ASX takes $51bn hit on worst day in 6 months

Australia’s sharemarket followed Wall Street’s sharp fall as the ‘bondcano’ erupted, losing $51bn on Friday, with stocks like Afterpay and Orica tumbling.

- Orica laments China tensions as Calderon exits

- Kogan.com profit jumps, passes 3m customers

- AMP, Ares plan $2.25bn private markets partnership

- Retail at its best in 60 years: Gerry Harvey

Welcome to the Trading Day blog for Friday, February 26. The S&P/ASX 200 crashed 1.9%at the open and continued lower, ending 2.4% lower on its worst day for 6 months. Afterpay fell as much as 12% during the day, finishing 11% lower. World markets earlier sank on interest rate worries, as bond yields pushed higher. The Australian dollar retreated after pushing above $US80c. With earnings season coming to an end, results from Harvey Norman, Kogan.com, Lynas, Coronado, Orica, Austal and Boart Longyear, among others, came through on Friday.

7.42pm:Qantas - American airlines alliance gets new nod

Competition watchdog the ACCC says it’s proposing to re-authorise the alliance between Qantas Airways and American Airlines for another five years.

“The ACCC considers the public benefits from this alliance are likely to continue under this re-authorisation,” ACCC Commissioner Sarah Court said.

Under the terms of the alliance, Qantas and Jetstar can co-operate with American on routes across the Pacific, covering ports in Australia and New Zealand, the US, Canada and Mexico, with co-operation allowed to occur across wide areas of operational and sales and marketing functions.

“Passengers travelling on Trans-Pacific routes could benefit through enhanced products and services, including a greater likelihood of increased capacity and new routes; increased connectivity and improved schedule choice. Loyalty program benefits and improved lounge access, cost savings and efficiencies are also likely to be a result,” Ms Court said in a statement issued on Friday night.

“The ACCC considers that the extent to which these public benefits are likely to be realised depends on the rate of recovery in demand for Trans-Pacific services following the COVID-19 pandemic. The greater the demand for these services, the greater the public benefit that is likely to be realised.”

6.23pm:British Airways parent cops €6.9bn loss

IAG, the owner of British Airways and Spanish carrier Iberia, said Friday it suffered a 2020 net loss of €6.9 billion on the fallout from the coronavirus pandemic.

The huge loss after tax compared with a net profit of €1.7 billion in 2019, IAG said, adding that its performance reflected “the serious impact that Covid-19 has had on our business”.

6.21pm:Nikkei tumbles

Tokyo’s key Nikkei index tumbled four percent at the close on Friday after a rout on Wall Street as rising bond yields in the United States and elsewhere stoked inflation fears.

The Nikkei gave up 3.99 percent, or 1,202.26 points, to 28,966.01, marking its largest fall since June 2016.

The broader Topix index dropped 3.21 percent, or 61.74 points, to 1,864.49. “Equities are starting to quiver on the outlook for higher rates with losses led by the tech sector,” said Tapas Strickland, senior analyst at National Australia Bank.

AFP

4.36pm:ASX’s worst day since September

Australia’s sharemarket followed Wall Street’s sharp fall as the “bondcano” erupted.

In its worst day since September 9th, the S&P/ASX 200 closed down 160.7 points or 2.4pc 6673.3 points, losing $51bn of market capitalisation.

That left it down 1.8 per cent for the week - its worst week in four - after hitting a 12-month high of 6917.3 points only last week.

Australian 10-year bond yields spiked 19bps to an 11-month high of 1.923% after US 10-year bond yields spiked 24bps to a 12-month high of 1.609% on stronger than expected initial jobless claims data and the worst 7-year bond auction in a decade.

After weighing on Tech stocks and other high-PE “COVID winners” all week, the explosion in bond yields started to cause broad-based risk aversion with AUD/USD reversing sharply from a 3-year high and Financials and Resources stocks underperforming along with the high Tech, Consumer Discretionary and Health Care stocks on Friday. Afterpay fell 11pc, Kogan fell 10% and Domino’s fell 5.6%, while BHP lost 2.6%, Fortescue fell 4.5%, Orica dived 18% on a profit warning and James Hardie lost 3.3%.

AMP surged 7.5% amid rising speculation of a partial sale of AMP Capital while Flight Centre dropped 6.6% on multiple broker downgrades.

4.00pm: ASX bounce falters with US futures

Australia’s share market is falling back toward the almost four-week low it hit this morning as US futures tumble. S&P/ASX 200 was down 2.1% at 6689 in late trading after bouncing from 6658.9 to 6717 intraday. NASAQ futures fall 0.8% and S&P 500 futures are down 0.4pc, pointing to another bad night on Wall Street with the NASDAQ set to break the 13,000 level

Perry Williams3.58pm:US coal riding China’s Aust ban

US metallurgical coal producers have been profiting from China’s ban on Australian coal, striking deals at double the price Queensland and NSW producers are receiving for their supplies in international markets.

The ASX-listed Coronado Global Resources - which runs the Curragh mine in central Queensland - has been able to keep supplying Chinese steel mills through its US mines at prices topping $US200 ($255) a tonne compared with half that for Australian supplies.

“The Chinese boycott has created a massive arbitrage. At one stage China was buying US metallurgical coal of sub quality to Australian coal at double the price,” Coronado chief financial officer Gerhard Ziems told The Australian.

“Australian coal was $US102 a tonne and China was buying at more than $US200 a tonne.”

Beijing’s ban has sparked a massive shift in trade flows for coal.

Australia has been forced to find new markets in distant Europe while US producers have pivoted to China, lured by giant profits on offer.

Australian producers are fetching about $US130 a tonne for metallurgical coal in the early part of 2021 but China is still paying rival suppliers $US180 a tonne after stripping out shipping costs.

“So you’re looking at $US50-60 per tonne. It’s still massive,” Mr Ziems said.

Coronado said it has cashed in supplying China chiefly from its Buchanan mine in Virginia.

Canada’s Teck Resources has been another North American producer diverting spot cargoes to China to take advantage of short-term pricing.

3.50pm:Nasdaq forming bearish pattern: charts

The NASDAQ 100 looks to be forming a “Head & Shoulders” top pattern.

A break of the “neckline” and uptrend line from March, at 13,000, should target 11,840, which is 10% below the current level, although the target should probably be adjusted to 12,1000 since there should be support at the Sept/Oct highs.

A break above the “right shoulder” at 13,607 would be the level to “stop-loss”.

Of course these patterns rarely work out exactly as planned, but the volume configuration is good. Overall, it probably needs to break down tonight to have a good chance of achieving bearish objectives, and the risk is that G20 finance ministers or central bankers will say something supportive at the G20 meeting.

Meanwhile the record outflow from Cathie Wood’s ARK invest fund was a bit of a warning this week, and with the 7-year auction struggling overnight and another $US1.9 trillion of Treasury supply, the market may be in the mood to “fight the Fed.”

Apart from using rhetoric, it seem unlikely at these levels that they will step in immediately with faster bond buying barring a meltdown in the market.

The Nasdaq dived 3.5% to 13,119.43 points on Thursday, its biggest fall since October.

Helen Trinca 3.25pm:Companies need more than lip service on bullies

Consider this. A woman is eating a muffin at her desk when her boss walks by and jokingly says: “Remember, a moment on the lips, a lifetime on the hips.” The staffer is outraged, complains to HR and the manager is called in for counselling.

Too tough? Woke? Or reasonable?

Consultant Saranne Segal, who has just compiled a report that claims bullying is “thriving” in Australia, which is ranked sixth highest in the developed world in terms of bad workplace behaviour, admits the muffin story is a little tough. But she says that “people have to mind their Ps and Qs today”.

“We have become more politically correct and people have to be mindful of that.”

Segal, who runs her own conflict resolution consultancy gives another example which is easier to view as bullying – which is broadly defined as repetitive, ongoing behaviour that impacts the health and safety of workers.

This one is about the receptionist whose boss always says as she passes by: “Where’s your smile? Put your smile on.” Repeated so often, it made the receptionist feel uncomfortable enough to raise it with HR.

3.04pm:The art of the business lunch

The art of the perfect business lunch takes years to perfect. You can’t just launch into your pitch from the get go, you need to ease into it, letting your guests take the edge off their hunger and perhaps allow the wine to do its work. And most importantly, you need the right venue - one where you’ll be greeted by name, establishing that you are indeed someone worth lunching with - where the menu is just right, and where the staff know the perfect balance between being attentive to your every need, and knowing when to give you space to clinch the deal.

Melbourne’s top-shelf restaurateurs have established themselves as the place to be seen doing business, or to serendipitously bump into those who are. As business leaders return to offices, and dining tables, around the nation, we’ve selected what we believe to be Melbourne’s top business restaurants for your dining and dealing pleasure.

Giuseppe Tauriello 2.36pm:Austal boosts profit amid regulatory probe

Shipbuilder Austal has maintained its full year earnings guidance despite the disruption to supply chains and vessel deliveries caused by COVID-19.

The company lifted net profit to $52.4m in the six months to December, up from $40.8m in the prior year, with stronger shipbuilding margins in the US and Australasia making up for a 19.1 per cent fall in revenue to $840.3m.

While full-year revenue is expected to come in lower than previously expected, down from $1.8 billion to $1.65 billion, Austal has maintained its full-year EBIT guidance of $125m.

EBIT was up 17.6 per cent in the first half to $70.5m.

Austal chief executive Paddy Gregg said the improved bottom line in the first half was driven by “excellent shipbuilding operating margins in both of our USA and Australasia operations”.

“This highlights the success of the pragmatic initiatives Austal has implemented to increase our efficiency, reduce our cost base and set the business up for sustained profitability,” he said.

2.22pm:Weakest annual growth in business loans in 9 years

Business conditions and confidence have improved at the beginning of 2021, notes Ryan Felsman, senior economist at CommSec.

“Australia’s success at supressing the virus and economic re-opening have boosted economic activity as restrictions have eased. Private sector business investment surged 3.0 per cent in the December quarter with spending on plant, equipment and machinery up 5.7 per cent, thanks in-part to generous government tax incentives and record low borrowing costs.

“But challenges remain. In another Covid-19 survey from the Bureau of Statistics (ABS) released today, 41 per cent of respondents said that border restrictions, capacity constraints and on-going cleaning requirements were still significantly impacting Aussie businesses. Aside from the successful roll-out of vaccines, state and territory government policies still remain a risk to business operating conditions and supply chains.

“Perhaps even more of a concern is that businesses reported weakening revenue growth over the summer months. In fact, the proportion of firms reporting an increase in revenue fell from 25 per cent in December to 17 per cent in February. Two in five business owners said that their cash-on-hand would cover less than three months of business operations. And just 23 per cent of businesses reported that they had planned capital expenditure plans over the next three months.

“The caution is also reflected in very weak business demand for loans or credit. The Covid-19 shock has seen business credit contract in eight out of the past nine months to January. Excess capacity remains - as is usual in a recession - and mostly cashed-up businesses appear reticent to invest in the near-term. Nevertheless, hiring intentions remain firm in the more buoyant parts of the economy.

“The federal government has so far spent around $9 billion less than expected. In addition, Government receipts are around $5.4 billion higher than expected. As a result the federal government has scope to provide further assistance to consumers and business as needed.

“The budget deficit may have soared but the servicing cost is actually lower than three years ago – courtesy of rock-bottom interest rates. If you had to borrow, now is the time to be doing it,” says Felsman.

1.57pm:Firm RBA response needed: RBC

After the extreme bond market volatility of the last week, markets will be looking for a “firm response” from the RBA at its monthly board meeting next Tuesday, according to RBC.

“In Tuesday’s statement, the RBA is likely to repeat its commitment to highly supportive monetary conditions,” says RBC’s head of Australian and New Zealand fixed income and commodity strategy, Su-lin Ong.

She says that because 10 year bond yields are about 70bps higher, the 10 year AU/US spread is about 35bps wider (at 40bp), and the TWI about 4 per cent higher than a month ago when the RBA announced a second round of quantitative easing, the central bank “may well opt to “strengthen its language and measures” at the meeting. “At a minimum, we would expect a step up in yield-curve control for the next couple of weeks - possibly including more purchases on non QE operation days - plus the possibility that any further and sustained market dislocation forces the RBA to step in and buy across the curve in greater size than the standard $5bn weekly QE schedule,” Ms Ong says.

1.31pm:nib MD offloads shares

nib managing director Mark Fitzgibbon has offloaded 45,000 shares in the company worth $252,000.

In a statement the company said Mr Fitzgibbon sold them on market on February 24 to meet “a personal income tax obligation resulting from past awards of remuneration for his role in the form of nib shares’.

1.14pm:Woodside ratings affirmed; outlook negative: S&P Global Ratings

S&P Global Ratings says: “We are affirming our ‘BBB+’ long-term issuer credit rating on Perth-based LNG company Woodside. We are also affirming our ‘BBB+’ issue rating on the company’s senior unsecured debt.

“Risks for oil companies are escalating amid rising environmental, social, and governance (ESG) awareness and the broader global energy transition. We have revised our industry risk assessment to reflect our view that producers face increased uncertainties about profitability, volatility, and the evolution of the energy transition. Increasing adoption and transition toward renewable energy to address climate change are likely to have broad implications for hydrocarbon demand, prices, and producers of fossil fuels. Based on the greater industry risk and on a relative basis, we view Woodside’s business risk to have incrementally weakened and as such we expect moderately stronger financial metrics for the ‘BBB+’ rating.

“The transition will continue to accelerate due to the COVID-19 pandemic and the growing adoption of ESG investment mandates among global investors and financial institutions, in our view. As a result, the risk of divestment and capital market access may become more challenging and costly for hydrocarbon producers. Moreover, declining industry profitability over the past decade underscores increased industry cyclicality.

“We believe Woodside’s higher exposure to LNG relative to peers and its low-cost portfolio of assets somewhat mitigate the heightened industry risk. Underpinning the company’s credit strength is its established track record as an LNG operator with low-cost operations and exposure to mostly low-risk jurisdictions. In addition, Woodside’s focus on LNG means the company’s operating dynamics can show some resilience compared with many producers selling into spot markets. While LNG companies go through development periods of immense capital intensity, cash flow generation is relatively robust for decades once these facilities are completed, particularly if the operating costs are low. We anticipate that Woodside will implement a sustainable funding strategy for its upcoming major growth projects before any final investment decision is made.”

John Stensholt 12.47pm:Seven steps up cricket rights stoush

Seven West Media’s stoush with Cricket Australia over the value of its broadcast rights has taken another twist, with the network seeking the removal of the independent arbitrator set to rule on the dispute.

Venture Consulting chief executive Justin Jameson was appointed in December to rule on the dispute between Seven and Cricket Australia, after the broadcast stepped up its battle to receive a discount on its $82m cash and contra annual deal alleging cricket was delivering an inferior summer of sport to the network.

But Seven on Friday wrote to Mr Jameson demanding he recuse himself from the case, arguing that he is is not independent enough to make a decision on the cricket rights after Venture published a paper entitled “Sports rights hits an inflection point: new distribution players and models arising” earlier this week.

In a letter seen by The Australian, Seven said it “is shocked” the paper was published on the same day Mr Jameson requested final comments on his draft expert determination on the cricket rights and concerned about the paper’s negative outlook for the free-to-air television sector.

“Seven submits that it is clear that the expert has taken an extremely negative view of the Free-To-Air television industry in Australia,” the network wrote.

“Seven submits that despite the weight or proven and sourced evidence by Seven of the detrimental effects of the season, the expert has expressed personal views and theses that Free-To-Air is in decline, sport is in decline and that cricket is in decline”.

Mr Jameson reportedly made a draft determination earlier this week that Seven, which had asked for a $70m reduction in its rights fee, was only entitled to a small annual discount of about $5m.

A final determination is due next week.

Ben Wilmot 12.33pm:Australian Unity says Canada bid ‘significantly undervalues’ assets

The fight for the last remaining large scale portfolio of hospital and healthcare assets owned by Australian investors has kicked off, with funds manager Australian Unity saying a bid by Canada’s NorthWest Healthcare Properties for the near $2.5bn portfolio significantly undervalues the assets and could upset ties with healthcare operators.

The aggressive move by the Northwest, which is understood to be backed by capital partner Singaporean heavyweight GIC, would see the Canadian group become the country’s dominant private medical landlord.

Rivals including Dexus, Centuria Capital and Barwon are all looking to expand in healthcare, as are owners like US company Medical Properties Trust, seeking to ride the demographic bulge that is driving demand for healthcare services.

12.21pm:ASX 200 trims loss but remains vulnerable

Australia’s sharemarket recovered slightly from a morning rout that followed a bond-driven tumble on Wall Street.

The S&P/ASX 200 index was down 1.9%at 6700.1 after falling as much as 2.6%to an almost 4-week low of 6658.9 then bouncing to 6708.

US 10-year bond yields have fallen 4bps to 1.485 after rising as much as 24bps to a 12-month high of 1.609%after a very weak bond auction .

The pullback in US bond yields has relieved the selloff in Australian bonds with the 10-year yield up 6bps at 1.79.2%after rising 19bps to an 11-month high of 1.928 in early trading.

NASDAQ 100 futures dived as much as 1%before recovering to be down 0.3%and S&P 500 futures were up 0.1% after falling 0.1pc.

The tentative indications of a potential bounce on Wall Street helped the Australian market recover intraday.

Indeed with a F20 Finance Ministers’ meeting tonight, there could well be some supportive comments from officials.

But the S&P/ASX 200 looks vulnerable while below its 50-day moving average at 6745 and former support around 6775.

Banks are outperforming and resources have recovered somewhat with NAB down 1% and BHP down 1.8pc.

But high PE stocks in the Tech, Consumer Discretionary and Health Care sectors remain under pressure.

Afterpay is down 9pc, Domino’s is down 7.7% and CSL is down 2.3% .

Orica is down 20% on a profit warning.

12.06pm:ASX winners and losers at midday

Orica is one of the biggest losers this morning, down almost 19pc, after slashing its earnings outlook and announcing boss Alberto Calderon will step down after six years in the top job at the explosives manufacturer.

Mr Calderon, formerly a top executive at mining giant BHP, will be replaced by Sanjeev Gandhi, Orica’s group executive and president of Australia Pacific Asia.

Orica blamed trade tensions between Australia and China and COVID-19 ructions for denting demand for thermal coal, forcing it to slash supplies of ammonium nitrate to local miners as part of a $125m earnings hit.

Coronado Resorces is down almost 18pc. Coronado Global Resources said it made an annual loss, as it grappled with the disruption to coal supply and pricing from the coronavirus pandemic, the US-China trade dispute and a fatal accident at its Curragh mine in Australia.

Kogan.com is 10% down, Pointsbet is off 9.5% and Domino’s Pizza is 7.5% lower.

Afterpay fell as much as 12% this morning after resuming trading following a trading halt on Thursday to raise $1.5bn to lift ownership of its US unit from 80 per cent to up to 93 per cent.

The banks are lower. ANZ, Westpac, CBA and NAB are all down around 2pc. BHP is down 2pc, Rio Tinto is 1.5% lower and CSL has lost 2.4pc. Telstra is down 2.4% as well.

Winners include AMP, one of the most actively traded stocks so far today, up 4.6pc, Lynas Rare Earths, up 3.7% and Silver Lake Resources, up 3pc. Mpower is up 20pc.

Jared Lynch 11.52am:Bubs suffers with collapse of the Chinese daigou market

The collapse of the Chinese daigou market has claimed another victim with goat milk-focused infant formula producer Bubs diving almost doubling its half year loss despite ramping up investment across more traditional ecommerce sales channels.

COVID-19 has continued to expose the ongoing reliance of daigous - or students, tourists and increasingly small corporate groups running their own China export business - for a raft of Australian companies.

Bubs dived 71 per cent deeper into the red, reporting a $12.9m loss in the half year to December 31, compared with a $7.56 million loss in the previous corresponding period.

Its EBITDA loss plummeted to $14.4m from $5.3m a year earlier. Revenue meanwhile caved 33 per cent to $18.29m, overshadowing gains the company made in the Australian and mainstream ecommerce sites in China.

But the company maintained its product margin at 34 per cent and said it expected modest growth across the full year, buoying investors.

Shares were trading 4.5 per cent higher at 58c at noon on Friday, compared with a 2.3 slump across the broader share market.

David Ross 11.45am:Betmakers boosts revenue but costs blowout nixes profit

Gambling technology provider Betmakers has romped in an 88 per cent increase in revenue but losses ballooned at the business on the back of increased costs.

The group posted a loss of $4.9m, driven by a $3m share based payments expense and $831,355 in costs related to acquisitions.

Expansion into the United States market cost the business $883,589, however this investment is yet to yield revenues.

Betmakres spruiked its proposed acquisition of Sportech’s tote and digital assets to be delivered in the next quarter, which it flagged as set to add substantial revenues and earnings to the business.

The expansion will boost the business’s market in the US, giving access to 36 states and 100 business customers in the gaming and gambling industry.

No dividend was paid.

David Ross 11.33am:Isentia revenue sinks after hacking attack

Isentia has posted a big hit to revenue and profit after being rocked by a hacking incident earlier in the year.

The software and media business saw a $10.4m fall in revenues for the half, dragged down by the cost of the hacking incident that hit the business in the December quarter.

Discounts and credits offered to customers in response to the hacking event, as well as remediation costs saw Isentia slugged $3.3m in reduced revenue eleading to a direct impact on earnings to the tune of $4.4m

The overall cost of the hack is forecast to have a $7-8m hit to earnings for the full year.

The business posted a net loss after tax of $5.2m, a significant swing from the $677,000 profit in the first half last financial year.

Isentia CEO Ed Harrison said the business had “a difficult half”, including exiting loss making North Asia operations in September.

“Despite the recent challenges, our strategic roadmap remains in place and we are confident that our transformation programs will stabilise the business and eventually return it to growth,” he said.

Perry Williams 11.06am:Dalrymple Bay Coal Terminal has not shipped to China since Nov

Queensland’s Dalrymple Bay Coal Terminal said no shipments of coal have been sent to China since the middle of November as it slumped to a $113m annual loss, in line with prospectus forecasts.

China has banned taking new supplies of Australian coal, a hammer blow to one of the nation’s biggest export earners and a decision that has forced producers to source alternative markets.

Exports to China from Dalrymple Bay, which handles a third of Queensland’s coal exports, fell 13 per cent to 14.5m tonnes for the 2020 financial year.

The terminal’s exports handle production from nearly 20 mines and is dominated by metallurgical coal, used for steelmaking, with thermal coal accounting for less than a fifth of supplies.

Dalrymple Bay Coal Terminal fell to a $113m loss for the 12 months to December 31, just ahead of a $115m loss forecast in its prospectus and attributed to $129m of IPO costs. Revenue was $23m, lower than a $38m estimate in its prospectus.

The company has switched to quarterly payouts with a distribution of $22.5m to be paid for the first three months of the 2021 financial year while an on-market buyback program has also been launched.

The company floated on the ASX on December 8 but has seen its share price languish, trading at $2.05 compared with its $2.57 listing price.

Coal prices have rebounded since the start of 2021 despite ongoing trade tensions with China although broader concerns from institutional funds over investing in the fossil fuel has weighed on the stock.

11.00am:ASX falls 2.5pc; worst day in 6 months

Australia’s sharemarket fell 2.5% to 6660.3 points, its lowest level in almost-4-weeks.

The index is having its worst day since a 3.1% fall on Sep. 9th.

The #ASX 200 weekly chart shows the size of today's drop compared to the performance over the first 4 days. The index is now down 160pts or 2.34% to 6674 & on track for a weekly loss of 1.75% #ausbiz Source: Iress pic.twitter.com/al5HFWJLSB

— CommSec (@CommSec) February 26, 2021

10.34am:ASX 200 dives 1.9pc; Afterpay -10%

Australian shares dived in early trading after a rout on Wall Street.

The S&P/ASX 200 fell 1.9% to a 3.5-week low of 6701.3, exceeding a 1.3% fall projected by overnight futures.

The index has broken its 50-day moving average for the first time since early February.

A daily close below the 50-DMA would target the 100-DMA at 6545.

The February low was 6517 and that’s now very important support as a break could trigger a “broadening top” pattern.

Technology stocks are worst off with Afterpay down 10% after resuming trade after its capital raising and results.

WiseTech is down 5.4% despite two broker upgrades, while Xero is down 4.3% and Zip Co is down 7.6pc.

Consumer Discretionary is also underperforming with Flight Centre down 7.3% on multiple broker downgrades (though two upgraded), Domino’s Pizza off 6.6% and Kogan down 7.6% despite a decent report.

The Materials sector is also getting hammered with Orica down 27% on a profit warning, BHP down 1.7% and James HRadie down 5.1pc.

US futures have faded after rising 0.3% in early trading.

David Ross 10.22am:Lithium price slugs Orocobre, change expected

Lithium miner Orocobre is riding a rebounding price wave for the rest of 2021, but has still been slugged a US$29.1m loss for the half.

Lithium production at the miner was down nine per cent in the half compared to pre-pandemic levels, but sales were up.

Ocorobre sold 7738 tonnes of Lithium, up 21 per cent on the pre-pandemic levels, bringing in a revenue of Us$27m.

Lower prices saw sales price slashed 22 per cent to an average of $3492 per tonne.

But the miner is forecasting prices to turn a corner, predicting a 50 per cent price boost to $5550 a tonne for the second half.

Orocobre chief Martin Perez de Solay said Orocobre was hit by weaker market conditions but was focused on growth.

“Construction of our growth projects is progressing at the Naraha Lithium Hydroxide Plan and the Stage 2 expansion of Olaroz,” he said.

“We are now looking to the future with a study into Stage 3 at Olaroz and additional lithium hydroxide production.”

10.09am:What’s impressing analysts today?

A2 Milk cut to Underweight: JPM

A2 Milk target price cut 13% to $7.15: Sell rating kept: Citi

Atlas Arteria raised to Overweight: MS

Cleanspace Holdings cut to Hold: Bell Potter

Fleetwood raised to Buy: Moelis

Flight Centre cut to Equal-Weight: MS

Flight Centre cut to Underperform: CS

Flight Centre cut to Sell: Citi

Flight Centre cut to Neutral: UBS

Flight Centre raised to Hold: Ord Minnett

Flight Centre raised to Outperform: Macquarie

Nickel Mines cut to Sell: Shaw and Partners

Nickel Mines cut to Neutral: Citi

Nufarm cut to Neutral: CS

Nufarm raised to Outperform: Macquarie

Qube cut to Neutral: CS

Ramsay Health Care cut to Neutral: Citi

TPG Telecom raised to Buy: UBS

Wagners raised to Outperform: CS

Wagners raised to Outperform: Macquarie

WiseTech raised to Hold: Bell Potter

WiseTech raised to Neutral: Citi

Robert Gottliebsen 10.03am:Why the nation’s renters will be paying more

In most areas of Australia those paying rent for their residence face the real danger of much higher payments in coming years.

A series of forces are aligning where residential property owners will demand and obtain much larger returns. Most of those forces are unique to the property market but last night the world received another warning that the proposed actions of President Biden will lift US interest rates.

A significant benchmark indicator, the US 10-year bond rate, jumped to 1.5 per cent --- almost three times the level of last August.

I set out the background to this new global development earlier in the week under the heading “US bond yield, copper price hints at higher interest rates to come”.

It will take time for the US bond rate’s upward trust to have a significant impact on Australia, but the early warning signs are there and this reduces the price of shares.

But the residential rent market is impacted by a much wider variety of forces and they spread around the nation. The only major residential property area where there is significant weakness is in inner city Melbourne apartments.

Lachlan Moffet Gray10.00am:Omni Bridgeway suspends interim dividend as revenue plunges

Australia’s only listed litigation financier Omni Bridgeway has suspended its interim dividend as revenue plunged due to COVID-19 slowing the resolution of court cases in Australia.

The company said revenue fell to $16.1m from $54m in the prior comparable period, resulting in a $110m loss after $107m in impairments.

“The COVID-19 pandemic has interrupted dispute resolution systems to different degrees in jurisdictions where the Group has investments,” the company said.

“Of the 31 December 2020 Estimated Portfolio Value, approximately 8 per cent has a possible completion period (as such term is defined in the Company’s ASX announcement dated 29 January 2021) in the remainder of FY21 with 33 per cdnt in FY22.”

Lachlan Moffet Gray9.51am:Harvey Norman rides lockdown wave to riches

Harvey Norman has more than doubled its interim profit to $464m and declared a 20c fully franked half year dividend as sales for furniture, whitegoods and electronics continued to ride a wave of COVID-19 influenced demand.

Total aggregated sales revenue lifted 25.8 per cent to $5.12bn while earnings lifted 76 per cent to $779.84m.

Some parts of the company received JobKeeper from The Australian government to the tune of $3.63m, while overseas operations received $2.25m in wage support from foreign governments.

“All of which was passed on directly to their employees in order to retain the employees of those businesses,” the company noted in its report.

Executive chairman Gerry Harvey said the result validated the company’s unique strategy.

“The solid results delivered this half is a testament to the strength and resilience of the integrated retail, franchise, property and digital strategy and its ability to adapt and transform to the changing retail landscape and continue to navigate the uncertainties presented by COVID-19,” he said.

The company paid down debts during the period and was in a net cash position of $21.75 million at 31 December 2020, compared to a net debt position of $553.23 million at 31 December 2019.

“The net debt to equity ratio at 31 December 2020 was NIL, compared to a net debt to equity ratio of 16.57 per cent at 31 December 2019,” the company said.

The company said trading continued to be strong, with aggregated sales revenue tracking at 21 per cent above last year’s over January and February.

9.48am:ASX set to open at 3.5-week low

Australia’s sharemarket is set to fall sharply to a 3.5-week low after a meltdown in global bonds sparked a rout in stocks.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open down 1.3% at 6745, its lowest point since Feb 2nd.

The 50-day moving average should offer support at that level and the index may close back above the recent low at 6762.6.

With a G20 Finance Ministers meeting tonight, there’s a strong chance of supportive comments from officials.

Consumer Discretionary and Tech stocks underperformed the S&P 500 while other sectors mostly outperformed the index which fell 2.5% a 4-week low close of 3829.34.

The NASDAQ dived 3.5% to a 2-month low close of 13119.43, marking its worst day since October.

The ongoing selloff in the US bond market caused the selloff with the US 10-year yield spiking 24bps before ending up 14bps at 1.51pc.

BHP ADRs’ equivalent close at 49.52 was 1.9% below its close in Sydney.

Bluescope, Coles, Alumina and Lendlease are ex-dividend.

Lachlan Moffet Gray9.39am:Mesoblast in trading halt

Mesoblast has entered a trading halt pending an announcement regarding a proposed private placement to a targeted industry investor.

Lachlan Moffet Gray9.35am:Roc Private Equity offers $1.08 a share for Vital Harvest

Listed agricultural trust Vital Harvest has received a non-binding takeover proposal from Roc Private Equity to purchase it via a trust scheme proposal for $1.08 per share.

If the trust scheme is not approved by shareholders, Roc has proposed purchasing all assets of Vital Harvest for $314.8m.

The trust scheme proposal represents an 8 per cent premium to one offered by Macquarie Agricultural Funds Management last November and an 8 per cent premium on Vital Harvest’s last trading price of $1 a share.

The Vital Harvest board said it is assessing the offer.

The offer crashes a takeover play made by Macquarie’s asset management unit for the Vitalharvest Freehold Trust, which owns berry farms leased to Costa Group.

Roc has made a bid at $1.08 per share - a premium to Macquarie’s $1 per share - that would give it control of $300m worth of berry farms if successful.

Macquarie had support from trust manager Primewest which had committed the bulk of its 19 per cent stake into the bid via option agreements.

It also won the backing of the independent expert which dubbed its bid fair and reasonable and the independent board, albeit subject to a higher offer emerging

Additional reporting: Ben Wilmot

9.22am:Bond yields soar on US moves

Australian bond yields surged in early trading after big gains in US bond yields after a weak Treasury auction and stronger than expected US initial jobless claims and durable goods data.

The Australian 10-year bond yield rose as much as 19bps to a fresh 11-month high of 1.928% after an equivalent move in futures overnight.

The 3-year bond yields jumped 3bps to a 0.154% - highest since October. The surge in yields came despite the RBA’s “supersized” $5bn bond purchases yesterday, including a record $3bn for yield curve control.

A US Treasury bond meltdown overnight added to an accelerated global selloff which started in NZ with the change of RBNZ remit to include house price sustainability by considering “the impact on housing when making monetary and financial policy decisions”.

US 10-year Treasury bond yields finished up a massive 14bps at 1.52% after rising almost 24bps to a 12-month high of 1.609% after theTreasury’s 7-year bond auction saw the weakest demand in a decade.

“The market now prices the first 25bp rate hike in Australia by the end of 2022, despite the RBA having recently stated it didn’t expect to see the conditions for a rate rise until 2024 ‘at the earliest’,” notes NAB’s Tapas Strickland.

“With the US heading to full employment by the end of 2022 and Australia’s economic performance outpacing that of most countries, it’s no surprise to see markets pricing in the chance of rate hikes in 2022 and 2023.”

He also notes that after the selloff in bonds overnight, futures implied a US-10 year yield spread of some 43.5bps – well above where the spread was trading when the RBA first floated QE back in September 2020.

But the Australian dollar has at least temporarily been unnerved by global risk aversion, diving from a 3-year high of 0.8007 to a 3-day low of 0.7872 overnight as the NASDAQ dived 3.5% and the VIX index soared 7.6 points to 28.89pc.

Lachlan Moffet Gray9.17am:Gemworth swings to loss, but adds policies

Listed mortgage insurance provider Gemworth has swung to a $107.5m full year loss even as it added almost 10,000 policies to its portfolio as it made provisions in anticipation of future claims made by banks when borrowers default.

The company said it had now written 76,557 of policies worth $31.6bn, with low interest rates driving a lending boom - but it also provided relief to 63,000 borrowers experiencing difficulty throughout the year, impacting revenue.

$181.8m of deferred acquisition costs were written down, alongside a reserve of $109.1m.

“In response to the pandemic, repayment deferrals and moratoriums on foreclosures were introduced to support borrowers,” the company said.

“These initiatives interrupted the typical behaviour patterns of delinquencies and claims, leading to lower than anticipated claims activity.

“To allow for these unusual circumstances, Genworth increased reserving and refined our reserving methodology to bring forward the average timing for recognising the potential liability for losses.”

David Ross 9.05am:Sezzle loss widens, but customers, revenue grow

Buy-now-pay-later platform Sezzle has posted a wider loss, despite a major increase in sales and customers.

Total income across the business year-on-year surged 272.1 per cent.

The business posted $856m in underlying merchant sales.

Active consumers across Sezzle also grew 143.9 per cent to 2.2m by the end of 2020.

However, Sezzle’s loss after tax also jumped significantly, growing 144 per cent for the half to $31.8m.

This was well up on the $13m loss Sezzle posted the year before.

But Sezzle is pointing to a $250m deal that will fund the expansion of the business across the USA and into Canada, as the business attempts to keep pace with the rapid growth of other stablemates.

Company chair Charlie Youakim said the results reflected an exciting momentum for Sezzle, noting “2021 is off to a good start”.

Sezzle forecast underlying merchant sales of $2.5bn by the end of 2021

Lachlan Moffet Gray9.04am:AFG profits from strong housing market

Australian Finance Group has joined the ranks of mortgage broker groups and lenders reporting record interim results as the housing market roars back to life.

Net profit after tax lifted 36 per cent to $24.97m, a record result for the company, and an interim dividend of 5.9 cents a share was declared.

The company said residential settlements lifted 24 per cent to $20.92bn in the half, with year on year growth in every month of the period.

“Overall settlement volumes for AFG Home Loans were $1.47 billion and the AFG Home Loans trail book is now at $10.7 billion, an increase of 9 per cent. AFG Home Loans now has over 27,000 retail customers,” the company added.

CEO David Bailey said activity was strong in all corners of the market.

“It has been very pleasing to see that it is not just the first home buyers that have driven demand,” he said.

“The past six months we have seen increased participation from upgraders and, in the first half of the 2021 financial year, refinancers. All have been looking to take the opportunity, with interest rates being at all-time lows, to reduce the largest cost to their monthly budget.”

David Ross 8.54am:Nuix posts loss in first results since listing

Software solutions provider Nuix has announced a slight decline in revenue and a net loss as part of its first results to hit the ASX since listing.

However, Nuix flagged increasing customer numbers, the business adding 49 additional, with a boosted dollar value of deals made, which grew 17 per cent.

Revenue slipped 4 per cent year on year to $85.3m, with the business also reporting a statutory net loss of $16.5m.

However, on a proforma basis after tax Nuix reported a $9.4m profit.

Nuix CEO Rod Vawdrey said he was pleased with the results which demonstrated “the stickiness” of the business’ customer base.

The business flagged a strong 2021 which would be fueled by “exponential growth in data and regulatory compliance”.

Nuix forecast a full year revenue target of $193.5m and and pro forma earnings of $63.6m

Lachlan Moffet Gray8.53am:Boart Longyear sees strong mining activity rebound

Drilling equipment and services company Boart Longyear’s CEO Jeff Olsen said mining activity strongly rebounded in the last quarter and anticipates investment spending will soon return to historical levels.

Mr Olsen made the comments while handing down the company’s full year results to the ASX.

Revenue fell 11 per cent to $657m while EBITDA declined 31 per cent to $60m.

The company swung to a $99m loss with decreased operational activity impacting the bottom line by $10m, and impairments by $14m.

Mr Olsen said despite the impacts of COVID-19 on business through the year, he was already seeing a turnaround.

“The company saw an increase in activity levels through the fourth quarter. We anticipate activity levels will continue to increase through 2021 as mining houses look to recover lost ground of 2020 and implement investment spending to return reserve levels back to historic levels,” he said.

However, the company warned that it was looking at refinancing options in the year ahead which would most likely be “highly dilutive” to existing shareholders.

“The company anticipates the process, if successful, is likely to involve existing lenders converting all or part of their debt to equity,” it said.

“This transaction could be highly dilutive to existing shareholders and current lenders could assume significant governance rights and control.”

Lachlan Moffet Gray8.44am:Afterpay upsizes raising to $1.5bn

Afterpay has upsized and priced $1.5bn of convertible notes to fund an increase in the stake it holds in its US business.

The company told the ASX that the notes, which were released on Thursday, were “strongly supported” by eligible investors globally.

“The initial Conversion Price of the Notes is A$194.8220 per Ordinary Share, which represents a conversion premium of 45.0 per cent over the Reference Share Price (A$134.36 per Ordinary Share),” the company said.

The company said a planned sell-down by co-CEOs Anthony Eisen and Nicholas Molnar has been executed.

“An independent sub-committee of the Afterpay Board determined that it was in the best interests of Afterpay shareholders to enable this transaction,” it said.

“As a result, the Co-CEOs have sold 450,000 shares each at the Reference Share Price.”

Lachlan Moffet Gray8.40am:Record sales, revenue at Kogan with 3m active customers

Kogan.com has achieved record half year results while passing the three million active customer milestone, doubling its interim payout to shareholders.

The online retailer saw gross sales lift 97.4 per cent to $638.2m while revenue increased 88.6 per cent to $414m.

Net profit after tax lifted 164 per cent to $23.6m and a fully franked dividend of 16c a share was declared, compared to last year’s 7.5 cents interim dividend.

The company did not provide full year earnings guidance but did share its unaudited accounts for January, which shows that gross sales grew more than 45 per cent. year on year while adjusted EBITDA grew more than 90 per cent

Founder and CEO Ruslan Kogan flagged further investments in the platform, including “significant improvements to our logistics network, speed of delivery, range expansion, and improved competition on our platform to drive even better experiences for our customers.”

8.28am: Coronado posts loss amid US-China trade dispute

Coronado Global Resources said it made an annual loss, as it grappled with the disruption to coal supply and pricing from the coronavirus pandemic, the U.S.-China trade dispute and a fatal accident at its Curragh mine in Australia.

Coronado reported a net loss of US$226.5 million in the 12 months through December, compared to a profit of US$305.5 million in 2019. Annual revenue fell by 34% to US$1.46 billion.

Coronado temporarily suspended operations at the Curragh mine in January and February following the death of a contractor. This setback continued to impact operations over the first half of the year, the company said.

The miner was also impacted by wet weather in Australia, while the trade dispute between the U.S. and China limited exports from its U.S. operations. The deepening impact of the pandemic led Coronado to idle its U.S. mines temporarily in April and May.

“The second half of the 2020 fiscal year saw a marked improvement in production and sales from our U.S. and Australian operations,” Coronado said. “In the U.S., the Buchanan and Logan mines resumed operations in June 2020 and ramped up to near full production capacity by the end of the December.”

Still, a worsening trade dispute between Australia and China that built toward Beijing imposing restrictions on Australian coal imports took its toll. Coronado said Australian benchmark pricing for coal declined sharply in the final three months of 2020.

“Although Curragh rarely exports metallurgical coal to China, Australian benchmark pricing was nevertheless affected resulting in lower realized prices,” Coronado said. “In contrast, U.S. exports to China from the Buchanan mine attracted increasingly higher prices over the period.”

Dow Jones Newswires

Perry Williams 8.27am:Orica boss Calderon to step down

High profile Orica boss Alberto Calderon will step down after six years in the top job at the explosives manufacturer.

Mr Calderon, formerly a top executive at mining giant BHP, will be replaced by Sanjeev Gandhi, Orica’s group executive and president of Australia Pacific Asia.

Explosives manufacturer Orica has blamed trade tensions between Australia and China and COVID-19 ructions for denting demand for thermal coal, forcing it to slash supplies of ammonium nitrate to local miners as part of a $125m earnings hit.

China’s blacklisting of Australian coal has showed no signs of easing with Beijing’s move meaning producers have had to find new markets outside of the world’s biggest commodity consumer.

The coal ban will cut 60,000 tonnes of ammonium nitrate for the first half of the 2021 financial year compared with the prior year, about 7 per cent of Orica’s monthly ammonium nitrate volumes for the Australia, Pacific and Asia regions.

Orica estimates it will reduce earnings before interest and tax by $70m-80m in the first half of the year.

The bulk of Australian mines depend on Orica to keep their production running through its supply of bulk explosives and detonator systems

Mine closures in Columbia, social unrest in Peru and strikes in Chile have also hit the miner.

Orica will also incur a $20m-25m charge from the strengthening Australian dollar against the US dollar and other currencies and $15-20m in lower earnings from more arbitration costs on the Burrup plant in WA and SAP system stabilisation costs.

Lachlan Moffet Gray 8.23am:Austal cuts revenue forecasts

Shipbuilder Austal has maintained full earnings year guidance but reduced revenue forecasts as expanding margins begin to compensate for falling demand for some ferries amid COVID-19.

In its half year results the company, which is facing dual investigations in the US and Australia over potential corruption charges, reported a revenue decline of 19.1 per cent to $840.3m while net profit after tax lifted 28 per cent to $52.4m.

An interim dividend of 4c a share was declared.

Austal Chief Executive Officer Paddy Gregg said the USA and Australasian divisions performed well.

“The strong interim financial results were driven by excellent shipbuilding operating margins in both of our USA and Australasia operations, which flowed through to an enhanced bottom line,” he said.

Austal maintained its October 2020 guidance for FY2021 EBIT of $125 million and reduced revenue guidance to approximately $1.65 billion “as a result of the appreciating AUD, reduced USA Support activities and COVID-19 related program delays in Australasia.”

Lachlan Moffet Gray 8.18am:Lynas lifts profit, repays JobKeeper

Rare earths miner Lynas has lifted its interim profit as the global price for its commodities rose and repaid JobKeeper - but it did not declare a dividend.

The company recorded a net profit of $40.6m, compared to $3.9m in the prior comporable period as revenue lifted more than 10 per cent to $202.5m.

Lynas Rare Earths CEO and Managing Director Amanda Lacaze said the result was attributable to cost of sales staying steady while revenue increased on the back of hire prices.

““Despite ongoing uncertainty in the global economy and logistics/supply chain systems due to the effects of the pandemic, Rare Earths market settings were favourable and pricing for Rare Earths materials improved,” she said, adding that the strong result means the firm can repay the JobKeeper it received.

“We appreciated the support these payments provided our staff during a time of uncertainty and will repay approximately $1m in support received,” Ms Lacaze added.

8.16am:US stocks close sharply lower, led by tech shares

US stocks tumbled on Thursday as a wave of selling spread beyond the technology sector, taking down swaths of the market.

The Dow Jones Industrial Average, as of 4pm ET, dropped 561 points, or 1.8%, after closing on Wednesday at an all-time high. The S&P 500 shed about 2.5%, and the Nasdaq Composite lost 3.5%.

Stocks’ momentum has faltered the past week as investors have faced a sharp and swift rise in bond yields. Money managers have broadly attributed the shift to bets on the economy picking up, something that should be a boon to corporate profits. But the swiftness with which yields have moved has also had another effect: It has tempered enthusiasm for more richly valued, risky parts of the market.

Investors rushed out of some of the hottest stocks of the year, sending shares of companies like Apple, Alphabet and Netflix down.

While relatively cheap corners of the market appeared to hold up well at first, with bank stocks and energy producers initially higher for the day, those gains dwindled in afternoon trading.

The KBW Nasdaq Bank Index of 24 lenders slipped 1.8%, wiping out all of its earlier advance.

“The market is jittery. The bond yields’ rising is putting equities, especially growth stocks, under pressure,” said Sebastien Galy, a macro strategist at Nordea Asset Management. “There is a bit of a risk reduction broadly.”

One group of stocks that bucked the trend: “meme stocks” that have surged in popularity among individual investors this year.

In a wave of volatility reminiscent of last month’s rally, GameStop jumped 59%, while AMC Entertainment hovered around flat. The two stocks had soared in overnight trading.

The moves show “there is still liquidity and a lot of access to speculative bets,” said Sophie Chardon, cross asset strategist at Lombard Odier. “We have to be prepared to live with this kind of targeted bubble, but I wouldn’t see it as a threat to the global equity market.”

Meanwhile, government bond prices fell, with the yield on the benchmark 10-year Treasury note rising to 1.513% from 1.388% Wednesday.

“The rise in yields is supportive for banks; higher oil prices are supportive for energy. It is a change of leadership,” Ms. Chardon said.

Overseas, the pan-continental Stoxx Europe 600 edged down 0.4%.

Among individual equities, beer maker Anheuser-Busch InBev fell almost 6% after its fourth-quarter profit came in below estimates.

British packaging company DS Smith jumped 5.7% on reports that rival Mondi is exploring a takeover.

Investors have also been selling European government bonds in recent weeks as they look for higher returns. The yield on French 10-year bonds, which moves inversely to the price, ticked up above zero for the first time since June and reached as high as 0.024%.

In Asia, most major benchmarks finished the day up.

The Shanghai Composite Index added 0.6%, snapping a three-day losing streak, and Hong Kong’s Hang Seng Index climbed 1.2%.

South Korea’s Kospi Index rallied 3.5% after its central bank kept interest rates at historic lows, citing a need to continue supporting the country’s economy.

7.45am:AMP, Ares plan private markets joint venture

Wealth manager AMP said it has agreed a framework deal with US-based Ares Management Corp to create a joint venture for AMP Capital’s private markets businesses.

Under terms outlined by AMP on Friday, Ares would acquire 60 per cent of the joint venture and take over management control. AMP would own the remaining 40 per cent interest.

AMP said the joint venture would be worth $2.25 billion and include infrastructure equity and infrastructure debt, real estate and other minority investments. AMP would retain around $900 million of assets, mostly seed, sponsor and related investments.

The proposed transaction will mark the conclusion of AMP’s portfolio review. AMP and Ares have agreed to work toward a binding deal over a 30-day period of exclusivity.

Ares had previously approached AMP about a takeover of the entire company, but AMP said this month that such a deal wouldn’t proceed. AMP last year had received an indicative offer from Ares at an implied value of $1.85 per share.

Dow Jones

7.34am:Twitter aims to double revenue by 2023

Twitter Inc. plans to introduce a subscription service for content creators and said it would explore tipping, as it looks to double its annual revenue and accelerate user growth over the next few years.

The social-media company said the subscription initiative, called Super Follows, will give people an opportunity to receive payments for their content. Twitter expects it to appeal to so-called influencers with large internet followings and plans to launch it this year.

Twitter executives didn’t say when it would roll out tipping or share details on how it will work. The company also didn’t disclose how much of a percentage it would take from sales for that feature or Super Follows.

Dantley Davis, Twitter’s head of design and research, said that “an audience-funded model where subscribers can directly fund the content that they value most is a durable incentive model that aligns interests of creators and consumers.”

Twitter disclosed the new business models at an online event for analysts, its first in several years, and said they are part of Twitter’s broader goal of reaching at least $US7.5 billion in revenue or more by 2023, up from the $US3.7 billion it made last year, according to a Securities and Exchange Commission filing. The company is projecting its daily user base to grow to at least 315 million by the end of 2023, or around 20% annually between now and then.

Dow Jones

7.30am:Bitcoin may be weighing on tech stocks

“Blame it on Bitcoin” may be a new catchphrase if the tech sector keeps sinking.

Semiconductor maker Nvidia was down 8.1pc, at $US532.94, in recent trading amid a broader rout in the tech-heavy Nasdaq Composite index. The chip stock stands out because the company issued a strong earnings report Wednesday, including a lift from products related to Bitcoin and other cryptocurrencies.

Payments app Square, meanwhile, also continued its slide, down 4.3pc, at $US227.09. The company’s relatively strong earnings report on Tuesday included investments and operational gains from Bitcoin, and the firm said it plans to “double down” on the digital coin. That may be weighing on the stock, which is down nearly 20% in the last few sessions as Bitcoin prices have slumped.

Tech is under pressure for other reasons: Steep valuations have made the sector vulnerable to weakness in company forecasts. Rising bond yields pose a threat by pressuring the present value of future cash flows. Big Tech is also a crowded trade that could be losing favour as investors look for more-cyclical exposure or sectors with lower valuations.

But the trading patterns in Nvidia, Square, Tesla and other stocks may also be a sign of Bitcoin’s growing influence. Companies are ploughing capital into Bitcoin directly and related products and services, expanding exposure at a time when prices have skyrocketed more than 350% in the past year. Despite its recent slide, Bitcoin is still up 67% this year.

Dow Jones

7.18am:Lockdown laptop sales drive HP earnings

HP Inc.’s revenue rose 7% in the most recent quarter, driven by laptop sales as people continue to work and study remotely to curb the pandemic’s spread.

The latest results, which marked a returned to revenue growth even as the company grapples with shortages, also showed a recovery in the printing business, which is smaller by revenue but typically more lucrative.

Chief Executive Enrique Lores said in an interview that the company expects component shortages at least through the third quarter, “but the results of [the first quarter] showed that we can manage that situation and still deliver very strong results.”

HP, one half of the iconic Silicon Valley garage start-up Hewlett-Packard Co., has been trying to inject growth to its printing and computer business, investing in strategic growth areas like gaming. That’s where the roughly $US425 million deal for Kingston Technology Co.’s HyperX gaming peripherals division fits in, opening opportunities for HP like gaming headsets.

Dow Jones

7.05am:ASX set to tumble after Wall Street falls

Australian stocks are set to slump at the open after world markets sank on interest rate worries as bond yields pushed higher.

At about 70am, the SPI futures index was down 81 points, or about 1.2 per cent.

Yesterday, the ASX 200 rose strongly as a rise in S&P 500 futures added to positive overnight leads from equities and commodities markets offshore.

After bursting above US80c for the first time in three years on Thursday night, the Australian dollar dipped back below US80 cents, and this morning was at US79.07c.

Meanwhile, oil prices briefly hit fresh 13-month peaks on keen demand. However Brent oil was this morning down 0.2 per cent at $US66.88 a barrel.

Iron ore is up to 1 per cent at $US174.30 a tonne.

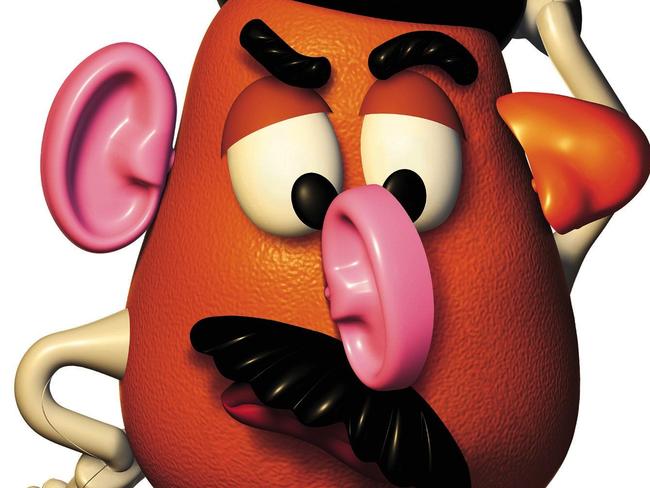

6.50am:Mr Potato Head no more: iconic toy goes gender neutral

Mr. and Mrs. Potato Head are going gender neutral, the company that makes the popular plastic toy announced.

Hasbro said it was dropping the honorifics from the spud’s name “to promote gender equality and inclusion.” From later this year, the toy launched almost 70 years ago, will be known simply as “Potato Head.” “Hasbro today announced the iconic brand will be reimagined for the modern consumer,” read a statement on the manufacturer’s website.

The rebranded toy in which children add facial characteristics and clothes to the body of a plastic spud will hit shelves in the fall.

It will allow kids “to imagine and create their own Potato Head family,” said Hasbro.

“The way the brand currently exists -- with the “Mr.” and “Mrs.” -- is limiting when it comes to both gender identity and family structure,” Hasbro general manager Kimberly Boyd told business magazine Fast Company. “Culture has evolved,” she added.

Mr. Potato Head first went on sale in 1952. On the back of its success, Mrs. Potato Head, along with traditional feminised accessories, was launched the following year.

The move follows other updates to classic brands, including Barbie, who was initially known for being tall, white and blonde but now comes in a range of ethnicities and body shapes.

In 2019, global toy giant Mattel released a line of gender-neutral dolls.

AFP

Jess Malcolm 6.43am:Facebook restores news pages

Content from news publishers is back in Facebook feeds on Friday morning, after Facebook and the federal government reached an agreement over the media bargaining code.

Facebook pages for news outlets such as News Corp (publisher of the Australian), Nine newspapers, and the ABC were restored in the early hours of Friday morning.

Last Thursday a blanket ban on news content was put on Australian media companies, enforced by the tech giant in response to the media bargaining code.

The media bargaining code was introduced by the federal government as a way to force tech companies to pay for the use of Australian news on their platforms.

Major Australian publishers have been in negotiations for the past week with Facebook and Google in a bid to strike a deal.

6.35am:McKinsey replacing global manager after scandals

The consulting firm McKinsey confirmed that it is voting to replace global managing partner Kevin Sneader after scandals including a role in the US opioid crisis.

The vote comes just weeks after McKinsey said it will pay $US573 million to US states to settle claims that it contributed to the crisis through its advice to pharmaceutical giants, including OxyContin manufacturer Purdue Pharma.

“We deeply regret that we did not adequately acknowledge the tragic consequences of the epidemic unfolding in our communities,” Sneader said at the time.

McKinsey advised Purdue on how to “turbocharge the sales engine” of the drug by up to $US400 million per year, according to a Massachusetts lawsuit, by arguing that the drug could reduce stress and make users more optimistic.

The settlement is rare in the history of the massive firm that advertises its ability to solve problems worldwide but has found itself accused of having a hand in creating a massive public health crisis in the United States.

McKinsey confirmed a report in the Financial Times on Thursday that the company’s partners are replacing Sneader after just one term in a post where serving two terms has been the norm.

“Every three years, McKinsey’s senior partners elect one of their colleagues to serve as the firm’s global managing partner,” a spokesperson said in response to an AFP inquiry.

“The election, which is conducted by an independent third-party firm, is now underway and we will announce the result after the election concludes.”

Almost half a million Americans died in overdoses from either prescription or illegal opioids between 1999 and 2018, according to the Centers for Disease Control and Prevention.

AFP

6.30am:Coinbase plans to go public with direct listing

Coinbase, an exchange for bitcoin and other cryptocurrencies, filed papers to become publicly traded, in the latest sign of the rise of digital currencies.

The San Francisco-based group, which plans a direct listing rather than initial public offering, pointed to strong growth in 2020 as it announced itself as a disrupter of the financial system.

The current financial system “is rife with high fees, delays, unequal access and barriers to innovation,” said Coinbase Chief Executive Brian Armstrong, according to a securities filing laying out the group’s plans.

Facilitating and promoting digital currency marks a path to a “more global, free and fair alternative,” Armstrong said.

“The cryptoeconomy is just getting started,” he said. “It is not intended to replace the traditional economy, but instead be a complement to it, much like email was to paper mail.” The Coinbase announcement comes in the wake of surging values of bitcoin as mainstream companies such as BNY Mellon and Mastercard unveil programs to enable digital currency use.

AFP

6.22am:US Treasury yields rise after positive jobs data

A wave of selling in US government bonds intensified, sending yields soaring after new data indicated a strengthening economic recovery and an auction of seven-year Treasurys met with tepid demand from investors.

The yield on the benchmark 10-year Treasury note reached as high as 1.539% and was recently 1.501pc, according to Tradeweb -- up from 1.388% at Wednesday’s close. Moves were also pronounced in shorter-dated bonds, with the five-year yield at one point hitting 0.865pc, up from 0.612% Wednesday.

Yields, which rise when bond prices fall, climbed after Labor Department data showed that the number of jobless claims fell sharply last week, signalling the job market could be stabilising after lay-offs edged higher earlier in the winter.

Investors tend to sell Treasurys when they expect faster growth and inflation, which lowers the value of bonds’ fixed payments and can eventually lead the Federal Reserve to raise short-term interest rates.

Yields spiked later in the session following a $US62 billion auction of seven-year Treasurys that analysts said showed extremely weak interest from investors.

Dow Jones

6.05am:Gold futures down a third session

Gold futures settled lower for a third consecutive session, pressured on the back of a sharp rise in US Treasury yields.

“The faster the global bond yields rise, the sharper the fall is for gold,” said Edward Moya, senior market analyst at Oanda. “The surge in Treasury yields most likely can’t keep this pace up so gold should start to stabilise soon,” but if the bond sell-off continues, and gold breaks critical support at the $1750 level, “technical selling could see this get another 5% uglier.” April gold fell $US22.50, or nearly 1.3 per cent, to settle at $US1,775.40 an ounce.

Dow Jones

5.15am:Stocks slide as bond yields rise

US stocks dropped, weighed down by declines in technology shares.

The Dow Jones Industrial Average slumped 1.6 per cent in afternoon trading after closing Wednesday at an all-time high. The S&P 500 fell 2.2 per cent, and the Nasdaq Composite lost 3 per cent.

Stocks have wobbled the past week as investors have grappled with a sharp and swift rise in bond yields. The shift, which money managers have broadly attributed to bets on inflation and growth picking up, has tempered enthusiasm for some of the pricier sectors of the stock market.

The S&P 500 technology sector slid 2.2 per cent, among the worst-performing groups in the index. Meanwhile, parts of the market thought to benefit most from rising economic growth, like financials and energy, wobbled between small gains and losses.

“The market is jittery. The bond yields’ rising is putting equities, especially growth stocks, under pressure,” said Sebastien Galy, a macro strategist at Nordea Asset Management. “There is a bit of a risk reduction broadly.”

One group of stocks that bucked the trend: “meme stocks” that have surged in popularity among individual investors this year.

In a wave of volatility reminiscent of last month’s rally, GameStop jumped 46pc, while AMC Entertainment climbed 7pc. The two stocks had soared in overnight trading as well.

The moves show “there is still liquidity and a lot of access to speculative bets,” said Sophie Chardon, cross asset strategist at Lombard Odier. “We have to be prepared to live with this kind of targeted bubble, but I wouldn’t see it as a threat to the global equity market.”

Meanwhile, government bond prices fell, with the yield on the benchmark 10-year Treasury note ticking up to 1.460pc, from 1.388% Wednesday.

“The rise in yields is supportive for banks, higher oil prices are supportive for energy. It is a change of leadership,” Ms. Chardon said.

Overseas, the pan-continental Stoxx Europe 600 edged down 0.3pc.

Dow Jones

5.10am:US trade nominee says Biden team backs use of tariffs

The administration of President Joe Biden views tariffs as a valuable policy tool, the nominee to be the next US Trade Representative, Katherine Tai, told lawmakers at her confirmation hearing.

“Tariffs are a very important part of our fair trade remedies toolbox,” Tai told the Senate Finance Committee, signalling the new US team on commerce policy had no plans for a complete about-face from the hard line stance of Donald Trump’s government.

Tai -- who also echoed the Biden administration’s commitment to multilateral bodies during the hearing -- signalled support for maintaining Trump administration tariffs on imported steel and aluminium and vowed to keep China honest on an agreement struck a year ago.

“We have to acknowledge that we have ... a very significant global marketplace problem in the steel and aluminium markets that are driven primarily by China’s overcapacity,” Tai said. “But it’s not, it’s not just a China problem.” Tai said she would work to ensure that China meets its commitments under a January 2020 trade accord between Beijing and Washington.

But she said she supports a “holistic review on China” and US-China strategy. Tai also noted that the United States was a founding member of the World Trade Organization, which had been a favourite punching bag for the Trump administration.

“We need to be having hard conversations in Geneva in a constructive way” in order to strengthen the body,” Tai said.

AFP

5.05am:Rate worries sink stocks

The effect of reassurances by US Federal Reserve chief Jerome Powell on interest rate hikes faded as bond yields pushed higher and stocks fell.

Wall Street had jumped on Wednesday as it took on board Powell’s message and positive news on COVID-19 vaccines, with the Dow hitting another record.

But on Thursday Wall Street moved lower, with the Dow, S&P 500 and Nasdaq Composite all in the red in late morning trading.

In Europe, early gains faded with London, Paris and Frankfurt all ending the day lower.

Earlier this week Powell again reiterated the US central bank’s commitment to keep the financial taps wide open until inflation sits persistently at its two per cent target and unemployment has been tamed.

Equities have soared in recent months on optimism over a vaccines-propelled global economic recovery, but fears persist that an imminent US government stimulus program will fuel inflation and force the Federal Reserve to reverse its ultra-loose monetary policy.

World markets have become jittery over the prospect of higher borrowing costs just as US President Joe Biden’s $US1.9 trillion pandemic stimulus package is set for its first big legislative test when the US House of Representatives votes on it on Friday.

Addressing fears that inflation could jump too sharply, Powell stated that rising prices are “a different thing from persistent high inflation, which we do not expect and if we do get, then we have the tools to deal with it”.

Oanda analyst Craig Erlam said that Powell’s soothing tones -- along with some positive news on the pandemic front, helped boost stocks late on Wednesday, “but already we’re seeing that fade” as yields on bonds continue to rise.

“Despite Powell’s assurances, investors are growing increasingly convinced that higher inflation will prompt central banks to tighten sooner,” he added.

In addition to rising yields US Treasuries, the rate on 10-year French government bonds rose above zero for the first time since June 2020.

Yields on German government 10-year bonds have also been rising if they still remain in negative territory.

The rising yields on government bonds, or the rate of return for investors, may indicate higher inflation expectations as the economies rebound from the pandemic.

“Yields are rising across the board, a sign of confidence in the global economy to recover powerfully in the post-pandemic world,” said Erlam.

“But it’s also a massive headache for central banks keen to remain extremely accommodative in the early stages of the recovery,” he added.

Market analyst David Madden at CMC Markets UK agreed that a rise in government bond yields -- an indication of government borrowing costs -- across Europe has sparked concern at the European Central Bank (ECB) about tighter borrowing conditions.

Meanwhile, oil prices briefly hit fresh 13-month peaks on keen demand, while the European single currency rose against the dollar on Powell’s remarks.

Asian equities steamed ahead on the latest reassurances from the Fed.

AFP

4.58am:World’s biggest wealth fund divests from tax dodgers

Norway’s sovereign wealth fund, the world’s largest with assets of $US1.3 trillion, said it had last year, for the first time, divested from companies it believes had dubious tax reporting practices.

The fund uses a slew of criteria in its investments -- ranging from human rights and climate change to corruption -- in order to measure companies’ sustainability and calculate their financial risk.

It informs the 9,100 companies worldwide in which it holds stakes of its expectations, holds discussions with them, and, barring compliance, can exclude them from its portfolio.

For the first time last year, it divested from seven companies, citing a lack of fiscal transparency, but did not specify which companies had fallen short.

“Our analysis showed that there may be an elevated risk of tax not being paid where economic value is created,” the fund wrote in a report on Thursday.

“These were also companies that had very weak or non-existent reporting on tax.” In total, the fund divested from 32 companies in 2020 due to practices it said posed a financial risk.

That brings the number of companies black-listed since 2012 to 314, including 170 for climate risks.

According to the fund the divestments have paid off and over the years they have increased the return on its share portfolio by around 0.41 percentage points, or 32.7 billion kroner (3.2 billion euros).

In addition to its own financial risk criteria, the fund also follows several purely ethical guidelines laid out by the Norwegian parliament, which bar it from investing in makers of nuclear or “particularly inhumane” weapons, and the coal and tobacco industries, among others.

AFP

4.57am:US jobless claims plunge

New applications for US unemployment benefits plunged last week to the lowest level since late November, according to government data, a hopeful sign for the jobs recovery.

However, economists were reluctant to declare victory since total aid including workers receiving special pandemic assistance remains at over a million.

First-time jobless claims fell by 111,000 in the week ended February 20, to 730,000, seasonally adjusted, the Labor Department reported.

And filings for one pandemic program created for workers not eligible for normal state unemployment benefits fell 161,000 to 451,402, according to the report.

“The drop may be signalling a turning point for labour market conditions. However, the data continue to suffer from noise related to issues of backlogs and fraud,” said Nancy Vanden Houten of Oxford Economics.

“We expect a more sustainable labour market recovery to take hold closer to mid-year with broader vaccine distribution and the arrival of more fiscal support.” Jobs gains have picked up as more businesses have gradually reopened and vaccine programs accelerate, with the US unemployment rate falling to 6.3 per cent in January.

AFP

4.55am:Yellen urges G20 to ‘go big’ with stimulus