Afterpay board reshuffle was ‘in the works’

Afterpay co-founder Nick Molnar is adamant the company’s executive shake-up has been in the works for some time.

The co-founder of “buy now, pay later” provider Afterpay, Nick Molnar, is adamant the company’s executive shake-up has been in the works for some time, as it moves to fend off an Austrac probe and stiff competition from rivals.

Afterpay yesterday announced Mr Molnar would be shifting out of the chief executive role to take up a new gig as chief revenue officer, with current chairman Anthony Eisen to take the reins as managing director and CEO.

The company, which has faced criticism over its governance in recent weeks, will also appoint two new independent directors and an independent chairman.

Speaking to The Australian, the 29-year-old Mr Molnar said the changes were a reflection of how he and Afterpay co-founder Mr Eisen had been operating since the company was founded in 2014.

“I’ve been spending a significant amount of my time in the US building relationships and scaling our vision from retail engagement and customer relationship perspectives,” Mr Molnar said.

“The reality is Ant and I have been working in this way since the day we started, so from my perspective nothing’s really changed in that regard.

“There’s never ego associated with anything we do. The opportunity in front of us is to scale as fast as we can and really capture it … And the way Ant and I really work together is quite special.”

Mr Eisen told The Australian the changes would help Afterpay attack its global ambitions.

“It’s not changes at all that just relate to trying to put a governance point of view across,” Mr Eisen said. “From our perspective, good governance is good business. It addresses some of those issues, but what’s good for the business is at the core of our decision-making.

“The opportunity that we have is global and aligning the organisational structure around that global opportunity is a key differentiator for us. Changing our structure allows us to really focus on that.”

The ASX-listed tech darling has endured a rollercoaster few months, facing an Austrac probe as well as new competition from the likes of Visa and PayPal.

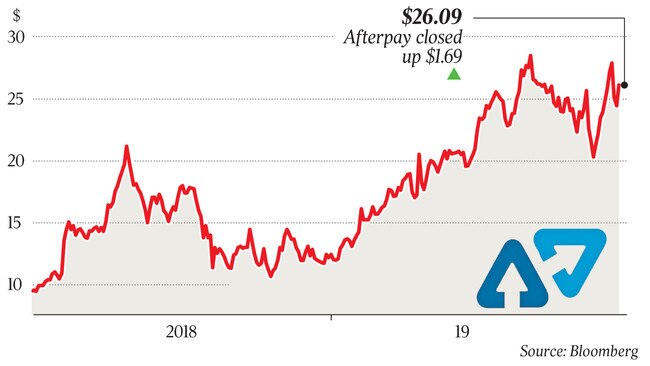

The company’s share price fell 15 per cent on Friday after Visa announced a pilot program in which customers can pay with instalments at the checkout using Visa cards.

However, Mr Molnar said that Afterpay had an advantage to the likes of Visa in its lack of encumbrance by legacy infrastructure.

“It’s humbling to see the opportunity start to be brought to the surface, and it’s great to be having the discussion about competing with some of the best companies in the world,” he said.

“The opportunity is far bigger than we ever participated, but having that purity of business model and something with no legacy is not something to be underestimated.”

Investors approved of yesterday’s announcement, sending shares up 6.9 per cent to $26.09 by the close of trade, against a flat close for the benchmark S&P/ASX 200 index.

Elana Rubin will serve as interim chairwoman while the board searches for Mr Eisen’s replacement. Meanwhile, Malte Feller has left Facebook to join Afterpay as the company’s global chief operating officer, and current chief operating officer Barry Odes will shift to a chief-of-staff role.

Group head David Hancock, who took that role following the merger of Afterpay and Touchcorp in mid-2017, will depart Afterpay in the next 12 months.

The company added that Mr Eisen and Mr Molnar remained “fully committed to the business” and “remain as excited as ever by the potential to build an Australian-listed global technology company that is focused on delivering a customer-centric and trusted service to a global audience”.

It said they do not intend to sell any further shares during the current financial year, after shares plummeted on news the pair would sell $100 million worth of stock last month.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout