Delays at US ports in post-pandemic squeeze

US shipping operations remain clogged as ports, truckers and warehouses can’t find enough workers or agree on 24/7 operations.

Nike doesn’t have enough sneakers to sell for the holidays. Costco Wholesale is reimposing limits on paper towel purchases. Prices for artificial Christmas trees have jumped 25 per cent this season.

Despite mounting shipping delays and cargo backlogs, the busiest US port complex shuts its gates for hours on most days and remains closed on Sundays. Meanwhile, major ports in Asia and Europe have operated around-the-clock for years.

“With the current work schedule you have two big ports operating at 60 to 70 per cent of their capacity,” said Uffe Ostergaard, president of the North America region for German boxship operator Hapag-Lloyd. “That’s a huge operational disadvantage.”

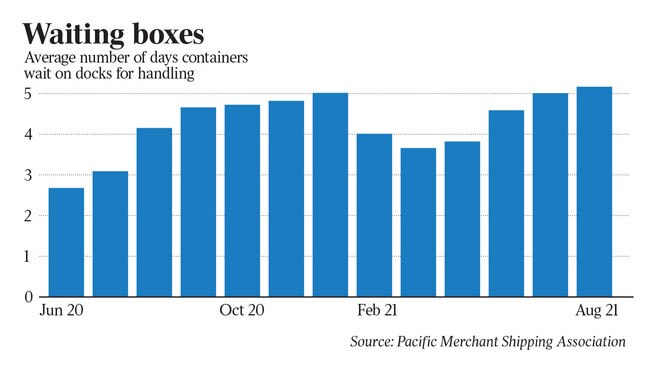

The American supply chain has so far failed to adapt to the crush of imports as businesses rush to restock pandemic-depleted inventories. Tens of thousands of containers are stuck at the ports of Los Angeles and Long Beach, California, the two West Coast gateways that move more than a quarter of all American imports. More than 60 ships are lined up to dock, with waiting times stretching to three weeks.

Participants in each link in the US chain – shipping lines, port workers, truckers, warehouse operators, railways and retailers – blame others for the imbalances and disagree on whether 24/7 operations will help them catch up. All of them are struggling with a shortage of workers.

The ports of Los Angeles and Long Beach are managed separately and operate 13 private container terminals. Long Beach officials said last week they would try operating 24 hours a day from Monday to Thursday. Gene Seroka, executive director of the larger Port of Los Angeles, said his port would step more cautiously, keeping existing hours while waiting for truckers and warehouse operators to extend their hours.

“It has been nearly impossible to get everyone on the same page towards 24/7 operations,” Mr Seroka said.

Truck drivers often don’t show up to pick up boxes at the inundated container yards to make space for the next load to come in, say shipping and port executives. Truckers blame terminal congestion, saying delays at one appointment can cause them to miss the next, and that shipping lines aren’t doing enough to clear out the towers of empty containers taking up space at the docks.

Before any changes this coming week, the longshore routine at the ports involve two shifts: 8am to 4pm and 6pm to 3am. An overnight shift of five hours is available, but it is up to 50 per cent more expensive and rarely used, say liner and terminal operators who foot the bill. Cargo pick-ups on Saturday are also rare, being charged as premium shifts, and there is no work on Sundays.

The International Longshore and Warehouse Union, which represents the dockworkers, said its members would work a third shift or on weekends, but the pileup of containers must first be fetched out of the port, so there is space to unload more from ships.

“Congestion won’t be fixed until everyone steps up and does their part,” said Frank Ponce De Leon, a coast committeeman at the ILWU. “The terminal operators have been under-utilising their option to hire us for the third shift,” he said.

Regulations limit truck drivers to 11 hours of driving in a 14-hour workday. Port truckers often prefer to start early so they can maximise the number of loads they move a day, said Tom Boyle, CEO of Quik Pick Express, a trucking and warehousing provider.

Night shifts are less popular. Drivers who pick up loads late at night don’t always have a place to put them. Truckers might have to park a box in a drop yard, and then deliver it later when the destination warehouse is open.

Nike executives said that the amount of time it takes to move a cargo container from Asian factories to North America is now about 80 days, or twice as long as it was before the pandemic. Moving items such as paper towels or furniture within the US is also a challenge, with Costco executives saying it can be difficult to find trucks or drivers on short notice.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout