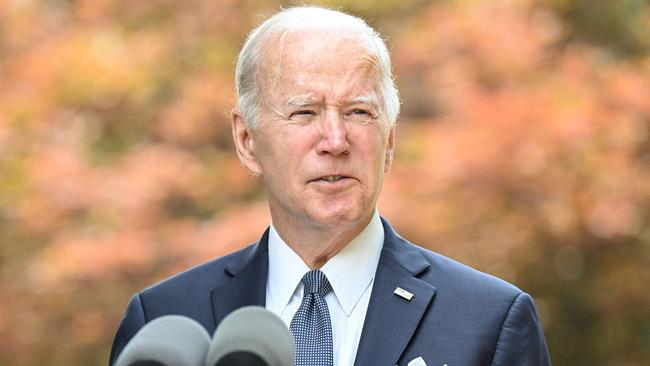

Rising risk of recession creates new headache for Biden

The White House is deploying a strategy to highlight economic bright spots as the Fed tackles inflation.

The Federal Reserve’s efforts to slow inflation in the US are raising the possibility of higher unemployment, a slower-growing economy and a recession, prospects that could create new headaches for the Biden administration.

As the country heads into midterm-election season, much of the political discussion has centred on solid economic growth and robust employment versus the damaging impact of inflation. More recently, warnings about the prospect of an economic downturn – which could come in 2023, according to some estimates – have complicated the economic picture in a new way.

Mr Biden and his advisers are already grappling with inflation trending near a four-decade high, wavering consumer confidence and headwinds posed by Russia’s war in Ukraine. Republicans lay blame for surging prices on the administration, saying it stoked inflation with pandemic-related stimulus and then failed to counter it as prices rose. They have lambasted Mr Biden and Democratic lawmakers ahead of the midterm elections that will decide which party controls Congress.

“It is this president and his all-Democratic government who have drained American families’ pocketbooks, and every poll shows our citizens understand that sad reality all too well,” Senate Minority Leader Mitch McConnell recently said on the Senate floor.

Mr Biden and his economic team have maintained the economy is well-positioned to withstand challenges, pointing to factors such as a strong labour market and unemployment trending near a 50-year low. They are deploying a strategy seeking to improve Americans’ view of the economy, which could bolster confidence and help underpin consumer spending.

“Our economy is in a transition from what has been the strongest recovery in modern American history to what can be a period of more stable and resilient growth that works better for families,” Brian Deese, the director of the National Economic Council, said on Sunday on CNN’s State of the Union.

The strategy includes Mr Biden increasing travel domestically to tout economic bright spots and the administration’s efforts to lower consumer prices. He is also drawing a starker contrast between his policy agenda and that of Republicans, who the administration says would do little to combat inflation and seek to raise taxes on American families.

“It’s an economy with some real headwinds, but American households are facing those headwinds from a position of strength,” said Jared Bernstein, a member of the White House’s Council of Economic Advisers. “There are a number of important economic indicators that underscore that position of strength.”

The White House faces two hurdles. Economic concerns rate highly among voters, so messages about the strength of the economy risk falling flat. And changing the direction of the economy is only partly within the administration’s control, with the strongest levers held by the Fed. The central bank is mounting an aggressive effort to tame inflation without substantially slowing the labour market and the broader economy, a feat some economists say may be difficult to accomplish.

Federal Reserve chair Jerome Powell told The Wall Street Journal last week that “there could be some pain involved” in bringing down inflation and that unemployment might rise slightly. Treasury Secretary Janet Yellen last Wednesday said the outlook for the global economy was challenging and that higher food and energy prices were “having stagflationary effects”, referring to a combination of high inflation and weak growth. US stocks tumbled sharply last week.

On Sunday, Mr Deese said the White House supported the Fed’s approach. “We need to give the Fed the space and the independence to do its job, which is to get inflation under control,” he said.

Matthew Luzzetti, chief U.S. economist at Deutsche Bank Securities, said he expected that the Federal Reserve would need to take more drastic steps to cool inflation, which would increase the risk for a recession in 2023. Deutsche Bank forecasts that consumer inflation, excluding often-volatile food and energy prices, will ease from current levels by the end of 2022 but will remain well above pre-pandemic levels.

“In the near term, we see an economy that is strong and resilient, but in a way that continues to put upward pressure on prices and wages,” Mr Luzzetti said. “That will necessitate a more aggressive monetary policy response, which we think is the source of the recession,” he added.

Mr Bernstein at the White House said the pandemic had created a set of economic circumstances that didn’t readily fit into traditional calculations about whether a recession is on the horizon. “Rather than try to jam this unique and bespoke economic moment into a probability model, I think it’s better to try to sort out the headwinds and tailwinds,” Mr Bernstein said. “And when we do that, we see an economy that still has fundamental strengths.”

Inflation presents a vexing challenge, both for the administration and the Fed. Consumer prices rose 8.3 per cent in April from a year earlier, meaning Americans of all stripes are paying more for petrol, groceries and travel, even if they feel secure in their jobs.

What’s more, an economy that had been rapidly expanding since early 2020 has shown some signs of slowing, contracting in the first quarter.

Larry Summers, Treasury secretary in the Clinton administration, told the Journal earlier this month that he believes a recession in the next two years is more likely than not: “I think the risks are just quite substantial,” he said.

Economists surveyed by The Wall Street Journal in April on average put the probability of the economy being in recession sometime in the next 12 months at a still-moderate 28 per cent, but up from 18 per cent in January and just 13 per cent a year earlier.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout