US economy shows remarkable resilience in face of trade turmoil

Donald Trump’s policies have created headwinds, but the US economy is pushing through them.

The world’s most powerful economy is showing remarkable resilience in the face of enormous pressure.

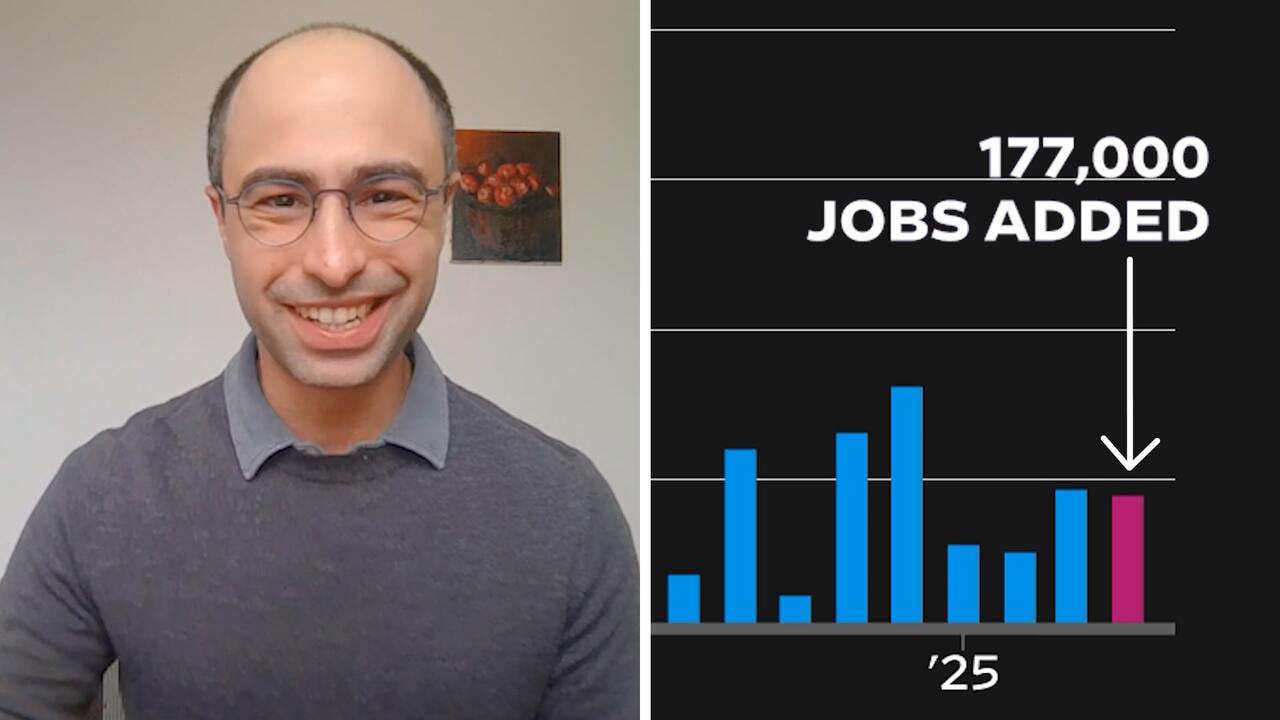

Employers added more jobs than many economists expected last month, and the low unemployment rate held steady. The US economy contracted in the first quarter, but the result was distorted by a rush of imports that offset generally solid demand. The stock market rallied sharply from its April lows.

Yet real turmoil is threatening that strong foundation. President Trump’s ever-changing tariff policies, government cuts and immigration restrictions are disrupting trade and sparking deep unease among consumers, businesses and investors. Trump’s 145 per cent tariffs on Chinese imports are causing cargo shipments from China to plummet, prompting major retailers to warn of likely price hikes and even shortages of some goods. In early April, economists forecast the likelihood of a recession in the coming year to be twice as high as it was at the start of the year.

At the moment, however, things are still looking surprisingly good.

“For another month, the actual data coming from a key US jobs report failed to justify the bad vibes and anxiety that preceded it,” said Cory Stahle, an economist at Indeed Hiring Lab. “Against most expectations, the US labor market stayed strong in April, seemingly immune to mounting uncertainty and tariff-related volatility.”

The pace of job creation has been steady, with the economy adding an average of 155,000 jobs over the past three months, only marginally lower than 2024’s average monthly gain of 168,000 jobs. Hiring has slowed, but businesses have so far been reluctant to cut workers, and the level of initial jobless claims remains low.

GDP’s first-quarter contraction, by an annualized 0.3 per cent, was largely caused by importers rushing to bring goods to the US ahead of tariffs. But demand remained solid. Consumer spending, the largest source of demand in the economy, slowed to the lowest pace since mid-2023, but still grew at a 1.8 per cent rate over the previous quarter.

Spending by the federal government fell, driven by a decline in military-related purchases, but business spending was robust.

With economic data hanging tough, investors have pushed back expectations for when the Federal Reserve will lower interest rates. Interest-rate futures now imply there is a little less than a 40 per cent chance the Fed policymakers will cut rates by their June meeting, down from nearly 70 per cent a month ago. The Fed is almost certain to leave rates on hold at its meeting next week.

Still, worries about tariffs, job security and possible price increases are causing some Americans to tighten their belts. American Airlines and Delta Air Lines said domestic leisure travel has softened, with the most price-sensitive travelers in particular cutting back. Pampers maker Procter & Gamble and OxiClean maker Church & Dwight reported that US sales growth slowed in the first quarter. Restaurant chains including Chipotle Mexican Grill and Starbucks have experienced slower US sales. McDonald’s said first-quarter sales at US locations that have been open more than a year fell by 3.6 per cent from a year earlier.

“Low- and middle-income consumers, in particular, are being weighed down by the cumulative impact of inflation and heightened anxiety about the economic outlook,” McDonald’s Chief Executive Christopher Kempczinski said on an earnings call.

Uncertainty over Trump’s policies has prompted many big companies to yank their profit forecasts for the year, and to step up cost cutting. General Motors this week said tariffs will wipe out up to a quarter of its net profit this year. Apple warned that current tariff plans would add $900 million to costs this quarter, and said that figure could rise.

Without the resources of their larger counterparts, small businesses could get particularly slammed by scarce or higher-cost goods, worries Apollo Global Management chief economist Torsten Slok. “The important statistic in that context is that 80 per cent of employment in the US economy is in businesses with less than 500 workers,” he said.

Surveys of consumers and businesses are flashing red. The Conference Board said its index of consumer confidence fell to its lowest level last month since May 2020, shortly after the pandemic hit. People are deeply worried about the job market, with 65 per cent of Americans surveyed by the University of Michigan last month saying they expect unemployment to rise over the next year. Manufacturing and service-firm surveys conducted by regional Federal Reserve Banks show companies expect to rein in capital spending.

As Trump entered office, many manufacturers “were emboldened or bullish at first, with the potential for tax reform, permitting reform and regulatory reform on top of what was a pretty decent economy at the time,” said Mark Denzler, chief executive of the Illinois Manufacturers’ Association. “And then the tariff issue came and created a real whack of uncertainty.”

One German company in Illinois was getting ready to buy an expensive piece of manufacturing equipment from China that would have created new jobs in its factory. But now because of the extra import tariff cost it isn’t moving ahead with the purchase, Denzler said.

Many manufacturers are stuck in similar paralysis. The Institute for Supply Management on Thursday said that manufacturing activity contracted for a second month in April, with businesses reporting they have been rattled by tariffs.

Tourism-related measures have also taken a hit. There were 7.8 per cent fewer visitors to Las Vegas in March than a year earlier, according to the Las Vegas Convention and Visitors Authority. Canadians, long the top source of international visitors to the US, are boycotting American vacations to protest Trump’s threats to their sovereignty. Fewer travelers from Europe are coming to the US.

A preliminary reading on retail sales from the Chicago Fed suggests that spending moderated last month following a pre-tariff flurry. Based on measures including foot traffic and card transactions, retail sales excluding autos fell by an inflation-adjusted 0.5 per cent in April from the previous month, after rising 1 per cent in March.

Worries about a recession were rising sharply as of early last month, when economists polled by The Wall Street Journal put the probability of a downturn occurring within the next year at 45 per cent, versus 22 per cent in January. The survey concluded April 8, the day before Trump suspended some tariffs for 90 days while ratcheting up levies on China.

Those odds aren’t as high as the 63 per cent economists predicted in October 2022—a forecast that didn’t come true. But JPMorgan Chase economist Mike Feroli reckons the economy is in greater peril now and that many economists are simply nervous about getting another recession call wrong.

“Absent the experience of 2022 and 2023, I think people would say, ‘Oh, we’re definitely going into a recession,’ ” he said.

Gregory Daco, chief economist at EY-Parthenon, has lowered his recession odds from 60 per cent in early April to 45 per cent. That isn’t because of anything he has seen in the recent economic data, but because he believes the White House will ratchet back tariffs against China and reduce levies against other countries.

While concerns about Fed interest rate increases fueled economists’ worries in 2022, the economy still had a head of steam coming out of the pandemic, with government stimulus and an end to lockdowns fueling fierce demand.

Much of that post-Covid rocket fuel has worn off, leaving today’s economy more exposed to shocks.

The trade tension Trump has stoked is also hampering some US exports. Gary Wishnatzki, owner of a large berry farm in Florida, said Canadian outrage over Trump has caused supermarkets there to stop buying his fruit, forcing him to find new domestic buyers. In recent years, Canada accounted for about 10 per cent of Wish Farms’ sales, he said.

Yet he added that a bigger problem for the farm is one of the economy’s longer running problems: a shortage of workers.

Andrew Logan, chief executive of Logan Clutch Corporation in Cleveland, said the manufacturer’s difficulties finding skilled labor have left it better prepared to deal with tariffs. The machinery-parts company has invested heavily in automation as it has struggled to find workers, which has also helped it lower production costs—a big benefit now as tariffs threaten to raise some input prices, Logan said.

The company buys most of its materials in the US, which further protects it from tariffs. “But the real challenge will be when more companies begin to onshore goods and services,” Logan said. “This will likely put a strain on the internal US supply chain, and drive up costs, and eventually prices.”

Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout