Advice never mattered more

These are unchartered waters but the trick post-pandemic is not to panic.

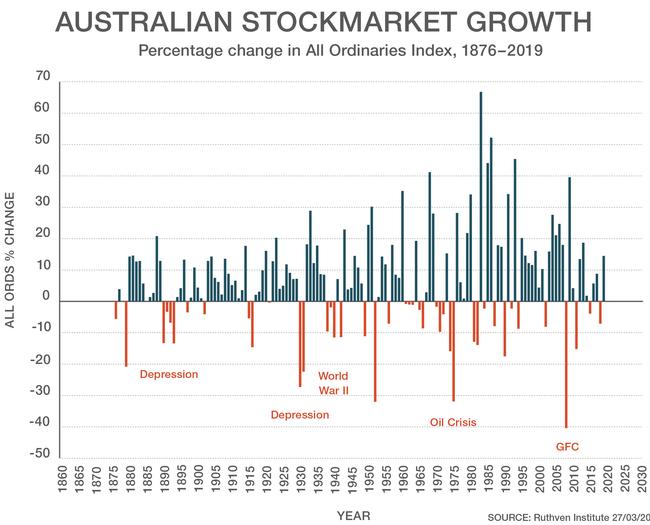

No Australian alive today has ever experienced, as an adult, a stockmarket crash of 30 per cent in three weeks, unemployment levels equal to those at the tail end of the Depression in 1935, 15 per cent of the entire economy being shut down for months by the government and car sales nearly halved in a couple of months.

Only six months into this year, we have already experienced all of these things.

Less than 1 per cent of today’s 25.5 million Australians were even teenagers during World War II; only 7 per cent were even alive. As a society in 2020, we have had very little blooding, shocks or wake-up calls.

Indeed, less than half the workforce has even experienced a recession — until now.

And, of course, no one has any adult experience of the 1918-19 Spanish flu pandemic, which claimed the lives of about 12,000 Australians — or 0.2 per cent of the population — and accounted for a minuscule 1.9 per cent of all Australian deaths. We got off lightly from that pandemic, and without a recession. With the coronavirus, if Australian COVID-19 deaths reached an unlikely 1000, it would equate to only 0.65 per cent of the total for this year.

Despite this, we are entering a recession that may extend to a depression, with widespread unemployment, falling house values, a plunge in net household wealth and the loss of more than 650,000 businesses this year and into next year (compared with a normal loss of about 580,000 every two years). Such is the price of an unprecedented panic in a peacetime economy.

To a large extent, financial advisers and their clients find themselves in uncharted waters, so to speak. If ever there was a time to pick the very best advisers in 2020 and beyond, it is now.

So, what investment choices do Australians have? And what will financial advisers recommend to their clients? Broadly, the choices are as follows:

One’s mix of investments depends on two key issues: a client’s appetite for risk, and an adviser’s best forecast about the yields (income and capital gain) of the various investment classes.

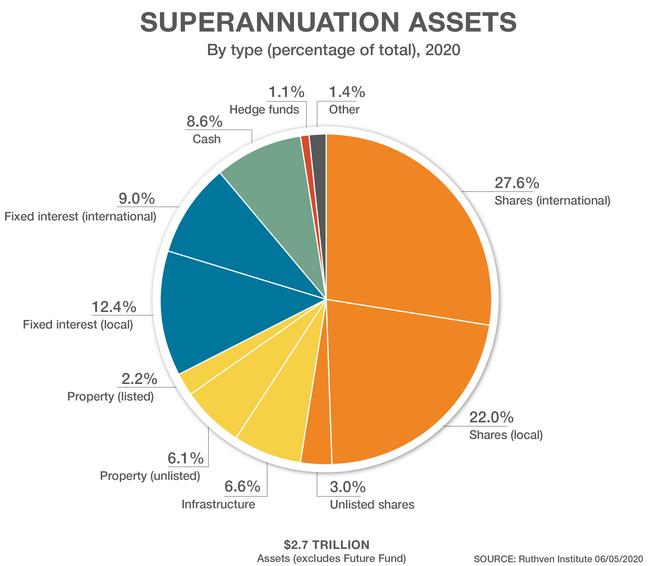

Retirees are mostly risk-averse and know the wisdom of not putting all one’s eggs in one basket. This is evident in the nation’s mix of superannuation assets in 2020. Wealth creating assets (shares) dominate at 53 per cent of the total, rent earning assets (property) account for a further 15 per cent, and the remainder (totalling less than a third) of Australia’s superannuation assets are in interest bearing, hedging and other investments.

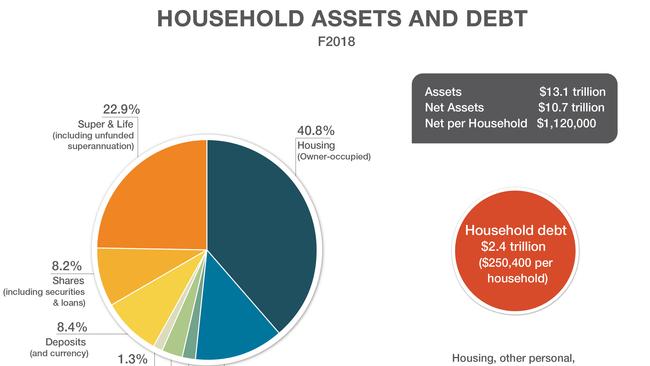

Of course, we must remember that not all investments are in superannuation funds. Of Australia’s collective household assets, totalling $13.1 trillion in FY2018, superannuation accounts for about $2.7 trillion; the remainder is made up of owner-occupied dwellings to the value of around $5.7 trillion, and around $4.5 trillion in direct investments (including shares, deposits and investment property).

So, financial advisers have a theoretical market of $9 trillion — or more than three times the value of superannuation assets — to work with.

Of course, they cannot reach the majority of it due to do-it-yourself judgment (in choosing housing), outsourcing (in the case of superannuation) and a lot of DIY in private investment. But there is still more than $2.5 trillion available within this market.

Which asset classes earn the most? Across very long periods, shares do best, followed by infrastructure and other property, then interest-bearing deposits. Precious metals are headed by gold, the price of which has gyrated in longish cycles of 30 to 40 years since it was abandoned as a currency backing role in the 20th century, so knowing when to get in and out is important. One could say the same for collectables such as artworks, classic cars, stamps and the like.

During the past two decades, the yield on investment classes — including capital gain — has ranged from 4.5 per cent to 10 per cent a year, with all being ahead of inflation. But volatility in each class makes a mockery of the pecking-order yields suggested earlier on an annual, or even decade-long, timeframe.

This year’s collapse in share prices is an obvious example. Bond yields, which have collapsed — albeit more slowly — from 15 per cent in the mid-1980s to 1 per cent this year, is another. But share prices remain the scariest variable for many investors, especially the retired. Yet, as said earlier, wealth creating assets always perform best across the long term.

So, the task of financial advisers is multifaceted, as are their supporting professionalism, skills, forecasting ability and client sensitivity (risk appetite). The loss of wealth already this year has heightened the nervousness — if not panic — among Australian investors.

As the health-related fears of COVID-19 recede, they will be replaced by a second global financial crisis later this year and into next year; the cost ($320bn of taxpayers’ money on top of a damaged economy) will test financial advisers for several years.

Of course, managing one’s finances effectively is not only a personal or household challenge. Australian businesses will be equally challenged during this time, with survival being the prime concern for many. Nor is this principle a new one; such is the importance of prudent financial management that it forms one of the Ruthven Institute’s 12 golden rules for the corporate world’s best practice profitability.

It is unfortunate that our wake-up call has come in the form of a looming economic collapse — but we also have the opportunity to learn from this crisis and prevent its recurrence in the future.

-

Phil Ruthven is founder and chief executive of the Ruthven Institute. To access an extended report on this topic, email info@ruthven.institute or visit www.ruthven.institute

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout