US Workday rival Rippling picks Sydney as its launch pad into Australia and Asia Pacific

Tech unicorn Rippling is valued at more than $17bn and says Sydney is the logical location to crack the Australian and Asia Pacific markets as it seeks to hire at a rapid rate.

Sydney has cemented its place as Australia’s tech services capital, attracting upstart Rippling that is seeking to disrupt behemoth Workday as it muscles in on the Asia Pacific market.

Rippling, which has a $US11.3bn valuation ($17.4bn) — greater than the market cap of Xero but less than Salesforces’s $282.bn and Workday’s $US80.2bn — has embarked on a hiring spree as it opens a regional head office in Sydney.

It has already recruited 35 Australians and plans to hire more in the months ahead across sales, marketing and product functions. The company has tapped experienced executive Matt Loop as its Asia-Pacific vice-president.

Mr Loop, who also oversaw the entry of Slack and LinkedIn into the Australian market, said Sydney was a logical pick for the company as its first headquarters in the region because of its proximity to a number of existing clients and its talent pool.

“Sydney is a place that I know very well. I’ve been here for 20 years and helped a couple of other kinds of hyper-growth companies with their expansions in this region, and so it just made sense,” he said.

“It was the perfect place for us to have access to great talent in the technology world, be close to the majority of our customers, and work to expand our coverage across the Asia-Pacific.”

Founded in 2016 by Parker Conrad, Rippling has weathered the headwinds that have affected the growth of many tech companies and has accelerated its global expansion, with a slew of office openings in key markets such as the UK, as well as increasing headcount globally.

Mr Loop said he expected Rippling to hire at a fast pace over the years in Australia as its presence in the region expanded.

“We’ll be really thoughtful about how we grow and, as our customer base continues to build up in this market, we’ll continue to bring people on to support them, as well as looking to other opportunities more broadly across Asia,” he said.

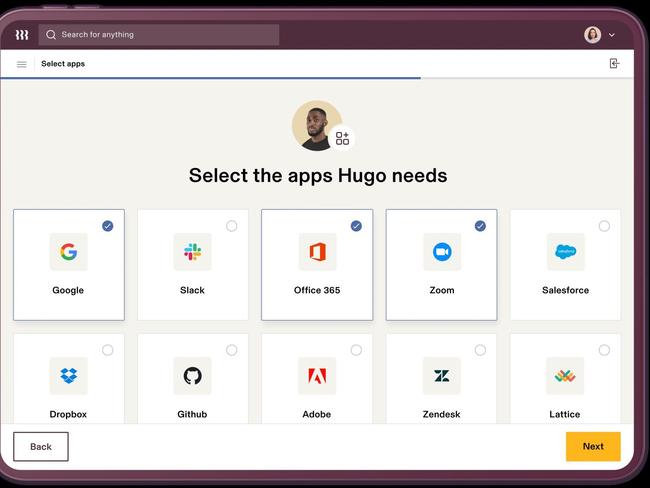

Rippling is a platform that bills itself as a one-stop shop to run HR, IT and finance operations. It brings together all of the workforce systems that are normally scattered across a company, such as payroll, expenses, entitlements and devices.

Mr Loop said siloed systems were proving a particular pain point for Australian businesses and were adding greater complexity to payroll. He said the firm originally saw a gap in the market for a one-stop shop for employee relations. “Rippling believes that we have been building software wrong for the last 20 years and what’s been happening in the SaaS world for the last couple of decades is that people are really focusing on a narrow niche,” he said. “It creates this big challenge for companies of sprawl where they have tens or hundreds of applications with nothing streamlined.”

Mr Loop said Rippling’s success so far was largely because of the real difference it offered workplaces compared to other platforms such as Workday, particularly when there was more government spotlight around industrial relations and underpayments.

“There is nothing else in the market, particularly in Australia, that really addresses the challenges of Australian companies today,” he said.

“There’s increased scrutiny around ensuring people are paid correctly. If you do not pay correctly, you are front-page headlines and so if we can provide that platform to companies that consolidate everything into one tool, then we can support and stream the whole payroll process.”

Research commissioned by Rippling found that 45 per cent of Australian businesses were looking to switch their existing HR and payroll systems in the next year because of the growing complexities, with 63 per cent of companies using more than three solutions to manage their staff.

Mr Loop said that Rippling was the human resources answer to Salesforce, which allows businesses to have a single view of customer data that can be used across a number of different uses from sales to marketing and analytics.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout