Trading Day: ASX nears two-month low as virus fears linger

Shares are down 6pc for the week as all sectors traded in the red, led by a drop in Woolworths after a warning on the virus impact.

- Private sector drives construction fall

- The latest coronavirus numbers

- Don’t buy the dip yet: Saxo Markets

- Woolworths warns of coronavirus impact

That’s it for the Trading Day blog for Wednesday, February 26. The spread of coronavirus outside of China spurred a third day of heavy selling on the local market to send the ASX down 2.31 per cent, to take the three-day sell off to 6 per cent , or $128bn of value.

The Aussie dollar remained under pressure, trading down 0.1pc at US65.94c at the local close, to just shy of its recent 11-year low of US65.82c while US gold futures traded up 0.5 per cent and Australian 10-year yields down by 1 per cent to 0.927 amid increased safe haven demand.

Woolworths led declines as it warned that the travel ban was impacting some areas with high numbers of Chinese students while Nine Entertainment edged higher as it laid out plans for $100m in cost cutting measures.

US futures have ebbed through the day, and now point to a 0.5 per cent rebound when the markets reopen later this evening, after the Dow and S&P 500 both closed down over 3pc last night.

4.37pm: Virus sell-off by the numbers

Shares finished Wednesday’s session down 2.31 per cent to 6708.1. That takes the three-day fall to 6 per cent, the biggest three-day fall in 4.5 years, while the ASX trades at a 7-week low.

For the day, shares were overwhelmingly negative, with just 8 stocks of the top 200 notching a gain over the session – that’s 96 per cent of the benchmark’s stocks that traded in the red.

Today’s loss marks a 6.6 per cent drop from Thursday’s record high of 7197.2, but still a 0.36 per cent gain from the start of the year.

At the local close, China’s Shanghai Composite is bouncing by 0.14 per cent, while the Hang Seng trades down by 0.75 per cent and Japan’s Nikkei is lower by 0.9 per cent.

Here’s the biggest movers at the close:

Perry Williams 4.34pm: Adelaide Brighton plans stockpiles

Australia’s biggest cement company, Adelaide Brighton, plans to keep high stockpiles of raw materials over concern the coronavirus may cut access to imported supplies.

The company – which supplies products to construction, infrastructure and mining projects throughout Australia – said it will keep at least three months stockpiles of raw materials given uncertainties over the disease outbreak.

“Our strategy is to keep our stock levels high at this point in time,” chief executive Nick Miller said. “Ultimately this is a moving target and it’s too early to really judge the impacts.”

To avoid the risk of import routes being blocked, Adelaide Brighton may also look at boosting production of lime for WA’s mining industry and clinker in South Australia for east coast construction markets.

“Having this mix of imports and locally manufactured goods during situations like this is critically important,” Mr Miller said.

“We do have additional capacity in our lime kilns in Western Australia and we do have capacity that we could turn on at our Angaston plant in terms of production of clinker should we run into a situation where we can’t get access to the international market.”

The company imports oxides from China but has significant stocks in place and holds no other exposure to the country.

“We are bringing in bulk materials and our stockpiling strategy can assist in terms of supply streams.”

ABC shares finished the session down 4.95 per cent to $2.88.

4.31pm: Heavyweight miners, banks fuel selling

Iron ore miners came under pressure on Wednesday after comments from China’s top industry group that daily crude-steel output was almost 6pc lower than at the same period last year, while steel inventories had spiked to more than double.

Rio Tinto was in focus ahead of its results, finishing down 1.8 per cent to $91.89, BHP pulled lower by 2.1 per cent to $35.55 and Fortescue decline a more moderate 0.5 per cent to $10.88.

Banks were sold off heavily – NAB led the decline with a 2.1 per cent hit to $26.24 while ANZ closed lower by 2 per cent to $26.07, Commonwealth Bank lost 1.7 per cent to $85.35 and Westpac wound back by 1.7 per cent to $24.66.

Results from Woolworths prompted a 2.7 per cent slip to $40.73 as the supermarket chain said it was already seeing softer grocery sales in areas which are normally buoyed by Chinese student demand.

Rival Coles finished lower by 1.6 per cent to $15.21.

4.12pm: Three-day fall worst in 4.5 years

The local market finished Wednesday’s session just off its daily lows, dropping 159 points or 2.31 per cent to 6708.1.

That takes the three-day sell off to $129bn, the worst three-day fall in 4.5 years.

Tech was hardest hit, down 3.6 per cent for the session, while PolyNovo was the worst performer, down 21pc after its results.

3.16pm: Shares set new 7-week low

Australia’s S&P/ASX 200 share index has fallen 2.5pc to a new 7-week low of 6696.4 in late afternoon trading.

The index is now trading below its 200-day moving average, currently at 6713, for the first time in more than 12 months.

If it hits 6684.1, the index will have erased all of what was, as of last Thursday, a 7.7pc year to date rise to a record high of 7197.

3.01pm: Ethical fundie boasts profit boost

Australian Ethical says it is proving that investors don’t have to choose between doing well and doing good.

The ethical wealth manager on Wednesday announced its first-half profits rose 40 per cent to $4.4m on $23.3m in revenue, as its net inflows doubled to $295.8m.

Its net inflows to its managed flows rose 150 per cent to $96.4m, with its overall funds under management reached $4.14bn as of January 31. Board chairman Steve Gibbs called it the best six months for the company ever.

“It’s all about the realisation that people actually care where their money is being invested,” he said. “That sentiment is really pulling them to come to us. All of the numbers are just fantastic.”

Its superannuation members increased 13 per cent in the half to 43,264.

AAP

2.36pm: Bubs sales boosted on stockpiling

Australian baby formula producer Bubs has reported more sales from some Chinese buyers even as it flagged fears the coronavirus outbreak will hamper supply. Baby formula from Australia is a valued commodity in China, where the virus – which has killed close to 2700 people – is making the transporting and delivery of goods difficult.

Bubs, which on Wednesday reported a $7.5m first half net loss, said some traders in China were buying more of its products since mid-February as they try to secure baby food supplies.

These customers are mainly buying from the corporate Daigou distribution channel in Australia.

But the company warned the virus impact is making delivering products to China challenging.

The virus outbreak is having adverse sales effects too.

Some retailers in Australia have reported fewer sales of Bubs products due to fewer Chinese tourists and students.

BUB shares last down 1.4pc to 71.5c.

AAP

2.23pm: Hong Kong warns of record deficit

Hong Kong’s financial secretary Paul Chan has warned the Chinese outpost is likely to post a record deficit in its next full year budget.

In his budget speech, Mr Chan said the spread of coronavirus had dealt a severe hit to the economy and sentiment, as he said the near-term impact on the economy could be greater than SARS.

Mr Chan also unveiled $HK120bn on counter-cyclical measures, including a cash handout of $HK10,000 for each permanent resident over 18 years of age, taking some fiscal responsibility.

That’s helped the Hang Seng rebound from its daily lows, last down 0.67pc.

Eli Greenblat 1.47pm: Aus Vintage Asian demand drops off

Australian Vintage, whose wine brands include McGuigan, Nepenthe and Tempus Two, has seen a drop off in its formerly strong Asian export business as well as disappointing sales in North America but says its pushing ahead in the UK.

The winemaker, which this afternoon reported a 4.2 per cent slide in revenue to $137m for the December half and a drop in net profit to $5.863m from $6.486m, also said the coronavirus has had no impact on its business as China only represented a small part of its sales.

The interim result included increased wine costs amounting to $1.5m due to the disappointing 2019 vintage, adverse SGARA financial impact of $1m attributable to higher cost of water and fire damage, increased investment of $700,00 in marketing to both grow and maintain brands in our key markets and restructuring costs of $500,000.

The company said in the UK sales of the McGuigan brand increased by 9 per cent. Sales of the higher priced McGuigan Black Label and Reserve ranges have increased by 14 per cent. “The growth in the UK market is not finished but it will require further investment in marketing and advertising,” it said, but said the Asian and North American markets were more challenging.

“Australian Vintage’s Asian sales performance was particularly disappointing given the momentum in recent years. The $2.7m sales decline is a consequence of Australian Vintage’s major distributor focusing on reducing working capital following a change in senior management.”

No interim dividend was declared.

AVG shares last down 2.1pc to 46c.

1.38pm: Waislitz fund trading at ‘unjustified discount’

Billionaire investor Alex Waislitz says he is working to rectify the “unjustified discount” of shares in his tech fund to their net tangible assets, as tech stocks globally remain under pressure from the coronavirus outbreak.

The high-profile investor at the helm of the listed Thorney Tech fund, which counts Afterpay ZipMoney and Updater among its biggest holdings, touted its $5.1m profit increase for the half and said net tangible assets improved to 37c per share in January.

Despite that, shares in the fund are trading at 25c apiece on Wednesday.

“Directors believe that TEK’s continued strong performance over time will eventually result in a share market re-rating of TEK shares and the elimination of the unjustified discount to NTA which currently exists,” Mr Waislitz said in Chairman’s report.

“We continue to look at actions which will help encourage this re-rating to occur.”

He added that directors were confident of solid growth in the medium to long term, and that the group was “as well placed as it could be in the current (coronavirus) circumstances”.

1.14pm: Private sector drives construction fall

A downturn in private sector non-residential construction was the key driver for the last quarter’s biggest construction decline in over a year.

ANZ’s Catherine Birch estimates the worse than expected drop will detract close to 0.4 percentage points from fourth quarter GDP growth due next week, “even before effects from COVID-19 start to flow through”.

Similarly, NAB notes that the dip in the data suggests some downside risk to its forecast of a 0.4pc rise in Q4 GDP.

Australian construction work done dropped 3.0% in Q4 with the weakness concentrated in the private sector. #ausecon #aushousing @cfbirch pic.twitter.com/MK624mvguW

— ANZ_Research (@ANZ_Research) February 26, 2020

1.02pm: Risk aversion reigns as virus spreads

Local shares remain under pressure at 1pm, with investor sentiment firmly risk averse.

The benchmark ASX200 is lower by 2.2 per cent or 151 points to 6715.2, just shy off daily lows of 6712.4.

Gerard Cockburn 12.57pm: Afterpay to maintain growth: MS

Morgan Stanley says Afterpay (APT) will continue on its growth trajectory, despite questions surrounding the regulation of the broader buy now, pay later industry.

Ahead of the company’s first half results tomorrow, the brokerage has upgraded its FY20 revenue estimates by 5 per cent, saying signs point to further expansion of the service’s customer base.

By the end of the calendar year, Morgan Stanley expects the digital lay-buy company to increase its active customer base to 7.1 million.

A senate inquiry is currently assessing whether buy now, pay later platforms should have further regulation placed upon the emerging industry. The Reserve Bank is also reviewing the industry’s method of payment.

The broker maintains its overweight rating on the stock, with a price target of $45.

APT shares last traded down 4.5pc to $35.35.

12.48pm: The latest coronavirus numbers

As coronavirus continues to spread across borders, the epicentre of the virus, Hubei, has reported a slowdown in new deaths.

The latest data out of China shows total confirmed cases rose to 78,064 across the country, with a death toll of 2715 as at the end of Tuesday.

Of those, 401 new cases were reported in Hubei and 52 new deaths in the province.

Importantly, 2422 patients were reportedly discharged across the country, marking more people getting better than being admitted.

More of concern now is the growing totals in nearby Korea – where the case count is now more than 1000, from just 51 a week ago.

12.35pm: US futures turn down after rise

S&P 500 futures turned briefly negative after rising as much as 0.7pc in early trading.

The local market largely ignored the early rise in US futures, with the S&P/ASX 200 subsequently falling as much as 2.2cp to a 7-week low of 6712.4.

A 1pc rise in S&P 500 futures yesterday proved to be a very poor guide to Wall Street as the physical index dived 3pc.

Indeed the market’s ongoing assessment of the risk from coronavirus remains fluid to say the least.

But the immediate risk is for a technical bounce in the S&P/ASX 200 off the 200-DMA at 6713.

Gerard Cockburn 12.20pm: Treasury share could be buyin op: UBS

Investment bank UBS has cut its forecasts for winemaker Treasury as it tips coronavirus to negatively impact its 2020 financial year earnings, but says the recent share slide could be a buying opportunity.

After the company yesterday warned it was going to miss its guidance, UBS now expects a 60 per cent drop in earnings in the second half of the financial year, caused by a dry up of exports to the Chinese market, which make up more than 20 per cent of group earnings.

UBS says its brokers had been in contact with a TWE distributor in China, who said sales volumes since Chinese New Year had “slowed materially”.

“His view [Chinese distributor] is it will negatively impact TWE’s ability to bundle the next release of Penfolds … and push out demand until inventory at both customer and distributor levels clears (likely months),” analyst Ben Gilbert writes.

But Mr Gilbert also notes that consumption will likely return to normal after the outbreak subsides, while a lack of discounting, “likely because of no demand to discount to”, was also a pleasing sign.

UBS says its price target and rating on the stock is under review, but that the stock’s valuation was “beginning to look compelling”.

TWE last traded lower by 2pc to $10.95.

12.02pm: Shares pull to daily low as havens rally

Local shares are trading at their lowest levels in 7 weeks, as the market drop extends to 2.2 per cent in early Asian trade.

Shares had initially fallen less than expected, but extended a decline to 6716.2, a 150 point fall, at midday.

High growth tech stocks are the worst performing, down 3.4 per cent, led by a 8.5 per cent sell-off in Appen after a downgrade, while Afterpay shed 4.4pc.

Meanwhile, spot gold is rising 0.4pc to $US1652.35 while the US 10-year bond yield falls 2bps to 1.3371pc.

10.44am: Construction down most since Q3, 2018

Australia’s construction work done for the December quarter sank 3pc by value, the biggest fall since the third quarter of 2018.

The change was much bigger than Bloomberg’s consensus estimate of minus 1pc and was also at the low end of the range of estimates.

Leading indicators were pointing to a fall and some construction sites in Sydney and Melbourne shut briefly because of smoke from the bushfires.

Residential construction fell 4.6pc, non-residential fell 3.4pc and engineering work fell 1.5pc. All were weaker than most economists expected.

This is a weak input to the partial data for 4Q GDP which is due next Wednesday.

11.37am: Don’t buy the dip yet: Saxo

Sharp falls in global markets have been driven by a misselling of risk, and set to persist even as the coronavirus threat eases, according to Saxo Markets.

Australia Strategist Eleanor Creagh describes the recent turn as flipping “very suddenly from outright complacency to all out panic”, with the effects exacerbated by the current heady valuations in the market.

“The S&P 500 is by no means oversold, despite the violent price action over the last few days, and there is capacity for a continued corrective move. Buying the dip is not such a sure thing against the current backdrop,” she notes.

“The state of play is currently unprecedented and we do not have a good analogue to replicate, so the outcomes and ultimate impact is going to remain a moving target. Until we see some sort of containment and verifiable recovery in economic activity a more cautious stance is appropriate.”

She adds that there is no ruling out another wave of panic selling.

11.20am: Construction data to show 1pc slip

Construction Work Done data are due for release at 11.30am.

Bloomberg’s consensus estimate is for a 1pc fall in Q4 after a 0.4pc fall in Q3.

Leading indicators point to falling activity, and some construction sites in Sydney and Melbourne briefly shut down in the quarter because of smoke from widespread bushfires, says NAB’s Rodrigo Catril.

NAB expects a 0.5pc fall, with residential construction expected to fall 2 per cent, non-residential building expected to rise 0.9 per cent and private engineering work done expected to rise 1 per cent

11.18am: National Storage consolidation on track

National Storage REIT says its consolidation strategy is progressing as planned, as it continues to negotiate for a takeover from three suitors.

Handing down its first half results, the storage centre operator posted underlying earnings growth of 31 per cent to $34.5m, and after tax profit of $150.7m.

Chief Andrew Catsoulis said same centre occupancy had lifted by 0.3 per cent to 82.4pc over the period, with further improvements tipped in the second half as its new website and marketing initiatives were implemented.

The group reaffirmed that there was no certainty of a binding proposal from any of its three suitors, Gaw Capital, Warburg Pincus and Public Storage, but that discussions were ongoing.

“NSR continues to target EPS growth of 4 per cent and underlying earnings of $78m assuming no material changes in market conditions. However, as noted above, the current takeover discussions may impact timing of revenue related to new developments, joint venture arrangements and acquisitions,” it said.

NSR shares last down 0.63pc to $2.38.

11.01am: Coles could push ahead Woolies in food: Jefferies

Woolworths early trading in the third quarter suggests it could be underperforming rival Coles, according to Jefferies.

After the supermarket giant handed down its first half results this morning, analyst Michael Simotas notes that the supermarket’s Australian food performance in the second quarter was only slightly ahead of Coles – with same store sales growth of 3.8pc versus Coles’ 3.6pc.

“Overall, we don’t believe the result is good enough given the valuation premium,” Mr Simotas says.

WOW shares last down 2.4pc to $40.84.

10.54am: China to meet trade deal terms: SCMP

Top Chinese officials have reportedly reaffirmed the country’s ability to meet its trade deal terms with the US, despite the coronavirus outbreak.

The South China Morning Post has reported China is “fully expected” to hold up its side of the deal.

The news is helping US futures to edge higher by 0.4 per cent, while softening some of the blow to our local market – the benchmark ASX200 last down 1.74pc from an early drop of 1.9pc.

Eli Greenblat 10.44am: Woolies warns of coronavirus impact

Woolworths, the nation’s biggest retailer, has warned that its supermarkets in suburbs with high catchments of Asian shoppers and overseas Chinese students have suffered softer grocery sales since January as the coronavirus also threatens to delay shipments of key products.

Chief executive Brad Banducci told The Australian this morning that the supermarket giant, which also owns general merchandise store Big W and liquor retailer Dan Murphy’s, had noticed a drop off in sales in the wake of the coronavirus and the absence of Chinese students who are currently in lockdown in China.

“In terms of our comments and the whole supply issue which we can talk to on the coronavirus and some delays over shipping product out of China which are not impacting us at the moment but if the delays continue could be a material impact,’’ he said.

Up to 70,000 Chinese students are stranded in China and likely unable to commence the new University year as inbound flights for non-citizens remain on hold and classrooms and lecture theatres in Australia lay empty.

“The comment I want to make as we come out of resort (holiday) time and we go back into that school and back to university time we are starting to see some volatility – it is still very early days – in our stores that are slightly more skewed towards supporting and serving our Asian customers and we are starting to see a little bit of softness there of course as we don’t see the students flowing into our supermarkets.”

WOW shares last down 3.1pc to $40.55.

10.28am: Shares near two-month low

Australia’s sharemarket dived at the open, albeit not quite as much as expected.

The S&P/ASX 200 fell 2pc to an almost 2-month low of 6732 after the S&P 500 dived 3pc on coronavirus worry.

But with S&P 500 futures up 0.3pc in early trading, the S&P/ASX 200 has stabilised after the opening fall.

The Communications, Utilities, Consumer Staples, Technology, Energy, Industrials, Health Care and Financials sectors are underperforming.

Telstra and AGL are trading ex-dividend, while Woolworths is down 3.6pc on a disappointing start to the second half.

In the tech sector, Afterpay and Xero are down more than 2 per cent while Woodside is down 3.1pc on weaker oil prices.

10.25am: Healius surges on takeover interest

Healthcare provider Healius is surging 15 per cent early, after the receipt of a $2.1bn takeover aftermarket yesterday.

Shares are trading at $3.17 at the open, and as much as $3.21 – off the takeover bid of $3.40.

Last night, the group said it had received an unsolicited, non-binding indicative offer from a wholly owned subsidiary of Partners Group to acquire all of the shares in the company by way of a Scheme of Arrangement

Bridget Carter 10.19am: Blackstone bows out from O-I buy

DataRoom | Private equity giant Blackstone is understood to have bowed out of the competition to buy the Australian and New Zealand Owens Illinois business as the deadline for final bids is once again pushed back.

It leaves Pacific Equity Partners and Visy to battle it out for the glass bottle and container manufacturer that now is expected to sell for less than $1bn.

Final bids were due February 19 then pushed back to February 27 before being delayed once again.

Prospective suitors of the business have been underwhelmed by its declining manufacturing volumes and large capital costs.

Visy, which is self-advised, is thought to be eager to extract synergies from the glass bottle and container manufacturer, where as PEP has strong expertise in driving earnings growth in the manufacturing space.

PEP apparently approached O-I about a year ago offering to buy the business before a sales process was launched by Goldman Sachs.

Blackstone was advised by Macquarie Capital and PEP Credit Suisse.

10.11am: Shares shed 2pc early

Shares have dropped 1.9 per cent in opening trade, to start a third day of losses for the local market.

The benchmark ASX200 is lower by 132 points or 1.93 per cent to 6734.3.

It comes after US markets slipped more than 3 per cent on a warning that the spread of coronavirus to the US was only a matter of time.

Bridget Carter 10.01am: Healius in focus after $2.1bn bid

DataRoom | Healius shares are set for an opening rally after the group late on Tuesday said it had received an unsolicited, non-binding indicative offer from a wholly owned subsidiary of Partners Group to acquire all of the shares in the company by way of a Scheme of Arrangement.

The proposal is at $3.40 cash a share, valuing the company at $2.1bn, and is subject to a number of conditions including six weeks of due diligence.

In a statement to the ASX, the board of Healius said it would assess the proposal and keep the market informed in accordance with its continuous disclosure obligations.

“The board has not yet formed a view on whether the price offered under the proposal represents an appropriate value for Healius in the context of a control transaction or in light of the other strategic initiatives currently being explored by Healius,” it said in the statement.

HLS shares last traded at $2.76.

9.53am: PolyNovo reports sales surge

PolyNovo, the biotech helping burns victims from the White Island volcano and bushfire crisis, says the sales of its signature NovoSorb BTM solution were up 129 per cent for the first half.

Handing down its first half results, the group tipped the growth would continue to increase further as new markets came on stream.

“BTM sales in January 2020 were more than three times the sales in January 2019,” the company said.

Still, the company posted a $2.4m loss after tax, up 26 per cent on the previous corresponding period.

9.46am: Woolworths underpayments bill rises

Woolworths has upped its estimated staff underpayments to $315m and says the final amount could still be higher once a review into the nine-year scandal is complete.

The supermarket giant – which also owns Big W – on Tuesday said it would exceed its initial guess of $200m to $300m in salaried staff underpayments potentially dating back to 2010, with a review having now covered five years of data.

The previous estimate, which identified at least 5,700 affected team members, was based on two years worth of information.

Wednesday’s update comes after Woolworths told investors in December it expected the bill from its wages underpayment scandal to come in at the lower end of the $200m to $300m range it first flagged in October, even as more cases came to light.

“The calculations of the salary payment shortfall involve a substantial volume of data, a high degree of complexity, interpretation, estimations, and are subject to further analysis of prior periods and the Fair Work Ombudsman’s ongoing investigation,” Woolies told the ASX on Wednesday.

AAP

9.42am: Futures suggest another early tumble

Australia’s sharemarket is set for its third big fall in a row after the S&P 500 dived 3pc amid concern about the spread of coronavirus.

Futures relative to fair value suggest the S&P/ASX 200 will open down 2.2 per cent at almost 2-month low of 6710. That’s right on the 200-day moving average line which has held for the past 12 months.

At that point, the index will be down 6.3pc in 4 days and 6.8pc off the record high of 7197 it hit last week.

It could bounce to the former major pivot level of 6870 assuming no worsening of coronavirus news and a bounce on Wall Street.

Overnight, US and European equities dived and Brent crude oil fell 2.3pc to US$55.01, but spot gold fell 1.5pc to $1635.05 suggesting safe haven demand has eased. Similarly, while the US 10-year bond yield hit a record low of 1.3055pc, it bounced to close down 2 bps at 1.35pc.

But if the spread of coronavirus worsens, the S&P/ASX 200 could break its 200-DMA at 6710. The next key chart support levels look to be 6600, 6500 and 6400.

Market set for another tough start. #SPI -162pts or -2.37%. After hitting a record high last Thursday, the local sharemarket has slumped by 3.8% in just two days #ausbiz

— CommSec (@CommSec) February 25, 2020

S&P 500 futures rose about 1pc in Asian trading, but European and US equities dived after the virus spread to Croatia, Switzerland, Spain and Austria.

The US sharemarket suffered further after US Centres for Disease Control and Prevention said Americans should be prepared for the virus in the US

“We expect we will see community spread in this country,” said Nancy Messonnier, director of the CDC’s National Center for Immunisation and Respiratory Diseases. It is not a matter of if, but a question of when, this will exactly happen.”

Results from ten of the top 200 including Rio Tinto and Woolworths are out today.

Five of the top 200 including Telstra, AGL and Domino’s trade ex-dividend.

9.30am: Inquiry fallout halves Regis profit

The fallout of the aged care royal commission continues to weigh on care provider Regis Health, halving its profits for the first half.

Handing down its results, chief Linda Mellors said the results were a reflection of challenges to the overall industry as she pledged to optimise business performance through occupancy improvement strategies, especially in Western Australia.

The group posted net profit of $12.1m, down 50.5pc on the same period last year, but maintained its full year guidance saying it expected an improvement in occupancy through the second half.

The board declared a 4.02c per share dividend, 50pc franked.

Lilly Vitorovich 9.25am: Nine cuts costs as profit drops

Nine Entertainment has outlined $100m of cost cutting from its free-to-air business over the next three years, as the advertising slowdown hits its Channel Nine broadcasting business.

The media company says advertising market conditions were “softer than expected” for the start of 2020.

It comes after Nine posted a 41 per cent drop in full year profit to $101.9m – including $75.2m in writedowns and stripping out earnings from businesses sold (including regional newspapers) over past year.

Nine’s broadcasting and free to air earnings were down 29 per cent over the half to $145.5m while digital and publishing earnings were up slightly.

Nine says expects full year financial 2020 EBITDA to come in at a “similar level” to FY19 of $423.8m.

9.18am: What’s on the broker radar?

- AUB Group raised to Buy – Baillieu

- Alumina raised to Hold – Shaw and Partners

- Appen cut to Hold – Bell Potter

- Crown Resorts raised to Buy – Morningstar

- Evolution raised to Buy – Canaccord

- G8 Education raised to Overweight – Wilsons

- GUD Holdings raised to Hold – Morningstar

- Hub24 raised to Outperform – Credit Suisse

- Nine Entertainment raised to Buy – Morningstar

- Oil Search raised to Overweight – JP Morgan

- Oil Search raised to Buy – Goldmans

- Saracen Minerals raised to Buy – Canaccord

- Silver Lake Resources raised to Buy – Canaccord

- Soul Pattinson raised to Hold – Morningstar

- Spark raised to Outperform – Credit Suisse

- Sydney Airport raised to Hold – Morningstar

- Wagners cut to Neutral – Credit Suisse

- Wagners target price cut 30pc to $1.60 – Morgans

Bridget Carter 9.07am: HPI in $30m pub tilt

DataRoom | Hotel Property Investments is raising $30m through JPMorgan and E&P Corporate Advisory to acquire two pubs.

The raise is at a 4.7 per cent discount to the company’s last closing price.

Shares are being sold at $3.23 each.

The company is currently in a trading halt.

It comes after HPI recently struck a deal to extend the length of its pub leases with its tenant Australian Venue Company, and some believe this will make the company more attractive as a takeover target.

The agreement also comes as KKR’s Australian Venue Company, which has expanded from when it was acquired by the buyout fund from Bruce Dixon as Dixon Hospitality and is HPI’s tenant, tests market interest for an IPO spearheaded by investment bank Citi.

9.03am: Virgin swings to loss

Virgin Australia Holdings, the country’s No. 2 airline, swung to a statutory net loss in the fiscal first half and warned that revenue for the full fiscal year would be flat, in part due to impacts from the coronavirus epidemic.

Virgin Australia said its statutory net loss attributable to owners of the company was $97 million, compared to a net profit of $55 million in the prior period. Revenue was $3.1 billion, a rise of more than 1PC.

No interim dividend was declared.

The airline said the statutory loss was due to one-off costs associated with its Velocity frequent-flyer acquisition, write-offs of assets no longer in use and workplace reductions. Stripping out those costs, the company said its underlying profit before tax was $14.5 million, prior to the application of accounting changes.

Looking ahead, Virgin Australia said it expected the coronavirus epidemic to impact fiscal second half earnings by between $50 million and $75 million. It expected a group capacity reduction of 3pc in the fiscal year, noting short-term reductions in markets significantly impacted by the virus.

Dow Jones Newswires

Perry Williams 8.50am: Adelaide Brighton profit down

Cement producer Adelaide Brighton saw its annual net profit fall 35 per cent after taking a hit from lower volumes and rising raw material costs and expects its 2020 profit to fall a further 10 per cent due to challenging construction markets.

Underlying net profit after tax for the December year fell to $123m from $191m a year earlier, at the lower end of $120m to $130m guidance given to the market in August.

Construction materials markets softened in NSW and Queensland due to an oversupply of apartments and falling consumer confidence, the company said.

“While the short-term outlook remains subdued, we expect east coast demand to improve in 2021, with the benefit of stimulus from fiscal and monetary policy measures,” chief executive Nick Miller said.

It forecast 2020 net profit after tax will fall a further 10 per cent indicating a result of around $111m for the current year. A cost cutting program will deliver more than $30m in gross savings this year.

A dividend of 5c a share will be paid to shareholders, down from last year’s 20c payout.

Jared Lynch 8.44am: InvoCare profit surges

InvoCare – the biggest funeral home operator in Australia, New Zealand and Singapore – has posted a 54.6 per cent surge in full year profit to $41.2m amid a spike in deaths.

Chief executive Martin Earp said on Wednesday the number of deaths had increased 2.9 per cent in 2019 “back toward the long-term trend” after a 3.3 per cent decline in 2018.

The company’s revenue firmed 3.5 per cent in the full year to December 31, while it renovated 106 of its funeral homes with plans to refurbish another 74 in 2020.

Recent regional acquisitions also added $4.3m to earnings, as did InvoCare’s Protect & Grow strategy – the company’s reinvestment strategy to update its product offering, which Mr Earp outlined last August.

8.40am: Woolworths profit falls 8pc

Woolworths has posted an 8 per cent fall in half year net profit to $887m.

The supermarket giant said sales rose 6pc to $32.4bn

It declared an interim dividend of 46c.

8.35am: Dow down nearly 900pts

A rout in global financial markets deepened, sending the Dow Jones Industrial Average down nearly 900 points and heightening the anxiety of investors around the world.

The latest wave of selling marked the blue-chip benchmark’s worst two-day percentage decline in two years. Fear rippled across financial markets, sending the yield on the 10-year U.S. Treasury note to a record low and crude-oil prices tumbling below $US50 a barrel.

For much of the past several weeks, money managers have been fixated on one issue: the potential for a growing coronavirus epidemic to hit global economic activity.

Hope that health officials would be able to contain the epidemic, resulting in only a short-term disruption to growth, had helped keep stocks near all-time highs up until just last week.

But in the past two days, that optimism has increasingly turned into scepticism — wiping out what S&P Dow Jones Indices estimated amounted to $US1.7 trillion from the U.S. stock market.

“The size of this economic shock is looking increasingly large on a global scale,” said James Athey, a senior investment manager at Aberdeen Standard Investments. “What we’re just seeing here is the crack in that sentiment-driven equity rally.”

The Dow Jones Industrial Average fell 879.44 points, or 3.1pc, to 27081.36, ending at its lowest level since October. The S&P 500 fell 97.68 points, or 3pc, to 3128.21 and the Nasdaq Composite lost 255.67 points, or 2.8pc, to 8965.61, erasing its gain for the year.

Major indexes opened modestly higher Tuesday but erased their gains within the first hour of the trading day. Markets hit new lows after reports showed the disease had spread even further and the US Centres for Disease Control and Prevention warned it was preparing for a potential pandemic.

The market had showed signs of fragility well before stock exchanges even opened for trading in New York. Futures tied to the S&P 500 and Dow had rallied overnight, seeming to point to a potential rebound for the stock market in the hours ahead. But the gains proved fickle — with much of them fading by sunrise.

“Every effort at a snapback rally has been just as quickly pushed back down,” said Frank Cappelleri, executive director of brokerage Instinet. “The fact that [futures’ gains] didn’t even get through the night — it probably put a lot of traders on edge.”

With Tuesday’s declines, eight of the S&P 500’s 11 sectors are in negative territory for the year. The worst among them, energy, has shed 19pc so far in 2020 — reflecting investors’ fears that a slowdown in global economic activity will drag oil prices lower.

Dow Jones Newswires

8.30am: Disney CEO Iger steps down

The Walt Disney Co. has named Bob Chapek CEO, replacing Bob Iger, effective immediately.

The surprise announcement Tuesday makes Iger executive chairman. Chapek was most recently chairman of Disney Parks, Experiences and Products. Iger will remain chairman through the end of his contract December 31, 2021.

Iger said it was an “optimal time” for him to step down following Disney’s acquisition of Fox’s entertainment assets and the launch of Disney Plus streaming service in November.

“Did not see this coming — Wowza,” tweeted LightShed media analyst Rich Greenfield.

Chapek is only the seventh CEO in Disney history.

AP

8.20am: Copper dips

Copper prices edged into the red as investors struggled to calculate whether any coronavirus-related loss of metals demand would outweigh weaker output. Worries about the virus spreading outside of China had pushed London Metal Exchange (LME) copper to a two-week low on Monday while zinc slid to its weakest since June 2016.

Most LME prices bounced in Asian trading on Tuesday as some investors regarded the sell-off as exaggerated and others locked in profits from bearish positions, but copper gave up its gains in European activity.

Three-month LME copper dipped 0.1 per cent to $US5,685 a tonne in final open- outcry trading.

Reuters

8.10am: Wall St plunges over 3pc

The Dow Jones Industrial Average has closed down 3.1 per cent, or 879 points, at 27,081.

The broadbased S&P 500 tumbled 3.03 per cent, while the tech-rich Nasdaq Composite Index shed 2.8 per cent.

8.05am: Bond yield at record low

The yield on the benchmark 10-year U.S. Treasury note fell to an all-time low, the latest milestone in a decades long bond rally driven by persistently low inflation and turbocharged by worries the coronavirus could disrupt an already-sluggish global economy.

After hovering below 2pc for several months, the 10-year yield was pushed sharply lower by reports that coronavirus cases had surged in countries as disparate as Italy, South Korea and Iran. As investors fled riskier assets for safer ones, like bonds, the Dow Jones Industrial Average fell more than 3pc, while U.S. crude oil lost more than 2.5pc.

The yield on the 10-year note fell as low as 1.310pc on an intraday basis and settled at 1.328pc, according to Tradeweb, compared with 1.377pc Monday. Both of those marks beat record lows set in July 2016 after the U.K.’s vote to leave the European Union.

Treasury yields, which fall as prices rise, are a key economic gauge, typically rising when growth and inflation are accelerating and sliding when the economy is losing steam. They also play a critical economic function by helping determine borrowing costs for consumers, businesses, and state and local governments.

Dow Jones

7.30am: US stocks down over 3pc

Wall Street stocks sank deeper into the red in late afternoon trade on mounting fears over the coronavirus and its potential to derail global growth.

After starting the session higher, major US indices quickly reversed course and by midafternoon were on track for a second straight rout as US public health officials warned about an inevitable outbreak here and major companies cited the illness as a threat to their business performance.

Shortly after 7.30am (AEDT), the Dow Jones Industrial Average was down 3.4 per cent, or 930 points, at 27,035.

The broadbased S&P 500 tumbled 3.2 per cent, while the tech-rich Nasdaq Composite Index shed 2.9 per cent.

AFP

7.25am: ASX set to fall for third day

Australian shares face another hammering after big falls on US equity markets overnight following a warning for Americans to prepare for the coronavirus.

At 7am (AEDT) the SPI200 futures contract was down 153 points, or 2.24 per cent, at 6,673, pointing to another sharp fall when the local market opens.

Local stocks lost $US37.8 billion in value on Tuesday in the Australian share market’s second worst day of 2020, following Monday’s 2.25 per cent plunge.

It was followed by another sell off overnight on US markets after the US Centres for Disease Control and Prevention said Americans should begin to prepare for community spread of the new coronavirus.

Oil prices also continued their fall on fears of a demand hit from the flu-like virus that has infected more than 80,000 people.

The Australian dollar was buying US66 cents at 7am (AEDT), down from US66.12 cents on Tuesday.

AAP

7.20am: Oil extends falls

Oil prices fell again, weighed down by investors’ concerns about how the spread of the coronavirus outside China will affect global oil demand.

US crude prices fell 3pc to $US49.90 a barrel after falling 3.7pc yesterday. Brent, the global gauge of prices, declined 2.4pc to $US54.95 a barrel after dropping 3.8pc the day before.

Investors were still trying to gauge the fallout from the virus. Although China is seeing a drop in new coronavirus cases, outbreaks continue to grow outside the country, spooking investors who had thought the worst had passed.

Dow Jones

7.10am: Tesla driver was playing game

The National Transportation Safety Board says the driver of a Tesla SUV who died in a Silicon Valley crash two years ago was playing a video game on his smartphone while his vehicle was being controlled by a partially automated driving system.

Chairman Robert Sumwalt said at the start of a hearing that systems like Tesla’s Autopilot cannot drive themselves yet drivers continue to use them without paying attention.

“If you own a car with partial automation, you do not own a self-driving car,” Sumwalt said in opening statements. “This means that when driving in the supposed ‘self-driving’ mode, you can’t read a book, you can’t watch a movie or TV show, you can’t text and you can’t play video games.”

The board will determine a cause of the crash at the hearing and make recommendations to prevent it from happening again. Sumwalt says government regulators have ignored the board’s previous recommendations for measures to prevent these crashes.

The March 2018 crash involving a Tesla Model X SUV killed Apple engineer Walter Huang when it swerved and slammed into a concrete barrier dividing freeway and exit lanes in Mountain View, California.

AP

6.55am: Dow plunges more than 900pts

A rout in global financial markets deepened, sending the Dow Jones Industrial Average down over 900 points and Treasury yields sliding to fresh lows.

In afternoon trade the blue-chip index was down 921 points, or 3.3pc, near the lows on a volatile trading day. The S&P 500 fell 3.2pc and the Nasdaq Composite lost 2.9pc, erasing its remaining gains for 2020.

After losing 3.9pc, or $82bn of value, in the last two days, Australian stocks are headed for more heavy losses today. At 6.40am (AEDT) the SPI futures index was down 167 points.

For much of the past several weeks, investors have been fixated on one issue: the potential for a growing coronavirus epidemic to hit economic activity around the world.

Hope that health officials would be able to contain the epidemic, resulting in only a short-term disruption to economic activity, had helped keep stocks near all-time highs up until just last week. But in the past few days, that optimism has increasingly turned into scepticism — sending stocks, oil prices and bond yields sliding.

Selling accelerated overnight after reports showed the disease had spread even further, with countries from Switzerland to Austria to South Korea reporting new infections.

Meanwhile, the yield on the benchmark 10-year U.S. Treasury note — used as a reference rate for everything from mortgages to student loans — fell to 1.319pc, trading around a record low, according to Tradeweb.

“The size of this economic shock is looking increasingly large on a global scale,” said James Athey, a senior investment manager at Aberdeen Standard Investments. “What we’re just seeing here is the crack in that sentiment-driven equity rally.”

Among the biggest decliners in the stock market Tuesday: shares of companies whose profits are vulnerable to slowdowns in consumer spending and travel.

Bank stocks retreated, with Citigroup, Goldman Sachs and Bank of America all down at least 2pc. The continued slide in long-term bond yields threatens to cut into banks’ lending profitability.

Energy shares also tumbled. The S&P 500 energy sector is trading down 18pc for the year, hurt by fears that a slowdown in global economic activity will drag oil prices lower.

Meanwhile, traders placed bets on further volatility. The Cboe Volatility Index, which tracks expectations for swings in the S&P 500, jumped 8.8pc to bring its year-to-date gain to 98pc.

“I just don’t think we can accept the numbers coming out of China at face value,” said Mark Grant, managing director and chief global strategist at B. Riley FBR.

With little clarity on the severity of the epidemic, as well as uncertainty about if officials will be able to effectively contain it, Mr. Grant said he wouldn’t be surprised if there was further volatility across markets.

Elsewhere, the Stoxx Europe 600 ended down 1.8pc, closing out its worst four-day stretch since 2016, after having fallen more than 3pc Monday.

China’s Shanghai Composite Index lost 0.6pc, while Japan’s Nikkei Stock Average, which was closed Monday, fell 3.3pc.

Dow Jones

6.48am: US warns of virus spread

US federal health authorities said they now expect a wider spread of the new coronavirus in the US and are preparing for a potential pandemic, though they still are unsure about how severe the health threat could be.

Nancy Messonnier, director of the National Center for Immunisation and Respiratory Diseases at the Centers for Disease Control and Prevention, said the agency expects sustained spread and called for American businesses, schools and communities to brace themselves for potential outbreaks.

“We expect we will see community spread in this country,” said Dr. Messonnier. “It’s more of a question of when.”

In the US, there have been 14 confirmed locally diagnosed cases, with an additional three cases among Americans who returned from China aboard U.S.-chartered flights and 40 from the Diamond Princess cruise ship in Asia.

Dow Jones

6.45am: Iran official has virus

The head of an Iranian government task force on the coronavirus who had urged the public not to overreact about its spread has tested positive for the illness himself, authorities said, as new cases emanating from the country rapidly emerged across the Middle East.

Only a day earlier, a coughing and heavily sweating Iraj Harirchi said at a televised news conference in Tehran that “the situation is almost stable in the country.”

The acknowledgment of Harirchi’s illness underscores a growing crisis of confidence felt by many in Iran after nationwide economic protests, a U.S. drone striking killing a top Iranian general and Iran accidentally shooting down a commercial jetliner and insisting for days that it hadn’t.

AP

6.42am: US banks made $US233.1bn in profits

The US banking industry collectively made $US233.1 billion in profits in 2019, the Federal Deposit Insurance Corporation, the industry’s second-most profitable year ever.

The slight drop in profits from 2018 is due to the drop in interest rates, which happened in the second half of last year. The Federal Reserve cut its benchmark interest rate twice, in an effort to shore up the US economy, which was facing difficulties from the U.S.-China trade war and a slowing manufacturing sector. The FDIC’s look at the banking industry reflects a healthy – and incredibly profitable – industry. The number of “problem banks,” or banks that are at risk of failing, fell to 51 in the fourth quarter. That’s the lowest number of problem banks since 2006, right before the financial crisis.

AP

6.40am: European stocks extend losses

European stock markets fell further, although steeper declines in late trading did not match a major sell-off triggered by new coronavirus developments a day earlier.

Global equities have been hit by growing concern that the COVID-19 outbreak could derail the global economy.

More deaths and a surge in cases in Iran, Italy, Japan and South Korea has raised the risk of a pandemic.

After rebounding early, major European markets took fright and headed lower once again, with losses increasing as the day wore on to almost two per cent by the close.

A Paris investment manager said that the latest sell-off appeared to be broader based than an initial phase of selling that had focused on auto, leisure and luxury stocks.

Portfolio manager Frederic Rozier at Mirabaud France commented that the late acceleration in European declines was “fairly even,” and added: “We have the feeling it was the market (as a whole) that was being sold,” with the exception of some domestic stocks.

“In the first downward phase that we saw, fairly specific issues such as autos, leisure and luxury” were being dumped the most, he explained.

London, Frankfurt and Paris each ended 1.9pc lower.

On Tuesday, Tokyo’s main stocks index closed with a 3.3-per cent loss as traders caught up with global counterparts after a Japanese public holiday on Monday.

Other Asian equity markets recovered a bit meanwhile, with Hong Kong and Seoul posting increases.

CMC Markets UK analyst David Madden remarked Tuesday that “the brutal losses endured yesterday coaxed a few buyers out of the woodwork, but given that equity benchmarks are back in the red suggests that sentiment is still sour.

“The coronavirus crisis in Italy remains at the forefront of traders’ minds,” Madden said.

Italy has reported a big jump in cases — from six to 283 since Friday — and now has by far the highest number of confirmed infections in Europe.

AFP

6.38am: Regulator admits to data breach

Britain’s Financial Conduct Authority admitted to a data breach, in an embarrassing revelation for the regulator and its boss, who shortly takes over at the Bank of England.

The FCA said it had mistakenly published the details of around 1,600 consumers who had complained about the regulator, which is tasked with overseeing the conduct of Britain’s key financial sector, including any data breaches by banks for example.

The revelation comes just a few weeks before FCA chief executive Andrew Bailey replaces Mark Carney as governor of the Bank of England.

AFP

6.35am: US confidence disappoints

US consumers felt only slightly more confident in February, a result that fell well below analyst expectations amid fears of a worsening job market and business conditions, a private survey released Tuesday said.

The monthly survey was a mixed result compared to January’s upbeat assessment, though there were no indication that Americans were beginning to seriously doubt the strength of the world’s largest economy, where consumer spending is a mainstay.

The Conference Board also moderated its result from January, dropping by almost a full point its initial result that showed consumers upbeat at the start of the year.

Consumer confidence rose in February to 130.7 — below analysts’ predictions of 132.0 — from January’s 130.4, a downward revision from the initial estimate of 131.6.

6.32am: US home prices rise 2.9pc

U.S. home prices rose at a faster pace in December as mortgage rates remained low and a falling supply of available properties set off bidding wars between buyers.

The S&P CoreLogic Case-Shiller 20-city home price index climbed 2.9pc in December from a year earlier after posting a 2.5pc gain in November.

Just 1.42 million homes were on the market at the end of January, down nearly 11pc from a year earlier. The limited supply pushes prices higher. Prices in the 20 cities are up 63pc from the low they reached in March 2012 in the wake of the financial crisis and 6pc above their July 2006 pre-crisis peak.

AP

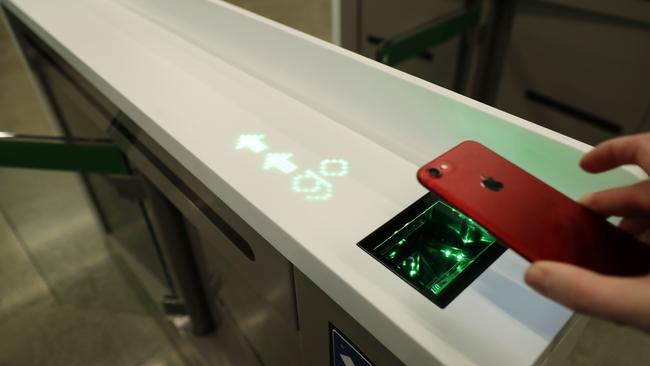

6.30am: Amazon opens cashier-less store

Amazon is aiming to kill the supermarket checkout line. The online retailing giant is opening its first cashier-less supermarket, the latest sign that Amazon is serious about shaking up the US’s $US800 billion grocery industry.

At the new store, opening in Seattle, shoppers can grab milk or eggs and walk out without checking out or opening their wallets.

Shoppers scan a smartphone app to enter the store. Cameras and sensors track what’s taken off shelves. Items are charged to an Amazon account after leaving. Called Amazon Go Grocery, the new store is an expansion of its 2-year-old chain of Amazon Go convenience stores.

AP

6.28am: Coronavirus vaccine?

The drugmaker Moderna has shipped a potential coronavirus vaccine for humans to government researchers for testing.

Shares of the biotech company soared a day after the company said it sent vials to the National Institute of Allergy and Infectious Diseases for early-stage testing in the United States.

More than 80,000 people have been infected globally from the viral outbreak that began late last year in China. A total of 35 cases have been reported in the United States.

More than 2,600 people have died from the virus in mainland China, including one U.S. citizen.

Shares of Moderna Inc., based in Cambridge, Massachusetts, jumped nearly 16pc in premarket trading. The stock started trading in late 2018 and set an all-time high price of $29.79 last April, according to FactSet.

AP

6.25am: UK agrees post-Brexit goal

Prime Minister Boris Johnson and his top ministers formally agreed Britain’s objectives and red lines in post-Brexit trade negotiations with the European Union, his spokesman said.

Details are due to be published on Thursday, but the primary objective is to ensure Britain’s “economic and political independence” after the Brexit transition phase ends on December 31.

EU ministers adopted their own joint negotiating mandate earlier Tuesday. The talks will begin in Brussels next Monday, the spokesman said.

A second round of negotiations has also been pencilled in to take place in London later in March.

AFP

6.20am: Strong 4th quarter for Macy’s

Macy’s is reporting stronger-than-expected sales and profits for the fourth quarter.

Shares were up 3pc before the opening bell.

The quarterly report comes three weeks after the department store chain said it was closing 125 of its least productive stores and cutting 2,0000 corporate jobs as it tests new smaller-store formats.

Macy’s also says that same-store sales, a key measure for a retailer’s health, slipped 0.5pc, including licensed businesses like jewellery. That was still an improvement from the 3.5pc drop seen in the previous quarter. The company says it is viewing 2020 as a transition year and reiterated its annual profit guidance.

AP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout