The Aussie investors making a motza from Nvidia

Australia’s biggest investors in Nvidia have received an added $8bn in value to their holdings in the AI chip maker in the past four months, and James Packer leads the field.

Australia’s biggest investors in Nvidia have added $8bn in value to their holdings in the artificial intelligence chip maker in the past four months, and James Packer’s stake is now worth almost $1bn.

Nvidia briefly this week surpassed Apple and Microsoft to become the world’s most valuable company, thanks to the demand for AI chips fuelling a tech boom that some analysts have compared with the dotcom bubble 25 years ago.

The $US3.22 trillion ($4.83 trillion) company has also been buoyed by a 10-for-one share split, which took effect late last week – a move Nvidia said it made to make its “stock ownership more accessible to employees and investors”.

The split has lowered the price of its shares dramatically and raised the overall share count so that if the company were trading at $1000, the split would price the shares at $100.

But it has not changed the overall value of the company, which has formed the bedrock of what has been hailed as a technological advancement bigger than the launch of the internet and smartphones, and will disrupt virtually every industry.

Nvidia also increased its dividend to US10c a share from US4c. Following the split, the investor payout will be US1c a share.

Among Australian funds, Macquarie has the biggest direct bet on Nvidia with about 41.8 million shares worth $US5.46bn. This is an increase from $US3.3bn in late February.

James Packer is Australia’s biggest individual investor in Nvidia in a list dominated by superannuation funds. Mr Packer has invested heavily in tech after he was forced to sell down his stake in Crown Resorts following royal commissions in two states and a damning inquiry in NSW.

He now has more than 4.4 million shares in Nvidia, worth about $US580 ($870m). The 56-year-old was last estimated to be worth $4.2bn by this masthead in March.

Mr Packer has also amassed a $US261.8m stake in Meta, which has been jockeying for position in the AI race, rolling out its Llama model across all its main platforms of Facebook, Instagram and WhatsApp. His other investments include Taiwan Semiconductor Manufacturing Co, Monday.com, Spotify, Afterpay owner Block, and foreign language learning app Duolingo.

The jousting for AI dominance has created oscillation in the title for the world’s most valuable company, a position Apple – which became the first to hit a market value of $US1 trillion in 2018 – has held much for the past decade, although there have been times when rival Microsoft has taken the lead.

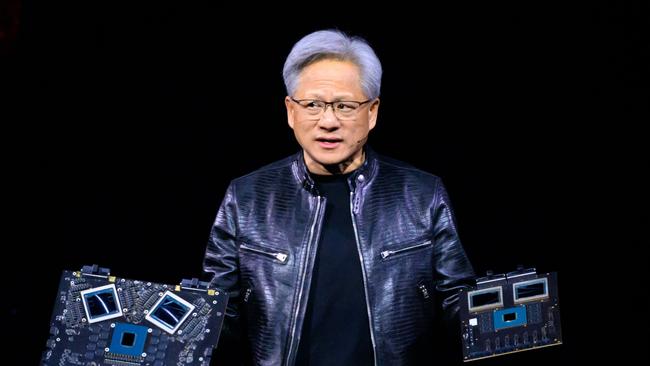

But it is Nvidia’s chips that are underpinning the AI boom. A chip buying spree – as Microsoft, Meta and Amazon scramble to lead AI’s development – has pushed the Nvidia’s share price to a record high.

It overtook Microsoft and Apple briefly this week, with its market value reaching $US3.34 trillion. But it lost the spot to Microsoft on Thursday (US time) after its shares eased 3.54 per cent.

Its chips are worth tens of thousands of dollars each and have become scarce, creating a highly valued commodity of the likes Silicon Valley has rarely seen. Its new chips, dubbed Blackwell, are bigger and faster than their previous versions.

The company is estimated to have more than 80 per cent of the AI chip market but other tech giants are forging ahead with developing their own custom chips.

But Melius Research analyst Ben Reitzes said he did not foresee “anyone challenging Nvidia’s margin in a major way for the next two years given the prospects for Blackwell”.

Dell founder Michael Dell, who is the world’s 12th richest person worth $US106bn, according to Bloomberg, said he was building an “AI factory” with Nvidia for Elon Musk, who previously called for a pause on AI’s rapid development.

Nvidia’s rise has been dizzying. It was the best performer on the S&P 500 last year, and has more than trebled in value in the past year. The company’s market value reached $US3 trillion this month, less than four months after hitting the $2 trillion mark.

The combined value of the holdings of Australia’s top 10 investors in Nvidia is now $13.4bn, representing a 65.2 per cent gain since late February.

Other Australian investors include Alphinity and Aware Super, which have about $US1.31bn worth of shares each, AMP ($US962m), Rest Super ($US806m) and UniSuper ($US792m).

Meanwhile, renowned stockmarket investor David Paradice’s Paradice Investment Management has about $US479,000 worth of shares.

UBS strategist Andrew Garthwaite said Nvidia was now trading at 15 times its 2029 earnings estimates and he drew parallels with the technology, media and telecom (TMT) or dotcom bubble.

“Logically, Gen AI will help all markets but likely the US the most; however in reality, all boats rise,” Mr Garthwaite wrote in a note to investors.

“The US potentially benefits the most because it owns many of the ‘tools’ in the ‘building’ of AI obviously but also it has the most flexible labour market (and thus is able to shed labour more easily to boost productivity).

“If Gen AI is about service sector or white collar productivity, then obviously it should help the service sector economies or stock markets the most (which puts emerging markets at a relative disadvantage).

“Nevertheless, back in the TMT bubble when similar arguments were made, the US was not the best performer.

“What actually ended up happening is that scarcity of value meant that the TMT-associated companies in Europe or Japan became more expensive than their US peers.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout