Soul Patts' Millner slams Swan's tax changes

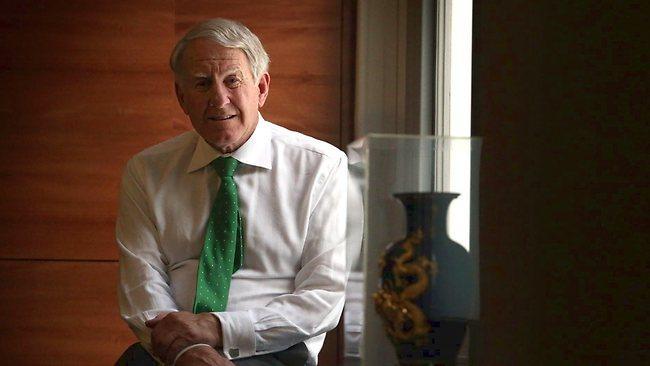

WASHINGTON H Soul Pattinson executive chairman Rob Millner is no fan of the Gillard administration, saying it is hostile to the business sector.

WASHINGTON H Soul Pattinson executive chairman Rob Millner is no fan of the Gillard administration, saying he struggles to recall a federal government that has been more hostile to the business sector.

"The cost of running a business is horrific with all the add-on costs, not to mention the constant fiddling with superannuation, which is people's nest egg," Mr Millner said.

More to the point, at least for Soul Patts, is that at last year's 20 per cent growth rate, the company's 2012 revenue of $912 million will comfortably exceed $1 billion by January 2014.

That means it will join the first batch of about 350 companies in switching from quarterly to monthly corporate tax payments, as a result of deficit-pruning moves announced in Monday's Mid-Year Economic and Fiscal Outlook.

"It's not very helpful, having to pay tax every month when you get paid every 40-60 days by some customers," the Soul Patts chief said.

"We're an investment company -- it'll be worse for an operating company.

"Some will have to fund their tax payments out of working capital, which means less money to run and grow the business.

"It's just another way of the government robbing Peter to pay Paul; the government thinks it can keep milking the business cow instead of cutting back on its own spending."

Payments for the goods and services tax are remitted monthly, as are pay-as-you-go instalments from employers.

However, critics of the change argue GST payments can be managed through accounting systems, unlike corporate tax where judgments have to be made on deductions that might be available, as well as when the money came in and went out.

By switching to a monthly company tax system, the government will get its hands on payments in the last two months of the June financial year that would have spilled into the following year under the existing quarterly regime.

In 2013-14, it is forecast about $5.5 billion will be brought forward, more than double the forecast surplus of $2.2bn.

The measure will be extended to 2500 companies with a turnover of more than $100m the following year, and 10,500 businesses with a turnover of more than $20m from January 2016.

The government has been at pains to point out that the total tax paid by companies will not change, but the business community has condemned the reform as a quick fix to honour Labor's commitment to a budget surplus.

Tony Stolarek of accounting firm Ernst & Young's national tax and tax policy services group said the change amounted to a funding "deferral" for larger businesses, instead of the present situation where they enjoyed a "free float" of cash.

"Some companies will need to ensure they have funding lines so they can deal with this new obligation," Mr Stolarek said.

"There's a significant transition issue involved, so it's sensible that companies have 15 months to sort their funding out."

Mr Millner said revenue in the Soul Patts group could be volatile, and not just because of the business environment.

For the company's 60 per cent-owned coal operation, New Hope Corp, which had 2012 revenue of $768m, a couple of missed shipments could make a big difference to the top-line.