The regulator argues that if Vodafone and TPG merge the chance of there being a fourth operator disappears, and the merger parties have argued that combined they represent a more competitive challenge and that apart they are weak — and in the case of TPG no chance of re-entering the mobile market.

TPG and Vodafone are among the only players in the market not aware the world is awash with cash looking for a home.

Thursday’s hearings on the merger offered an insight into how TPG is run, with the $1.3bn mobile spectrum purchase approved because it was what executive chairman David Teoh wanted and not on the basis of the financial case presented.

The figures before the board showed the deal had a negative present value of $290m, but Teoh argued this was using a conservative cost of capital at 10 per cent, which was above the real figure at 8.3 per cent.

No matter the spectrum deal turned into a positive value of $779m a few days later, when TPG was spruiking the purchase for a $400m equity raising and broker Macquarie demanded a positive spin.

Just moving a few numbers did the trick by pushing up the customer base, lowering the weighted average cost of capital and moving up the money to be spent on mobile towers.

When the positive numbers were presented to the market and the major shareholders backed the deal, the equity raising did very well and proved a boon to all the participants.

Teoh and Washington Soul Pattinson control more than 50 per cent of the company.

Under cross-examination from Michael Hodge QC, Teoh made it clear that “the future is mobile” as far as TPG is concerned. Long term, TPG has to be in the mobile market and his board, on the evidence presented on Thursday, pays much more attention to his views than what the financial numbers say.

TPG says no way. It’s already told everyone it’d stopped rolling out its network after the government banned Huawei, and it would all be too hard.

Ruth Huggins SC told the court earlier in the week that “TPG does not and never has operated a mobile network, let alone a disruptive one”.

She added: “The market and TPG have moved on.”

Based on Thursday morning’s evidence though, you would have to back the ACCC.

Suffice to that say while Teoh may be worth $2.5bn, he was no match yesterday for ACCC barrister Hodge. Asked about the way TPG works, Teoh confided: “I have the trust of the board.”

TPG says one of the reasons it won’t get back into mobiles is that it’s all too hard now with Huawei banned and Telstra too far in front.

The original plan was for a mobile network using the so-called “big dishes” you see on any mobile tower. But this was scrapped in favour of a “small dish” rollout that increased capacity in the big cities.

The point here is that Teoh made clear how much he thinks mobiles are the future, and he was happy to make a radical change in rollout strategy without the need for board approval.

He has 4G spectrum, after all.

But TPG says it’s not happening, so ultimately Justice John Middleton will decide.

This is a three-week trial and it is very early days.

King steps aside

In some schools the toughest job in a big bank is the CFO because he or she has the job of managing the $800bn balance sheet to keep the bank ticking.

Chief executives set the strategy and do the meet and greet stuff, but the CFO is in the engine room, responsible for keeping the shop running.

It’s no great surprise then after all he has been through to see Sydney shire boy Peter King step aside after 25 years at Westpac, the last five as chief finance officer.

At 49, he is but a pup but at this stage the party line says he’s just taking a break after what has been an extraordinary few years in banking.

Foreign exchange bid

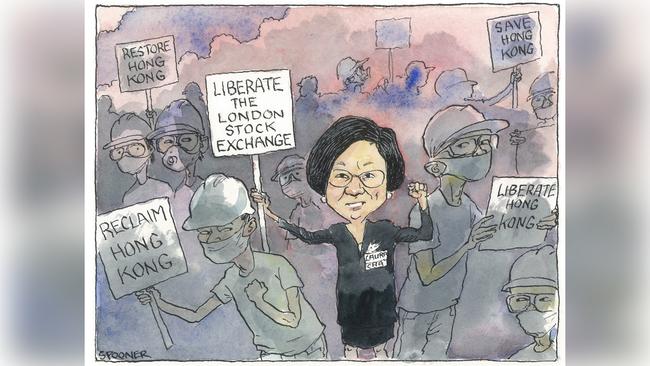

Hong Kong Stock Exchange chair Laura Cha’s audacious bid for London Stock Exchange appears doomed to failure amid the political turmoil facing both the target and bidder.

Launching the surprise $53bn bid yesterday, Hong Kong Exchanges and Clearing said a combination of two of the world’s largest exchange operators would create a global leader in capital flows and financial data.

Amid the rioting of recent months, Hong Kong faces an uncertain future and, having already fallen behind the Shanghai Stock Exchange, its importance to China as a financial centre is increasingly questioned.

Hong Kong is the fifth-biggest equity market in the world and London the seventh, in a ranking headed by New York and Nasdaq.

Hong Kong ranks third in Asia behind Tokyo and Shanghai.

The concept of the UK government waving goodbye to the LSE just as it presumably exits the EU is unlikely at best.

In any case the LSE has its mind on a $US27bn ($39bn) deal of its own to buy the Refinitiv group from Blackstone.

The financial data group includes Eikon terminals that rank a distant second to Bloomberg.

But the concept makes plenty of sense with exchanges potentially controlling valuable data.

The deal shows where the LSE sees the market future after several failed attempted marriages with, among others, Deutsche Borse and Toronto Stock Exchange.

The reality is that while global stock exchange mergers have gone in and out of fashion, at the end of the day domestic sovereignty is the factor that kills the deals.

The New York Stock Exchange remains US-owned, albeit controlled by derivatives player ICE. The Nasdaq is controlled by OMX, which also runs the Scandinavian exchanges.

Eight years ago when Singapore’s bid for the ASX collapsed, it was because the Australian government was not willing to cede control of its stock exchange.

The same factor limits what on any other grounds would be a rational move to combine the New Zealand and Australian stock exchanges.

Arguably it doesn’t matter where the exchange’s parent company is based, but where settlements are managed is important so if you split ownership maybe the options open up.

The ASX is not interested in foreign ties and instead it is working on a landmark new blockchain-based settlement system.

In many respects, Australia led the world when it combined the Sydney Futures Exchange and the ASX in 2006 and that product combination has driven most of the global deals since then.

Likewise, when the ASX listed itself in 1998 it also led the world.

The LSE has rejected potential suitors including Macquarie Bank and Nasdaq in recent years and the chances of a deal with Hong Kong look remote at best.

Two years ago, the TPG board approved a $1.3bn mobile spectrum purchase, underlining its intent to enter the mobile telecoms market and highlighting the ACCC claim that there may be a real chance it might happen again.