These companies are gearing up to capture high purity alumina demand

High purity alumina is seeing increased demand in a range of high-end technological uses. Here are the companies that are positioned to capitalise on this growth.

HPA sees use in manufacturing LEDs, mobile phones, watches and semi-conductors

It is also used to improve safety, reliability and performance of batteries

Australian HPA hopefuls look to better incumbents on pricing, quality and environment

Alumina may be best known as the feedstock for the production of aluminium metal but it also has a range of uses for the energy transition and many high-end technological uses in its highest quality form – the appropriately named high purity alumina, or HPA.

Depending on its quality, which is ranked from 3N (the lowest at 99.9% to 99.98%) up to 6N (99.999%), HPA has a range of uses such as in ceramics, catalysts, the manufacture of sapphire glass used in light-emitting diodes and mobile phones, as well as semi-conductors and in the preparation process for semiconductors.

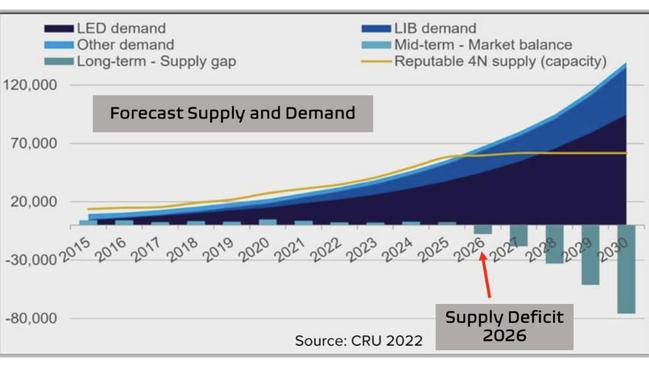

With electrification increasingly starting to take hold around the world, there is an increasing shift from incandescent light globes to extremely energy-efficient LEDs, which increases demand for higher-grade 4N HPA.

The same is also true of its uses in smartphone camera lenses, camera lights and watch faces.

Demand is also likely to increase further thanks to its use as a coating on the anode and cathode of lithium-ion and sodium-ion batteries (and as a separator between the anode and cathode in some batteries) to improve safety, reliability and performance.

Speaking to Stockhead, Impact Minerals managing director Dr Mike Jones said the highest purities were needed as sapphire glass needs to be crystal clear with no impurities in it.

He added that there’s a significant difference in pricing between the 3N and 4N grades then a big jump up to 5N, which is an ultrapure material.

3N HPA can range in price from US$5000-15,000/t while 4N HPA goes for a more robust US$15,000-25,000/t. 5N HPA easily goes for >US$25,000/t.

“But the volumes in 5N whilst growing are insufficient to create a robust business. So you really need to be in the 4N space, which is where the dominant uses are,” Dr Jones added.

“4N is the sweet spot between value and volume.”

Manufacturing and Australian competitiveness

Like many other commodities, a fairly decent chunk of HPA is produced in China through the treatment of aluminum metal, which is itself produced primarily from processing bauxite using the Bayer process to make smelter grade alumina.

“This is energy intensive and basically environmentally unfriendly as it produces a significant output waste output called red mud,” Dr Jones said.

Red mud has very high alkalinity and poses a significant environmental hazard if it is not stored properly.

While competing against Chinese products is typically challenging – often from a cost point of view, Dr Jones believes that Australian HPA producers can compete on several levels.

“The first is the second one is quality and the third one is the environmental footprint,” he said.

“The Australian producers like Alpha HPA , who are a leader in this space, Cadoux and ourselves – the three HPA groups if you like – use the hydrometallurgical approach to directly produce HPA.

“Ourselves and Cadoux are using natural feedstocks while Alpha HPA is using a chemical feedstock.

“As a result our input costs are significantly lower than the current incumbents and as a result the margins are particularly high.”

He adds that processes used by the three companies are less energy intensive and do not produce the same toxic mud that comes from using the Bayer process.

Australian HPA hopefuls

Alpha HPA (ASX:A4N) is arguably the front-runner in the push towards establishing Australian HPA production.

The company is already using its technology to produce HPA at its HPA First stage 1 project in Queensland where operations are underway to establish a meaningful inventory ahead of anticipated larger volume orders this year.

It has also completed Stage 2 bulk earthworks on time and budget and has reached contractual close for a $400m senior debt funding package.

Design of Stage 2 has progressed to the 30% engineering level as of the end of 2024 and has received the Material Change of Use approval from the state government along with Work Health and Safety accreditation from the Australian federal government.

It also expects the Future Made in Australia Bill, which is currently making its way through Parliament, to have a material positive impact on Stage 2 financial returns if it is passed.

Stage 2 will deliver a jump in production up to 10,000tpa of HPA equivalent and is expected to be operational in later 2026.

Early in March 2025, the company announced that engagement with the semiconductor sector for the use of HPA and HPA precursors as chemical mechanical planarisation (CMP) polishing slurries had gained momentum.

Demand is linked to power-semiconductor demand for high power switching applications, including EVs, EV charging, wind turbines and solar PV.

Highlighting this, Alpha HPA has received a letter of intent from a CMP sector end user for the supply of up to 4000tpa of a range of HPA materials.

Cadoux (ASX:CCM) is targeting the development of a HPA project in WA that has received Major Project Status and has produced samples from its pilot plant that are being assessed by prospective customers.

Its project is estimated to have capex of US$202m and deliver average annual EBITDA of US$186m with payback in three years.

After-tax IRR and net present value have been estimated at 55% and US$1.01bn while cash costs are estimated at US$6217/t HPA.

Mine life is currently assessed at 25 years though the project has sufficient resources for >100 years at the 10,000tpa output capacity.

Work is currently focused on a small-scale production and demonstration plant as it progress towards commercialisation of its high-quality HPA refining facilities.

Meanwhile, Dr Jones’ Impact Minerals (ASX:IPT) centres its HPA ambition around its Lake Hope project in WA that has a measured resource of 730,000t grading 25.8% alumina, or 189,000t of contained alumina.

This grants it very high levels of confidence that it will be more than capable of supporting a proposed 10,000tpa HPA plant for 15 years.

It will also underpin a maiden probable or proven reserve subject to ongoing mining studies, test work and economic studies to be completed as part of the PFS.

What’s unique about Lake Hope mineralisation, which sits in the top two metres of the lake sediment, is a set of sulphide minerals that lend themselves to a relatively straightforward conversion into HPA.

“We intend to take this material from Lake Hope, leaving a very low environmental footprint from the mine, and then trucking it to a processing plant in Kwinana,” Dr Jones said.

With the mineralisation grading at an average of about 25% alumina, he adds that the company will need to transport about 50,000t of this material to alumina per annum to produce the 10,000tpa of HPA envisioned by the scoping study.

“That's actually not a very large amount of material when you consider that the iron ore companies are moving millions of tonnes of material per year,” Dr Jones noted.

“As a result, the process plant that's been designed for us has a relatively small footprint and is very elegantly designed.”

The earlier scoping study had outlined attractive economics for a proposed 10,000tpa HPA plant including net present value of $1.3bn and one of the world’s lowest operating costs at US$3264 per tonne inclusive of byproducts, which compares favourably with those reported by other ASX-listed HPA hopefuls.

Other takeaways from the scoping study include initial capex of $253m, post-tax internal rate of return – a measure of profitability – of 55% and post-tax cashflows of $4.87bn over an initial 25-year mine life.

Dr Jones adds the company currently expects to complete its pre-feasibility study towards the end of the current quarter or the start of the next quarter.

“That will really set us up then to move into the next stage, which is obviously the definitive feasibility study, and trigger the option for us to acquire 80% of the project,” he said.

“We will have three months to make up our mind after the completion. And that would give us an 80% holding in the company that holds the project and all of the intellectual IP that goes with it.”

Impact and its partner CPC Engineering also received a research grant late last year from the federal government under the CRC-P program.

Along with Edith Cowan University, which has a groundbreaking membrane technology that will be applied to the project, the company will be part of a three-way research project to build a pilot plant.

“That's one of the big goals for the next six months – to build a pilot plant and start producing enough material for potential offtake clients to test,” Dr Jones said.

“We have discovered that unless you've got a pilot plant, no one would really take you seriously.”

He added the research project will look to develop new membranes to fit into various parts of the process – in particular to clean up the acid at the backend.

At Stockhead, we tell it like it is. While Impact Minerals is a Stockhead advertiser, it did not sponsor this article.