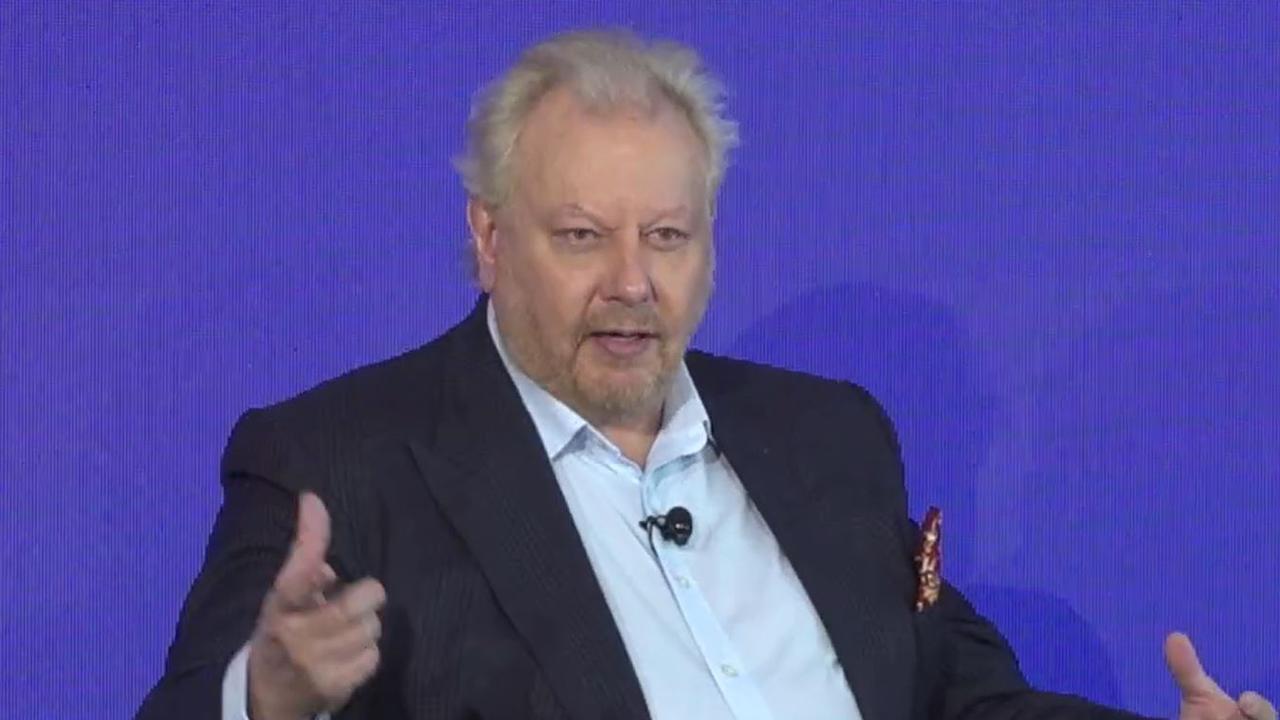

TPG missed the boat on mobile: Teoh

TPG Telecom boss David Teoh says his company is in no position to roll out a mobile network.

TPG Telecom boss David Teoh says his company is in no position to roll out a mobile network, despite the competition regulator’s claim that stopping the rollout was simply a ploy by the telco to get its merger with Vodafone Hutchison Australia across the line.

Fronting the Federal Court for a second day, the reclusive billionaire entrepreneur said that TPG’s financial health and fiercer competition from Telstra and Optus had shut the door on any mobile products.

“The company position today is different to what it was in 2017 — we have a deteriorating balance sheet, our debt is very high ... the bank would reduce our borrowing from next year,” he told the court on Thursday.

He added that TPG’s fixed line business was on a declining trajectory, and the mobile market had become more competitive over the past two years.

“We lost some valuable time and the market has changed. It has become very competitive,” he said, citing the latest plans released to the market by Telstra.

“The spectrum we have is not enough to compete with Telstra and Optus, so we could roll out a network but we won’t be able to compete on price nor quality.

“We are handicapped by what we have. It’s very hard at the moment. we don’t have the spectrum to compete,” he added.

Telstra recently launched a new $15 five gigabyte plan, which Mr Teoh said targeted the same price-sensitive customers TPG would chase. Given the reach of Telstra’s network, Mr Teoh said it would take TPG a “long time” to offer a service of comparable quality.

“In the beginning we would have a low quality product,” he said.

Whether TPG is capable of building a mobile network on its own is crucial to the fate of the proposed merger, and the tense encounter between Mr Teoh and ACCC’s legal counsel Michael Hodge QC shed unprecedented light on how the plans took shape.

According to Mr Hodge, Mr Teoh had been cavalier in his approach to entering the mobile market, with TPG’s board rubber-stamping a plan built on untested assumptions.

Peppering Mr Teoh with questions about the fundamentals of TPG’s mobile strategy, Mr Hodge said the financial consequences of the plan were irrelevant because he wanted to enter the mobile market.

“I reject that,” Mr Teoh retorted.

However, he conceded that TPG had been forced to rush its mobile strategy to beat Vodafone to 4G spectrum and had pushed ahead to buy the spectrum without a definitive model in place.

He added he wasn’t overly concerned about paying top dollar for the 4G spectrum, given its strategic importance, and he had the full support of the board.

“It was important for the company to get into mobile,” he said.

Pressed further on whether he had decided to press ahead with the acquisition irrespective of its negative consequences, Mr Teoh said he couldn’t recall the exact numbers.

“Sitting here I can’t remember what happened two years ago. I can’t recollect the exact detail of that meeting.”

However, Mr Teoh’s grilling did reveal the relatively unstructured way in which TPG’s management was making investment decisions.

While Mr Hodge was surprised by the apparent lack of documentation, Mr Teoh said TPG was not an overly bureaucratic company.

“In TPG we are quite agile. We talk frequently on the phone, so the company is quite dynamic. We are not that bureaucratic, so things are moving very fast in the company,” he said.

He added that TPG needed to move fast to secure the 4G spectrum after Vodafone, which decided against participating in the 2013 “digital dividend” auction, pitched a $594m offer to the government in May 2016, an unsolicited bid that was rejected.

TPG ended up paying $1.2bn for the 4G spectrum in April 2017, with the purchase the most expensive spectrum buy in recent history. The hefty price tag forced TPG to raise $400m in fresh equity, a process that forced it to tweak the financial model underpinning its mobile strategy.

The net present value of the network was tweaked from negative $290m to positive $779m, with the telco raising its monthly customer acquisition target from 45,000 to 60,000. It also increased the time frame of the rollout from seven to 12 years and lowered its weighted average cost of capital from 10 per cent to 8.3 per cent.

Mr Hodge used the revised model to highlight that TPG was committed to rolling out a mobile network no matter the cost. “You knew it was a high price, you knew you were about to pay more than anybody else in the world (for the spectrum) and it was going to be 4G network,” he said.

TPG shares rose 0.5 per cent to $7.02 on Thursday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout