Strategic Forum: Steve Bannon, former Trump adviser, warns of economic warfare with China

Former Trump adviser Steve Bannon warns Australia is at the ‘tip of the spear’ in an information and economic war with China.

- Treasurer talks up US-China deal

- Support for investment ‘critical’

- China still keen to invest

- ‘Two billionaires a week’

- ‘More concern over Warren than tension’

- Marles stumbles on ‘grand plan’

- ‘Pants down’: no China strategy

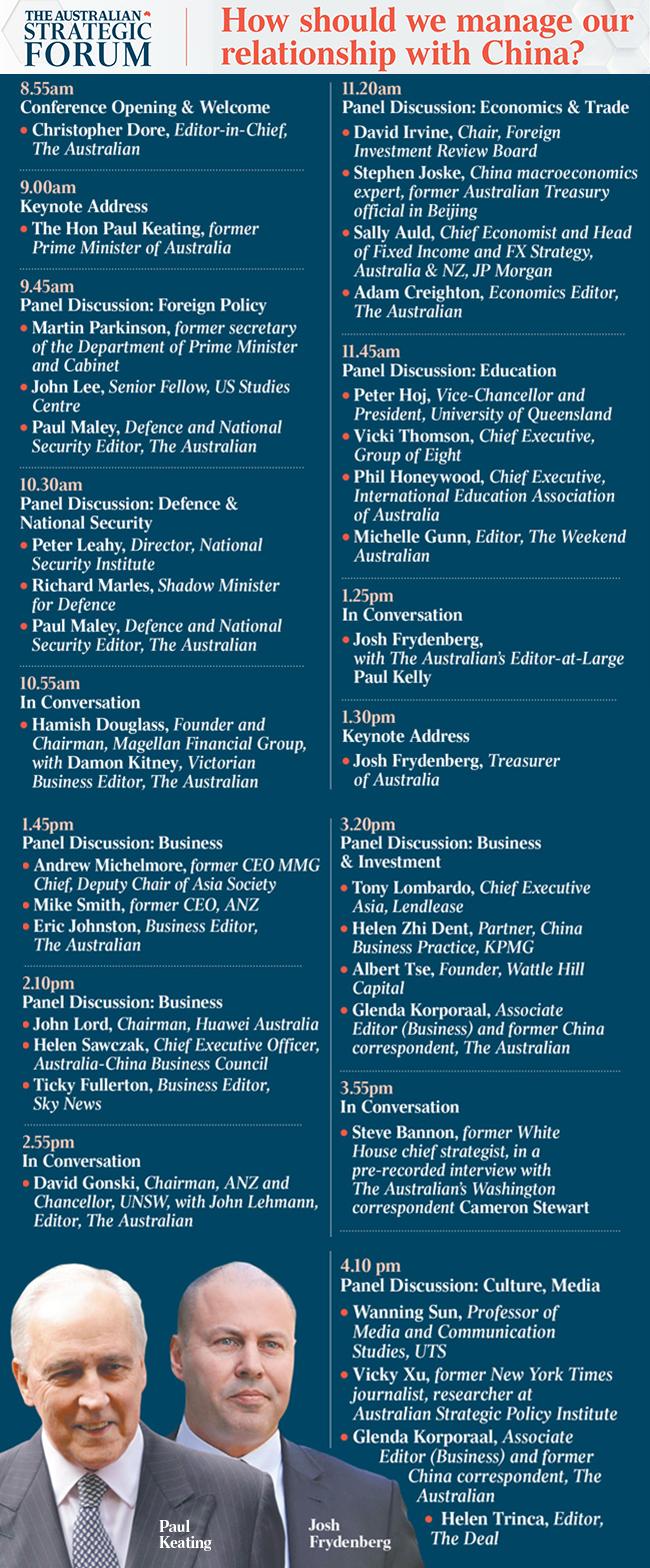

Welcome to our coverage of The Australian’s Strategic Forum — how should we manage our relationship with China? Guest speakers included former PM Paul Keating and Treasurer Josh Frydenberg. Scroll down to see how the day unfolded.

Greg Brown 4.45pm: Former Trump adviser’s warning

Steve Bannon, former chief strategist to Donald Trump, has urged Australia against keeping a constructive relationship with China, declaring “we have to confront this totalitarianism”.

Mr Bannon said people who were worried about the economic impacts of a bad relationship with China should acknowledge “this is a historic time”, likening it to Europe in the 1930s.

“People in Australia need to understand that as this thing goes forward and it evolves from an information and economic war ... it is going to a kinetic war,” Mr Bannon told The Australian’s Strategic Forum via video conference.

“We are in the 1930s right now and China, Iran and Turkey are trying to control the (world) with their new partners, Russia, unfortunately.

“If we don’t in wisdom confront them on information warfare, like Huawei and all the media that they do; the propaganda ... If we don’t confront them on economic warfare today, and stand by our freedom and our rule of law, this is will slide to kinetic warfare. And where this war is going to start is the South China Sea.

“Australia has to understand: they are at the absolute tip of the spear geo-strategically.”

Mr Bannon also urged President Trump against making a trade deal with China.

“I think we have the Chinese Communist Party exactly where we want them,” he said. “All the project fear from the Wall Street crowd is nonsense.”

Chinese interference is a new topic and its playing out most seriously and dangerously in Australian, says @xu_xiuzhong #auschina2019 pic.twitter.com/FVjD5WeBVu

— The Australian (@australian) November 18, 2019

Paul Maley 4.25pm: Security fears cloud economic benefits

Australia is in for decades of complex, often fraught diplomacy in which a range of issues are litigated separately and without reference to each other. Read more here

Melissa Yeo 3.50pm: Bellamy’s deal a bit rich

Key Chinese-focused investment house Wattle Hill Capital says the $1.5bn Bellamy’s takeover deal is overvalued.

“At 50 times PE (price to earnings ratio), I think China is overpaying on the Bellamy’s deal,” Wattle Hill founder Albert Tse told the Strategic Forum.

He notes that Chinese consumers will still prefer the English labelled products from Bellamy’s as opposed to Chinese labels, with English labels selling 6 or 7 times better.

But while he acknowledges approval of the deal is “an important symbolic decision”, state-owned enterprises are becoming tighter, credit is becoming tighter and “Australia is not the highest of China’s priorities”.

Melissa Yeo 3.40pm: Health trumps property

Chinese investment into Australia is changing in nature, with healthcare now the most sought after local investment, usurping property from the top spot.

Speaking on a panel at The Australian Strategic Forum KPMG China Business Practice Partner Helen Zhi Dent said in the last year the health sector was the most in demand, but with the size of investments also changing.

“The regions in which the Chinese are investing is changing, the size of the investments is getting smaller, from mega deals more than $500m to more deals worth around $100m, and private investments are now more dominant than state-owned investment,” Ms Zhi Dent said.

“For the three years from 2014 to 2016, property was the most dominant but now the health sector is drawing the most interest.”

Now: panel discussion on business and investment. The Australian’s @GlendaKorporaal joins Albert Tse, Helen Zhi Dent and Tony Lombardo #auschina2019 pic.twitter.com/h8aIKcYkqB

— The Australian (@australian) November 18, 2019

Greg Brown 3.30pm: Opportunity knocks

Mr Gonski says hosting Chinese international students is good “soft diplomacy” for Australia because they stayed here for an extended period and received a “good product”.

He says many successful people in Asia were trained in Australia.

He also says there are opportunities for Australia to become the “food bowl for the world”, arguing agriculture was a big opportunity as Asia becomes increasingly wealthy.

Gonski also says the controversial Confucius Institutes were “wonderful”, adding UNSW approved the curriculum.

Greg Brown 3.20pm: Tensions not hurting uni sector

Mr Gonski, who is also the chancellor of UNSW, says there has been little impact on Chinese students over the tension between the two nations.

He says 15,000 of UNSW’s 23,000 international students are from China.

Mr Gonski applauds Education Minister Dan Tehan for working with the university sector to implement a mandatory code of conduct to deter foreign interference, rather than imposing it through legislation.

He said the code was “perfectly sensible”.

Greg Brown 3.10pm: Gonski: we can have our say

Mr Gonski says there is no inconsistency between sticking up for Australia’s democracy and having a good relationship with China.

“These are wonderful trading partners of ours. That doesn’t mean we shouldn’t have our say,” Gonski says. “As business people this is a great opportunity and one we should savour.

“I go to China roughly every 18 months. I have found it fantastic.

“I find the Chinese very business like, extremely focused on what is happening ... and although my language skills are terrible we can still have a laugh.”

Greg Brown 3.05pm: China ties ‘have soured’

ANZ chairman David Gonski says the relationship between China and Australia has soured over the past three years.

Mr Gonski says people viewed China as the future a few years ago and there were “not as many arguments (from) either side”.

Despite the challenges, Mr Gonski says the relationship with China is important for Australia’s future. “People like me strongly believe it is the future,” Gonski says.

The Australian’s Editor @lehmannatlarge and David Gonski, ANZ chairman and UNSW Chancellor, are in conversation now about #auschina2019 pic.twitter.com/aLVY5H8vra

— The Australian (@australian) November 18, 2019

Greg Brown 3pm: Treasurer upbeat on US-China trade deal

Josh Frydenberg says he is optimistic a trade deal will be struck between the US and China, declaring global investment and economic growth was being impacted by tensions between the two largest economies.

The Treasurer said he was encouraged by talks he held with US and Chinese officials on the sidelines of an October meeting with G20 finance ministers.

“History shows that we shouldn’t get our expectations up but at the same time I think the words from both the US and China are more encouraging than in the past,” Mr Frydenberg told Paul Kelly in an interview at The Australian’s Strategic Forum.

“Certainly the mood around the table among G20 nations was, unless China and the US can resolve these differences, we will see a negative impact on global economic growth as well as business investment and sentiment.

“The feedback is that business is withholding from making decisions because of the uncertainty that these trade tensions are creating.”

Mr Frydenberg said it was critical the global rules-based order was restored amid a breakdown in the participation in multilateral institutions.

“Global norms, regional architecture, the rules based trading system is under stress. And this is going to take a collective effort,” he said.

This is despite a recent speech by Scott Morrison who criticised “negative globalism”.

Mr Frydenberg said the relationship between Australia and China must “work for both countries” as he played down the tensions between the two nations.

“There is a recognition by both Australia and China that the relationship must and has and will work for both countries,” he said.

“We have to recognise that we have differences but we also have an alignment of interests on particular issues and where that alignment is present we need to work effectively together.”

The Treasurer last week approved a $1.5 billion takeover of infant formula producer Bellamys by China Mengniu Dairy Company.

Declaring it was “critical” the public supported Chinese foreign investment, Mr Frydenberg said he had extended the definition of critical infrastructure to include data.

“For example, when you buy a health company you could possess the data of hundreds of thousands of Australians and their sensitive information. So we are now very conscious of … the particular data that may be part of a foreign acquisition,” Mr Frydenberg said.

“Where security is less of a problem, we will continue to see decisions like the Bellamys decision that I made last week.

“Maintaining public sentiment in support of foreign investment is critical. That is absolutely a goal of the system to ensure people understand how important foreign investment is to jobs and economic growth here at home.

“If we do our job right, by making decisions based on (strict) criteria for foreign investment, the Australian people will come with us.”

He criticised Beijing for blocking the entry of Liberal MPs Andrew Hastie and James Paterson.

“That is deeply disappointing and I think it is counter-productive because here you had two elected Australian members of parliament who were looking to engage with the Chinese people,” Mr Frydenberg said.

“I’m also concerned by this notion that people have to repent or redress from their views in order to get entry into China.”

Melissa Yeo 2.45pm: ‘No evidence’ of Huawei wrongdoing

Huawei Australia chairman John Lord says there is “no proof” that the Chinese telco has done anything wrong locally or abroad, despite being at the centre of US-China trade tensions.

He says the company has not received any piece of paper regarding a ban or black listing in Australia and that concerns about its handling of data are unfounded.

“Huawei does not carry data, we provide ISP infrastructure and the Vodafones and Telstra’s of the world control the data,” he said.

“Huawei is here to stay, and over the next year we need to open the minds of Australia to innovation from other countries.”

Melissa Yeo 2.25pm: A warning over resources

Australia should not get complacent with demand for our own resources, according to former CEO of MMG Andrew Michelmore.

Citing examples of increasing production from Peru, and Guinea – where Fortescue was just last week snubbed on a development of the Simandou iron ore venture – he notes that Australia has to continue to work hard to maintain its position.

“There are alternatives, we shouldn’t try to jack up prices where they are unreasonable. I think we need China as much as China needs us and we need a good and open relationship,” he says.

“Trust is hard to develop but we need to be able to have conversations behind closed doors and not in the media.”

Greg Brown 1.55pm: Support for investment ‘critical’

Mr Frydenberg says it is “critical” the Australian public is supportive of Chinese foreign investment.

“Maintaining public support of investment is critical. (It’s vital) That people understand how important ongoing investment is to jobs and economic growth here at home,” Mr Frydenberg says.

“We have been a great beneficiary of foreign investment.

“If we do our job well by making decisions based on (a strict) criteria with foreign investment, the Australian public will come with us.”

Greg Brown 1.50pm: Visa ban ‘disappointing’

Josh Frydenberg says China’s decision to block Liberal MPs Andrew Hastie and James Paterson from visiting the country is “deeply disappointing”.

“That is deeply disappointing and I think it is counter-productive,” Mr Frydenberg says. “Two Australian members of parliament were looking to engage with the Chinese people.

“I’m also concerned by this notion that people have to repent from their views to gain access to China.”

Greg Brown 1.40pm: ‘Encouraging’ signs of trade deal

The Australian’s Editor-at-large Paul Kelly is interviewing Josh Frydenberg after the Treasurer’s keynote address.

Mr Frydenberg if asked if he is confident a trade deal would be struck between China and the US.

The Treasurer says the language from US and Chinese officials at a recent G20 meeting of finance ministers is encouraging.

“History will show that we shouldn’t get our expectations up but at the same time thing the words from both the US and China are more encouraging than in the past,” Mr Frydenberg says.

He says the “mood around the table” of G20 nations was that the trade war was affecting business investment and economic growth.

Treasurer @JoshFrydenberg addressing @australian Strategic Forum #auschina2019 pic.twitter.com/DEhfdDYnmg

— Judith Neilson Institute for Journalism & Ideas (@JN_Institute) November 18, 2019

Glenda Korporaal 1.10pm: China undeterred by FIRB rejections

China’s appetite for investment in Australia had not been substantially hampered by Foreign Investment Board rejections, FIRB chairman David Irvine told the Australian’s Strategic Forum today.

Mr Irvine, who is also a former head of ASIO and a former Ambassador to China, said China was now one of the largest foreign investors into Australia.

“Chinese investment in Australia has risen in the last decade to become quite significant,” he said.

He said there had been very few rejections of Chinese investment proposals in Australia.

“The number of proposals knocked back has been very small,” he said. “There have been one or two Chinese companies involved.

“You can’t say there has been a lack of Chinese investment interest in Australia as a result of Australian foreign investment conditions.”

He said that China had risen to becoming the largest new investor in Australia five years ago.

He said this had fallen in 2017-18 to the second largest level more recently but this had largely been as a result of new restrictions by the Chinese government on offshore investment in areas including real estate.

“The main reason (for the fall off in Chinese investment into Australia) is that the Chinese government put down a number of clamps on the flow of capital,” he said.

“It has clamped down on frivolous investments like football teams,” he said.

“It has impacted on the flow of private capital into real estate in Australia.”

"The Go8 is home to 63 per cent of Chinese students here. We do not see that as a negative and the majority go home to good career paths" - Go8 CE @ThomsonVicki on the panel at The Australian Strategic Forum - How should we manage our relationship with China? #auschina2019 pic.twitter.com/vG1uFB6X4s

— #Go8 (@GroupOfEight) November 18, 2019

Mr Irvine said that the issue of theft of technology was not a major issue in the assessment of Chinese investment into Australia as it was in the US.

He said one of the major issues for FIRB in considering foreign investment applications was community attitudes in Australia.

“Any investment in agricultural land or agricultural production would often produce a reaction in Australia based in attachment to the land.”

“That is one area at FIRB we look at very closely,” he said.

Mr Irvine said FIRB took a close interest in any proposed foreign investments into Australia which impacted on national security.

He it was also closely looking at any proposed foreign investments which impacted on data security.

But he said FIRB’s approach was to try to impose conditions on any proposals rather than to respond with blanket bans.

“We try to solve concerns not necessarily by issuing a blanket no to the investment,” he said.

“We look at the way we can establish conditions which go some way towards mitigating any security or any other concerns about the investment,” he said.

He said Chinese investors had generally been prepared to accept any FIRB restrictions on their proposed investments.

“By and large foreign investors, including Chinese investors, are very prepared to accept those restrictions and generally abide by them.”

Mr Irvine said it was “entirely understandable” that Chinese companies would be interested in investing in the food industry in Australia.

“China is interested in investing in food production in the outside world,” he said.

“I find it entirely understandable.

“I don’t think it is a threat (to Australia) if it is properly managed in Australia.”

He said it also need to be recognised that Australia was good for China as well with its exports of goods which China needed.

Greg Brown 12.20pm: Labor eyes ‘hawkish’ China plan

A Labor government would take a harder line on Beijing in the South China Sea than Scott Morrison, Richard Marles says. Read more here

“It’s great to be learning more about the impact of China on Australia and how this will transform our future diplomatic and economic dealings.†- Mitch (UNSW, 2015). Thanks @australian for hosting #AIEF Alumni at today’s #auschina2019 forum. pic.twitter.com/EL5joIVJVJ

— AIEF (@AIEFoundation) November 18, 2019

Eric Johnston 11.59am: FIRB to consider all areas around national security

Chairman of Foreign Investment Review Board and former ASIO boss David Irvine tells The Australian’s Strategic Forum that the FIRB will consider areas around national security and data protection when reviewing investment proposals. He notes that agriculture investments “will often produce a reaction with attachment with the land”. Irvine, says FIRB will not necessarily deliver a “blanket no” on investment decisions — rather Australia will look at whether or not we can establish conditions. “By and large foreign investors including China investors have been prepared to accept those conditions,” Irvine tells The Australian’s Strategic Forum.

Over next five years, India will become a very important market for us, says UQ vice chancellor Peter Hoj #auschina2019 @UQ_News

— Paddy Hintz (@Paddy_Hintz) November 18, 2019

Glenda Korporaal 11.50am: Blocked visas sign of ‘diplomatic immaturity’

China’s rejection of travel visas for two Australian politicians was a sign of diplomatic immaturity, Martin Parkinson the former head of the Department of Prime Minister and Cabinet has told The Australian’s Strategic Forum in Sydney today.

Mr Parkinson said China’s move to reject visas for WA Liberal politician Andrew Hastie, the chairman of the parliamentary security and intelligence committee and Liberal Senator John Patterson to be part of a proposed visit to China later this year hosted by the organisation China Matters.

He said the move had thrown away an opportunity for China to explain to the two politicians, who have been critical of China to explain China’s point of view.

“They have thrown away the opportunity to bring critics to China and explain what they are doing,” he said.

He said it would be “quite chilling” if the decision to ban the two politicians from visiting China led to other politicians self censoring their comments on China.

Mr Parkinson said he believed the decision was made by officials “second guessing what they think their superiors want.”

“I suspect that people are jumping at shadows in China and becoming quite risk adverse in trying to protect their own situation,” he said.

Mr Parkinson said people who were watching China a decade ago “were hoping that China was on a pathway to becoming a responsible citizen of the world” which would see China having some of the “soft power” of mayor powers.

Eric Johnston 11.44am: Quantum computing arms race

Magellan chairman Hamish Douglass says there is an arms race in investment in quantum computing between the US and China. This will underpin AI technology and likens the investment to the Manhattan Project (in reference to the development of nuclear weapons during World War II). Whoever gets a breakthrough will have a “serious economic advantage” Douglass says. Earlier Douglass who oversees more than $80bn of funds, says its risky “not to invest in China”.

Andrew White 11.28am: ‘China creating two billionaires a week’

Hamish Douglass says China is creating billionaires at the rate of two a week.

Magellan financial, which manages $93 billion of international equities, says it is playing the growth of wealth through luxury goods plays including LVMH and through mass market brands such as Starbucks, the coffee chain that is expanding aggressively in China.

Andrew White 11.22am: ‘More concerned about Warren than trade tensions’

Magellan Financial founder Hamish Douglass says that he is more concerned about developments in the US and the UK than he is about the trade tensions between the world’s two largest economies when he makes a decision about investment in China.

The international fund manager said investing in China will be risky but that that was the case with any investment decision.

We have had some very informed consultants working with us so we can understand the risks about investing in Chinese companies like @AlibabaGroup - ‘most attractively positioned company in China’ #auschina2019 pic.twitter.com/0t15KQvvx4

— The Australian (@australian) November 18, 2019

“To say that investing in China is hard and risky and pass on it is also itself a risky decision,” Mr Douglass told The Australian’s Strategic Forum.

“It is a risky decision not to invest in China in the next 20 years.”

Mr Douglass said he was more concerned about whether Democratic presidential candidate Elizabeth Warren was elected or about developments in the UK than he was about the trade tensions with China.

Mr Douglass said the risk in US technology platforms was much higher than in China where electronic communications and payments systems were much more developed and widely used.

Greg Brown 11.17am: Marles stumbles on Labor’s ‘grand plan’

Deputy Labor leader Richard Marles stumbles when former ASIO boss Dennis Richardson asks what his pre-election plan for a “guiding philosophy” with China.

Mr Richardson contextualised his question around the expectations of a Labor victory and Mr Marles becoming defence minister.

Dennis Richardson very fired up at @australian strategic forum

— Christopher Dore (@wrongdorey) November 18, 2019

#auschina2019 #auspol “without being rude†He says to Richard Marles what was Labor’s “grand plan†given Labor thought they would be in power now

“You’ve got a career ahead of you as a journalist,” Mr Marles joked.

Mr Marles eventually said Labor would have sought more good will, better diplomacy and an overriding architecture. His answer had little detail.

Mr Richardson said the answer showed Labor had no different plan from the Coalition.

Mr Marles hit back by saying Australia could do better and articulating its differences with China in a more respectful manner.

Let me be clear: we need a very robust position in terms of the South China Sea. To say there is no room beyond that for developing diplomacy which allows relationships to be built, is just wrong: @RichardMarlesMP #auschina2019

— The Australian (@australian) November 18, 2019

Mr Marles also said Labor would have been more hawkish on China’s position in the Great China Sea.

“Our interest lies in the global rules based order that has served our nation well,” Mr Marles said.

Greg Brown 11.00am: ‘Pants down’: no China strategy

National Security Institute director Peter Leahy says Australia has been left “pants down” on the South China Sea because it has no strategy on dealing with China.

“They are ahead of us in the South China Sea,” he said.

“Australia is a strategy-free zone.

“We need to look at what do we want and what do we need to do to achieve it.”

Former ASIO bass Dennis Richardson said Labor would handle the China relationship similarly as the Coalition, despite Richard Marles’ criticism of Scott Morrison having no “guiding philosophy”.

“I’ll bet you if you guys get into office you will no more have a guiding philosophy … you will no more have a grand plan than what we do at the moment,” he said.

Greg Brown 10.53am: ‘Some truth’ to Keating claims

Former ASIO head Dennis Richardson said there was “some truth” in Paul Keating’s claim the government was supplanting too much power to security agencies.

But Mr Richardson said his claim was “exaggerated” and the Morrison government was handling the relationship well.

He said it was good Australia had two moderate leaders as party heads, in Scott Morrison and Anthony Albanese.

Greg Brown 10.48am: Coalition lacks ‘guiding philosophy’: Marles

Deputy Labor leader Richard Marles says the Morrison government does not have a “guiding philosophy” on how it should deal with China.

“Trying to work out what is the guiding philosophy behind the way in which we as a nation are pursuing our relationship with China, that is a question that does not have an answer and right now it is the single biggest issue facing strategic policy in Australia today,” Mr Marles told a panel at The Australian’s Strategic Forum.

He said it was clear China was seeking to reshape the global rules based order.

“It is not clear what China’s global ambition is, whether it intends to be a global military competitor to the United States. It is clear that China is seeking to reshape the global rules based order and the South China Sea is an example of that,” he said.

Andrew White 10.12am: US won’t reclaim its power: Keating

The US will not return to being the power that it was as a result of China’s rise, former Prime Minister Paul Keating told The Australian’s inaugural strategic forum in Sydney.

Mr Keating said that US President Donald Trump was continuing the strategy initiated by Barack Obama with his pivot to Asia and talk of “red lines”.

“We want a region which gives China space to participate, but not dominate.†Former prime minister of Australia Paul Keating delivers the keynote address. #auschina2019 pic.twitter.com/EBGvdX3fH5

— The Australian (@australian) November 17, 2019

But while he lacked an apparent intellectual framework for his strategy, Mr Trump was taking the US in a direction that his successor would have, regardless of which side of politics holds the White House.

Mr Keating said that a policy of containment with China was unlikely to work as the so-called four powers alliance of Australia, the US, India and Japan had not gained any traction. Japan is seeking rapprochement with China and India was unlikely to emerge as an economic challenger to the Middle Kingdom.

Paul Keating says Australian media has been ‘recreant in its duty’ on reporting on the rise of China. #Auschina2019

— The Australian (@australian) November 17, 2019

Mr Keating also said that while it lost influence in Asia the US had not taken the opportunity to consolidate the Atlantic region ads an economic counter to the rise of China.

The Atlantic nations had combined economic might of $US40trn against China’s $12trn. But it had failed to sway Russia to its cause.

10.00am: Strategic Forum agenda

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout