Nvidia’s next steps in focus after record close, CES updates

Sky’s the limit on AI chip maker Nvidia’s gains for investors with a new record close overnight, but what’s next after a year that saw business double and market value triple.

How does any company follow up a year in which business doubled and market value tripled? For Nvidia, that answer seems to be: staying the course.

Nvidia led the way for Wall Street’s Magnificent Seven tech stocks overnight, rising 6.4 per cent to finish the session at a new record close of $US522.53 per share, making it the S&P 500’s third-best performer.

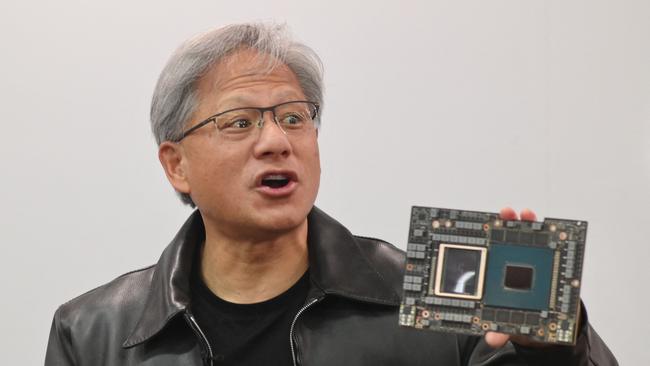

Nvidia’s gains came after it announced the group’s latest initiatives in videogaming and automotive technology, ahead of the CES trade show kicking off this week in Las Vegas.

The company has long used the annual consumer-electronics conference to showcase its products for those two markets.

The new announcements lean heavily into the generative artificial-intelligence theme that has made the once-niche chip maker into a household name, including new GeForce graphic processors designed for AI-enabled PCs and laptops.

Nvidia also announced new EV makers adopting its automated-driving system.

The explosive growth of Nvidia’s data-centre business – fuelled lately by booming demand for specialised systems that power genAI capabilities – has made everything else the company does feel rather incremental.

Gaming and automotive combined have typically accounted for more than half of Nvidia’s annual revenue; that contribution is expected by analysts to be around 19 per cent for fiscal 2024, which ends later this month, according to FactSet.

That proportion will fall even further in the year to come, as Wall Street expects Nvidia’s data-centre business to hit nearly $US78bn in annual sales in fiscal 2025 compared with $US15bn two years prior.

So while Nvidia is still expected to remain the dominant name in AI computing this year despite the onslaught of competition, investors are still faced with the challenge of valuing a chip company now worth nearly $US1.3 trillion – more than twice as much as its next-most-valuable chip-making peer.

For Wall Street, that answer seems to be to focus on the bottom line – and cash.

Growth will likely remain strong as cloud-computing giants and other tech companies are still in the early phases of their generative AI investments.

Analysts project Nvidia’s total revenue growing 55 per cent in the next fiscal year after a 118 per cent surge in the soon-to-end year.

But Nvidia’s booming bottom line – with pricing helped by the fact that its AI chips are considered must-haves for companies building genAI services – is a key reason Wall Street sees the stock still having a significant amount of upside remaining.

Adjusted operating income surged to $US22.4bn in the first nine months of the current fiscal year, compared with about $US5bn in the same period last year.

Wall Street sees Nvidia’s annual adjusted per-share earnings topping $US20 in fiscal 2025 – more than six times what the company earned in its latest fiscal year.

That has ironically made Nvidia’s stock look much cheaper even as its sticker price has surged over the past year.

Nvidia currently trades about 26 times projected per-share earnings – near its lowest range in at least five years and well below its average of 40 times over that period, according to FactSet.

Stacy Rasgon of Bernstein noted last week that Nvidia was also recently trading at a discount to the peer PHLX Semiconductor Index “for the first time in almost a decade, and is now (amazingly) the cheapest AI play, and likely already pricing in some prospect for an ‘air pocket’ scenario.”

Nvidia’s free cash flow for the past four quarters has totalled $US17.5bn – tying with Broadcom as the highest in the chip sector, according to data from S&P Global Market Intelligence.

In a note on Friday, Vivek Arya of BofA Securities projected Nvidia will produce $US100bn in free cash flow over the 2024-25 calendar years, with about a third likely going toward share buybacks and the rest available for pursuing more growth options – including mergers and acquisitions.

“We expect Nvidia to consider assets that help it create a more meaningful recurring revenue profile,” he wrote.

Trying for a major deal in what has become a highly unfriendly tech M&A market may be a stretch.

And Nvidia still faces other unique challenges in what has become a geopolitical minefield for chip companies.

The Wall Street Journal reported over the weekend that major Chinese companies may not be interested in the downgraded chips Nvidia plans to sell in that market – to comply with new US export restrictions.

But domestic AI demand is expected to keep Nvidia’s order book flush for a long while. This trillion-dollar chip maker likely hasn’t topped out just yet.

– The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout