Telstra stung by slowdown in homes connected to NBN

Telstra will cop a $400m revenue hit because of a slowdown in the number of homes being connected to the NBN.

Telstra will cop a $400 million revenue hit because of a slowdown in the number of homes being connected to the National Broadband Network.

According to Telstra, its total income for the current financial year is expected to be between $25.3 billion and $27.3bn.

Free cashflow for financial year 2020 will also be $100m lower, coming in between $3.3bn and $3.8bn. The company has also shaved $30m off its cost-reduction target for the year, from $660m to $630m.

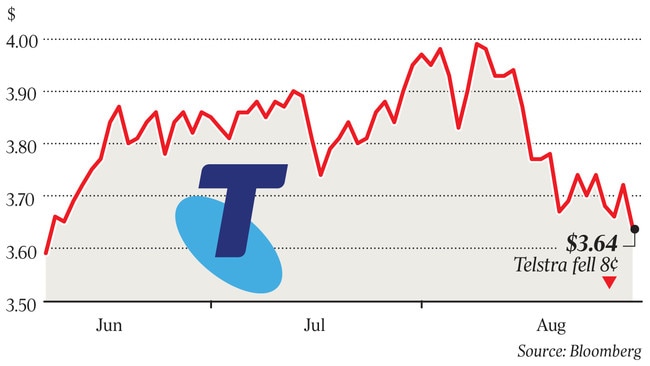

The revision, which sent Telstra shares down more than 2 per cent on Monday to $3.64, has been forced on the telco because of the latest slowdown in the NBN rollout, with half a million homes now expected to be on the network later than predicted.

According to NBN Co’s latest corporate plan, released on Friday, the number of homes with an active NBN service by June 30, 2020, will be seven million rather than the previously set target of 7.5 million.

The lower number of active services will not only weigh on NBN Co’s revenue projections, with its financial year 2020 revenue target cut from $3.9bn to $3.7bn, but also changes the timeline of the damage NBN is causing to Telstra’s accounts. Telstra had highlighted financial 2020 as the period of maximum damage, with earnings lost to the NBN forecast to increase between $800m and $1bn. However, Telstra said on Monday that the impact was now likely to spill into financial year 2021. “Telstra no longer anticipates FY20 being the year of peak NBN headwind and now estimates this will occur in FY21,” it said.

It was not all bad news for Telstra’s full-year numbers, with underlying earnings before interest, tax, depreciation and amortisation up by $100m. Telstra added there was no change to its underlying EBITDA, with it growing by up to $500m in 2020. The modified numbers highlight how closely intertwined Telstra’s fortunes are with that of the rollout of the NBN, with any changes to connection numbers a mixed blessing for the telco.

Delays in people connecting to the NBN reduce the overall payments Telstra receives from NBN Co. However, it also allows the telco to hold on to its customers for longer, especially those on the hybrid coaxial fibre footprint who pay higher prices to Telstra for fast broadband.

NBN Co chief executive Stephen Rue conceded last week that customers in metro areas were not signing up to the NBN in a hurry, but added that NBN Co’s overall take-up projections remained on track.

“We have looked at our modelling on when people sign up to the NBN and while people are taking longer to migrate we are still seeing a take-up rate of three-quarters of the nation signing up to the NBN,” he said at the launch of the latest corporate plan.

However, the slower than forecast customer migration also creates an opportunity for Telstra to reinforce its 5G capabilities, giving it the ability to give consumers on lower speed NBN plans a fixed-wireless option. Optus, which already has a 5G fixed-wireless product in the market, is also expected to capitalise on the opportunity.

NBN Co has consistently played down 5G as a potential threat to its business model, with Mr Rue saying only fixed-line networks, like the NBN, are capable of dealing with the data appetite of consumers. “We already compete against 4G networks … we believe 5G and fixed networks will become complementary to each other because of the capacity issue,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout