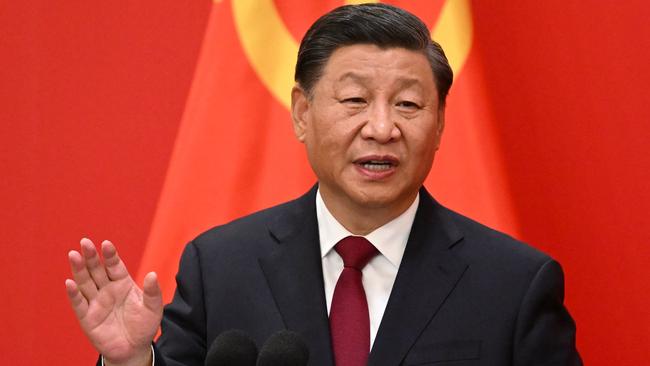

China’s new slate of top leaders stirs concern over economy

The world’s second-largest economy has been weighed down by Beijing’s zero-Covid policies and a downturn in the property market.

The new slate of China’s top leaders, packed with allies of Xi Jinping, has some economists fearing a further erosion of checks on the power of a Chinese leader who has overseen the biggest expansion of state control over the economy in decades.

On Sunday, China unveiled the leaders who will sit on the country’s most powerful decision-making body, the Politburo Standing Committee. All six men who took the stage with Xi Jinping are seen as loyalists of the Chinese leader.

Mr. Xi’s zero-Covid policies have suppressed consumer spending while borrowing limits imposed on developers have led to a steep downturn in the property market. A sweeping clampdown on the internet and private-education sectors has wiped out hundreds of billions of dollars in market value for many of China’s biggest companies and sent a chill through the entrepreneur community.

The outcome of the Communist Party congress signaled the likely continuation of policies that have concerned foreign businesses, including the zero-Covid policies and China’s deteriorating ties with the U.S., said Steven Okun, a Singapore-based senior adviser at McLarty Associates, a consulting firm. China will likely continue to draw closer to Russia, he said.

“For many foreign investors and businesses, China is not an option, it is essential,” said Mr. Okun. Still, he added, “new investment into the country has been paused by many, with record inflows going to Southeast Asia and India.”

The new lineup includes people with less experience on the economy and suggests there won’t be a mechanism to course-correct if Mr. Xi’s policies are failing, said Wang Hsin-hsien, a professor of East Asian Studies at the National Chengchi University in Taiwan. “Xi’s power is enormous and will not be shared,” he said.

“There is an increased risk that Xi’s economic-security agenda will trump economic pragmatism, as well as dangers of greater policy volatility and a lack of communication with global ripple effects,” said Michael Hirson, head of China research at 22V Research, a New York-based firm focused on investment strategy.

Last week, China abruptly delayed the release of its third-quarter gross domestic product figure without offering an explanation, adding to concerns among investors that it will become increasingly difficult to obtain a clear picture of the economy.

China’s Premier, Li Keqiang, who at times served as a counterbalance to Mr. Xi’s policies on the economy, is retiring. He is likely to be succeeded by Li Qiang, the Shanghai party secretary, The Wall Street Journal has reported.

Mr. Li’s political allegiance to Mr. Xi suggests he “will not question policies that could have a disruptive impact on the economy,” said Mr. Hirson.

Mr. Li was widely seen as the person responsible for Shanghai’s chaotic Covid lockdown earlier this year. Mr. Li had tried to adopt a lighter-touch approach to managing the pandemic but that faltered as the virus spread and Beijing brought in Vice Premier Sun Chunlan, who has led China’s strict approach to battling the pandemic nationwide.

Still, the impact that Mr. Li could have on China’s economy remains to be seen. Some businesspeople who have dealt with Mr. Li over the years say they are optimistic about the effect he could have on the economy because of his experience working with companies.

They said his record in Shanghai and other provinces suggests he would be business friendly. He oversaw the establishment of the STAR Market, also known as the Science and Technology Innovation Board, launched in 2019 with backing from Mr. Xi. He also brought foreign investment from companies such as Tesla Inc., which spent $2 billion building a factory there and started delivering cars in less than a year.

“We will give full support to the upcoming construction of Tesla projects, and we hope Tesla will expand co-operation with Chinese enterprises in clean energy and transportation,” Mr. Li said in a meeting with Tesla CEO Elon Musk in 2020, according to Chinese state media.

In the early 2000s, he served as the top commerce official in the coastal province of Zhejiang, home to what would become major private companies including Alibaba Group Holding Ltd. He was later promoted to party secretary of Wenzhou, a city in Zhejiang that became a thriving entrepreneurial hub after China opened up its economy in the late 1970s.

While he was in Zhejiang, Mr. Li started a new initiative to develop small towns with a business-friendly climate and a beautiful environment. The model was also endorsed by Mr. Xi’s government in 2015 and was expanded across the country.

While Mr. Li will be implementing Mr. Xi’s agenda, he might have more influence than his predecessor if he becomes the country’s next premier, the people said. That could enable him to nudge Mr. Xi’s policies in a more business friendly direction, they said.

Mr. Xi is more pragmatic than he is often given credit for, said Duncan Wrigley, chief China economist at Pantheon Macroeconomics in London. He said political transitions in China are often disruptive for policy-making, as officials are distracted by the long selection process to fill senior posts.

A return to normalcy after March, when government positions are announced at the National People’s Congress, “should be net positive for the economy,” he said.

Jason Douglas contributed to this article

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout