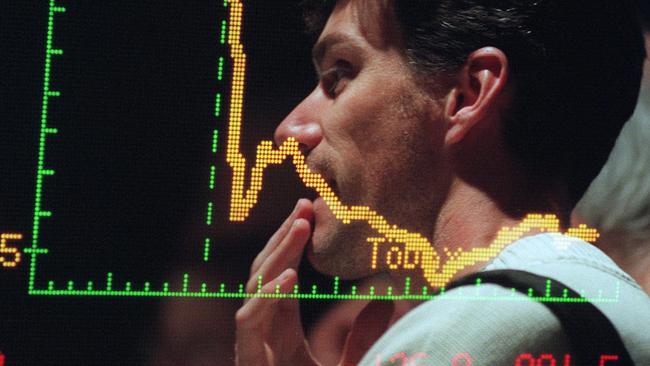

ASX 200 closes flat; ANZ slapped with $250m capital penalty; Tabcorp's $4.6m fine; Inghams misses profit estimates; Wall Street awaits Powell speech

APRA slaps ANZ with $250m penalty after trading scandal. Rex administrators given more time to find buyer. Elanor scraps dividend. ASIC's win in crypto firm fight. Inghams' profit miss, mixed guidance. Legal battles weigh on Fletcher.

Welcome to the Trading Day blog for Friday, August 23. The ASX 200 index closed flat, marginally down to 8023.90 points - ending its 10-day winning streak.

The Aussie dollar is near US67.25c at 5.20pm AEST.

More Coverage

Join the conversation

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout