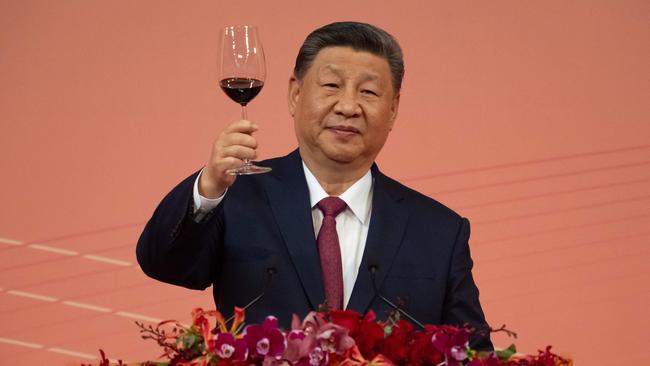

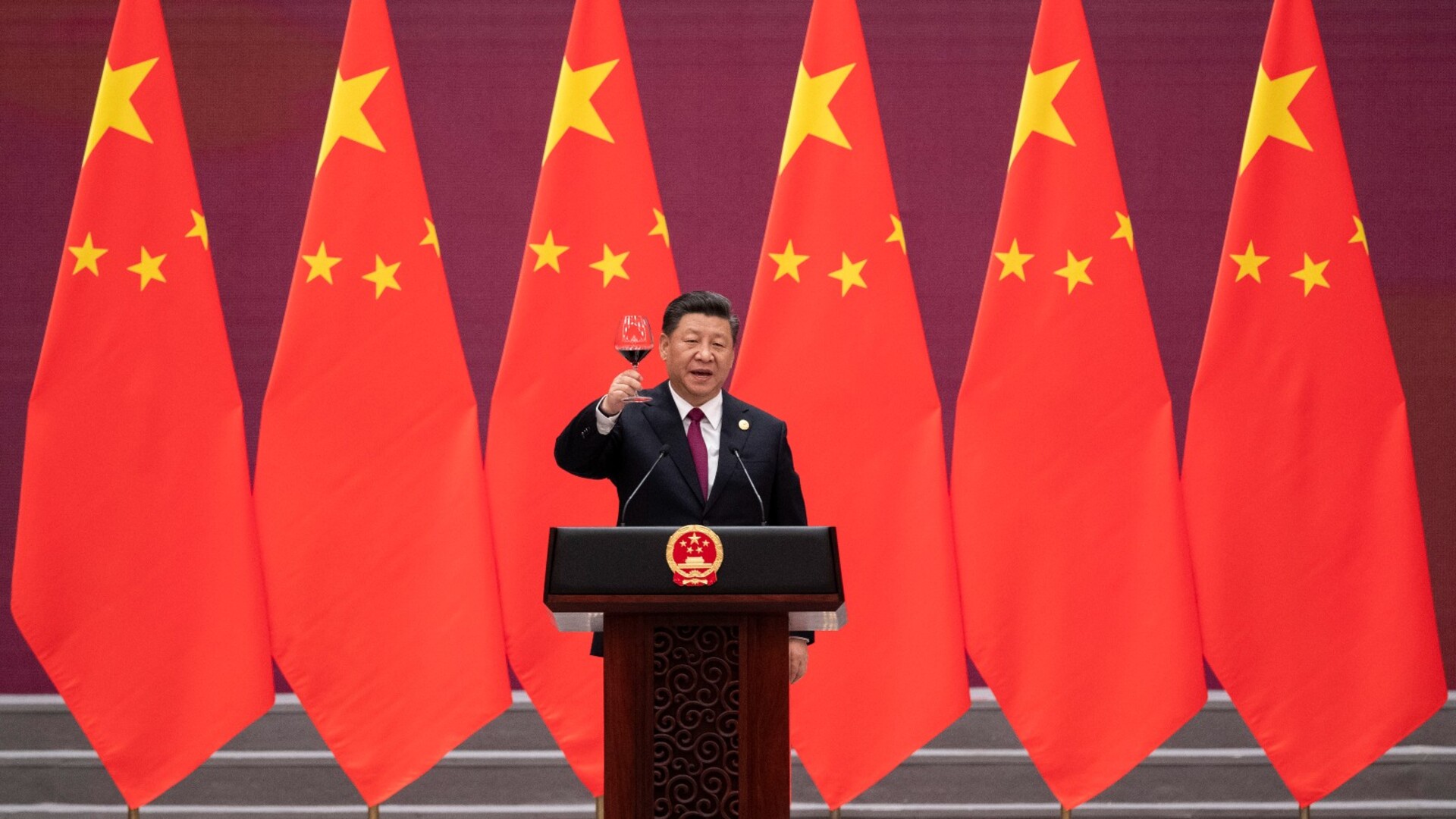

Xi digs in with top-down economic plan as China drowns in debt

China is reeling from a property bust and verging on a deflationary spiral. Growth has slowed and Western investment has collapsed. But Xi Jinping won’t change his course.

Some are calling it a “Lost Decade.” More than 10 years into the Xi Jinping era, it has become clear that much of China’s growth under his watch was driven by unsustainable borrowing, real estate speculation and investments in factories and infrastructure the country didn’t really need.

Difficult reforms that could have unlocked more durable growth, such as steps to increase consumer spending, were neglected in favour of policies designed to bolster Communist Party control.

Now, China is drowning in debt, reeling from a property bust that wiped out trillions of dollars of household wealth, and verging on a deflationary spiral. Growth has slowed, Western investment has collapsed and consumer confidence is near a record low.

And yet, as China squares off with the US for a second showdown over trade, Mr Xi is digging in. He’s convinced that his top-down approach to managing China’s economy, with plans to make it an even bigger industrial power, offers the best path for China to eventually surpass the US in economic might.

People close to Beijing’s decision-making say nothing that has befallen China in recent years has changed Mr Xi’s belief that the US is fading as the singular superpower, and that China’s importance is rising on the world stage.

“Xi still believes that the East is rising and the West is in decline,” said a foreign-policy adviser in Beijing, referring to a pronouncement the leader made three years ago when China’s economy, driven by Western demand for its exports, experienced a short-lived recovery from the Covid pandemic.

“It might just not be a straight line in his view.”

To achieve his vision, Mr Xi is building out a sweeping industrial supply chain intended to make whatever China needs, including semiconductors, to withstand more conflict with the US.

His government is also drawing up plans to hit back at any tariff hikes by President-elect Donald Trump, through retaliatory measures such as restrictions on sales of raw materials the US needs to make chips, car engines and defence-related products. He’s cultivating allies in the developing world to try to add pressure on the US.

What Mr Xi hasn’t done, many economists argue, is take hard-but-necessary steps to fix the country’s wounded economy.

While Beijing has rolled out some stimulus recently, it hasn’t acted decisively to clean up the troubled property sector, fully restructure local-government debt, and significantly increase consumption, which would support growth in the long run.

“A lot of the problems are of the government’s own making,” said Richard Koo, chief economist at Nomura Research Institute. Like many economists, Mr Koo believes China faces what he calls “a race against time” to address the country’s mounting growth problems before it slips into a long-term downturn, made worse by unfavourable demographics.

The State Council Information Office, which handles inquiries about China’s leadership, referred questions to the country’s top economic planning agency, China’s central bank and the ministries overseeing industry and commerce. None of those government institutions responded to questions.

Following Mr Xi’s moves I had a front-row seat over the past decade covering China as Mr Xi had opportunities to fix its economy, just as previous Chinese leaders did when they faced economic turbulence.

Every time, he took the fork in the road that led to more state control, and away from the kinds of changes that many Chinese economists say are necessary. Although some of China’s economic problems started before Mr Xi was in power, he failed to resolve them, leading even some of the government’s own advisers to talk privately about a lost decade.

In September 2018, I attended an economic forum at the Diaoyutai State Guesthouse in Beijing. At the time, some market-minded officials hoped that Mr Trump’s tariff threats would force Beijing to carry out long-delayed reforms such as giving private enterprise more room to prosper.

The government needs to “build consensus through debate and then implement reforms one by one,” said Wu Jinglian, a pro-market economist.

Zhang Shuguang, another liberal thinker, reminded the audience that Deng Xiaoping, the Chinese leader who launched the country’s “reform and opening” era, focused on integrating China with the US and other developed countries.

“Necessary concessions should be made,” he said, while cautioning against matching Washington tit-for-tat in an endless trade war.

Instead, the trade fight galvanised Mr Xi’s resolve to expand state control and plump up Chinese industry, even though it risked worsening tensions with the US.

His government showered preferred sectors such as semiconductors and electric vehicles with subsidies and encouraged banks to lend more to factories to increase production.

Mr Xi also launched a crackdown on the private sector. Meant to discourage irrational risk-taking and knock powerful business leaders down a peg, it wound up stifling China’s entrepreneurial spirit.

The result was an economy increasingly dominated by state-backed firms, with growing overcapacity of steel, EVs and other products. Today, China is more reliant on exports to drive growth than in 2018, making it more vulnerable to the kind of tariffs Trump is proposing.

Missed opportunities

Meanwhile, Beijing only half-heartedly addressed problems it had allowed to fester for years. As Mr Xi consolidated power, he asserted personal control over managing the economy, which previously was overseen by China’s premier, and surrounded himself with loyalists who had limited experience in economic policymaking.

The Xi leadership let China’s property bubble inflate for years, even though it was clear the market was overheated. Although Mr Xi finally popped the bubble in 2020, restricting credit to overleveraged developers, Beijing still hasn’t come up with a comprehensive plan to clean up the mess. Tens of millions of units sit empty and the market continues to languish.

Year after year, Beijing warned local governments against excessive borrowing. But it never strictly enforced the rules. By this year, local governments had taken on as much as $11 trillion in off-the-books debt to build transit systems and other projects, including many that failed. The borrowing made growth look better in the short term, but leaves China more vulnerable to financial instability.

Beijing also made repeated pledges to promote consumer spending. Yet household consumption makes up only about 39pc of gross domestic product in China, relatively unchanged in recent years, compared with around 68pc in the U.S. To change that, Beijing would need to do more to encourage people to spend more and save less, including by expanding China’s relatively meagre social safety net with greater health and unemployment benefits.

However, Mr Xi views American-style consumption as wasteful, and fears that providing too much state support to households could encourage “welfarism.”

One reader reached out to me recently to describe how China’s dimmed outlook affected everyday people. He said he had lost his management job at a Western manufacturing firm two years ago, after the company left China. Nowadays, he’s working as a ride-hailing driver to provide for his family.

“It’s not that I’m not working hard to find a better job,” the reader, who lives in central China, told me. “There is simply no opportunity.”

‘What’s so bad about deflation?’

As storm clouds gathered over China’s economy earlier this year, a key Communist Party advisory body prepared a report for leaders in Beijing. It warned that China could slip into a deflationary spiral — the kind of disaster that befell the U.S. during the Great Depression — if more urgent steps weren’t taken to rejuvenate growth.

Mr Xi was unperturbed.

“What’s so bad about deflation?” he asked his advisers, according to people close to Beijing’s decision-making. “Don’t people like it when things are cheaper?”

Mr Xi’s dismissal made the topic all-but-taboo in Chinese policymaking circles, the people said, despite concern among economists that China could fall into a vicious cycle of falling prices and weak demand. At a high-level conference this month, the leadership acknowledged the need to realise “reasonable price recovery” but left key details of how it would do this unclear.

China handled economic challenges more assertively before the Xi era. In the late 1990s, when China suffered from overproduction and deflation, then-Premier Zhu Rongji forced weak state-owned enterprises to close or merge, resulting in massive job cuts but also making the remaining companies stronger.

In 2008, amid a global financial crisis, Beijing put together a fiscal-stimulus program amounting to about 12pc of the country’s GDP at the time. Although that planted the seeds of China’s subsequent debt problems, it won Beijing’s economic policymaking credibility among international investors by showing it would do whatever it took to keep growth on track.

Digging in for a showdown

Mr Xi’s words and actions since the US election have shown he isn’t backing down. In his Nov. 7 congratulatory message to Mr Trump, Mr Xi offered a veiled warning about engaging in economic fights with China. “History tells us that both countries stand to gain from co-operation and lose from confrontation,” Mr Xi said.

About a week later, Xi used a meeting with President Biden in Peru to warn Mr Trump not to challenge Beijing on major issues the two powers are at odds over, including China’s sovereignty claim over Taiwan, human rights, its party-state system, or what Mr Xi calls China’s “right to development” – a reference to U.S. restrictions on Chinese access to Western chips and other technologies.

These “four red lines,” Mr Xi told Mr Biden, “can’t be challenged,” according to China’s official account of the meeting.

People close to Beijing’s decision-making say that Mr Xi views the economic challenges China faces as necessary pains in the process of replacing old growth drivers, including real-estate investment, with newer sources, such as high-value manufacturing including cars and chips.

They say Mr Xi and his team have been buoyed by progress they have seen in reducing Chinese reliance on Western products, while increasing the world’s dependence on China.

“The strategy has been working,” one of the people familiar with decision-making in Beijing said, “even as the overall economy struggles.” A November report by research firm Gavekal Dragonomics shows that China has become steadily less reliant on manufacturing imports for some types of semiconductors, as well as medical devices, industrial robots and devices used in self-driving vehicles.

But China still relies on American technology, capital and know-how, especially in areas such as high-end chipmaking, aviation and biotechnology.

And as exports are among the few bright spots in the Chinese economy these days, China needs to maintain its ability to sell to its major trading partners as much as possible to prevent another big hit to overall growth.

With a rematch of Trump vs. China coming, hopes are emerging among some Chinese economists that a new trade war will finally force the Xi leadership to shift its manufacturing-centric economic policy toward one more focused on empowering consumers. If Mr Trump follows through with his promise to impose higher tariffs, they reason, Chinese exports would inevitably decline and Beijing would have to bolster domestic demand to keep the economy going.

But the world has changed since Mr Trump’s first term. Both sides are more dug-in. Evan Medeiros, a former senior national-security official in the Obama administration, said Mr Xi’s leadership style will make it hard for China to manage Trump 2.0 effectively.

“I just don’t see Xi forging a grand bargain,” he said.

Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout