Oil rallies on Trump threat

That’s it for the Trading Day blog for Thursday, April 23. Australian stocks gave up an early 1.1pc rally to finish down by just 4 points – taking its losing streak to four days with energy still in focus after a rebound in oil prices. Overnight, US stocks lifted by more than 2pc amid hopes for the US to reopen by August but the local markets shrugged off the strong lead.

Locally, Ramsay Health dragged by more than 5pc after raising $1.2bn in a discounted placement while Lynas surged after progress on its US push.

Perry Williams 5.13pm: Abandoned ship prompts oil levy investigation

The federal government has opened an investigation into offshore oil abandonment liabilities after the operator of the Northern Endeavour production ship in the Timor Sea collapsed in February, sparking fears of an industry wide levy to recoup costs.

Resources Minister Keith Pitt has appointed British offshore regulatory expert Steve Walker to provide a review by May into the circumstances that led to the situation, which has raised issues about who pays for abandoned facilities if companies go bust.

“The review will consider how and why this situation arose, consider the roles and responsibilities of key stakeholders, and provide advice to the Government on possible areas for reform of the offshore oil and gas regulatory regime,” Mr Pitt said.

The liquidation of owner Northern Oil and Gas Australia on February 7 left the government with an estimated $200m bill. An operator has now been hired to keep the facility running in ‘lighthouse mode’ and undertake maintenance.

Gas giant Woodside Petroleum previously owned the project - which was permanently moored between the Laminaria and Corallina oil fields in the western Timor Sea - before selling the facility to NOGA in July 2015. The floating production and storage vessel has been in operation since 1999 with capacity of 1.4m barrels of oil.

5.02pm: Miners, energy in strong rebound

Energy was in focus again, as local producers cheered a reversal of recent momentum. The sector finished higher by 2.2 per cent led by a 2 per cent lift in Woodside to $20 while Oil Search put on 3.3 per cent to $2.50 and Beach Energy added 5.7 per cent to $1.31.

Materials too were a bright spot as the majors reversed Wednesday’s losses – BHP put on 2.7 per cent to $29.75 as Rio Tinto lifted 1 per cent to $86 and Fortescue added 1.1 per cent to $11.07.

Gold miner Evolution maintained its guidance for the full year and said recent rains at its NSW operations had eased some water supply concerns. Its shares finished higher by 1.6 per cent to $5.07, helped further by defensive buying.

Fellow gold stocks also lifted – Northern Star by 4.9 per cent to $13.34, Newcrest by 3.9 per cent to $28.48 and Saracen Minerals by 4.7 per cent to $4.28.

Here are the biggest movers at the close:

Bridget Carter 4.32pm: NSW mulls sale of WestConnex stake

DataRoom | RBC and investment bank Citi have been appointed to explore a potential sale of the remaining 49 per cent interest in WestConnex that remains owned by the New South Wales state Government.

It comes after the state government ran a beauty parade for an adviser to explore options for the $10bn-odd stake in the Sydney toll road network earlier this year.

Last month, the NSW government announced a scoping study would be launched for the 49 per cent stake in WestConnex that has not yet been sold.

It comes after Transurban and its backers, including the Abu Dhabi Investment Authority, the Canada Pension Plan Investment Board and Australian Super bought a 51 per cent stake in Sydney Motorway Corporation, the entity building WestConnex, for $9.26bn in 2018.

Other investment banks that were thought to have lined up for the mandate included those such as UBS, Goldman Sachs and JPMorgan.

Groups that were in the mix for WestConnex last time around are expected to be around the hoop should a sales process emerge, including parties such as Cintra and Abertis, while Atlas Arteria could also possibly be a contender. Canada’s OMERs could also be a contender.

4.13pm: Health offsets energy lift for flat finish

An oil rebound and global equity uptick still wasn’t enough to buck the local market’s recent losing streak – shares falling for a fourth day on Thursday, albeit only by slight margin.

The market leapt higher by 1.1 per cent in early trade, but failed to hold gains as health and real estate names dragged lower.

By the close, the benchmark ASX200 had clawed back from lows of 5181.7 to finish lower by 4.1 points or 0.08 per cent to 5217.1.

Meanwhile, the All Ords was off by just one point, or 0.02 per cent to 5272.8.

Joyce Moullakis 3.56pm: Proxy pressure builds for AMP strike

A second proxy advisory firm has called on investors to vote against AMP’s pay report, upping the pressure on the board ahead of a May annual general meeting.

Ownership Matters has joined peer ISS in telling shareholders to vote against AMP’s remuneration report.

“The transformation incentive – set at five times fixed pay for most senior executives and $7m for the CEO – permits significant vesting for performance below that of AMP’s ASX 100 Financial Services peers so long as AMP’s TSR (total shareholder return) is positive,” the Ownership Matters report said.

“A quarter will vest should AMP’s TSR be positive and its TSR underperform an equally weighted index of peers by 25 per cent over the period August 2019 to February 2023. Half will vest for performance 10 per cent below the peer index over this period; 75 per cent will vest for performance in line with that of the index.”

The report added the rewards appeared “disproportionately large”, even taking into account the challenges facing AMP as chief executive Francesco De Ferrari executes on his three-year transformation strategy.

Read more: AMP faces strike call from ISS

3.20pm: Oil prices jump as tensions rise

Oil prices soared Thursday as escalating tensions between the US and Iran in the Gulf eclipsed concerns about a coronavirus-triggered demand shock and storage facilities reaching capacity.

US benchmark West Texas Intermediate rose 9.72 per cent to $US15.12 a barrel, extending big gains from the previous session. Brent crude was up 9.03 per cent to $US22.21 a barrel

AFP

2.45pm: Supermarkets underperform global peers

Australian supermarket chains Coles and Woolworths have been some of the best performers on our local market amid the coronavirus rout, but are well behind gains from their global peers, according to Jefferies.

Analyst Michael Simotas writes that the two local giants have outperformed the ASX200 by 19 per cent since the market peak – while global peers are up 28pc against their respective indexes.

The brokerage points out that Woolworths’ hotels arm has been hit by social distancing restrictions while Coles convenience operations are its key drag.

“We like both COL and WOW but now have a preference for WOW given it has underperformed COL by over 20pc,” Mr Simotas writes.

Paige Taylor 2.33pm: Stokes excused from virus quarantine

Billionaire Kerry Stokes and his wife Christine were excused on medical grounds from two weeks of forced quarantine in a Perth hotel room when they flew in from the US recently, the couple’s spokesman says.

While West Australians returning from overseas and interstate must wait out 14 days of coronavirus quarantine in one of three city hotels, Mr and Mrs Stokes were able to go directly to their home in the riverside suburb of Dalkeith to self isolate.

People in hotel quarantine have complained repeatedly that they cannot get alcohol, that their windows do not open and that they are not allowed outside their rooms for even short periods of exercise. One 35-year-old man is in jail for sneaking out of hotel quarantine to see his girlfriend and another man with PTSD was filmed rolling on the floor crying and begging to be let out. Others report that medics pace the halls giving out sedatives.

The Stokes landed in their hometown of Perth on April 8 on a private plane from the United States. They had reportedly been locked down in a house they own in Colorado.

Read more: Kerry Stokes and wife Christine excused from hotel quarantine

1.37pm: Volatility spurs ‘exceptional’ Q1 for Bell

Bell Financial Group says the recent market volatility has given a boost to its trading platform, describing the quarter as “exceptional”, but says its forecasts for the year ahead are uncertain.

Chairman Alastair Provan addressed shareholders via videolink for the finance group’s annual general meeting this morning, sharing detail of unaudited first quarter revenue of $62m, up from $45.5m on the previous corresponding period. Profit soared for the quarter, up 147 per cent to $9.4m from $3.8bn in the same quarter last year.

Mr Provan said the group had adapted quickly to the coronavirus restrictions and could take advantage of the market turbulence.

“Our strategy of organic growth, opportunistic acquisition and focus on the areas that we know and understand well, aligned with our investment in technology, remains sound,” Mr Provan said.

“We believe we have a competitive advantage in many of the market segments in which we operate. Arguably we may be even more competitive in a changed landscape post COVID-19.”

He added that Bell’s application for its TPP platform to become a general clearing participant was expected to be formally approved in the second quarter, said to reduce its costs and grow a new business stream.

“We are currently engaged in discussions with a major ASX Participant who we hope will become our first external client,” Mr Provan said.

BFG last traded up 10.6 per cent to 99.5c.

1.07pm: ‘Normal’ growth not til FY22: Citi

In reopening the economy, the government will prioritise the health crisis and any relaxation of social distancing requirements will be done over a period of time, according to Citi.

“Moreover, lower social distancing doesn’t mean economic normalisation,” Citi chief economist Josh Williamson says.

“Importantly, we don’t see the economy producing quarterly GDP output in dollar terms equal to the pre-coronavirus period until Q4 2021. This means that the earliest we could expect to see “normal” yearly economic growth is FY22.”

1.02pm: Shares fall into negative

Australia’s sharemarket has turned negative intraday.

The ASX 200 fell 12 points to 5209.1 after rising 1.1pc to 5280 in early trading.

It comes as S&P 500 futures struggle with a 0.5pc fall after the US benchmark rose 2.3pc overnight.

US President Trump’s pushback on a partial relaxation of social distancing in Georgia early today was negative for global risk assets.

“I disagree with what he’s doing,” Trump said at a White House press conference Wednesday about Governor Brian Kemp’s announcement that tattoo parlours, movie theatres and nail salons in Georgia would begin opening this week, Bloomberg reported.

“I think it’s too soon,” Trump said. “Safety has to dominate.”

Here’s the biggest movers at lunch:

Max Maddison 12.49pm: Carsales sales leads drop by 25pc

Online automotive classifieds site Carsales.com has stood down 250 workers and slashed executive pay in response to a coronavirus-induced plunge in buying and selling vehicles.

Sales leads at its Australian flagship business were 25 per cent lower due to disruption from the pandemic, the company told the ASX.

To cut costs 250 employees, predominantly in external customer-based roles, would be stood down “temporarily”.

CAR last traded down 1.5 per cent to $12.77.

Read more: Carsales.com cuts staff, pay

Rosie Lewis 12.43pm: ATO approves 500K super drawdowns

The ATO has approved 456,000 applications for Australians to access their superannuation early, totalling $3.8bn of withdrawals. People can draw up to $10,000 each and the average withdrawal has been $8000.

The ATO has paid out $3bn to 177,000 businesses employing 2.1 million Australians, as part of the government’s cashflow boost measures.

The $750 cash payments for welfare recipients have gone to 6.8 million people totalling $5.1bn.

Rosie Lewis 12.28pm: Big banks to open JobKeeper hotlines

The big four banks have established new hotlines for customers to call so they can receive bridging finance before the JobKeeper payments kick in next month, Josh Frydenberg has announced.

There will be dedicated hotlines for businesses to use and then pay their staff ahead of receiving Jobkeeper money.

Banks have also agreed to expedite the processing of bridging finance applications, which will be taken to the front of the queue.

“Our message today is if you are a business or a not-for-profit operation that is eligible for the JobKeeper payment, as required, you need to pay your staff ahead of receiving the money from the Tax Office. Go to your bank, ring their hotline, ask for that support, and that support will be forthcoming,” the Treasurer said.

Follow the latest at our coronavirus live blog

12.04pm: ASX pares most of intraday gain

The intraday fade in the ASX200 is consistent with a negative outlook after the breakdown from a bearish wedge pattern on Monday.

The Index is up 0.2pc at 5231.2 after rising 1.1pc to 5282.6 in early trading.

A negative close would be a small victory for the bears.

Patrick Commins 11.53am: Resource boost drives trade jump

A jump in resources exports, especially iron ore, helped drive a 28 per cent jump in merchandise trade in March, according to preliminary figures released by the ABS.

Goods exports lifted $8.1bn to $36.1bn in the month, the Australian Bureau of Statistics revealed, suggesting international trade would help offset some of the damage to the economy from the COVID-19 pandemic, which is expected to drive the worst downturn since the Great Depression.

The ABS noted the “significant rise” in iron ore sales to China came after two months of broad export declines.

A 20 per cent lift in exports of non-rural goods to $4.8bn in the month accounted for the bulk of the month’s increase in trade, while rural goods exports increased by a similar proportion to $855 million.

Total imports lifted 10 per cent to $2.1bn, led by purchases of such items as laptop computers and mobile phones.

Aust ABS March prelim goods trade data:

— Shane Oliver (@ShaneOliverAMP) April 23, 2020

Exports +29%mom/+16%yoy

Imports +10%mom/-1%yoy

These are not seas adj & the export bounce may reflect a recovery after weather impacts

But suggests exports ok, imports trending soft with soft domestic demand. Both likely to slow ahead. pic.twitter.com/HYatDNkkxQ

Nick Evans 11.37am: Portland smelter survives Alcoa closures

Victoria’s Portland aluminium smelter has survived the latest round of closure announcements by Alcoa, but the global aluminium and alumina giant warned shareholders overnight its business was being badly affected by the global economic downturn.

Alcoa launched an asset review last September, warning its loss-making aluminium smelters could be closed if it could not cut costs and carbon emissions from a number of its higher cost operations, including Portland.

It has already committed to keeping the facility open until mid-2021, when Portland’s existing power supply agreement expires, but on Wednesday senior executives said Alcoa would hasten the pace of its internal review of loss-making operations as it prepares to deal with the global economic downturn.

Read more: Give me smelter: A town lifeline

11.20am: Webjet completes $118m retail offer

Webjet has announced the completion of its $118m retail entitlement, following an earlier placement for cash to survive coronavirus travel restrictions.

The group said this morning the offer had been taken up by approximately 73pc of existing retail holders with a scale back needed for the top-up facility after significant demand.

New shares under the Retail Entitlement Offer are expected to be allotted on Tuesday, April 28 and commence trading on the ASX on April 29.

Nick Evans 11.12am: De Grey seeking $28m for gold discovery

A exploration junior De Grey Mining is chasing $28m at 28c to back drilling at its emerging gold discovery in the Pilbara region of the state.

De Grey has been one of the hottest junior exploration stocks on the market since February, when drilling hit high grade intersections at its Hemi prospect, with the company’s shares surging from below 5c to as high as 40c in mid April.

It launched the $28m raising through Argonaut and Bell Potter on Thursday, pitching a placement at a 12.5 per cent discount to its last close of 32c.

Eli Greenblat 10.49am: Fashion brand PAS weighs restructure

Struggling fashion retailer PAS Group, whose brands include Black Pepper, Review and Yarra Trail, has placed its shares in a trading halt as it considers a restructure in the wake of the coronavirus pandemic and the hit to the retail sector.

“PAS requests a trading halt as it continues to consider the implications brought about as a result of COVID- 19 and so that the board can fully assess potential restructure options in relation to the company,’’ it said in a statement to the ASX.

It is understood that in recent weeks, the company had been trying to raise capital, but had been unsuccessful.

Some expect that the retailer’s major shareholders would offer more capital to keep the business afloat.

One of the major challenges for Pas Group is that it has 58 Review Clothing concession stores within Myer, which is closed until next month.

Coliseum Capital owns a 65 per cent interest in PAS after it launched a takeover bid for the fashion retailer in 2015.

PGR shares last traded at 4.6c.

Nick Evans 10.42am: Lynas surges amid US progress

Lynas shares are outperforming in early trade as investors cheer the rare earth miner’s progress in a US Department of Defence tender.

After the close yesterday, Lynas said it had progressed its bid with US partner Blue Line to win defence department funding to establish a heavy rare-earth separation plant in Texas.

It is understood Lynas is one of several potential suppliers to win through to the next round of the tender process, launched late last year.

LYC shares are up by 18 per cent to $1.65 as the best performing stock in the top 200.

Read more: Lynas moves a step closer to US push

10.30am: Share rise muted by S&P futures

Australian shares didn’t rise quite as much as expected this morning as US futures turned down.

The S&P/ASX 200 rose 1pc to 5275 versus a 1.6pc rise projected by overnight moves, as S&P 500 futures have fallen 0.5pc this morning.

The energy sector is leading gains with Oil Search up 4.4pc after a sharp 23pc rise in WTI oil futures overnight and a further 4pc rise this morning, while Santos is up 6.3pc after its production report.

The Materials sector is also doing well with BHP up 3.3pc, Rio Tinto up 2.2pc and Newcrest up 2.4pc with iron ore up 1.8pc, copper up 2.1pc and gold up 1.7pc overnight.

Technology is also outperforming amid broad gains in that sector in line with US peer strength.

Elsewhere, Financials are underperforming with Macquarie up just 0.5pc after Jefferies slashed its price target by 18pc.

The major banks are also lagging with gains of 0.4pc-1.1pc ahead of earnings reports in coming weeks.

10.25am: Jefferies warns of Macq impairment risk

Jefferies analyst Brian Johnson has cut his price target on Macquarie by 18pc to $137 after predicting a $500m impairment provision for the second half.

“Seemingly every day we see yet another source of ‘impairment’ charge risks,” Mr Johnson says.

Risks include aircraft leasing book and energy lending impairments, equity investment books, hedge fund distress and weaker markets.

But Mr Johnson has kept his Buy rating because of its leverage to public infrastructure stimulus, decarbonisation and demand for inflation-linked assets.

MQG last up 0.6pc at $98.44.

Jared Lynch 10.23am: API plays nice in landlord talks

Australian Pharmaceutical Industries says it has had “fruitful” negotiations with landlords as it seeks to keep its network of 500 Priceline Pharmacies open during the coronavirus pandemic.

COVID-19 has pitted many struggling retailers and landlords against each other, with some property managers even encouraging tenants to dip into superannuation to pay their rent, triggering a rebuke from the corporate regulator who warned such advice could lead to five years’ jail.

API chief executive and managing director Richard Vincent said the company had experienced a fall in foot traffic across its Priceline Pharmacies located in CBDs, while suburban and locally based stores continued to trade well.

“API will continue to monitor the financial performance of its Priceline network with the intention of keeping stores open and people employed where it is safe to do so. API has entered negotiations with landlords and in most instances those negotiations are proving fruitful,” Mr Vincent said.

It is a different strategy to Solomon Lew’s Premier Investments, which it would not be paying rent to landlords for the period of the COVID-19 shutdown.

API shares are down 4.4pc to $1.08 in early trade.

10.13am: Shares jump on US optimism

The local market has capped a three-day losing streak with a 1 per cent jump at the open, after a reversal in oil prices overnight.

The benchmark ASX200 is higher by 51 points or 0.98 per cent to 5272.5.

Materials and energy stocks are leading the charge higher – up by 2.6pc and 2.5pc respectively.

Eli Greenblat 10.10am: CC Amatil takes AGM online

Coca-Cola Amatil will hold a “fully virtual” annual general meeting next month with shareholders explicitly told to keep away due to concerns social distancing rules triggered by the coronavirus pandemic, with other companies set to follow CC Amatil’s example as public companies explore new ways to keep in touch with their investors.

The step to close down a public meeting means that thousands of people that would have attended the CC Amatil AGM in person can now be shelved, with the beverage group having a large shareholder base and its AGM’s typically a popular affair.

In its notice of meeting dispatched on Thursday morning along with the beverage company’s annual report, CC Amatil said it was taking its annual meeting scheduled for May 26 to the online world with shareholders to log on virtually to follow and vote at the AGM.

10.04am: BetaShares Crude ETF juggles exposure

Oil market volatility has sparked a shake-up of BetaShares’s futures exposure from its Crude Oil Index ETF.

The fund aims to track the performance of Crude hedged into Australian dollars, and includes exposure to future contracts with the nearest expiration date.

After this week’s plunge, at times into the negative, the fund has switched from one-month to three-month futures contracts in a bid to remove some volatility.

“In view of the unprecedented market developments in the last few days, and to reduce the risk to the Fund of the June 2020 futures contract trading at a negative price (which would reduce the Fund’s value to zero), BetaShares considers it prudent, and in the best interests of unitholders, to temporarily replace its investment exposure to the one-month (currently June 2020) contract with exposure to the three-month (currently September 2020) contract with immediate effect and until further notice, by arrangement with the swap provider,” it said in a statement to the market.

9.49am: Radio Rentals to shutter all stores

The coronavirus downturn has served a death knell to Thorn Group’s Radio Rental’s business, prompting the permanent closure of its 62 retail stores across the country.

The group said this morning it would expand its digital presence as it shut its stores “amid the coronavirus-driven downturn in the retail sector”.

Approximately 300 casual and full time staff will be made redundant as part of the changes.

“Thorn will undertake the run-down of Radio Rentals’ loan book, worth approximately $123 million as at 31 March 2020, which will be value creating and not draw down capital. The run-down is expected to immediately generate significant cash, above the redundancy and other costs,” it said.

In a strategy update the company, which also operates a leasing finance business, said the core of the Radio Rentals’ business will continue to operate and will be leveraged to develop a new, digital business model. Radio Rentals’ online store will be enhanced with a relevant product range to more closely match the needs of its customer base.

Thorn has also introduced new credit policies and collection processes, as well as cutting head office costs, to ensure the business model remains sustainable in the face of the adverse business conditions.

The embattled Thorn Group has taken a share beating following a string of profit downgrades, a class-action lawsuit and enforceable undertakings flowing from its treatment of consumers.

Read more: Thorn shares slump on fresh profit warning

9.47am: Shares to jump but risks remain

Australia’s sharemarket is set to jump at the open but risks associated with an unprecedented growth slowdown remain.

Futures relative to fair value suggest the S&P/ASX 200 will open up about 1.6pc near 5305 after the S&P 500 rose 2.3pc to 2799.3.

S&P 500 futures are down about 0.4pc this morning but oil futures – the bounce in which drove some of the rise in US stocks – are up 4.3pc in terms of June WTI June futures.

Outperforming US sectors included IT, Energy and Utilities, with Treasury Secretary Mnuchin’s expectation that most of the US economy will restart by the end of August, Senate passage of a $US484bn fiscal package and talk of a fourth US fiscal package helped push the US sharemarket higher, while the ECB confirmed it will include junk bonds as loan collateral, ahead of an expected downgrade of Italy’s sovereign credit rating later this week.

The other driver was oil, with June WTI surging from $US11.70 to $US16.18 after the US President added geopolitical risk by telling the Navy to destroy any Iranian gunboats that harass US ships.

European PMI and US jobless claims data will be in focus tonight along with an EU leaders teleconference which may discuss the need for debt mutualisation.

On the charts, the ASX 200 should fail at resistance in the 5345-5415 area after breaking down from a rising wedge pattern on Monday.

Nick Evans 9.43am: Drought fears ease at Evolution’s mine

Evolution Mining says rainfall and the completion of a new pipeline have eased the immediate concerns its flagship Cowal gold mine in NSW could run short of water, as the company’s mines churned out cash as the gold price climbed.

Evolution released its quarterly production report on Thursday, posting a 3 per cent fall in gold output to 165,502 ounces for the quarter as it processed lower grade ore stockpiles at Cowal.

But the immediate threat to Cowal posed by the savage drought in NSW has receded, with Evolution saying the combination of solid rain and the completion of earlier work to reduce Cowal’s reliance on external water sources, worth about $6m in the quarter, was paying off.

“Work continues to further reduce the reliance on fresh groundwater offtake through accessing subsurface saline water source,” Evolution said.

EVN last traded at $4.99.

9.34am: Santos revenue drops by 14pc

Satnos said its sales revenue fell by 14pc in the first quarter of its fiscal year after oil prices began to nosedive, outpacing a 4pc drop in oil and gas production.

Santos said its sales revenue totalled $US883m in the three months through March, lower than the $US1.03 billion reported for the prior quarter.

Santos said quarterly output of 17.9 million barrels of oil equivalent was held back by an unplanned domestic gas customer outage in Western Australia and the impact of Cyclone Claudia.

Chief Executive Kevin Gallagher said the company had performed strongly in the quarter despite challenges including the coronavirus pandemic and low oil prices.

“Our oil assets performed well with strong realised prices in the quarter, while our onshore assets performed particularly strongly including the highest quarterly Cooper Basin gas production in nine years and GLNG operating above guidance at 6.4 million tonnes per annum,” Mr Gallagher said.

Like other large energy companies, Santos moved quickly to reduce spending to insulate its business against headwinds from low oil prices and the coronavirus pandemic.

Dow Jones Newswires

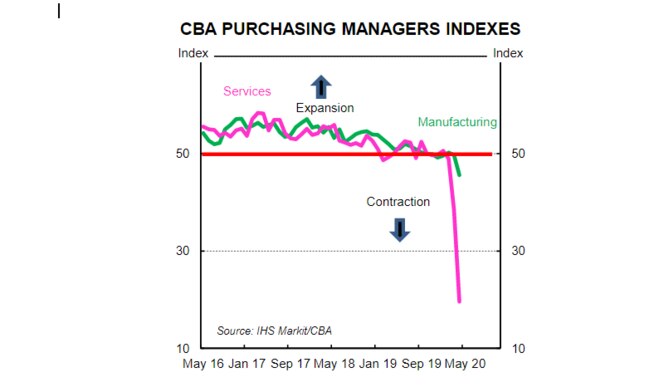

9.04am: Flash PMI plummets on shutdowns

Commonwealth Bank’s flash purchasing managers indexes for April have shown economic activity is plummeting amid coronavirus shutdowns, described by the bank’s head of economics as “astonishing”.

The early read of April activity shows services dropped to 19.6 from 38.5 previously – where any reading below 50 implies a contraction in activity. Manufacturing is more positive, coming in at 45.6 versus 49.7 last month.

“This is an astonishing result. The collapse in the headline index reflects the severe contraction in economic activity currently taking place,” head of Australian economics Gareth Aird said.

Overall, the composite PMI fell to 22.4 from 39.4 last month.

“Company shutdowns, government restrictions and steep falls in customer demand contributed to the overall reduction in activity,” CBA said.

“New orders also decreased substantially, while the global nature of the outbreak meant that new orders from foreign customers were also down strongly.”

Bridget Carter 9.03am: Is Qantas the next to raise equity?

DataRoom | Expectations are mounting that national carrier Qantas could be the next major listed company to raise equity, with some questioning whether its fuel hedging contracts put it on the back foot.

With the oil price plunging this week due to an oversupply of the commodity, some in the industry are believed to be concerned that major carriers could be caught in a corner after locking in fuel costs when prices was much higher.

It is understood that costs linked to fuel forward future contracts, which required a margin call, may have put additional pressure on Virgin Australia before it was placed into voluntary administration.

QAN last traded at $3.36.

Read more: Qantas raise closer to the runway

8.58am: What’s on the broker radar?

- BHP PLC raised to Buy – SocGen

- CSR raised to Outperform – Macquarie

- G8 Education cut to Market-Weight – Wilsons

- Macquarie target price cut 18pc to $137 – Jefferies

- Metcash raised to Hold – Morningstar

- Myer cut to Neutral – JP Morgan

- Nanosonics raised to Market-Weight – Wilsons

- Newcrest raised to Neutral – CIBC

- Ramsay Health cut to Neutral – Citi

- Ramsay Health cut to Underweight – Wilsons

Cameron Stewart 8.54am: America starting to reopen: Trump

Donald Trump has declared that America is starting to be open for business as his Treasury Secretary Steve Mnuchen predicted the US economy could be completely reopened by late August.

The bullish predictions came as more Republican states took tentative measures to reopen their economy and relax coronavirus restrictions.

But states remain sharply divided over the issue, with New York and California strongly rejecting moves to reopen their economy and saying their priority was public health.

A new AP-NORC poll found that 8 in 10 Americans support measures that include staying at home to fight the spread of the virus.

The poll found that only 12 per cent of Americans say the measures go too far, while 26 per cent think they do not go far enough and 61 per cent believe the steps taken are about right.

Recent promising trends suggest that more states will soon be in a position to gradually and safely re-open. pic.twitter.com/s1hJyEc1D9

— The White House (@WhiteHouse) April 22, 2020

8.49am: Ramsay raises $1.2bn

Ramsay Health Care has completed its $1.2bn placement with strong demand from domestic and offshore investors.

The private hospital operator said this morning that it had received significant interest and each investors existing holding had been a key consideration in the determination of allocations.

“The success of the equity raising is a clear endorsement of Ramsay’s long term strategy. It will strengthen our balance sheet and liquidity position, increase our financial flexibility, and ensure that we can continue to pursue our long term growth objectives,” chief Craig McNally said.

New shares will be settled later this month at $56 apiece.

7.50am: Gold surges

Gold prices jumped as much as 1.9 per cent overnight on expectations of more stimulus measures amid massive economic damage due to restrictions around the world to slow the novel coronavirus.

Spot gold was up 1.6 per cent at $US1,711.84 per ounce, which could be its biggest daily gain in nearly two weeks. US gold futures settled 3 per cent higher at $US1,738.30.

“This is the perfect storm for gold … Perpetual buyer is buying gold because of all the global stimulus going on,” said Michael Matousek, head trader at US Global Investors.

“Gold is in a bull market. You’ll be hard pressed to find something else that has this type of price action and this trend going on right now so you naturally have people gravitating towards it.”

Reuters

7.45am: ASX to open higher

Traders on the Australian share market are expected to follow a rally on Wall Street overnight after world oil prices rose.

At 7am (AEST) the SPI 200 futures contract was higher by 49 points, or 0.94 per cent, at 5,286.0.

US crude and benchmark Brent prices climbed after a collapse in the past two days, sending the S&P 500 energy index up 3.6 per cent.

Brent crude, the international standard, climbed 5.4 per cent to 20.37 dollars per barrel.

The Dow Jones Industrial Average, the Nasdaq and S&P 500 all finished trade 2.0 per cent or more higher.

In Australia on Wednesday, the S&P/ASX200 index recovered from a poor start to finish only 0.1 points lower at the close of trade, at 5,221.2 points.

The Australian dollar was buying US63.23 cents, down from US63.31 cents at Wednesday’s close.

AAP

7.35am: AMP assets under management slip

AMP Capital says total assets under management fell 5.3 per cent to $192.4 billion in the first quarter, amid market turmoil related to the coronavirus pandemic.

In an update, it said net external cashflows increased to $1.3 billion from net cash outflows of $20m in the same quarter last year, reflecting strong inflows into fixed income products managed by China Life AMP Asset Management.

Australian wealth management assets under management as at March 31 were down to $116.3bn “primarily reflecting COVID-19-related market movements”.

AMP Bank’s total loan book grew by $162 million to $20.8 billion and deposits grew by $773m to $15.2 billion.

AMP Chief Executive Francesco De Ferrari said: “Markets in Q1 were extremely volatile particularly in March, with significant falls in equities, fixed income and key commodities impacting our assets under management.

“We have seen some recovery since the quarter-end, but expect market volatility to continue and the economic impact of the pandemic to emerge over the remainder of the year.”

6.50am: Alcoa cuts aluminium forecast

Alcoa Corp lowered production projections, saying it now believes it will ship 2.9 million to 3 million tonnes of aluminium for the year as it scales back and responds to economic fallout from the new coronavirus.

Previously, the company expected shipments of 3 million to 3.1 million tonnes. Alcoa said the change in the forecast was due to its move to curtail capacity at a plant in Washington state later in 2020. The company also announced measures to conserve cash in response to the economic fallout from the pandemic.

The company didn’t provide quarterly projections on how it views supply and demand dynamics in the bauxite, alumina, and aluminium markets.

The company said it decided not to provide those forecasts due to uncertainty tied to the COVID-19 pandemic and its effects on the global economy.

Dow Jones Newswires

6.10am: US stocks claw back losses

US stocks rallied, clawing back some of the week’s losses, as oil prices rose and investors looked to corporate earnings reports to gauge the health of US businesses during the coronavirus pandemic.

The Dow Jones Industrial Average added nearly 2 per cent after dropping more than 1200 points to start the week.

The S&P 500 rose 2.3 per cent, and the tech-heavy Nasdaq Composite advanced 2.8 per cent.

After Wednesday’s wild market gyrations, Australian stocks are set to open higher. Ate 6am (AEST) the SPI futures index was up 49 points, or 0.9 per cent.

The US gains were broad, with all 11 sectors of the S&P 500 rising, led by the technology group, and 26 of the 30 members of the Dow Jones Industrial Average in the green.

“The psychology is ‘buy on the dip’ and that’s what’s fuelling this bear-market rally,” said Gregory Perdon, co-chief investment officer at private bank Arbuthnot Latham.

After days of turbulence in the oil markets, Brent crude, the global gauge for oil, was up about 5.7 per cent at $20.44 a barrel, after briefly plunging earlier in the day to levels last seen in 1999. The US crude benchmark jumped 20 per cent to $US13.91 a barrel following its lowest close in 21 years.

US oil futures on Monday dropped below zero for the first time, as the world economy slows and space to store unused crude ran short.

“Oil is really the big gorilla out there in the market right now because of the dramatic actions,” said Lisa Erickson, head of the traditional investments group at U.S. Bank Wealth Management. “The bigger picture is not just the near-term impact but longer term, the ultimate solvency of these companies and the potential impact on both their stocks and their bonds.”

With earnings season under way, investors are looking to corporate reports for insight on how the pandemic is affecting U.S. businesses as a broad swath of blue-chip companies report their results.

Shares of Snap soared 35 per cent after the social-media company reported a surge in the number of users as people who are homebound turned to its chat app for communicating with friends and family. Netflix shares ticked down 2.9 per cent after the streaming giant on Tuesday evening said it ended the first quarter with nearly 16 million new subscribers. The stock has rallied 31 per cent this year.

Oil prices rose after President Trump said on Twitter that he had instructed the US Navy to destroy Iranian gunboats “if they harass our ships at sea.” Despite large percentage moves, prices remain historically low.

The Trump administration is considering offering federal stimulus funds to embattled oil-and-gas producers in exchange for government ownership stakes in the companies or their crude reserves, the Journal reported.

Overseas, the benchmark Stoxx Europe 600 index climbed 1.8 per cent. In Asia, Japan’s Nikkei 225 closed 0.7 per cent lower, while benchmarks in Hong Kong, South Korea and Shanghai ended higher.

Dow Jones Newswires

5.45am: Oil prices rally

Beaten-down US oil prices rallied following dramatic declines earlier this week even as American crude inventories near capacity levels.

Futures for the benchmark West Texas Intermediate for June delivery jumped 19 per cent to $US13.78 a barrel in New York. WTI sank into negative territory on Monday for the first time, but that was for the May contract that expired Tuesday.

Brent crude oil, the international standard, rose $US1.04, or 5.4 per cent, $US20.37 a barrel.

The gains came despite weekly government data showing a big jump in oil stockpiles. Analysts said the oil market got a boost from US President Donald Trump’s threat to shoot at Iranian boats in a key waterway.

I have instructed the United States Navy to shoot down and destroy any and all Iranian gunboats if they harass our ships at sea.

— Donald J. Trump (@realDonaldTrump) April 22, 2020

AFP

5.40am: Boeing to lay off 10pc of workers

Boeing plans to reduce the workforce in its civil aviation unit by 10 per cent to cut costs as the coronavirus causes a crisis for airlines, two sources familiar with the matter told AFP.

The lay-offs would impact the unit manufacturing the 787 and 777 long-haul aircraft as well as the troubled 737 MAX, the sources said.

A Boeing spokesman said the company is offering “voluntary lay-off” programs to try to avoid future cuts, but did not confirm the size of the planned reductions.

AFP

5.35am: Oil jumps after Trump threat

Oil prices rocketed higher after US President Donald Trump threatened to shoot at Iranian boats in a key waterway for crude shipments.

Earlier in the day, the European benchmark, Brent North Sea crude for delivery in June, had fallen to $US15.98 per barrel — the lowest level since June 1999 as investors continued to worry about oversupply in view of the slump in demand as countries shut much of their economies to slow the spread of the coronavirus.

West Texas Intermediate’s new June contract dropped more than 10 per cent to as low as $US10.26.

But prices subsequently rocketed higher, with WTI climbing nearly 40 per cent at one point to hit $US16.18.

“It would be nice for oil’s push higher to come from a less troublesome catalyst,” said Spreadex analyst Connor Campbell.

“Donald Trump’s order for the navy to ‘shoot and destroy’ Iranian gunboats that ‘harass’ American ships causes some investors to return to the black stuff, lifting Brent crude back towards $US21 per barrel with a near 8 per cent comeback.”

The Gulf is a major gateway for oil to reach international markets, and previous spikes in tensions between US and Iranian vessels have seen crude prices similarly surge higher.

Trump’s order came one week after 11 small armed Iranian Revolutionary Guards Corps speedboats swarmed around US Navy and Coast Guard ships in international waters in the northern Gulf.

Iran said it put its first military satellite into orbit Wednesday, making it an emerging “world power”, in a move that also stoked tensions.

AFP

5.28am: Delta posts big losses

Delta Airlines suffered huge losses in the latest quarter and announced additional cost-cutting measures as coronavirus shutdowns have devastated air travel.

The company emphasised steps it is taking to boost liquidity amid a heavy cash-burn as it continues to fly sparsely-populated flights even with much of the global plane fleet grounded.

Delta and other airlines received funds from the US Treasury as part of the $US2 trillion US relief legislation approved last month as the virus forced much of the economy on lockdown.

Even with that support, the carrier said it will slash expenses in June by 50 per cent, which will reduce its daily cash-burn from $US100 million at the end of March to $US50 million by the end of June.

Delta, the first of the large US carriers to report results, lost $US534 million in the first quarter, compared with profits of $US730 million in the same period a year ago. Revenues fell 18 per cent to $US8.6 billion.

5.25am: Elliott fined over takeover fight

The French markets regulator said it had imposed a 20 million euro fine on US hedge fund Elliott Management, accusing it of “inaccuracies” during its bid to block a takeover deal five years ago.

Elliott, run by top Republican donor Paul Singer, was also found to have obstructed the inquiry launched by the Autorite des Marches Financiers (AMF) after the battle.

With a value equivalent to $US21.8 million, it was the highest fine ever handed out by the AMF, matching recent penalties for Morgan Stanley and the French bank Natixis in separate cases.

In 2015, Elliott started buying up shares in Norbert Dentressangle, a French shipping and logistics group that was the target of a takeover offer from its American rival XPO.

The AMF said Elliott misled regulators by saying it had used contracts for difference (CFD), a derivative financial instrument settled in cash, to acquire its 9.2 per cent stake big enough to block the full takeover.

But Elliott had in fact used equity swaps, settled in shares, and later failed to declare on time its intentions in the takeover battle.

AFP

5.20am: Heineken beer sales choked

Heineken, the world’s second largest brewer, said coronavirus containment measures strangled sales, which dropped by 14 per cent by volume during March.

Governments have closed restaurants and bars worldwide, banned sporting events and urged people to remain home to reduce the spread of COVID-19.

“Our performance for the first quarter reflects the initial impact of those measures, and volumes in March were obviously heavily affected,” Heineken chief executive Jean-Francois van Boxmeer said in a statement.

The next three months did not look much better, either.

Beer sales by volume fell by 14 per cent in March according to the earnings statement, when many governments began to implement confinement measures.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout