Superannuation reforms risk ‘cooking the economy’

Pushing funds to invest in national priority areas risks inflating asset values, says Jeremy Cooper, who led the super review system under the Rudd government.

Jeremy Cooper, who led the super review system under the Rudd government, is warning that proposals to push super funds to invest further in national priority areas risk overcooking the economy and artificially inflating asset values.

Mr Cooper, former deputy chairman of the Australian Securities & Investments Commission who also ran retirement investments giant Challenger for 12 years, warned that businesses acquired by super funds would be forced to lift their fees and prices to ensure a return for members.

He said the national debate about superannuation investment, which has been reignited by Jim Chalmers and the Albanese government ahead of the May budget, should address the key challenge of how Australia’s “relatively medium-sized economy” would respond to a “massive out-of-proportion super savings system”. “You need to be careful what sort of impact that has, the reinvestment of the money,” he said.

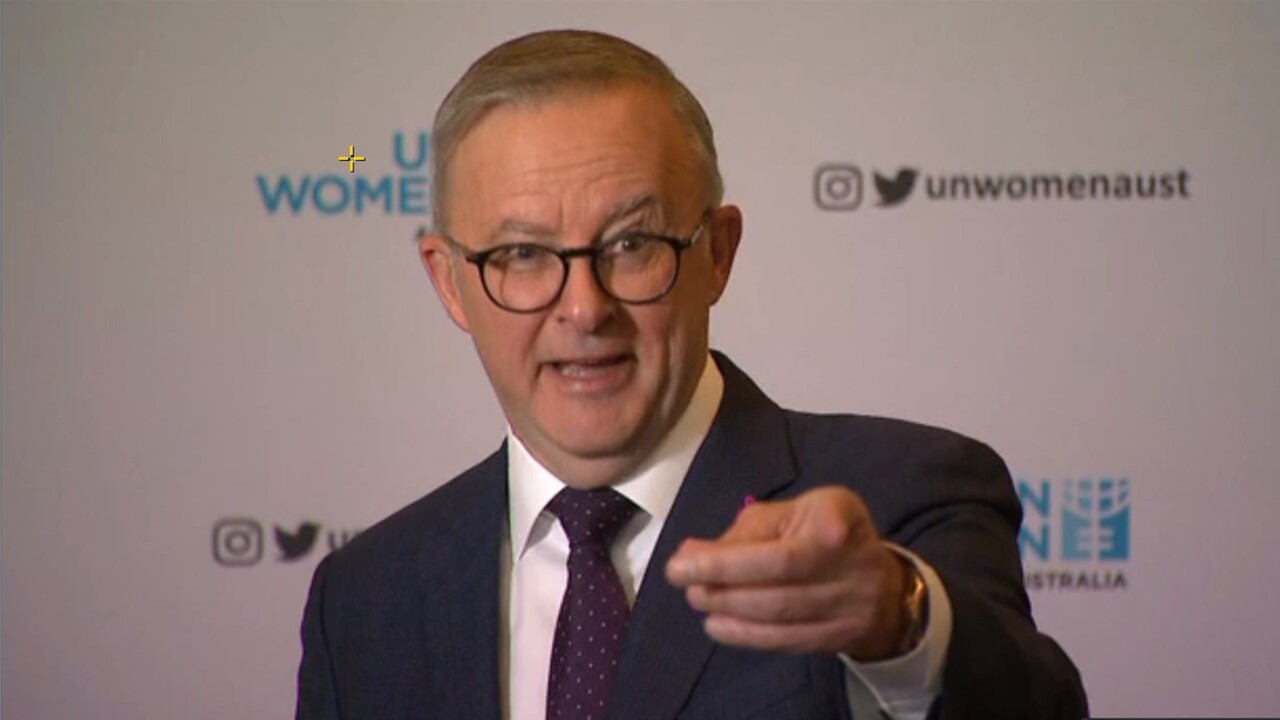

The Treasurer, who has been pledging there’ll be no “major changes” to superannuation, on Sunday said Australians needed to consider if tax concessions for the largest balances were “the most bank for buck”.

He has left open the possibility of reining in tax concessions for super balances with $3m or more, or capping the amount Australians can put in their super accounts. “Less than a per cent of people have got more than $3m in their superannuation,” Dr Chalmers told Sky News’ Sunday Agenda program.

“The average balance is almost $6m for the people who’ve got more than $3m. And so we need to grapple with whether or not in the course and in the context of a budget in structural deficit, how we can continue to make the tax concessions meaningful and generous in superannuation, but recognise that that might not be the most bang for buck we can get for some of these concessions.

“We want superannuation to be concessional when it comes to a tax point of view. But I think it’s important that we investigate and look at and consult on whether or not we can make some of these tax concessions more sustainable.”

He has vowed to “maximise” superannuation’s potential, including through “greater investment in our national priorities, in a way that delivers for members”.

Mr Cooper said Norway’s national pension fund had guardrails prohibiting it from investing within Norway because of the distortionary impact the country’s huge savings pool would wreak on the national economy.

“That amount of money can just cook the economy,” Mr Cooper said. “When you look at the projections of how large super gets compared to the ASX in 40 years, it is quite eye popping.”

Mr Cooper said the heft of Australia’s retirement savings pool was already being felt in the country’s stock exchange, which was “overweight”, compared with the country’s economy.

Opposition treasury spokesman Angus Taylor accused the government of breaching the trust of Australian voters after Anthony Albanese said he had no plans to change the superannuation system during the election campaign. “This is Australians’ money. That should be the starting point because Labor starts from a different point of view, which is it’s fun for them to tax it as they see fit,” Mr Taylor told Sky News.

Greens leader Adam Bandt said he would consider any changes to super put by the government, but claimed Labor could “rob Peter to pay Paul” and use a crackdown on tax concessions for the fattest super balances to fund the stage 3 tax cuts.

Targeting tax concessions for the largest balances could save the budget $1.5bn a year, while the stage 3 tax cuts are set to cost $21bn each year from their start date in mid-2024.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout