Pandemic is accelerating us into the future

So many of the trends were underway but the pandemic just put a bullet underchange.

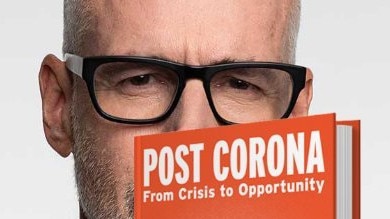

Scott Galloway’s Post Corona: From Crisis to Opportunity is one of the first books to attempt to predict some of the long-term outcomes of the pandemic.

Followers of the high-profile New York University marketing professor, who was a keynote speaker at the recent Australian Sohn Hearts & Minds investor conference, know that Galloway’s most successful marketing exercise is himself.

Galloway now generates more than $2m a semester for the university, teaching classes of 280 students on video at a cool $US7000 ($9298) a head — almost double the number he taught face-to-face pre COVID.

This book, which is more of an essay, can be downloaded from Amazon (one of the big tech companies he follows) and is a good insight into the ideas which have become part of the popular debate in the US during 2020.

We know the pandemic has accelerated trends such as online shopping, WFH, videoconferencing and telehealth while decimating the travel industry and bricks-and-mortar retail. And Galloway argues this will continue, writing that “the pandemic’s most enduring impact will be as an accelerant”. It will accelerate changes already present in society, creating a new generation of winners and losers.

“In any crisis,” he says, “there is opportunity and the more disruptive the crisis, the greater the opportunity.”

Take shopping for example.

This year accelerated the demise of bricks-and-mortar retail, with an avalanche of bankruptcies in the US retail sector including big names such as Neiman Marcus, JC Penney, Brooks Brothers, Ann Taylor, Dean & Deluca and car rental company Hertz.

At the same time online retailing has rocketed.

The winners are the tech giants — Amazon, Google and Facebook — which have seen their share prices soar off the back of products that are all in cutting-edge online businesses.

“We registered a decade of e-commerce growth in eight weeks as our lives moved online and business went remote,” Galloway says.

He argues that the companies which will survive in a post-COVID world are those with plenty of cash, which can get their fixed costs down and whose management has acted quickly to adjust to or take advantage of COVID-driven changes.

He sees 2021 as a year when the big and already successful get bigger and more successful, snapping up companies which have struggled.

“Companies with cash, debt collateral with highly valued stock will be positioned to acquire the assets of distressed competitors and consolidate the market,” Galloway says. “The biggest toll will be on companies with lots of employees that have a bad balance sheet.”

While Hertz, which had high debt levels and owned 700,000 cars in the US, has gone bankrupt, the capital-light Uber has generally prospered during COVID (particularly as life has opened up) thanks to its gig economy workers who supply their own cars.

Galloway also argues that in this environment, corporate leaders need to be prepared to move quickly to adjust to the changed circumstances, cutting costs and making decisions about their future operations.

He quotes Dr Mike Ryan, the WHO’s executive director, who said earlier this year of the approach to handling the pandemic: “If you need to be right before you move, you will never win. Perfection is the enemy of the good when it comes to emergency management. Speed trumps perfection. The greatest error is to be paralysed by the fear of failure.”

Galloway predicts that the future will see the continued rise in power of the big tech companies given their increasing share price and high level of cash reserves, arguing that moves by governments to rein in their powers will have limited success.

The rise in their share prices this year means Amazon, Apple, Facebook, Google and Microsoft now make up more than 20 per cent of all the publicly trading companies in the US by market capitalisation.

“It’s big tech’s world,” Galloway says.

“We just live in it. The pandemic has taken this trend — the increasing dominance of our lives and economy by a few tech companies — and accelerated it 10 years.

“Big tech is the 21st-century version of John D. Rockefeller and Andrew Carnegie.”

He describes them as a new cohort of US companies that are “too big to fail”, which should probably be broken up for antitrust reasons — like the old Ma Bell (AT&T) — but probably won’t be. He predicts they will use some of their multi-billion dollar stores of cash to move into new sectors.

Galloway says digitally based healthcare is a sector of the future and suggests that Apple could make the big leap from its health monitoring wearable technology into the health care sector.

The future, he says, will go to companies such as Amazon, which can amass lots of data about customers and put it to astute use in connecting with customers and working out which new businesses to move into.

One of the strongest business models of the future, he says, is the “rundle” — companies which can bundle together business with recurring sources of revenue (such as subscriptions).

“Firms that convince customers to enter into a monogamous relationship with them are positioned to accumulate more value over time than firms that interact with consumers transactionally,” he says.

The book details how the pandemic has accelerated the already evident income inequalities of American capitalism.

The “secure” jobs at Hertz, for example, have been replaced by the insecurity of the world’s armies of Uber drivers.

The continued strong share market has seen the wealthy get wealthier while those on lower paid jobs — who can’t work from home and who don’t own their own homes — have been the most vulnerable.

There are many opportunities from the changes brought about by the pandemic.

But if it is an accelerant of social trends, including further accelerating already existing trends towards income inequality in countries such as America and Australia, there are also social dangers ahead for the capitalist societies of the West.