Closing Bell: ASX rebounds as RBA holds rates; Whitehawk soars 150pc after US Fed deal

ASX bounces back, RBA keeps rates steady with no rush to cut, and China’s factory growth beats expectations.

ASX bounces back, Trump tariffs in focus

RBA holds rates steady, inflation watch continues

China’s factory growth surprises, exports rise

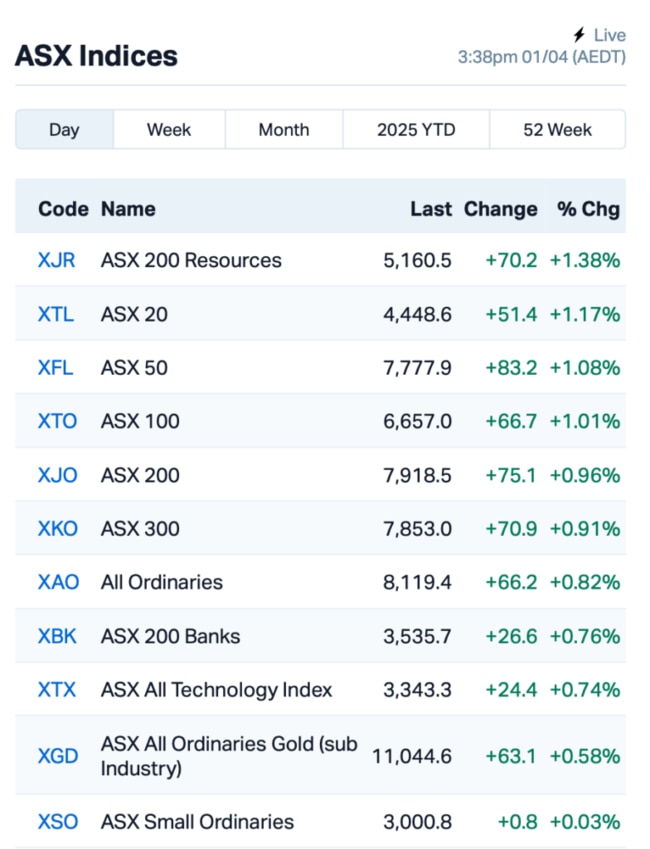

After falling 1.6% on Monday, the ASX rebounded by almost 1% today, but the market remains cautious ahead of Trump’s planned tariff announcement.

The positive momentum followed a volatile session on Wall Street overnight, where the S&P 500 had a wild ride.

It dropped by as much as 2% at one point, spooked by ongoing fears about global trade, but managed to claw back and close up by 0.6%.

Trump is now set to announce new tariffs on April 2 in the White House Rose Garden.

His spokeswoman has just said these will be “country-based” tariffs, with no exemptions for now.

These could target places like the EU, Japan, India, and Canada. Trump says this will help US manufacturing and bring in cash for things like tax cuts.

However, there’s worry it could mess with supply chains and raise prices, and Wall Street’s been nervous about this for weeks.

Meanwhile back home, the RBA decided to leave the cash rate at 4.1% this afternoon, in line with what most analysts were expecting.

RBA Governor Michele Bullock pointed to ongoing global uncertainties and the need to be cautious about inflation, which remains a priority for the central bank.

“The RBA seems to be focusing on returning inflation to target levels, as it has added the word ‘sustainably’ in the statement...”said Junvum Kim at Saxo.

“Despite a tight labour market, the RBA is seeking more evidence on inflation trends before easing rates further.”

The market is currently pricing in about a 70% chance of a rate reduction in the May’s meeting, so there's a lot riding there for the ASX in the next few weeks.

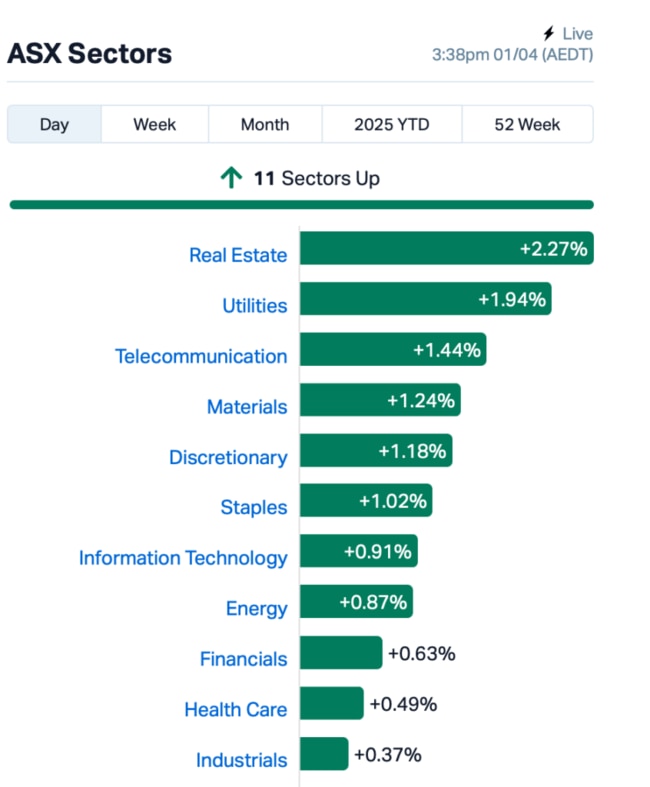

On the ASX, all 11 sectors were in the green today, led by Real Estate.

In large caps news, NZ insurance company Tower (ASX:TWR) tumbled 8% after Bain Capital sold off its entire 68.3 million shareholding in Tower.

SSR Mining (ASX:SSR) also fell 8% despite a positive 2025 outlook where it expects over 10% more gold production. Investors were likely spooked by the $60 to $100 million development cost for the Hod Maden project.

Meanwhile some good news over in Asia. China's factory activity picked up faster than expected, with a private survey released today showing growth at its quickest in four months.

The Caixin manufacturing index rose to 51.2 in March, beating forecasts of 50.6. This suggests things are improving, especially in exports.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap WHK Whitehawk Limited 0.020 150% 92,820,658 $5,195,168 EDE Eden Inv Ltd 0.002 50% 8,474,556 $4,109,881 LNU Linius Tech Limited 0.002 50% 860,477 $6,151,216 OZM Ozaurum Resources 0.087 34% 19,970,592 $14,727,497 GGE Grand Gulf Energy 0.002 33% 50,000 $3,675,581 ICR Intelicare Holdings 0.008 33% 226,564 $2,917,129 M2R Miramar 0.004 33% 70,750 $1,369,040 PPG Pro-Pac Packaging 0.026 30% 3,959,303 $3,633,754 JLL Jindalee Lithium Ltd 0.310 29% 365,838 $17,662,044 CZN Corazon Ltd 0.003 25% 5,000 $2,369,145 AVE Avecho Biotech Ltd 0.006 20% 657,725 $15,846,485 EVR Ev Resources Ltd 0.006 20% 2,704,488 $9,929,183 IPB IPB Petroleum Ltd 0.006 20% 353,720 $3,532,015 EGR Ecograf Limited 0.340 19% 1,225,400 $129,427,568 PGD Peregrine Gold 0.195 18% 131,267 $13,111,555 XGL Xamble Group Limited 0.020 18% 6,315 $5,763,242 PAT Patriot Lithium 0.055 17% 25,134 $5,941,644 PUA Peak Minerals Ltd 0.011 17% 1,094,225 $25,265,892 DVL Dorsavi Ltd 0.007 17% 774,371 $4,387,428 HHR Hartshead Resources 0.007 17% 7,743,902 $16,852,093 INF Infinity Lithium 0.028 17% 640,842 $11,102,210 ODE Odessa Minerals Ltd 0.007 17% 2,329,278 $9,597,195 XPN Xpon Technologies 0.007 17% 490,000 $2,174,649

Cybersecurity firm WhiteHawk (ASX:WHK) skyrocketed 150% after bagging a major spot as the core cyber partner on a massive US$920m US federal government contract. Teaming up with Knexus Research and other big names, WhiteHawk will deliver AI-powered tools for managing cyber risks in federal supply chains. This 10-year deal could bring in recurring revenue as task orders are released. Backed by a 2025 White House Executive Order, the contract will streamline government procurement, opening up more opportunities for WhiteHawk.

Concrete tech company, Eden Innovations (ASX:EDE), announced that Holcim US has placed its first major order for EdenCrete Pz7, worth around $145,668, for a large construction project in Colorado. This order will cover 25,000 cubic yards of concrete. Over the past 10 months, Eden has received over $675,000 worth of orders from Holcim in the US and Ecuador. EdenCrete Pz7 is also being trialled in countries like Canada, Mexico, and the UK, which could open up more markets for the product in the future.

RC drilling at OzAurum’s (ASX:OZM) Mulgabbie North has confirmed a major gold system at the Cross Fault discovery, with hits including 48m at 1.66g/t gold from surface. Further drilling, including diamond drilling will kick off next week, aiming to expand the 260,000oz project’s potential.

Pro-Pac Packaging (ASX:PPG) has acknowledged a challenging start to 2025, with results for the first quarter falling below expectations. The company is now conducting a strategic review to improve profitability and assess funding needs, with a focus on resolving short-term requirements. To support this, Pro-Pac has appointed David Hewish from Leaders on Demand as Chief Transformation Officer for six months to help implement the changes.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CDT | Castle Minerals | 0.002 | -33% | 2,218,239 | $5,783,469 |

| HCD | Hydrocarbon Dynamics | 0.002 | -33% | 620,000 | $3,234,328 |

| JAY | Jayride Group | 0.002 | -33% | 54,554,116 | $4,235,177 |

| RAN | Range International | 0.002 | -33% | 651,898 | $2,817,871 |

| CRS | Caprice Resources | 0.060 | -30% | 63,820,533 | $43,492,470 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 1,750,000 | $9,673,198 |

| SUM | Summitminerals | 0.057 | -24% | 890,233 | $6,534,599 |

| KGD | Kula Gold Limited | 0.006 | -21% | 9,084,155 | $6,448,776 |

| CPO | Culpeominerals | 0.012 | -20% | 7,085,541 | $3,299,433 |

| CR3 | Core Energy Minerals | 0.012 | -20% | 2,175,435 | $3,666,629 |

| EMU | EMU NL | 0.028 | -20% | 113,936 | $6,776,049 |

| AQX | Alice Queen Ltd | 0.004 | -20% | 8,756,082 | $5,734,450 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 3,560,792 | $8,100,749 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 1,111,044 | $15,392,639 |

| HLX | Helix Resources | 0.002 | -20% | 2,000,000 | $8,410,484 |

| TEG | Triangle Energy Ltd | 0.004 | -20% | 115,000 | $10,446,170 |

| WNX | Wellnex Life Ltd | 0.370 | -20% | 454,188 | $30,877,673 |

| HTG | Harvest Tech Grp Ltd | 0.013 | -19% | 194,075 | $14,201,610 |

| AX8 | Accelerate Resources | 0.005 | -17% | 839,995 | $4,723,132 |

| BEZ | Besragoldinc | 0.040 | -17% | 1,515,285 | $19,943,470 |

| CCO | The Calmer Co Int | 0.005 | -17% | 146,391 | $15,323,228 |

| CTN | Catalina Resources | 0.003 | -17% | 910,001 | $4,548,786 |

| EPM | Eclipse Metals | 0.005 | -17% | 191,315 | $17,158,914 |

| AUG | Augustus Minerals | 0.031 | -16% | 314,453 | $4,410,083 |

| AVG | Aust Vintage Ltd | 0.110 | -15% | 2,420,105 | $42,830,180 |

IN CASE YOU MISSED IT

Firetail Resources (ASX:FTL) has awarded contracts to Abitibi Geophysics to survey its Skyline copper project in Newfoundland for Cyprus-style VMS targets.Skyline’s stratigraphic sequence is said to be identical to Cyprus’ Troodos Ophiolite, which hosts over 30 historical mines.

Caprice Resources’ (ASX:CRS) drilling at the Island project extended high-grade gold at Vadrians to 250m along strike and made a new discovery 250m south. A 5000m Phase 3 drill program will target further extensions and test over 30 new gold targets.

Belararox (ASX:BRX) has identified 20 drill targets at its Kalahari Copper Belt project, with a third EM survey set to refine them further. A 2000m RC drilling program will begin in July to test the high-priority areas.

AnteoTech (ASX:ADO) has appointed Glenda McLoughlin as its new non-executive chair, recognising her extensive investment banking and board experience spanning more than 20 years. The company has farewelled outgoing chair Ewen Crouch AM and Dr. Katherine Woodthorpe AO, thanking them for their contributions as it advances the commercialisation of its clean energy and life sciences technologies.

Well-funded GWR Group (ASX:GWR) has agreed to amend the terms of its Wiluna West iron ore project royalty agreement with Gold Valley, adjusting payments in response to lower iron ore prices. To date, the company has earned a royalty of $2.53 million, with all amounts received.

Mount Hope Mining (ASX:MHM) has completed a ground gravity survey at its namesake project in the Cobar Basin, NSW. The survey covered 97 km² with 1732 stations, exceeding initial plans, and data is now being processed by Southern Geoscience Consultants to refine exploration targets for potential Cobar-style mineralisation.

Sun Silver (ASX:SS1) has appointed former Barrick Gold and Nevada Gold Mines chief geologist, Keith Wood, as exploration manager to drive resource development at Maverick Springs in Nevada. Wood has over 25 years of experience, leading major discoveries and growth strategies in the silver state, strengthening Sun Silver’s technical leadership as it advances its silver-gold project.

At Stockhead, we tell it like it is. While Firetail Resources, OzAurum Resources, Caprice Resources, Belararox, AnteoTech, GWR Group, Mount Hope Mining, and Sun Silver are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.