Trading Day: ASX surges after US rally, Lendi to merge with CBA’s Aussie

Australia’s share market reacted positively to strong gains on Wall Street but closed on an intraday low.

- CBA’s Aussie to merge with Lendi

- KKR in deal talks with Freedom

- Xinja gives up bank licence

- Rex hit for disclosure failing

That’s all from the Trading Day blog for Wednesday, December 16. Australia’s sharemarket reacted positively to strong gains on Wall Street but closed on an intraday low. The Dow had added 1.1 per cent, the S&P 500 rose 1.3 per cent and the Nasdaq advanced 1.3 per cent.

Nick Evans 7.54pm: Sundance fights on for African iron ore project

Former market darling Sundance Resources faces a fight to keep hold of its African iron ore project as the price of the steelmaking commodity peaks, with the company saying it would take the Republic of Congo to arbitration over a decision to strip it of one half of its Mbalam Nabeba iron ore project.

Sundance was once worth more than $1bn as it approached a development decision for the 40 million tonne a year project, which straddles the border of Cameroon and Congo.

But the iron ore crash put paid to any near-term development and Sundance has since had a torrid time finding financial backers for the multi-billion iron ore project, which needs a 510km railway line through Cameroon to reach a port.

Glenda Korporaal 7.01pm: Crown gets go ahead to open Sydney non-gaming areas

Crown Resorts has been given the go ahead by the NSW Independent Liquor and Gaming Authority (ILGA) to open non gaming sectors of its resort at Sydney’s Barangaroo.

The NSW authority announced on Wednesday that it had approved an interim liquor license for Crown’s Barangaroo resort.

It is also considering a further two liquor licenses in restaurants in the non gaming areas of Crown Sydney with a decision expected “within the week”.

The announcement follow the authority’s move last month to block Crown from opening the gaming part of its Barangaroo development which was originally scheduled to open this week.

While the gaming facilities are still banned until at least February when former NSW supreme court judge Patricia Bergin is due to deliver her report into Crown’s suitability to hold a gaming license in NSW, Wednesday’s announcement from ILGA indicates than Crown can now begin planning to open its non gaming areas.

Crown is believed to be reviewing the implications of Wednesday’s announcement.

In its statement issued on Wednesday, ILGA said its position on Crown not opening its gaming operations at Barangaroo had not changed.

But it said it had agreed to work with Crown Resorts to enable the opening this month of all non gaming areas at Barangaroo including accommodation, restaurants, bars and entertainment areas.

6.16pm: Rio confirms timeline for Oyu Tolgoi underground

Rio Tinto has completed the definitive estimate work for Panel 0 of the Oyu Tolgoi Underground Project, confirming a revised budget of $6.75bn with sustainable production expected to commence in October 20225, in line with previously announced ranges.

These estimates now include the known and forecast impacts of COVID-19.6, the company said in a statement to the ASX after the market closed on Wednesday.

Panel 1 and Panel 2 (which are required to support the ramp-up to 95,000 tonnes of ore per day) are currently subject to further studies, with initial recommendations expected by mid-2021. These studies will also consider options and associated costs to recover the copper contained within the pillars added to the mine design of Panel 0, Rio Tinto said.

James Kirby 5.47pm: Xinja banking news ‘not what we wanted’

It’s not ever yday we get a bank closing its doors and handing money back to those unlucky enough to have placed faith in it.

But the closure of Xinja, one of our much-hyped digital banks, is a major development and not one to be welcomed.

It’s going to cast a cloud over all new arrivals in the “digi-banking” sector and it’s going to strengthen the stranglehold the big four - ANZ, CBA, NAB and Westpac - already have on the system.

Moreover, it should prompt some serious revision at the regulators who signed it off as a fully licensed, government-guaranteed “bank” when the operation clearly lacked elementary banking skills such as matching assets with liabilities.

Xinja’s 44,000 account holders are about to find out just how “traditional” the local financial service scene remains as they try to track down and untangle direct debits and other arrangements they may have made with the neobank in recent months..

Despite the extraordinary circumstance of a bank shutting up shop, Xinja depositors have been given very little time to find alternative arrangements.

At a very difficult time of the year, everyone is going to have to find another bank within a week. From December 23 Xinja says all inbound payments of any kind will no longer be accepted.

What a mess and what rotten timing!

Valerina Changarathil 5.45pm: Ex-ABC head joins Mighty Kingdom

Former ABC managing director Michelle Guthrie has been appointed chair of an Adelaide gaming business with plans to list on the sharemarket next year.

Mighty Kingdom also said on Wednesday it had raised $4m in pre-IPO funding from institutional, family and sophisticated investors.

The money was raised through a convertible note, offering a discount on an initial public offer likely early next year.

Mighty Kingdom’s plans follow that of bigger Victorian rival Playside Studios, which lists on the sharemarket this week.

Elise Shaw 5.12pm: $A in narrow range ahead of FOMC

Commonwealth Bank’s Global Markets Research team notes AUD/USD traded in a narrow range near 0.7555 ahead of the FOMC meeting.

“Australia‑China tensions continue to simmer in the background and look likely to extend into 2021.

“However, iron ore exports, Australia’s largest export to China, remain unaffected and elevated iron ore prices are underpinning AUD.”

The team said that some analysts predict the FOMC will announce today an increase to its asset purchases or ‘twist’ its asset purchases by selling short‑term bonds to buy long‑term bonds.

“These are risks but are not our base case. The FOMC has been slowing the pace of asset purchases recently.

“Further, if it wanted to increase asset purchases it has given itself the leeway to do so at any time. Another focus will be whether the FOMC changes its forward guidance. We think it will link the timeframe for continuing asset purchases to economic conditions.

“This change should not be interpreted as the FOMC readying to tighten policy. Current conditions suggest asset purchases will be maintained for some time yet. If the FOMC does provide more accommodation, the USD could fall modestly.”

Ben Wilmot 5.07pm: Centuria swoops on industrial portfolio for $62.5m

The acquisitive Centuria Capital Group has bought three industrial assets, worth a collective $62.5m, for a soon to be launched fixed-term unlisted property fund, the Centuria Industrial Income Fund No.1.

The vehicle is expected to launch in February with a 6 per cent forecast distribution yield as Centuria broadens its unlisted platform, which was its foundation.

It now runs listed office and industrial trusts as well as some unlisted funds, including offices and healthcare assets. Two of them are based in Brisbane and the other in Adelaide.

Centuria joint CEO Jason Huljich said the pure-play unlisted industrial fund was designed to capitalise on the strong tailwinds from Australia’s resilient industrial sector, which has grown significantly throughout the COVID-affected period.

“This trio of assets provides a range of tenants across the logistics, manufacturing and distribution sectors, which are all located in core industrial markets within close proximity to major transportation infrastructure,” he said.

4.40pm: ASX ends up 0.7% at intraday low

Australia’s sharemarket reacted positively to strong gains on Wall Street but closed on an intraday low.

It rose as much as 1.3pc to a 4-day high of 6719.6 before closing up 0.7pc at 6679.2 points, its lowest level since the open.

The rebound from a 7-day low on Tuesday came after the S&P 500 surged 1.3pc as optimism about US fiscal talks and vaccinations outweighed the prospect of greater economic shutdowns due to the worsening pandemic in the US and Europe.

A tilt to value stocks followed a similar move in the US, with the Materials, Consumer Discretionary and Banking sectors outperformed, although Technology was by far the strongest with Afterpay up 4.2pc to a record high close of $4.20.

BHP, Rio Tinto and Fortescue jumped close to 2 per cent after falling sharply on Tuesday amid iron ore price jitters, while the four major banks rose 0.8-1.4pc after digesting profit taking following a widely expected and favourable APRA ruling which will allow bigger dividend payments.

Tabcorp jumped 3.8pc on decent volume, rekindling speculation about potential interest from private equity buyers.

3.45pm: Tabcorp jump raises questions

Tabcorp shares jump 4.1pc to three-week high of $4.07, headingfor the biggest one-day rise in six weeks, on volume 39pc above the 20-day average.

The Australian’s DataRoom reported last month that separate private equity consortiums had approached former BetEasy boss Matthew Tripp about a potential $9bn breakup deal for the waging giant. That pushed the share price up 16pc to $4.10, the biggest rise since listing in 1994. The company said at the time that it isn’t aware of a proposal, but the share price subsequently hit a 9-month high of $4.19 and has remained above $3.775 since then.

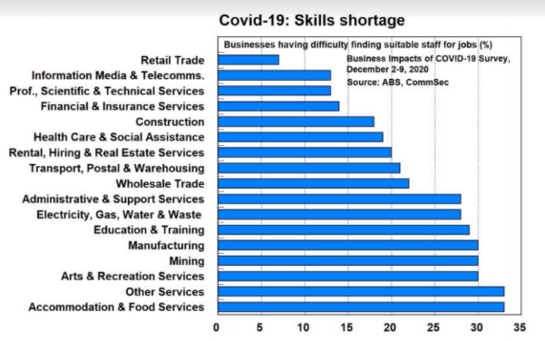

Elise Shaw 2.21pm: Aussie businesses ‘experiencing a skills shortage’

CommSec senior economist Ryan Felsman notes purchasing managers’ indexes provide a timely update on conditions and activity in both the manufacturing and services sectors.

Preliminary readings in December show that the Aussie economic recovery is gathering momentum, he says.

“In fact, the easing of Covid-19 restrictions - with the removal of state and territory border controls - has boosted business confidence, improved conditions and lifted activity. While overall job creation was still moderate, private sector companies increased employment for a second successive month in December.

Felsman says that importantly, IHS Market economists reported: “Business confidence improved at the end of 2020, with the overall degree of optimism reaching its highest since August 2018.”

Aussie manufacturers lifted production into year-end with growth in new orders the strongest in over two years.

IHS Market reported that factory employment “expanded at the fastest rate in just under three years.”

Felsman says that of course, the pandemic recession has been services-led due to widespread shutdowns of consumer-facing private sector businesses.

But Australia’s “growth engine” is getting back on its feet after Victoria and South Australia emerged from their second lockdowns. In its services sector survey, IHS Markit economists said: “Firms enjoyed the strongest rise in new work in 41 months and responded to this by continuing with their hiring efforts.”

Felsman says that with the jobless rate at 7 per cent nationally in October (latest reading), it is hard to believe that Aussie businesses are experiencing a skills shortage. But the Bureau of Statistics (ABS) today revealed that: “One in five (21 per cent) businesses reported that they were having difficulty finding suitably skilled or qualified staff.”

In its December business survey, ABS statisticians also reported: “Almost one in six (15 per cent) employing businesses reported that, based on current operations, they did not have a sufficient number of employees.”

So what professions are in demand? “Businesses reported having difficulty finding suitably skilled tradespersons, hospitality workers and STEM professionals,” the ABS said. “Other in demand jobs included labourers, drivers and managers.”

READ MORE: Firms struggle to find skilled workers

Joyce Moullakis 1.51pm: Lendi, Aussie merger worth $550m+

The proposed merger between online mortgage broker Lendi and Commonwealth Bank-owned Aussie is said to be worth between $550m and $600m.

Sources told The Australian that was the valuation parties were ascribing to the mooted deal, and the objective was to consider listing the combined company on the ASX in about two years.

Under the proposed deal structure, Lendi investors will hold the majority shareholding of 55 per cent in the merged business, while CBA will hold a 45 per cent and continue to provide funding for the Aussie Select branded home loan product. ANZ and Macquarie Group are Lendi shareholders.

The transaction value was not disclosed in a joint statement on Wednesday, and it requires a green light from the competition regulator. Deal completion is expected by mid calendar 2021.

The Australian last month flagged the parties were putting the finishing touches on a deal.

CBA has been weighing a divestment of its mortgage broking interests over several years, as it retreats to core areas of banking.

Mackenzie Scott 1.40pm: New home sales at decade high

The number of new house sales rose to a decade high through November as stimulus continued to support the construction industry.

The Housing Industry of Association’s (HIA) monthly New House Sales report showed buyers had purchased 15.2 per cent more houses last month than in November 2019 in Australia’s five largest capital cities.

Record levels of construction follow a growth trend that has been underway since the federal government's HomeBuilder stimulus was introduced in June. In the three months to November, sales were 41.1 per cent higher nationally on last year’s figures, with significant rises in NSW and Victoria.

Ben Wilmot 1.37pm: Dexus shrugs off crisis with value lift

Listed property group Dexus has cited a strong run of recent office and industrial sales as it said its portfolio had risen by $109m over the last half.

The company said 111 of its 122 assets, comprising 42 offices and 69 industrial parks, were externally valued, resulting in a total estimated increase of about 0.7 per cent over the half.

Dexus CEO Darren Steinberg said there was continued interest and demand from investors despite softer fundamentals in the office occupier market.

“These investors are looking through the current cycle, recognising the long-term value and benefits of being able to increase their investments in Australian real estate. This dynamic, coupled with lower for longer interest rates, has supported cap rates and asset values,” he said.

Mr Steinberg argued that the independent valuations demonstrated the resilience of high-quality assets in prime locations.

“The office portfolio value was in line with prior book values as a result of the softer valuer assumptions over the next 12 months relating to rental growth, downtime and incentives, being offset by successful leasing,” he said.

The industrial portfolio experienced a rise of about 4.5 per cent, reflecting recent portfolio leasing and the continued investment demand for industrial assets globally.

The weighted average capitalisation rate across the total portfolio tightened from 5.05 per cent in June to 5.01 per cent at the end of December. Offices tightened to 4.95 per cent and industrial to 5.36 per cent.

Perry Williams 12.40pm: Australia to be top LNG exporter

Australia is on track to hit record LNG exports this year, retaining its status as the world’s biggest gas shipper, although revenues remain sluggish due to the crash in energy prices.

Exports may reach 78m tonnes in 2020, according to consultancy EnergyQuest, eclipsing last year’s 77.5m tonne total and surpassing Qatar at 77m tonnes.

Shipments of LNG to China have shown no sign of the fallout that has devastated Australia’s coal producers after Beijing’s move to ban the fossil fuel.

Australia supplied China with 2.6m tonnes of LNG in November, up from 2.2m tonnes in October and higher than a year ago.

Revenues for producers continue to take a hefty hit, reflecting an oil price crash earlier this year which has cut income across the industry.

Australia’s LNG income is estimated at $2.9bn for November, down over a third from six months ago, but showing a recovery after a September low of $1.8bn and October’s $2.2bn.

Producers’ coffers may receive a further bonus in the new year given the rapid recovery in LNG spot prices in recent weeks.

The benchmark for LNG spot prices in North Asia, JKM, jumped to a 26-month high of $US11.23 per million British thermal units this week compared with just $US2 mbtu in June.

The jump is partly to a string of supply disruptions including Chevron’s Gorgon outages and possible issues at the Wheatstone and Ichthys LNG plants, EnergyQuest said.

The huge volatility in LNG spot prices may also raise issues for Australia’s manufacturers who have been campaigning for an LNG netback price.

EnergyQuest estimates the Wallumbilla netback price is currently $12.53 a gigajoule based on the LNG spot price, more than domestic manufacturers can likely afford.

12.13pm: Leading index best in at least 60 years: Westpac

A leading indicator of Australia’s economy rose at the strongest pace in at least six decades.

The Westpac-Melbourne Institute Leading Index - which indicates the likely pace of economic activity relative to its trend or “potential” growth - rose to 4.38pc in November from 3.77pc in October.

“This is the strongest growth rate in the sixty year history of the measure,” said Westpac chief economist, Bill Evans.

“That said, the gains still largely reflect the severity of the preceding contraction which saw the Index growth rate drop to an extreme low of minus 5.5pc in April.”

Westpac raised its growth forecasts for 2020 and 2021 last week from minus 3pc and minus 2.8pc to minus 2pc and minus 4pc respectively.

“That 4pc growth rate in 2021 is comfortably above trend and is highlighted by a 4.5pc annualised growth pace in the first half of 2021,” Mr Evans said.

“The forecasts are consistent with the ‘above trend’ signal coming from the leading index.”

12.10pm: ASX extends rise to 1.2pc

Australia’s share market extended its rebound throughout the morning despite some slippage in US futures.

The S&P/ASX 200 rose 1.2pc to a four-day high of 6713 points, even as S&P 500 futures fell as much as 0.2pc after an overnight surge on Wall Street.

A close in the index today above 6683.1 would be its best since last Wednesday, when it also hit a 9.5-month intraday basis high of 6745.3.

While the Tech sector was strongest, heavyweight value sectors - Materials and Financials - contributed most of the strength to the index.

Optimism over US fiscal stimulus talks and vaccines continued to offset the worsening pandemic and increasing pressure for lockdowns in the US and Europe.

Afterpay was up 3.2pc at $113.70 after hitting a record high of $115, while BHP, Fortescue Metals, Rio Tinto, James Hardie and ANZ rose at least 2 per cent.

Joyce Moullakis 11.55am: CBAs Aussie to merge with Lendi

Commonwealth Bank has facilitated a merger between online broker Lendi and its subsidiary Aussie Home Loans, in a deal that will shake up the mortgage broking market.

Under the proposed deal structure, Lendi shareholders will hold the majority shareholding of 55 per cent in the merged business, while CBA will hold a 45 per cent and continue to provide funding for the Aussie Select branded home loan product.

The transaction value was not disclosed in a joint statement on Wednesday, and it requires a green light from the competition regulator. Deal completion is expected by mid calendar 2021.

The Australian last month flagged the parties were putting the finishing touches on a deal.

CBA has been weighing a divestment of its mortgage broking interests over several years, as it retreats to core areas of banking.

The announced transaction also comes as broking aggregator groups AFG and Connective are awaiting a court judgment, so they can put the finishing touches on a marriage.

The Lendi and Aussie deal gives the former access to the well-known Aussie brand and national network across more than 970 brokers and over 210 stores.

Aussie gets access to Lendi’s proprietary digital technology and platform.

11.50am: Home loan arrears fell in October

S&P Global Ratings says its index of Australian mortgage arrears fell to 1.07pc in October from 1.12pc in September.

Borrowers still under COVID-19-related mortgage-deferral arrangements beyond October were likely granted an extension by lenders, S&P said.

Low interest rates and competitive refinancing conditions are closely correlated with the decreasing arrears.

Lenders will not want to rush into foreclosure processes at the end of mortgage-relief periods, choosing instead to work with borrowers by restructuring loans and moving them into formal hardship programs, it said.

Dow Jones Newswires

Bridget Carter 11.23am: KKR talks with Freedom on acquisition

Private equity giant Kohlberg Kravis Roberts is understood to be in advanced talks with Freedom Foods about an acquisition of its cereals and snacks division.

It is believed that the New York-based global investment company with US$221.8bn of assets under management is eager to buy the business, to add to its acquisition of the iconic Tim Tams and Shapes maker Arnott’s Biscuits.

KKR purchased Arnott’s in 2019 for US$2.2bn from Campbell Soup Company.

Arnott’s chief executive George Zoghbi had earlier signalled that the biscuit maker was eager to embark on acquisitions.

Freedom Foods was placed in a trading halt in June after its share price fell more than 20 per cent with news of the shock departure of its managing director Rory Macleod and, earlier, chief financial officer Campbell Nicholas.

It later said that it would remain in voluntary suspension to investigate its financial position, revealing further write downs and the need for additional provisioning for out of date stock.

Freedom and its auditor Deloitte now face a class action.

On Wednesday, Freedom said it was assessing options for its cereal and snacks division after a potential sale was the muesli bar business was flagged by DataRoom in October.

Sources earlier said Freedom Foods had approached potential buyers, which would likely include groups such as Uncle Toby’s, Arnott’s Biscuits, Carman’s and Sanitarium.

Freedom added on Wednesday that it was would embark on a $280m capital raising and would announce recapitalisation plans by mid December.

Cliona O’Dowd 11.05am: ANZ caution on dividend rise

ANZ will review its dividend policy in the New Year amid an improving economic outlook and APRA’s move to scrap the cap on payout ratios, but chairman Paul O’Sullivan has cautioned that any decision will be influenced by how the COVID-19 crisis evolves as support measures wind down.

Addressing shareholders at the company’s annual general meeting on Wednesday, Mr O’Sullivan also warned of further pressure on margins as he predicted the current low interest rate environment would endure for some time.

“Ultimately, our final decision (on dividends) as a board will be influenced by how the remainder of the crisis evolves, particularly from a macro-economic perspective, and our views on the longer term sustainability of our dividend,” Mr O’Sullivan said.

“Let me assure you however, your board is acutely aware of the reliance many shareholders place on their regular dividend, and on the value of franked dividends,” he said, adding that ANZ agreed with APRA on paying out a reduced dividend in 2020.

“I can assure you my focus will be on improving shareholder returns through a focus on good customer outcomes, cost discipline and the efficient use of capital while continuing to build a strong culture.”

11.03am: Super returns better than expected: Chant West

Super fund returns are closing in on a “better than expected” result for the 2020 calendar year, according to Chant West.

“Share markets surged in November, powering the median growth fund (61 to 80pc in growth assets) to a return of 4.9 per cent for the month,” says Chant West senior research analyst, Mano Mohankumar.

“That drove the cumulative return for the first eleven months of the year to 2.6 per cent.

Markets are up slightly in December so far and we estimate that, with two weeks to go, the calendar year return is now sitting at about 3 per cent.”

10.40am: Bullish sentiment gives sell signal: BofA

Bullish share market sentiment has given a contrarian “sell signal” for global equities, since COVID vaccine hope has induced a “buy the reopening” trade, according to BofA.

The US investment bank’s monthly survey of global fund managers overseeing $US534bn found their average cash balance fell to 4pc in December, leaving them “underweight” cash for the first time since May 2013.

This marks BofA’s “most bullish 2020 fund manager survey” and it has triggered a sell signal for global equities, according to BofA’s chief investment strategist, Michael Hartnett.

Backtesting shows a one-month return of -3.2 per cent when cash is 4pc or lower, he says.

At the same time BofA’s “Bull & Bear Indicator - which uses the cash level as an input - has risen to 6.7. Levels above 8.0 say “sell” on that indicator.

The survey also found that fund manager positioning in equity and commodity markets was the most overweight since February 2011.

The allocation to Emerging Markets equities was the most since Nov 2010 and investors were still overweight US & EU equities.

There was also a jump in the allocation to the consumer discretionary and industrials stocks to the highest level since April 2014, as well as banks, where funds were overweight for the first time since January 2020, but Tech remained their largest overweight.

The most crowded trades were long Tech, short US$ and long Bitcoin.

“We say sell the vaccine in the March quarter,” Mr Hartnett said.

“Contrarian asset allocation trades are long cash-short stocks, long US$-short EM.

Contrarian equity trades are long energy and staples, and short tech and industrials.”

10.23am: ASX jumps 1pc at open, BHP up 2pc

Australia’s share market has surged on broad-based gains amid hopes of US fiscal stimulus and COVID vaccinations.

The S&P/ASX 200 jumped 1pc to a 3-day high of 6697 after a 1.3pc rise in the S&P 500.

The Tech sector is leading gains with Afterpay up 3.8pc.

But the market also has a value tilt as the Materials, Energy and Financials sectors are also outperforming.

In those sectors, BHP, CBA and Fortescue Metals have rebounded sharply to be up 2pc, 1.4pc and 2.3pc respectively.

Lilly Vitorovich 10.11am: WPP halt amid UK control bid

Australia’s biggest advertising company, WPP AUNZ, has sought a trading halt amid talks with its biggest shareholder, UK giant WPP PLC, about its unsolicited proposal to buy the remaining shares it doesn’t already own.

The trading halt is expected to remain in place until Friday morning.

WPP AUNZ’s request comes more than two weeks after the London-based group offered to buy the remaining 38.5 per cent that it doesn’t own for 55c a share in cash.

The ASX-listed company said on November 30 that the proposal was being considered by its independent directors and advisers. It also advised its shareholders to take no action until it receives the independent director’s formal recommendation.

WPP PLC’s 55c a share offer represented a premium of about 34.1 per cent of WPP AUNZ’s closing share price of 41c on November 27.

If successful, the deal would give the UK heavyweight full ownership and control of its Australian and New Zealand operations. WPP AUNZ has more than 60 brands, including Ogilvy, Ikea Communications, Wunderman THompson and Xaxis.

WPP AUNZ shares last traded at 57c on the ASX.

9.47am: ASX to rise on US optimism

Australia’s share market is expected to rise after the US market jumped on optimism about US fiscal stimulus talks, US emergency use approval for Moderna’s COVID vaccine and a 5pc rise in Apple shares.

Overnight futures relative to estimated fair value suggest the S&P/ASX 200 index will open up 0.7pc at a two-day high of 6778 points after falling 0.4pc on Tuesday.

A tilt to value stocks is likely based on US leads, with the Energy, Materials, Real Estate and Financials sectors outperforming in the US market along with Utilities and Technology.

In commodities, spot iron ore gained 0.8pc to $US155.75 a tonne, WTI crude oil rose 1.3pc to $US47.59, spot gold rose 1.4pc to $US1,852.18 and LME copper gained 0.6pc to $US7775 a tonne.

BHP ADR’s equivalent close at $42.80 was up 2.4pc on BHP’s close in Sydney.

Overall the market should be fairly quiet before the outcome of the FOMC meeting at 6am (AEDT) on Thursday.

US retail sales and Market PMI data are due for release overnight.

On a contrarian note, BofA’s monthly survey of fund managers found they’re are underweight cash for the first time since May 2013, with levels down to 4pc.

At the same time, investors are the most bullish on stocks and commodities since February 2011. The plunge in cash exposure is setting off the broker’s sell signal for equities.

9.24am: Rex hit for disclosure failures

ASIC says it’s restricted Regional Express Holdings Limited from issuing a reduced-content prospectus and using exemptions for reduced disclosure in fundraising documents until December 2021.

It says its decision was based on Rex’s failure to disclose to the market that it was considering the feasibility of flying to capital cities in addition to its regional operations, as told to a journalist in May.

“The decision means Rex will not be able to rely on reduced-disclosure rules and instead must issue a full prospectus in order to raise funds from investors,” ASIC said in a statement.

“ASIC considers the ability to use a reduced-disclosure prospectus a privilege that is dependent on compliance with other aspects of the law, including that companies meet their ongoing disclosure obligations.”

ASIC says its investigation into Rex’s conduct is continuing.

David Swan 9.18am: Xinja gives up banking licence

Xinja will hand back its banking licence and remove its transaction and savings products, with the neo-bank blaming the COVID-19 pandemic and a difficult capital raising environment for its decision to cease being a bank.

A company spokesman said Xinja was already returning customers‘ deposits, and will instead focus on its US share trading product.

“After a year marked by COVID-19 and an increasingly difficult capital-raising environment, and following a review of the market in Australia, Xinja has decided to withdraw the bank account and Stash (savings) account and cease being a bank,“ the spokesman said.

“This was an incredibly hard decision.

“We hope to refocus the business in other areas such as our US share trading product, Dabble, should circumstances allow.”

He added APRA is closely monitoring Xinja’s return of deposits to ensure that funds are returned in an orderly and timely manner, and customers are being given the required 7-day notice before their accounts are closed. Customers should transfer their money elsewhere as soon as possible, he said.

Xinja had $413m in retail deposits on its balance sheet at the end of October, according to APRA figures. The bank had written no loans, the figures show.

In October Xinja shut off its public roadmap, with co-founder Camilla Cooke blamed a shifting of business priorities and a lack of development resources for failing to meet its targets.

8.46am: What’s impressing analysts

ANZ cut to Underperform: Jefferies

CBA raised to Buy: Bell Potter

CBA cut to Sell: Morningstar

GWA Group cut to Sell: Morningstar

Maas Group started at Add: $3.05 target price: Morgans Financial

New Century started at Hold: $0.25 target price: Canaccord

Vocus raised to Hold: Morningstar

8.42am: Ex-BlueScope boss gets suspended sentenced for obstructing ACCC

Jason Ellis, a former general manager of sales and marketing at BlueScope Steel, has been sentenced to eight months in prison for inciting the obstruction of an ACCC investigation into alleged price fixing.

However Magistrate Atkinson yesterday ordered that Mr Ellis be released, without entering custody, upon entering into a recognisance in the sum of $1000, on the condition that he be of good behaviour for two years, the ACCC said in a statement.

Magistrate Atkinson also ordered that Mr Ellis pay a fine of $10,000.

“This is the first time an individual had been charged with, and convicted of, inciting the obstruction of an ACCC investigation,” ACCC Chair Rod Sims said.

Mr Ellis incited two fellow BlueScope employees to give false information and evidence to the ACCC over discussions he and those BlueScope employees had during their meetings with certain other steel companies.

The ACCC was investigating allegations that, between September 2013 and June 2014, BlueScope and Mr Ellis attempted to induce various steel distributors in Australia and overseas manufacturers to enter arrangements containing a price fixing provision.

The ACCC has since filed separate civil cartel proceedings against BlueScope and Mr Ellis, which remain before the Federal Court.

Eli Greenblat 8.36am: Beacon set to double profit

The rush to set up home offices and refurbish homes during COVID-19 has helped push Beacon Lighting sales and earnings higher in the first half. The lighting retailer forecasts its December half profit will more than double.

In a trading update on Wednesday Beacon Lighting said for the 26 weeks to December 27 it was forecasting sales to be $147 million to $152m, against sales for the first half of 2020 of $122.5m.

It said it was expecting first half profit for 2021 to be between $19.5m and $21.5m against 2020 first half profit of $9.5m.

Will Glasgow 8.13am: Beijing says unaware of coal ban

Beijing has claimed to be unaware of a ban on Australian coal that was revealed by China’s state-controlled media.

The blacklisting of Australia’s $14bn annual coal exports to China was all-but-formalised at a high level meeting with major Chinese power companies held on Saturday to address a surge in coal prices in the world’s second biggest economy.

At the meeting the National Development Reform and Commission – China’s top economic planning agency – gave approval for clearance restrictions to be removed from coal imports from all countries except Australia, according to reports by state-controlled media.

China’s Foreign Ministry spokesman Wang Wenbin said he was “not aware” of the ban, which has been widely reported throughout China and the world.

In Beijing’s first comments on the ban, Mr Wang accused Australia of casting itself as a “victim, pointing an accusing finger at China.”

“This move is meant to confound the public and we will never accept it,” Mr Wang said at a regular press conference in Beijing on Tuesday evening.

Those comments came hours after Prime Minister Scott Morrison said discriminatory action on Australian coal exports would “obviously be in breach” of World Trade Organisation rules and the China-Australia FTA.

The nation’s top miners on Tuesday held crisis talks over the escalating trade tensions with China, as ship owners holding black-listed Australian coal off the Chinese coast threaten legal action over the mounting costs of a ban that has crunched the nation’s second biggest export industry.

8.05am: Wall St up as investors track stimulus talks

US stocks climbed as investors welcomed signs of progress in negotiations over an economic relief package in Washington.

The S&P 500 rose 1.3 per cent as of the close of trading in New York. That followed four consecutive days of losses, which marked the index’s longest losing streak since September.

The Dow Jones Industrial Average advanced about 340 points, or 1.1 per cent. Meanwhile, the technology-heavy Nasdaq Composite advanced 1.3 per cent.

A bipartisan group of lawmakers urged Congressional leaders on Monday to forge ahead with a $US748 billion spending package that would avoid the thorniest issues holding up a deal. The top four congressional leaders were expected to meet today (AEDT) to discuss a coronavirus relief package and a year-end spending bill.

Investors have been closely monitoring prospects for a stimulus deal, especially as the potential for further COVID-19 lockdowns in the months ahead has grown. Despite the initial rollout of a vaccine by Pfizer and BioNTech in the US on Monday, the country is still facing a winter that could be difficult as cases continue to rise.

“The [vaccine] news is here and now the market is just digesting some of these [November] gains and looking for the next catalyst as we move into next year,” said Keith Lerner, chief market strategist at Truist Advisory Services.

In corporate news, shares of Apple climbed after Nikkei Asia reported that Apple plans to produce up to 96 million iPhones in the first half of next year, a nearly 30 per cent year-over-year jump. Shares of the iPhone maker rallied 4.1 per cent.

In overseas markets, the regionwide Stoxx Europe 600 index ticked up about 0.3 per cent. China’s Shanghai Composite Index ended 0.1 per cent lower in a mixed session for Asian stocks. Japan’s Nikkei 225 slipped 0.2 per cent.

Dow Jones Newswires

7.56am: Fed opens final 2020 meeting

US central bankers opened their final policy meeting of the year to review how best to support the economy as the COVID-19 vaccine rollout gets underway.

But with the benchmark lending rate already at zero, there is little left for the Federal Reserve to do, absent an agreement in Congress on a new federal relief package to help ailing businesses and unemployed workers.

At most, economists say officials in the policy-setting Federal Open Markets Committee (FOMC) could provide more information on potentially increasing the pace of bond purchases above the current $US120 billion a month.

But economist Diane Swonk of Grant Thornton said anyone waiting for an announcement of more asset purchases is “likely to be disappointed.” “Officials will only increase asset purchases if credit markets hit another roadblock and begin to seize,” Swonk said in an analysis.

However, she said “they are likely to signal they will keep those purchases in place until the economy is well beyond the current crisis.” Officials could make adjustments in the types of assets they buy, extending into longer-term debt as an insurance policy against the near-term risks.

AFP

7.37am: Median super fund returned 4.9pc in November

SuperRatings says November was the strongest month for superannuation in 2020, delivering the 8th consecutive month of positive returns as share markets push to record highs.

The research house says the median balanced option returned 4.9 per cent, as members return to the black after a volatile year.

Since the start of 2020 the median balanced option has delivered 2.3 per cent and is on track to finish the year in positive territory.

Super has bounced back strongly in the second half of the year, returning 7.5 per cent from the start of July to the end of November, reversing big falls in February and March.

SuperRatings says the median growth option returned an estimated 6.2 per cent in November and 2.4 per cent over the calendar year, while the median capital stable option returned an estimated 2.0 per cent in November and 1.7 per cent over the calendar year.

7.10am: Short-term oil demand outlook bleak

It will be several months before coronavirus vaccinations start to boost global oil demand, with the recovery in some of the world’s wealthy countries “going backwards” this quarter, the International Energy Agency said Tuesday.

In its monthly oil-market report, the IEA cut its forecast recovery in demand for 2021 by 170,000 barrels a day to 5.7 million barrels a day. That included a reduction of 400,000 barrels a day to its forecast demand for the second quarter, when analysts had expected the expansion of vaccination programs around the world to begin lifting economic activity.

The agency also lowered its demand forecast for the final quarter of 2020. Demand has somewhat recovered in the second half of the year from its historic 16 per cent drop in the second quarter, but that resurgence “is almost entirely due to China’s fast rebound from lockdown,” the IEA said.

But the demand outlook in the wealthy countries that make up the Organization for Economic Cooperation and Development is bleak, according to the IEA.

With another wave of infections having prompted a return to lockdown measures in Europe, demand there in the final three months of the year is expected to be even weaker than it was in the third quarter, the agency said.

Expected pressure on the airline industry in 2021 was a major driver behind the IEA’s downgrades.

Oil prices climbed, hitting nine-month highs and rising with broader risk assets on hopes for a U.S. pandemic-relief package, according to Edward Moya, an analyst at broker Oanda. Global benchmark Brent crude added 0.9 per cent to $US50.76 a barrel. West Texas Intermediate futures, the U.S. benchmark, rose 1.3 per cent to $US47.62 a barrel.

Dow Jones

7.06am: ASX set for positive open

Australian stocks are poised to open higher amid a rally on Wall Street fuelled by progress in stimulus talks, and more good news on a COVID-19 vaccine.

At about 5am (AEDT) the SPI futures index was up 42 points, or 0.6 per cent.

Yesterday, Australia’s share market sank 0.4 per cent to an eight-day low amid falls in miners and banks.

Brent oil rose 0.9 per cent to $US50.76a barrel.

Spot iron ore rose 0.8 per cent to $US155.75 a tonne.

6.57am: Retail tycoon Nygard faces sex-traffiking charges

Canadian retail tycoon Peter Nygard faces sex-trafficking and racketeering charges, according to an indictment unsealed by Manhattan federal prosecutors.

He was arrested Monday in Canada, according to prosecutors in the US attorney’s office for the Southern District of New York.

The 79-year old has previously denied the allegations and declined through a spokesman to comment on his arrest.

Mr Nygard stepped down as chairman of his company, Nygard International, in February after federal and local authorities raided its Manhattan office as part of an international sex-trafficking probe.

The company filed for bankruptcy in March. In April, a Canadian judge allowed an accounting firm to sell and liquidate part of the business empire founded by Mr Nygard.

Prosecutors accused Mr Nygard of using his company’s influence, as well as its employees and funds, to recruit and maintain a stream of adult and minor-aged female victims for his sexual gratification, and that of his friends and business associates.

Mr Nygard is accused of frequently targeting women and girls from disadvantaged economic backgrounds and had a history of abuse, prosecutors said. He allegedly controlled his victims through threats and false promises of career advancement, prosecutors added.

He is also being sued in a Manhattan federal court by women accusing him of rape, sexual assault and human trafficking. The class-action lawsuit was filed in February by 10 unnamed female plaintiffs. An additional 36 women have since been added to the complaint.

Lawyers for Mr Nygard have said in court papers that the lawsuit’s allegations are false.

Dow Jones Newswires

6.49am: Tilt in renewables deal with Newcrest

Tilt Renewables says it has finalised a deal to supply power from a wind farm to Newcrest Mining’s Cadia mine in NSW.

Tilt’s offtake agreement with Newcrest is for the supply of electricity and green products for a 15-year period from the Rye Park Wind Farm in NSW.

Newcrest will use the agreement to support its long-life Cadia mine in NSW, as well as helping it achieve its corporate emissions intensity reduction target.

The offtake agreement, for around 55pc of its output, will provide the foundation for the construction of the proposed 400MW wind farm.

Angelica Snowden 6.41am: Aussie rapid Covid test gets US tick

The US Food and Drug Administration has authorised the country’s first rapid at-home test for COVID-19, developed by an Australian biotech company.

The test is available over the counter, does not require a prescription and produces a result in around 20 minutes.

The test, made by Brisbane-based Ellume, will sell for around $30 and the company plans to roll out three million units in January 2021.

It came after the US provided $US30M into the company to develop the tests to speed up the production of tests.

Commissioner of the Food and Drug Administration Stephen Hahn said the emergency use authorisation represented a “major milestone.”

It is an “antigen” test, meaning it works by detecting a surface molecule of the coronavirus, unlike the more common PCR tests that look for the virus’ genetic material.

The technology involved is similar to a home pregnancy test.

The Ellume test uses a nasal swab that doesn’t go as far back as the nasopharyngeal swabs used in clinical settings, and is therefore more comfortable to self-administer.

According to the FDA, it correctly identified 96 percent of positive samples and 100 percent of negative samples in individuals with symptoms.

In people without symptoms, the test correctly identified 91 percent of positive samples and 96 percent of negative samples.

5.30am: Immutep shares rise after update

Shares in Australian-based biotech Immutep rose 16 per cent to $US3.47 in US afternoon trading.

The biotechnology company, focused on cancer and autoimmune disease earlier, gave an update on its clinical programs.

The company also said that following recent $US7.7 million warrant exercise it “is in an excellent financial position” with a cash runway extended beyond end of calendar year 2022.

Immutep said that in the current quarter, it completed an equity financing and raised about $29.6 million in a placement supported by institutional investors from Australia and offshore.

Shares rose sharply Thursday after Immutep said it reported statistically significant survival benefit for key patient groups in the ongoing Phase IIb AIPAC study in metastatic breast cancer. The company said it had encouraging first overall survival follow-up data from the ongoing study of its lead product candidate eftilagimod alpha.

Dow Jones Newswires

5.20am: US stocks rise as investors track stimulus talks

US stocks rose as investors cautiously welcomed signs of progress in negotiations over an economic relief package in Washington.

In lunchtime trade the S&P 500 was up 1.1 per cent, on track to potentially reverse four days of losses that amounted to the index’s longest losing streak since September.

The Dow Jones Industrial Average advanced about 1.1 per cent. Meanwhile, the technology-heavy Nasdaq Composite jumped 0.9 per cent.

A bipartisan group of lawmakers urged Congressional leaders to forge ahead with a $US748 billion spending package that would avoid the thorniest issues holding up a deal. Congress is running out of time to strike a deal before the year-end holiday season.

Investors have been closely monitoring prospects for a stimulus deal, especially as the potential for further COVID-19 lockdowns in the months ahead has grown. Despite the initial rollout of a COVID-19 vaccine by Pfizer and BioNTech in the U.S. on Monday, the country is still facing a winter that could be difficult as COVID-19 cases continue to rise.

In corporate news, shares of Apple climbed after Nikkei Asia reported that Apple plans to produce up to 96 million iPhones in the first half of next year, a nearly 30 per cent year-over-year jump. Shares of the iPhone-maker rallied 3.5 per cent.

Energy stocks, banks and materials companies also rallied. In contrast, shares of several vaccine-makers tumbled. Pfizer fell 2 per cent while Moderna slid 4.6 per cent. The Food and Drug Administration said Tuesday that Moderna’s COVID-19 shot is highly effective, suggesting it could soon be added to the arsenal against the pandemic. Shares of the company have climbed more than 650 per cent this year.

In overseas markets, the regionwide Stoxx Europe 600 index ticked up 0.3 per cent. China’s Shanghai Composite Index ended 0.1 per cent lower in a mixed session for Asian stocks. Japan’s Nikkei 225 slipped 0.2 per cent.

Dow Jones Newswires

5.10am: Mesoblast ADRs fall after heart drug results

Mesoblast ADRs fell 16pc to $US14.21 in US morning trading.

The Australian company on Monday unveiled top-line results from the DREAM-HF Phase 3 trial of rexlemestrocel-L in 537 patients with advanced chronic heart failure.

Over a mean 30 months of follow-up, patients with advanced chronic heart failure who received a single endomyocardial treatment with rexlemestrocel-L on top of maximal therapies had 60pc reduction in incidence of heart attacks or strokes and 60pc reduction in death from cardiac causes when treated at an earlier stage in the progressive disease process. Despite significant reduction in the pre-specified endpoint of cardiac death, there was no reduction in recurrent non-fatal decompensated heart failure events, which was the trial’s primary endpoint.

“This suggests that rexlemestrocel-L reduces mortality by mechanisms that are distinct from those of existing drugs that reduce hospitalisation rates but do not significantly impact cardiac mortality,” the company said.

“We expect the mortality benefit observed in this seminal Phase 3 trial will support a potential path for approval of rexlemestrocel-L in patients with advanced chronic heart failure,” said Mesoblast Chief Medical Officer Fred Grossman.

The company said it is planning to meet and discuss potential pathways to approval based on mortality reduction with the U.S. Food and Drug Administration.

Chardan Capital Markets said in a note that the study not achieving its primary endpoint “is consistent with our low expectation for a positive result from this study.”

“As always, we believe that companies should follow the scientific process in guiding their clinical development process. Hence, in our opinion, we believe that the mortality findings in the phase III, at best, serves as a hypothesis that will need to be validated in another phase III study,” Chardan said in its note. The firm maintained its Sell rating on the stock.

Dow Jones Newswires

5.00am: Europe markets mostly rise

European and US stock markets mostly rose on optimism over US stimulus and vaccines, but London stumbled ahead of the capital’s tightened coronavirus restrictions as dealers also tracked Brexit trade talks.

“UK-EU trade talks, vaccines, US stimulus talks and politics are all assisting the bullish mood,” said market analyst David Madden at CMC Markets UK.

The British pound rose as Brussels and London continued to pursue extended talks for a long-awaited Brexit trade deal.

“Recent tones out of the EU have highlighted the potential for a breakthrough if the UK and EU are willing to compromise,” Joshua Mahony at IG said.

“However, investors were dealt a fresh dose of reality today after Johnson admitted that a no-deal is the most likely outcome at this point,” he added.

London’s FTSE 100 fell 0.3 per cent as a strong pound hurts multinationals which dominate the index and whose earnings are mostly in dollars.

But in the eurozone the Paris CAC 40 nudged higher and in Frankfurt the DAX 30 climbed 1.1 per cent as there was good news on the vaccine front.

The European Medicines Agency said on Tuesday it had moved forward a meeting to decide on authorisation for the Pfizer-BioNTech vaccine by more than a week to December 21.

And in the US, a second coronavirus vaccine took a step towards emergency use approval when a FDA briefing document recommended experts give Moderna’s jab a green light when they meet on Wednesday.

Meanwhile Asian equities closed lower as investors focused on surging COVID-19 infections that are forcing many governments to impose tighter containment measures London faces new tough restrictions as it follows swathes of Britain into the highest tier of containment, the Netherlands was preparing to enter its strictest lockdown since the pandemic began, and New York City could also soon be facing a “full shutdown”.

AFP

4.58am: FDA Finds Moderna vaccine 94.1pc effective

The US Food and Drug Administration said the COVID-19 vaccine developed by Moderna Inc. was “highly effective,” setting the stage for an emergency authorisation later this week that would add a second vaccine to the arsenal against the pandemic.

The agency posted online documents, prepared by its staff and by Moderna, analysing the safety and effectiveness of the vaccine in a large clinical study. The findings will go before an independent advisory panel that will vote Thursday on whether to recommend FDA authorisation.

Barring complications, the FDA is aiming to authorise emergency use of the Moderna vaccine Friday, following the same timetable as last week with the first COVID-19 vaccine from Pfizer Inc. and BioNTech SE.

Doses of Moderna’s vaccine could be shipped this weekend, with vaccinations starting early next week. Which vaccine people get will be decided by factors including availability, with the Centers for Disease Control and Prevention and the Trump administration’s Operation Warp Speed overseeing distribution. Federal officials have said the Moderna vaccine will be more suitable for smaller hospitals in rural areas because it is shipped in smaller quantities than Pfizer’s.

The FDA’s review of a 30,000-person clinical study confirmed Moderna’s earlier disclosure that the vaccine was 94.1pc effective at preventing COVID-19 disease with certain symptoms, including severe disease.

Dow Jones

4.55am: Norway OKs North Sea carbon storage project

Norway gave approval Tuesday to a giant project to capture and store CO2 below the North Sea, a technology that could help efforts to reduce carbon emissions.

The Northern Lights project aims to inject CO2 captured from Norwegian industrial firms into geological formations 2,600 metres below the seabed where it should be trapped permanently.

Initially the project aims to capture and store 1.5 million tonnes of CO2 per year from 2024, but could be expanded to handle as much as 5 million tonnes per year.

4.50am: EU unveils rules targeting tech giants

The European Union unveiled tough draft rules targeting tech giants like Google, Amazon and Facebook, whose power Brussels sees as a threat to competition and even democracy.

The landmark proposals -- which come as Silicon Valley faces increasing global scrutiny -- could shake up the way Big Tech does business by menacing some of the world’s biggest firms with mammoth fines or bans from the European market.

EU competition chief Margrethe Vestager said the bloc’s draft laws to regulate the internet aimed to bring “order to chaos” and rein in the online “gatekeepers” that dominate the market.

“The Digital Service Act and Digital Markets Act will create safe and trustworthy services while protecting freedom of expression,” she told a press conference.

The EU says the long-trailed legislation would see internet behemoths face fines of up to 10 per cent of their turnover for breaking some of the most serious competition rules or even risk being broken up.

It also proposes fining them six per cent of revenues or temporarily banning them from the EU market “in the event of serious and repeated breaches of law which endanger the security of European citizens”.

The Digital Services Act and its accompanying Digital Markets Act will lay out strict conditions for doing business in the EU’s 27 member countries as authorities aim to curb the spread of disinformation and hate speech online, as well as Big Tech’s business dominance.

A source close to the EU commission said ten firms faced being designated as “gatekeepers” under the competition legislation and subjected to specific regulations to limit their power to dominate markets.

The firms that would be subject to stricter regulation are US titans Facebook, Google, Amazon, Apple, Microsoft and SnapChat, China’s Alibaba and Bytedance, South Korea’s Samsung and the Netherlands’ Booking.com.

The proposals will go through a long and complex ratification process, with the EU’s 27 states, the European parliament, and a lobbying frenzy of companies and trade associations influencing the final law.

AFP

4.45am: Autos drive gain in US industrial output

US industrial production continued to recover in November, driven in part by a jump in auto manufacturing, but the sector remains far below last year’s level, the Federal Reserve reported.

Total output increased 0.4 per cent last month compared to October, but remains 5.5 per cent lower than November 2019 as industry continues to try to replace production impacted by the world’s worst COVID-19 outbreak.

Factories have been recovering steadily since May, except for a very small dip in September, according to the Fed data.

Manufacturing last month rose 0.8 per cent -- its seventh consecutive gain -- boosted by a 5.3 per cent jump in motor vehicles and parts. Without that surge, factory output would have increased only 0.4 per cent, the report said.

AFP

4.42am: Zara owner Inditex sees sales recovery

Spanish textile titan Inditex, owner of global fashion retailer Zara, posted a higher than expected net profit in its third quarter as sales recovered from the disruption caused by the pandemic.

The group, which also owns the Bershka and Massimo Dutti brands, recorded a net profit of 866 million euros ($US1.05 billion) in the three months from August to October, a 26 per cent drop from the same time last year.

Analysts surveyed by financial information service Factset had expected a net profit of 821 million euros.

Sales reached 6.0 billion euros, up from 4.7 billion euros on the previous three months, the company said in a statement.

But they were still far lower than the 19 billion euros in sales recorded during its third quarter of last year before the pandemic forced the closure of stores around the world.

“These results are the direct consequence of effective management in every area of the company and the ability to react and adapt in an unpredictable environment,” Inditex executive chairman Pablo Isla said in the statement.

The company said 5.0 per cent of its stores were closed during the third quarter and “trading restrictions” affected 88 per cent of its retail network.

AFP

4.40am: Disaster-linked losses in 2020 hit $US187bn

Total losses from natural and man-made disasters so far this year are estimated at $US187 billion (154 billion euros), up 25 per cent from 2019, the reinsurance giant Swiss Re said.

A full $US175 billion were from natural catastrophes during a year characterised by unusual numbers of storms, wildfires and hurricanes, according to preliminary figures.

That marks a hike from 2019 when natural disasters caused losses of $US139 billion but remains below the 10-year average of $US202 billion.

Insurers covered less than half of the total losses, dishing out $US83 billion, making 2020 the fifth-costliest year for the industry since 1970, Swiss Re said in a statement.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout