Lunch Wrap: ASX runs out of puff, but Life360 keeps rocketing higher

Wall Street’s flying but the ASX skids this morning. Life360 rockets again, while stocks like Macquarie and Aristocrat stumble.

ASX cools off after five-day sprint

Wall Street tech stocks roar back to life

Life360 rockets again, CBA reports solid quarter

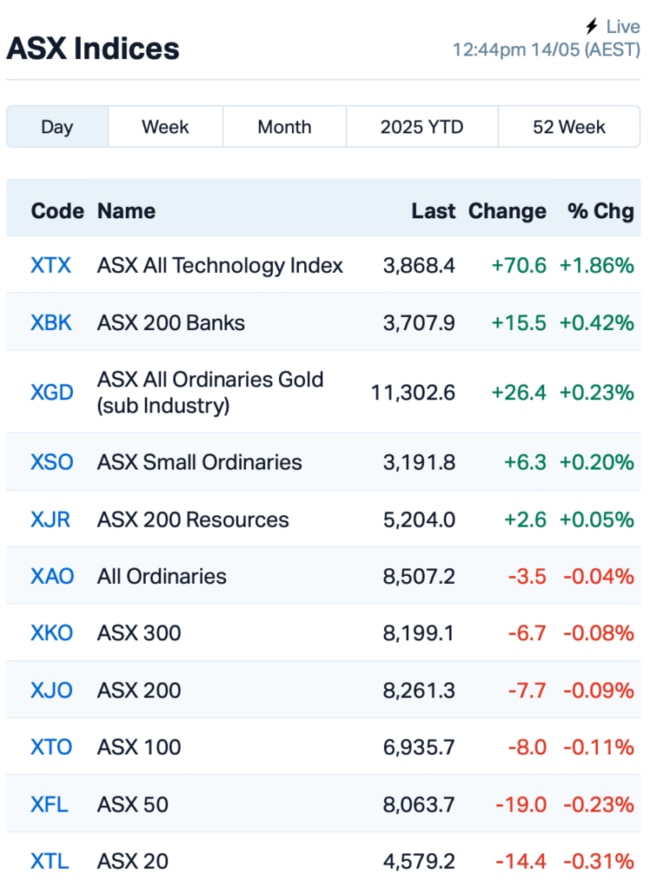

The ASX ran out of puff this morning, snapping a five-day winning streak with a small 0.05% dip by lunchtime, AEST.

The local slump stood in contrast to a cracking session on Wall Street last night, where tech stocks took off on the back of easing trade tensions.

The S&P 500 rose 0.7% and, in a bit of a milestone, finally wiped out all its 2025 losses.

Nvidia led the charge, up 6%, pushing the Nasdaq deeper into bull market territory.

CEO Jensen Huang announced Nvidia will be shipping more than 18,000 of its flash new GB300 AI chips to Saudi firm Humain. The deal was unveiled during a Trump-led CEO tour of the region.

Cyber firm Palantir also soared 9% after news of a monster US$142 billion defence deal with the Saudis.

Microsoft, on the other hand, announced 6000 job losses as it reshuffles to stay lean in a shifting tech landscape.

April’s US CPI reading came in softer than expected, cooling inflation jitters and pushing Fed rate cut bets back to September.

Back home, the spotlight was on wages this morning.

The Aussie Wage Price Index came in at 0.9% for the quarter, just a touch above forecasts. It’s solid, but not scorching.

Enough for the RBA to take a breath, but not enough to slam the door on rate cuts altogether, experts said.

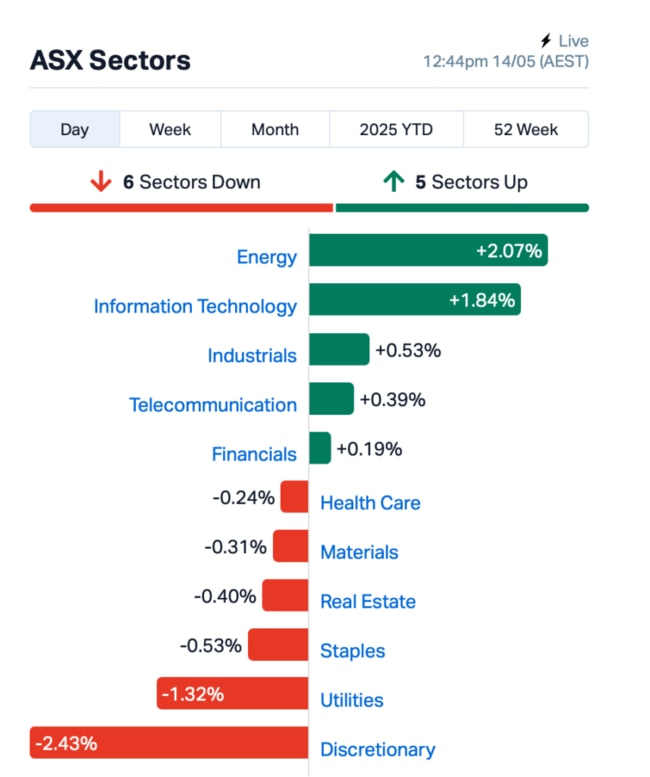

Over to the ASX, energy stocks were running hot after Brent and WTI both surged 2.5% overnight.

In large caps news, Macquarie Group (ASX:MQG) dropped 2% after ASIC launched legal action over its short-selling disclosures. Not the headline you want when you're the country’s top investment bank.

Gaming giant Aristocrat Leisure (ASX:ALL) took an even bigger hit, down 13% after missing half-year revenue targets, dragging down the discretionary sector.

Woodside Energy Group (ASX:WDS) moved the other way, rising 3.5% after flagging that Saudi giant Aramco might take a stake in its Louisiana LNG project.

Commonwealth Bank (ASX:CBA) lifted 0.6% after posting a 6% jump in quarterly profit. Margins are holding, lending’s up, and while Aussie households are still doing it tough, the bank said its numbers are holding firm.

And finally, Life360's (ASX:360) stock price is still going vertical. After jumping 14% yesterday, it was up another 10% by late morning, riding a wave of new users and fattened-up revenues in Q1. Investors are clearly liking 360’s direction, and its speed.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 14 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CRB | Carbine Resources | 0.007 | 75% | 3,813,685 | 2,206,951.02 |

| RMI | Resource Mining Corp | 0.009 | 50% | 4,346,709 | 3,992,434.42 |

| ERA | Energy Resources | 0.002 | 50% | 20,902,963 | 405,396,240.82 |

| SFG | Seafarms Group Ltd | 0.002 | 50% | 800,000 | 7,254,898.77 |

| TMX | Terrain Minerals | 0.003 | 50% | 25,000 | 4,497,113.20 |

| CP8 | Canphosphateltd | 0.025 | 39% | 13,771 | 5,521,689.49 |

| HFR | Highfield Res Ltd | 0.150 | 36% | 1,043,191 | 52,148,474.73 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 20,043,674 | 8,179,555.88 |

| OSL | Oncosil Medical | 0.004 | 33% | 539,205 | 16,123,037.83 |

| CXO | Core Lithium | 0.096 | 32% | 66,896,706 | 156,440,134.71 |

| VMT | Vmoto Limited | 0.099 | 25% | 669,530 | 30,722,291.12 |

| CAV | Carnavale Resources | 0.005 | 25% | 3,250,520 | 16,360,873.58 |

| DTM | Dart Mining NL | 0.005 | 25% | 3,141,990 | 4,792,222.31 |

| TFL | Tasfoods Ltd | 0.005 | 25% | 1,103,013 | 1,748,382.06 |

| OIL | Optiscan Imaging | 0.120 | 20% | 374,805 | 83,534,080.30 |

| EAT | Entertainment | 0.006 | 20% | 23,005 | 6,543,930.08 |

| EM2 | Eagle Mountain | 0.006 | 20% | 100,000 | 6,242,705.09 |

| IPB | IPB Petroleum Ltd | 0.006 | 20% | 36,557 | 3,532,015.30 |

| IPT | Impact Minerals | 0.006 | 20% | 5,029,166 | 19,247,483.08 |

| SPX | Spenda Limited | 0.006 | 20% | 1,539,635 | 25,383,685.14 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 333,333 | 23,423,889.92 |

| PUA | Peak Minerals Ltd | 0.019 | 19% | 25,360,278 | 44,917,140.64 |

| MIO | Macarthur Minerals | 0.020 | 18% | 81,374 | 3,394,313.67 |

| HVY | Heavymineralslimited | 0.235 | 18% | 148,859 | 13,513,718.40 |

Carbine Resources (ASX:CRB) has just locked in a mining lease for its Muchea West Silica Sand Project in WA. The lease (M70/1433) covers part of the project’s 110Mt high-grade silica resource, and runs for 21 years. It’s a big step forward, but it doesn’t mean mining can start just yet. Carbine still needs environmental and defence-related approvals, including green lights around the Muchea Air Weapons Range.

MRG Metals (ASX:MRQ) has been granted the Linhuane heavy mineral sands licence in Mozambique’s Gaza Province. The 56km² site sits right near the coast, and covers an 18km stretch of promising palaeodune. Old Rio Tinto drilling shows high-grade mineral sands close to surface, with standout hits like 10.5m at 15.6% THM and 10m at 17.9% THM. No drilling has gone deeper than 10.5m yet, so there’s still plenty of potential to uncover.

Core Lithium (ASX:CXO) has updated the numbers at its Finniss Lithium Project in the NT, locking in 10.73Mt at 1.29% Li₂O in Ore Reserves, enough to cover the first 10 years of its mine plan. The Grants Reserve has doubled to 1.15Mt with a shift to underground mining, which is expected to lower costs and unlock more tonnes. Overall Mineral Resources have edged up slightly to 48.5Mt, with an extra 310kt added from old tailings and stockpiles. CXO reckons there’s still more life to squeeze out of the broader tenement package, too.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 14 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RLC | Reedy Lagoon Corp. | 0.001 | -50% | 200,000 | 1,553,413 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 38,727,750 | 2,600,499 |

| OLH | Oldfields Holdings | 0.029 | -26% | 371,923 | 8,309,306 |

| ADY | Admiralty Resources. | 0.004 | -20% | 126,000 | 13,147,397 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 2,650,000 | 16,167,639 |

| RLL | Rapid Lithium Ltd | 0.002 | -20% | 100,000 | 3,112,362 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 1,237,939 | 16,442,127 |

| G11 | G11 Resources Ltd | 0.013 | -19% | 1,114,626 | 15,465,954 |

| TG1 | Techgen Metals Ltd | 0.022 | -19% | 55,049 | 4,283,974 |

| PIL | Peppermint Inv Ltd | 0.003 | -17% | 102,484 | 6,712,918 |

| NPM | Newpeak Metals | 0.011 | -15% | 58,500 | 4,186,933 |

| IFL | Insignia Financial | 3.385 | -15% | 3,666,851 | 2,682,904,572 |

| OEQ | Orion Equities | 0.145 | -15% | 3,532 | 2,660,369 |

| ARV | Artemis Resources | 0.006 | -14% | 67,822 | 17,699,705 |

| LM1 | Leeuwin Metals Ltd | 0.155 | -14% | 1,006,444 | 18,145,149 |

| NZK | NZK Salmon Ltd | 0.195 | -13% | 728 | 121,091,011 |

| REE | Rarex Limited | 0.026 | -13% | 2,437,172 | 24,025,375 |

| AEI | Aeris Environmental | 0.040 | -13% | 237,000 | 11,315,749 |

| TAS | Tasman Resources Ltd | 0.020 | -13% | 88,486 | 3,704,157 |

| ALL | Aristocrat Leisure | 59.470 | -13% | 2,433,840 | 42,614,449,136 |

| MYX | Mayne Pharma Ltd | 5.940 | -13% | 1,085,076 | 551,659,165 |

| AHK | Ark Mines Limited | 0.210 | -13% | 83,467 | 15,878,568 |

| AVL | Aust Vanadium Ltd | 0.012 | -12% | 2,902,196 | 112,250,555 |

| ATS | Australis Oil & Gas | 0.008 | -11% | 6,519,912 | 11,862,562 |

IN CASE YOU MISSED IT

Indiana Resources (ASX:IDA) is drilling for more high-grade gold at the Minos gold deposit in South Australia with a reverse circulation rig already onsite. The company plans to drill about 6600m, looking for extensions to gold hits of up to 21m at 8.43 g/t gold and 38m at 6.54 g/t gold.

DY6 Metals (ASX:DY6) has exploration imminent over a pair of recently acquired rutile and mineral sands projects in Cameroon. Watch StockTake for more.

At Stockhead, we tell it like it is. While Indiana Resources and DY6 Metals are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.