Deutsche Bank to pay $US75m to settle Jeffrey Epstein accusers’ suit

The payout by Deutsche Bank is believed to be the largest sex-trafficking settlement involving a banking institution.

Deutsche Bank has agreed to pay $US75m ($113m) to settle a proposed class-action lawsuit alleging the financial institution facilitated Jeffrey Epstein’s sex-trafficking ring, said lawyers who sued the bank on behalf of alleged victims.

A woman who is listed anonymously as Jane Doe in court papers filed the suit last year in New York on behalf of herself and other accusers of the disgraced financier. She alleged Deutsche Bank did business with Epstein for five years while knowing that he was using money in his bank accounts to further his sex-trafficking activity.

The Doe plaintiff alleged she was sexually abused by Epstein and trafficked to his friends from about 2003 until about 2018 and was also paid in cash for sex acts. The lawsuit alleged Deutsche Bank ignored red flags including payments to numerous young women. The settlement is expected to compensate dozens of accusers.

Epstein died by suicide in a federal jail in New York in 2019 while awaiting trial on sex-trafficking charges.

Dylan Riddle, a spokesman for Deutsche Bank, declined to comment on the settlement but said the bank had invested more than €4bn to bolster controls, training and operational processes, and had increased the size of its workforce dedicated to fighting financial crime. “In recent years Deutsche Bank has made considerable progress in remedying a number of past issues,” he said.

The bank didn’t admit wrongdoing as part of the settlement, according to people familiar with the matter.

The plaintiffs’ lawyers, from the law firms Boies Schiller Flexner and Edwards Pottinger, said on Wednesday (Thursday AEST) they believed the $US75m was the largest sex-trafficking settlement involving a banking institution.

“This groundbreaking settlement is the culmination of two law firms conducting more than a decade-long investigation to hold one of Epstein’s financial banking partners responsible for the role it played in facilitating his trafficking organisation,” they said in a joint statement.

The Deutsche Bank complaint was one of two lawsuits that took aim at banks for allegedly enabling Epstein to recruit and groom hundreds of underage girls and young women for sex with himself and his associates. The suits were filed in November when New York State opened a year-long window during which people who say they were sexually assaulted could file lawsuits, no matter when the conduct occurred.

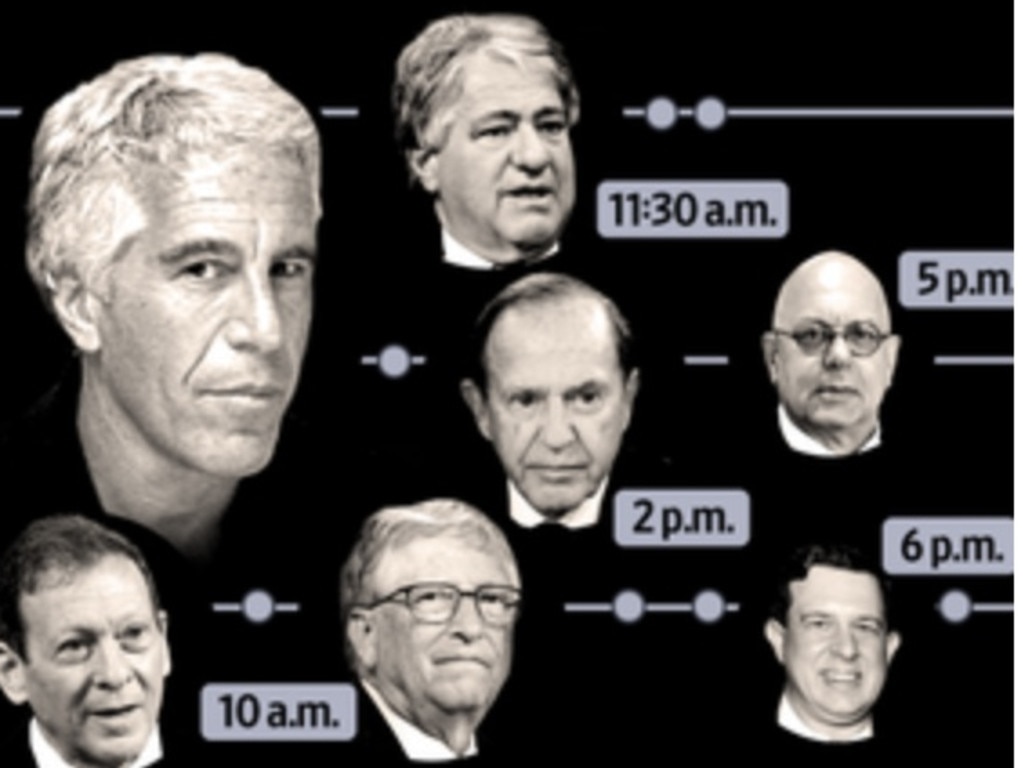

The other lawsuit, filed by the same law firms, is against JPMorgan Chase. The US Virgin Islands also sued JPMorgan late last year, saying the bank facilitated Epstein’s alleged sex trafficking and abuse by allowing the late financier to remain a client and helping him send money to his victims. Both suits against JPMorgan are ongoing, and Jamie Dimon, the bank’s chief executive, is scheduled to be deposed in the cases later this month, according to people familiar with the matter.

JPMorgan declined to comment on the Deutsche Bank settlement. “In hindsight, any association with Epstein was a mistake and we regret it, but we do not believe we violated any laws,” a JPMorgan spokeswoman has said. “We are committed to combating human trafficking and we will continue to look for ways to invest in advancing this important mission.”

The Deutsche Bank settlement came after the bank didn’t oppose the plaintiff’s request to certify the lawsuit as a class action. The agreement still needs to be approved by a federal judge.

Epstein started to bank with JPMorgan around 1998 and then turned to Deutsche Bank after JPMorgan closed his accounts in 2013. Both banks worked with Epstein for years after he pleaded guilty in a Florida state court in 2008 to soliciting prostitution from a minor.

New York State’s financial regulator fined Deutsche Bank $US150m in 2020 for failing to properly monitor its dealings with the convicted sex offender and other lapses. Deutsche Bank said at the time that it was a mistake to take Epstein as a client and acknowledged weaknesses in its processes, and that it had learned from its mistakes.

New York’s financial regulator found Epstein, his related entities and associates had more than 40 accounts at Deutsche Bank.

Under the terms of the settlement, dozens of eligible accusers will each automatically receive $US75,000, according to people familiar with the matter. Accusers can potentially receive a larger award if they choose to make claims against Deutsche to an administrator of the $US75m settlement, the people said. The claims could result in an accuser getting a payment of upward of $US5m, the people said.

Epstein’s accusers have pushed for decades to hold him and his associates accountable. In 2022, Prince Andrew settled a federal sex-abuse lawsuit filed by Virginia Giuffre, one of Epstein’s most prominent accusers who now lives in Perth, agreeing to make a substantial donation to her charity.

Ms Giuffre accused Epstein and Ghislaine Maxwell of forcing her to have sex with the British royal when she was a teenager in the 2000s.

Maxwell was convicted of sex-trafficking in 2021 for recruiting and grooming underage girls and young women for sex acts with Epstein at his Florida estate, New York mansion and his compound in the US Virgin Islands. She is currently serving a 20-year prison sentence.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout