Closing Bell: ASX wobbles into the green as ASIC cracks down on Macquarie

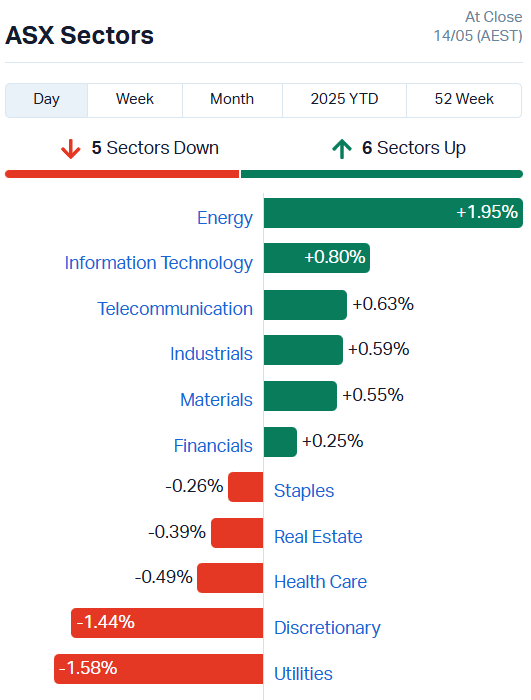

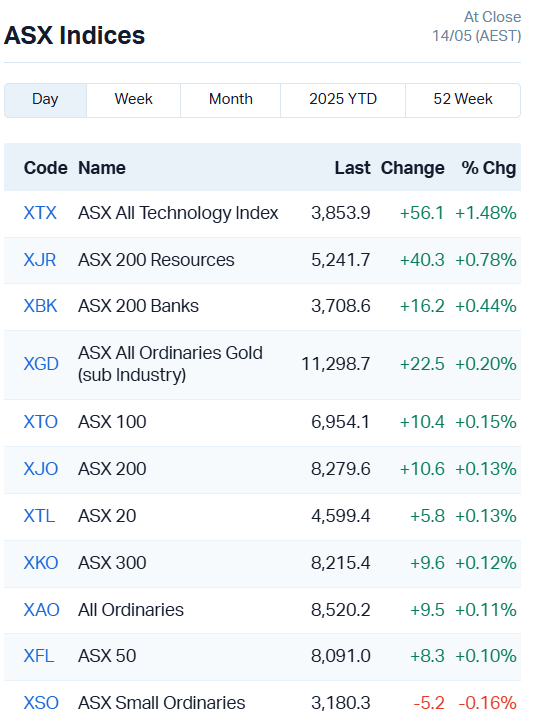

The ASX has wobbled into positive territory, adding just 0.13pc on the back of a strong Energy sector and a lift in banking stocks.

ASX just scrapes into the green in last hour of trade, up just 0.13pc

Nasdaq gains lay runway for Info Tech strength

Tariff pause continues to push up oil and energy stocks

After all the excitement of the last few weeks, the ASX appears to have taken a little bit of a breather today, moving only marginally in either direction before settling essentially flat, up just 0.13%.

A pattern is certainly emerging – energy and tech stocks are flying high again, leaving the rest of the market in their dust.

A sizeable 1.61% jump in the Nasdaq last night laid the groundwork for a smooth day of trading for ASX tech stocks, and another uptick of 2.5% for oil fuelled similar gains in the Energy sector.

The ASX 200 Banks index also rose, lifting by 0.44%. Commonwealth Bank (ASX:CBA) was a large part of that success, adding 0.82% to its share price after lifting quarterly profits by 6%. NAB (ASX:NAB) joined the party, gaining 1.38%.

Westpac (ASX:WBC) wasn’t so upbeat, shedding 1.2%, while Macquarie (ASX:MQG) took an even bigger hit, falling 1.6% after another ASIC crackdown.

ASIC cracks the whip over underreported short sales

The Australian Securities and Investment Commission has sued Macquarie over alleged misleading conduct, with accusations the investment bank misreported millions of short sales to the market operator for over 14 years.

More specifically, ASIC is saying Macquarie failed to report the correct volume of short sales by at least 73 million over that period, and could have misreported between 298 million and 1.5 billion short sales total.

The regulator isn’t accusing Macquarie of nefarious conduct, but rather points to “multiple systems-related issues, many of which remained undetected for over a decade”.

“We allege Macquarie’s failures may have led to the financial services industry relying on misleading and false information for over 14 years,” ASIC chair Joe Longo said.

“MSAL’s repeated systemic failure to detect and resolve these issues indicated serious neglect of its systems and disregard for operational controls and technological governance.”

Macquarie says it self-reported the issue to the regulator in late 2022 when it was discovered.

“The reporting issues identified in the proceedings have been remediated with additional controls implemented,” Macquarie’s statement on the ASIC case reads.

“MSAL is now reviewing ASIC's claim. As the matter is before the court, it would be inappropriate for Macquarie to make further comment.

“Macquarie takes its compliance obligations very seriously and continues to invest in programs to further improve systems and controls across the Group.”

It’s the second time in the space of a week ASIC has cracked down on Macquarie specifically, and the fourth time Macquarie has been sued by the regulator in the last year.

ASIC’s markets disciplinary panel fined Macquarie a record $4.9 million for failing to prevent suspicious orders in certain futures markets in September 2024.

"Our actions reflect the ongoing and deep concerns we have with Macquarie Group and its weak remediation of long-standing issues, which led us to impose additional conditions on Macquarie Bank's Australian Financial Services licence only last week," Longo said.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EEL | Enrg Elements Ltd | 0.002 | 100% | 1100000 | $3,253,779 |

| RMI | Resource Mining Corp | 0.011 | 83% | 19137567 | $3,992,434 |

| ALR | Altairminerals | 0.003 | 50% | 11473112 | $8,593,488 |

| CRB | Carbine Resources | 0.006 | 50% | 4063685 | $2,206,951 |

| ICU | Investor Centre Ltd | 0.003 | 50% | 745323 | $609,023 |

| SFG | Seafarms Group Ltd | 0.0015 | 50% | 814424 | $7,254,899 |

| TEG | Triangle Energy Ltd | 0.003 | 50% | 191590 | $5,223,085 |

| TMX | Terrain Minerals | 0.003 | 50% | 228781 | $4,497,113 |

| DY6 | Dy6Metalsltd | 0.13 | 48% | 2012152 | $5,208,353 |

| HFR | Highfield Res Ltd | 0.16 | 45% | 1386267 | $52,148,475 |

| CP8 | Canphosphateltd | 0.025 | 39% | 13771 | $5,521,689 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 35478987 | $8,179,556 |

| OSL | Oncosil Medical | 0.004 | 33% | 992229 | $16,123,038 |

| MKL | Mighty Kingdom Ltd | 0.009 | 29% | 247776 | $3,402,992 |

| JLL | Jindalee Lithium Ltd | 0.54 | 29% | 240349 | $32,180,956 |

| OKJ | Oakajee Corp Ltd | 0.015 | 25% | 50000 | $1,097,352 |

| OIL | Optiscan Imaging | 0.125 | 25% | 390631 | $83,534,080 |

| ASR | Asra Minerals Ltd | 0.0025 | 25% | 1040000 | $6,765,117 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 749585 | $12,693,855 |

| DTM | Dart Mining NL | 0.005 | 25% | 3141990 | $4,792,222 |

| MOH | Moho Resources | 0.005 | 25% | 7176246 | $2,923,498 |

| TFL | Tasfoods Ltd | 0.005 | 25% | 1103013 | $1,748,382 |

| VEN | Vintage Energy | 0.005 | 25% | 581304 | $7,892,887 |

| VML | Vital Metals Limited | 0.0025 | 25% | 1247433 | $11,790,134 |

| HVY | Heavymineralslimited | 0.245 | 23% | 171997 | $13,513,718 |

Making news…

Carbine Resources (ASX:CRB) has just locked in a mining lease for its Muchea West Silica Sand Project in WA. The lease (M70/1433) covers part of the project’s 110Mt high-grade silica resource, and runs for 21 years.

It’s a big step forward, but it doesn’t mean mining can start just yet. Carbine still needs environmental and defence-related approvals, including green lights around the Muchea Air Weapons Range.

Highfield Resources (ASX:HFR) invited investors to a market call today, outlining a letter of intent announced yesterday that would see Qinghai Salt Lake Industry Co., Ltd make a US$300 million equity subscription.

The funds will go to HFR’s Muga potash project in Spain, which is expected to be a high margin, low capex potash operation with all permits and key licenses already in place.

DY6 Metals (ASX:DY6) is poised to begin exploration at its recently acquired rutile and mineral sands projects in Cameroon. Check out StockTake for more.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.001 | -33% | 40428110 | $2,600,499 |

| OLH | Oldfields Holdings | 0.029 | -26% | 773397 | $8,309,306 |

| GGE | Grand Gulf Energy | 0.003 | -25% | 15062886 | $11,201,549 |

| ADY | Admiralty Resources. | 0.004 | -20% | 126000 | $13,147,397 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 3165433 | $16,167,639 |

| RLL | Rapid Lithium Ltd | 0.002 | -20% | 100000 | $3,112,362 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 1306120 | $16,442,127 |

| FNR | Far Northern Res | 0.12 | -17% | 7390 | $5,838,545 |

| LM1 | Leeuwin Metals Ltd | 0.15 | -17% | 1328882 | $18,145,149 |

| PAT | Patriot Resourcesltd | 0.05 | -17% | 45981 | $7,585,078 |

| REE | Rarex Limited | 0.025 | -17% | 3293129 | $24,025,375 |

| ARC | ARC Funds Limited | 0.096 | -17% | 45696 | $5,917,000 |

| LMG | Latrobe Magnesium | 0.011 | -15% | 5158011 | $34,119,931 |

| NPM | Newpeak Metals | 0.011 | -15% | 58500 | $4,186,933 |

| OEQ | Orion Equities | 0.145 | -15% | 3532 | $2,660,369 |

| FIN | FIN Resources Ltd | 0.006 | -14% | 71501 | $4,864,219 |

| SP8 | Streamplay Studio | 0.006 | -14% | 350000 | $8,969,552 |

| AEI | Aeris Environmental | 0.04 | -13% | 237000 | $11,315,749 |

| TAS | Tasman Resources Ltd | 0.02 | -13% | 164884 | $3,704,157 |

| OCT | Octava Minerals | 0.034 | -13% | 101996 | $2,379,363 |

| 8CO | 8Common Limited | 0.014 | -13% | 457725 | $3,585,518 |

| GUL | Gullewa Limited | 0.07 | -13% | 151243 | $17,441,774 |

| RIM | Rimfire Pacific | 0.021 | -13% | 3415876 | $60,429,453 |

| FLN | Freelancer Ltd | 0.185 | -12% | 27266 | $94,692,125 |

| 5EA | 5Eadvanced | 0.61 | -12% | 15890 | $10,334,503 |

IN CASE YOU MISSED IT

Indiana Resources (ASX:IDA) is drilling for more high-grade gold at the Minos gold deposit in South Australia with a reverse circulation rig already onsite. The company plans to drill about 6600m, looking for extensions to gold hits of up to 21m at 8.43 g/t gold and 38m at 6.54 g/t gold.

DY6 Metals (ASX:DY6) has exploration imminent over a pair of recently acquired rutile and mineral sands projects in Cameroon. Watch StockTake for more.

Trading Halts

Aurumin (ASX:AUN) - transactions on non-gold mineral rights at Sandstone

Babylon Pump & Power (ASX:BPP) - cap raise

First Au (ASX:FAU) - major gold project acquisition

Latitude 66 (ASX:LAT) - Finland court appeal update on Kuusamo KSB Project

Legacy Minerals Holdings (ASX:LGM) (ASX: LGM) - cap raise

Lucapa Diamond Company (ASX:LOM) - recapitalise and restructure announcement

Norwood Systems (ASX:NOR) - cap raise

NRW Holdings (ASX:NWH) - implications legislation proposed by the SA government

At Stockhead, we tell it like it is. While Indiana Resources and DY6 Metals are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.