COVID-19 spawns new breed of younger online share traders betting on global stocks

The pandemic has spawned a new, younger breed of online share trader, including more women, says CMC Markets.

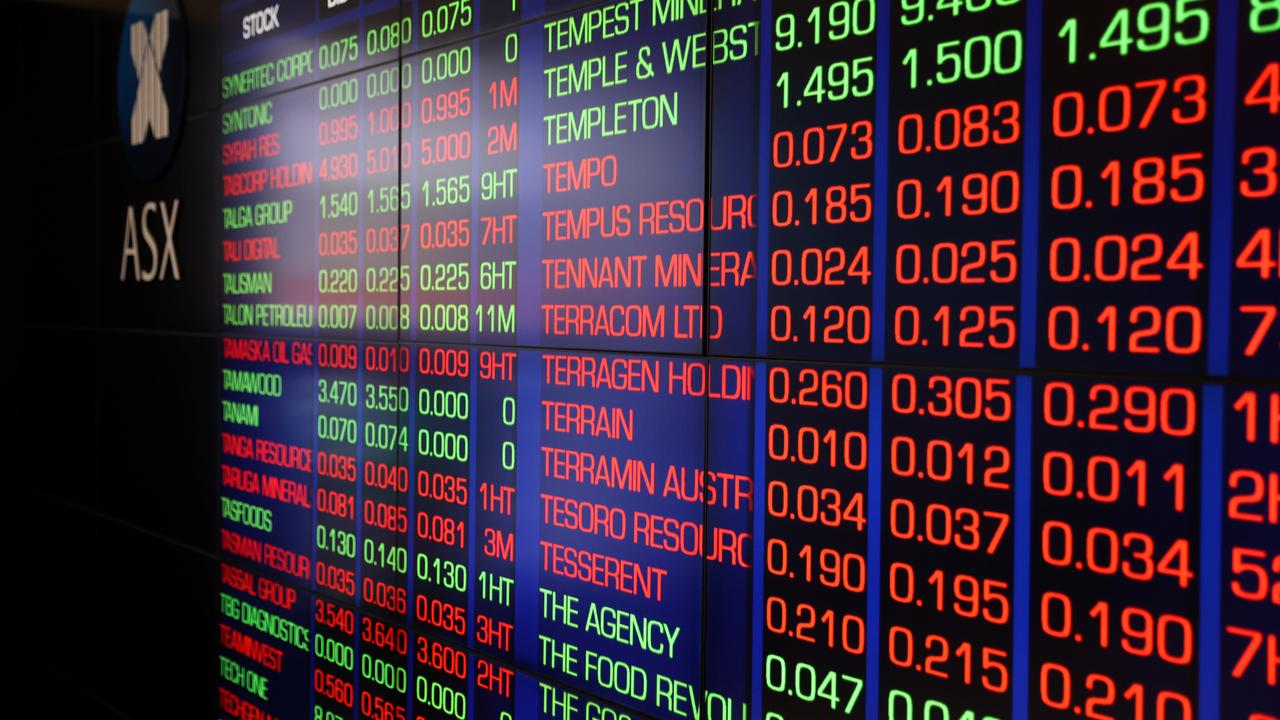

The nation’s second largest retail stockbroking platform, CMC Markets, says the COVID-19 pandemic has spawned a new, younger breed of online trader more prepared to buy international technology stocks.

CMC’s Head of Asia Pacific & Canada, Matt Lewis said more Australian women were also trading shares online, holding more diversified, internationally-focused portfolios than traditional male traders.

“We have seen an increase of a few per cent in female traders. We have always seen that as you go further out of Australia, especially in Singapore and into wider Asia, it always had a higher proportion of female traders. We have always in Australia had 5 per cent or more below that,’’ Mr Lewis said.

“Generally females have a more diversified portfolio into international stocks and a longer hold time in terms of trade execution. A more investing bent, if that’s the right term.”

The online retail trading sector has seen a mass entrance of new traders start investing driven by market volatility during COVID-19.

“COVID-19 has absolutely had an impact, it has accelerated an appetite that was already there. And it has created the new norm. Even in states where COVID-19 has fallen away, we have seen higher trading activity than the 12 month pre-COVID average,” Mr Lewis said.

According to CMC’s annual report, the firm now has over 24,970 active clients across Asia Pacific and Canada, an increase of 19 per cent year on year. In the Australian stockbroking business net trading revenue is up over 106 per cent this year, to £31.8m ($56.3m).

“Last year and this year has been like no other with the influx of new traders into the marketplace. The exponential growth in volumes we haven’t seen since the start of the online broking boom,” Mr Lewis said.

“That has introduced a new type of client. In the stockbroking side, we have introduced 60,000 new accounts into our business in the last six months. We have seen the average age three to four years younger than our average on boarding before.”

While this new breed of trader is looking to trade ASX shares, they are also seeking markets overseas to trade household brand names like Apple, which is why CMC now offers 15 international exchanges on its platform and has scraped commission on stocks from multiple global exchanges.

The pandemic has also spawned an appetite to trade tech stocks like Afterpay, plus a broader range of products.

“No longer is your typical client focused just on domestic equities. We have moved to open up international markets. We offer 15 but the majority of international trading takes place in the US market. We are seeing absolute trading in the Teslas of the world. A day rarely would go by without us seeing Tesla as our biggest US trade,” Mr Lewis said.

“It has grown from 1 per cent of total trades to around 5 per cent.

Millennial traders (up to the age of 36) are very much driving the type of products that they want.”

CMC has been using both internal and external market analysts and educators to responsibly educate and onboard the huge influx of beginner traders to their platforms this year.

It has also been conducting webinars and issuing e-books covering topics such as how to protect your capital and how to trade volatile markets.

“Australian investors and traders have always been well market educated. The notion of super or people having that compulsory super introduces share ownership at a very young age. And the ease of access to online brokers,’’ Mr Lewis said.

“The Millennials are also much more demanding for mobile devices. They want a service that is not inferior to your desktop. If I look at our CFD business, we see upwards of 62 per cent of all trade activity gets executed on a mobile device. In our stockbroking business, we see that approaching the 30 per cent level. We would anticipate there is a lot more growth to go.”

The London Stock Exchange listed CMC, the second largest stock broking platform in the country behind CommSec, provides direct online retail trading platforms.

It also partners with financial institutions to white label their trading platforms such as ANZ and Bendigo Bank and is talking to a number of groups about partnerships and white label offerings.

“We have also been working on thematic basket theme trades — for example sustainability, remote working, technology — that is something we are introducing through to our client base to provide those trading ideas.

“Or I like electric cars, how do I trade them?” Mr Lewis said.

“We are also introducing algorithm trading for our retail client trade — we believe it will reduce trade execution costs. Over the course of the year we are also looking to introduce some model portfolios — we are talking to potential partners on that.”