Australia’s largest customer, China, faces different challenges and the way they are tackled will impact shares and bonds.

And while the internal Chinese problems led by a property collapse capture the headlines, China’s most serious problem is rarely talked about – China’s potential invasion of Taiwan is causing businesses around the world, including Australia, to actively examine ways of becoming less dependent on China.

From the 1970s onwards a benign and friendly China performed a miracle by convincing America, Australia and many other countries to close down their local manufacturing industries and source from China instead where the costs were much lower.

That massive world reorientation delivered an era of low global inflation and interest rates. For Australia, it delivered a commodity boom as we supplied the raw materials for the Chinese industrial build up.

But that era has ended, and enterprises around the world are closely examining how they decouple from China.

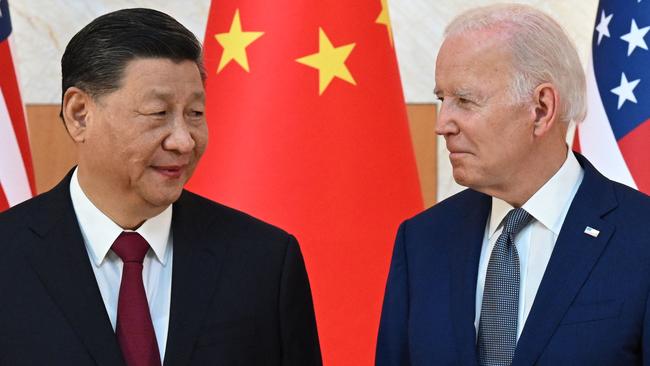

It’s not easy because Chinese enterprises are fully aware that their larger customers are looking to go elsewhere, so are fighting hard to keep them. And the Chinese are skilled operators, so switching can increase costs, although the US, under President Biden, is engaged in a massive technology oriented subsidisation of a return to America.

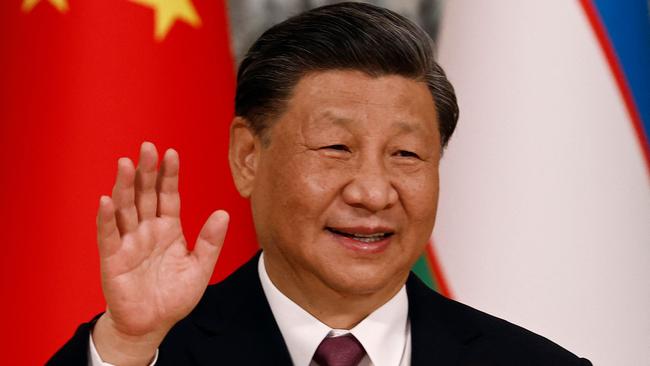

Decarbonisation and US subsidies were always going to be factors in this global change in direction, but such a massive change required a much bigger force. That driver came via the emergence of a Chinese dictator who wanted to reunite China and Taiwan, using force if necessary.

Chinese enterprises who are watching their market share slowly erode look north to Russia and watch with apprehension the rapid disintegration of the Russian economy, including a run on the Russian currency and much higher interest rates.

The Russian disintegration was caused because the Russians also had a dictator with territorial ambitions – he wanted Ukraine.

In the case of Russia, the disintegration after the Ukraine invasion has been relatively swift, whereas China’s threats to Taiwan create an impact that is more like a slow torture.

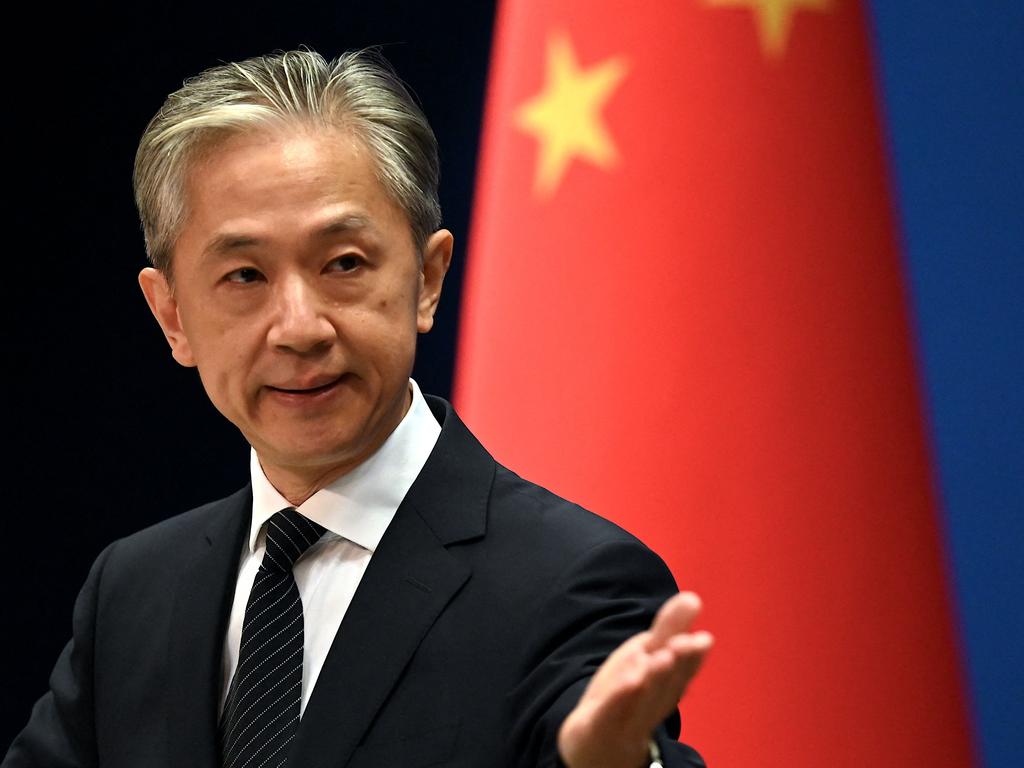

The top strategists advising Chinese dictator Xi Jinping will be telling him that the bursting of China’s property bubble and the decline of its technology giants (the actions of Xi exacerbated the technology decline) are contributing to very high youth unemployment and, if unaddressed, will cause great social upheaval.

The word from China is that the Middle Kingdom is starting on yet another stimulation program involving infrastructure but, given the lower trends in Chinese population, building more bridges to nowhere is seen by the Chinese as not a real solution.

What China really needs is a return to being seen as a global friend and extending its arms into Europe to help in a post-Ukraine war reconstruction. But that requires a different attitude from Xi Jinping and an end to the Ukraine war.

Neither are easy to achieve.

That leaves a third alternative to reduce Chinese youth unemployment – conscript them into the defence forces and invade Taiwan, hoping for a quick win.

Meanwhile, countries like India and Indonesia are benefiting from the switch away from China.

Australia has China as its major customer, so the last thing we want is for Xi Jinping to take the Taiwan invasion option. We should also be aware that China itself is preparing to reduce dependence on Australian iron ore and other minerals by sourcing from Africa. But that’s a long term game.

Meanwhile, the risk of massive sales of US bonds by China and the disruption that will create to the US economy and world interest rates is a danger that looms larger when you look deeper at the China problem.

With US 10-year bonds yields moving past 4.2 per cent, the markets have a whiff of this danger.

The world’s stock markets are beginning to realise that reducing inflation and interest rates is going to be a harder task than first envisaged, so we are seeing share and bond prices decline amid fears that the era of low interest rates is passing.