Resources Top 5: Delivering clean energy in Mexico as hydrogen emerges

As the world moves toward greener energy solutions, new sources of carbon-free fuel are sought after with hydrogen increasingly popular.

Pure Hydrogen has signed a new agreement to extend its Mexican hydrogen distribution plans

A strategic development agreement will enable Buru Energy to progress its gas supply strategy in northern WA

The first diamond hole at Koonenberry Gold’s Sunnyside prospect has delivered

Your standout small cap resources stocks for Wednesday, April 2, 2025.

Pure Hydrogen Corporation (ASX:PH2)

As the world moves toward greener energy solutions, new sources of carbon-free fuel are sought after with hydrogen increasingly popular, at least the ‘green’ and ‘white’ varieties.

White hydrogen is naturally occurring and does not require industrial production, green hydrogen is made using renewable energy and grey hydrogen is frowned upon as it is derived from fossil fuels.

Green hydrogen is the focus of a number of alternative energy players but white hydrogen is attracting attention after the world’s largest resource was uncovered in France.

It was reported in late March that this discovery, which has the potential to reshape global energy strategies by providing a new source of carbon-free fuel, has an approximate value of US$92b.

For years, the hydrogen industry has faced two major challenges: the high cost of producing green hydrogen and the pollution caused by grey hydrogen.

White hydrogen offers a solution. Since it already exists underground, it does not require energy-intensive processes like electrolysis nor does it rely on fossil fuels.

If similar deposits exist elsewhere, this could signal the beginning of a major shift in energy production worldwide.

Research suggests that natural hydrogen could be far more abundant than previously thought and this could lead to an international race to locate and extract natural hydrogen reserves.

Work is still needed, however, to understand the full potential of these hydrogen reservoirs and to develop safe, efficient methods to extract them.

Pure Hydrogen Corporation (ASX:PH2) is one company making noise in the space, particularly in hydrogen-friendly Mexico where it has signed a landmark supply and distributor agreement valued at US$28m.

The deal with Mexico City-based GreenH2 LATAM is for the supply of hydrogen equipment and has seen PH2’s shares increase 23.4% to a daily high of 9.5c

In November 2024, the company expanded its global distribution network for zero emission vehicles built by HDrive, in which PH2 has a 70% stake, and hydrogen equipment via a deal with GreenH2 LATAM to order at least 20 vehicles within 12 months of the term sheet being signed.

It’s great timing for Pure Hydrogen (ASX:PH2) to expand Mexican distribution plans, with the recent election of Claudia Sheinbaum as president who has a goal to boost renewable energy to 45% of electricity production by 2030.

This latest collaboration with GreenH2 is expected to capitalise on the policy changes, further strengthening the partnership’s potential for growth and long-term success.

It means PH2 is the preferred supplier on two projects in Mexico for the supply of hydrogen equipment – including four 2.5MW electrolysers - hydrogen compression and refuelling equipment, and hydrogen storage and transport equipment.

“We are delighted to finalise this transformative agreement with GreenH2 LATAM, underscoring the increasing demand for hydrogen solutions in Latin America,” PH2 MD Scott Brown said.

“Following our recent orders with TOLL Transport and Heidelberg Materials, this deal further validates our strategy and enhances our global reach.

“North America remains a key market for us, presenting immense revenue opportunities. While hydrogen equipment sales typically involve extended lead times, our robust pipeline positions us for continued growth and long-term success.”

Buru Energy (ASX:BRU)

Gas and liquids company Buru Energy has made a major breakthrough in its strategy to provide energy in the north of WA by signing a strategic development agreement with Clean Energy Fuels Australia to co-develop the Rafael gas project.

This milestone in Buru’s goal to commercialise Rafael’s 85 billion cubic feet of gas resource and transition from explorer and developer to long-term producer has been recognised by investors, who have sent the company’s shares to 4.9c, a 36.12% increase on the previous close.

Buru aims to replace long-haul trucked or imported fuel used for power generation and mining in the state’s north with a local source of trucked liquified natural gas (and liquids).

CEFA offers a solution and has a track record of developing and operating small-scale LNG infrastructure assets in Australia. Its trucked LNG model has been proven to reduce long-term regional energy costs and emissions – as well as providing a viable alternative to diesel.

This agreement will combine Buru’s upstream resource and expertise with CEFA’s downstream and midstream capabilities, strong financial backing and extensive experience in WA’s domestic LNG market.

CEFA will fully finance, build, own and operate an LNG plant with a capacity of up to 300 tonnes per day at the Rafael project. They will also be responsible for the distribution of LNG and condensate to end users.

This investment in Buru’s gas project will be recovered through gas processing fees charged to the company over Rafael’s estimated 20-year production life.

Buru plans to pursue a final investment decision for the project later this year, with the drilling of a development well expected in 2026 and robust cashflows from the second half of 2027.

“Rafael is the only confirmed source of conventional gas and liquids in onshore Western Australia north of the North West Shelf Project,” Buru CEO Thomas Nador said.

“It is a unique opportunity to provide energy to a growing market that is not connected to a gas pipeline and currently faces challenges with high energy costs and security of supply.”

Koonenberry Gold (ASX:KNB)

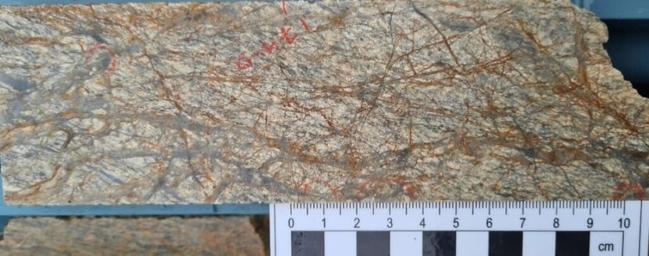

Reaching a two-year high of 6.2c, a 51.22% increase on the previous close on volume of more than 121 million, reflects the success of Koonenberry Gold’s first diamond hole drilled at Sunnyside prospect within its Enmore gold project in northern NSW.

The hole returned a 170m intersection grading 1.75g/t gold from 77m and within this was an 18.3m interval at 9.95g/t gold from 172.9m, which coincided with previously reported visible gold zones.

The new assays validate historical results, as 25ENDD001 was drilled as a diamond core twin of historical reverse circulation hole OSSRC006 that returned 174m at 1.83g/t gold from surface including 3m at 8.86g/t from 172m.

Results also provide further evidence of this system’s potential to host broad intervals of gold mineralisation, along with high-grade gold zones. Gold mineralisation remains open up-dip in the preferred granite host rock, along strike and at depth.

“This hole was planned to target high-grade vein sets at a high angle to the main shear zone and we have certainly demonstrated the potential for this system to carry exceptionally high gold grades as well as verified the broad zones of gold mineralisation intersected in historical drilling,” KNB managing director Dan Power said.

“Samples from holes 25ENDD002, 003 and 004, which all intersected visible gold, are now at the lab and will be reported through April.

“Drilling at Sunnyside is ongoing and continues to target extensions to the system, which we have demonstrated to have a 240m vertical depth extent on three sections

OzAurum Resources (ASX:OZM)

OzAurum continues to bask in the glory of broad, high-grade gold RC drill results from Tuesday which confirmed the new Cross Fault discovery at the Mulgabbie North project Shares rose again on Wednesday, up by 47.8% to a daily high of 13c with more than 37 million changing hands.

Other results from Cross Fault, which is 2km south of the 260,000oz Mulgabbie North resource, are 12m at 4.26g/t gold from 18m, including 2m at 22.58g/t; and 17m at 1.65g/t gold from 45m, including 39m at 1.09g/t from 31m.

As well as owning 100% of the Muilgabbie North and Patricia gold projects in the Norseman-Wiluna Greenstone Belt of WA, in the shadow of Northern Star Resources’ (ASX:NST) Carosue Dam gold mine, OZM has critical mineral interests in Brazil.

Applications have been lodged for 50,000ha of tenure prospective for niobium and REE adjacent to known Brazil carbonatite complexes at Catalao II Project and Salitre which are being mined for niobium and phosphates.

Niobium and REE targets within OZM tenure have been identified with seven interpreted circular features.

Kula Gold (ASX:KGD)

Kula Gold has made progress at the Mt Palmer Gold Mine joint venture with Aurumin near Marvel Loch in the Southern Cross Goldfields of WA

Aircore drilling has delivered 12m at 3.4g/t gold from 24m which adds to previous results of 4m at 3.02g/t from 18m and 7m at 3g/t including 1m at 10.6g/t.

This lode is 500m south of the main Mt Palmer Gold Mine workings and is starting to demonstrate a contiguous zone of shallow gold mineralisation open north, south and at depth.

Drilling is ongoing, with 808m completed to date over 16 holes.

Mt Palmer mine produced more than 150,000 ounces of gold at 15.9 g/t from 1934 to 1944 and is north of the Nevoria Gold Mine (+600,000 ounces of gold) and east of the circa 2.4-million-ounce Marvel Loch Gold Mine.

The mine closed in part due to the continuation of WWII severely restricting access to labour and materials and subsequently the mine flooded and was never reopened. Limited systematic exploration has been carried out since that time.

With this drilling, Kula has met its expenditure requirements to earn 80% of the Mt Palmer Gold Mine JV.

“We are very pleased to report this excellent result kicking off our second drill campaign at Mt Palmer with 12m at 3.4g/t gold from 24m. The next batch of assays will be very interesting,” Kula’s managing director Ric Dawson said.

"Kula has now met its expenditure requirement to earn to 80% and takes a major position in this very promising ~10km gold belt.

"This Mt Palmer acquisition aligns with the Kula’s strategy to focus exploration near existing operations to fast track any discovery to monetary success.”

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Pure Hydrogen, Koonenberry Gold and OzAurum are Stockhead advertisers, they did not sponsor this article.