Surging iron ore price lifts ASX, Westpac under fire

The ASX rose 0.4pc to a 5-day high on a daily close basis and the $A stayed firm after hitting a more than 2-year high in early trading. Resources led after a jump in iron ore and oil prices

- Booktopia in strong ASX debut

- Sezzle on track to beat guidance

- Iron ore price surges after Vale cut

- Macquarie in $US1.7bn wealth deal

Welcome to the Trading Day blog for Thursday, December 3. The ASX hit a 3-day high as iron ore miners surged after the spot price hit a 6-year high and the S&P 500 rose 0.2pc to a fresh record high. Qantas delivered an upbeat update, Macquarie said it’s buying Waddell & Reed, and Westpac accepted an enforceable undertaking from APRA.

Jared Lynch 6.30pm: Government spends up on vaccine advice

The federal Department of Health spent more than $1.2m on consultants advising on the rollout of COVID-19 vaccines, with one contract equating to about $26,000 a day.

As the Morrison government sets a date for when the first Australians will be inoculated against the virus, The Australian can reveal the Department of Health has recruited external advice regarding the delivery of a coronavirus vaccine.

The advice was sought despite the Therapeutic Goods Administration having yet to approve the four types of vaccines the government secured in a $1.7bn deal.

McKinsey and Company has been the biggest beneficiary, with the Department of Health paying the firm $660,000, or $26,000 a day, for one month’s work, according to government tender documents.

McKinsey Pacific Rim won the contract to provide vaccine and treatment strategy advice, with the contract completed between August 17 and September 17.

Big four consultancy firm Ernst & Young received $550,000 of taxpayers’ cash to complete a 2020 Influenza Evaluation and Covid Vaccine System Readiness Review. Work began on November 3 and is set to be completed by the end of the financial year, according to tender documents.

The cheapest tender, at $31,000, was awarded by the Department of Foreign Affairs and Trade’s Aid Program to ABT Associates to provide advice on “COVID-19 vaccine delivery capability and gaps in Pacific Island countries and Southeast Asia”.

ABT Associates, which has a global staff of more than 3000, was given six weeks to November 30 to complete the contract.

Despite spending $1.2m on advice from consultants, the government is yet to formally engage pharmaceutical wholesalers, including ASX-listed companies Sigma and Australian Pharmaceutical Industries, about using their logistics networks to deliver the vaccine across the country.

Read more: $26,000 a day for vaccine advice

5.09pm: Tokyo closes higher

Tokyo stocks closed marginally higher on Thursday as optimism over coronavius vaccines deflated selling pressure following a recent surge.

The benchmark Nikkei 225 index rose 0.03 percent, or 8.39 points, to 26,809.37, while the broader Topix index was up 0.07 percent, or 1.28 points, at 1,775.25.

4.30pm: ASX ends +0.4%; miners surge

Australia’s S&P/ASX 200 share index finished up 0.4pc at 6615.3 - a 5-day high on a daily close basis - after hitting a 3-day high of 6628.2 intraday.

But while resources surged amid higher commodity prices, gains elsewhere were narrowly based. The Materials and Energy sectors rose strongly and Real Estate was narrowly in the green, but all other sectors fell, led by declines in the Health Care and Technology sectors.

Fortescue surged 13pc after spot iron ore rose 3.6pc to a 6-year high of $US136.75 as Brazilian iron ore giant Vale cut annual output expectations again and flagged only a limited lift in production in 2021. Whitehaven Coal rose almost 9pc after Bloomberg reported that China was set to allow a thermal coal cargo to unload amid a recent ban on such imports from Australia. There were also massive gains in Rio Tinto and BHP, which surged 6.9pc and 4.9pc respectively. But banks suffered from a switch to resources despite higher bond yields.

Westpac fell 0.5pc after accepting an enforceable undertaking from APRA over past anti-money laundering charges. Macquarie rose 0.2pc with its $2.3bn plan to buy US wealth manager Waddell & Reed having no impact on the share price.

The Australian dollar’s rise to a more than 2-year high of 0.7419 crimped non-resources offshore income earners, with CSL down 0.7pc.

4.00pm: Aussie banks well-positioned - Moody’s

Moody’s Investors Service says Australia’s four major banks are well positioned to manage the remaining risk from the coronavirus outbreak, with sizeable provisions adequate to cover receding asset risk. Fiscal stimulus and monetary easing that have prevented a sharp deterioration of economic conditions and while non-performing loans will increase, strong balance sheets and earnings should provide a sufficient buffer, according to the ratings agency.

It notes that loans under payment-deferral programs have declined significantly, suggesting growth in problem loans will be manageable, while banks hold sufficient loss provisions to cover potential increases in loan losses. Profitability will improve as credit costs decline but banks will face challenges in growing revenue, Moody’s says. Deterioration of asset quality will weigh also on capital ratios, it says, but it predicts that they will likely remain strong.

Major banks are down as much as 0.6pc today amid a switch to resources.

3.25pm: Westpac card use at year’s high

Westpac’s Card Tracker index - based on millions of card transactions processed by Westpac each day - implies annual growth in card activity is running above pre-COVID levels.

The index rose 0.4 percentage points to 110.5 in the week ending November 28th, a new weekly high for the year despite a significant drag from the lockdown in SA.

The SA state index plunge 15.9 points to 96 – comparable to the steep drop seen in Victoria when it went into its ‘second wave’ lockdown back in August.

But since the SA restrictions were lifted shortly after they were introduced, there should be a resurgence in card use there in coming weeks, according to Westpac senior economist Matthew Hassan. “If so, the national index could push significantly higher,” he says.

The index read excluding SA this week was 111.7.

“Excluding SA, the detail showed a solid gain across discretionary categories, most notably for travel, which is coming from an extremely weak starting point but looks to be showing a more meaningful rally now that internal border restrictions have been eased,” Mr Hassan says.

“Card transaction flows across ‘essentials’ dipped, mostly reflecting expenditure switching from areas like basic food towards services such as hospitality.

For SA, activity fell heavily across both discretionary and essentials, the latter driven by an unwinding pre-lockdown stockpiling surge in the previous week.

Various mobility measures confirm SA has largely returned to pre-lockdown movement patterns. As such, this particular disruption should unwind in the first week or two of December. Meanwhile a further easing of local restrictions and interstate border controls should drive a continued lift in travel and hospitality activity.”

2.55pm: ASX hits fresh 3-day high

Slight gains in US stock index futures lifted the Australian share market to a fresh 3-day high in generally quiet mid-afternoon trade as resources continue to surge.

After an early rise to 6626.3, the S&P/ASX 200 dipped to 6601 before rising to 6628.20, its highest point since February 27th. At its high today the index was up 0.6pc.

The additional rise came as S&P 500 futures rose 0.2pc and Nasdaq futures rose 0.3pc.

Apart from gold stocks, resources stocks have continued to surge after commodity prices rose overnight. Fortescue rose 14pc, Rio Tinto rose 6pc and BHP rose 4.3pc after Vale cut annual output expectations and flagged only a limited lift in production in 2021.

Woodside, Beach and Viva Energy rose more than 2pc after a rise in US crude inventories and reports that OPEC+ made headway toward sustained output cuts.

Whitehaven Coal rose 9pc as Bloomberg reported that China was set to allow an Australian thermal coal cargo ashore amid the recent ban.

But breadth is lacking - all sectors apart from Materials and Energy are in the red.

Falls in the Financials sector are particularly disappointing given that US 10-year bond yields surged to a three-week high overnight.

The S&P/ASX 200 was last up 0.5pc at 6621.

2.47pm: First home buyers re-enter market

The HomeBuilder grant and low interest rates has pushed first home buyers into the market, with new home lending hitting record highs in October.

Figures from the ABS show new loan commitments hit $22.7bn in October, up 0.7 per cent from the month prior and 23.3 per cent from October last year .

Owner occupied construction lending rose by 10.9 per cent in October to reach $2.85bn, up 85.5 per cent year on year and 65.6 per cent since July when the HomeBuilder grant was introduced.

External refinance fell off its recent highs, down 7.1 per cent month to month but still up 22.9 per cent year on year at $12.1bn.

The value of owner occupier first home buyer loan commitments rose 3.1 per cent month to month, while the total number of owner occupier first home buyer loan commitments rose by 3.4 per cent.

First home buyer loan commitments comprised 35.3 per cent of all owner occupier commitments, excluding refinancing.

Lilly Vitorovich 2.43pm: Cricket fans flock to Foxtel

The latest cricket series between Australia and India, which was exclusively broadcast on Foxtel and Kayo, has proved hugely popular with sports fans.

The third and final One Day International, which saw India beat Australia by 13 runs on Wednesday night but lose the series, boasted an average audience of 435,000 viewers across Foxtel’s pay-television and streaming platforms (Foxtel, Foxtel Go/Now and Kayo).

That’s up 33 per cent from last year’s final ODI game.

The second session, which went well into Wednesday night, attracted an audience of 552,000.

The ODI series attracted an average audience of 498K across Foxtel’s platforms, and was the highest rating ODI series in subscription television (STV) history. That’s up 31 per cent from 379,000 viewers on the three-game ODI series against last year.

The strong audience numbers bodes well for the T20 series between Australia and India, which kicks-off on Friday night. The second match will be played on Sunday followed by the third and final game on Tuesday.

The second ODI was the most-watched ODI game ever on STV with 586K, surpassing the 2015 World Cup Final, which had an audience of 544,000.

The second game is also the third most-watched sporting match across STV platforms ever behind the 2011 Rugby World Cup semi-final (734,000) and final (649,000.)

1.45pm: Omni Bridgeway mulls listing options

Litigation funder Omni Bridgeway is reviewing its international listing options but currently favours the London Stock Exchange as it looks to access capital to expand its geographic footprint over the next five years.

At an investor briefing, the company said it is looking to expand into New Zealand, Latin America, South Korea, Japan, India and parts of Africa as it looks to raise its funds under management from $2bn to $5bn while increasing its headcount from 161 to 210.

Omni Bridgeway said it was undergoing a review “designed to test various options in relation to listing venue, including dual vs sole,” indicating it is considering leaving the ASX.

Omni Bridgeway and others in the litigation funding industry have felt the impact of new government regulations that require them to hold Australian Financial Service Licences and conduct businesses as a managed investment scheme.

The industry says these rules are not “fit for purpose” and will reduce return for investors and class action members.

Last night Labor sought to disallow these regulations in the senate, but was foiled when One Nation said it would work with the government to amend the rules next year.

Ben Wilmot 12.46pm: Analysts back Investec moves

Investec Australia Property Fund’s recent internalisation of its management and acquisition of rights to run an unlisted opportunistic trust could provide an earnings boost, according to Macquarie analysts.

The move also aligned the interests of management and shareholders and the asset management platform provided an avenue for growth alongside stabilised assets.

“While the financial benefits of internalisation are moderate, internally-managed vehicles generally trade ahead of those that are externally managed,” Macquarie said.

The opportunistic TAP fund is targeting a total equity commitment of $300m which could provide additional upside to earnings with Macquarie rating the stock Outperform.

Ben Wilmot 12.42pm: Elanor builds health real estate empire

Listed real estate fund manager Elanor Investors Group’s main health fund has bought a medical facility in the Rockingham in Western Australia, as it expands in the rising asset class.

The $22.9m acquisition of the centre at 2 Civic Boulevard reflects a 5.75 per cent capitalisation rate and was the fourth acquisition for the fund since it was set up in March.

Buying the three-level medical facility took the fund’s value to more than $183m.

The acquisition is the fourth for Elanor’s funds management business in the last quarter and follows the recent acquisitions of Riverside Plaza, Burke Street, and Logan Road.

Patrick Commins 12.36pm: Iron ore dominates trade surplus lift

There’s no immediate sign of damage to overall export earnings from Chinese trade aggression, after Australia’s trade surplus lifted $1.6bn to $7.5bn in October.

No surprise that the solid monthly boost was dominated by a $1.7bn - or 14 per cent - surge in metal ore shipments, according to the seasonally adjusted figures from the Australian Bureau of Statistics.

The figures showed the value of exports of goods and services in October rose $1.8bn, or 5 per cent, from a month before to $35.7bn, while imports lifted $178m, or 1 per cent, to $28.3bn..

With foreign borders closed, the trade data is really about changes in the value of merchandise.

There was an 8 per cent lift in rural goods exports to $3.5bn, and also an 8 per cent increase in non-rural exports, to $25bn - a figure dominated by the above-mentioned metal (iron) ore component.

With stories of customs duties slowdowns in China and ships stuck outside ports, coal sales dropped 2 per cent to $3.2bn.

The effect of the pandemic can be seen in the fall in exports versus the end of 2019, alongside a much larger fall in services - both in and out of the country.

Relative to the end of last year, export earnings are down by 12 per cent, with goods 4 per cent lower and services down by 41 per cent, on Westpac calculations. Imports are 20 per cent down on pre-pandemic levels, with goods exports off by 8 per cent and services 58 per cent lower.

12.17pm: New car sales turn a corner

New car sales lifted for the first time in two and a half years in November as the Australian economy kicked back into gear, according to new figures from the Federal Chamber of Automotive Industries.

Over November a total of 92,205 new vehicles were sold across the country, an increase of more than 10,000 sales - or 12.4 per cent on November 2019.

It is the first time the new car industry has recorded a year-on-year sales increase since April 2018 - 31 months ago.

Tony Weber, chief executive of the FCAI, said the industry was pleased to see an uptick in sales. “Recent Australian new vehicles sales have seen 31 months of straight decline,” Mr Weber said.

“This has been caused by a number of well recognised factors, including the COVID-19 pandemic, and environmental and financial issues.

“With the Australian economy showing improvement, it’s good news to see new vehicle sales trending in a more positive direction.”

12.06pm: Shares fade with $A after early rise

Australia’s share market remains higher at midday but halved its early gain, alongside a slight pullback in the Australian dollar.

The S&P/ASX 200 was up 0.3pc at 6610 after rising as much as 0.6pc to a three-day high of 6626.8, amid buoyant offshore markets and strong gains in iron ore miners.

The Aussie dollar meanwhile had fallen 0.2pc to US73.98c since the New York close, after hitting a more than three-year high of US74.19c, marginally above an early September September peak of US74.14c.

The early rise in the currency followed a record high close in the US share market and commodity price gains including a 2.8pc jump in spot iron ore to a six-year high of $US136.75 a tonne.

Fortescue Metals surged 12pc, Rio Tinto rose 4.4pc and BHP was up 3.6pc, as the iron ore price rose after Vale cut annual output expectations again and flagged only a limited lift in production in 2021.

But apart from the materials sector, energy was the only other sector still in the green at lunch, with Woodside Petroleum up 1.9pc.

Banks and insurers weighed on the market, as an early rise in government bond yields proved short lived.

Westpac was down 0.5pc after accepting an enforceable undertaking from APRA over past anti-money laundering claims.

Macquarie Group was down 0.3pc, with no reaction to news that it’s buying US wealth manager Waddell & Reed for $2.3bn.

12.01pm: AppsVillage soars on TikTok deal

Software solutions provider AppsVillage has surged 77 per cent following an announcement it will partner with TikTok to allow small and medium business to advertise on the platform.

Shares in the company are now trading at 0.17 cents, giving the company a market capitalization of $16.9m.

AppsVillage CEO and Founder Max Bluvband said through AppsVillage companies will be able to create and manage ad campaigns on the popular app in three minutes.

Patrick Commins 11.55am: Home lending surges

A surge in new lending to build houses has driven new home loan commitments to an all-time high of $22.7bn in October, as Australians rushed to take advantage of record low borrowing costs and incentives such as the government’s HomeBuilder scheme.

New borrower accepted commitments lifted 0.7 per cent, the seasonally adjusted figures from the Australian Bureau of Statistics showed.

New lending to owner-occupiers (that is, not investors) climbed 0.8 per cent to $17.4bn - an incredible 30 per cent higher than a year earlier, the ABS reported.

Commitments for the construction of new dwellings jumped 10.9 per cent and was the largest contributor to the lift in owner occupier new lending.

ABS head of finance and wealth Amanda Seneviratne said the value of construction loan commitments has risen by 66 per cent since July, “which coincides with the June 2020 implementation of the government’s HomeBuilder grant in response to COVID-19”.

“Feedback from lenders was that there has been a large increase in first home buyers applying for these construction loans over the last few months,” Ms Seneviratne said.

The offers cash grants for housing construction projects and has been extended from December to March, but at a lower amount $15,000 rather than $25,000.

The new figures come a day after national accounts figures confirmed the country bounced out of the COVID-19 recession over the September quarter.

Perry Williams 11.47am: Chevron names new Australian chief

Energy giant Chevron has appointed a new Australian boss, Mark Hatfield, with Al Williams to depart after two years in the role.

Chevron - which operates the Gorgon and Wheatstone LNG projects in Western Australia - has relocated Mr Hatfield, who was previously the US major’s head of its Gulf of Mexico unit.

Mr Williams, in charge of Chevron’s Australian unit since January 2019, has been appointed vice president of corporate affairs, reporting to chief executive Michael Wirth.

Mr Hatfield will be based in Perth and start on March 1, 2021.

Mr Williams has endured a mixed few years in charge amid one of the biggest oil market crashes seen in a generation.

Chevron cut up to 600 Australian jobs due to a “perfect storm” of the pandemic and crude slump and more recently suffered a major outage at its Gorgon LNG plant.

The energy operator in June kickstarted one of the biggest shake-ups in the state’s LNG sector for decades after indicating it would sell its 16.7 per cent stake in the $34bn North West Shelf plant, operated by rival Woodside Petroleum.

11.09am: Booktopia makes strong ASX debut

Shares in online book retailer Booktopia have listed on the ASX at $2.86, representing a healthy 24.3 per cent stag profit on the initial public offer price of $2.30.

Booktopia was founded in 2004 in Sydney by chief executive Tony Nash, Simon Nash and Steven Traurig.

The offer price was $2.30 a share, with total proceeds of the float to be $43.1m and the book retailer to emerge on the market with a market capitalisation of $315.8m and enterprise value of $299.5m.

Shares listed at $2.86 and on Thursday morning traded as high as $2.90.

It came amid buoyant market conditions, with the ASX200 rising as much as 0.6pc to a 3-day high of 6626.8.

Earlier, Booktopia issued a trading update and set itself a target of using robots in its distribution centre next year.

It said that based on unaudited management accounts for July to November 2020, the key trading measures - including total units shipped and average order value - are tracking in line with forecasts provided in its prospectus.

It also announced the first stage of its investment of $20 million in the distribution centre is now completed and fully operational in time for the traditional pre-Christmas sales period.

It said as part of stage 2 the company will commence a trial of autonomous robots at the distribution centre in early 2021.

10.55am: Sezzle on track to beat guidance

Listed buy now pay later provider Sezzle set new records over the month of November, with underlying merchant sales up 188.5 per cent year on year to $153.8m.

It brings annualised underlying merchant sales to US$1.36bn, ahead of company’s guidance of achieving annualised sales of $US1bn.

Active consumers crossed over two million for the first time in November while the number of active merchants reached 24,846, up 164.5 per cent year on year.

Over the Black Friday-Cyber Monday shopping weekend, a four day total of $US28.5m was reached, a 146.4 per cent increase on last year.

10.52am: Analysts bullish on iron ore

Analysts are converging on a bullish view on iron ore following Brazilian miner Vale cutting annual output expectations overnight, sending the benchmark price to six year highs in excess of $US136 a tonne.

Analysts at Macquarie say demand for iron ore from China will remain strong, while high steel margins and low port stocks will ensure there will be a constant need to produce more ore, which is likely to favour Australian miner Fortescue Metals Group.

RBC Capital Markets believe port inventories in China will unwind to levels last seen in 2015 as steel production growth rates in China run at 15 per cent year on year growth.

“The iron ore market is therefore likely in our view to stay in a very tight position, for at least another 6 months,” the analysts said.

“In our view, this will likely serve to drive expectations of both consensus iron ore prices higher, but also the willingness for the market to price these cashflows into the equities.”

Eli Greenblat 10.47am: Booktopia to list, plots robot rollout

Online book retailer Booktopia has issued a trading update as it prepares to list on the ASX today, and set itself a target of using robots in its distribution centre next year.

It said that based on unaudited management accounts for July to November 2020, the key trading measures - including total units shipped and average order value - are tracking in line with forecasts provided in its prospectus.

It also announced the first stage of its investment of $20 million in the distribution centre is now completed and fully operational in time for the traditional pre-Christmas sales period.

“Stage 1 has increased outbound potential capacity from 30,000 units to 60,000 units per day, and includes a purpose-built mezzanine, more conveyor lines and new packing machines,” the company said.

It said as part of stage 2 the company will commence a trial of autonomous robots at the distribution centre in early 2021.

“The robots can increase operational efficiency by up to four times and increase storage capacity by 80 per cent.”

Ben Wilmot 10.42am: Charter Hall to develop Visy facility

The acquisitive Charter Hall Group’s largest industrial fund, the $5.8bn Prime Industrial Fund, has snapped up a 6.45 hectare site in the Melbourne suburb of Epping, where it will build a new facility for an arm of the Visy empire.

The company has agreed a 34,777sq m pre-lease to Visy Logistics for a ten-year term starting in March 2021, when the facility is expected to be completed.

The 33,800 sq m high clearance warehouse will comprise eight recessed loading docks and 11 at-grade roller door access points with 20–35 metre wide canopies. The facility will also include a two level office of circa 1,059sqm and parking areas.

Visy has signed a ten-year net lease with three five-year options and fixed annual rent reviews of 3.25 per cent. Visy will be relocating from CPIF’s Somerton Logistics Centre.

Charter Hall’s chief investment officer, Sean McMahon, said that Visy has grown to become a major tenant of Charter Hall as it occupied more than $290m of assets.

Charter Hall also undertook a $215m sale and leaseback of three assets from Owens-Illinois Australia which is now a subsidiary of Visy.

10.40am: Gold set to retreat: Macquarie

Analysts at Macquarie believe the gold price is beginning to slide back towards “fair value” after reaching November highs of $US1957.45 an ounce, but retain a neutral longer term outlook on the price.

They say the current downwards pressure on the price is due to momentum selling and ETF liquidation, with gold ETF holdings are down 3.5Moz from their 11Moz high

They also said the November PMI numbers would also put downwards pressure on the gold price through 2021, but sustained weakness in the US dollar and the upcoming Federal Reserve Open Market Statement may push investors into the safe-haven asset if they feel the economy isn’t performing, pushing up the price.

Silver Lake Resource is the established gold miner most favoured by the analysts, while juniors Westgold Resources and Bellevue Gold were singled out for operational leverage and development potential respectively.

Spot gold was last trading near $US1929 in late US trade.

10.23am: Iron ore drives ASX gain

Australia’s S&P/ASX 200 share index rose 0.4pc to a three-day high of 6618.1 in early trading.

Strength has mostly been driven by the heavyweight iron ore miners as the spot price surged after Vale cut annual output expectations again and flagged only a limited lift in production in 2021.

Fortescue Metals has surged 10pc, while BHP is up 4pc and Rio Tinto is up 3.8pc.

The Energy sector is up on higher commodity prices with Origin up 1.4pc, while Xero and Computershare are supporting the Tech sector.

But Financials are surprisingly weak considering the rise in bond yields which helps their business.

Kogan was up more than 5 per cent following the $122.4m of New Zealand online retailer, Mighty Ape

10.03am: Aussie dollar at over two-year high

The Australian dollar hit a more than two-year high of US74.19c, slightly above its September peak of US74.14c.

A sustained break above this level would target a move to the next chart point at US76.50 and could ultimately set it up for a test of US80.00.

It comes as buoyant global risk assets and rising bond yields outweigh any concern about deteriorating relations with China.

As well as a fresh record high close on the S&P 500 last night, spot iron ore rose 3.6pc to a six-year high of $US136.75, WTI crude rose 1.5pc to $US45.23 and spot gold rose 0.9pc to $US1831.40, although base metals fell.

Iron ore jumped after Brazilian iron ore giant Vale cut annual output expectations again and flagged only a limited lift in production in 2021.

Crude oil rose as US crude oil inventories fell by 679,000 barrels last week and amid reports that OPEC+ has made headway toward a deal on oil output cuts.

Australia’s 10-year bond yield has touched a three-month high of 1.008pc following a surge in US bond yields after Republican senators tabled a $980bn bill which for one would extend extra unemployment benefits through Jan 31st.

The Aussie dollar was the top-performing G-10 currency on Thursday, rising 0.6pc.

It may crimp the share price performance of non-commodity producing offshore income earning companies.

The Aussie dollar was last trading around US74.15c.

9.41am: ASX to open higher, commodities to shine

Australia’s share market is expected to rise on the back of buoyant offshore markets.

Overnight futures relative to fair value suggest the S&P/ASX 200 index will open up 0.4pc near Wednesday’s high of 6616.

While offshore markets were generally quiet, the FTSE100 rose 1.2pc after the Pfizer-BioNTech vaccine was approved for use in the UK with vaccinations to start next week.

The S&P 500 rose 0.1pc to a fresh record daily closing basis high of 3667 amid outperformance from the Energy, Financials, Communications, Health Care and Utilities sectors.

While the S&P 500 Materials sector was weakest, resources stocks should benefit from firmer commodity prices.

Spot iron ore rose 3.6pc to a 6-year high of $US136.75, WTI crude rose 1.5pc to $US45.23 and spot gold rose 9pc to $US1831.40, although base metals fell.

Despite worsening Australia-China trade relations, London-listed shares of BHP and RIo Tinto surged 4.8pc and 5.6pc respectively.

BHP ADR’s equivalent close at $40.73 was a 3.6pc premium to BHP’s close in London.

Sharply higher bond yields should boost the Financials sector, with the US 10-year bond yield up 12bp to 0.94pc.

Australia’s 10-year bond yield has touched a 3-month high of 1.008pc and AUD/USD has hit a more than 2-year high of 0.7419, slightly above its September peak of 0.7414.

Macquarie may jump after agreeing to buy US wealth manager Waddell & Reed, but Westpac may lag after accepting an enforceable undertaking from APRA over past money laundering charges.

APRA said Westpac failed to deliver expected risk governance improvements despite almost two years of remediation, undermining confidence in Westpac’s ability to quickly remediate these weaknesses.

9.35am: G8 hit with class action

G8 Education has confirmed it has been served with class actions proceedings filed in the Victorian Federal Court by Slater and Gordon.

The claim was brought on behalf of investors who acquired G8 shares between 23 May 2017 and 23 February 2018, and were allegedly impacted financially after the ASX 200 company failed to disclose to the market material information relevant to its 2017 financial performance.

Slater and Gordon practice group leader Andrew Paull said investigations indicated that at the time G8 made its May 2017 forecast, it knew that it faced an increase in costs as a result of regulatory changes affecting staffing levels, and that it was unlikely to increase its occupancy rate to the level required to achieve the May 2017 Forecast

Nick Evans 9.28am: Iron ore price surges after Vale cut

Australian iron ore miners are set for another strong run after Brazilian iron ore giant Vale cut annual output expectations again and flagged only a limited lift in production in 2021.

Overnight, Vale cut 2020 production guidance to 300 million to 305 million tonnes, down from previous expectations of 310 million and 330 million tonnes.

Vale says it expects 2021 output to rise to between 315 million and 335 million tonnes.

The benchmark price for iron ore immediately surged on the news, topping $US136 a tonne and hitting fresh six-year highs on the expectation of supply shortages in the first quarter of next year as China’s steel industry powers ahead.

Vale’s ongoing woes are likely to further bolster the earnings of BHP, Rio Tinto and Fortescue Metals Group, along with smaller Australian miners such as Mineral Resources and Mount Gibson Iron, which have already cashed in on high iron ore prices over the last two years.

RBC Capital Markets resources analyst Broda Tyler said he expected a shortfall in iron ore supply in 2021, with markets to “stay in a very tight position” for at least another six months.

Fortescue closed Wednesday at $18.23, Rio Tinto at $104.99, BHP at $39.31, MinRes at $31.87 and Mount Gibson at 73.5c.

Eli Greenblat 9.23am: Kogan buys NZ’s Mighty Ape

Online retail marketplace Kogan.com has extended its reach into New Zealand after agreeing to pay $122.4 million online store Mighty Ape.

It comes after a number of Kogan deals to expand its coverage including the acquisition of furniture brand Matt Blatt and the online business of consumer electronics store Dick Smith.

Mighty Ape is one of New Zealand’s leading online retailers, with a focus on gaming, toys and other entertainment categories.

Kogan.com said the combination of two market leaders would enabled Mighty Ape to build on its strong customer offering, and provides the infrastructure to further scale.

Mighty Ape is forecast to post 2021 revenue of $A137.7 million, gross profit of $45.7 million and EBITDA of $14.3 million.

The Mighty Ape online business has more than 690,000 unique customers , and more than 895,000 subscribers.

The purchase price of $122.4 million, payable over four tranches and subject to variation under earn out through to delivery of 2023 financial results.

9.19am: Macquarie buys US wealth manager for $US1.7bn

Macquarie Group has agreed to buy NYSE-listed US-based asset and wealth manager, Waddell & Reed for $US25 a share cash, in a deal worth $US1.7bn ($2.3bn).

On completion of the transaction, Macquarie has agreed to sell Waddell & Reed’s wealth management platform to LPL Financial Holdings for $US300m plus excess net assets.

Macquarie will also enter into a long-term partnership with LPL, making Macquarie one of LPL’s top-tier strategic asset management partners.

It expects the increased scale and diversification of the combined platform to create significant long-term benefits for clients, advisors and shareholders.

Macquarie Asset Management’s AUM are expected to increase to over $US465 billion ($650 billion, making the combined business becoming a top 25 actively managed, longterm, open-ended US mutual fund manager by assets under management, with the scale and diversification to competitively position the business to maintain and extend its high standards of service to clients and partners.

Robyn Ironside 8.42am: Qantas upbeat despite looming loss

Qantas remains on track for a substantial loss in the 2021 financial year but will start making repairs to its balance sheet in the next six months following the devastating impact of COVID-19.

In an upbeat market update, the airline forecast a return to 80 per cent of pre-COVID domestic capacity early next year, following strong demand for flights on the back of border reopenings.

Qantas boss Alan Joyce said the airline would be at close to 70 per cent of capacity in December which was “very positive compared to where we’ve been”.

“Between Qantas and Jetstar there were over 200,000 fares sold for flights to Queensland in the 72-hours after border reopenings with Sydney and Victoria were announced,” Mr Joyce said.

“We’re also seeing people book several months in advance, which reflects more confidence than we’ve seen for some time.”

He warned they were still a “long way off anything approaching normal” and no significant international flights would take place before the 2022 financial year.

8.30am: What’s impressing analysts?

Evolution Mining cut to Hold: Jefferies

Sims cut to Sell: Morningstar

Worley cut to Underweight: JPMorgan

8.21am: Westpac in risk pledge after APRA concerns

The prudential regulator has agreed to a court enforceable undertaking from Westpac, which is pledging to “substantially its efforts to address risk governance deficiencies”.

It comes after the Australian Prudential Regulatory Authority “expressed concerns with the bank’s progress in remediating weaknesses including an immature and reactive risk culture, unclear accountabilities, capability shortfalls, and inadequate oversight.”

APRA said its concerns emanate from the review into Westpac that commenced late last year after AUSTRAC made allegations of anti-money-laundering breaches in relation to the bank’s failure to report more than 19.5 million instructions for overseas money transfers to the financial crimes regulator.

Additionally, APRA was concerned that Westpac’s June 2020 reassessment of its processes highlighted that changes made in risk governance had been only “incremental.”

In the statement of claim AUSTRAC said a number of these transactions were “suspicious” transfers sent to the Philippines, and could have been for the purposes of child exploitation.

The case resulted in the largest corporate civil penalty in Australian history - $1.3bn - and claimed the scalp former CEO Brian Hartzer,

In its statement, APRA said it had concluded that the bank’s “customer outcomes and risk excellence programis not sufficiently far-reaching” to address “wide-ranging risk governance gaps.”

Additionally, the regulator said “long-standing weaknesses remain unaddressed, and have contributed to new prudential issues; and weak execution was a key root cause of the bank’s risk governance issues.”

“APRA’s conclusion is that Westpac has failed to deliver the expected risk governance improvements despite almost two years of remediation,” the regulator said on Thursday.

“This has undermined APRA’s confidence in Westpac’s ability to remediate these weaknesses in a timely manner.”

The enforced undertaking requires Westpac to develop an integrated plan that incorporates all its risk management programs, obtain independent assurance over the implementation of the plan and assign accountabilities for its delivery to named executives and the board, with outcomes included in remuneration decisions.

8.07am: US stocks close higher

Wall Street ended higher after struggling to find direction for most of the day.

All three major US indexes tumbled after the opening bell, with the Dow Jones Industrial Average falling more than 200 points, before paring losses.

By mid-afternoon, after signs emerged that lawmakers were willing to engage in stimulus talks, the S&P 500 and Dow Jones Industrial Average jumped into positive territory. The blue-chip index as of the close of trading in New York was about 60 points higher, rising 0.2 per cent. The S&P 500 also rose 0.2 per cent, setting a fresh closing record.

The Nasdaq Composite, meanwhile, dropped less than 0.1 per cent.

Both the S&P 500 and the Nasdaq notched records yesterday.

The market has been propelled higher in recent weeks by optimism that Covid-19 vaccines will help accelerate the economic rebound. That has led to a jump in stocks that are sensitive to economic growth, including energy and banks and recently helped the Dow vault above 30000 for the first time.

Overnight, however, much of that momentum moderated, even after the U.K. granted emergency-use authorization for a Covid-19 vaccine developed by Pfizer and BioNTech. Public health experts expect that a similar authorization in the U.S. could come later this month.

“That’s exciting but that was also expected,” Chris Konstantinos, chief investment strategist at RiverFront Investment Group, said of the U.K.’s green light of the vaccine. “We’re in a bit of an information vacuum. We’re through earning season and now the market is kind of waiting until the end of the year and watching vaccine news and stimulus news.”

Still, investors say they are optimistic about the equity markets in the months ahead as they anticipate a strong economic recovery once swaths of the population are vaccinated in the U.S. next year. The Federal Reserve’s commitment to providing sustained stimulus has also extended investors’ risk appetite.

Overnight, small signs that U.S. lawmakers were willing to engage in negotiations over a new coronavirus-aid package helped stocks trim their early-morning losses, some traders said. But the likelihood of stimulus remains uncertain. U.S. lawmakers this week reignited talks for coronavirus relief packages, with House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin discussing measures by phone for the first time since the election.

Overseas, the Stoxx Europe 600 edged down slightly. Conflicting reports about the status of the talks between the European Union and the U.K. on a post-Brexit trade deal led to choppy trading in the region.

Dow Jones Newswires

Bridget Carter 7.29am: Major shareholder quits Healius

Institutional investors have bought up stock in Healius after major shareholder Jangho sold its stake in the company on Wednesday night for $3.55 per share.

The 14.9 per cent interest in the healthcare provider was offloaded through broker Jarden and comes after former suitor Partners Group had an option over the shares in the $2.3 billion company that it bought for $3.30 per share.

Healius shares closed at $3.70 on Wednesday.

Partners made a $2.1 billion takeover bid for Healius at the start of the year that was rejected by the company board.

It offered $3.40 per share.

China’s Jangho had a stake of about 15.9 per cent that it started purchasing in 2016 when shares were trading around the $4 mark.

Two years ago, it made a $2bn takeover bid for Healius.

The offer was rebuffed by the board. And it was also expected to face challenges obtaining Foreign Investment Review Board approval for its proposal.

Since the Partners bid, Healius has sold off its medical centres for $500m to BGH Capita, leaving it largely with a diagnostic imaging and pathology arm.

Partners was expected to let its option in the Jangho stake lapse, as earlier reported by DataRoom.

The option lapsed last month.

7.04am: ASX poised for early gain

Australian stocks are set to open a little higher as global markets marked time, as a rally fuelled by vaccine hopes petered out.

This was despite confirmation that the UK will next week begin rolling out the Pfizer-BioNTech drug against COVID-19.

Around 7am (AEDT) the SPI futures index was up 26 points, or 0.4 per cent.

Yesterday, the ASX ended flat.

The Australian dollar is higher at US74.00c.

Iron ore jumped 2.8 per cent to a new six-year high of $US136.75 a tonne.

Brent oil rose 1.8 per cent to $US48.25 a barrel.

6.50am: Wall St wobbles between small gains and losses

US stocks rose in afternoon trading after struggling to find direction for most of the day.

All three major U.S. indexes tumbled after the opening bell, with the Dow Jones Industrial Average falling more than 200 points, before paring losses.

By mid-afternoon, after signs emerged that lawmakers were willing to engage in stimulus talks, the S&P 500 and Dow Jones Industrial Average jumped. The blue-chip index was recently trading about 30 points higher, rising 0.1pc. The S&P 500 rose 0.1pc.

The Nasdaq Composite, meanwhile, dropped 0.1pc.

Both the S&P 500 and the Nasdaq notched records yesterday.

The market has been propelled higher in recent weeks by optimism that Covid-19 vaccines will help accelerate the economic rebound. That has led to a jump in stocks that are sensitive to economic growth, including energy and banks and recently helped the Dow vault above 30000 for the first time.

Dow Jones

6.36am: ECB defends private calls to investors

The European Central Bank’s chief economist plans to place private calls to banks and investors after the ECB’s policy meeting next week, he said, continuing an unusual communications practice that has raised eyebrows among financiers and central-bank officials.

Since March, Philip Lane, the chief economist, has spoken directly with a select group of global institutions in the hours after the bank’s policy decisions, in an effort to clarify its sometimes puzzling public pronouncements, according to people with whom he spoke and a review of his schedule.

The calls, reported by The Wall Street Journal, break with the central bank’s usual practice of delivering information to all market participants at the same time. They were made to big investors such as BlackRock Inc. and banks such as Goldman Sachs Group Inc. and JPMorgan Chase & Co.

“Our standing approach right now is to continue those calls,” Mr. Lane said in an interview with Reuters published Wednesday on the ECB’s website.

“It’s a structured, systematic approach where we rotate across different types of ECB watchers,” Mr. Lane said. “It’s also true that we should always review and keep in mind our communication policy.”

Dow Jones

6.30am: Fed sees more signs US activity slowing

More US regions saw economic activity stall or slow in November as COVID-19 cases surged, and businesses were less upbeat about their prospects, the Federal Reserve said.

The Fed’s beige book survey of economic conditions said four of 12 regions saw little or no growth, while four others saw activity dip last month.

While firms in most districts still have positive outlooks, “optimism has waned” amid “concerns over the recent pandemic wave, mandated restrictions (recent and prospective), and the looming expiration dates for unemployment benefits and for moratoriums on evictions and foreclosures,” the report said.

AFP

5.20am: Wall Street wobbles

US stocks slipped, pulling back from the previous day’s record highs as rising coronavirus cases and a murky outlook for a coronavirus stimulus weighed on investor sentiment.

All three major US indexes tumbled after the opening bell, with the Dow Jones Industrial Average falling more 200 points, before paring losses.

In lunchtime trade the blue-chip index was down 0.1 per cent. The S&P 500 was teetering between small gains and losses, up just 0.3 per cent, a day after the benchmark set its 27th closing record of the year. The Nasdaq Composite, meanwhile, dropped 0.14 per cent after also setting a record Tuesday.

The market has been propelled higher in recent weeks by optimism that COVID-19 vaccines will help accelerate the economic rebound. That has led to a jump in stocks that are sensitive to economic growth, including energy and banks and recently helped the Dow vault above 30000 for the first time.

However, much of that momentum moderated, even after the UK granted emergency-use authorisation for a COVID-19 vaccine developed by Pfizer and BioNTech. Public health experts expect that a similar authorisation in the U.S. could come later this month.

“That’s exciting but that was also expected,” Chris Konstantinos, chief investment strategist at RiverFront Investment Group, said of the U.K.’s green light of the vaccine. “We’re in a bit of an information vacuum. We’re through earning season and now the market is kind of waiting until the end of the year and watching vaccine news and stimulus news.”

Still, investors say they are optimistic about the equity markets in the months ahead as they anticipate a strong economic recovery once large swathes of the population are vaccinated in the U.S. next year. The Federal Reserve’s commitment to providing sustained stimulus has also extended investors’ risk appetite.

“Why would you be a seller of stocks when you know that policy support, both fiscal and monetary, is there and probably will be there going forward?” said Derek Halpenny, head of research for global markets in the European region at MUFG Bank.

He added that he expects stocks to continue rallying in coming weeks, despite valuations that appear to be stretched.

U.S. lawmakers this week reignited talks for coronavirus relief packages, with House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin discussing measures by phone for the first time since the election.

But investors remain sceptical about the prospects for fresh stimulus spending in the weeks before President-elect Joe Biden is sworn in.

Overseas, the Stoxx Europe 600 edged down 0.1 per cent. Conflicting reports about the status of the talks between the European Union and the U.K. on a post-Brexit trade deal led to choppy trading in the region.

In Asia, the major stock indexes ended trading on a muted note. Japan’s Nikkei 225 closed almost flat, while the Shanghai Composite Index and Hong Kong’s Hang Seng Index slid roughly 0.1 per cent.

Dow Jones Newswires

5.08am: Partner sought for Marengo project

Rockfire Resources said it is planning to seek interest from parties to form a farm-in and joint venture for the Marengo project in Queensland, Australia.

The London-listed mining company added that it is looking for a partner to explore the project on its behalf as it wants to focus resources on the Lighthouse, Copperhead and Copper Dome projects in Australia.

“The company remains strongly focused on organic exploration success and, as usual, Rockfire is extremely busy with its exploration efforts, with a large amount of ongoing work across our various projects,” Chief Executive David Price said.

Dow Jones Newswires

5.05am: Stocks pause after vaccine-fuelled rally

Stock markets marked time as a rally fuelled by vaccine hopes petered out despite confirmation that the UK will next week begin rolling out the Pfizer-BioNTech drug against COVID-19.

As is often the case, stock markets rally on hopes of good news and then fall back when the anticipation becomes reality.

“The lack of market reaction suggests that this decision was probably widely expected at some point,” noted Michael Hewson, chief market analyst at CMC Markets UK.

On Wednesday, Britain became the first western country to approve a COVID-19 vaccine for general use, a major advance in the fightback against the coronavirus.

London’s FTSE 100 was the only index to post a major gain, up 1.2 per cent, although that may have been mostly due at drop in the value of the pound, which tends to boost the value of multinationals with most of their earnings in dollars.

Frankfurt shed 0.5 per cent and Paris closed up less than 0.1 per cent.

The pound slid against the dollar and euro, as EU Brexit negotiator Michel Barnier told diplomats he could not guarantee a trade deal being agreed with Britain ahead of a December 31 deadline.

Elsewhere in trading, oil prices rose on reports that OPEC and other major producers have made progress towards reaching an agreement on extending output cuts that have provided support to the commodity through the pandemic. They were set to meet again on Thursday.

AFP

5.00am: China passes US as Europe’s top trade partner

China pushed past the United States in the third quarter to become the European Union’s top trade partner, as the COVID-19 pandemic disrupted the US while Chinese activity rebounded.

Over the first nine months of 2020, trade between the EU and China totalled 425.5 billion euros ($US514 billion), while trade between the EU and the United States came in at 412.5 billion euros, according to Eurostat data.

For the same period in 2019, the EU’s trade with China came in at 413.4 billion euros and 461 billion euros with the US.

Eurostat said the result was due to a 4.5 per cent increase in imports from China while exports remained unchanged.

AFP

4.57am: Peugeot-Citroen to offer electric versions of all vans

French automaker PSA said it would offer all-electric versions of all its van models by the end of 2021 as it moves towards offering electric versions for its entire line-up by 2025.

“Following the 2020 launch of electric versions of their medium van models (D-Van) and large van (E-Van), the four PSA brands, Peugeot, Citroën, Opel and Vauxhall will complete their line-ups in 2021 with all-electric versions of their compact van (B-Van) and associated passenger cars.

That means Peugeot’s Partner, Citroen’s Berlingo and the Opel/Vauxhall Combo will get electric versions.

PSA has considerable progress to go to meet its 2025 target as its brands offer only 2 all-electric passenger car models each at the moment.

AFP

4.55am: Boeing 737 MAX flight aims to reassure

The Boeing 737 MAX was to take another key step in its comeback to commercial travel with an American Airlines test flight for news media.

After being grounded for 20 months following two deadly crashes, US air safety officials in mid-November cleared the MAX to return to service following changes to the plane and pilot training protocols.

American Airlines plans an initial commercial flight on December 29. The test flight Wednesday between American’s headquarters in Dallas and its maintenance centre in Tulsa, is intended to bolster public confidence in the jet.

The MAX had been a cash cow for Boeing prior to the Lion Air and Ethiopian Airlines crashes that together claimed 346 lives. But those calamities plunged the aerospace giant into a crisis that was worsened by the coronavirus and its devastating impact on commercial air travel.

AFP

4.53am: US private job growth slows

US private employment continued to grow in November albeit at a slower-than-anticipated rate, according to private data, raising fears the US economy’s momentum was slowing amid the renewed COVID-19 wave.

Payroll services firm ADP said private jobs rose 307,000 last month, seasonally adjusted, with firms of all sizes showing increases, though that gain was slower than October’s upwardly revised gain of 404,000.

The US economy has been recovering from mass lay-offs earlier this year caused by the COVID-19 pandemic, but those gains were fuelled in part by easing of business restrictions as well as massive spending by Congress.

Many of those federal programs have lapsed while virus cases are surging across the United States to levels not seen since the start of the outbreak.

That has raised fears that the government’s key November employment report to be released Friday will show a retreat in hiring.

AFP

4.50am: Climate goals need 6pc fossil fuel cuts: UN

Oil, gas and coal production must fall six per cent a year in order to limit catastrophic global warming, the United Nations warned, even as high-polluting nations bank on fossil fuels to drive their COVID-19 recoveries.

The UN’s annual Production Gap assessment measures the difference between the Paris Agreement climate goals and nations’ planned production of fossil fuels.

Wednesday’s edition found that despite this year’s dip in production due to the pandemic, that gap remains large: countries plan a two-percent annual increase through 2030.

This is equivalent to more than double the fossil fuel production that would be consistent with the Paris deal’s more ambitious goal of limiting warming to 1.5C above pre-industrial levels.

AFP

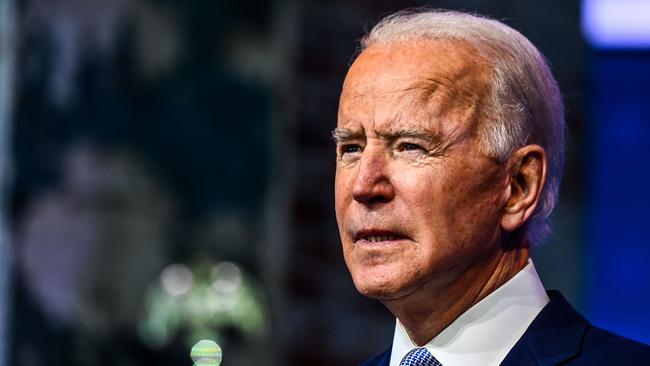

4.45am: Biden vows no quick rollback of Trump’s China tariffs

Joe Biden will keep Donald Trump’s trade-war tariffs on China for the time being when he moves into the Oval Office next month, the president-elect has told US media.

Rancor and recrimination have defined the relationship between the world’s two biggest economies over the last four years, with Trump slapping import fees on billions of dollars’ worth of Chinese goods with tariffs.

Biden meanwhile has been a strident critic of China’s human rights record and analysts have predicted his administration will maintain a hawkish posture towards Beijing.

“I’m not going to make any immediate moves, and the same applies to the tariffs,” Biden told the New York Times in an interview.

“I’m not going to prejudice my options.” Since winning last month’s presidential election, Biden has hinted at a trade policy that would mend Washington’s alliances with Europe and the Asia-Pacific.

He has said the United States must join forces with other world democracies to present a united front in global trade policy as a counterweight to China.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout