The US market is ripe for growth in premium and luxury wines, says Treasury Wine Estates

Treasury Wine Estates, the makers of Penfolds, is on a mission to recruit the next generation of US wine drinkers.

Treasury Wine Estates chief executive Tim Ford says the winemaker will soon bring to the market innovations for its 19 Crimes wine label to arrest its slowing sales pace.

And Mr Ford said the company was well positioned to benefit from the shift by drinkers in the US to more expensive wines.

Presenting Treasury Wine’s pitch for the biggest premium and luxury wine market in the world, Mr Ford led an investment roadshow in California’s Napa Valley where he showcased the growth attributes of the US market.

As rival beverage categories such as beer, spirits, and hard seltzer show signs of decline or flatlining across some age segments, Mr Ford and his senior wine executives told analysts Treasury Wine Estates had the opportunity to recruit the next generation of wine drinkers.

This greater push into the US would be enabled by its relationships with the right distributors and retail partners in the biggest states as well as the continued pivot of its wine portfolio to premium and luxury wines.

He said this was evident by Treasury Wine’s Americas division, which in the past two years had lifted the proportion of sales generated from premium and luxury wines from 69 per cent in 2020 to 92 per cent in 2022.

That premium Treasury Wine US portfolio was led by brands such as Beringer, Stags’ Leap, Frank Family vineyards, Etude, Beaulieu Vineyard and iconic Australian luxury brand Penfolds.

Citi analyst Sam Teeger said increased disclosure around its Americas business and the performance of its luxury wines, as unveiled at the Napa investor roadshow, would be seen as positive.

He said it might encourage investors to focus beyond the recently underperforming 19 Crimes and focus more on the successful Stags’ Leap labels, which may have been overshadowed by the recently acquired smaller Frank Family vineyards.

“Further, the luxury portfolio is growing at around three times the rate of the premium portfolio, consistent with industry premiumisation trends,” Mr Teeger said.

“Within the luxury portfolio, there has been significant investor focus on the recently acquired Frank Family vineyards.

“However, Stags’ Leap was the largest contributor to 2022 national sales revenue within the luxury portfolio, and grew at a three-year compound annual growth rate of 23 per cent to 2022 – more than double the rate of the other luxury brands.”

The company indicated its confidence that more growth was to come for Stags’ Leap. Beringer and Beaulieu also experienced double-digit growth over this same period, he said.

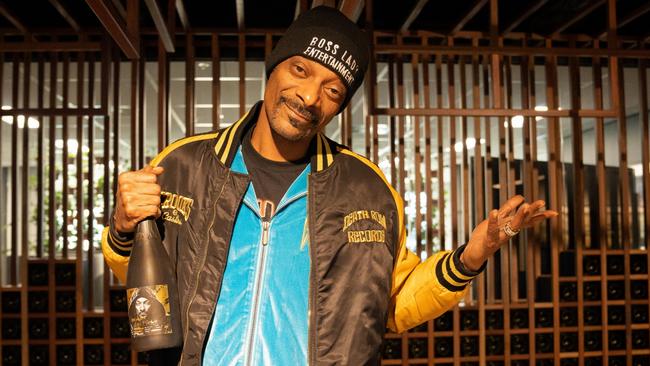

UBS analyst Shaun Cousins said the 19 Crimes label, whose brand ambassadors include US rapper Snoop Dogg, was an important brand for recruiting customers to the wine category, but it was now operating in a more challenged external environment led by a decline in the US$10-15 bottle segment.

Innovation has been skewed to partners like Snoop and has driven strong growth, yet arguably at the expense of shelf space for other wines in the range.

Mr Cousins said in a note after the US roadshow that innovation for the 19 Crimes classic range was now being stepped up thanks to limited-time offers, a label change and a new augmented reality experience.

“Albeit Treasury Wine acknowledges arguably around four to five months too late,” he said.

Mr Teeger said despite the recent 19 Crimes slowdown, its three-year net sales revenue compound annual growth rate of 22 per cent was the best of Treasury Wine’s premium brands. “The new 19 Crimes platform is expected in the coming months with market entry planned for Brazil and Mexico,” Mr Teeger said.

“The refreshed 19 Crimes classics tier product will have new packaging, a taste check, limited-time offers and new partnerships.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout