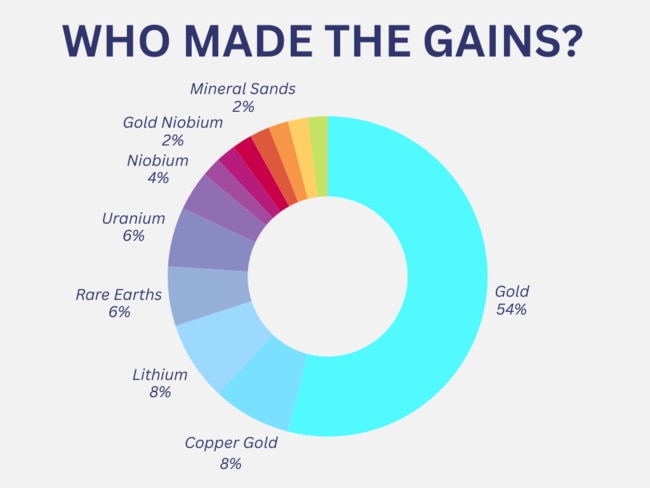

Who made the gains?: Gold dominates our top 50 ASX resources stocks in February

Gold stocks soared last month, with a host of precious metals hunters surging over 100% as prices hit record levels.

Gold stocks soared as the price inched closer to US$3000/oz

Kalgoorlie Gold Mining took out top spot with a 281% gain

Uranium play Greenvale Energy nabbed third place in a sea of goldies

It looks like we’re inching ever closer to a world of US$3,000/oz gold, after a sustained rally above US$2900 last week before futures dropped to US$2868/oz.

ANZ Research attributed the capitulation to a higher US dollar, predicated on the idea that Donald Trump’s tariffs on Mexican and Canadian products would go ahead this week as planned.

Interestingly, a World Gold Council report last week downplayed the longer-term significance of the “run on vaults” at the Bank of England, which saw Comex prices run as investors sought to move bars to the States ahead of potential precious metals tariffs.

“Gold has not been a direct target of tariffs, but market reactions to trade uncertainty has driven a significant shift in trading behaviour and impacted the gold price,” the WGC’s Juan Carlos Artigas and John Reade said.

“The movement of gold from London to the US, rising COMEX premiums and concerns over availability were largely the result of risk management decisions rather than true supply issues.

“Now that COMEX inventories appear to be well-stocked and the backlog of withdrawals from the BoE continues to be cleared, these disruptions should ease over the coming weeks. However, this period serves as a stark reminder that even indirect trade policy concerns can send ripples through global financial markets."

With battery metals prices still in the bargain bin and gold flying, it stands to reason investors are gravitating to junior gold explorers with a story to sell.

Gold wins the month, again

No surprise that February’s top ASX resources gainer was a goldie, with Kalgoorlie Gold Mining (ASX:KAL) up 281% after declaring the Lighthorse discovery at Pinjin.

The Ardea Resources (ASX:ARL) spinoff reported the 17m at 4.81g/t Au from 48m discovery hole, which included 8m at 9.2g/t and ended in mineralisation, which is well located given its proximity to Northern Star’s Carosue Dam and Ramelius’ planned Rebecca/Roe gold project.

A close second – and very close to the 200% mark – was fellow gold junior Caprice Resources (ASX:CRS), up 190% for the month on news that Phase 1 drilling at its Island project had returned thick, shallow, high-grade gold in multiple stacked lodes.

The drilling returned gold assays of up to 28m at 6.4g/t from a down-hole depth of 114m including 4m at 16.4g/t from 130m in hole 24IGRC009 at the Vadrians Hill target, and 12m at 3.9g/t from 90m including 6m at 5.9g/t from 94m in 24IGRC001 at the Baxter target.

The company’s goal is to find a potential mirror of Ramelius Resources’ (ASX:RMS) Break of Day deposit just 12km away, which has a resource of 327,000oz at a super-high grade of 10.4g/t gold.

Other commodities that moved juniors beyond the 100% mark included uranium and copper, with Greenvale Energy (ASX:GRV)and Blackstone Minerals (ASX:BSX)soaring 148% and 126% for the month, respectively. But more on them later.

Here are the top 50 ASX resources stocks for the month of February

Security Description Last %Mth MktCap KAL Kalgoorlie Gold Mining 0.061 281% $20,755,557 CRS Caprice Resources 0.058 190% $25,711,472 GRV Greenvale Energy Ltd 0.082 148% $39,923,613 OZM Ozaurum Resources 0.068 127% $13,428,427 BSX Blackstone Ltd 0.061 126% $36,879,897 E79 E79 Gold Mines 0.042 121% $5,363,538 ASO Aston Minerals Ltd 0.018 100% $22,016,093 EVR EV Resources Ltd 0.005 100% $9,662,517 FAU First Au Ltd 0.003 100% $4,143,987 RR1 Reach Resources Ltd 0.014 100% $12,242,039 FRS Forrestania Resources 0.019 90% $4,724,180 C1X Cosmos Exploration 0.1 85% $12,415,992 RAS Ragusa Minerals Ltd 0.024 85% $3,422,371 CAE Cannindah Resources 0.075 79% $50,237,517 FIN FIN Resources Ltd 0.007 75% $4,544,881 GES Genesis Resources 0.007 75% $5,479,889 ORD Ordell Minerals Ltd 0.56 75% $17,434,620 TYX Tyranna Res Ltd 0.007 75% $19,727,552 NMR Native Mineral Res 0.075 74% $53,500,465 HTM High-Tech Metals Ltd 0.26 73% $8,045,802 TOR Torque Met 0.1 72% $26,696,729 NAE New Age Exploration 0.005 67% $8,625,596 PNT Panther Metals 0.015 67% $3,722,561 QXR QX Resources Limited 0.005 67% $6,550,389 RGL Rivers Gold 0.005 67% $8,418,563 YAR Yari Minerals Ltd 0.005 67% $2,894,147 WYX Western Yilgarn NL 0.038 65% $4,704,763 OKJ Oakajee Corp Ltd 0.013 63% $1,188,798 HVY Heavy Minerals 0.295 62% $17,096,116 LAT Latitude 66 Limited 0.072 60% $10,468,251 KFM Kingfisher Mining 0.055 57% $3,061,755 CVR Cavalierresources 0.18 57% $9,833,177 DRE Dreadnought Resources Ltd 0.017 55% $70,706,400 AYM Australia United Min 0.003 50% $5,527,732 CDT Castle Minerals 0.003 50% $5,690,442 EEL Enrg Elements Ltd 0.0015 50% $4,880,668 GBR Greatbould Resources 0.072 50% $57,691,625 RLC Reedy Lagoon Corp. 0.003 50% $2,330,120 VRC Volt Resources Ltd 0.0045 50% $18,117,573 ZMI Zinc of Ireland NL 0.015 50% $7,938,150 CGR Cgnresourceslimited 0.1 49% $8,623,928 ARN Aldoro Resources 0.4 48% $77,053,994 DES Desoto Resources 0.105 48% $9,721,530 KNB Koonenberrygold 0.031 48% $30,110,533 GDM Greatdivideminingltd 0.47 47% $13,210,917 CAZ Cazaly Resources 0.016 45% $6,919,545 NSM Northstaw 0.029 45% $8,180,295 CZR CZR Resources Ltd 0.26 44% $61,551,008 SFX Sheffield Res Ltd 0.215 43% $82,909,040 MAT Matsa Resources 0.057 43% $43,956,636

More small cap standouts

As we mentioned earlier, Greenvale Energy made a notable showing in February, with executive chairman Neil Biddle telling the Resources Rising Stars Summer Series in Brisbanethat Australia could end up being home to half of the world’s uranium resources – and the company wants to get in on the action.

“There’s 110 reactors planned to start construction in the next five years and there’s 32 countries, there’s 14 large banks, and there’s a whole lot of big, smart companies investing in uranium now that are standing behind the nuclear industry trebling in size over the next 25 years,” Biddle said.

Since the Fukushima nuclear disaster in Japan in 2011, there’s been very little exploration for uranium in Australia, which Biddle believes could change if the government does.

And Greenvale certainly seems to be preparing for that eventuality, adding five uranium projects to its portfolio in the past few months to join its existing Alpha torbanite project in Queensland.

Four of the new projects are in the Northern Territory but the most advanced, Oasis, is in Queensland, just 50km from the town of Greenvale.

Oasis was acquired last month for $200,000 cash and 20 million Greenvale shares. Biddle, who was a co-founder of lithium producer Pilbara Minerals, said Oasis was discovered in the 1970s by Esso, but little work had been done on the project since.

The company is focused on large anomalies across the 90 square kilometre property that have never been tested.

“It’s a block of rocks that have been intruded by a big alkaline granite system and it looks to us like a classic intrusive alaskite-style uranium deposit,” Biddle said.

“These are typically very big deposits. Rossing in Namibia is the classic example of that kind of deposit.

“We are pretty confident we’ve got something very similar to that here.”

Exploration will start in April, following Queensland’s wet season.

OzAurum Resources (ASX:OZM)

The company surged in Feb off high-grade gold intercepts from shallow aircore drilling at its Mulgabbie North gold project.

Notably, the project sits just 30km west of Lighthorse, and delivered a new high-grade gold discovery on February 3 of 20m at 3.57g/t from surface and 10m at 6.59g/t from 12m among a string of other significant intercepts from drilling along the Relief Shear.

Those strikes are located around historical intercepts that were drilled but never followed up, with RC drilling last conducted over 38 years ago.

A RAB hole in 1998 by Gutnick Resources also intersected ‘significant mineralisation’. This was followed by the company noting on February 5 that visible gold was observed from the top composite assay of 4m at 14.17g/t.

Blackstone Minerals (ASX:BSX)

BSX nabbed a spot in the top 10 this month with its merger plans with IDM International to acquire the Mankayan copper-gold project in the Philippines.

The project is described by BSX managing director Scott Williamson ‘as one of the largest high-grade undeveloped porphyry projects globally’.

Mankayan features a large mineralised system with a high-grade core and orebody that remains open to the north, south and at depth, which provide opportunities for resource growth.

Historical drill intersections include 911m at 1% copper equivalent from 156m, including 253m at 1.43% copper equivalent and 543m at 1.08% copper equivalent from 262m.

E79 Gold Mines’ (ASX:E79)

And a notable mention for gold junior E79, which scored a binding farm-in and joint venture agreement for Scorpion Minerals (ASX:SCN) to earn up to 70% in the company and its Jungar Flats gold project in WA’s Murchison region.

This would make Scorpion the largest tenement holder in a shear running from Spartan Resources’ Dalgaranga to Westgold Resources’ Big Bell in WA’s Murchison.

Historical exploration at Jungar Flats has already proven that gold is indeed present – particularly at the Middle Bore prospect where wide-spaced shallow RAB returned assays of up to 18m at 1.49g/t gold from 18m while deeper diamond drilling struck 6m at 1.43g/t gold from 148m.

Scorpion is understandably keen to test this potential and is already preparing to launch in late February a reverse circulation drill program to test multiple walk-up high-grade gold targets with systematic soil geochemistry and detailed mapping along with historical intercepts such as 12m at 7.40g/t gold from 44m, including 2m at 42.4g/t at the Lantern target and 5m at 8.28g/t gold from 9m at Cap Lamp.

To earn an initial 51% interest, the company will be required to spend $1.5m within three years. This can be increased to 70% by spending a further $1.5m within five years.

At Stockhead we tell it like it is. While OzAurum Resources, Scorpion Minerals, Caprice Resources and Greenvale Energy are Stockhead advertisers, they did not sponsor this article.