Tipping point coming in January for household spending: Woolworths

Shoppers will finally rein in their budgets next month as interest rate hikes hit and back-to-school bills mount, the supermarket giant’s chief executive says.

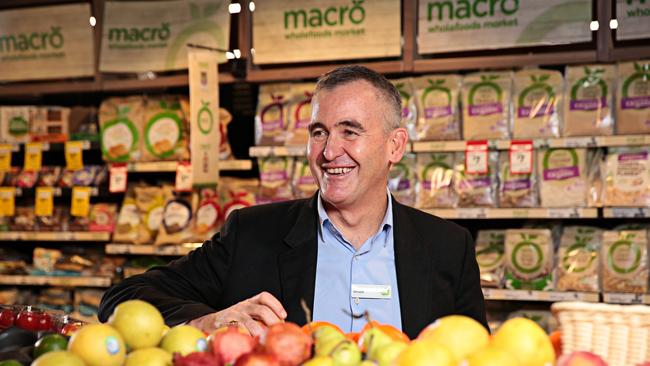

Woolworths chief executive Brad Banducci has warned suppliers that households will hit a “tipping point” in January as eight months of interest rate rises, higher energy costs and back to school bills finally forces shoppers to rein in spending and hunt for value.

Mr Banducci told the supermarket giant’s suppliers in a confidential forum late last month that shopping habits will “unquestionably change” next year and the “tipping point” will mean one of the most significant changes in buying behaviour in years.

Cost of living will be “top of mind by the end of January” for the average shopper who will make value a strong focus in their new shopping habits for 2023, Mr Banducci said. This conclusion was supported by internal Woolworths data, shown to the group, which revealed 41 per cent of its customers now say they are picking up more products from the shelf when on promotion.

The Reserve Bank hiked rates by 25 basis points to 3.1 per cent on Tuesday, although it noted that the effects of rate rises since May were yet to be fully felt by families.

“Importantly, the impact from rate tightening is emerging in the data – interest costs on mortgages increased 36 per cent in the quarter, and housing weakness is slowing both turnover and associated consumer spending categories,” wrote Morgan Stanley economist Chris Read in a note last week.

“With rate hikes continuing and lagged impact flowing through, these headwinds will accelerate significantly in 2023.”

In his address at a closed-door meeting of suppliers on November 30, Mr Banducci said: “Back to school is a tipping point, it’s always a tipping point but this year it’s a bigger tipping point than usual where we think our customers are going to stop talking about value and acting on value.”

“You get back from your holidays, you pay your bills, you start paying for your children’s schooling, and you are not in your normal habitual shopping cycle and you establish new habits.

“Customers see inflation, they experience the impact, they’ve had savings to rely on, at Christmas they want – or should I say deserve – to celebrate with family and friends.”

That savings rate – which grew to more than $200bn during the Covid-19 pandemic – is steadily being eroded as the savings rate drops by almost two-thirds to just under 7 per cent and as households direct more money into mortgage and daily expenses.

The pressure would then be on suppliers and retailers to offer value to these consumers who will start to factor these costs to their household budgets when making purchases at the supermarket.

“We all need to work very hard to ensure that we are prepared for the tipping point and are prepared to give customers the value they need, not the value they want,” Mr Banducci told suppliers.

“It’s about giving the value they need, given the pressure they are going to see next year with interest rates, energy and food inflation continuing on.

“As customers go into the new year, they are going to make adjustments, what they see as value is unquestionably going to change and we will all need to lean into this and help customers get the value they need.”

Other retailers are also privately concerned about a post-Christmas economic slowdown, when consumers start receiving their credit card bills, budget for back to school costs and many homeowners roll over from lower fixed mortgage to much higher variable mortgage loans.

“We continue to hold the view that rising interest costs and staples inflation are likely to weigh on consumer spending over calendar 2023.” Macquarie brokers told clients last week after analysing high frequency consumer data. “If November exit momentum can be maintained, it should be a strong Christmas for discretionary retailers, but price is key to driving sales.”

In particular, Macquarie’s researchers noted Woolworths and Coles had both highlighted that grocery volumes had fallen by between five and seven per cent in the three months to the end of September, and top-line growth was “lacklustre” despite a surge in food prices during that time.

In October, Coles chief executive Steven Cain said he believed households would “push the boat out” for their spending on holiday season celebrations and only then turn to focusing on budgets in January or February as credit card bills landed and many rolled on to new variable home loans.