S&P/ASX 200 posts best lift in 6 days as Zip Co, Nearmap spike, Google tie-up with Seven West

ASX lifts as Zip Co, Nearmap surge. CCA offer raised, Crown confirms CEO change. JB Hi-Fi record sales. Google, Seven West news tie-up.

- Coke takeover bid lifted

- Nearmap hits back at short attack

- JB Hi-Fi rides pandemic boom

- Coonan to lead Crown as Barton quits

Welcome to the Trading Day blog for Monday, February 15. Stocks lifted the most in six days, with Zip Co and Nearmap rocketing. Overnight there were new records on Wall Street and a rise in oil prices. Nearmap and Zip surged locally, while JB hi-Fi posted record sales and Seven West announced a new tie-up with Google.

7.37pm: No Apple talks: Nissan

Japanese auto maker Nissan said on Monday it is not in talks with Apple to develop self-driving cars, a week after Hyundai also denied reports it was discussing the top-secret project with the US tech giant.

Apple’s Project Titan is devoted to electric autonomous vehicles and has been in the works for several years - but details of the venture have been kept under wraps by the notoriously tight-lipped company.

Nissan’s denial came after the Financial Times reported that the iPhone maker had approached it in recent months about a tie-up related to the project, which did not go ahead.

“We are not in talks with Apple. However, Nissan is always open to exploring collaborations and partnerships to accelerate industry transformation,” the Japanese firm said.

A source close to Nissan told AFP that the company “doesn’t need Apple to sell” its cars.

“When you make a product under the Apple brand, you give your soul - and your profit margins - to Apple,” the source said on condition of anonymity.

“We are not interested in giving Apple the best that we offer. This should be under the Nissan brand.” The denial followed a similar statement from South Korea’s Hyundai and its affiliate Kia last week after reports said Apple had wanted to discuss a potential partnership to develop electric vehicles and batteries.

AFP

7.17pm: Europe makes positive start

Europe’s major stock markets rose at the start of trading on Monday in a positive start to the week, with London’s FTSE 100 index up 0.9 percent to 6,649.31 points.

In the eurozone, Frankfurt’s DAX 30 index rose 0.4 percent to 14,104.81 and the Paris CAC 40 added 0.5 percent at 5,732.44 points.

AFP

Lilly Vitorovich 5.03pm: Seven will keep JobKeeper

Media | Seven West Media chief executive James Warburton has ruled out returning $33.4m of federal government JobKeeper subsidies, despite the Kerry Stokes-controlled media group returning to profit.

Mr Warburton says the business qualified for the $130bn JobKeeper scheme last year, which helped the free-to-air television network and newspaper publisher ride out the coronavirus crisis.

“I think from our perspective we qualified for JobKeeper in accordance with the program, and it did its job,” Mr Warburton told The Australian.

“We would have had to retrench or sack 120 or 150 people, staff took a 20 per cent pay cut, which contributed to liquidity in the business through the time and we employ hundreds and hundreds of people in terms of production.

“So for us, it helps us emerge as a stronger, larger tax payer, let alone what we’ve paid in tax over the last sort of nine to 10 years. So that’s exactly what the program was intended for, and that’s been the use.”

Giuseppe Tauriello 4.57pm: Liquidator cops 3-year ban over forged docs

A high-profile Adelaide liquidator who was found to have provided forged documents to ASIC has copped a three year ban in the Supreme Court.

Macks Advisory’s Peter Macks has had his registration suspended for the next three years and will be forced to step down from his current insolvency appointments.

Last October Mr Macks was found to have provided fabricated documents to the corporate watchdog as part of an investigation into his conduct.

Justice Sam Doyle found that in 2010, Mr Macks fabricated two memoranda by placing on them the initials of colleagues working at PPB - the firm he worked for at the time.

The documents were later supplied to ASIC as part of its investigation into his conduct as liquidator of two companies - Bernsteen Pty Ltd and Newmore Pty Ltd.

ASIC had been seeking a seven-to-10 year cancellation of Mr Macks’ registration as an insolvency

practitioner.

Read more: Macks Advisory’s Peter Macks cops three-year ban

4.32pm: ASX puts on best lift in 6 days

Australia’s sharemarket rose strongly on Monday as US futures gains added to strength on Wall Street and domestic earnings season continued to impress.

The S&P/ASX 200 closed up 0.9 per cent at 6868.9 points, its best rise in six days, after hitting a one-week high of 6883.7.

S&P 500 futures rose as much as 0.5 per cent, adding to positive leads from Wall Street after the US benchmark rose 0.5 per cent on Friday.

China’s markets remained closed for Lunar New Year holidays and the US share market and the LME will be closed tonight for President’s Day.

Nearmap surged 19 per cent after reporting, Zip Co jumped 17 per cent after its US roadshow and Bendigo Bank surged 11 per cent after reporting.

Among heavyweights, BHP rose 2.3 per cent before reporting at 0830am Tuesday, CSL rose 1.2 per cent, ANZ rose a1.6 per cent on a positive read-through from Bendigo, while Fortescue rose 2.5 per cent and Telstra rose 2.2 per cent.

Surging bonds yields helped banks and the Australian dollar with Australia’s 10-year bond yield up 10bps to an 11-month high of 1.324 per cent.

Bridget Carter 3.36pm: New player in Bingo game?

DataRoom | The contest for takeover target Bingo Industries could extend beyond the CPE Capital and Macquarie Infrastructure and Real Assets consortium, with murmurings in the market that at least one other party is waiting in the wings.

The name that comes up in conversation is Singapore’s Keppel Corporation, which is thought to be close to advisory firm Rothschild.

More to come

David Swan 3.21pm: NBN flags potential price increase

NBN Co has flagged potential wholesale pricing changes that would increase the cost of its high-speed plans by $2 per month, as the company seeks to bolster its average revenue per user (ARPU) which was flat in its most recent results.

NBN announced on Monday it had invited more than 50 internet retailers and consumer advocacy groups for feedback on pricing changes, as demand for data continues to soar as a result of the COVID-19 pandemic and widespread shifts to remote work.

The company on Monday released a new consultation paper ahead of a months-long consultation process, with an interim paper to be delivered in the middle of 2020, though the company has delayed any substantive changes to FY24. Telstra has criticised the move, declaring NBN ‘pushed the hard decisions down the road’.

NBN Co is specifically seeking feedback on two options, one that would freeze access charges at May 2021 levels and increase capacity inclusions by between 0.10 Mbps to 0.50 Mbps in May 2022 at no extra cost to retailers.

Option two involves NBN increasing its access charge by $2 for plans over 50Mbps, but providing up to an additional $2.80 worth of CVC inclusions over and above the inclusions proposed in Option 1, which chief customer officer Brad Whitcomb said represents effectively a 17 per cent to 29 per cent discount for the additional CVC inclusions.

If NBN increased its charges by $2 per month, retailers would either have to wear the cost themselves or pass it on to consumers.

2.45pm: Novatti shares jump 36.5pc

Payments fintech Novatti’s share price has jumped by as much as 36.5pc today and the ASX issued a speeding ticket hoping for some explanation.

Novatti said in a statement to the ASX that the Payments and Fintech sectors globally have seen significant growth and re-rating by markets, in particular as a result of Covid-19 and the rapid digital transformation of payments and financial services.

It said Novatti’s business has continued to grow strongly, as announced in the recent quarterly update which highlighted major business and financial progress, including:

- New record quarterly sales revenue of $3.79m, up 52pc year-on-year, highlighting consistent, long term growth

- New record half yearly sales revenue of $7.35m, 49pc higher year-on-year, as first half total revenue hits $8.2m

- Core payment processing business achieving seventh consecutive quarter of record revenue

- Past investment in platforms delivering strong and consistent growth as new partnerships, including UnionPay, Google Pay, Samsung Pay, providing leverage for the business to scale

- Capital applied to accelerate growth as current strategy remains fully-funded with $9m in cash as at 31 December 2020.

2.30pm: Harmoney adds Paul Lahiff to board

Online direct personal lender Harmoney has appointed Paul Lahiff to the board as a non-executive director, effective today.

He will also sit on Harmoney’s Audit and Risk Committee and Remuneration and Nomination Committee.

He currently sits on the board of ASX-listed AUB Holdings, as well as payments company Sezzle Inc. He is also a Director of Australian neo-bank, 86 400 Holdings, and NESS Super.

Lahiff was the CEO and managing director of Mortgage Choice from 2003 until 2009, a former managing director at Permanent Trustee, and before that at Heritage Building Society.

2.21pm: Zip Co shares hit record; +15pc

Zip Co shares have surged 15pc to a record high of $12.46, on track for their biggest one-day gain in six months.

It comes amid speculation that its recent US roadshow could lead to a US share-listing which could broaden the investor base.

John Durie 2.13pm: Coonan Crown lift ‘convenience over good governance’

Helen Coonan’s well-flagged elevation to the role of executive chair at Crown Resorts is an extraordinary benefit of convenience over good governance.

Having served on the casino operator’s board for close to a decade, including a year as chairman, she is clearly as much part of the culture of the company as any other figure.

But she emerged as a natural successor to lead the company, until a new CEO is found, because she impressed casino licence inquiry commissioner Patricia Bergin as a credible witness.

As a long-time director Coonan either knew what was going on at Crown or should have and, while not directly linked to Consolidated Press, was on the board with James Packer‘s support.

Her position then is in large part due to Bergin’s carefully chosen words of support.

NSW gaming regulator Philip Crawford has also declared his support for her in the executive chairman role, in an even more bizarre twist.

Bridget Carter 1.53pm: Ares to bid for ‘only part’ of AMP funds division

Ares Management’s highly anticipated bid for AMP Capital is set to be for only part of the funds management division, according to sources.

The Australian columnist John Durie revealed on Monday that Ares Management is working to close a purchase of the $3.1bn unit as early as this week.

It came after AMP told investors last week while handing down its full year results that Ares had abandoned its bid for AMP but that it continued to “engage constructively” with Ares on the possible sale of AMP Capital division.

AMP Capital has $193.8bn worth of infrastructure, real estate and equities under management and is considered the ‘jewel in the crown’.

The understanding is that a partial sell down would enable AMP to pay a special dividend and launch a share buyback program while participating in any upside that the business was to experience.

It would also prevent the separation of the business from AMP’s bank and wealth manager.

Sources say that a formal offer by Ares is set to value AMP Capital at “well over” $3bn, or 87c per share, which is the valuation estimate of AMP Capital by analysts at investment bank Citi.

The move by Ares to bid only for AMP Capital was flagged by DataRoom on February 7 after hopes started to fade during December that the US-based suitor would buy the entire business.

Ares was always known to be keen to own only AMP Capital, but finding buyers for the remaining wealth and banking operations at an acceptable price has proved to be challenging.

Last week AMP reported a 32.8 per cent fall in its 2020 underlying profit to $295m, including $110m from wealth management, $119m from its bank and $139m from AMP Capital.

1.41pm: Nearmap +17%; squeezing shorts

Nearmap shares rose 17.4pc to a 3-month high of $2.535, on track for its biggest rise in almost 10-months.

At this point any short positions established since November 12 will be underwater.

The short squeeze follows Nearmap’s rejection of claims made by J Capital in a short selling report last week.

No doubt the rally has been helped by better-than-expected earnings and upgraded guidance in its report today.

About 5.5pc of NEA shares were sold short as of last Tuesday.

NEA last up 16.2pc at $2.5050.

READ MORE: Superannuation funds stop lending stock to short sellers

Eli Greenblat 1.03pm: CCA backs sweetened Euro Partners takeover offer

Coca-Cola European Partners has thrown another $500 million on the table to win over recalcitrant shareholders in its takeover bid for Coca-Cola Amatil, hoping a sweetened bid of $13.50 will win over investors in its grand plan to create a global soft drink bottler stretching from Europe to Australasia.

CC Amatil, which is due to release its full-year results on Thursday, announced on Monday that its suitor Coca-Cola European Partners had upped a takeover bid launched in November to $13.50 per share, from $12.75.

The higher offer values CC Amatil, which has operations across Australia, New Zealand, Indonesia, Papua New Guinea and parts of the Pacific, at $9.8bn and derives an enterprise value of $11.08 billion for the business.

David Ross 12.32pm: Super funds give slim January gain

Superannuation funds have hit 10 months of gains, but wild markets that threaten to wipe out moves higher are not off the cards yet, industry analysts claim.

Superannuation research organisation SuperRatings found January resulted in a 0.4 per cent return for median growth members, in what analysts termed “a small but positive result”.

The SuperRatings data showed the median capital stable option eked in a 0.1 per cent gain.

But over the financial year to date superannuation median balanced options have returned 9.1 per cent, reflecting the speed at which the market picked up after it crashed in March 2020.

SuperRatings said current trends indicated the superannuation market was “in good health and well positioned for 2021” despite the emergence of new Covid-19 variants and rolling lockdowns that have hit most Australian states in recent weeks and months.

SuperRatings chief Kirby Rappell said superannuation holders should prepare for a bumpy ride.

“Super funds have had a promising start to 2021, but the pandemic isn’t over yet,” Mr Rappell said.

12.16pm: Bendigo delivers a solid beat: Macquarie

Bendigo & Adelaide Bank delivered a solid result which beat market expectations across most of the key line items, according to Macquarie analyst, Josh Freiman

“Despite having more substantial volume growth than peers, BEN managed margins well in 1H21 as it benefited from improved deposit pricing trends,” he says.

“Furthermore, our analysis suggests that the impact of growing through white label product is not as detrimental to margins as some fear.

In this context, we expect the regionals to continue to benefit from an improved revenue outlook as housing growth is getting better, and deposit pricing trends provide offsets to margin pressures resulting from the lower rate environment.”

Mr Freiman has a Neutral rating and $9.00 target on BEN.

BEN last up 9.8pc at $10.42.

12.00pm: ASX hits 5-day high as US futures rise

Australia’s sharemarket extended its rebound from the five-day low of 6802.4 that it reached on Friday after a new 5-day lockdown of Victoria.

It came as a rise in US futures added to positive leads from Wall Street and earnings reports had an overall positive impact.

The S&P/ASX 200 rose 1pc to 6877.1, extending early gains as S&P 500 futures climbed 0.4pc.

It’s not far from an 11-month high - daily closing basis - of 6880.67 hit last Monday.

It’s also within striking distance of an 11-month intraday high of 6901 also hit last Monday.

But with the US and China closed today it’s hard to see the S&P/ASX 200 breaking these levels today.

Bridget Carter 11.24am: Price of Entain’s bid for Tabcorp wagering revealed

Ladbrokes parent company Entain is offering $3 billion cash for Tabcorp’s Wagering and Media arm, DataRoom has learned.

It comes as pressure mounts for the $9.8 billion Australian betting company to reveal more details about the proposal when it delivers its half year results on Wednesday.

The understanding is that as part of its negotiations with Tabcorp, Entain explored various structures for a purchase of the wagering division.

Among the proposals were a cash bid and an alternative involving cash and CHESS depository interests.

However, following prolonged discussions about different structures, it is understood that what is currently on the table is a cash offer at $3bn, in line with valuation estimates by analysts.

Yet the door is understood to remain open for a deal also with a scrip component, should that be favoured by some shareholders, with negotiations likely to also continue on price.

Tabcorp said on February 2 that a number of proposals for the Wagering and Media operations had been received after DataRoom revealed that a party had put forward an offer for that part of the business about two weeks earlier, with sources pointing to Ladbrokes.

The results on Wednesday could see the company announce a demerger of the Tabcorp Wagering and Media arm.

11.21am: Nearmap +15pc on earnings, guidance

Nearmap shares have surged 15pc to a one-week high of $2.48 after resuming trade following a halt last week pending its response to a short sell recommendation from J Capital.

Nearmap rejected the claims by JCap and reported materially better than expected earnings and cash flow, while revising its annualised contract value forecast to the upper end of $120m-$128m.

Goldman Sachs Ashwini Chandra kept his Buy rating and $2.75 target price, while noting the risk that his expectation of a strong economic recovery through 2021 doesn’t eventuate, investment in sales and marketing fails to drive revenue growth, competition hits customer growth or margins, or costs are higher than expected.

Morgan Stanley’s James Bales stayed Overweight with a $3.10 target price, while RBC’s Garry Sherriff retained an Outperform rating at $3.00 target price.

“We expect that given recent scepticism around US sales effort, strong growth in key verticals of government, insurance and roofing will be well received,” he said.

NEA last up 12pc at $2.42.

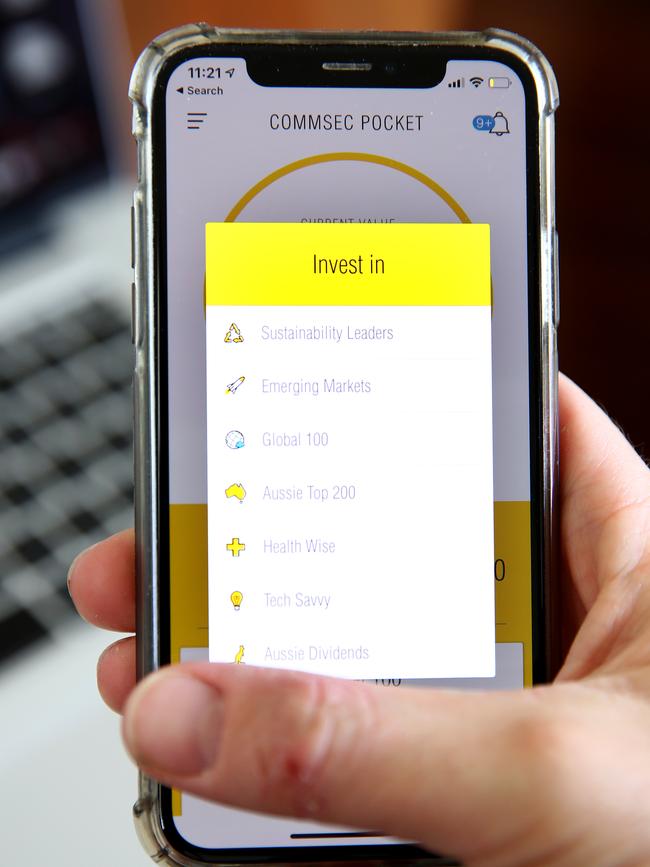

Cliona ODowd 11.06am: CommSec Learn aims to inform first-time traders

Online broker CommSec has launched a new learning tool aimed at first-time traders after it recorded a spike in new users to its platform in 2020.

CommSec Learn is a series of free learning topics designed to help investors make more informed investment decisions.

The launch of the new tool comes after the broker recorded an 18 per cent lift in new users following the market crash in February and March as retail investors rushed to participate in the recovery. This compared to the 8 per cent growth it saw pre-COVID-19.

The vast majority of these new customers — 83 per cent — were under 44 years of age, and over the past 12 months, these first-time traders have accounted for 10 per cent of all trades placed through the broker. This compares with 4 per cent pre-COVID.

Last year, CommSec also saw a 200 per cent increase in investors seeking basic trading information on its website, including on how to place a trade. But there were fewer searches on investment foundation topics such as planning and strategising.

“We saw a huge consumption of our educational materials when COVID hit,” CommSec executive general manager Richard Burns said.

“We felt there was an opportunity to help build those important investment foundations and assist investors in hopefully achieving long-term success.”

CommSec Learn is a way for investors to grow their skills and knowledge at their own pace, he added.

The stockmarket crash in 2020, combined with new, user-friendly trading platforms, has seen an unprecedented rise in the number of investors entering the market.

Over the six months through December, CommSec saw a 100 per cent rise in trading volumes compared to a year earlier.

It also recorded 230,000 new accounts over the same period, with a large number trading through its user-friendly Pocket app. The app has attracted 170,000 customers since its launch in mid-2019.

READ MORE: Sharemarket investing back with a bang

10.59am: BEN beat driven by lower bad debts: GS

Bendigo & Adelaide Bank’s interim cash profit of $219.7m beat Goldman Sachs’ estimate by 31pc, largely on a significant outperformance on bad & doubtful debts at just 6 bps of total loans versus Goldman’s estimate of $26bps.

“The quality of the result was”solid, for while revenues were exactly as we expected, the 2 per cent pre-provision operating profit beat was driven by lower than expected expenses, which we had previously been worried would disappoint in light of BEN’s better revenue performance,” says GS analyst Andrew Lyons.

He also notes that BEN will pay an interim dividend of 23.5 cents a share versus his estimate of 17 cents a share, with a backdated FY20 final dividend of 4.5 cents a share.

Economic indicators are performing ahead of expectations, however uncertainty remains around the impact on the economy when government support ceases

While Sell-rated on BEN, Mr Lyons notes upside risks including continued growth in mortgages at levels well above the system and better-than-expected performance on costs.

BEN last 7pc at $10.16.

10.46am: CBA upgrades iron ore, oil, LNG forecasts

Commonwealth Bank’s Global Markets Research team sees three major themes in commodity markets in 2021.

“First, China’s demand impulse should ease. Second, the economic recovery outside China is likely to be strong. Third, supply growth should broadly be robust enough to meet demand,” the team notes.

Iron ore: We upgrade our price outlook over the next few years, but maintain our declining profile. Prices are likely to stay high in H1 2021 as China’s stimulus measures from 2020 keep China’s steel demand supported. But by H2 2021, we see iron ore prices falling more sharply as policymakers deprioritise growth in China’s commodity‑intensive sectors.

Coking coal: We had anticipated premium coking coal prices to stabilise around ~$US135‑140/t (FOB Australia) this year. We think that those price levels are still likely by the end of the year, but in the near term, we are likely to see prices track higher.

Thermal coal: We expect deficit conditions that emerged last year to ease into a surplus in 2021, weighing on prices. Heating demand in North Asia, which has helped prices soar so far this year, will eventually ease. Other negative price drivers include i) rising seaborne supply and ii) increasing local production in India and China.

Oil: Oil prices are likely to continue to gain this year on i) rising demand linked to the COVID‑19 vaccine and stimulus plans, ii) OPEC+ supply discipline and iii) US shale oil supply discipline. We expect setbacks in H1 2021 as lockdowns weigh on oil demand.

LNG: Spot LNG prices have eased in the last few weeks and we expect that trend will continue through 2021. Tepid LNG demand growth and strong US LNG supply growth suggest that surplus conditions will once again return to LNG markets later this year.

Gold We expect gold futures to track sideways this year, as slowly rising US 10 year real yields are offset by a weaker US dollar. We think gold prices will remain range‑bound between $US1800‑1900/oz in 2021.

10.40am: Robust start to earnings season: MS

It’s been a robust start to February earnings season in Australia, according to Morgan Stanley.

With greater certainty around COVID impacts, vaccine developments and policy intent the early signals “confirm a greater conviction to guide and generally confirm robust recovery pillars in place,” says the US investment bank’s Australian equity strategist, Chris Nicol.

“Earnings per share beats are on show at 48 per cent and dividends per share is not far behind at 38 per cent, but it seems the combined ratio of recovery profile, distribution conviction and earnings quality is satiating investor appetite.”

As of last week, earning and revenue beats have exceeded misses by 3 times while dividends beats exceeding misses by 2.7 times.

10.24am: ASX +0.8%; NEA, BEN, GPT surge

Australia’s sharemarket jumped amid positive earnings reports and record highs on Wall Street.

The S&P/ASX 200 rose 0.8pc to 6863.5 in early trading with the Materials and Energy sectors leading on commodity price gains.

Banks were also strong on a positive readthrough from Bendigo Bank, while Nearmap and Zip Co boosted the Tech sector, Domino’s Pizza and JB Hi-Fi lifted Consumer Discretionary and Aurizon buoyed Industrials.

Among standouts, BHP rose 1.7pc, Bendigo rose 8pc, Nearmap gained 9.5pc, Zip was up 3.8pc, Domino’s rose 3pc, JB Hi-Fi was up 1.6pc and Aurizon jumped 4.2pc.

Perry Williams 10.23am: CIMIC sells Middle East business for ‘nominal sum’

CIMIC has sold its Middle East business for a nominal sum to a privately owned UAE investor, bringing an end to a costly foray into the region involving billions of dollars of writedowns and anger among Gulf locals still chasing unpaid debts.

Australia’s largest construction company, formerly known as Leighton, said UAE based investment company SALD would buy the entire BIC Construction joint venture consisting of CIMIC’s 45 per cent stake and a 55 per cent holding owned by ex-Al Habtoor chairman Riad Al-Sadik for a nominal amount.

CIMIC said it has agreed to “contribute a certain amount of funds into BICC” as part of the deal but said it did not increase its financial exposure previously outlined a year ago when it announced plans to abandon the Middle East.

READ MORE: CIMIC exit ends costly Gulf foray

10.05am: JB Hi-Fi could underperform: Jefferies

Jefferies analyst Michael Simotas notes that JB Hi-Fi’s sales growth slowed in January relative to the December quarter run rate, although that might be due more to stock availability than demand.

He also notes that the interim payout was healthy but with no additional capital management, as the company faces the prospect of weaker sales compared to large jumps last year due to the pandemic.

JB Hi-Fi said it was “not appropriate” to give guidance on its FY21 sales and earnings outlook.

“We believe the stock could underperform modestly,’ Mr Simotas says.

10.02am: Incitec Pivot cautions on earnings

Incitec Pivot said that maintenance at one plant and unexpected outages at others would cost it roughly $26 million in earnings before interest and tax during the first half versus earlier expectations.

A major maintenance project at its Waggaman plant would take two weeks longer than expected, reducing earnings by $15 million, the company said Monday. The capital cost of the so-called turnaround has also increased by $10 million, Incitec said.

The plant is expected to be operational again by mid-March.

Incitec also said its ammonium nitrate plants in Louisiana, Missouri and Cheyenne, Wyoming have recently experienced unplanned downtime because of equipment failure. The total hit to earnings will be about $11 million, the company said.

“Excluding the impact of these outages, (Dyno Nobel Americas Explosives) business earnings for 1H FY21 are expected to be in line with the prior corresponding period,” it said.

Dow Jones Newswires

9.46am: ASX set to rebound amid results

Australia’s sharemarket is set to recover from Friday’s selloff triggered by Victoria’s latest COVID lockdown.

Friday night futures suggest the S&P/ASX 200 will open up 0.6pc at 6847.5.

The S&P 500 finished up 0.5pc at a record-high close of 3934.83 amid growing expectations that President Biden’s stimulus plan will be passed.

Commodities were mostly strong with WTI crude up 2.1pc to $US62.43 a barrel, LME copper up 0.8pc and zinc up 1.8pc though gold was flat and there was no spot iron ore price with China closed.

BHP ADRs equivalent close at $45.34 was a 1.4pc premium to its close in Sydney.

Bond yields have seen renewed pressure with Australia’s 10-year yield hitting a fresh 11-month high of 1.274pc after US Treasuries rose 4.5bps to an 11-month high of 1.2082pc.

US bond yields rose amid increasing political momentum for US fiscal stimulus and a 6.5-year high in the 1-year inflation expectation in Uni of Michigan Consumer Confidence data.

While retaining some caution over the economic impact of the VIC lockdown and case numbers in the days ahead, the sharemarket remains earnings focused with eight S&P/ASX 200 companies reporting today.

Nearmap will resume trading after rejecting the short sell report from J Capital and CC Amatil shares should lift after CCEEP made a final offer of $13.50 a share.

Holidays in much of Asia - including China - along with the President’s Day holiday in the US will make for overall quiet trading.

Focus turns to Australian employment data on Thursday.

Ben Wilmot 9.25am: GPT forms $800m logistics venture with QuadReal

The GPT Group has struck a strategic partnership with Canada’s QuadReal Property Group to set up an $800m unlisted logistics trust, with the 50:50 venture to acquire and develop a portfolio of Australian prime logistics assets.

The partnership launched with more than 20 per cent of the targeted investment committed across two assets. This includes the acquisition of a $137m fund-through development at Truganina in Melbourne’s west, and a $38m speculative logistics development at Metroplex Place, Wacol in Brisbane.

GPT chief executive Bob Johnston said growth of the logistics portfolio was a core focus for the company and it had made strong progress in securing development and investment opportunities in the sector.

‘’The logistics market continues to benefit from structural tailwinds driven by growth in e-commerce, food and pharmaceuticals distribution and the recovery in the housing market,’’ he said. The value of GPT’s logistics portfolio has doubled since 2017 to $3bn and the company is chasing fresh acquisitions, including with QuadReal.

9.24am: What’s impressing analysts, today?

- ASX cut to Sell: UBS

- Costa Group cut to MarketWeight: Wilsons

- Wesfarmers cut to Neutral: CS

9.20am: Strong start to reporting season: Macquarie

It’s been a strong start to reporting season, according to Macquarie’s Australian equity strategist, Matt Brooks.

Of 31 results watched by the broker, 16, or 52 per cent, beat its half-year EPS estimate by 5pc or more while 7, or 23pc, missed.

“This is a solid beats-to-misses ratio of 2.3 times,” Mr Brooks says.

The first week of reporting was always going to be hard to top, since no companies missed his estimates by 5pc or more.

But the second week was still good, with 11 beats and just 7 misses out of 24 results.

Mr Brooks notes that the main driver of EPS beats has been better margins.

And most of the misses were from stocks that already had challenges before the pandemic - like Unibail, AGL, Telstra and CIMIC.

Also, as expected, the Financials and Resources sectors have dominated in terms of positive surprises, while Real Estate has been more disappointing.

“The barbell (of Financials and Resources) is doing the heavy lifting, “Mr Books says.

“This is consistent with the trend since August 2020, where a rise in forward earnings has been driven by upgrades to Resources and Financials.”

Overall, the upgrade cycle in consensus estimates for earnings continues.

Unlike recent years, earnings per share beats are translating into upgrades for the current financial year.

Of 31 results, Macquarie has upgraded its FY21 EPS estimates by more than 5pc for 16 companies (52pc) and downgraded its estimates for just 5 companies (16pc).

Notable upgrades in Week 2 were CBA on lower bad debts and the insurers, Suncorp and IAG.

After a 1 percentage point in the past week, Macquarie’s “bottom up” EPS growth forecast for the Australian market in FY21 is now up 10.7pc.

Falling bad debt estimates for the banks could drive further sector upgrades such that FY21 bank EPSg outpaces the market, according to Mr Brooks.

And consistent with the trend in US results, Covid “winners” are proving more likely to beat than Covid “losers”.

But the relative return after a beat is much higher for Covid losers - at 5.7pc - than winners - at 1.0pc.

“We again see this as a sign that investors should rotate to Covid losers, “ Mr Brooks says.

As with the recent US reporting season, Media and Banks - both are also posting good results in Australia.

Consumer Services - travel and leisure - and Energy are the only sectors with more misses than beats, but “these are key Covid loser sectors to rotate into on a 12-month view,” according to Mr Brooks.

“The latest Covid scare in Victoria may create another buying opportunity in Covid losers.”

And with the latest OECD leading indicator data showing the US expansion continues to accelerate, he remains positive on stocks, with a preference for Covid losers, value, cyclicals, beneficiaries of higher bond yields - banks, insurers - and stocks with high domestic exposure, as rising commodity prices lift the Australian dollar.

Perry Williams 9.35am: Beach Energy profit dives as oil price sinks; guidance lowered

South Australian oil and gas producer Beach Energy saw its first half profit tumble by half on lower oil prices and lowered its annual production guidance amid higher decline rates at its Western Flank oil fields.

Underlying net profit after tax fell 52 per cent to $128m, falling short of $143m consensus, after revenues declined by nearly a quarter to $726m as its realised oil price fell by 40 per cent over the six-month period.

Underlying earnings before interest, tax, depreciation and amortisation decreased by 35 per cent to $407m, missing $453m consensus expectations.

Beach narrowed its production guidance for the 2021 financial year to a 25.5m-26.5m barrels of oil equivalent range from 26m-28.5m boe previously. On a pro-forma basis, guidance for 2021 is 26.5m-27.5m boe reflecting Beach’s acquisition of Senex’s Cooper Basin and Mitsui’s Bass Basin assets.

Beach boosted its capital expenditure guidance to $720m-760m from $650m-750m.

Underlying EBITDA was also lowered to a new range of $900m-950m from $900m-$1000m previously while unit operating costs rose to $9-$9.40 per boe from $8.25-$8.75 originally.

Beach said the performance of the Western Flank oil fields in the Cooper Basin were not as the company had expected.

While Western Flank oil production was up 8 per cent on the prior period across 27 horizontal wells, it saw higher than expected decline rates in a number of wells.

“The company is focused on understanding the reasons for this prior to deciding the optimum production strategy for these assets,” Beach said.

Beach will pay an interim dividend of 1c per share, steady on last year.

Lilly Vitorovich 9.26am: Seven West Media partners Google to provide news content

Seven West Media announced it has entered into a LOU to form a long-term partnership with Google to provide news content to the Google Showcase product which launched in Australia in early February.

The agreement will be subject to executing a long form agreement within the next 30 days.

Seven West Media chairman Kerry Stokes AC said: “This is a great outcome for Seven West Media and for Google. Our new partnership recognises the value, credibility and trust of our leading news brands and entertainment content across Seven and West Australian Newspapers.

“I’d like to thank Prime Minister Scott Morrison and the chair of the Australian Competition and Consumer Commission, Rod Sims, with particular recognition of Treasurer Josh Frydenberg, who has been instrumental in the outcome of this ground-breaking agreement.

“Their outstanding leadership on the implementation of the proposed News Media Bargaining Code has resulted in us being able to conclude negotiations that result in fair payment and ensure our digital future,” he said.

“The negotiations with Google recognise the value of quality and original journalism throughout the country and, in particular, in regional areas.

“Google is to be congratulated for taking a leadership position in Australia and we believe their team is committed to the spirit of the proposed code.”

Lilly Vitorovich 9.17am: Seven West Media cost cutting delivers profit

Seven West Media has returned to the black as chief executive James Warburton’s turnaround plans including major cost cutting starts to deliver results as the metropolitan free-to-air television advertising market bounces back strongly.

The group, which counts Kerry Stokes as its biggest shareholder, said the metro free-to-air-TV ad market rose 0.6 per cent in the first-half to December, with the second quarter recording a hefty 17 per cent jump.

Seven West on Monday posted a statutory net profit of $116.4m for the six months to December 26 from a net loss of $49.4m, although revenue fell 9.8 per cent to $644.2m.

Its interim underlying earnings rose 24 per cent to $165.7m from $133.1m a year ago.

Seven recorded significant items of $41.5m before tax, which primarily relate to the reversal of “onerous contracts”.

Excluding significant items, Seven‘s costs dropped 17.5 per cent to $493.7m as Mr Warburton cut costs across the group as well as temporary net cost savings related to COVID-19.

Seven’s net debt dropped 42 per cent to $329m in the first-half of the 2021 financial year.

The group said its $170m costing cutting plan is on track with a further $30m of cash savings identified.

No dividend was declared, inline with recent years.

Cliona ODowd 9.12am: Bendigo and Adelaide Bank lifts first-half cash profit

Bendigo and Adelaide Bank has eked out a lift in first-half cash profit, as it grew customer numbers and market share in lending and deposits, while at the same time reducing costs.

For the six months through December, Bendigo Bank posted cash earnings of $219.7m, up 1.9 per cent on the prior corresponding period.

Net profit surged 67.3 per cent to $243.9m, while total income grew 3.3 per cent to $849m.

Over the six-month period, total lending jumped 9.2 per cent to $68.3bn. This compared with 0.1 system growth over the same period.

Residential lending grew 14 per cent, or 3.6 times system, and was further strengthened by a 26.3 per cent increase in applications on the prior half, the lender said.

Over the past six months it also saw a $5bn increase in customer deposits.

Lachlan Moffet Gray 9.08am: GPT Group loss as portfolio value hit, rent waived

Office and retail landlord GPT Group swung to a $213.1m net loss in its annual report as the value of its portfolio took a $712.5m hit and just over $95m in rent was waved.

However, funds from operations were down just 12.9 per cent on the previous year at $554.7m.

This, plus the divestment of the group’s interest in 1 Farrer Place, Sydney, for $584.6m, means the group’s final distribution of 22.5 cents per security, will be less than the 26.48 cents per security paid out last year.

The company also announced an on-market buy back of 5 per cent of securities.

The company did not provide forward guidance, with CEO Bob Johnston citing uncertainty over state lockdowns.

“The path of the recovery may be uneven and disrupted by unexpected events and the differing approaches taken by each state government,” he said.

“Melbourne’s CBD in particular is currently lagging in its recovery when compared to Sydney and this will have a bearing on the recovery of assets like Melbourne Central.

“The group has strong conviction that Melbourne Central will recover and once again be a key destination.”

David Swan 9.06am: JCap short report ‘inaccurate’; revenue up, loss narrows: Nearmap

Nearmap has rejected a report from Beijing-based short seller J Capital as inaccurate and unsubstantiated, following an attack last week that sent the aerial map maker’s shares tumbling.

J Capital said in a report Nearmap had used ‘accounting tricks’ to misrepresent the success of its US business, claims Nearmap boss Rob Newman said showed a deep misunderstanding of its business.

“The report contains many inaccurate statements, makes unsubstantiated allegations and presents a misleading representation of our business. Our company has delivered a very strong result which clearly demonstrates the strength of our business and the high levels of engagement of the Nearmap team,” Dr Newman said.

“All members of the board are resolutely committed to the company’s long-term growth.”

In its results Monday Nearmap declared “record performance” for its US business. It posted revenue for the half ending December 31 2020 up 18 per cent year-on-year to $54.7m, with its North American revenue up 30 per cent to $21.7m. It posted a net loss of $9.38m, from a loss of $18.6m a year earlier.

Joseph Lam 9.04am: Weekend lockdown cost Victorian economy $1bn

Experts estimate the Victorian economy lost almost $1bn over the weekend as a snap lockdown halted Lunar New Year and Valentine’s Day celebrations.

Victorian Chamber of Commerce chief executive Paul Guerra said the state had lost out on some of its biggest trading days this time of year.

“We’ve had estimates north of 500 million nudging that billion dollar mark,” he said.

“Grand final day also cost the economy about a billion dollars.”

Mr Guerra said business is still seeking clarity moving forward.

“What we now need is clarity out of the state government that we can get going by Thursday,” he said.

“From Friday afternoon when it was first announced there was anxiousness then it went to anger.”

“It’s difficult to have faith when we’re back in this position.”

Perry Williams 9.01am: Santos takes writedown hit on lower gas reserve levels

Santos had taken a further $US139m ($179m) writedown after lowering its level of gas reserves in Western Australia and Papua New Guinea taking total annual charges to $US895m.

The energy producer said it would take a $US98m impairment of goodwill after reserve revisions of -15m barrels of oil equivalent in PNG and -20 mmboe in Western Australia, including the Reindeer gas field in WA.

A further $US41m per-tax charge has also been taken on unnamed late-life, exploration and evaluation assets.

After previously flagging a $US756m hit last August due to lower oil prices, Santos will take a $US895m pre-tax impairment at its annual results this Thursday or $US653m after tax.

“The expected impairment charges will be excluded from underlying earnings and are subject to finalisation of the full-year accounts, auditor processes and Board approval,” Santos noted.

Santos gained its hold on the Reindeer field through the blockbuster Quadrant deal in 2018.

Overall, Santos reported 933m boe of proved plus probable reserves at the end of 2020, an increase of 34m boe before production.

Santos confirmed a final investment decision will be made on it Barossa project in northern Australia in the first half of 2021 which would see approximately 380m boe commercialised to 2P reserves.

Lachlan Moffet Gray 8.58am: Charter Hall REIT profit 24pc higher

Charter Hall’s retail REIT has recorded a boosted statutory profit of $82.8m, up 24.1 per cent on the previous comparable period, with most of the trust’s assets managing to remain open and trading positively throughout the pandemic.

The trust also boosted distribution by seven per cent to 10.7 cents per unit.

Despite having to support tenants throughout the half year to the tune of $5.8m, the Charter Hall’s retail CEO Greg Chubb said the “defensive characteristic” of the trust’s assets helped boost earnings.

“We saw very strong MAT growth from our supermarkets of 8.2%, up from an already strong 5.2% at June,” he said.

“This lifted the percentage of supermarkets paying turnover rent to 65%, reflecting the quality of the CQR’s convenience retail centres and their dominant positions within their respective catchments.

“The gradual normalisation of conditions also saw leasing activity recover strongly, with a record 224 specialty leases completed at an average +2.5% leasing spread.

“Pleasingly, we also saw occupancy lift to 97.8%, up from 97.3% at June 2020.”

Rhiannon Hoyle 8.54am: Aurizon net profit drops 22pc

Aurizon Holdings Ltd. said first-half net profit declined by 22%, although the company raised its interim dividend by 5% as it reported steady underlying earnings on a year ago.

The Australian rail operator recorded a net profit of 267.0 million Australian dollars (US$207.2 million) for the six months through December. That was down from a net profit of A$343 million in the same period a year ago.

Underlying earnings before interest and tax totalled A$454 million, flat year-on-year. Aurizon declared an interim dividend of 14.4 Australian cents a share, up from 13.7 cents last year.

Aurizon revised its full-year Ebit guidance to A$870 million-A$910 million from A$830 million-A$880 million earlier.

The company said it does expect coal-haulage volumes to be weaker than expected, however. It now projects volumes between 200 million metric tons and 210 million tons, from an earlier projection of 210 million-220 million.

Dow Jones Newswires

8.52am: AUD/USD may retest multiyear high

AUD/USD looks to be heading for a retest of an almost three-year high of US0.7820 set on January 6.

The currency has bounced strongly after some minor false breaks below its 50-day moving average - now at US0.7661.

A brief negative reaction to the extension of QE by the RBA early this month appears to have run its course.

And the global risk appetite has improved, with strong gains in commodity prices and fresh record highs on Wall Street last week.

Global markets should be very quiet today with China remaining closed for Lunar New Year and US markets and the LME closed for President’s Day.

AUD/USD was last at US0.7762.

Lachlan Moffet Gray 8.42am: Altium profit slides as customer spending drops

Electronics design software company Altium has seen a slight revenue and profit slide in the first half of the financial year as the ongoing pandemic impacts customer spending in the EU and the US.

The $4bn company saw net profit after tax fall 14.6 per cent US$19.7m after seeing EBITDA decline by 15.1 per cent to US$27m.

The company declared an interim dividend of 19c a share, just 1c below last year’s interim dividend.

Eli Greenblat 8.33am: JB Hi-Fi posts record sales, dividend jumps

JB Hi-Fi is riding a wave of demand from consumers locked down in their homes through the Covid-19 pandemic, to post record sales and earnings for the December half that has generated an almost doubling of its interim dividend to shareholders.

The consumer electronics giant, which also owns The Good Guys, on Monday announced sales up 23.7 per cent to $4.9bn as net profit rose 86.2 per cent to $317.7m.

The company said online sales were up 161.7 per cent to $678.8m, reflecting the huge boom in online shopping through the pandemic.

The interim dividend was lifted 81.8 per cent to $1.80 per share and payable on March 12.

JB Hi-Fi Australia total sales grew by 23.3 per cent to $3.36bn with comparable sales up 24.2 per cent. The key growth categories were communications, computers, visual, games hardware and small appliances. Online sales grew 201.9 per cent to $515.6m or 15.4 per cent of total sales.

At its The Good Guys chain, total sales grew by 26.4 per cent to $1.45bn, with comparable sales up 26.4 per cent. The key growth categories were refrigeration, portable appliances, laundry, floorcare, televisions and computers.

READ MORE: JB Hi-Fi rides pandemic boom for record sales and profit

Lachlan Moffet Gray 8.25am: Crown Resorts confirms CEO Barton replacement

Crown Resorts has confirmed CEO Ken Barton has stepped down from his role, to be replaced by Helen Coonan who will assume the role of executive director.

READ MORE: ILGA backs Coonan as Crown boss

Lachlan Moffet Gray 8.24am: Coca Cola European Partners ups cash bid for CCAmatil

Coca Cola European Partners has increased its cash bid for the ASX listed Coca Cola Amatil to a “best and final” $13.50 a share.

It represents a 2.8 per cent premium on Coca Cola Amatil’s last trading price of $13.13 a share and is 5.9 per cent above the $12.75 a share offered last year.

The revised offer values the Australian company at $9.82bn on a 100 per cent diluted equity basis.

Coca Cola Amatil’s related party committee and group managing director have endorsed the offer.

8.19am: Beach Energy reserves boost at Enterprise

Beach Energy has confirmed reserves in relation to the Enterprise gas field, located in exploration permit VIC/P42(V) (Beach: 60% and operator, O.G. Energy: 40%) in the nearshore Victorian Otway Basin.

The discovery has led to a 2P (proved and probable) reserves booking for the Enterprise gas field in which Beach has booked net 2P undeveloped reserves of 21 MMboe (34 MMboe gross), as at 15 February 2021.

Beach Energy managing director and CEO Matt Kay said the reserves booking for the Enterprise field is a fantastic achievement for Beach, with results ahead of pre-drill expectations.

“The material Enterprise discovery helps to ensure a continued pipeline of gas to the Otway Gas Plant – a key supplier to the East Coast gas market.” Mr Kay said.

“The liquids content in the field is more than double our pre-drill expectation, significantly increasing the value of the discovery.

7.52am: CBA launches Green Loan to boost renewable tech in homes

Commonwealth Bank has announced a new CommBank Green Loan, which will make it easier for CommBank home loan customers to purchase and install renewable technology.

The bank’s Group Executive Angus Sullivan said: “As part of our commitment to the responsible global transition to net zero emissions by 2050, we’re supporting our customers access renewable energy through sustainable housing solutions.

“The CommBank Green Loan offers an historically low 0.99% p.a. secured fixed rate loan for eligible CommBank customers to fund up to $20,000 in renewables repaid over 10 years with no set up, monthly service or early repayment charges, adding to our already market leading home lending solutions.”

READ MORE: CBA loan powers up green energy

Bridget Carter 7.38am: Contact Energy raising up to $NZ400m through Jarden, Macquarie Capital

Contact Energy is raising up to $NZ400m through Jarden, Macquarie Capital.

This includes a $NZ325m institutional placement and a retail offer worth up to $NZ75m.

Shares are being sold at $NZ7, a 2.8 per cent discount to the last close.

7.07am: Contact Energy to build geothermal plant, raise $NZ400m

Contact Energy Ltd. said it will build a new geothermal power plant in New Zealand, funded by a share sale and reduced dividends, and review the future of its thermal generation capacity.

The company said it will invest $NZ580 million in the Tauhara geothermal plant.

It plans to raise $NZ400 million through the sale of shares to institutional investors at a fixed price of $NZ7 share and a $NZ75 million retail offer.

Dow Jones Newswires

Cliona O’Dowd 4.55am: Market set to open full of energy

The Australian sharemarket is expected to open higher after US markets closed out last week at record highs, with the energy sector, in particular, tipped to fare well.

ASX futures are pointing to a gain of 37 points, or 0.5 per cent, at the open, signalling most of Friday’s losses should be reversed in early trade.

Strengthening commodity prices should help boost the local market at the start of the week, CommSec chief economist Craig James said.

“The futures market hasn’t been a great indicator for our market of late but there are good reasons why the market should be higher on Monday,” he said.

“We’ve had the oil price move higher: Nymex and Brent both rose 2.1 per cent (on Friday). So that’s going to be good for the energy sector.”

Oil prices finished last week at 13-month highs on hopes that US President Joe Biden’s fiscal stimulus package will lift the US economy and increase demand for oil. Over the week, Brent rose 5.2 per cent to $US62.43 a barrel, while Nymex crude gained 4.6 per cent to $US59.47 a barrel.

Base metal prices were also mostly stronger, with copper close to its highest level in eight years. However spot iron ore is unchanged.

The strong commodities environment was boosting the Australian dollar, Mr James said.

“That’s why the Aussie dollar is being well supported above US77c,” he noted. In Friday’s trade, the local currency climbed from a low of US77.17c to a high near US77.65c. It was trading at US77.55c at the US close.

This morning the dollar was US7756.

The Australian sharemarket finished Friday’s session down 0.6 per cent, with investors spooked about the five-day snap lockdown in Victoria.

The benchmark S&P/ASX 200 index fell to a six-day low of 6802.4 following the announcement, closing down 43.4 points, or 0.6 per cent, at 6806.7 points.

Investors will be watching coronavirus case numbers in Victoria very closely in the coming days, Mr James said. Earnings season will also be in focus, with results expected from Bendigo and Adelaide Bank, Bank of Queensland, BHP, Coles, Rio Tinto, and QBE, among others.

4.45am: Biden nominee on collision course with oil industry

Deb Haaland is poised to make history on two fronts, as both the first Native American cabinet secretary and as the architect of what could be a landmark change in the US government’s relationship with oil.

First, she will need to be confirmed by the Senate as President Biden’s nominee for interior secretary -- and Republicans are girding for a fight.

The Democratic congresswoman from New Mexico has joined with pipeline protesters, supported the Green New Deal and opposed fracking on public lands. For a cabinet post that oversees the government’s longstanding, multibillion-dollar partnership with drillers on federal lands, Ms. Haaland’s environmental politics are in contrast to those of her predecessors.

“Fracking is a danger to the air we breathe and water we drink,” she wrote in 2017, the year before she was elected to Congress. “The auctioning off of our land for fracking and drilling serves only to drive profits to the few.”

Fracking has become the source of most oil and gas produced in the U.S., and Ms. Haaland’s history of criticising it has alarmed leaders from fossil-fuel-producing states. Many come from the West, home to nearly all of the drilling on federal land, and where states benefit from the money.

“To have a nominee who has taken the most radical positions, supports the most radical policies on natural resources is unprecedented,” Sen. Steve Daines (R., Mont.) said in an interview. “A lot of our Western states...depend on the revenue that comes out of those federal lands to fund governments.”

The Senate Energy committee hasn’t set a date for Ms. Haaland’s confirmation hearing. Mr. Daines said he would seek to use procedural powers to delay the appointment if she can’t satisfactorily address his concerns.

Dow Jones

4.40am: Wall Street recap

Major Wall Street stock indices ended at records on Friday, concluding a solid week on expectations for more US stimulus and an economic rebound fuelled by coronavirus vaccines.

All three major indices finished at all-time highs, with the S&P 500 gaining 0.5 per cent to finish at 3,934.83, up 1.2 per cent for the overall week.

The Dow Jones Industrial Average edged up 0.1 per cent to 31,458.40, while the tech-rich Nasdaq Composite Index also won 0.5 per cent to 14,095.47.

Markets meandered through much of the week, but generally drifted higher following mostly good corporate earnings. Much of the economic data has been weaker, but investors view that dynamic as lending further momentum to President Joe Biden’s stimulus proposal.

“We can see that Biden wants to move forward with his package quickly,” said Gregori Volokhine, president of Meeschaert Financial Services. “We can also see more progress on coronavirus vaccines.”

Among individual equities, Disney dropped 1.8 per cent after reporting strong growth in new subscribers for its streaming service, while its parks and recreation division continued to suffer during COVID-19. Disney reported quarterly profit of just $US17 million compared with $US2.1 billion in the same period a year earlier.

But PayPal jumped 4.7 per cent as the company released long-term growth targets that project annual revenues reaching $US50 billion or more in 2025, compared with $US21.5 billion in 2020.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout